What caught my eye this week.

You know the big things you grapple with as a kid – where does space end, what happened to your hamster when he went to sleep and never woke up, and why would anyone ever kiss anyone ever EVER yuck?

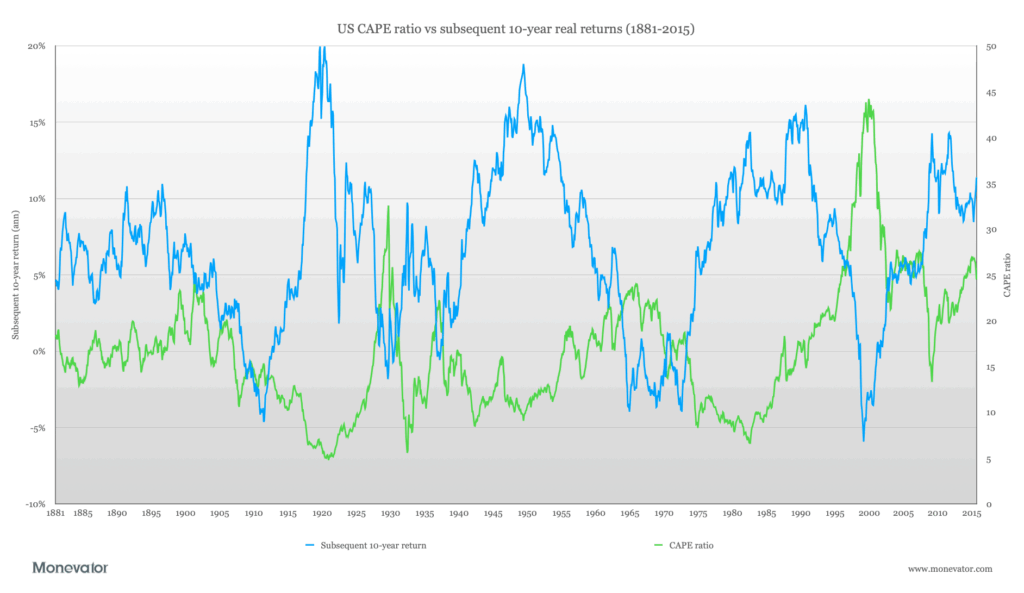

Well I find the graph below from asset manager GMO similarly perplexing.

GMO has charted the valuation of energy and mining stocks compared to the S&P 500. The graphic shows that the relative valuation of such stocks is at an historic low:

Just look at that thing! It’s enough to make abandon passive investing, fire up Freetrade, and get to work being contrarian, right? 1

Before you do: a moment.

GMO puts forward resource equities as a value opportunity and inflation hedge, but of course there are two ways for such extreme divergences to be corrected.

And watching your diehard gold/oil/mining bug mate getting rich when such shares soar is by far the least painful.

Because this is a comparative chart, and the other way for the ratio to return towards its average is for the wider S&P 500 to plunge in price.

Which today mostly means a tech crash.

Yet technology shares are expensive for a reason. We’re living in a 90% economy world where millions of our fellow citizens are afraid to even leave their homes. Each day tech wins more long-term mind-share and revenues at a rate not seen in the previous 100 years.

Or maybe not – not sustainably, anyway?

Ponder, ponder, ponder.

Have a great weekend!

From Monevator

Stocks and shares ISAs: everything you need to know – Monevator

Put 150 years into your retirement calculator and smoke it – Monevator

From the archive-ator: Day three in the Big Brexit House – Monevator

News

Note: Some links are Google search results – in PC/desktop view you can click to read the piece without being a paid subscriber. Try privacy/incognito mode to avoid cookies. Consider subscribing if you read them a lot! 2

UK economy continued to recover in July – BBC

House prices soar to record highs, despite Covid-19 – Guardian

Pension freedoms age to rise to 57: how could it impact you? Which

Record gold prices create insurance headaches for vault keepers – MSN

Silicon Valley’s new stock exchange is open for business – Protocol

Government bond yields have already given us so much – GMO

Products and services

Post Office and AA credit card accounts transferred to Norwegian company – Guardian

Starling Bank implements negative rates for high balance Euro accounts – ThisIsMoney

Tandem and Asda cashback credit cards close: what are the alternatives? – Which

Sign-up to Freetrade via my link and we can both get a free share worth between £3 and £200 – Freetrade

