Do you like simplicity? How about convenience? What about spending nearly none of your time on investing but getting on with your life instead?

Then multi-asset funds are made for you.

In this post, we’ll help you choose the best multi-asset fund for your situation. You’ll learn how they work, and we’ll offer some thoughts on what features matter.

What are multi-asset funds?

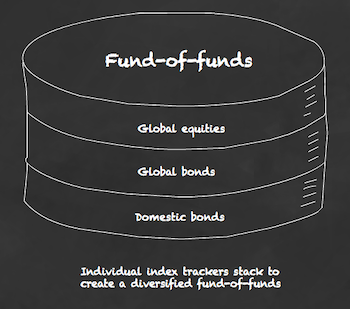

A multi-asset fund (also known as a fund-of-funds) offers you an instant portfolio with a single investing purchase. Instead of painstakingly choosing your own equities, bonds, and other assets, you accept the fund manager’s selection.

The manager will diversify you across the major asset classes. They’ll also handle rebalancing and swallow the complexity of portfolio management.

A fund-of-funds is so-called because it wraps several specialised funds into one neat investing package.

Each individual fund gives you exposure to a different sub-asset class. For example, one fund will invest in US stocks. Another in the UK. Yet another in the Emerging Markets.

A multi-asset fund is essentially a meal deal. You may get a heartier helping of corporate bonds, say, than you’d otherwise have chosen, but that’s the trade-off.

You relinquish control on the grounds that the manager’s choice will provide a positive experience, minus the hassle of making all the decisions yourself.

How do fund-of-funds work?

Fund-of-funds invite you to focus on the most fundamental decision in investing: how much risk do you want to take?

Each multi-asset fund in a given range corresponds to a different risk level. You pick the fund that best fits your risk appetite. You then simply choose how much to invest and leave management to get on with it.

The risk levels are typically labelled something like:

- Cautious

- Moderate

- Balanced

- Growth

- Adventurous

The higher your risk level, the more equities and fewer bonds your chosen fund-of-funds contains.

An adventurous fund may be 100% equities. A cautious fund can be as high as 80% bonds.

Risky business

Risk levels are predicated on the risk-reward trade-off.

This investing theory holds that higher rewards accrue over time to investors who bear more risk.

The empirical upshot is that equities have typically been the best asset for growing wealth over the long term. That’s because investors have demanded a premium for putting up with their volatility and periodic crashes.

The downside of taking risk? Your investments can be underwater until the market recovers.

That’s where bonds come in. High-quality government bonds can moderate stock market losses. But their crash protection doesn’t always work. And it usually curtails growth somewhat.

A risk-averse investor – perhaps one who’s older and more interested in wealth preservation – should choose a multi-asset fund towards the more cautious end of the spectrum.

On the other hand an investor who’s gung-ho for growth is liable to have a large risk appetite. Perhaps because they’re confident they’ll ride out temporary setbacks without panicking about paper losses.

Going back to the meal deal analogy, picking the riskiest multi-asset funds is like telling the chef you’re up for his extra hot spicy curry. Despite knowing it’s almost certain to give you a squeaky-bum-time at some point.

If you’ve no idea how to even begin to choose your level, see our piece on risk tolerance.

The middle fund-of-funds in each range usually approximates the 60/40 portfolio.

Best multi-asset funds

Here’s my pick of the best multi-asset funds available:

| Multi-asset funds range | Passive or Active? | OCF (%) | Watch out for | We like |

| Vanguard LifeStrategy | Passive | 0.22 | Home bias | High proportion of government bonds |

| Fidelity Multi Asset Allocator | Passive | 0.2 | – | No home bias Small cap equities Property |

| HSBC Global Strategy Portfolio | Active | 0.19-0.22 | – | No home bias Property |

| Abrdn MyFolio Index | Active | 0.2 | Home bias Junk bonds Low government bonds |

Property |

| VT AJ Bell Funds | Active | 0.31 | Home bias Junk bonds Low government bonds |

– |

| Legal & General Multi-Index Funds | Active | 0.31 | Home bias Junk bonds Low government bonds |

Property Index-linked bonds |

| BlackRock Consensus Funds | Active | 0.22 | Home bias Very low US Very low emerging markets |

– |

| BlackRock MyMap Funds | Active | 0.17 | Junk bonds | No home bias Commodities |

| Schroders Global Multi-Asset Portfolios | Active | 0.21 | Home bias Low government bonds |

Commodities |

Source: Monevator research

The table lists the multi-asset fund ranges I think merit further investigation.

- The best fund-of-funds for you is a personal decision.

- Your choice from any particular range should be guided by your risk tolerance.

But how would I choose the best multi-asset fund for me?

Fund-of-funds fundamentals

Above all, I believe most investors benefit from a passive investing strategy.

Hence the top spots go to the two multi-asset fund ranges that adhere reasonably well to a passive approach.

This means their asset allocations aren’t likely to change much while you’re not looking. Moreover their portfolios consist mostly of index trackers.

The other multi-asset funds in the table also hold lots of index trackers. But the difference is they employ active management.

An active mandate gives the managers licence to change your asset allocation.

Some operate within wide risk bands, too – some fund-of-funds can contain anywhere from 40% to 85% equities.

This flexibility sounds like a strength. But it’s often counterproductive in practice, because even the experts’ powers of prediction are weak.

The ‘sell’ is that a skilled manager has the potential to deliver great performance while protecting their investors from downside risk. That claim is mostly a vain hope, as we’ll see in a moment.

Overall, active management is likely to be a less effective strategy for most people.

Of the passive multi-asset funds, the Vanguard LifeStrategy range is the clear leader. Its balance of sensible asset allocation, consistency, reasonable cost, and long-term returns make it a great choice.

Every other contender on the list must really be viewed as an alternative to Vanguard LifeStrategy.

That said, you may want to consider putting some money into a Vanguard LifeStrategy alternative once your portfolio has grown large enough that it makes sense to diversify your fund manager risk.

You don’t want all your eggs in one basket, in short. Our investor compensation scheme piece explains more.

A couple of additional notes on the table:

- OCFs listed are based on the best available fund share class that’s accessible via UK brokers on a non-exclusive basis.

- Add your fund’s transaction costs to gain a full picture of its total charges.

Multi-asset funds: what to watch out for

There are many ways to rank funds.

Counterintuitively, recent results aren’t foremost among them. Primarily because as all the fund literature baldly states: “Past returns are no guarantee of future performance.”

For that reason it’s better to pick an option that best suits your circumstances and is geared towards investing best practice.

All things being equal:

- Passive is better than active

- Low cost is better than high cost

- Property, small cap equities, index-linked bonds, commodities, and gold are good diversifiers

- Junk bonds and thematic investments are highly questionable diversifiers

Home bias1 has resulted in many of the fund-of-funds holding more UK equities than investing theory suggests is optimal.

Multi-asset funds that overweight the UK are usually underweight US equities, too. This posture may work for or against you, depending on the whims of the market gods. But as a deliberate choice it makes most sense for retirees with bills to pay in the UK, or if you believe the US market is dangerously overvalued.

Note that fund-of-funds typically carry only small payloads of index-linked bonds. The funds rely on equities as a long-run inflation hedge instead.

Inflation is a big concern for retirees. If that’s you, then consider target-date funds with stronger anti-inflation defences.

Beware trivial asset allocations. Holding 2-3% of something won’t make much difference to your return. However it may help the fund look more sophisticated!

Fund-of-funds and corporate bonds

A fund’s allocation to corporate bonds is worth investigating if you’re choosing an alternative to Vanguard LifeStrategy.

Many multi-asset fund ranges include a large percentage of corporate bonds in their asset mix.

And while bonds are generally assumed to reduce risk, whether they do so depends on the type of bond:

- High-quality government bonds are reasonable hedges against a stock market crash. (High quality means a credit rating of AA- and above)

- Corporate bonds – even when dubbed ‘investment grade’ – are less useful in a crisis

- High-yield (or junk) corporate bonds typically heighten risk – much like equities

So pick a fund-of-funds with a strong government bond asset allocation and credit rating if you want to keep a tight rein on risk.

That may mean dropping down a risk level or two if you’re set on a fund that devotes the lion’s share of its bond allocation to corporate debt.

