What caught my eye this week.

I am heading away early for the weekend, so not much time to muse over any of this week’s abundant links.

So I’ll just highlight this rather striking statistic from the ONS, as reported by The Guardian:

“It now costs nearly £19,500 to buy enough residential floor space for a decent-sized coffee table in London’s priciest borough – but only £777 to accommodate the same small piece of furniture in a living room in south Wales.”

Obviously that’s an apples to oranges comparison (and I say that as a fan of South Wales!)

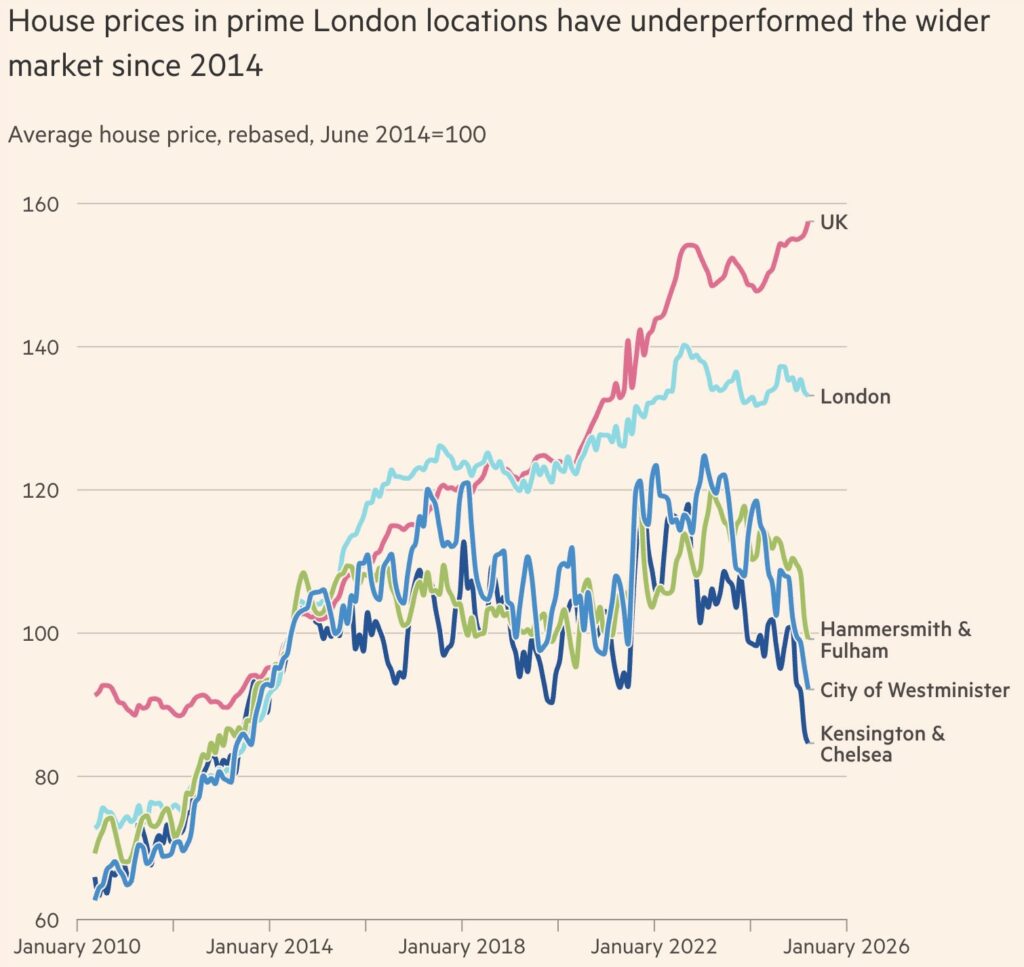

But can the London market really hold such a premium for much longer in the face of Brexit?