New rules introduced for shared ownership schemes – ThisIsMoney

Roboadvisers make slow progress gaining ground with investors [Search result] – FT

1,200-year old Anglo-Saxon coin could sell for £80,000 – ThisIsMoney

Homes for sale with an orchard [Gallery] – Guardian

Comment and opinion

Save like a pessimist, invest like an optimist – Morgan Housel

More: Q&A with Morgan Housel – Part 1 and Part 2 at Abnormal Returns

Do you really need to buy a property right now? [Search result] – FT

Business – Indeedably

Is China the closest thing to investing normality right now? [Search result] – FT

An endless responsibility – The Reformed Broker

Terry Smith can’t market time. You think you can? – Evidence-based Investor

#1 money lessons from Morningstar’s long-time staffers – Morningstar

Upside-down markets: profits, inflation, and equity valuation in fiscal policy regimes [Nerdy] – OSAM

Naughty corner: Active antics

Watch out for wide divergences between growth and value – Verdad

China investment trusts come of age – IT Investor

How Reddit’s option traders started a snowball that pushed tech stocks higher – Bloomberg via MSN

More: The option-fueled crowded trade in large cap tech – The Aleph blog

Selling Xaar: Why heavy R&D and high cyclicality are not a good mix – UK Value Investor

Now Buffett’s Berkshire Hathaway is buying a tech IPO – MarketWatch

“Tech = unoriginal, lazy, consensus, etc” – Investing brosef [h/t Abnormal Returns]

Hedge funds are feeling bullish… about themselves – Institutional Investor

Politics and the pandemic

UK’s new lockdown limits could knock V-shaped recovery for six – ThisIsMoney

Sweden claims ‘vindication’ over anti-lockdown policy as Covid cases hit new low – The Week

More: Anders Tegnell and the Swedish Covid experiment [Free read] – FT

They never officially had Covid. Months later they’re living in hell – Wired

Could wearing a mask help foster low-dose Covid-19 immunity? – PopSci

What’s changed? – Barry Ritholz

Brexit: EU ultimatum to UK over withdrawal deal changes – BBC

UK [at last] signs its first major post-Brexit trade deal, with Japan – BBC

Kindle book bargains

How Innovation Works by Matt Ridley – £1.99 on Kindle

The Deficit Myth: Modern Monetary Theory by Stephanie Kelton – £0.99 on Kindle

How to Get Rich by Felix Dennis – £0.99 on Kindle

Bitcoin Billionaires: A True Story of Genius, Betrayal and Redemption by Ben Mezrich – £0.99 on Kindle

Off our beat

The WEIRDest people in the world – The Atlantic

New Zealand’s ‘brain gain’ boost – BBC

UK mathematician wins richest prize in academia – Guardian

Life after 2020: finding the track – Haystack

Why we all need philosophy [Very long] – Mark Manson

The little cards that tell US police to go easy on the bearer [Couple of weeks old; unbelievable] – Vice

And finally…

“To get why investors sell out at the bottom of a bear market you don’t need to study the math of expected future returns; you need to think about the agony of looking at your family and wondering if your investments are imperiling their future.”

– Morgan Housel, The Psychology of Money

Like these links? Subscribe to get them every Friday!

- Note: That’s an affiliate link to Freetrade. Sign up and we both get a free share.[↩]

- Note some articles can only be accessed through the search results if you’re using PC/desktop view (from mobile/tablet view they bring up the firewall/subscription page). To circumvent, switch your mobile browser to use the desktop view. On Chrome for Android: press the menu button followed by “Request Desktop Site”.[↩]

Comments on this entry are closed.

“Tech” can’t be a safe bet anymore than banks or oil were at some stage. And many of the companies that are valued as “tech” today are no more so than the many that died during the dot-com boom 20 years ago.

Surely there are 4 ways for that ratio to revert back towards the mean; 2 you already mentioned in the price of S&P and price of E&M. The other two are the earnings of S&P and earnings of E&M. The ratio is presumably of two ratios (P/E) itself so the graph can be broken down into [ P(E&M) / E(E&M) ] / [ P(S&P) / E(E&M) ].

Which means that the ratio can also revert if the earnings of S&P go up or earnings of E&M go down. Relative to what is assumed in the earnings in the calculation of course.