UK multi-asset funds results check

Source: Trustnet Chart tool

The results comparison above compares the UK fund-of-funds that are closest to a 60/40 equity/bond split in each range.

We already know that past performance does not predict the future. But it’s still worth checking the five-year and ten-year timeframes. Do any trends pop out?

For example, over ten-years the passive Vanguard LifeStrategy 60 has comfortably beaten its active management rivals, apart from HSBC Global Strategy Balanced.

This result is a microcosm of the entire passive vs active investing debate.

If you pick any broad market, you will likely find active funds at the top and the bottom of the league tables.

Most passive funds, meanwhile, usually loiter somewhere in the top half.

The problem is that the table-topping active funds regularly change. To benefit from the winners, you have to be able to choose them ahead of time. There lies the rub, and sadly picking the winners is much harder than plumping for whoever has done well of late.

That said, Global Strategy edged Vanguard LifeStrategy by 0.2% when we first began tracking multi-asset funds six years ago.

Three years ago, Global Strategy eked out a 0.4% lead over LifeStrategy while now the gap is 0.6%.

So Global Strategy has consistently delivered over that timeframe (which is still short in the scheme of things) and seems like a well-run fund.

Short termism

Five-year returns are the minimal viable comparison period in my view – a blink of an eye in investing terms – and not long enough to draw firm conclusions from.

Over the stubbier time-frames, short-term management decisions can pay off for a while.

For example, the Abrdn MyFolio Index III fund currently holds 75% equities – at the very top end of its range for risky assets.

That move has juiced its returns for now. The fund boasts the best one-year return in the table. But very few managers enjoy 10-year winning streaks. They tend to fall back into the pack over time.

That’s why the 10-year return is a much better test of prowess. Mistakes tend to cancel out temporary runs of good form.

The benchmark

I’ve added the IA Mixed Investment 40-85% returns to the table, inside the green dotted lozenge. These numbers show the average return for all funds belonging to this category, and are a reasonable yardstick for comparison.

(The Investment Association, or IA, is the trade body that represents the UK’s investment management industry.)

Because this category is dominated by active funds, you can see that many investment professionals aren’t adding value over ten-years, given that the passive Vanguard LifeStrategy 60 comfortably surpasses the 4.9% average.

But it’s actually worse than that.

The DIY passive alternative to holding multi-asset funds like these is to run a two-fund 60/40 portfolio.

For example, you could have:

- 60% in global equities

- 40% in global bonds hedged to GBP

Rebalance every year and you’d enjoy a portfolio that captures the bulk of the risk-reward trade-off offered by the funds-of-funds in the table.

Over 10-years, that 60/40 portfolio2 delivered a 6.3% annualised return.

You would think that the vast majority of skilled active managers could best such a simple portfolio. Yet they have not.

ESG multi-asset funds

Most multi-asset managers also now offer fund-of-funds with an ESG spin.

It’s extremely difficult to verify ESG credentials. Hence we’ll just offer a few leads for further research:

- BlackRock MyMap Select ESG

- Legal & General Future World Multi-Index

- Abrdn MyFolio Enhanced ESG

Vanguard’s candidate is its SustainableLife Fund range. But this fund’s holdings are too concentrated for my liking.

Also, all of the ESG options above are actively managed.

Multi-asset ETFs

A handful of multi-asset ETFs trade on the London Stock Exchange. JustETF maintains a good list.

iShares’ Portfolio ETF range is worth a look.

The rest are either too narrowly focused, expensive, or new to make the table for now. We’ll keep an eye on them though.

The Swiss army knife of investing

If managing your investments makes you want to stick pins in your eyes then rest easy – a multi-asset fund is a good way to get the job done.

Choose a fund loaded with equities to take more risk in pursuit of higher rewards. Or opt for a fund-of-funds with more bonds for a smoother ride.

Ultimately, it’s your topline equities/bond split that will count most towards your long-term result.

Go for the extra bells and whistles if you believe the evidence. But don’t be fooled into thinking that more always means better.

Take it steady,

The Accumulator

Hi TA,

Please clarify something for me. A fund-of-funds has an Annual Charge of its own (for instance Vanguard Lifestyle 100% has a reported 0.29%). However it is composed of underlying funds all of which, presumably, have their own on-going charges. If so, isn’t the investor paying two layers of charges? One for the underlying funds and secondly for the convenience of having then packaged in the fund-of-funds. The underlying funds typically have annual charges of 0.3% so the total charges paid for holding the underlying equities in the fund-of-funds is some 0.6%.

Perhaps I have got it wrong but I don’t really see how it can be otherwise.

Cheers. Great web-site

Paul S

Any word of if and when Vanguard will make their target retirement income funds available in the UK?

These automatically ‘lifestyle’ the equities/bond ratio to allow a higher percentage of equities at the start and gradually more bonds over time.

Example:

https://personal.vanguard.com/us/funds/snapshot?FundId=0305&FundIntExt=INT

@Paul S.

You are wrong. The underlying charges are included in Funds of (oeic/UT and I think ETF) funds. However, don’t forget your broker my add a holding charge of about 0.35% or so.

I’m pretty sure that funds of ITs don’t include the underlying charges so be careful there!

I am still trying to figure out the best place to park £70k of Vanguard Lifestrategy funds in a SIPP, few trades. Interactive Investor perhaps?

@WestCountryEscape I totally agree the need target retirement funds here in the UK.

@Paul S

Its a very good question and practice varies

With Vanguard the fees quoted are inclusive of all the management costs

With a lot of other people’s funds of funds they are not and you can end up paying 2 or more levels of fees

Generally I personally think all funds of funds are a bad idea

Since so much of the world’s equity and bonds indexes are US/European (which you can track for an annual charge of peanuts) any fund of funds ends up bein more expensive than a judiciously chosen DIY portfolio of maybe 6 funds/etfs

IMHO its not to much to ask anyone to make four comparisons once a year:

– is my asset allocation right

– are my funds costs low enough compared to the market leaders

– is my platform still cheap enough compared to the market leaders

– will my fund generate the income I want

The above is actually less work getting car and home insurance each year

@Greg and Neverland

Thanks for those comments. I found two articles (FT and Telegraph) from late 2012 both of which warned about layered fees for Fund-of-Funds.

Telegraph Dec 2012

“But this comes at a price, Mr Connolly said. “The investor has to pay two levels of fund management charges – one for the overall fund manager and another for the underlying funds, on top of any fee to their adviser. This makes them expensive.”

FT Nov 2012

“Fund of funds is a great concept in theory, but terrible in practice,” says Alan Miller, chief investment officer at SCM Private. “Investors are marketed fund of funds as a way of spreading risk and increasing diversification. However, these advantages are frequently more than offset by the extra significant layering of costs and fees.”

I would love to think that Vanguard play it straight……I am a Jack Bogle fan….but I cannot find anywhere on their website that spells it out. I would appreciate it if you could point me to where that is done.

Cheers.

@Pauls

I run my huge globally diversified investment portfolio ( :/ ) using 6 of the ETFs on Vanguard’s list

You’ll find its cheaper in terms of AMC than their lifestyle funds

You could probably make do with just 2 in a small portfolio, although the saving is less

Others can probably point you in the direction of marginally even cheaper etfs

PS. I know this is kind of ignoring your question 😉 but I think you are asking the wong question

I’ve always wanted to know the answer to Paul S’s question too, but have been too afraid to ask! 🙂

@Neverland

I don’t use lifestyle funds. However the charges for them are central to the posting by The Accumulator. I just felt it needed to be clarified.

@ Paul S – No layered charges, the OCFs (plus spreads / dilution levies / platform charges) are what you pay. Yep, certain fund-of-funds have been guilty of sharp practices but not these passive types. Each company except Architas uses its own brand funds within the wrapper to keep costs down. Architas roam free across different product providers and as such are more expensive than the rest: with OCFs in the 0.6+ range.

HSBC are in the 0.5s

L&G are in the low 0.3s

Vanguard are 0.29

BlackRock are 0.23 – 0.29.

However, I think the structure of the various offerings means DIY-ers should choose Vanguard or HSBC and then the price differential makes that choice clear.