From Monevator

Do you need income protection insurance? – Monevator

From the archive-ator: The poor performance record of active funds – Monevator

News

Note: Some links are Google search results – in PC/desktop view these enable you to click through to read the piece without being a paid subscriber. 1

Old £1 coins defunct from Sunday, but shops likely to ignore deadline – Guardian

Bitcoin rises 75% in a month to top $5,000 – ThisIsMoney

Amount retirees can ‘safely’ withdraw each year from pension drops to just 1.9pc – Telegraph

National Living Wage has boosted low salaries without job losses – Guardian

‘Hard Brexit will plunge the UK into recession, wipe 18% off growth by 2030, and cost each worker £11,500,’ warns investment bank – ThisIsMoney

Products and services

How would ETFs fare in a market downturn? [Search result] – FT

Remortgage now to grab a cheap fixed-rate mortgage – Guardian

Tips on buying a new build home – ThisIsMoney

‘We are being ripped off by our freeholder – what are our rights?’ – Telegraph

Thousands of loyal Yorkshire BS savers to see 3.55% rate slashed – ThisIsMoney

How much does it cost to leave your stockbroker? – Telegraph

Self-employed and want a mortgage? Halifax only needs proof of one-year’s income – ThisIsMoney

Comparing the costs of the new electric vehicle energy tariffs – ThisIsMoney

A summary of UK workplace pensions – DIY Investor

Comment and opinion

Passive versus active investing: A debate – Bloomberg

Look after the pennies – Retirement Investing Today

Investors do not underperform their investments – Advisor Perspectives

(What to do if you have) enough already – Humble Dollar

When mean reversion fails: Thoughts on the expensive market – Charlie Bilello

‘Momentum’ investing bubble worries fanned by focus on market cap [Search result] – FT

Do Index Buyers Make Overvalued Stocks More Overvalued? [Bit geeky, PDF] – I.I. Journals

Unearthing bargains among high-yield stocks [PDF] – John Kingham

When it comes to the numbers – SexHealthMoneyDeath

Why Thaler’s Nobel is a well-deserved nudge for behavioural economics – Tim Hartford

Down on the farm: Q3 portfolio review – Fire V London

Finding winning fund managers: The perils of past performance – Behavioural Investment

Off our beat

Use what exists: A strangely inspiring interview with Jeff Goldblum – Shortlist

Charts: How Americans differ by age – Visual Capitalist

Electric car Vs winter – Mr Money Mustache

And finally…

“A retirement income plan should be based on planning to live, not planning to die. A long life will be expensive to support, and it should take precedence over death planning.”

– Wade Pfau, How Much Can I Spend In Retirement?

Like these links? Subscribe to get them every Friday!

- Note some articles can only be accessed through the search results if you’re using PC/desktop view (from mobile/tablet view they bring up the firewall/subscription page). To circumvent, switch your mobile browser to use the desktop view. On Chrome for Android: press the menu button followed by “Request Desktop Site”.[↩]

Comments on this entry are closed.

Honestly. If Brexit precipitants a house price crash it will have been worth it for that alone.

Regarding the Telegraph article on SWRs. The Morningstar link is http://media.morningstar.com/uk/MEDIA/Comprehensive_update_on_the_Safe_Withdrawal_Rate.pdf

For those considering ER, an SWR of 2% (40-year retirement, 50bp fees) gives a success rate of 93%. An SWR of 2.5% a 75% success rate. Seems fairly insensitive to asset allocation (higher equity returns offset by greater vol and thus SoR risk). Definately food for the SWR bears.

Must admit this plays reinforces my pessimistic views. I am still not confident to retire even with a current SWR of 1.6-2.1% (depending of my assumptions). Waiting for the after the next crash to re-evaluate.

@zxspectrum48k

I’ve always said I’d FIRE with a WR of 2.5% plus expenses of about 0.2%. Since then I’ve stayed on working a little longer but also allowed myself more FIRE discretionary spending which is now 47% of my planned FIRE spending. If I went today I’d be at 2.4%.

If a severe bear appeared at the wrong time my plan would then be to just cut back on some of that discretionary spending until order resumed.

