What caught my eye this week.

The markets are throwing in the towel on the notion of ‘transitory’ inflation, or at least transitory US inflation. The US consumer price index just jumped 6.2% – the most since 1990 – and alternative measures that strip out everything that Americans actually want to buy show rising prices, too.

Some holdouts believe this is an American issue. They finger more generous fiscal stimulus in the US. Europe and Asia might yet avoid surging prices, they suggest. But that doesn’t seem likely to me.

Prices are already up in the UK and inflationary Brexit impacts – border friction and staffing shortages – are piling on top of the global trend.

More generally, Covid and waves of economic shutdowns happened globally. Those disruptions are what’s causing rising prices.

The best case – which I still haven’t totally given up on – is that inflation should ease as we get past the worst of Covid. Some price rises may even reverse as deflationary forces prevail again.

However I’m coming around to the view that higher prices may persist.

And that’s mainly because they are already persisting!

The more we see rising prices, the more companies and consumers expect more of the same. Companies will increase prices where they can. We’ll try to get pay rises to keep up.

That in a nutshell, is what they call spiraling inflation.

We best hope it doesn’t get out of hand.

Keep on keeping on

Should Central Banks be quicker to raise rates in response to rising prices? The US bond market has been mildly roiled recently by fast-shifting calculations concerning exactly that.

I’m not convinced the boss bankers should hurry, however.

Let’s think about why we have these rising prices today.

Back at the beginning of Covid consciousness – late February to March 2020 – there was no consensus as to how nations should or would tackle the threat.

As long-time readers may remember, I was wary of mandating blanket economic shutdowns. True, that had seemingly done the trick in China. But China had only needed to totally switch off one province, and I feared the consequences of shuttering countries. I wondered if Westerners would even submit to such mandates. And if they did, there would be a big sudden hit to GDP – as well as some lasting economic damage (or ‘scarring’).

As it became clear a second wave of Covid was coming in the UK by late summer 2020, I gave up my side hustle as a freelance epidemiologist. It was clear I’d misread some of the early data. Moreover the experts were right – Covid would be with us for a time. No use in wishful thinking.

Nevertheless, that time looked truncated when the vaccines arrived in Autumn 2020. Especially when their efficacy data was better than anyone expected.

Since then though the vaccine picture has got murkier. Vaccines have done a great job preventing death and reducing hospitalization. But – perhaps because of the emergence of the delta variant – they have done less well curbing transmission. Worse, more than 100 people are still dying of coronavirus every day in the UK. That includes plenty of unvaccinated. The picture is similar the world over. This all has consequences for our economies, and hence inflation.

Persistent Covid has led to a pattern in most countries of waves of infection, some measure of lockdown and restriction, and then periods of rebounding economic activity. Set against that is a rising count of vaccinations (that has rightly made people feel safer) and natural infection (that probably hasn’t, but has ultimately conferred the same antibodies so should).

It’s looking likely the pandemic endgame is that most people in most countries get vaccinated, but the virus never vanishes. Many of us will encounter Covid again in the wild during an Nth wave, but we may not be much affected after repeated vaccinations and low-level infection. There are good new drugs to treat infections coming on-stream, too. Eventually, Covid fades into the background as enough people have been exposed, perhaps multiple times. With luck it doesn’t flare up as something deadlier or even more infectious.

One reason for this fatalistic attitude is what’s going on in Europe right now.

For the past few months people have asked why the UK can’t be more like the Germans, say, who had seemed to have avoided a delta wave.

In recent days though a new wave has taken off in Europe:

True, the vaccination rate isn’t especially high in Germany and Austria. There may be other local factors, too.

But there really doesn’t seem much room between the most extreme measures – China’s zero-tolerance say – versus trying to vaccinate as many as you can and then opening up and running hot, as we’ve done.

Anything less than fortress isolation and it seems that (delta) Covid will find you out, sooner or later. After that it’s about managing peak numbers to prevent pressure in hospitals.

The Netherlands is even going back into a partial lockdown.