The Vanguard all-World equities etf has a TER of about 0.3%

The Vanguard UK all-gilt etf has TER of just over 0.1%

Its even cheaper if you go for the individual etfs including the US equity etf

Compare with the above

I’m now being asked to pay another 0.45% for HL on top of the Vanguard charge, therefore 0.74%.

It looks like I can get L&G direct from them as an ISA with no additional charge therefore 0.3% ish.

@neverland

re DIY vs lifestrategy – what you save in TER basis points on the you could pay back in dealing charges and exit fees

for example the difference between 6 trades vs 1 at £10 a pop is roughly equal to the difference of 15 basis points on a £33k pot per annum – plus you get smashed if you want to change platforms

@rhino

Going away from fund of funds does play out better with a larger pot of course

But quite quickly a 0.1% saving in TER (for example) starts to generate annual savngs

On a £50k starter portfolio thats £50 per year, in the example above that should generate an annual saving on a fixed fee platform like ATS/iweb/iii

I have to point out that I only rebalance and trade once a year due to sloth

@neverland

yes – i’m tempted to have a crack at maintaining a bunch of etfs

i started on a bunch of hsbc tracker funds at hl pre platform fees

had to consolidate that to a lifestrategy when they brought in the £2 tax

now i’m having to shift platform due to the .45% tax

i’m keeping the sipp though as its small and still cost effective so i will still have an hl account – i could repopulate my now empty fund acc with etfs, no annual management fees and i think i could use the new regular trader to get dealing down to £1.5 – could be worth a go..

ps i am also moving from monthly to annual purchases due to sloth – makes a lot more sense, only 8.3% of the current level of effort

Great post, sad to see the market of these types of funds is so poor. I was trying to find out what the heck was in the L&G funds but its so difficult its just not worth it. That’s the beauty of vanguard – they are 100% transparent.

I think the great thing about Lifestrategy is it stops you messing with things! I have some and a mix of other trackers, the Lifestrategy always trumps my total performance – although it will take years before I know if my slightly different passive allocation (more time hale) will be better.

Couldn’t help notice the ad for Henderson Cautious Managed Fund at the side of the page. Charles Stanley says this about the fees:

TER/OCF 1.51%

Initial Charge 0%

Annual Mg’mt Fee 1.25%

Cofunds Rebate ** 0.25%

https://www.charles-stanley-direct.co.uk/ViewFund?Sedol=3247763

Since it has high fees and an active nature we can assume the LifeStrat will outperform over time. Vanguard uber alles it seems. If only they would pay you to advertise here!

I receive a final salary pension. One of my financial risks is that the pension scheme gets into trouble, falls back on the PPS, and so loses me nearly all of my inflation protection. How should I best protect myself from this? I should say that I am disinclined to invest in index-linked gilts because not only are their returns unattractive, but also because the sort of economic developments that might torpedo my pension scheme might well be the sort that lead HMG to default on the inflation-protection of ILGs. A bit of gold might be wise, but what else?

Now that many of our SIPPs and ISAs have a capped annual charge rather than a monthly fee per holding, I’m thinking it might be an idea (and interesting) to split our single investment in a fund of funds up. So rather than having the whole SIPP in one place like Vanguard LS80, maybe put a third in the Black Rock consensus, a third in L&G and leave a third in Vanguard LS80.

It wouldn’t cost anymore now that the fee structure has changed, and it’d be very interesting to see which performed better over a number of years.

It would also lower your potential losses if one of the companies involved turned bad.

What do you guys think?

Hi,

Wow! What a fantastic website. I have learnt so much in the last few weeks reading this, so thank you for that.

However, my head is doing somersaults with this RDR shenanigans, so wondered if anybody would offer their opinion!

I started investing in the Vanguard Lifestrategy funds less than a year ago, I have around £6k in an ISA and 9K in a SIPP, both at HL.

Due to the small amounts, I wasnt going to move them but have just seen that Charles Stanley (for the ISA) also do the VLS with a slightly cheaper platform fee. I currently pay just £100 per month into each.

I am thinking I should stay true to all i have read about maintaining low costs, but in my case is it worth it? Especially with transfer costs etc.

Or should I just set up a new ISA with CS in April pay all the £200 p/mnth into that whilst moving the HL ISA into the SIPP at a similar rate?

I know its not a major thing for some of you seasoned investors, but any opinions would be greatly appreciated.

@ Acky – I probably wouldn’t at the moment unless you can get HL to waive transfer costs. After June 2 HL are axing their £75 SIPP transfer fee, so you’d be paying £55 to transfer each account. Calculate how long it would take you to recoup that versus your next best option: http://monevator.com/compare-uk-cheapest-online-brokers/

The broker market is going through a massive period of flux. Things may be clearer in 12 months or so, so don’t feel too much urgency to pull the trigger.

@ Vestor – You’re giving up transparency on your broad asset allocation in exchange for some comfort that you’d be better protected if a company like Vanguard went bust and your assets weren’t ring-fenced. A remote possibility but not impossible. Only you can decide if that’s worth it. I’d personally rather know what my asset allocation is but that’s just me.

If you do decide to diversify funds then pay attention to where they’re domiciled. If they’re not based in the UK (but are say in Ireland) then investor compensation protection may be less or non-existent:

http://monevator.com/investor-compensation-scheme/

@Acky

You have a sensible set-up at the moment. For small amounts of money, it isn’t worth chopping around once you’ve got someone fairly competitive as prices will change in the future too!

A 0.1% improvement in fees on £15k is £15. Remember your time is valuable too! Obviously, as the value of your savings goes up you should take a closer look. If you were in Alliance Trust, say, I would tell you to move as their flat fees now punish small holdings, but HL are ok here.

I’ve currently got my SIPP (YouInvest), invested in IT’s. I’m 15 years off retirement but starting to think that maybe I should accept that I’ll be better off invested in trackers (and more diversified). Reading Ian Vestor’s comments above leads me to a similar question, what is the maximum amount I should consider investing with one company? I wouldn’t like to move everything to VLS only for them to fold (unlikely I know but never say never!)

Would I be better splitting the pot into 4 and going with HSBC, L&G, Vanguard and BlackRock?

@Accumulator

Many thanks for the link and advice, all appreciated.

In a strange way I’m attracted to the way the Black Rock consensus and Arhcatis funds are ‘managed’. I fully understand the concept of rebalancing and asset allocation within a SIPP, but it seems to me that these other funds that lack transparency are attempting to offer some degree of management within a fully passive tracker fund of funds.

I assume that they’ll basically shift the weighting in and out of the different funds according to larger scale global movements and trends. So if gilts/bonds start sliding and equities start booming, they’d re-weight in that direction and visa versa.

Obviously this blows in the face of true passive index investing, but is it not possibly an interesting hedge in some respects? Or am I showing my naivety here? Feel free to say yes!

@ The Investor and Greg.

Thanks for the replies.

I will leave things exactly as they are and let things take their course.

@ Vestor – all passive funds will move in concert with the aggregate decisions of every investor in that particular market – that’s how a tracker operates. But these products overlay that with an extra level of active management ‘sell’ – a group of investors who have been shown to underperform the market time and time again. So I think that aspect is a mirage. I don’t blame you for wanting to diversify beyond one company. I think that’s a good idea. But doing it with these products means not being in control of your actual asset allocation.

Thanks for the help Sir. I’ll duly note your comment and avoid those funds.

Maybe just going 50:50 with the HSBC and VLS funds is the answer. As I say, it’d be interesting to see if one out performs the other over the longer timeframe.

Maybe also worth checking out the new cheap tracker fund of funds that HL have promised us.

@Harry

I personally like ITs and have about the same in ITs as trackers. I think a sensible approach is to have a backbone of a big, cheap tracker. (Vanguard LifeStrategy is the one I’ve always referenced but now there are others, they deserve a closer look. e.g. This article!)

Then one can add a bit of flavour with some ITs and potentially other trackers. This bit is entirely optional though! (For my sins, I do have a few active OEICs too.)

I think ITs like CGT, RICA, PNL, BACT can be used effectively to lower the overall volatility while maintaining pretty much the same returns. However, the big problem now is you have to rebalance! Therefore, it is far more effort than just having a portfolio-in-a-box.