I’ve been saying for years that the much touted 4% Rule is a dangerous thing, particularly for those who just take it at face value and don’t understand what it’s really based on. It looks like others are now starting to catch up.

@ zxspectrum48k – ‘For those considering ER, an SWR of 2% (40-year retirement, 50bp fees) gives a success rate of 93%’

VWRL yields about 2% and costs 0.25% so if one has the stomach for it one can improve on 93% can’t one, and one’s not actually touching the capital. Investment trust fans will say similar with higher running yields. At this level SOR is academic assuming one can live off the yield and one is not providing for end of world scenarios.

@RIT – I thought the whole point of the 4% rule is that it is the minimum one can withdraw based on the worst sequence of historic returns. I think this is what Kitces says anyway.

I’m simply going to take a fixed % each year and adjust my lifestyle around that. It eliminates SOR risk altogether and seems a simpler approach all round.

@Pulpo, I always forget the exact definition of SWR. But a critical question is whether you take the same % every year or the same £. Assuming that for most people, they think of the % based on year 1 withdrawals, and thereafter withdrawals are flat / inflationary, VWRL yield is not a fair comparison. I.e. if your cost of living is £20k, and you think £1m of VWRL is going to be enough, I don’t think it is. If markets soon drop 25% then VWRL’s yield will not rise to compensate, and you will end up with less than £20k income and you will selling your VWRL to fund living expenses. Which will prove nervewracking.

@pulp

For UK investors a few problems with the 4% Rule:

– It’s based around a US investor

– For that investor with 50% US stocks : 50% US bonds it only worked in 96% of cases

– It doesn’t include any expenses

Wade Pfau did some work that showed for a UK investor with 50% UK stocks : 50% UK bonds and a 100% backtested success rate resulted in a SWR of 3.05%. So after say 0.25% in expenses you’re down to 2.8%.

Of course we’re all probably more diversified than either of those examples these days so it’s all a bit academic anyway.

Unless we’re at cross purposes, the yield will absolutely rise.

Dividend income (which is what drives the natural yield of an ETF, after costs) is much less volatile than capital values. The cash income paid out by a market/index/ETF does fall a bit in aggregate now and then, in recessions or with big currency moves, but ignoring that the yield will rise when the market falls.

e.g. £1,000,000 in VWRL pays out £20,000 in income, so the yield is £20K/£1m = 2%.

Say market/VRWL falls 25%. Assume companies in underlying VWRL index maintain their dividend payments.

VRWL capital value now £750,000. It still pays out £20,000 in income. Yield is now £20K/£750K = 2.68%.

Of course, if you were relying on selling down capital such as most passive investors / my co-blogger @TA like to plan to do, rather than on the natural yield, it’s a slightly different story. You would have to sell some of your diminished portfolio at the lower valuation. You’ll either have to get by with less income than they year before, or you’ll have to deplete your portfolio faster than you would have (and hope it bounces back, which the SWR backtesting took into account in its scenarios it ran through).

In this instance a reasonable way to try to mitigate having to sell shares in bear markets for income is to have several buckets that you work through before you’re selling shares. (Cash then fixed income etc).

See this article: http://monevator.com/how-to-live-off-investment-income/

And as I say, sometimes total market dividend payouts do fall. Those who can stand to pay up for active investment in retirement might try the stalwart UK equity income investment trusts with multi-decade records of not cutting dividends. The downside is higher costs (i.e. fewer £ to you) and the past is no guarantee of future, even if you’re paying for it!

The big downside of trying to live of natural yield is of course you’ll need a bigger pot than if you’re living off / selling down capital. In practice that’s why most don’t plan to do it, understandably.

@ The Investor – yes, absolutely correct on the yield but one does, as you say, need a bigger pot. My reference point though was @ zxspectrum48k indicating he was a bit twitchy at a 1.6% to 2.1% withdrawal rate which seems needlessly pessimistic to this amateur.