Keep on pushing

Back to inflation, and Covid’s impact on the economy. What we’ve seen over the past 22 months as the pandemic outlined above has played out is:

- Consumers save a lot when in lockdown

- Most are happy to spend when restrictions ease

- This has led to wild fluctuations in the savings rate

- It’s also left companies by turns over and under-estimating demand

There has been huge disruption to supply chains and working practices caused by both Covid and by the measures that restrict its spread.

Some people believed we could switch off the economy and then on again with almost no impact. Almost like moving one cell in a spreadsheet from column A to column B.

And indeed, this has sort of happened at the aggregate level – albeit at the cost of a piling up a lot of national debt to make this ‘suspended animation’ possible (via furlough payments and the like).

GDP recovers sharply from lockdowns in most countries. Even where a lot of jobs were lost, such as in the US, the vast majority of those who want work have now found it again.

However it has not been exactly like that cell copy-and-paste process when you look into the weeds.

Maybe I’ve spent 20 years too long reading company reports, but I was adamant that turning off the economy would snarl up the global economy to some degree. Today’s companies are run so efficiently they get disrupted by almost anything, and they happily make this plain to shareholders. So it was clear that suppliers and customers unpredictably blinking on and off like a globalized game of Whack-a-mole would cause trouble.

In this stop-go economy, if you need this or that commodity or component to finish your product and meet recovering consumer demand, you will pay more for it. Perhaps a lot. Since you can pass at least some of the higher cost to newly-ravenous consumers, you do. Hence rising prices.

Still, I believed this would be a one-off shock that would get sorted in a few months. But I was wrong about that. The rolling waves of Covid and those on/off restrictions mean different bits of the economic tapestry continue to go offline at different times. So the disruption continues, perhaps hidden by what’s captured in noisy overall GDP figures.

There are other factors, too. I’ll leave you to Google if you’re curious, but the biggie is obviously a labour shortage in many Western markets.

Some people left the workforce early – aka the Great Resignation. Others don’t want to do what they did before, having reassessed their lives from their comfy couch for a year. (Put service staff into this group). Some people are still scared of getting sick. A lucky few have maybe made so much from rising asset prices of all descriptions that they don’t need to work any more.

Near-zero interest rates are a factor at the margin, too. To lots of everyday people, saving seems a waste of time. True, rates have been low for a very long time, but many people didn’t have any savings for much of the past decade anyway, so they were none the wiser.

Now they do have cash – from government support and enforced confinement – they see little incentive to save it.

The wealthy already save too much (arguably), but I notice many are now happier to flash extra cash at the margin, post-Covid. Certainly my richer friends have paid almost any price to travel this summer. Even I overpaid for my recent jaunt to Cornwall.

It all adds up.

People get ready

So basically we have more people with more money to spend chasing goods and services that cost more to make because someone somewhere in the world couldn’t or wouldn’t make or do something else, or didn’t want to buy what someone else made.

Simple, eh?

The trouble is it’s hard to see this situation changing anytime soon. That’s because Covid continues to be felt across the globe.

Companies will get better at flexing their supply chains – they already are – but there’s a limit. Anyway, it costs money. That is itself a recipe for higher prices a few months from now.

Then you have recovering rents (for landlords of all sorts) and other postponed inflationary hikes as we return to normal. (Some of this should be eased from a CPI perspective by the 2020 recession lows falling out of the statistics.)

I suspect all this is why the Bank of England and the US Federal Reserve aren’t yet raising interest rates. Making money more expensive on top of everything else won’t do anything to solve short-term disruption problems. Much higher rates could make it much worse.

That said, Central Banks know they can’t let this get out of control. Raising rates will curb demand, even if it doesn’t help the supply situation. So we can be pretty sure they will act eventually – probably once they believe the economy is sufficiently settled to take the shock.