Lumping energy and mining together doesn’t make a lot of sense. That index has dropped because energy stocks (oil and gas) have collapsed and I am guessing that they make up most of the weight in that index. Mining stocks have been booming. I work in the industry and I am surrounded by newly minted millionaires and people who have paid off their mortgages because the price of some local companies have gone up by 1000% over the few years since the nadir in 2015.

As someone exposed to the declining energy/mining/oil economy with my work- I can tell you that no matter how bad some parts of the economy are, it’s worse for my cohort.

I’ve been saving for the last 15 years for FI/FU – no stress for me but there are thousands of people who are used to spending lots but are now going broke.

Growth/value is one thing with the market and share prices but it’s a disaster for anyone involved in the industry.

Day three in the Big Brexit House – In case you missed the headline in the ‘I’ regarding the Internal Market Bill – “Britannia waives the rules”.

With regards to the main article, I am just wondering what practical impact this analysis should have on our portfolios. The main drive of the article is that the 60/40 portfolio (and other similar asset allocations) are now inherently more risky. This is due to a decrease in interest on the bond element of the allocation, and due to the reduction in the hedging effectiveness of bonds in a depression, as rates are already near zero, and cannot really be reduced any further. Meaning that bonds may now provide less diversification benefit in an equity crash. All this implying that the 60/40 portfolio produces less return, and is subject to a larger drawdowns in market crashes.

So does this mean that we should be considering a steeper glidepath for our asset allocations, assuming we do not decide to adopt on any of the “alternatives” to bonds mentioned in the article?

I’m assuming that accumulators would want to increase their chances of a decent return, and hence will increase their equity allocations. De-accumulators will then want to decrease the riskiness of their portfolio, and will hence decrease their equity allocation in a low interest rate environment.

Myself, I’m currently contemplating switching from an 80/20 strategy, to a 100% strategy, but with an increased emergency fund (perhaps invested in premium bonds or the like). Just wondering how others have adjusted there portfolios, if at all, for the drop in interest rates to near zero. Thanks

The F.T. China article is interesting, but offset and tempered well by the Atlantic’s piece on Henrich and his “WEIRD” theories. We are very different societies.The latter (Atlantic piece) makes me wonder if the breech of trust that our government has just committed over the Brexit deal might just bite us on the bum more than the government has allowed for in the worst case.

JimJim

@Flying Scotsman – regarding the GMO article, I think the suggestion is really that 60/40 portfolio owners (I’m one of them also) need to look more closely at what they wanted out of (gov) bonds and try and find some other way, as the traditional role is no more (and this isn’t going to change anytime soon). Right now, 60/40 has both higher risk and less return than in the past (5, 10+ years back). One way is to go more into equities (I’ve done the same as you) but that’s just taking on more risk in the hope of more return (I am eyes open and can afford this) and isn’t what the GMO article recommends. It doesn’t help with portfolio hedging.

To me, it all boils down to risk/return and accepting 60/40 isn’t going to meet its long term historical returns for the foreseeable – and if you want/need those returns, you need to find another way (hard). Maybe it will revert one day, but that day might be after I’m dead/need my investments. There is a race to the bottom (mostly reached) on yields, which means govt bonds aren’t working properly anymore in any portfolio that needs them for returns or hedging. Neither will rates rise (much or fast) because that would crush the market. To me, this is a problem far more depressing that COVID but it’s also been going on a lot longer.

The implication for me seems to be that it is currently much harder to see passive investing in the same light.

With Tech (or rather 5 tech stocks) being >20% of the S&P 500, many of the US and developed world index trackers funds are of course now far less diversified also. That means that even the “brain-off” life and retirement at xx years type funds are in reality heavily skewed towards 5 companies.

For example the Lifestrategy 80% fund has over 40% of its equities in three Vanguard funds (Dev World ex-UK, US equities, and an S&P 500 ETF) which all have ~20% of their holdings in just 5 US tech. companies).

OK – that’s perhaps stating the bleedin’ obvious, but I wonder if there’s an argument for a current need to use more underlying funds to get better sectoral and global exposure. Haven’t quite reconciled that one in my head.

The contrarian (and I appreciate non-passive) view for me has been to mostly get out of the US (and therefore tech) for now. Just feels too much like I’ve unwittingly been sucked into a very non-passive high risk bubble.

