Good reads from around the Web.

Often it feels like the best thing to do as a writer about investing is to repeat what you said last week.

In a Bloomberg podcast I link to below, the entertaining hosts bemoan how boring the markets are right now. That’s understandable – they’re both journalists, and they want to write about drama.

Nobody becomes a journalist to say “nothing doing here, as you were”. But that’s actually pretty good advice to live by when it comes to investing.

While The Accumulator continues to labour away on his book, I’ve republished some of his old articles to remind people what we’re missing. Frustratingly, TA has a habit of putting in useful contemporaneous snippets of data when he writes (whereas I try to wax eternal, like a Poundshop Marcus Aurelius). Many of his older pieces can’t just be dusted down and passed off as new. But more than a few can, because the best financial principles are timeless.

The alternative is to just keep saying the same thing, but to try and say it better each time. This is hard. Shakespeare’s 150-odd sonnets go over the same ground as doggedly as a Roomba, but they don’t really get better as you go on. And I’m no Shakespeare.

The third approach (and the motivation for these weekly roundups) is to see how other people approach the same topics, and to applaud them when they knock it out of the park.

Which brings me to Just Keep Buying, a piece this week from the Of Dollars and Data blog. It sees the anonymous author (hey, I already feel a kinship) approach the age-old topic of dollar-cost averaging with a mix of succinct prose and revealing graphics.

This is the best bit:

If I still haven’t convinced you [to just keep buying each month] let me tell you a story.

The story is about a man with possibly the worst luck in investing history. He made a total of 4 large stock purchases between 1973 and 2007. He bought in 1973 before a 48% decline in stocks, bought in 1987 before a 34% decline, bought in 2000 before the dot com crash, and bought in 2007 before the Great Recession.

Despite these 4 individual purchases that totaled a little less than $200,000, how did he do? He ended up with a $980,000 profit for a 9% annualized return.

What was his secret? He never sold.

I’d go and read the whole article if I were you.

Happy Easter! How I wish I could still eat all my chocolate eggs in one morning. Thank goodness they used marshmallows in that famous test, not Cadbury’s Caramels.

From the blogs

Making good use of the things that we find…

Passive investing

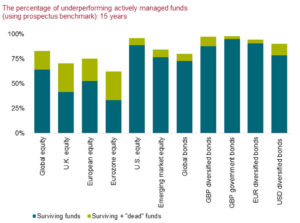

- No, active managers don’t beat the market ‘over the cycle’ – Reformed Broker

- The fee paradox: Managers’ fees fall but total costs rise [PDF] – via TEBI

- The best sales tactic in finance – A Wealth of Common Sense

- Are expected rate changes ‘priced into’ bonds? – Oblivious Investor

- Tadas Viskanta: Let’s keep ETFs weird – Enterprising Investor

- What does it mean when people say the market is overvalued? – Retirement Researcher

Active investing

- Seatbelt laws and the lesson for investors – The Value Perspective

- How to avoid yield traps: Part 2 [PDF] – John Kingham

- Peter Lynch’s best thoughts on market history – Novel Investor

- Reading venture capitalists – Howard Lindzon

Other articles

- Bond basics: Why prices fall when rates rise – Canadian Couch Potato

- If you’re prepared to earn a bit, you can semi-retire much earlier – Concordant Blog

- Retirement society – SexHealthMoneyDeath

- Five years later: Reflections on life after work – Financial Samurai

- On power laws and time – What I Learned On Wall Street

- Why do people experience different retirement outcomes? – Retirement Researcher

- 16 things your successful friends have given up – Tim Denning

- There is no bucket list. Life is the bucket – Ted Rheingold

Product of the week: The Telegraph reports that Atom Bank is back with more table-topping – and likely loss-leading – products. Last time Atom crashed its own App with the popularity of its market-beating savings bond. Now it’s offering five-year fixed rate mortgages at as little as 1.29% (with a £900 fee and a 40% deposit). Get ’em while they’re hungry! Outliers like this don’t stick around for long.