@ RIT – yes, we can all invest like each other these days can’t we so does ones domicile matter as much as it used to? And as for ‘only’ worked in 96% of cases I’m not quite sure what one can say!

@pulpo. The US has one of the highest SWRs, arguably because it was the most successful economy of the 20th century. In that sense the US is the anomaly (with Japan at 0.5% at the other end of the scale). If globalization continues and capital flows remain free then, if anything, SWRs would converge which could mean that 4% is unlikely to be repeated. Moreover, analysis by Pfau (and others) shows that SWRs are correlated with long-term bond yields and CAPE ratios, both of which argue for lower numbers.

I do accept your point about being within the “yield shield”. However, I also think that FvL is correct that dividends may fall to some degree in a major equity correction (though TI is correct that are far less volatile). The more relevant point is I simply have no stomach for a 100% equity portfolio. I’m going to have to look to EM fixed income, HY corp bonds, P2P etc to get a chunk of my returns. My pessmism is also caution over a possible 60-year retirement. For the next 15 years I’ve got school and uni fees to pay which could grow at CPI+4%, plus a very high likelihood of increased taxation, probably including wealth taxes.

I’m surprised that there is no discussion here about bond laddering.

I have a significant proportion of my portfolio in short term bonds (not funds), mainly inflation linked.

Although I do not attempt to exactly match cash flows with demand for cash, nevertheless I feel this represents a defensive positioning.

I’d be interested in other views.

I binned VWRL when I reshaped my SIPP to build a predominantly natural yield tilted portfolio, so all my equity ETFs and investment trusts have to yield at least 3% and most closer to 4%. Commercial property yielding closer to 5%.

I find choosing the fixed income part more challenging as you can’t get a yield over 3% without moving into higher yielding (less credit worthy) corp bonds or EM govt bonds. I will take some risk and own some of these (as currency hedged ETFs), but get too greedy and you are going to have no “safe” assets when a downturn in those sectors hits, perhaps simultaneously with an equity crash.

I guess its just a question of holding enough of a buffer in cash and short dated quality bonds to enable you (mentally and cashflow wise) to weather a storm and just accept that thanks to QE you won’t even keep up with inflation on that part of your pot (even if they are inflation linked gilts, due to the current pricing which guarantee a real loss @ The Borderer!)

I rarely find myself more bullish than most, but all this talk about ~2% SWR seems a little OTT. Happy to take feedback on my current, simple, portfolio.

P2p ~ 4.5% interest

Ftse 100 tracker ~ 3.7% yield

Preference shares ~ 6% yield (ok no inflation cover but look at the yield)

Individual shares ~ 4% div yield

BTL ~ 4% current rental yield

B

I hope TI or TA will come and explain more eloquently than I can that the SWR has nothing to do with the yield of the portfolio. I’ve recently read a number of posts (on other forums as well as here) which are claiming that if you can live on the natural yield of your portfolio, the SWR doesn’t apply because you are never going to spend your capital. This is a misunderstanding of both the concept and method of the SWR.

Yields can change, the very act of selecting securities based on yield will affect the riskiness of your portfolio. The SWR considers total return – and conceptually, dividends are simply returns that a company chooses to pay out rather than reinvest. These choices can be affected by eg national tax regimes (hence US companies tend to pay lower divis than UK).

Whether the actual money you drawdown happens to be less than the natural yield, or is taken by selling some of the assets, doesn’t make any difference to the probability of success. Taking the natural income only also amounts to a variable drawdown strategy, which will also increase success rates by cutting drawdowns when income payouts reduce.

@VanguardFan – it depends on the size of your pot and how much you wish to drain it. Of course yield is simply a component of return, you’re addressing Monevator readers here (!) but if one can live on that component it provides some insulation. That’s not say payout ratios won’t fall when times are hard, and yields will undoubtedly rise.

@Boltt @ All – about 10 months ago Vanguard were forecasting 10 year expected returns of 3.8% real on a 60/40 portfolio. Of the equity component 60%/40% was invested US/Internationally respectively and 70%/30% US/Internationally for the bonds.

