For a long time we couldn’t compare the rates of interest on cash in investment accounts for one simple reason.

Brokers weren’t paying any interest on cash!

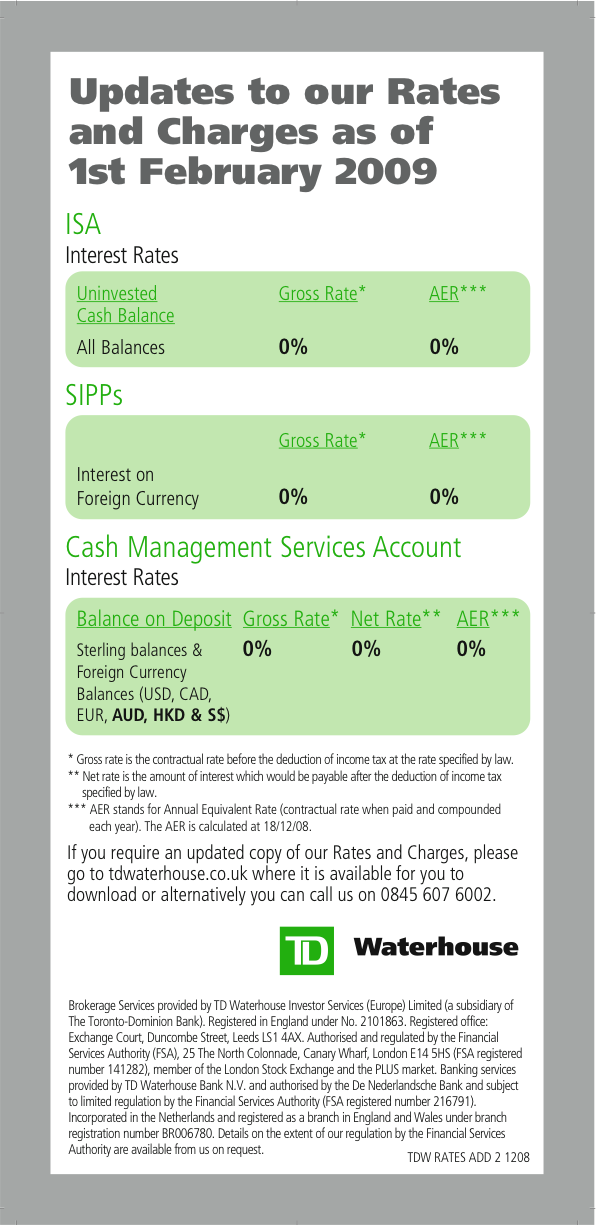

Rising rates have so dominated the news for the past 18 months that it’s easy to forget that interest rates were near-zero for more than a decade.

Even savings accounts at your bank paid no interest. So your online broker1 was more likely to send you a Christmas hamper from Fortnum and Mason than to cough up interest.

But now the Bank of England’s rate is 5% and everyone is giddy about cash again. (Let’s leave aside the fact that inflation in the UK is still nearly 9%…)

As a consequence, many investment accounts do now pay some interest.

Not all of them, not always very much, and it’s often difficult to find out exactly what interest rate they are paying – but it’s better than nothing.

You still won’t find these interest rates featured in our broker comparison table though.

You can blame the platforms for that.

(Don’t) show me the money

It’s easy to point the finger at faceless corporations for making life hard for the little guy.

And believe me, I have been blaming not them but my co-blogger The Accumulator for the past few months for the lack of an interest rate column in our table.

“Let’s include interest on cash in investment accounts in our broker table,” I intoned from my lofty throne, like Zeus commanding the lesser gods to do his bidding.

The Accumulator looked up.

“Um, that’s an interesting idea *cough* something *cough*,” he said, before going back to doing whatever he wanted to do as usual.

This time The Accumulator was engrossed in a couple of months of deep-diving into commodity correlations.

What a thrill-seeking hedonist, I snorted. Why can’t he simply collate the interest paid on cash in investment accounts with the rest of the data he trawls to keep our table updated?

“Fine! I’ll do it myself!” I harrumphed.

Yeah that was a stupid idea.

The Accumulator is a platform maven. My co-blogger navigates the Byzantine information silos that pass for a broker’s help pages like a spaniel sniffing for truffles.

So at the least he would have confirmed the woeful job some platforms do of highlighting their rates of interest on investment accounts much quicker than I did.

But I don’t think he would have found all the data. In fact I suspect he knew this was a Sisyphean nightmare – hence his evasive action.

And so even as Monevator readers too called for rate data to be included in our modestly famous comparison guide, The Accumulator bumped around in his fat-suit, plotting lean hog futures against corporate bonds and keeping his head down.