Nice off beat Vice article.

Easy to sneer over the pond at the “get out of jail” police cards carried by some err..lucky US citizens. Of course here in the UK we had the Police Widows org badges that did pretty much the same thing for minor infringements. Anecdotally I know two cases from a few years ago. Not sure if that still continues but suspect it does for trivial matters. And if that wasn’t enough you can always offer to shake a police officer’s hand or roll your trouser leg up although I’d like to think that ceased when Kenneth Noye tried it on even when on camera.

Personally I’m more worried about the effect of deglobalisation on equity and bond prices than how much of my passive portfolio is FANG on any given day

The market has survived the decline of a lot of formerly huge companies eg GE, Kodak, GM

My passive investments are holding their own just fine fully recovered from the downturn with a few extra thousands in hand

As a 75 year old seen 3 or 4 of these so called Armageddon moments where it’s different this time!

Economic forecasters do seem to be just one step up from shamans-mostly wrong!

My Vanguard Global Bond Index Tracker Fund hedged to the Pound (VIGBBD) is 4.15% YTD and has produced 4.5% pa over the last 10 years

My bond fund is 65% of my portfolio as I have made my pile and am a conservative voter and 18 years retired

In moments like these everyone looks for new ways

I haven’t found a substitute for bonds yet that isn’t pure gambling-not the way I run my savings!

I keep looking but currently holding on -doing nothing and “enjoying “ (-not the right word!)-the ride

xxd09

The Matt Ridley book comes up as £1.99 for me. Was relieved, because that’s what I bought it for last week! (so hate it when prices drop after I buy).

Is Amazon offering different pricing depending on customer?

@ Flying Scotsman – allowing my allocation to equities to head up from 60% but 100% would be too risky for me. More convinced than ever that a vanilla 4% SWR won’t cut it. 3% safer but there are alternatives.

I’ve like GMO thought pieces. I’d agree that low bond yields mean lower returns for higher risk in conventional portfolios. My benchmark targeted inflation+4%, post tax (8-10% nominal pre-tax), with a 5-6% volatility budget. Neutral was 25% government bonds (long-duration nominal, no linkers), 10% EM bonds, 25% equities (big US/Nasdaq tilt), 25% alternatives (hedge funds, infrastructure, PE), 10% property, 5% Cash/Gold, symmetric FX benchmark. Think ‘Permanent Portfolio gone seriously off piste’. Over two decades, it’s delivered about 9% passively (active hedging takes it somewhat higher).

I was already moving toward the idea that inflation+2% is a more realistic passive return target. I’m not sure COVID changes anything at a macro level. Rather it brings forward a few themes (tech dominance) and delays others (wage inflation pressure). While, long-term, real yields go ever more negative (don’t fight multi-century trends!), we are due the mean-reversion you get every few decades. Similarly, there was wage inflation pressure building with Chinese labour supply going negative in 2022. COVID kicks that into touch but I still think, medium-term, demographic pressures could offset deflationary automation. A rotation from monetary dominance to fiscal dominance is now possible. So at this point I’m an ex-bond bull. The problem is I don’t really believe G10 equities generate great returns or EM is a saviour given globalisation went into reverse from 2012.

So I’ve upped my passive equity benchmark 10% to 35% (still US tech tilted), reduced govt bonds by 15% to 10% (long-duration but with linkers), halved EM bonds to 5%, increased alts by 5% to 30% (hedge funds) and added 5% to gold/cash. I view this as volatility neutral but returns expectations drop about 2%/annum. With a lower bond allocation, risk-hedging and diversification is now provided by hedge funds which are all long convexity/risk-off in character. But I was never a 60/40 passive purist.

@159F. Oh yes. In London, a black rat windscreen sticker was once the thing. Although the pudding could be over egged by having a black rat with “ecilop” under it.

But those days are largely gone because enforcement is automated by camera and run by local authorities.

Freemasonry membership in general has fallen. But one knowledgeable copper explained that if you smile. Be polite and laugh at the officers witticisms then you can have a better than average chance of getting words of advice.

As for Police Widows/NARPO/International Police Association/Federation badges. Wearers are showing out to everyone. Not always a good thing.

