Good reads from around the Web.

You have until midnight tonight (5 April) to shovel any free cash into your ISA to make the most of your 2013/2014 allowance.

If you’re still reading then either you have already filled your ISA – well done – or you haven’t got enough spare cash.

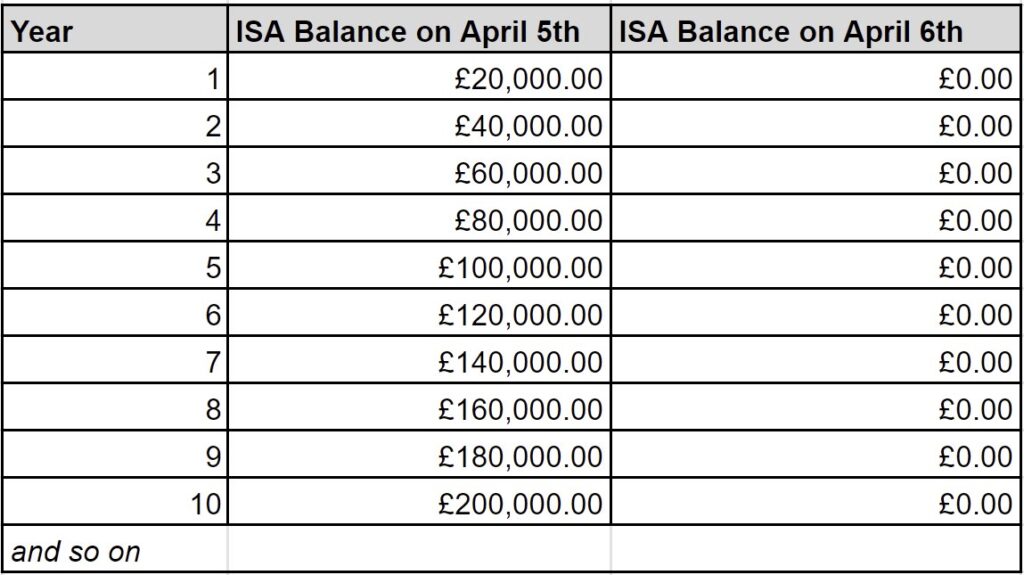

Or you’re a silly billy. Because there is no advantage to holding any cash or investments outside of an ISA. Nada. Zip.

The Guardian has a summary of some of the best places to stash your cash, though I can’t say whether you’ll be able to get money into every one of them in the scant hours remaining. Some firms are faster than others.

Alternatively, if you’ve got a share ISA already open, double check to see if you’ve already filled it to the max this year.

Me, I load up my shares ISA within the first few days of every new tax year. Why waste a moment of potential tax-free compounding?

So I’ll be smugly enjoying a smoggy London day!

From the blogs

Making good use of the things that we find…

Passive investing

- Foolish in love and money – Rick Ferri

- High frequency drama vs dramatically lower costs – Total Return Investor

- Chasing complexity – the research puzzle

Active investing

- Passive versus active investing – Investing Caffeine

- More on “the dark side” of tracker funds – Irate Investor

- When should a share be labelled “speculative”? – Beddard/iii

- How much should you pay for a company? – Geoff Gannon

- Finding value in today’s UK stock market – UK Value Investor

Other articles

- Should you test an advisor with part of your money? – Oblivious Investor

- Risk takes centre stage when you retire – Retirement Cafe

- London is forever blowing house price bubbles – Under the Money Tree

Ruse of the week: Are you an older saver of pensionable age with £8,000 handy? The Telegraph explains how a loophole in the new pension legislation enables you to make a near-instant £500. Hargreaves Lansdown, which pointed out the wheeze, expects it to be closed down soon enough.

Mainstream media money

Some links are Google search results – in PC/desktop view these enable you to click through to read the piece without being a paid subscriber of that site. 1

Passive investing

- Michael Lewis’ book on high frequency trading and you – NYTimes

- Try doing nothing for a change – Ritholz/Bloomberg

Active investing

- “Peakdrift” is a curse of the market [Search result] – FT

- Flying “PIIGS” outperform [Search result] – FT

- Only mid-cap value managers beat US indices in past 5 years – CityWire

Other stuff worth reading

- London house price madness can’t end well… – Guardian

- …and now could be the worst time to buy-to-let – Telegraph

- You don’t work as hard as you think you do [Search result] – FT

- Why don’t the 1% feel rich? – The Atlantic

- UK farmland prices rising faster than prime London – Telegraph

Book of the week: Curious about all the high frequency trading fuss in the media this week? The book that started it – Flash Boys – is already number nine in the Kindle charts!

Like these links? Subscribe to get them every week!

- Reader Ken notes that: “FT articles can only be accessed through the search results if you’re using PC/desktop view (from mobile/tablet view they bring up the firewall/subscription page). To circumvent, switch your mobile browser to use the desktop view. On Chrome for Android: press the menu button followed by “Request Desktop Site”.”[↩]

Comments on this entry are closed.

I tend to do our S&S ISAs in April but it’ll be a struggle this year!

I’ve sold down some unwrapped shares to make use of the final fling of 13/14 CGT allowance, plus there is some Vodafone money left, but I’m still not going to be able to them just by throwing in ongoing dividends.

Hey, look at me, I’m grumbling about a tax allowance going *up*!

“Because there is no advantage to holding any cash or investments outside of an ISA.” Pah, we can get 4% p.a. (or better) on cash in current accounts, 3.2% p.a. net. No instant access Cash ISA comes close.