If you have enough money going in, and choose income units in your big tracker, you may be able to achieve rebalancing by directing new money to the required places, keeping it cost effective. However, you’ve added a human judgement element into the equation, and we’re rubbish!

Some ITs are pretty cheap and can be cheaper after platform fees are applied to trackers. e.g. SMT, TMPL have OCFs of 0.5% Mostly it is _cheap_ funds that do well, rather than simply trackers!

@Greg

I used to invest pretty heavily in ITs like RIT Capital Partners, Alliance Trust and a lot names that have now disappeared

Back then discounts were much higher and the strategy looked like a one way bet to me. For instance I could pick up RIT Capital Partners at a more than 30% discount to NAV in the 90s

When I look at the narrow NAV discounts these days it doesn’t look half as attractive

If ITs ever seriously fall out of fashion again you could have an underperformance issue

I’m not convinced about passive investments in bonds, so a strategy I’ve taken in one of my accounts is to use the Vanguard LS 100% for my equities and use an M&G active bond fund for the fixed income allocation.

Obviously I will have to re-balance the broad equity/bond spread manually but I feel a bond fund can often add value over a simple passive bond investment. I don’t feel the same way about active equity funds!

Hi, I see Monevator got an honourable mention in the Daily Mail, This is Money, this morning. Practically mainstream.

@ Greg, thanks.

I also like IT’s & they’re doing ok but i’ve no bond allocation. I’ve got 20% cash but no bonds. My cash isn’t earning anything but then people seem to be bearish on Gilts and I don’t think corporate bonds (HDIV, CMHY, IPE) offer me diversification from my equities? Can you get Govt bond allocation with IT’s? or is it better to use the tracker route?

@neverland

Point taken! However, ITs only make up a fraction of my holdings and I think there are enough advantages to make the discount risk worth taking.

@Harry

Some of the ITs I mentioned have a big slug in bonds, though don’t rely on them to stay that way long-term as it is a tactical choice! I think with the returns for Gilts projected to be so low, a tracker is probably the best way as fees will be even more important! I like BACT as it can get hedge-fund like behaviour without the fees, all while curing cancer! Watch out for the premium though!

You can get plenty of ‘alternative bonds’ via ITs, which might be worth a look, but they are no substitute for high-quality debt! TFIF, AEFS, NBLS, DREF, JGCI, RECI, SWEF etc. (HDIV you’ve mentioned but don’t think it’s a normal bond fund!) I’d imagine most people would want to steer clear! It’s just making things more complicated!

Greg

What does the audience think of when it comes to funds such as Dimentional Funds (http://www.dfaeurope.com/pdf/fact_sheets/global/global_targeted_value_fund_d.pdf)? These seem to bypass the traditional holding by market cap.

@Frugal: http://monevator.com/why-market-cap-investing-still-works/

Monevator mentioned on thisismoney.co.uk, fame! 🙂

http://www.thisismoney.co.uk/money/diyinvesting/article-2568429/Minor-Investor.html

I want to put another £8k (lump sum) into the market but I’m already heavily overweight in UK All Share Trackers and nervous about the current lofty heights of the US. I already make much use of Vanguard trackers. I also intend to drip feed some additional money into emerging markets over the next year or so as they appear to be out of favour.

One option for my £8k lump sum that I have been considering was Vanguard LifeStrategy 80 or 100. However, the high weighting of US and large UK puts me off so I thought about making up my own fund of funds by putting equal amounts of £1k into each of 8 different cheap trackers.

The ones I’m thinking of are listed below. I will probably use ACC versions of HSBC funds where available. Given the low amounts I am very unlikely to re-balance this portfolio within a portfolio, at least for 2 or 3 years, so it will be interesting to watch how each market’s performance compares to the others and also to my other holdings including LifeStrategy 80 which I already hold.

UK FT100

UK FT250

US

Europe ex UK

Japan

Pacific exJapan

Emerging Markets (L&G or Blackrock depending on charges)

Gilts (HSBC)

What do others think of this?

Great reading the above comments and the support for vanguard lifestrategy. I am transferring a 180k sipp currently managed by an expensive and useless IFA so I can reduce the fees. Seriously considering lifestrategy 100 however he yield is so low at just over 1% and no one seems to be mentioning that. Am I missing something here? Why would I put up with such low yield when there appear to be such better options in the 3-5% yield band out there?

@ Mr Beethoven: here’s a selection of low cost trackers that will beat the HSBC ones you’ve got in mind: http://monevator.com/low-cost-index-trackers/

I’ve got no problem with the regions you wish to invest in, I don’t really get why you would overweight, for example, the Pacific yet are worried about overweighting the UK. Here’s a piece to help you come up with a more grounded asset allocation: http://monevator.com/asset-allocation-construct/

@ Ben – not sure what better options you have in mind? I’m concerned with overall return rather than yield as an isolated component of that.

@ The Accumulator, thanks for the response. I’ll take on board your list of HSBC-beating trackers and re-consider.

Regarding the weightings, the reason is that this additional lump sum only represents about 5% of my investment in funds and overall I’m massively overweight in UK large and underweight everything else. This additional money will address that only slightly but is more for fun. I want to spread this money across different markets but I’m not convinced that adopting conventional weightings is the way I want to do it – unless I was convinced that US will outperform the others or that I want my portfolio to move in line with the world.

I have no idea which market will perform best, though with emerging markets being so out of favour at the momement it must be in with a good chance, so I thought I’d try giving every market an equal weighting in this portfolio within a portfolio and then it would be interesting to see which performs best in 2014 and which in 2015 and so on. Whichever it happens to be wouldn’t matter to me as I would have it, although I would also have the worst as well.

It just feels to me that that ths would add a bit of interest to my portfolio whilst still remaining passive.

Keep up the good work, this is a fantastic resource.

@ Greg,

Thanks again i’ll take a look at your suggestions & give it some more thought.

Cheers

Hello there,

I wonder if anyone could help me with a question. I don’t see any article on here discussing this in much detail. I currently have around £45000 in a Vanguard life strategy 60% accumulation fund that’s not in an ISA wrapper. If I want to gradually bed an ISA and move around £3000 of this a year into an ISA account as I am saving £12000 per year as a target.

Do I have to tell HMRC if I use my capital gains allowance to be able to claim it per say. I wonder if I am wrong in having thought previously that if you don’t go over the £11000 mark in gains per year then you do not have to tell the HMRC. Upon reading up on this, I have seen something that says you tell HMRC if you make over £2500 from capital gains (not sure if reading this right).

I also seem to have misunderstood this in that if I was to sell part of the fund, it is only the gain from when I bought it that is counted. And it seems that if you don’t use the allowance, you might suffer more tax for example. If my fund grows by £10999 one year and £109999 the next, if I don’t sell after 1 year but sell after 2 I will have to pay tax on £10098. Therefore, it is better to sell and purchase back after 1 month to in essence use the allowance? Leading back to my first query. Do you need to tell HMRC This even if you are below the allowance?

Kind regards,

Thanks for your time

Chris

I would love it if an article was written for people who have a fund invested outside of an ISA discussing here tax issues as if I was not able to understand this correctly, I think others may be the same.

@Chris — Does this article help? –> http://monevator.com/defuse-capital-gains-on-shares/

I have been working on another article with a worked example, but got bogged down in explaining why (legally) avoiding taxes is important and isn’t morally indefensible.

Whenever I write about reducing/avoiding (not evading!) tax I get a some flak in comments and over email for whatever reason, but anyway I will push through the thrown tomatoes and publish the article eventually!

Attention commentators! Check the date when looking at comments above this one — we’ve updated our post five years on since first publishing, to reflect all the new entrants in the market. 🙂

Fidelity Multi Asset Allocator Growth was closed in February 2019. Only the Defensive and Adventurous funds are on sale at Interactive Investor.

It’s available on AJ Bell Youinvest and Fidelity say it’s still with us:

https://www.fidelity.co.uk/factsheets/?id=F00000PJ3H&idCurrencyId=&idType=msid&marketCode=

Thanks for the updated article, but where’s my (alternative to Vanguard) silver bullet! 😉

It seems the closest to it is either the Fidelity Multi Asset Allocator, or splitting between a global equity and UK gilt tracker as you mentioned. However (apologies if you’ve discussed this elsewhere) if doing the latter, should we not look to diversify the gilt element to be global gilts (if such a thing exists)?