@Flying Scotsman I am wrestling with this bonds issue as well and have been for the last 5 years. I compared the return of Vanguard LS60 and LS100 on Trustnet over various time periods from 1 month to 5 years including the Covid19 crash up to 12/9/2020. The only time period where LS60 was ahead of LS100 was the one year time frame and then not by much. Bear in mind that Vanguard will have done regular rebalancing through the crash – not sure everyone would do that if holding discrete equity and bond funds. Even on the one year time frame the LS60 was only marginally ahead of LS100.

So I think that 100% equities and a cash cushion long enough to avoid selling during a crash is a valid approach, especially for people in the wealth creation phase. If the GMO article is saying that Bonds will be even less useful in future, that adds to the argument.

There was a recent article by TA on this explaining how well bonds had worked in 2020, but I don’t think it told the whole story. Over the last 5 years LS100 is 35% higher than LS60. If you are in the accumulation phase can you really afford this bond comfort blanket?

@ Barn Owl – You don’t hold bonds because you expect them to outperform equities over time. You hold them so you don’t panic and sell when stock markets crash. Or endure years of misery wondering what happened when your 100% equities portfolio falls by 30% but this time it takes several years to break even. Those are outcomes I can’t afford.

@ ZX – what are your selection criteria for hedge funds?

@BarnOwl. Regarding cash and equities I remember reading an article comparing the 60/40 equity / bond with 75/25 equity/cash . Over 10 year periods going back over 50 odd years the results were very similar with a small increase in volatility in the 75/25 portfolio.

@TA I completely understand that. But I have been well trained not to panic during a crash by this excellent blog (amongst others). When it came to it earlier this year I did not come close to selling equities. I recall there was a Vanguard? study that said not many private investors did. It comes down to risk tolerance and to your financial position. What may be right for you may not be right for everyone.

One thought that has occured to me is perhaps equities (as a whole) are not as risky as they used to be. Everytime a crisis hits where you expect your portfolio to drop 30%+ for a sustained period, central banks turn on the taps and bang assets go above where they were before the crisis in a matter of weeks/months. Maybe bonds and cash are being held by those who are living in the old paradigm of risk, and they are now much more risk averse position than they think. Maybe this time, it really is different….

@TA. It’s like picking stocks. Over the last 30 years, 5% of S&P stocks have generated 85% of the returns. 55%+ lost you money. HFs are no different. Wheat from chaff.

My criteria are best represented by an example you may have heard of. I’ve owned the Brevan Howard Master Fund (BHMF) since 2007. The fund focuses on macro, fx, and rates: mostly yield curve trading with long volatility bias. No credit or equities. Importantly, it’s doesn’t overlap with conventional assets. It’s available as the IT BH Macro (BHM) though I own it direct via it’s Cayman entity (saves a bit on fees). I’ll use BHM data in the following to be conservative.

In USD return terms, since 2007, BHMF has generated 9.35%/annum for a total return of 350%. That compares to the S&P total return at 5.69%/annum over the same period for a total return of about 213%. Both clearly return more in GBP terms but that’s just GBP/USD falling so I’ll ignore that.

It happened to outperform the S&P but that’s not the point. The value for me is when it performed. The BHMF return volatility is 8.59%/annum on monthly basis but 8.55% on an annual basis. Compare that with say the S&P which has 13.81% on a monthly basis but 17.69% on a yearly basis. So BHFM not only has only 50-60% of the volatility but it also shows good mean-reversion of volatility. There is no tendency for one up/down month to be followed by another and another.

BHMF’s worst down year was 2017 when it lost 1.42% (S&P was up 20%). In fact, in the period 2012-17 it made on average just 2%/annum when the S&P made 16%/annum. It’s best year included 2008, 2018, 2020, when it made 14-22%/annum (S&P lost 9.4%/annum). BHMF’s average monthly return correlation with the S&P is a whopping -40% (-45% on an annual basis).

These are exactly the properties I want. Much higher negative correlation than conventional assets, so it’s a genuine diversifier. It offers risk-hedging since it can make outsize returns in periods of stress (+18% in Mar 20). Cyclically it makes more at the start and end of cycles than mid cycle since it’s a long volatility strategy. Yes, it can have long periods when it only makes a few percent but that typically coincides with low volatility periods where conventional “carry” assets do well.