@vanguardfan

Thanks for the response.

If the assets held are Real Assets then isn’t the natural yield a proxy for being better than the SWR?

I agree yields can change but dividends are much more stable than asset prices.

My logic is along the lines of – most of the asset held are Real (so should hold their real value in the long term) and if the natural yield is considerably greater than 3.33% (for example) this gives quite a few years of coverage for inflation (should the current dividends, in £’s terms not increase). I recognise the risk of falling dividends being a possibility for some of the assets.

Thanks

B

When the FTSE-All Share yield is at 3.6% and when the average yield of the investment trust UK equity income sector is at 3.6% then I feel confident that a withdrawal rate based on this natural yield is reasonably safe. I favour those investment trusts with long records of increasing their dividends, that hold good income reserves. If times become difficult then special dividends will not be repeated and some dividends may not be increased, but I think not many of these trusts will actually reduce dividends. If you want to be cautious you could hold two year’s expenditure in cash, and/or rely on say 85% of the natural yield (i.e. 3.06%), but 1.9% or 2.5% as a SWR is rather too cautious.

Plenty of comments on here today about drawing down a portfolio in retirement. I am going to retire very soon aged 62 and will be living off the income from my modest portfolio. I have done a lot of research on vairous methods and have had input from retirees living off their portfolios. The biggest takeaway is that whatever SWR you use it must be flexible enough to accommodate future situations ,in other words a flexible withdrawl rate is best. The other important point regards the safe part of your portfolio stick to short , medium govt bonds and cash dont juice it up looking for yield in other words dont try to pick up pennies in front of a steamroller.

I don’t understand this stuff about 1.6% or lower SWRs. As for the 0.5% quoted for Japan, surely that’s complete nonsense – ignoring inflation, you could withdraw an amount equal to 0.5% of your starting pot for 200 years. I know life expectancy is pretty high in Japan, but really?

One issue with relying on just the natural yield is you are going to die leaving a fund which, at least in nominal terms, is untouched. There is a good link in this article about also planning for life, not just death. If you don’t want or need to leave money behind, that money is something you could have enjoyed whilst you existed.

RIT wrote a piece about the old morningstar research on SWR which this new piece ‘updates’. In short, I think the research is fatally flawed because it appears to use normalised hypothetical returns and standard deviations which means their calculations will not perform at all similarly to the real world. I say appear because they provide no calculations or reasons around their return assumptions so we have no idea how they came up with their figures.

Bizarrely, with this update, they have identified this issue – highlighting that a portfolio could have a 50pc drawdown in one year and argue that this could be the situation with asset prices being at “highs”. However, they don’t appear to (and probably can’t) update their distributon calculations for their so called “fat tails”. Simply put, any normal-based distribution of simulated returns is fatally flawed as we know market returns do not follow a normal distribution.

Another issue I take with all SWR is they do not take into account what we really need in the real world, not that our portfolios become worthless but whether we have sufficient cash to live on. It’s entirely possible to have a negative net worth but have plenty of cash (through e.g. negative equity, a retiree in the late 90s may have had a woeful looking SWR but will likely have made out like a bandit unless did not own a house or they held everything in cash). Conversely, you could have a valuable portfolio but due to a liquidity crisis not be able to realise cash or readily convert assets to cash at a reliable price such as during the financial crisis.

@boltt 4.5% p2p seems low. I’m getting 11% before defaults, perhaps 8% after them, but recoveries are unclear. Companies offering hefty provision funds bring that down, but I’d rather cover myself and expect the higher return for the higher risk, which it certainly is.

Generally if you are so risk averse as to not accept 2% returns as safe, perhaps you should not be in equity at all, as its volatility will keep you up at night.

Instead of playing with 2% or 3% or indeed 4% SWR or living on natural yield at 2-3% in retirement and rolling the dice as far as market volatility goes isn’t it better to calculate the part of your spending that is compulsory i.e gas and electric + council tax +groceries etc (say £1k per month) so roughly 12k per annum…. via inflation linked annuity (with transfer to partner feature in case of death) and invest the rest in basket of equity income investment trusts yielding 4%or more on avg with several yrs on revenue reserves?