Thanks!

Hi, does anyone know if the vanguard life strategy funds are UK domiciled ( I know the HSBC global strategy is)? Asking to avoid possible complications due to excess reportable income. Thanks!

Hi Pipp, if you look up any Lifestrategy fund on Morningstar the domicile is listed as UK on the “management” tab.

I’m a bit surprised to see SLI’s MyFolio only mentioned in the “too expensive/active/inaccessible” list at the end. Certainly the active “MyFolio Managed” and “MyFolio Multi-Manager” range (and their Income variants) are unlikely to be of interest to Monevator types on cost grounds, but the “MyFolio Market” ones (5 risk levels, accumulation units only, OCFs 0.3-0.37%) seem to be exactly the “off-the-shelf cheap portfolio of cheap passives” kind of thing we like, and appear to be not unlike L&G multi-index at first glance. Available on ATS. Top 10 holdings of the mid-risk “III” shows it to be a collection of Vanguard, L&G & iShares passives, with just one sub-5% SLI property fund qualifying as active. Think it might have been more expensive in the past (e.g 0.71% OCF mentioned in a 2016 article on it). Last time I looked at the performance (last few years risk-return curves over the risk levels) it was behind Lifestrategy or L&G multi-index, but ahead of Blackrock Consensus; I suspect the discrepancy is largely explained by degree of home bias carried. Don’t actually hold any (already have Lifestrategy & some L&G multi-index) but thought it looked interesting as another option for this kind of thing… did I miss something awful about it?

Firstly, thanks for another informative post. I’d missed this one the first time around. Maybe update slightly more frequently? Annually?

My other question… what about 40/60 instead of 60/40? Those folk with shorter timeframes may want to consider something slightly lower risk and whilst LS40 is fairly obvious, searching for fidelity for example failed this novice!

I hold five different iShares ETFs to maintain a 80/20 portfolio and to set up my geographical balance with a bit of home bias.

The average OCF is about 0.12% which beats all the ‘funds of funds’ available.

Maintaining the asset allocation is currently achieved through periodic new contributions. I use De Giro which gives me very cheap trading costs as well so periodic re-balancing would be fairly easy.

It’s slightly less convenient than a single fund but seems optimal for me at the moment.

I should probably look to diversify away from iShares which I will try to do at some point.

@Jonny Do you mean like this..? https://www.vanguardinvestor.co.uk/investments/vanguard-global-bond-index-fund-pound-sterling-hedged-accumulation-shares

Was that FE link supposed to bring up the chart for them all ? It doesnt for me. The link shows

https://www2.trustnet.com/Tools/Charting.aspx?typeCode=NUKX,NB:AFIA,NB:AFIB,NB:AFIC

@Simon — Hmm, I see the same thing. When I edited @TA’s piece I presumed it was just a link to root Trustnet actually, and didn’t really interrogate it. Let’s see what he says.

I’m not sure I understand many of the arguments here or the obsession people have with Life Strategy. If I held a generic world tracker and then diverted an additional amount of my portfolio to a dedicated UK tracker than that would introduce a weighted ‘bias’ to my portfolio. Seems other funds get slated for deviating from the global weightings but Vanguard can do this and it’s accepted. If home market or currency risk is the argument, then why would you invest outside your own markets at all? Ultimately any of this is assumption on future in unknowns, but at least keep the arguments consistent.

*KLAXON* All or Nothing Alert Triggered *KLAXON*

I agree that the home market bias and currency risk aspects of LifeStrategy versus other funds or strategies are worth discussing and debating.

However just because you want a bit less currency risk — or even if you want a bit more — that doesn’t get us to “why would you invest outside your own market at all?” as you ask.

Investing across lots of markets has advantages. Investing across multiple currencies *may* reduce volatility, although it’s probably in the long-run uncompensated risk. Buying loaves of bread in your local currency when you retire and thus your local currency being very important BUT also wanting the best (personally risk adjusted) chance of being able to buy the most loaves of bread you can with your savings when you get there is rationale. 🙂

Nothing personal, but whenever I hear a dramatic “all or nothing” statement (which like anyone I occasionally slip into myself) I think it needs restating that most things in investing are not all or nothing decisions. 🙂

Hi TA,

First of all thanks to Monevator for shifting me from saving to investing a few years back. I am now almost entirely in VLS 60. I had struggled, doing my own research, to find attractive looking alternatives, so this article is very useful.

The Fidelity MAA looks attractive, and I note your point about ‘stable asset allocation’. However the fund sheet states ‘mixed investments 40 – 85% shares’. So doesn’t this mean that the current 60% equity allocation is subject to potential considerable change over time, or am I missing something?

Any comments gratefully received.

Cheers

FS

@ Frugal – I think you’re referring to the Investment Association Sector referenced on the web page for the Fidelity MAA Growth fund? They used to actively manage these funds but stopped in March 2018. I suspect they haven’t bothered to change the IA Sector.

Download the fact sheet pdf and it says:

Asset allocation exposure of the fund will be typically allocated as follows: 60%

higher risk assets (e.g. shares) and 40% lower risk assets (e.g. bonds and cash).

From the annual report:

The fund is managed to provide diversified and efficient exposure to global

markets, and is rebalanced periodically to keep asset allocation in line with

the fund’s long-term strategic asset allocation. Its asset allocation is not

adjusted in response to the market outlook.

@ Simon – it’s a link to the charting tool but the tool doesn’t retain the data. You have to start from scratch every time sadly.

@ Fundleaner – Fidelity Multi Asset Allocator Strategic = 40/60

@ Tim – I couldn’t find the Standard Life MyFolio Market funds on the platforms I checked, namely: AJ Bell, Hargreaves Lansdown and Interactive Investor. Seems like they still involve some degree of active management. Using index trackers doesn’t make a product passive – that’s a sleight of hand that a lot of products on this list use. Market timing is still an active strategy even if you’re using passives.

@ Jonny – I’m agnostic about investing in global government bonds vs gilts. This is the global index tracker equivalent of gilts: iShares Global Government Bond ETF (IGLH). The Vanguard fund mentioned above includes corporate bonds.

Some details of the 0.17% OCF Blackrock MyMap funds as reported here: https://www.sharesmagazine.co.uk/funds/fund/QD4K/holdings

so BlackRock MyMap 3 (64% bonds, 34% equity, 2% alternatives) has the following holdings:

ISH UK GILTS 0-5 ETF GBP DIST 18.08%

ISHARES US EQUITY INDEX (UK) X 17.74%

ISH GBP ULTSHRT BND ETF GBP DI 15.06%

ISHARES $ TREAS BND 1-3 ETF US 12.12%

ISHARES UK GILTS ALL STOCKS IN 11.10%

ISHARES CONTINENTAL EUROPEAN E 6.88%

ISHARES 100 UK EQUITY INDEX (U 4.91%

ISH $ TRES BND 7-10 ETF $ DIST 4.08%

ISHARES EMERGING MARKETS EQUIT 3.04%

ISHARES INDEX LINKED GILT INDE 2.06%

the considerable use of short-dated UK and US treasuries makes it quite different to almost anything else in this field.

And no corporate bonds!