Mainstream media money

Some links are Google search results – in PC/desktop view these enable you to click through to read the piece without being a paid subscriber of that site. 1

Passive investing

- The maths behind the futility of active investing – Bloomberg

- FCA prepares for the march of the robo advisors [Search result] – FT

- Have US inflation-linked bonds (TIPS) delivered? [Deep dive] – Morningstar

- Simplicity is an under-rated virtue for older investors [Search result] – FT

Active investing

- Yale’s faith in active managers has not been shaken – Bloomberg & Bloomberg

- When a Harvard pedigree won’t help you – Institutional Investor

- Six ‘boring’ shares that have beaten Amazon – Telegraph

- The hidden cycles that rule the markets [Podcast] – Bloomberg

A word from a broker

- £1,500 tax-free from your pension pot for retirement advice – Hargreaves Lansdown

Other stuff worth reading

- The elderly now paying tax on dividends [Why I long urged ‘pointless’ ISAs] – Telegraph

- Will London fall? [Superb layout] – New York Times

- Credit cards: Flexible friend or implacable foe? [Search result] – FT

- Student loan interest rate set to rise to 6.1% – BBC

- You’ll wait a long time for a mammoth return from premium bonds [Search result] – FT

- Tax burden gap rises between higher and lower earners [Search result] – FT

- The ‘fix-perts’ explain how to repair seven common household items – Guardian

- Could Brexit really affect Britain’s property market? – ThisIsMoney

- Millennials forced to choose between a child and a career – Guardian

- The utter uselessness of job interviews – New York Times

- John Hamm would like to buy a time machine – Wealth Simple

Book of the week: According to wealth manager turned author Jonathan DeYoe: “Our relentless obsession with money and investing is ruining our happiness and causing bad financial outcomes.” If that resonates with you (and it might if you’re reading the small print of a financial blog, though it’s not really in my own interest to point that out!) then you could try his new book, Mindful Money. It’s only £6-something on Kindle, so not too much deep thought required.

Like these links? Subscribe to get them every week!

- Note some articles can only be accessed through the search results if you’re using PC/desktop view (from mobile/tablet view they bring up the firewall/subscription page). To circumvent, switch your mobile browser to use the desktop view. On Chrome for Android: press the menu button followed by “Request Desktop Site”.[↩]

Comments on this entry are closed.

As a personal finance journalist myself, I definitely agree that the lack of drama is a problem as far as content is concerned.

I never write investing scare stories or jump on the latest trendy bandwagon. If I don’t believe it will benefit others, I don’t write about it.

Thankfully though, I work for myself and don’t have to answer to demanding bosses the way my former national newspaper colleagues do.

That’s reassuring but if he was Japanese investing solely in his home market what would be the outcome? Asking as there is the odd suggestion that we may be turning Japanese.

My comment on the SexHealthMoneyDeath article:

I take exception to your comments about Vicki Robin’s interview with the Mad FIentist. I listened to it too, and marvelled at the vitality in her voice: she sounded decades younger than her stated age. “She just wouldn’t shut up’ — huh? Why should she? She was the one being interviewed! Why should the Mad FIentist ‘get a word in edgewise’? He was doing a great job as an interviewer, keeping himself in the background and eliciting great stories from Vicki (I have enjoyed hearing Brandon tell his story on other podcasts where he was the interview subject).

Yeah, since you’re wondering whether you’re betraying any old git tendencies, those derogatory (sexist?) comments put you definitely in that territory, imho.

No, the best bit of Just Keep Buying was “I have only ever invested in a bull market (2009–2017)”.

I want to invest every month over a variety of passive funds but how do you do this when platforms and funds have minimum investment limits? What is the mimumum i van put in each month over how many funds? An article on minimum investment limits would be helpful.

I laughed at the chap who’s puzzled that he’s made no friends among the self-absorbed types who go to the gym.

He could try team sports – cricket or five-a-sides perhaps. Or sociable sports – badminton is pretty good for that. Or even, God help us, tennis – though if he refuses to make friends at the golf club presumably he’d do the same at a tennis club. Bowls; he could take up bowls.

Or go to a Scottish Country Dancing class: keeps you fit, keeps you jovial, and even the greatest curmudgeon could hardly refuse to talk to people whose hands he holds. Hell, choirs, orchestras, am dram …..

Maybe he’s too clumsy for those activities, though: graceless in more senses than one.

Is that Tim Denning article a satire? I genuinely can’t tell. Very subtle if it is, utterly horrendous if it isn’t.

@TheRhino — I agree with almost all of it, although I am far too softhearted to ditch some of my negative friends. (Perhaps karma, because I am some of my friends’ relatively negative friend). Way back in the Monevator archives there’s some of that sort of thing written by me, even.

@YamiKuriboh — There are lots of relevant articles on the site, have a dig around using the search box in the top right. Here’s one to start you off: http://monevator.com/how-to-invest-on-a-budget/

I was wondering if anyone would help share their experiences on something. I am hoping to setup a low cost JSIPP for my daughter, though from what I have found on HL etc, the charges seem quite high, especially since I am looking to make periodic topups rather than a monthly direct debit. Are these high due to a lack of competition? Any online platofrms anyone would recommend?