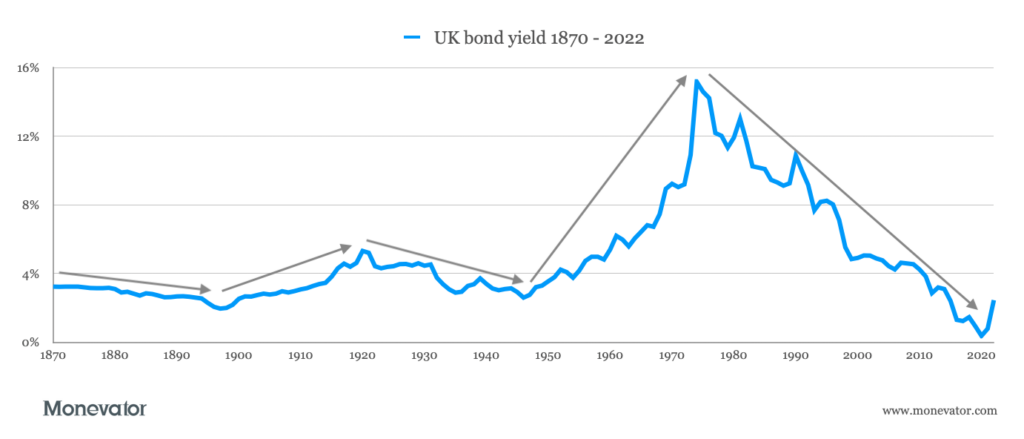

Maybe we can all agree not to ask for a pay rise? That’s our best bet for dodging embedded long-term higher inflation – and consequently much higher interest rates, which would do wonders for our cash deposits but smash bonds, and likely also hit richly-valued shares.

How about it? A collective sacrifice for the good of a long-forgotten statistic like CPI?

Yeah, me neither. Best buckle up for a bumpy ride…

…or else hope that all this inflation fear becoming the consensus means we’re actually at the peak of inflation concerns? Maybe when the Fed blinks – and everyone is all-in on inflation – it’ll be time to contrarily buy 10-year Treasuries?

Funny things, markets.

Have a great weekend everyone!

From Monevator

How to complain about a financial provider – Monevator

FIRE update: six months in – Monevator

From the archive-ator: How gold is taxed – Monevator

News

Note: Some links are Google search results – in PC/desktop view you can click to read the piece without being a paid subscriber. Try privacy/incognito mode to avoid cookies. Consider subscribing if you read them a lot! 1

US inflation hits its highest level since 1990 at 6.2%… – Sky News

…while crisps and soft drinks lead a surge in UK food prices – Guardian

Brexit: UK looks likely to trigger Article 16 – BBC

Disadvantaged graduates earn half as much as privileged peers in first job – Guardian

Could tougher EPC regulation hit the price of Britain’s Victorian homes? – ThisIsMoney

“We lost festive savings in family WhatsApp scam” – BBC

It’s time to scoop up cheap UK stocks, says JP Morgan – Market Watch

It’s time to scoop up cheap UK stocks, says JP Morgan – Market Watch

Products and services

Investment trusts rediscover their roots with a 21st century twist [Search result] – FT

Is Bitcoin now too big to fail? – Institutional Investor

Open a SIPP with Interactive Investor and pay no SIPP fee for six months. Terms apply – Interactive Investor

Seven things you should know about Junior ISAs – Which

Venerable dealer Stanley Gibbons touting co-investment into world’s most valuable stamp – Showpiece

Uber raises London fares by 10% in effort to lure back drivers – Guardian

Another article on the ins and outs of heat pumps – ThisIsMoney

Homes with great walks on the doorstep, in pictures – Guardian

NFT mini-special

How NFTs create value – Harvard Business Review

You nowadays need to buy a basket of crypto assets – Fred Wilson

NFT games are a tax-filing nightmare [US but relevant] – Protocol

Comment and opinion

What it’s like to grow up in a FIRE family – Budgets are Sexy

You are what you eat, and invest – Incognito Money Scribe

Index funds track the ‘investable’ half of markets – Pragmatic Capitalism

Asset allocation when you have enough – Morningstar

When cash is king – Humble Dollar

How to invest when inflation is high – Of Dollars and Data

When the living is easy – Banker on FIRE

Thoughts on Safe Haven by Mark Spitznagel – Simple Living in Somerset

Taxing – Indeedably

Remembered: first steps on a nine year march to FIRE – A Purple Life

Do interest rates matter more to the economy or the stock market? – AWOCS

The mirage of direct indexing – Enterprising Investor

Naughty corner: Active antics

Institutional investors don’t care about gold anymore – Klement on Investing

Valuing Tesla. Again. – Musings on Markets

Investing lessons from the Stoics – The Undercover Economist

Long-term investors must make a Ulysses pact – Behavioural Investment

The return of the return gap: Ark Innovation edition – Morningstar

A candid account of some less-than-stellar investment trust trading – Getting Minted