That way the annuity part will protect ppl from volatility of the market and natural yield from market will mean that the cushion of extra money in the form of capital (if required) or trust to be passed on.

Given annuity rates of 3% £12k (inflation linked) will require roughly 400k. A couple with 800k pot should then be able to ‘earn’ £28k per annum without so much as looking at their portfolios ever again.

Any views on this?

My wife and I are in our mid 30s and are working towards £1M pot so that we can ‘retire’ using the above mentioned method.

@Rishi – isn’t your 3% inflation linked a bit optimistic? I tried to find similar values, but a joint annuity with 3% escalation and 50% joint life was more like 2.3%.

@rishi, yes, I think it’s a very good idea to have a low risk ‘floor’ of income such as from an annuity, a state pension or a DB pension. This effectively reduces the amount you need to draw down from invested assets and hence helps to keep within a safe withdrawal rate. It also keeps things simple as your faculties decline!

There are no doubt many different practical ways to arrange ones finances to cover expenses, once you no longer have income from paid work. A lot of it comes down to psychology. To my mind, the ‘SWR’ is really no more nor less than a rough rule of thumb to help a) provide a rough target for people in the accumulation phase and b) help prevent over or underspending in the decumulation phase. It’s not really a terribly helpful tool for practical financial management…

In real life, no one is going to drawdown in the idealised way the SWR research assumes (ie percentage of starting portfolio, increasing annually by inflation). What manypeople will tend to do is tighten the belt when the portfolio is doing badly, and spend a bit more freely when it’s done well.

A lot of it comes down to knowing yourself. If you’re naturally a hoarder who finds it easy to regulate spending, you’re more likely to underspend and oversave. If you’re naturally a spendy person then you’ll need to find ways to force yourself to save in the accumulation phase, and to limit what you can drawdown in decumuation.

@TI – Apologies, I wasn’t clear. We are not at cross-purposes. You are right that if capital values fall then yields will typically rise – because as you say dividends tend to be more stable than share prices. I missed the crucial word ‘enough’ – i.e. the yield will not rise *enough* to compensate.

For instance look at the 2008/9 bust. FTSE-100 peaked in 2007 but dividends started dropping in 2009. iShares’ FTSE-100 ETF paid £0.202 dividends in 2008 but only £0.162 in 2010; so as its price dropped by about 40% (from >600p to <400p) the dividend fell too, just not as much. Yes the yields have risen (from about 2.9% to about 4.0%), but if you were taking £20200 of income before, your income after would have fallen to £16200. To bridge the gap you'd have needed to sell about £4k of capital. I'm using FTSE-100 as a concrete example but believe this same effect applies to VWRL/S&P-500/etc too.

@FireVLondon — Thanks for coming back with more thoughts. I think it’s perhaps best to talk about cash dividend payments for an asset you already hold, rather than yields, but I understand that isn’t what finance types tend to do and perhaps it’s down to personal choice.

i.e. Once I have bought the FTSE 100 tracker as (hopefully just one of…) my income vehicles, what I care about is looking at the flow of cash from it, not the yield it happens to be on. (To some extent I can be capital value agnostic — that is a big benefit of being an income focused investor versus a seller of capital).

You’re right dividends did fall. Obviously the financial crisis was a BIG event but that’s not to say we won’t see others or they won’t fall again (as I say in my reply). I think you’re right to apply it to VWRL or anything else… dividend payments can fall.

It’s worth noting that by 2011 it was up to c.£0.18p and by 2012 it had surpassed the pre-crisis payout so there were only really two down years and only one bad one.

But as I have already said, my retort would be to use cash buffers rather than sell capital, as here:

http://monevator.com/how-to-live-off-investment-income/

I would be set up like that anyway to smooth my living-off-income strategy. The downside, as conceded, is you’ll need more money. (I’d say a year’s full income in cash, beyond emergency fund, minimum).