Interest on cash in investment accounts at a few platforms

Maybe you’re thinking that this is where I’ll reveal that – after a week spent combing the platforms, calling their service desks, and meeting their hired representatives in the shadows of Canary Wharf – I’ll now unveil a comprehensive guide to interest rates at every broker out there?

Reader, your faith is touching.

But unfortunately I ran out of puff.

For example I spent half an hour digging around Lloyds Banking Group’s website to no avail. Both when navigating its own menus and when swooping in over the walls with a targeted Google raid.

At the time of writing I still don’t know if Lloyds pays interest on investor cash! Perhaps I’m missing something obvious but the information has eluded me.

At least its High Street rival Barclays clearly states it pays no interest on cash in investment accounts. And it only took me a couple of minutes to find that out.

It was similarly hit and miss with the other platforms.

Maybe this isn’t entirely nefarious obfuscation on certain platforms’ part. I get the impression today’s much higher interest rates have caught some platforms on the hop, like they have the rest of us.

Remember how Vanguard seemed to almost accidentally be paying a high interest rate earlier this year? And then how it at least appeared to revise the rate down when we noticed?

It could be a factor, but remember that uninvested cash left lying around in customers’ accounts is a profit center for most financial services companies. Pooled together, it can earn a decent chunk of interest that boosts their bottom line – at the expense of our own.

So they do have business reasons not to want their customers thinking too hard about interest.

Okay, now show us the money

Just to complicate matters, most of the platforms that do pay interest will give you a different rate depending on how much cash you have on their platform.

Which clearly makes doing any side-by-side comparison even trickier.

So for now I’ll just post a taster comparison. Focusing shamelessly on those platforms who offer us an affiliate fee should anyone sign-up, as compensation for my suffering.

But we will revisit and expand this table in a few months when – like a mother who gets broody again after she’s forgotten the experience of child birth – I have forgotten the pain.

Note: Rates are changing frequently. These are the latest as I write.

Examples of rates of cash on investment accounts: ISAs

As I discuss below, big gobs of cash should really be held in a cash ISA. But here’s what you’ll get with a few different investing platforms with a share ISA.

| Platform | Interest rates (range) | Notes |

|---|---|---|

| AJ Bell | 1.7% to 2.2% | Better rate is above £10,000 |

| Bestinvest | 4.1% | High rate on all accounts |

| Dodl by AJ Bell | 0% | Free dealing quid pro quo? |

| Hargreaves Lansdown | 2.5% to 3.5% | Four tiers up to £100,000+ |

| Interactive Investor | 1.5% to 3.5% | Three tiers up to £100,000+ |

| InvestEngine | 0% | Free dealing quid pro quo? |

| Plum | 2.99% to 3.82% | Higher with premium plans, cash must be moved into ‘pocket’ |

Examples of rates of cash on investment accounts: SIPPs

Rates of interest on cash held in pensions are generally a little higher. That’s good, given the difficulty of accessing or moving money held in a SIPP.

| Platform | Interest rates (range) | Notes |

|---|---|---|

| AJ Bell | 2.95% to 3.45% | Better rate is above £10,000 |

| Bestinvest | 4.1% | High rate on all accounts |

| Dodl by AJ Bell | 0% | Free dealing quid pro quo? |

| Hargreaves Lansdown | 3.2% to 4% | Tiered, higher in drawdown |

| Interactive Investor | 2.25% to 3.5% | Three tiers up to £100,000+ |

| InvestEngine | n/a | Doesn’t offer SIPPs yet |

| Plum | 2.99% to 3.82% | Higher with premium plans, cash must be moved into ‘pocket’ |

Where else to stash your cash

Excuse me for stating the obvious, but you don’t need to have your portfolio’s cash allocation kept in an investment account with your broker.

You’ll generally earn better interest elsewhere.

Cash can just accidentally accumulate with your broker, of course. Especially if you’re an active investor or you own a lot of income funds without dividend reinvestment switched-on.

But I also see people holding cash with their brokers as a result of mental accounting.

They think “I have £200,000 in my stocks and shares ISAs and I want some of that in cash as a safety cushion”.

Really they’d be better off holding that cash elsewhere and thinking of their assets holistically.

Sometimes you may have a good reason to hold cash in an investment account.

Perhaps you’re building up dividends for a particular purchase, or maybe you’re a naughty active investor indulging in a bit of (ill-advised) market timing. Or you’ll hold cash in your pension because you reason that adding to that bucket has special constraints – yet you want to really dial down the risk.