Compare it not with equities but bonds, gold or cash. Cashs earn less than zero, Gold zero in real terms. Short duration bonds don’t make a dent in a risk-off event and have a negative real yield. Long-duration bonds are a great risk-off hedge but they could lose as much as equities in risk-on periods. Funds like BHFM are a good replacement. A few percent per year in the good times and some bang when everything else goes south.

Finally: this is not a recommendation!

@ ZX – So I should be 100% in BHMF? Gotcha! OK, not really. I hear you on “this is not a recommendation.” It’s interesting to read your thought process and understand more about what’s out there if you have the skill to sort the wheat from the chaff.

@ Richard – now that’s a thought from the Dark Side. Highly seductive. A pattern forming, something we’d all like to believe. But then if equities are not as risky as they used to be then they’re unlikely to be as rewarding either.

@ZX. Well you make a very convincing case to include some active funds in the fixed income space going forward. The hard bit is finding a bunch that give satisfactory results.

I had a couple of the Brevan Howard macro hedge funds in my mix for a couple of years and sold them what they did circa nothing. Which I 100% get isn’t the point, and understood then, too! But I do think it’s harder to hold active funds going through a dry spell then say government bonds doing nothing. The danger is the active fund has lost the plot. (Which was the BH narrative of I remember correctly — that their black box wasn’t working with protracted low rates or some similar fear.)

Which isn’t to say they are a bad hold — indeed I’m thinking I might re-up again. More a point of conversation (and a ‘well done‘ for sticking with them!)

@The Investor – those of us without @ ZX’s expertise might be well advised to familiarise (or remind) themselves of Uncle Warren’s bet with the hedge fund. Unless one understands exactly what one is getting into, and why, they’ve always seemed best left to the experts.

An alternative, and generally overlooked, strategy is to look inside one’s own budget and see what costs might be trimmed there. It doesn’t take much effort to find a few percent, it’s within one’s control and anyone who has ambitions to FI anytime soon will find something. One can then abandon the temptation to drift into areas of the market one might not quite understand, or glibly ratchet up the risk, in the knowledge that one can subsist quite happily with lower expected returns. Abandoning return maximisation is (moderately) liberating.

@TA – indeed. Interestingly nearly everything I read is telling me to expect lower stock returns in the future. So perhaps stocks are moving down the risk / return spectrum. The very action that prevents a crash also prevents growth due to debt / austerity / zombie companies etc. No more boom and bust – those famous last words….

Our understanding of risk is perhaps already outdated. We will look back and realise 60:40 is now far to conservative for the average accumulator. But where to go beyond the stock market to try and generate returns for reasonable risk? What about car parks, care homes, leasing cars and other schemes that promise 11% returns. My journey to the dark side is nearly complete (and no, don’t invest in these ‘schemes’).

There are good reasons for the price of energy and mining stocks compared to be so out of line with much of history. The energy markets are going through unprecedented change and there is considerable uncertainty as to the value that can be obtained from the hydrocarbon assets they are sitting on. Metal, etc. miners perhaps less so, but there must be uncertainty about China’s future appetite.

There is always an element of talking their own book when it comes to the likes of GMO, but on the whole I thought their article was quite good. I reached the same conclusions on government bonds a few months ago and sold the lot, moving from a long held 60:40 portfolio to something similar to a Warren Buffett style 90:10 fund. World market instead of S&P 500, cash instead of bills/short dated bonds and adjustments to allow for higher expected short term expenditure, assumed 70% net withdrawal rate from our SIPPs, etc, but basically Warren Buffett 90:10.

I agree with GMO that there aren’t really any alternatives to government bonds, but disagree about cash. Fund managers never have a good word to say about cash for obvious reasons. As for some of the other suggestions, they are not something I can access without paying fat fees to someone like GMO. After the fat fees have been leached off (come what may), it is unlikely to be much benefit left for me (even assuming there was in the first place), so no thank you.

The one area I might have some time for is value investing, and I respect GMO’s honesty in admitting they have been getting this wrong for quite a few years. There is good evidence for the value factor and the spread between growth and value is extreme right now, but again it is a matter of whether value investing is worthwhile for me after paying additional fees and costs. I have though found a few value ETFs though that do not appear to be complete rip offs.

As the GMO article has brought the discussion back to the the inevitable bonds / allocation question can I ask what the community does (if anything) about looking at portfolio allocation from a whole household perspective?