Covid corner

The Covid [treatment] drugs are finally here [Search result] – FT

Over 11 million booster shots now given in Great Britain – UK Gov

Kindle book bargains

Exponential: How Accelerating Technology Is Leaving Us Behind by Azeem Azhar – £0.99 on Kindle

Happy Sexy Millionaire: Unexpected Truths about Fulfilment, Love, and Success by Steven Bartlett – £0.99 on Kindle

Billion Dollar Loser: The Epic Rise and Fall of WeWork by Reeves Wiedman – £0.99 on Kindle

Liar’s Poker by Michael Lewis – £0.99 on Kindle

Environmental factors

Climate talks into overtime as nations near deal – BBC

Where to find an extra £20,000 for an electric car, and other COP 26 questions – BBC

The enormous hole that whaling left behind – The Atlantic

Turning cities into giant sponges to embrace floods – BBC

Off our beat

Experts from a world that no longer exists – Morgan Housel

Truth is elusive, but it isn’t evasive – Seth Godin

Will Johnson’s Global Britain ever escape the shackles of Brexit? – New Statesman

Things nobody ever tells you about making friends in adulthood – Art Of Manliness

And finally…

“Like the old miners, coal has almost completely disappeared from our lives.”

– Jeremy Paxman, Black Gold: The History of How Coal Made Britain

Like these links? Subscribe to get them every Friday! Note this article includes affiliate links, such as from Amazon. We may be compensated if you pursue these offers, but that will not affect the price you pay.

- Note some articles can only be accessed through the search results if you’re using PC/desktop view (from mobile/tablet view they bring up the firewall/subscription page). To circumvent, switch your mobile browser to use the desktop view. On Chrome for Android: press the menu button followed by “Request Desktop Site”.[↩]

Comments on this entry are closed.

The money printers going brrrr has completely distorted the price signal and destabilised the system. It will take a *very* long time to recover (if ever).

Good article, what happens next…no idea.

The combination of unusual conditions that we have seen over the last couple of years is a reminder that risk is something we believe we can ‘game’, but in fact we face uncertainty.

@HariSeldon (traditional or re-imagined hologram?)

When was the last time there were the ‘usual conditions’? It has always seemed ti be unusual since the 70’s, at least.

It should be noted that, while the market is pricing an increased probability for interest rate hikes from major central banks, it isn’t pricing any increased probability for higher inflation over the long term. The yield curve has flattened aggressively. The spread between the 1-year rate in 1-years time (the 1y, 1y forward) and the 1-year in 10-years time (10y, 1y forward) is just 83bp. It was 250bp six months ago.

The current rise in inflation is still more supply side (cost push), than demand pull based. There is pent up demand from higher saving but that is still less of an issue than supply bottlenecks.

The problem for central banks is that they have to manage second round effects i.e. inflation expectations. You never have sustainable CPI rises without wage price inflation. If people, however, start demanding higher wages on the back of temporary supply shocks or one-off demand, then you get a price spiral. The major economies simply cannot cope with higher wages without higher productivity. It will price them out of the market very quickly, causing recession, a credit crisis and unemployment.

Hence the yield curve is pricing rate rises but also increased long term recession risks. This is not the yield curve behaviour we observed in the 1970s. In fact, it’s the exact opposite.

Who cares about inflation?

Seriously, who cares?

Decades of house price inflation is a good thing. A decade and a half of roaring stock values, a good thing.

Even minimum wages have been beating inflation.

Who is losing out? Those who are leaving money idle in bank accounts and moaning about 0.5% rates? Screw them, they’ve had that money long enough to know that cash gets killed and stocks win out over time.

Fixed income pensioners? They can just cut their cloth a little leaner and out up with a lower standard of living, you don’t do anything to deserve it anyway.

Final salary pension holders? Your benefits greatly outweigh what you paid in over the years – and a benefit you denied to younger generations.

Finally, central banks don’t really give a toss about inflation. So raise rates to 0.5% and see what good it does.