Still, the rate of interest on cash in investment accounts is so low that it is unlikely to be your best choice on even a short-term time horizon.

On a longer timescale it will cost you for sure.

So where should you be parking your cash for the longer-term?

Cash ISAs and savings accounts

You can get a much higher rate of interest with cash ISAs and standard savings than at your broker.

In an ideal world any strategic cash allocation – held say as part of a Permanent Portfolio-style plan – would be nestled inside a cash ISA, where it can grow unmolested by HMRC.

With interest rates now half-decent, beware that you won’t need a vast balance in a non-tax-sheltered saving account before you’ll be paying tax on interest.

Anyway, just don’t make the mistake of thinking you need cash in the same account as your shares or similar. Think holistically about your investing (and your net worth for that matter).

I do this via a master spreadsheet. It pulls together all my ‘pots’ and other assets – including my own home – via a bunch of dedicated sub-sheets.

Money market funds

If for some reason you don’t want to (or can’t) keep your portfolio’s long-term allocation to cash in a proper cash ISA, then money market funds may pay you a higher rate than your platform.

My co-blogger’s view is the teeny-tiny risk that comes with even the best of these funds – because they are funds, not cash – is not worth a slightly higher interest rate.

Read his comprehensive piece on money market funds to find out why.

I’m a little more sanguine. I wouldn’t keep all my cash in a money market fund (and my cash would only usually be a relatively small part of my portfolio, anyway) but I don’t think a toe in this pond will hurt in 99.99% of alternative histories. Legitimate money market funds almost never fail.

And even if something should go wrong, it’ll probably only cost you a delay in access or – worst case – a couple of percent in a very dire scenario. (I don’t think anything as bad as the latter has ever happened with a mainstream UK/US money market fund, for context.)

Still, there are risks. From market turbulence to incompetence to fraud and more.

Cash is cash and nothing else is cash.

Index-linked and conventional gilts

As I write you can earn more than 5% on a one-year gilt held to maturity.

That’s very hard to beat. There are tax advantages too if your cash is outside of a shelter.

Index-linked gilts pay a much higher real yield (because your 5% nominal on a vanilla gilt or cash in the bank is -4% in real terms with inflation at 9%). But they come with other complications.

Bonds have been terrible assets to own for the past couple of years. But over the long-term they’ve beaten cash on an annualized basis, and you’d expect them to do so in the future.

However even short-term conventional gilts are relatively volatile compared to cash.

Everything is volatile compared to cash!

So if you want your cash-like allocation to be unchanged day-to-day, then it has to be cash.

Other kinds of bond funds, and alternatives

Corporate bonds, high-yield bonds, REITs, absolute return hedge funds, infrastructure trusts…

…whatever bracket you want to include these in, they are not even close to cash.

Generally you should think of them as part of your equity allocation – not fixed income – when you think about your portfolio’s risk profile.

I won’t write more here because – yes – only cash is cash. These ‘cash proxies’ certainly aren’t.

How much interest on cash does your favourite broker pay?

To wrap up, you may have noticed that I have used the phrase ‘interest on cash in investment accounts’ several times in this article.

That’s because as mentioned we will eventually collate and update a table of rates for all the major brokers. And my SEO minions (um, that’s me and TA, armed with Google) have told us to put down a marker in advance, which we will revisit when we have all the data.

(This, incidentally, is also why you might feel like you’ve read the same story about your favourite 1990’s film star’s new spouse a dozen times. It’s a sorry side-effect of the modern Internet.)

Anyway, how about we crowdsource a few more brokers’ interest rates payable?

If you – whether as a user or an employee disguised as a user – can point me in the comments below to a URL that clearly lays out the interest on cash in investment accounts at a particular broker, then I will gratefully include it when we revise this post.

(Bonus marks if you can embarrass me by pointing to the rates at Lloyds…)

In the first instance we’ll add to the tables here. Later we can embed them on the broker comparison page.

Unfortunately the multitude of different tiers the brokers use mean it’ll probably be too much to ever expect a clear column making it easy to compare the different platforms’ rates.

Which, cynically, I expect is by design not accident.

Do you know the secret spot where your coy broker reveals what it pays in interest on cash in investment accounts? Let us know in the comments below.

- Also known as platform. They’re synonymous. [↩]

iWeb – 0% on ISA and GIA. One of their few disadvantages.

They definitely pay interest on the SIPP, possibly at AJBell rates, but I haven’t confirmed.