We’ve reached the stage where we have no new surplus money to save or invest; it’s just a matter of moving the moolah around to best advantage. Since we’ll soon be able to bung £15k p.a. each into NISAs, we are perfectly happy even to withdraw cash from ISAs to increase the interest we get. I can’t see any point in withdrawing non-cash, though. Unless it is to replace a Gold ETF by yer actual sovereigns.

I’ve been saving into PEPs/ISAs since I was in my mid 20s and have never taken so much as a penny from these wrappers. My projections suggest that I won’t need to touch them until my late 60s, but their existence will improve my quality of life well before then.

I’m looking around for an index tracking ISA for the new tax year and, thanks to reading blogs like this, perhaps paying a bit more attention to fees and charges than I used to. I didn’t think I was a particularly clueless passive investor, but I am losing the plot a bit with regard to fees and charges. Has this all changed recently? I have had some letters over the last few months from my existing ISA providers regarding new charging structures, but I can’t seem to find any recent articles on the web about how charging works in general.

For example, Fidelity’s FTSE All-Share tracker appears to be available inside an ISA at a 0.3% annual charge (https://www.fidelity.co.uk/investor/research-funds/fund-supermarket/factsheet/fees.page?idtype=ISIN&fundid=GB0003875324&UserChannel=Direct) with no other charges mentioned. That looks pretty cheap to me.

I’m sure I’ve read that the Vanguard funds are really cheap. My Google-fu isn’t up to finding many places which will let me invest in them. The best I’ve come up with so far is via Hargreaves Lansdown’s ISA. The fund itself has a 0.4% initial charge and a 0.15% annual charge – OK, I can accept that the non-zero initial charge is compensated for by the low annual charge for long-term non-meddling passive investors. But Hargreaves Lansdown themselves seem to want to charge 0.45% per annum (capped at £45) on the first £250,000 of funds – presumably in addition to the Vanguard fund charges. As I work it out, that means if I have £15,000 in the ISA, the HL fee will be £45, the Vanguard fee will be £22.50 for a total of £67.50 or 0.45% per annum – more expensive than Fidelity even before I pay the 0.4% initial charge on the Vanguard fund.

What am I missing here? Any advice would be greatly appreciated!

What dearime said – the obvious advantage is that it’s easy to beat the poor return on cash offered by ISAs at present. Most of us need some cash on hand 😉

Zorn, I keep turning over in my mind the attractions of this tracker – an Investment Trust.

http://www.aberdeenuktracker.co.uk

You could invest in it via the management company’s own ISA for £24 p.a. with (free, I presume) dividend reinvestment. Scroll down to p 47

http://www.theaic.co.uk/sites/default/files/statistics/attachment/AICStats28Feb14.pdf

do any bright sparks out there no of any unit-trusts or etf trackers that target the micex, i.e. russia? or potentially an emerging markets tracker that contains a strong exposure in that direction?

@zorn a fair place to start would be reading the ‘compare brokers’ post under the ‘investing’ tab on this site..

there is a ‘best-buy’ table in there which presents a lot of relevant information

HL is generally considered to be a bit expensive for passive investors now

@zorn It appears to me that you aren’t quite comparing like with like. The Fidelity fund you linked to can indeed be held within an ISA, and the fund itself charges a 0.3% AMC.

However, whoever it is you choose to have your ISA with will also charge you some sort of platform fee for the administration costs, etc. (In the past this would typically be invisibly paid for out of commission on the funds; now, post-RDR, this doesn’t go on any more and the costs are up-front.)

0.45% is what Hargreaves Lansdown charge to hold an ISA with them – and you’re right, this platform fee is in addition to the fund’s annual management charges. So if you were to hold that Fidelity fund in an HL ISA, it would cost you a total of 0.75% a year. The Vanguard fund would cost a total of 0.6% in the same ISA.

(Note that there are better value ISA providers – for example Charles Stanley charges 0.25% and offers Vanguard funds too.)

With regards to HL’s high fees, perhaps it’s a case of you get what you pay for, as illustrated in this post here: http://simple-living-in-suffolk.co.uk/2014/04/hargreaves-lansdown-saves-the-day-at-the-eleventh-hour-of-the-old-tax-year/.

To quote “Using Hargreaves Lansdown’s website brought it home to me just how crappy all the low-cost platform websites I’ve used were.”

I’m prepared to put in a little extra work using a more basic platform given how much better a return it’s going to give me over the long term. However, BestInvest’s platform does everything I want, and their phone and email support is rapid, polite and well-informed.

At the end of the day, we’re all free to choose whichever platform we like, with only the high cost and hassle of switching limiting competition.

@weenie HL work out pretty cheap for small SIPPs so its a win win on cost and customer service

Interesting debate.

Having screwed up my strategy of NHS pension as a bond equivalent plus income IT’s and ETFs to top it up by moving to New Zealand. Which, to be fair, has many attractions but cheap and accessible share trading isn’t one of them

For various reasons – like a lack of CGT and the kiwi equivalent of HMRC deciding that tax free pension lump sums in the UK on retirement would be taxable in NZ- it’s possible that converting the NHS pension to an income drawdown (a qrops) may be advantageous. Maybe. Possibly.

Given the best deal here for a market based pension has 1.25% annual charges and financial advisors are under the impression they can beat the market (smaller local market so may be possible) it’s less attractive.

As for a SIPP or ISA holding foreign shares leads to a tax on an assumed 5% gain per annum plus several recent financial scandals (plus ca change!) means most locals invest in CGT free BTL.

I’ve reluctantly closed the ISA’s to invest directly int the few ETF’s and Uk IT’s listed on the local market and hope it all works out!

Keep up the good work!