A key reason Germany, the Netherlands, Austria etc are seeing a new Covid waves is because they (or many of their constituent provinces/states) recently decided to follow the English example of removing public health measures, including in schools. Unlike here, though, there is much lower tolerance of mass deaths and a crippled health system, so measures are being reintroduced swiftly. There is good reason why European economies have recovered better from Covid than the UK (furthest of all G7 economies behind its pre-pandemic output).

On inflation, an interesting aspect is the different pressures on goods and services. The pandemic’s impacts have seen a massive rise in demand for the former (including cars and equipment which rely on tight supply chains) but not so much the latter. In terms of services a lasting effect might well be a greater focus on the quality of life at home – good for builders, takeaways, online services; less so for traditional services that require physical presence in a fixed location.

>more than 100 people are still dying of coronavirus every day in the UK

*more than 100 people are still dying every day after having a positive test at some point in the past month

@driftglass — I don’t think we should get back into Covid debates here, I think that is more or less settled at the level of blog discussion, unlike say March 2020. However to your point [my bold]:

“Total number of deaths of people whose death certificate mentioned COVID-19 as one of the causes, by date of occurrence.”

My understanding is that only if/when a qualified person *has* said Covid contributed to the death does it go on the death certificate.

https://coronavirus.data.gov.uk/details/deaths

@ZXSpectrum48k — Indeed. I almost bought some UK gilts again in mid-October, which would have been nice timing, albeit for the wrong reason (I thought inflation fears were overdone) and I can certainly imagine buying them/US Treasuries a bit early (/soon) on the grounds that the market is too optimistic about medium-term growth, especially in the UK. But things are very choppy at the moment as you know and I’m a stock picker at heart, so happy to dither about on the fringes of my portfolio with this stuff. 🙂

@Faustus — Interesting commentary on goods versus services. I had brunch at a place in Paddington Basin today and it was utterly rammed. The waitress insisted it was quiet compared to the past few Saturdays (mostly because it’s got too cold for people to sit outside). Perhaps one’s perception of any long-term shifts here are influenced by one’s own recent experience? I can certainly see a case for an ongoing re-upping on the nation’s ‘nesting’ obsession. Then again, a lot of my friends tell me they will never take overseas travel for granted again…

p.s. The place was Bondi Green and I recommend the brunch if you’re in the area! 🙂

> But there really doesn’t seem much room between the most extreme

measures – China’s zero-tolerance say – versus trying to vaccinate as many as you can and then opening up and running hot, as we’ve done.

While this false dichotomy dominates the Covid debate in this country it is quite likely that we will continue to see worse health (and most likely economic) outcomes from Covid.

The types of mitigations that are needed to prevent Covid “running hot” have been known for a while, and appear to be mostly ignored. This includes

– better ventilation (and HEPA filters) in public spaces, especially schools (implemented in some European countries but basically non-existent in the UK; would likely cost a fraction of the dysfunctional Test&Trace system)

– mask wearing in crowded indoor spaces and on public transport (not in the UK), ideally with FFP2 grade masks or better

– isolation for infected people and their contacts (including proper financial support so that they can actually afford to do it; not implemented in the UK )

– working from home *where practical*

– broad vaccination coverage including children and adolescents (not happening in the UK)

– third booster doses

Virtually none of these measures would be especially onerous, and they would likely also benefit the economy. But I am pretty certain we are not even going to try them because we (and surprisingly that includes even some of the UK medical establishment) have convinced ourselves that no alternatives exist even as other countries are demonstrating that they can work.

As Faustus says, it is perhaps not surprising that countries that follow the UK example are seeing similar outcomes.

There’s the saying: ‘the cure for high prices, is high prices’.

People won’t pay beyond certain price points, even for essential goods. Applying a stock market analogy it appears we’re currently in a price discovery phase for various everyday goods, where we find out how essential some goods really are and what people are really prepared to pay.

All goods eventually find a balance of demand/supply but not before they’ve spiked higher like a pump and dump stock. New EV for £35k instead of £30k?, people whose wages haven’t kept up the pace will drop off the list of potential buyers, buy second hand, run their diesel for another few years, or move to renting (short or long term) instead.