This is the page that is supposed to show Lloyds Interest Rates, but the link doesn’t open!

https://www.lloydsbank.com/investing/ways-to-invest/share-dealing-services/charges.html

It’s basically the same service as iWeb and Halifax, who don’t pay any interest on cash balances, so I’m guessing it’ll be the same (they both pay 2.65% on SIPPs)

https://www.iweb-sharedealing.co.uk/charges.html#:~:text=We%20do%20not%20pay%20interest,above%20held%20in%20the%20account.

https://www.halifax.co.uk/investing/start-investing/share-dealing-services/charges.html#:~:text=We%20do%20not%20pay%20interest,above%20held%20in%20the%20account.

Interactive Brokers pay 0% on the first £8k, then base -0.61% (so 4.39% currently) in GBP. Similar in other currencies

https://www.interactivebrokers.co.uk/en/accounts/fees/pricing-interest-rates.php

Thanks both. A URL would be great where possible so I can check the latest when we update — cheers! 🙂

Nice article! I have a different view on this:

“My co-blogger’s view is the teeny-tiny risk that comes with even the best of these funds – because they are funds, not cash – is not worth a slightly higher interest rate.”

IMO, checkings account or deposits are riskier and offer much less returns than Monetary Funds.

Banks will always offer less than the official interest rate. (As an example, I live in Spain, and as of today, checking accs and deposits are offered at 1-2% max). Monetary funds’ expected return is 3,5-4%. The main difference is that, with banks, you know with certainty what return you will get, whereas in a MF, it is uncertain, as it adapts to the current interest rate of the market.

Additionally, your money in a bank account is subject to credit risk, which in a Monetary Fund is diversified among many entities. There is a minimal amount “guaranteed” by the government (in Spain 100,000€), but everyone knows that, if shit hits the fan, this will not hold.

I consider Monetary Funds as a superior cash investment, both in terms of security and returns. As always, it is a good idea to diversify between several funds, and having some cash in a checking account.

Vanguard: currently 2.45% on all accounts.

https://www.vanguardinvestor.co.uk/need-help/answer/will-i-receive-interest-on-cash-held-in-my-account

Lloyds see 10.20 of T&C’s. No interest paid ,now where is the prize I could have won?

I have an ISA with Lloyds, and I can confirm they don’t pay interest on cash balances. However, I too can’t find anywhere confirming that! (I don’t a SIPP with them, so no info on that.)

@all

For comparison, I keep my portfolio cash in a Nationwide Loyalty Saver account, which is currently paying a gross interest rate of 3.5%.

Can’t find an info page to link to, but I currently have some ISA cash in a Lloyds account waiting for a transfer. Earning interest at 0%, unless it’s deposited annually (pretty sure that’ll be a nope).

Worse financial mistake I’ve made (of a great many) was going to cash in March 2008, after Bear Stearns, and finding was not psychologically equipped to buy back in as the markets recovered and ripped higher over and after 2009. Stuck earning effectively nil whilst sitting on sidelines. Eventually piled back into index tracking in early 2013, but cash cost me dear. Liquidity fetishism, as John Maynard Keynes called it. Worst is, I knew it was a mistake even as I did it. At least now there’s some yield to cash (but deeply negative in real terms). Personally, I’d now keep cash scaled to realistic rainy day requirements using separate savings, and have a small buffer in ISA/SIPP/GIA to meet platform fees and, if you’re inclined to active investment, as dry powder for opportunistic deployment.

1% interest on up to £2k cash for Freetrade’s ISA, plus you get the free dealing too. (3% on up to £4k on their Plus plan).

EDIT – link to their plans: https://freetrade.io/compare-plans

I’ve started to use HL Active savings. It’s pretty easy to get 4-6%. My spouse is a non tax payer so all the interest is tax free too. So far it seems very useful.

@Vespaboy @others — Thanks, URLs to the info appreciated. 😉

Fidelity are currently paying 2.75% for ISAs/GIAs and 3.25% for SIPPs.

https://www.fidelity.co.uk/statutory-and-regulatory-disclosures/how-we-manage-your-cash/

Interesting article in the FT today on this topic:

https://www.ft.com/content/1abacce1-e864-4ce6-b8d4-a61c151bd9ff

@John @others — Thanks for the info and the link! 🙂

No ISA or SIPPs and only technically a broker, but Wise are offering an instant access interest paying account, which is linked to SONIA short term money market fund. Advertised rate is 4.22% AER as they only publish the 30 day rate once a month, but the actual current rate/yield today is 4.59% net. Also allows switching to a stocks fund. Both funds are BlackRock.

As ever, investing platforms shouldn’t need to be forced to do things via regulations to be decent. This is a few numbers (at most) which should just be readily available with no effort to find. Why are these not easy to find?, we probably can make a few good guesses.