An alternative is to use vehicles like long-term performing equity income UK investment trusts, with the risks I’ve stated already (cost, underperformance, and may fail in extremis anyway though I think unlikely).

@Vanguardfan — I’ll do a post on this sometime. However I do have a different view to you… I think living off income as opposed to ‘selling down a total return’ strategy is a valid and non-delusional approach if you can afford it. Income as you say is only one component of return, but it is smoother and it takes away selling decisions, and highly reduces the chances of having to sell in a bear market (so is helpful against sequence of returns risk). But it is not a free lunch; overall your capital will probably grow less for the emphasis on income, and more so if you use active managers to deliver it via trusts or similar. (Pretty sure you and I have discussed this before! Hard to remember as it comes up so often 🙂 )

In short, I see it as a personal/emotional type decision, whereas some, including possibly you (and my co-blogger to a lesser extent) seem quite dogmatic that a strategy looking at income is ‘wrong’. We will have to agree to disagree on that.

(I am not saying it is ‘right’ either! I am saying ‘it depends’, and the key factors are the person and their wealth and aspirations.)

@L: Ah ok. So maybe 50k or so more should be invested to make the maths work.

Thanks!

@vanguardfan: agree. My suggestion was just to take care of the behavioural aspects during the de-accumulation phase. Basically maintain low anxiety levels when the market gyrates knowing that the bills will be paid irrespective of market return.

TI – I don’t think the ‘living off income’ strategy is either delusional or ‘wrong’, but I do think it is essentially a mechanism for behavioural management; i.e. by restricting withdrawals to the natural income, one is avoiding excessive and unsustainable withdrawal rates. I accept there’s a bit more to it than that, but I view the psychological advantage as one of the main pluses of the income strategy. (I think the main downside is that it may lure people into thinking they ‘must’ achieve a certain yield, and this might encourage unnecessary risk taking)

I was trying (probably failing) to make a slightly different point, which is that I have read more than one poster (not here) suggest that a ‘take the income’ strategy means you don’t have to think about SWRs as the strategy can’t fail (ie you can’t spend down capital). I think this is conceptually flawed as well as practically risky (for the reason Fire v London pointed out, ie dividends can fall short of your requirements).

As I said above, I think practical decumulation strategies need to suit the individual – there’s no right answer, the only test is that it works. I will be using a combination of ‘floor’ income, cash buffer, ‘take the income’ and finally, selling down assets (some selling is necessary anyway to manage capital gains). What I’m not going to do is select my assets on the basis of yield – I’m not going to target or tilt towards higher yields than the market.

@vanguardfan — Thanks for the further thoughts. I did see we weren’t *quite* so far apart as I had first presumed on this when I saw your more recent reply to @Rishi, although clearly we are still pretty far apart.

I certainly don’t disagree with the psychological plus aspect of an income-focused strategy — in fact I’ve mentioned it a few times above, it’s what I mean when I say you probably won’t have to worry about selling in a bear market etc, provided you had enough money in the first place (and as I keep stressing *this* is the real downside of the natural income strategy IMHO. It’s simply unreachable for most).

Clearly people will have to do what they can with what they’ve got. But I wonder if some who dismiss income-focused investors as irrational/similar have really thought about the alternative (especially for the average person looking for a ‘rule’, even if they themselves are hardened investors etc)

I am pretty experienced and relatively good at being contrary, but I will happily admit the standard SWR methodology sounds much harder to me in practice than in principle. There may be readers who can envisage saving for 30-40 years diligently into a portfolio and then coolly dumping ever greater chunks for their discounted equities for a couple of years on the trot in a long bear market to raise their income, after a lifetime of buying in the dips and bagging a bargain, but I am not one of them. (Of course one could to some extent use the cash buffers method I propose to try to avoid doing this to some extent with a selling capital strategy, too).