Wage inflation spiral is the risk like you say. But pay rises must be something that happen to other people – in 12 years I’ve had 2 increases of v.low% (multinational industrial service company). (The rises don’t matter to me anymore as I have a v.large FU pot and don’t need their wage, I want to move to a 50/50 job-share or will leave if they don’t allow it).

I’d imagine there’ll be opportunities beginning to emerge right now for players in various markets who can work out how to produce and sell various goods at a lower price and hence take advantage of an over-inflated market.

Substitution (of higher cost commodities with lower cost commodities) should work through the system eventually if prices stay high enough for long enough – anyone remember vegetable oil? When diesel prices went up in the early noughties it was commonplace for people to fuel their diesels with a substitute mix of anything up to 80/20 veg oil/diesel. Veg oil then costing around 50-70p per litre. Illegal, but half of London’s delivery vans smelt of fish n’ chip shops. Doesn’t work in modern diesels, blocks up the injectors. But it could, if circumstances made it so expense that it was worth making the engine with injectors that didn’t block. Point being that beyond a certain point of pain people will adapt and not accept it, in the worst cases they’ll revolt.

Also, how about ‘the cure for current economic predictions is old economic predictions’. Here’s one from 2011 about prices being too high. The last paragraph is good: https://leighdrogen.com/the-cure-for-high-prices-is-high-prices-98858ec6f0e4

I am not sure it is yet possible to work out if inflation is a problem. It is conventionally measured by comparison of two spot measurements 12 months apart – but we know 2020 was a highly aberrant year for consumer spending, and 2021 is still subject to quite a lot of distortions. The question is whether, when everything settles down, prices will end up roughly on the long term trend line extrapolated forwards from 2019.

There seems to me to be the same confusing message about any central bank response. Discussions of interest rate rises all seem to assume a change from 0.1% to 0.25% in the first instance, and then possibly to 0.5%. For most consumers everyday borrowing is on credit cards with typical interest rates of around 20%, so a change of 0.15% or 0.4% isn’t going to factor highly in spending decisions. And on average, over the last year people’s borrowing has decreased (or savings increased) meaning there will be less of an impact than usual anyway.

As far as investments go, @ZX tells us that those modest rate rises are already “priced in”. Which means they will have negligible effect. An unexpected larger rise would no doubt spook the markets, but that is highly unlikely without first taking away QE so in practice it would be strongly signalled.

@whitesheep — as my links note we’ve administered 11 million booster doses. Also I’m typing this on a tube in a mask although admittedly probably 25% not wearing one. Most of my friends are still working from home. So I didn’t think we’re doing nothing. I accept it’s not enough from some perspectives.

Like the U.K. establishment you mention I hoped the vaccines would prove more of a silver bullet then they did. Given we’re evidently not going to “do a China” it’s not clear to me that there’s a lot of point in say 70% mitigation, given nearly everyone has had a year to get vaccinated. (Not everyone, no, some can’t unfortunately.) Reasonable people in the US (eg Drs Fauci and Gotlieb) seem to believe that absent variants the worse will be over there in most places by spring, so there are a range of views.

But as I say I have no firm/contrary view on this nowadays and I think your comment is very reasonable. Cheers!

@Jonathan B (#13):

Sounds reasonable – but could you please remind me when reasonable last made the news?

@Al Cam. Being reasonable is obviously my downfall! I would never have made a politician.

@ZX:

Stumbled upon this FED paper a few weeks ago which you may find interesting:

https://www.federalreserve.gov/econres/feds/why-do-we-think-that-inflation-expectations-matter-for-Inflation-and-should-we.htm

Explain to a layman please. Are things getting more expensive or is money getting worth less after all the printing?

Also the veg oil comment not quite right you can use used veg oil in a private car for a certain amount of miles with no duty due to HMRC. Although I know people were literally going into the supermarket, buying the oil and filling straight up. It feels like it didn’t last long though, veg oil soon went up to around a quid a litre.