@TA: Re the SLI MyFolio Market funds… odd, I can see them on HL (besides ATS): e.g https://www.hl.co.uk/funds/fund-discounts,-prices–and–factsheets/search-results/s/standard-life-inv-myfolio-market-ii-class-p-accumulation , https://www.hl.co.uk/funds/fund-discounts,-prices–and–factsheets/search-results/s/standard-life-inv-myfolio-market-iii-class-p-accumulation , https://www.hl.co.uk/funds/fund-discounts,-prices–and–factsheets/search-results/s/standard-life-inv-myfolio-market-v-class-p-accumulation (although strangely not the “IV” risk level so far as I could see). I haven’t looked into much detail about how their asset allocation is determined or how frequently it’s tweaked, but they seems to be run on much the same basis as L&G’s multi-index funds (in the same “volatility managed” IA grouping too), and surely the same “market timing” arguments must apply to L&G multi-index too: L&G hide them away in their a “for professionals/intermediaries only” area, but if you care to look for them you can find some nice quarterly updates from Justin Onuekwusi (L&G’s multi-index manager) describing how he’s positioning things based on a view on valuations, where we are in the economic cycle etc. It does indeed look pretty “active” compared with Lifestrategy’s allocations which hardly ever change (although even there I note there was a story a week or so ago about Vanguard wanting to dial back on Lifestrategy home bias… but waiting until after Brexit… market timing again!?! https://www.telegraph.co.uk/investing/funds/vanguard-lifestrategy-brexit-has-stopped-us-cutting-back-british/ ). Seems to me that the fundamental problem is that while indexing within an asset class is easy enough these days, as soon as you start allocating across multiple asset classes you have to make what’s fundamentally an “active” decision, even if it’s only picking which Lifestrategy % you buy. Maybe the only “pure” thing to do is something like holding the world’s investable assets in proportion: the “global market portfolio” https://www.bogleheads.org/forum/viewtopic.php?t=251190 .

Thanks Tim, I missed them on HL. Re: management style, from the factsheet:

“The fund is actively managed by the investment team. Their main focus is to select funds within each asset class and ensure that the strategic asset allocation (long-term proportions in each asset class) meets the fund’s objectives. In addition, they will take tactical asset allocations (changing short term proportions in each asset class) to improve returns. It may consist of up to 40% actively managed funds.”

The MyFolio Market II Fund lists 26 holdings (including 3 broad UK equity trackers!) including corporate bonds, emerging market debt and junk bonds. I’ll put it in the table next time but it doesn’t look like we’re missing a trick here.

Choosing an asset allocation and sticking with it is not “active”. It’s a fundamental investing decision that begins with your split between equities and bonds. We need to choose equities/bond split in line with risk tolerance not, say, the global allocation of capital between the two. So while I have no edge that leads me to think I ought to have more holdings in Amazon than a total world tracker, it’s legitimate for me to tilt towards UK equities if I want to reduce my exposure to currency risk e.g. I’m about to start drawing down on my SIPP and my bills will be paid in £s.

Choosing an asset allocation in line with your long-term objectives and individual circumstances is just good sense. Short-term tactical asset allocation in the hope of beating the market is a recipe for failure.

Newbie question:

Is there a good app/program/website to monitor your chosen fund(s) prices, and perhaps receive alerts when they drop below a certain level, etc?

I know you can find graphs of prices on multiple websites, but wondered if there was a really goof (and reliable) tracking app that everyone is using?

@TA I note that neither L&G’s multi-index nor SLI MyFolio Market “choose an asset allocation and stick with it”. What they both seem to do is target some particular level of volatility (different for each fund in the range) and then adjust asset allocation to try and stay true to that. However that “In addition, they will take tactical asset allocations (changing short term proportions in each asset class) to improve returns” in the MyFolio factsheet does seem pretty damning… I can’t see anything equivalent to that in the L&G multi-index factsheets… on the face of it, they seem to be claiming to be entirely about managing volatility. On the other hand, there’s an interesting 2017 article on L&G multi-index here: https://www.professionaladviser.com/professional-adviser/feature/3023041/actively-passive (note the “actively passive” strapline!) which mentions the manager “is ensuring the portfolios only have exposure to those areas he considered to have strong return and growth prospects” and there’s even a quote “We aim for true diversification and are trying to be properly active”… so it’s not clear that L&G multi-index is any less guilty of “activeness” than MyFolio Managed! There’s perhaps an interesting debate to be had on whether tactical asset allocation to manage volatility is somehow less evil/more feasible than doing it to boost returns.

“There’s perhaps an interesting debate to be had on whether tactical asset allocation to manage volatility is somehow less evil/more feasible than doing it to boost returns.”

Agreed. Though what odds would you give me on it being the Emperor’s new clothes?

I’ve been pondering this a bit. Not sure I am so concerned about the potential for asset allocation to be tweaked as you are. After all, the Vanguard Lifestrategy allocations are not set in stone. I believe they have reduced the home bias once already and have expressed a wish to do so again but are inhibited by brexit ( don’t think they elaborated). So it could change. In any case, why would a fire and forget allocation be so desirable if it is some sense still based on human judgement at one place in time?

All this assumes that any adjustments are relatively small.

I agree about the commercial bonds though, wish the HSBC range weren’t so gung ho, after all the yields on offer across the range are hardly a big draw. Ditto hedging, think that is in Vanguard’s favour, at least from my perspective.

Thanks for the article.

HSBC state that they hedge all fixed income holdings back to GBP.

I think you’ve got Fidelity Multi Asset Allocator Growth wrong – Trustnet says it’s 27.9% managed: https://www.hl.co.uk/funds/fund-discounts,-prices–and–factsheets/search-results/f/fidelity-multi-asset-allocator-strategic-class-w-accumulation

Please can you explain?

The Fidelity Multi-asset Allocator Funds are are about to change their investment strategy… Due to change June/July 2020. I need to re-read the details but a brief scan read has me concerned that the fund is ditching the reference to the blended index they are tracking and giving the fund manager more discretion… Might be time to reassess if it is the fund for me. Hopefully this article will be updated annually too!

Thank you for the heads up on this Al. An annual update is a good idea.

Re the Fidelity fund, can I please check which global bond fund(s) you have as unhedged.

Hi – This is a very useful article and one of the most commonly referenced on some forums. Can i please ask if you are planning any update as the last one was 3 years ago? Thanks.

Hi Jay, thank you for that. Much appreciated. And yes! There is an update in the works. Hopefully it’ll be out in the next 2 or 3 weeks.

Post updated!

At risk of heresy, there is one active fund I’ve found which personally I’d be as happy with, if not happier, than the passive funds listed here – the McInroy & Wood Balanced Fund.

They are a small-ish, family-run Scottish boutique, & one of the only places I’d trust to look after e.g. a little old lady’s money. The people I’ve met are not city slickers at all, the fund is 50-60% equities, a bunch of bonds (including inflation-linked) and more recently they’ve had some gold.

They probably aren’t significantly better than the passive funds, but certainly have kept up with them or slightly beaten them.

I like the fact that a) I trust them to change things if necessary (e.g. more inflation-linked bonds) and b) the companies they hold are ‘decent’ companies in terms of governance, instead of some of the nonsense trackers have to hold.

Anyway, I don’t mean this to sound like an advert – I have no affiliation, but I’ve followed them for years & been constantly impressed (the one thing I’d change is have more US equities – they’re too UK/Europe biased for my liking) by their performance, their literature & the people I’ve met there.

@tom_grlla

At a charge of 1.1% I think I’ll give it a miss thanks.

@tom_grlla. I’m not saying it’s bad, but it’s five times more expensive, for example, than the passive option of Vanguard LS 80. The performance differences aren’t five times difference. I understand your reasoning but it’s a hefty premium to pay.

My set up is (/will be) Vanguard LS 80 as the main core of my S&S ISA (in time I’m aiming for 80% of my ISA being LS80), which on reflection is the near perfect vehicle for me. Happy with the 0.22% cost and with ii, its the ultimate no-think, put in regularly and leave play. (Ignoring the, ahem, bond collapse)

I also have a SIPP that has AJ Bell’s Adventurous fund as the workhorse in that, plus another SIPP with HL that only has L&G’s Future World index, if only for peace of mind and risk aversion across funds and platforms. But the aim is roughly the same – mainly passive.

A big, big fan of the Lifestrategy funds, discovering them was genuinely life changing, however I do compliment this with smaller amounts in small cap index fund, a global property index fund and a commodity etf. The absence of those is my only minor gripe with the Vanguard offer (and possibly a high bias towards UK domestic holdings) In addition I have a smaller collection of mostly global investment trusts as my active/income/growth etc plays within my ISA with different purposes. Is it needed? Probably not but it satisfies my active itch.

Rinse and repeat, rebalance the active side of things every year, eventually plan to dial down to LS 60, or a blend of 80 and 60.

Any views on target date funds as opposed to lifestyle funds eg Vanguard 2030 currently has 64:36 equities to bonds; 2035 69:31 and 2040 74:26. With the built in glide path is this even better for set and forget or is that just too laissez-faire?