@dearieme

‘No, the best bit of Just Keep Buying was “I have only ever invested in a bull market (2009–2017)”.’

The FI blogs are awash with investors akin to this. They face a very interesting episode of self discovery come the next nasty equity bear market.

The data shows that the average index mutual fund investor materially/significantly underperforms the index they’re attempting to invest in. Index ETF investors fare worse still, on average massively underperforming the indices they’re attempting to invest in. Most investors – and it really is a significant majority – cannot help but chase rising prices and flee from falling prices.

The rising market since 2009 has suffered periodic bouts of turbulence, all of which have been overcome. With a helicopter view, the price chart’s journey from bottom left to top right starts to appear inexorable. Investors are being conditioned by this to place ever greater trust in stocks. In time, trust leads to complacency, leading to recklessness and eventually greed.

Many are going to discover for themselves just how and why it is that the average investor fares so poorly compared to the asset class they are notionally invested in. It probably won’t be pretty and some will not make it through to the other side, but all will gain some self knowledge they didn’t previously enjoy.

@Toby Mory — Hello!

I think we should distinguish between ‘ETF users’ and ‘index investors’.

I can quite believe the former lag the benchmark returns tracked by the ETFs they (temporarily) own, as a vast amount of ETFs are in the hands of active investors and traders who use ETFs as proxies for baskets of stocks.

In contrast, I doubt the majority of index investors (as the term is used around here) do significantly underperform their benchmarks on a multi-year basis.

I am sure I once read an article by Vanguard in fact that showed it estimated only a low (from memory single digit percentage) of investors in its index funds actually significantly sold down their funds in the last bear market. Frustratingly, I couldn’t find it when having a conversation with Ben Carlson (of ‘A Wealth of Common Sense’ fame) although Ben did point out to me that interestingly the fund group DFA actually managed to increase inflows into its bespoke benchmark tracking funds during the last bear market. It only allows access to its funds through select IFAs only though, and I believe it puts that success down to such hand holding.

I’d certainly agree with you that the average active investor / person who thinks about the markets a lot is hyper-skittish in a crash. When I was writing articles like these…

http://monevator.com/being-fearfully-greedy-why-i-buy-in-bear-markets/

http://monevator.com/strategies-for-investing-in-bear-markets/

http://monevator.com/who-isnt-buying-the-market-right-now/

…it is hard to explain now how totally out of trend that was. I’d find my articles slagged off on forums etc. (I guess I was lucky that we didn’t go down the Japan route…)

But of my 5-6 personal friends who I long ago nudged into investing monthly into a rather ad hoc basket of tracker funds, none of them sold through the bear market. In as much as any even spoke to me about it, they just said “well now isn’t the time to sell is it?” but pretty much they didn’t even look. (They only get statements once a year from the platform they’re all on for historical reasons, and they virtually never check online, going on what they tell me when we very rarely speak about it). I suppose they are biased by my pep talks at the onset though.

If you do mean “index fund investors” as the rest of your comments seem to suggest, I’d be interested to see a source / evidence. 🙂

@Dartmouth — You might find some interesting stuff in the following article and the comments below it, although it is a couple of years old now:

http://monevator.com/how-to-invest-for-children/

@The Rhino and @The Investor – I also reacted very badly to the Tim Denning article. Particularly point 2. This world is plagued by very lucky people who cannot accept that they were lucky and put it all down to the superiority of their intellect or effort. This leads to the process so corrosive to society of sneering at those who are not “successful”; blaming them for stupidity, idleness and poor attitude. This means that the successful, who are usually running things, have no obligation to care a jot for those less successful as it is “their fault”.

I have worked hard, been blessed with a reasonable intellect and a lot of curiosity. I have also been astonishingly lucky in all sorts of ways and I am not ashamed to admit it. I have seen and worked with so many people who have lost out and thought – Yep! That could easily have been me.

The attitude of entitlement, and much of the rest of the sub-Randian nonsense in the rest of the list, is a … Oooh! I had better stop before I start swearing and get banned. Grrrr!

@ Toby Mory

“The data shows that the average index mutual fund investor materially/significantly underperforms the index they’re attempting to invest in.”

Would be interested in a link to the data or an analysis thereof. If I understand what you are saying it is that investors underperform the index they are targeting because they trade too actively in index funds, not because the funds available materially underperform the target index. Is that correct?