We’ve been looking at consolidating a ragtag of 5 old occupational schemes one of us has acquired. But in total they are only about a 1/6 of the total. Therefore any “not equities” allocation doesn’t really move the overall balance of the portfolio at all. And therefore keep it simple in a global equities fund (and accepting all the issues that come with that).

Looking at this from the other end. I’ve wondered if people diversify across their household in terms of funds and approaches?

I think psychologically it’s very difficult to “zoom out” and consider the whole pot when you practically have these discrete portfolios in different accounts. And for another post there is the issue of the extra pressure of advising your partner on their hard earned vs managing your own!

(Thanks for another good thread – esp @ZX for that window into the world of hedge funds and @xxdo9 for continued sharing of managing all this at the sharp end of the spending phase!)

@ Andy J – that’s an interesting question. I invest on Mrs Accumulator’s behalf because she has no interest. Therefore I’ve never taken her risk tolerance into account but I would do so if I knew she was checking her portfolio, or our finances weren’t shared.

I treated our accounts as a ‘whole pot’ and we ended up with asymmetric portfolios because different / cheaper versions of funds were accessible to each of us. Now I wish I’d created mirror-image portfolios because we’ll be tapping into them at the same time and they are for the same objective – to support us in retirement. I now see how differences between them could affect tax planning in the future. You might also want to manage things differently if one of you is in danger of breaching the lifetime allowance. I did make sure there are enough bonds in each of our accounts. I wanted to make sure that we could both go a good few years without selling equities in the event of a savage bear market.

Thanks @ZX for the percentage breakdown and example of one of your alternative investments, that’s very helpful in improving my understanding. Along with the GMO article it has prompted me to undertake a review of the ‘fix and forget’ portion of my investments; its been a few years since I last looked closely at the portfolio.

I’m currently holding 2% cash, which is around 4 years total household expenditure. Property is 5% (excluding my own homes), 7% EM Bonds, 5% US Treasury and 18% Global bonds. The rest is in various forms of equity, including 4% mining shares and 4% Global Value (VVAL).

@Andy J – I helped my wife set up her portion of investments on a very simple ‘fix and forget’ basis mainly using Vanguard LifeStrategy. It avoids the hassle of having to re-educate her if things needed to be re-balanced. So yes, we do diversify across different platforms and investment types. As for zooming out to look at our investments on a consolidated basis I can’t do that without her help, but I’m pretty sure her allocation will be 60% Equity, so in light of the current discussion I might need to scale back the bonds and look to alternatives.

@TA @Passive Pete – thanks for replying. TA I think your points about tax and timing are bang on. And ultimately needs to include the ultimate timing question of longevity. I need to do some more checking on IHT. And yes there is some LTA planning going on here too. I’ve begun to read the Michael McLung book to get further ideas on how to manage the next stage so that is a factor too.

Interesting to hear how people approach it – as ever there are obviously pros and cons of the standardise / diversify approach. Can be hard to pull the trigger on alternatives when you think you’ve already hit the right combo of platform, funds etc tho.

Does anyone see anything wrong in holding 90/10 bonds/equities portfolio? Considering I am 40 planning to retire at 55 I must be a real chicken s**** with such allocation. I do want to move into more equities but waiting for that second deep or at least some (historically more often happening) 10% correction in equities. Meanwhile I have a FOMO sitting on my bonds as equities only go up since last crash. So yes, I am guilty of timing the market I guess. I am doing all this because I do not want to expose my savings to dive significantly at the very beginning of my investing journey. Just want to have a good start and after that I am ready for eternal passive discipline of never selling. But to experience market crash at the very beginning of investing is scary. I am worried it might put me off investing for good and this is something I will not let to happen.

@Andy J, I always treated our various investment accounts as one big portfolio, allocated 60:40 equity bonds. Within that, I tried the best I could to optimise where things went to minimise tax. For example our SIPPs are very overweight US listed ETFs as we can receive dividends without any holding taxes that way, but we are underweight US shares in our ISAs and unsheltered investment accounts.

I found McLung’s book very thought provoking. We are not following it, but I found reading it very helpful in forming our new drawdown strategy.

@Peter, you have not really given enough detail on your circumstances, but from what I have read, having only 10% in equities at 55 is historically not optimal if your drawdown rate is going to be about 3%. Below 50% equities, your risk of running out of money rises as you reduce the equity allocation.