@Darts n hiphop

Personally I believe target date funds aren’t particularly desirable unless you’re intending on purchasing an annuity. The “de-risking” is effectively a measure to reduce volatility as a purchase date approaches. In a world of drawdown post retirement I’m much more a fan of establishing a portfolio which is then maintained from say 10-15 years prior to retirement until it ends up in the hands the executor of your will.

@Darts n hiphop – for me, it depends on what the final bond allocation is.

I personally wouldn’t want to go any lower than 60% equities. I’d happily invest in a target date fund until then.

I think the declining equity glidepath mechanism is valuable. I know my own risk tolerance fell and 100% equities didn’t seem so clever once I had a lot to lose.

But I’d put a note in my calendar to switch to something like LifeStrategy 60 once the target date fund hit the 40% bond mark.

I held a fair chunk of HSBC global Strategy Cautious until last year. I am looking to go back into it once the air clears. On the hedging of it’s bond holdings I thought they did hedge but on relooking could only find this gnomic statement,

‘The manager can also adopt a currency overlay strategy, typically with reference to the equity exposure, as the fixed income exposure is deemed to be hedged at the strategic asset allocation level ‘.

It would be nice to have something definitive.

Can you set it so the comments appear newest first. I read the second comment about TargetRetirement not being in the UK… Panicked… And frantically logged in to Vanguard to check my entire pension wasn’t invested in the US! 🙂

@ Accumulator. Are the Fidelity Multiasset Funds really passive. They use passive funds but as far as I understand they use strategic asset allocation to mess around with their holdings. If that’s right then they really are active funds. Perhaps I’ve got the wrong end of the stick though?

@Toomuchcake has put in writing my own thoughts – although sometimes re-reading older comments does bring new perspectives. But, yes, newest first please if that’s not a pain for you.

@ Passive Investor – every multi-asset manager reserves the right to review the allocations – even Vanguard. In my experience the Fidelity Multi Asset Allocators are pretty consistent. They’re stable enough that I’m happy to accept they take a passive approach.

That said, no multi-asset fund sticks to a recognised benchmark such as the MSCI World. In that sense you could argue they’re all active to some degree. For my money that’s too pedantic, but you could argue it.

@Ondrew @Toomuchcake — Thanks for the feedback. I don’t think we’re going to do it though, as personally I hate it when comments show newest first, and reading becomes some sort of Time’s Arrow experiment! 😉 (Or you have to jump to the bottom first).

I can see it’s an issue with these updated posts though. One option would be to delete all the old comments, but then we’d lose some good stuff?

In any event I’ll keep it in mind and if we ever do a comment reboot perhaps we can make reversing order optional. 🙂

@ The Investor

How about a link to ‘Latest Comments’ or similar at the end of your text?

@Kraggash — Not a bad idea, I’ll consider it. Also, I’ll probably delete these housekeeping comments later today just to keep the focus on multi-asset funds, but appreciate the feedback. 🙂

I picked up on your Target Retirement Date fund suggestion. Looking at the Vanguard 2015 Retirement Fund it has 14 holdings at less than 3% weight, and 9 below 2%. I agree with your ‘non-trivial’ comment but all the slice-and-dice multiasset funds end up with a significant tail of low allocation stuff owing to retaining all lines across the board and algorithmic division to tailor to the volatility range sought.

also worth mentioning is the Aviva Investors Multi-asset Core Fund range – 5 funds with different levels of exposure to equities and bonds.

OCF 0.15%

from what I can tell they hold bonds and equities directly rather than via funds

Cheers, Adrian. The thing that put me off including the Multi-asset Core funds is the 0.3% performance fee on top of the OCF. It’s also heavily into long-short plays, so seemed a bit too ‘active’ overall to me.

As a beginner to this world, what I would like to ask is can you use these multi funds when needing to spend from them for example in retirement (or are they just really better for accumulating your funds?)

Why I am asking this is from what I have read lately, wouldn’t you need shares/bonds spilt in different funds so you can draw on those doing better (i.e. if shares are poor then cash in some, hopefully, better performing bonds) but with these multi funds presumably you would have to cash in a portion of both at the same time – so have to cash in a proportion of poorer performing shares as well? Is this correct?

Thanks Sophie

Hi Sophie,

Having separate equity and bond funds is a good option for someone who is relatively hands on with their investments in retirement but it’s not compulsory.

It is also fine to fund your cash needs by selling down each asset in proportion to its weight in your portfolio.

You’re right that this is what happens if you held a multi-asset fund in retirement.

However, if the fund rebalances then the higher performing asset will be sold off and the poorer asset bought in at a cheap price – achieving a similar effect to you only selling off the higher performing asset.

There are endless debates over what the best withdrawal method is in retirement. And the truth is they all involve some trade-offs, and the best method during your personal retirement can only be known in retrospect i.e. after historians see what the markets did during the period you were retired.

Owning a multi-asset fund in retirement means trading off personal control for simplicity. There’s nothing inherently wrong with this and it doesn’t mean you’re doomed to a worse outcome.

But if you decide you want to adopt a withdrawal method, which takes into account market conditions at the time of sale then, yes, you’re right a multi-asset fund isn’t the way to go.

Sorry, this is a long-winded answer. In a nutshell, I’m saying if you want a multi-asset fund then it can still serve you well in retirement. Other withdrawal techniques are available and aren’t guaranteed to do any better.

If you’d like to dig deeper into this then here’s some useful links:

https://monevator.com/review-living-off-your-money-by-michael-mcclung/

https://monevator.com/dynamic-asset-allocation-and-withdrawal-in-retirement/

https://monevator.com/how-much-should-i-put-in-my-pension/

Thank you, The Accumulator, no it’s not a long winded answer – I never expected such a good detailed answer that explained everything perfectly!

No I’m not hands on at all – I don’t have the knowledge as many investors on here do, so really should stick with the passive multi asset funds. As long as there is a reasonable chance of a better return than savings accounts – due to the inflation problem – creeping up to possibly 18% I hear (quite scary.)

I like the idea of the Vanguard LS funds due to minimal effort/simplicity (and less chance of me making a mess of these) and have read about them on your site. I was confused as to how I could sell down just bonds with these funds but due to your very good explanation, now understand that this is taken care of due to the rebalancing (which I did read about auto rebalancing for the VG funds but didn’t appreciate what it actually did.)

I think Monevator is a fantastic site, in fact the best I have come across with lots of very well written and informative articles for financially challenged novices like me – through to the more experienced investors. Also a lot of other sites seem to be focussed on American investors and not so many on UK ones like Monevator.

Keep up the good work.

Thanks once again,

Sophie

Do people on here think that its safe to hold more than the FSCS compensation limit (£85k) with Vanguard? Or should I look to be shuffling money into Fidelity or other platforms? Thanks

Oops! Sorry, Ive just read https://monevator.com/investor-compensation-scheme/.

But Im still confused. If Vanguard were to go kerput, the investments theyve made are with other companies arent they? The compensation is to cover the administration of Vanguard, which for each investor is likely to be much much lower than £85k?

(Im probably not making sense and just confusing myself)

@Tufty — I cannot give personal financial advice or speak directly about Vanguard (which is obviously about as strong as they come).

However IMHO nobody should ever be using the word ‘safe’ if they are talking about anything other than cash in an NS&I account.

With literally everything else something could go wrong, and there are degrees as to (a) how wrong it could go and (b) what the chances are of (a).

It’s a bit like people ask “am I safe wearing a mask and keeping two meters away?” with Covid. No, there’s a spectrum of risk. From doing mouth to mouth with somebody currently infected with Covid to walking around an empty supermarket and being incredibly unlikely to hit the one micro-droplet still lingering in the air, that somehow you’re unlucky enough not to be able to kill with your immune system, etc.

This might seem pedantic but it re-frames your question as something that can be deconstructed.

How likely is Vanguard to get into trouble? How likely is it that Vanguard hasn’t properly segregated any funds? How likely is it if Vanguard is in trouble that the FSCS will pay out quickly? If even Vanguard is in trouble, how likely is it that my alternative secondary fund manager is also in trouble? Etc etc etc.

At the same time, how much hassle is it to reduce the risk of catastrophic failure?