@old_eyes — Yes, of course I can see what you’re both saying. I have friends who watch X Factor, and I can’t believe it. This sort of article is clearly from the same drawer of Marmite. 😉

However I disagree with your take on what point (2) is saying. It is not, as I read it, saying “sit in a bathtub of champagne and laugh at poor people whilst spending your inheritance / profits from the Invisible Hand pointing out your genius / lottery winnings because you don’t believe in luck but had a SYSTEM that told you what numbers were going to come up in the lottery”.

It’s saying “Don’t mope about carping that some people have all the luck, life is a lottery”, in the pub, third night of the week, with a bunch of similarly downbeat mates.

I had a friend a couple of weeks back who told me I was “lucky” that Monevator was a successful blog, because most websites aren’t, and blogs are something from 2005 anyway. She then expressed surprise when I reminded her it wouldn’t be a big Friday night for me, because like for maybe 460 of the past 500 Saturday mornings over the past 10 years I’d be up at 8am to write my Weekend Reading list.

Not the greatest example, just the first one that sprang to mind. I was definitely lucky (great parents, clever, healthy in the main) and if anything I’ve been woefully unsuccessful given my skillset/talents. I do know (well, have met) the sort of people who bang on about how they made every penny out of nothing (but their public school education, gap year with future captains of industry, six-figure house deposit from mum and dad, etc).

But I know a good few people who are self-made (a few well into two commas) and none of them sat around waiting for something to lucky to happen to them, nor spent time fuming about the luckier ones.

Most say they’re lucky all the time. But what I think they mean is that American phrase that sets even me off — “blessed”.

Where you’re born and to who makes a huge difference, and gives a massive leg-up to some. But what are you going to do about that? Ask for a re-roll of the ovarian lottery?

There are some terribly unlucky things that can happen to people, mostly involving health.

That allowed, I think don’t blame luck is a far better rule for life than blame luck.

@The Investor

I think we agree. Hard work is an important part of most people’s success (although not all people). We should always strive the best we can if we want any sympathy at all, and wallowing in self-pity because of ‘bad luck’ is unattractive and makes it hard for people to warm to you. My father was a well balanced personality – a chip on both shoulders. He traced all his misfortunes to a very specific set of events, and from then on his strategy was to rail against the universe and ‘them’ whilst not listening to anyone and repeating the same mistakes over and over again.

My point was rather that I just meet so many ‘successful’ people who simply and straightforwardly deny that luck played any part in their success, and look on not achieving as a moral failing. That allows them to claim that society owes nothing to those who failed, and that means they shouldn’t have to pay any taxes.

Don’t blame luck is a far better rule for life than blame luck, but not to acknowledge the role of luck in the outcomes for each of us, and therefore the responsibility of those in a community who succeed to have some obligations to those who struggle, leads to a very dark place for society (and that means all of us).

I was particularly taken aback by the news this week that the interest rate on student loans is switching to RPI +3%.

In an era where you can get mortgages at 1.29% we are expecting students to cough up what would currently be 6.1%.

I wonder why there hasn’t been more made of this, have the students just accepted it now or does the nominal debt they take on resonate more than any change to interest rate calculations?

Big shout for the Canadian Couch Potato bond article. For the first time, I’ve actually grasped the notion of the relationship between bond prices and interest rates!

It’s put-money-in-ISA time again, and I’m having that little struggle about buying more bonds to keep my asset allocation correct vs keeping it in cash…

Cheers for the links, as always!

@The Investor: Thank you for the link. I had thought I had gone through the site thoroughly, but obviously I hadn’t. A bit discouraged that there aren’t many options and the fees seem high for setting up JSIPP and without putting in a relatively large sum fees may eat any growth up.

Re Luck : Someone said “you make your own luck” and presumably there is a grain of truth somewhere in that?

Petula was wondering if all we have to do is to buy good stock and watch it go up, then why Mr M do we bother with all this Fixed Whatsit business and other diversification nonsense?

Drew her attention to the sentence “What I am talking about is the continual purchase of a diverse set of income producing assets” quite early in the article.

So Pet, if Brussel Sprouts are expensive “let us eat cabbage”.

The FT ‘search result’ links have stopped working for the last couple of weeks – any ways around this?