The fact of the matter is the vast majority of people — at least in the UK — have never historically had to manage down their equity portfolios through their retirement and multiple market cycles, let alone tried to time it so they end up with a minimal pot at the end. They have usually bought an annuity (for good reason) or else outsourced it / pooled their resources (via effectively a company pension). I am a bit skeptical that readers will find it quite so straightforward when they’re in the mid-70s and they don’t like the new-fangled VR interfaces and they’re worried about their grandkids and the news is terrible and they suspect markets are overly cheap because they’ve seen crashes and bounce backs before, yet they log in and dutifully sell the required chunk of their shares as dictated by their plan back in 2017…

To that end I fully agree with your comments about practice and theory being two different things. I suspect self-managed Mr or Mrs 4% come rain or shine is a very rare beast, in reality. I am sure it’s usually a fudge.

Anyway, rather than discuss it more here I’ll mention a teaser, which is that @TheAccumulator has a post up tomorrow that plays right into this debate! Be interested to see what everyone makes of it.

TI, I wouldn’t say we disagree, we are just looking at the problem with different eyes 😉

Totally agree that retirees happily selling 4% a year are vanishingly few (though I think they may exist in greater numbers in the US). Most people cope better with a regular income stream, which is an argument in favour of a ‘floor’ income strategy.

I do have one (genuine curious) question. With a ‘natural income’ drawdown strategy, what % withdrawal do you aim for? Let’s say I’m a ‘no edge’ investor faithfully holding my global equity and government bond trackers. VWRL yields a little less than 2% currently, and VGOV 1.6%. So either I’m in the supremely cautious SWR territory anyway, or I have to actively pick higher yielding assets, which if I have no edge, is surely more hazardous? My key concern with this strategy is people (not you, but reasonably informed novices like me, say, or some of the Daily Telegraph case studies) starting off with the approach of ‘I need a 4% drawdown, I’ll select assets on that basis’ without being aware of the potential risk.

My other comment is back to practicalities. The typical (wealthy) retiree will likely have assets spread across SIPP, ISA and taxable accounts. A typical tax optimisation strategy (depending on personal circumstances) might suggest a withdrawal sequence from taxable, then ISA and finally SIPP. There’s not a lot of sense in taking income from an ISA before liquidating taxable assets. So I agree, any purist approach is unlikely to survive contact with reality…

I will read the next article with interest.

taken from https://www.theguardian.com/money/2017/oct/18/uk-adults-financially-vulnerable-fca-interest-rate-rise

37% of 25-34 year olds have taken out payday loans

can that possibly be correct? That seems astronomically high?

@The Rhino — Interesting link. It does seem high, but it seems to be saying “in their life” rather than “ongoing”. Most early 20-somethings I’ve known have either been overdrawn or run towards £0 as their next paycheck approaches. I can well imagine them trying a payday loan outfit. As I understand it most such loans are paid off quick, too, so while a startling statistic I’m not sure it tells us too much about their ongoing financial health? (Unlike much of the rest of the data about them, such as indebtedness and low pay. 🙁 )

Still scary

While the writing is a bit woolly, the other takeaway (if I’ve interpreted correctly) is that 50% of 25-34 year olds have a net worth of < £1000

That is quite precarious

The other thing that I'm trying to reality check at the moment is whether it's time to take out private health insurance. I'm going to conduct a survey of every medic I know

Ooohhh anecdote time:

We’ve seen prime London property falling for a while now, about two years. Everything else was moving fast. Now it seems to be spreading out. London zone 6, a relatively crappy place, the kind of place affordable to someone who couldn’t buy in, say, zone 3 or 4. In the past three years, boom! 40% price inflation. In the last 6 months, several properties on the same street up for sale since before the summer, some now even enrolling multiple agents. Zero buyer interest. Many refusing to drop the price, some dropping the price but still on the market. The fact that this is very, very far from prime values makes me think the market is coming down, and it’s coming down hard.

Agree with the first poster, though, this is about the only positive outcome I can see from Brexit.