I can tell you that personally I would never have all my money in one place, simply because the risk of losing everything if a lot of even very unlikely things happen together for a one-in-a-million outcome would be too destructive to my future.

I’d rather split between at least two platforms and two fund managers, because even if I’ve slightly increased the odds of something going wrong (still likely very small if I choose properly and pay attention) I’ve *probably* taken the risk of a freak failure wiping me out off the table.

Probably not the answer you were looking for but I hope helpful.

Have a read of this:

https://monevator.com/assume-every-investment-can-fail-you/

p.s. The other main good reason for splitting your money across at least two platforms is that very often compensation schemes can take a while to kick-in/pay-out. Even if you believe that ultimately you will get all your money back, waiting until then is likely to be psychologically very difficult and may present practical issues too (e.g. cashflow issues if you’re living off your investments).

Thanks @The Investor – a very helpful and thorough answer!

Looks like Ill be transferring some funds from Vanguard to another platform, and leaving the LS100 to do its thing for a year or so and then reassess. 😉

@Tufty If you are transferring funds from Vanguard to another platform, you’d be wise to buy into a different fund manager on the new platform. Otherwise you’d still retain your exposure to Vanguard and you wouldn’t have achieved your desire to de-risk.

I’m just revisiting this, and looking at the Fidelity Multi Asset Allocator Growth Fund W Accumulation.

The Fidelity page says:

“The Fund will invest at least 70% into funds that use an ‘index tracking’ (also known as ‘passive’) investment management approach (these may include Funds managed by Fidelity), with the aim of pursuing a lower cost investment approach.”

Source: https://www.fidelity.co.uk/factsheet-data/factsheet/GB00B9C3GS90-fidelity-multi-asset-alloc-growth-w-acc/portfolio

Is this something to be concenred about, when looking to take a passive approach? Is it something that has changed since the article was last updated?

I note Vanguard LS60 states >90% in passive funds:

“The Fund gains exposure to shares and bonds and other similar fixed income investments by investing more than 90% of its assets in Vanguard passive funds that track an index (“Associated Schemes”)”

source: https://www.vanguardinvestor.co.uk/investments/vanguard-lifestrategy-60-equity-fund-accumulation-shares/overview

We have plenty of both of these funds. I’m stuffed to the gills with LS60 over a couple of platforms. My wife is on Fidelity’s platform so has been getting the W fund above as an alternative to Vanguard. Fidelity’s ongoing charge for this is 0.2% (to V’s 0.22%) so they can’t be doing much active dabbling surely. Looking at the ‘Portfolio’ section top ten holdings they seem to be index funds.

Looking down the charts the Fidelity fund has a cumulative 5-year performance of 24.1% against LS60’s 21.5%, so I’m happy enough we went with it anyway and shall stick with it.

I’ve come back to this article time and again. It’s so full of useful information and written in a simple way but is pretty detailed. Just the way I like it.

Great article – very useful.

Just a question on the property allocations – do they mean actual physical property or property shares/ REITs?

Hiya, it’s REITs.

Wouldn’t it be great if there was ever a fund that include stuff like Trend Following, Long Vol, Gold…

Those capital efficient ETFs Return Stacked and Wisdom Tree do, you’d think could be enhanced to give more asset classes.. (and made available to UK retatil!!)

And surely the permanent portfolio with no leverage must be and easy one to implement.

Still great article. Pity to see that there are only 2 choices for passive ones and yet still Vanguard beats Fidelity 🙂

Second that @Algernond #109.

The Fidelity M-A Fund (as the prospective best of bunch) is just a 60/40 with 64% in US and 7% EM.

https://www.fidelity.co.uk/factsheet-data/factsheet/GB00B9C3GS90-Fidelity-Multi-Asset-Allocator-Growth-Fund-W-Accumulation/portfolio

Granted, there’s some SC and property in the mix there, but how is this really diversified beyond just manually going 60% into Vanguard Global All Cap fund (VAFTGAG) and 40% in DM AAA bonds hedged to £Stg?

Properly diversified would also need (in addition to global bonds/ equities) some GLD, commodo, trend following and maybe some Infra and listed Global Macro HF.

Contrastingly, if you go with LSE listed WGEC ETF then you get 1.5 x a 60 (global equity) / 40 (global bonds) for just 25 bps all in – meaning that you can go 67% into that capital efficient ETF leaving 33% for GLD, commodo, trend etc.

A better proposition IMHO.

In the active column the CT Universal MAP range at 0.29 including a separate income fund might be worth a look.

@TI, @TA – There’s a way to directly link to specific fund charts on Trustnet. Take the Citicode for each fund, add the letter “F” to the start of this, then add this to the URL separated by a comma.

For example:

– Vanguard LifeStrategy 60% Equity A Shares Acc (citicode ACDQ)

– L&G Multi-Index 5 I Acc (citicode J84X)

– HSBC Global Strategy Balanced Portfolio C Acc (citicode G1HD)

Can be linked with the URL:

https://www2.trustnet.com/Tools/Charting.aspx?typeCode=FACDQ,FJ84X,FG1HD

The URL won’t update automatically when using the drop-down menus, so it has to be changed manually. The Citicodes are given on each fund page on Trustnet. I find this quite handy as it allows fund charts to be bookmarked for easy access.

I’ve only skimmed the above comments, but did you consider the CT (Columbia Threadneedle) range of multi asset funds? For example their Universal Map Growth fund (~75% equity) compares favourably with the HSBC Global Strategy Dynamic fund – which in itself is better than most funds of this type. The CT OCF is 0.29% so not bad. It appears to hold equity and bonds but no property, derivatives etc. Less volatility than the HSBC fund. Overweight in the UK (21%), but lower US weighting (40%). 5 star Trustnet rating. I can’t see many drawbacks. Can you?

At times like these, it seems a great idea to just set up a portfolio like a permanent portfolio/ all weather portfolio, and don’t tinker with it.

https://www.lazyportfolioetf.com/allocation/harry-browne-permanent/

https://www.lazyportfolioetf.com/allocation/ray-dalio-all-weather/

I somehow can’t quite get fully on board with a 25% gold allocation for the permanent portfolio so would probably be happier with the all-weather but then I can’t quite fully get on board with the 55% bond allocation!

@Andrew Leicester

I agree the CT Universal MAP Growth fund is good as a more active option. I was tempted but what put me off were the Transaction costs, the fund OCF is 0.29% and the transaction costs were 0.31%, so this is what made me think again and choose a different option.

https://www.fidelity.co.uk/factsheet-data/factsheet/GB00BF99W284-ct-universal-map-growth-c-acc/key-statistics

I used to see the UK bias in e.g. LifeStrategy as a flaw, but apparently there is independent research showing a long-term benefit from a moderate home bias with stocks (percentage in Vanguard’s ballpark), historically. This was from some podcast with a credible source.

@Rhydian Jenkins Good spot about the transaction charges. Using the Fidelity website suggest 0% transaction charges for the HSBC fund. Is that right do you think? Which fund did you choose in the end?

@Andrew Leicester

I can’t say definitively as in this document from HSBC it lists transaction costs as 0.02%:

https://www.assetmanagement.hsbc.co.uk/-/media/files/attachments/uk/common/enhanced-disclosure-2024-08-30.pdf

Though this document was from last year, but I would take from this and the Fidelity site that the transaction costs seem low.

@ADT – That’s a fantastic tip! Thank you for sharing that. Will make life much easier!

@klj and Andrew Leicester – I’ve looked at CT Universal MAP funds before but knocked them out due to very aggressive active management strategy. The licence each fund had to range across asset allocations was extremely wide last time I looked – though that was three years ago, so they may be less freestyle now. I’ve just checked the returns for the Balanced fund (which aligns with the comparison chart in the post) and it’s excellent over 5 years: 9.1% annualised.

It’s return since inception (Nov 2017) is 6.2% versus 5.5% for the 60/40 portfolio. I’d be happy with that margin of outperformance if they can keep delivering. I’ll take another look in time for the next update.

Re: HSBC fund. No fund can deliver 0% transaction costs over extended periods – unless it doesn’t trade. Probably an artefact of the reporting period. Transaction costs tend to bounce around.

@klj – hadn’t seen your comment.

@The Accumulator – Thanks – I’ll look at that.