@TI Yes very much agreed. And your coverage of Covid (as with most topics) tends to be very good. 🙂 Apologies if I am side-tracking this into yet another Covid discussion. I have just become very alert to the defeatist narrative that there is nothing much that can be done between doing nothing at all or a maximal lockdown. It just almost guarantees worse outcomes in the face of evidence when the literature and other countries continue to demonstrate that other measures can be effective and you can do better than we are doing at the moment on both health and economic outcomes – you don’t have to be perfect and even 30% lower infection rates are better than nothing (and yes other countries will continue to have surges in cases as well). (As you happen to mention Dr Gottlieb, a year and a half ago I actually posted a link in these comments to one of his papers outlining a more structured and nuanced approach.) The waning of immunity from both (two doses of) vaccination and natural infection and the emergence of variants also makes it less likely that any future benefit will arise from letting the virus “run hot” – we will all need boosters.

A major driver of infection at the moment appear to be schools (which then spills over into older age groups). Vaccination roll-out for children has been late and a complete mess in contrast to the adult vaccination campaign earlier in the year. As I am writing this, about a third of kids in one of my children’s classes have tested positive this week (one child went to hospital), and I am awaiting the results of the latest round of PCR tests (which also explains why I am probably a bit grumpy on the topic at the moment). At the same time, apparently the local health authorities have decided to keep the class open regardless, and the school advises the parents to watch out for the three classic symptoms that have been known to be outdated for ages (and most of the positive cases didn’t have either). Not trying very hard would seem to be an understatement to describe the effort. But enough from me, back to investing.

@Jim — I think things are getting more expensive. But — unlike with the post-financial crisis QE — there is probably some impact from the ‘money printing’ this time around.

That’s because last time we saw basically assets and liabilities get traded around between banks and central banks (simplifying).

This time there’s been much more fiscal stimulus (money given to businesses and consumers) which has been made possible by debt (money printing) and consumers are spending this money.

But in my (humble) opinion most of the rises are due to the dislocations and consequences I talk about in the article. (Others disagree 🙂 )

I actually think there are still massive deflationary forces out there, which will probably reassert themselves soon (mostly technology, but also some continuing globalization, and also demographics, for example). Also growth stumbles (as @ZXSpectrum says the market doesn’t expect the economy to go on a tear years into the future — even a non-inflation adjusted tear!)

@Jim “Are things getting more expensive or is money getting worth less after all the printing?”.

Don’t fall into the trap of thinking that money has some sort of absolute value. If gold goes from $1000/oz to $2000/oz, you don’t know whether it’s gold that’s gone up or the US dollar down. You never know whether it’s the numerator or denominator (or both) that has changed. You only observe a series of bilateral measures. The absolute values are unobservable and therefore meaningless.

@AlCam. Whether output gaps and the Phillips curve is real is a question for economists. I’d argue not since neither are observable. They are inferred from combinations of observable variables. Economic theory though is built on unobservables. It’s a key weakness.

Practically, though, it doesn’t matter. Most major central banks seem to care deeply about output gaps, the Phillips curve and long-term inflation expectations.

Personally, I’m not in the business of caring whether central banks are right or wrong or what they actually deliver in terms of hikes or cuts. One thing I learnt early on was that it’s far easier to predict what the market thinks a central bank will do, that to actually predict what they will do. You trade expectations, never delivery. At the moment they actually do something, you should be long gone.

@petejh. “Wage inflation spiral is the risk like you say. But pay rises must be something that happen to other people – in 12 years I’ve had 2 increases of v.low% (multinational industrial service company). (The rises don’t matter to me anymore as I have a v.large FU pot and don’t need their wage, I want to move to a 50/50 job-share or will leave if they don’t allow it).”

Same here. My salary in nominal terms is the same it was in 2009 so a real pay cut of about 27% where I live over those years so I am already doing my bit to stop the wage/price spiral. In the first few years it was not too big a deal but now I can clearly see my standard of living declining due to the accumulating fall in my purchasing power. Fortunately I also have a stash of FU money and had already decided to prioritise living for the here and now more by moving onto a 50/50 jobshare so I had already made the mental switch to accepting a modest and frugal standard of living.

@TI Re Bondi Green – did you know the chain (Daisy Green) is currently Crowd funding on Seedrs? Perhaps you did and this is a Shill!

They do seem great so i’m tempted by the crowdfund, although i have never had much success in that area… but you have mentioned your interest in VC / crowdfunding ventures before. Tempted?

Btw the Shill bit was a joke