Interestingly however, HL did reduce my LISA platform fee to 0.25% from 0.45% out of the blue and I struggled to see any details of this on their website when I last checked for new investors, it seemed to only ever refer to ISA and SIPPs at 0.45%. So maybe the platforms are just a bit lazy with keeping hings like this up to date – I personally would have thought HL would be making a big thing about reducing their fees on LISAs. Yes, I know HL is a more expensive platform too than others, for my LISA, I am happy to pay their fees for the platform and service.

@ Leonard – interesting to hear how it looks from where you are and your thoughts on the likelihood of deposit guarantees holding.

Right now, a money market fund in the UK would earn around 4.92% based on the SONIA rate, but from that I need to subtract fund charges and platform fees.

I’ve got an easy access cash account that’s currently earning 4.18%, so probably 0.5% less than the money market fund after expenses.

Which makes sense because you are taking more risk with the MMF:

https://monevator.com/money-market-funds/

There are various attempts underway by regulators to make the money market sector more resilient after the experience of the pandemic – when the side-effects of the previous wave of reform (after the Global Financial Crisis) became apparent…

My bottom line is I want to minimise risk in my cash holdings. Money Market funds pay more because they take more risk. They’re not investing in cash.

This will be considered heresy, but hear me out.

At age 44, I have about 500k in my SIPP with HL.

I still contribute 40k into my employers pension at the moment with all the lovely tax relief, and do a periodic partial transfer to the SIPP. I’m not going to up it further as can’t afford to yet (need some money in the here and now!)

So with HL now offering 4% (on above 100k, but still some on the first hundred), that could be another 20k per year ‘risk free’ (ahem, forget inflation).

So if rates stay at this level or go up I can do absolutely nothing and still get over the old LTA by the time I’m allowed to access my SIPP (58). And the amount I get in interest will only increase as the fund grows.

I mean, yes, maybe £1.2m or so will be nothing in 12 years, but it’s a tempting way to simplify my life. I might just go 50/50 with a global tracker like vwrl and forget bothering with anything else.

Here’s the link to the Lloyds T&C (as @Vespaboy said, no interest on cash, per term 10.20 on page 18): https://www.lloydsbank.com/assets/media/pdfs/investments/direct-investments/terms_conditionsjan2023.pdf

I don’t think you can be expected to blush over missing that!

(£1.50 commission to get cash in and out of a money market fund, so I personally don’t get too worked up by the lack of interest.)

Good post but not fully comprehensive!*

There are a number of new online.(or app only) brokers who give decent returns on cash.

(They tend to have referral programmes too btw)

The beauty of these is that you can open an account & deposit cash and start earning interest in minutes!

I’m getting 4.25% on one,.interest paid monthly to boot!

And if I need the money, I can have it back in my account in minutes.

It beats the old school alternatives of 3-5 working days. I don’t hold much cash but I’m doing much better with what used to be stranded pots of a few depreciating pounds.

The £1,000 savings allowance is getting swallowed up fast!

*the way rates are moving, it would be a full time side hustle just keeping up with who is offering what.

AJ Bell pages

For cash in broking account https://www.ajbell.co.uk/sipp/charges-and-rates

above £10k, 3.45%

up to £10k, 2.95%

For specific savings rates is here: https://www.ajbell.co.uk/cash-savings#list

These are

a) Fixed term – shortest currently is 6 month at 5.3% AER, and

b) Notice – shortest is 30 days notice at 3.75%

HL has a weird setup with cash management accounts for the SIPP / ISA.

With HL cash from dividends in the ISA / SIPP gets paid into the “Income Account ” for each. Every month they transfer it into the “Capital Account” from where it can be reinvested, or you can do it yourself on demand. As far as I can tell interest is only calculated on the Capital Account, so if allowing dividends to accrue for some months before reinvesting it is worth moving the money to the Capital Account as soon as dividends are paid.

Also HL does not seem to pay interest on the “Loyalty Account” which is where cash-back incentives are paid if you do a transfer-in and they are offering that.

@All – for those using HL Active Savings (“AS”) Hub as a short term cash holding facility before investing, and selecting no penalty unlimited no notice withdrawal options; check that you haven’t put it into the Rate Saver via Metro Bank option (5.06% p.a.). You can read the headlines today (reported talks with Treasury and PRA, Metro share price crashing – all a bit 2007/8ish for my liking). I’ve just pulled out some spare cash from there (which was awaiting investment into GIA for potential ILG purchase). Now going with Coventry BS via HL AS (5.08% p.a., with 3 penalty free no notice withdrawals p.a.)

Trading212 now paying 5.2% p.a. using overnight money market funds.