You need an investment plan. Once you have one of those just follow it and don’t pay any attention to the ups and downs of the market. Buy, hold, rebalance once a year if your chosen asset allocation gets too far out of line. Forget trying to time the market as this is impossible, except by pure luck.

@ Peter – this piece may help with some ideas to move more gradually into equities:

https://monevator.com/lump-sum-investing-versus-drip-feeding

@Naeclue @TA thanks for replying. Before I took a plunge into investing of my hardly earned money, I did a massive amount of research (including reading this incredible blog). I got into investing subject about 2 years ago. Over time it became a hobby and by now it has probably transitioned into sort of mini obsession. So you can imagine I do have some knowledge in investing field. I know for example that on average DCA is not as profitable as investing a lump sum and that you need investment plan(I got one), etc. So theory is not a problem. Emotions are. Fear of loosing my own hardly earned money at the very beginning of investment journey is huge in my case. Chance why I have so defensive portfolio. So it looks like fear stands in a way to do the right thing. And I don’t know how to overcome this. I keep thinking of gradual rebalancing towards equities (I like to call it DCA rebalancing) as a potential solution. But now the question is how often and how much so I can still have a good sleep. Not easy to calculate something which is strictly tied to your own character. Extraordinary uncertainty surrounding current times also does not help in making decision towards equities.

Peter-well done in fessing up your problem

I really only started seriously investing at 40

Now 75 retired 18 years

Passive investing was my saviour-the books of John Bogle especially

Made my pile and am now 30/65/5 -equities/bonds/cash

You have to invest in equities to get growth -no way round that

A rough John Bogle guide for your portfolio is your age minus 10 in bonds-your case 30% at least

At 40 you have many investing years ahead with more downturns like this one

You must have a Asset Allocation you can live with through downturns and not panic and sell

Historically 60/40 equities bonds performed as well as 40/60 equities bonds-so you are not really taking big gambles

However this only applies if you are using Global Index Tracker Funds-Equities and Bonds

More reading needed to give yourself confidence

Lars Kroijer website and book-Investing Demystified is good

You can make it with a 10/90 equities bonds but it will be harder,take longer etc etc but you must have the self confidence in your chosen asset allocation to “stay the course” in bad times-very personal

xxd09

@Paul, good luck, I think all of us learning from Monevator take a little while to plan our own course. But the thing to remember is that there is no “perfect” investment strategy unless you are lucky – and you cannot plan for luck. You just need to find an approach you are happy with in terms of likely gain and risk.

In my case, I decided having too high a proportion of bonds carries risk, as well as too much equity. So although it fluctuates a bit, my wife and I don’t go a huge way off 50:50. Mind you our cautiousness (at the thought of having to fill in tax forms as much as anything) means we only invest our ISA allowances each year and are currently overweight in cash following an inheritance, so you could argue we have low equity risk. And even though pound cost averaging has been shown to perform less well historically, I decided to do it on the basis that if I am only investing a part of our annual allowance I find it easy to ignore the state of the markets, wheras if I were to invest all at once I would get stressed about pressing the button.

Obviously, the talk is all about expected yields being lower in the future. But we can only function in the world as it is, and as long as our funds do OK for what they are we aren’t going to add risk to chase further returns. But then we are in the fortunate position of having a floor DB pension income, so there isn’t a specific yield needed for our plans.

But that’s us. By the sound of it you are developing your own approach.

@zx re lockdown and working. Newsflash – we are not all the same! I absolutely need personal contact and connection with others, on a regular basis – and that means more than just the three people in my household, dear though they are to me.

Also, re work. I don’t particularly miss my job or the work, even though it was interesting, varied, fairly autonomous and socially worthwhile (in my opinion). I certainly wouldn’t last five minutes in a job like yours. However, I also think it takes more than a summer to work out whether just mooching around and decluttering would be enough to fill decades. For me, I think not, although I’ve only recently started to feel frustrated/stagnant, and I do think a lot of that is due to the loss of choices due to the pandemic restrictions. I’ve never been much of a potterer or very keen on domestic chores. I also have a bit of a problematic work ethic/social conscience which means I feel a need to be contributing to society in some way, which shaped my career choices as well. That need hasn’t gone away, so I guess better find out how to fulfil it…