@old eyes, magneto

Lucky people often react singularly negatively to the idea that they didn’t make it all themselves. I guess it just damages their self-image too much. This example is from the 2012 US election campaign:

http://www.factcheck.org/2012/07/you-didnt-build-that-uncut-and-unedited/

Thank you The Investor 🙂

I very much enjoyed the article on the relationship between bond prices and interest rates. How exactly does one go about buying bonds and uk gilts specifically? I can buy bond funds through my platform but i’m not sure if gilts are available. Then again, interest rates are very low at the moment and prices can only go down so maybe it isnt a good time to buy bonds at the moment! Are there any articles on these points planned?

I’ve had a cracking idea for an app. I’m going to call it ‘Success!’. You install it and it goes through your contacts and deletes everyone who doesn’t work 10 times harder than the average man. Ultimate productivity hack. I’m moving to mountain view to sell this bad boy. See you losers..

@uhm — They seem to be working fine for me, can you clarify what the problem is? (As I am sure you know, they return a list of links in Google. The article with the words that match the description in the Weekend Reading links is the one for you.) Perhaps you’ve read too many FT articles or something? When I click on the link here to test and follow through, in my browser that does not have an FT subscription that I log into, it works fine.

@Dartmouth

One option for a JISA is Alliance Trust. The fees are £40 per year, plus £1.50 per month for monthly dealing plus 0.5% stamp duty on UK registered investment trusts. You would need to invest quite generously each month into one investment trust at a time in order for these costs to become reasonable. I’d be interested to know if you find anything more cost effective.

@David M – I have been going through the providers listed here: http://moneytothemasses.com/quick-savings/parents/best-junior-stocks-and-shares-isa and appears that Charles Stanley may be initially cheaper but with % charges may become pricy over time. Also considering Fundsmith JISA though 1% charges.

Not working for me either unfortunately. I’m on Android, and they’re going to a Google Home page, with no searches inputted.

@Matt — Thanks for the input. This is really odd. I just checked on Chrome (third browser, never logged into FT) and it’s working fine.

Maybe it’s an Android / mobile thing?

If anyone else could share their experience of whether the FT Search Links are working for them (Yes is as useful as No) please share.

@Rhino – Oh god there would be a market for that app!

The FT links work on Android for me. Browsing with Chrome on Nougat (7.0)

Yes, the links are coming up fine for me on an Android phone. I then open them in an Incognito browser to read.

Thanks for the shoutout on my early retirement article.

Looks like property prices are getting more affordable in London now. You guys getting excited or what?!

Sam

I have JISA with Charles stanley – no dealing fees and just the 0.2% platform fee. Currently balance is £25K so about £50 total fees. I have 7 funds which need annual purchases so dealing fees for ATS would be substantial. There are a lot fewer options for fixed fee JISA and junior SIPPs so it may be a while before transfer is worthwhile…

If i switched to a single LS fund that would make it more evenly balanced vs ATS. Have reasons for not wanting to use ATS for these accounts (keeping my own accounts private while wanting to show the teenagers what is happening with theirs) and tbh i am struggling to find an alternative

Thanks @Lauraw — Yes, from testing on our end it seems we can recreate a problem after a certain number of clickthroughs, and can get rid of it by deleting cookies. (Maybe I’ve included a few more FT links than usual recently, and that is storing up more cookies/limits for people?!)

@Sam — London property has been soft at the top end for a couple of years, yes, but only a few signs of it filtering down to mere mortal levels. (Say sub-£1 million properties). So far more a sticky market and price cuts curbing price inflation. But no real turn in affordability, employment, or desirability yet. Mainly driven so far by sensible but somewhat punitive tax changes. Be interesting to see how London response to Brexit getting more real in the months ahead. I’m twitchy to buy but would like at least 20% off just to get to overvalued levels (from insane overvalued levels). 😉

Isn’t the platform fee 0.25%? Happy to be proven wrong as it will be saving myself and child money!

Yes sorry, my mistake!

@dartmouth and david m re child accounts: worth noting that iWeb will hold a child SIPP, but not a JISA. I think ATS are probably the only flat fee fund friendly JISA provider?

@dartmouth When I researched Jisas and jsipps I chose ajbell/sippdeal as the best deal for etf holdings at the time. I needed to hold a foreign share which limited things — can’t recall what the alternative was without that constraint.

Thanks for the links this week, TI. Lots of bond news — are they returning to the price when P2P and high rate bank accounts might no longer be the store of choice (tl;dr: no) – but always good to read.

And lots on market timing — although I’m not sure the article that said I could only become a multimillionaire instead of a billionaire by trying it was supposed to be encouraging my bad habits.

Election article next week and how to use it to time the market? 😉