Good reads from around the Web.

Only a hedge fund manager could be arrogant enough to make a bet about investing returns with super investor Warren Buffett:

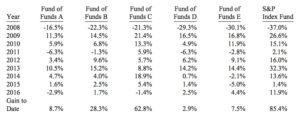

Results are in for the sixth year of the competition sometimes called the $1 million bet, and Warren Buffett — once a piteous straggler in this 10-year wager on stock market performance — has opened up a sizable lead over his opponent, New York asset manager Protégé Partners.

Buffett’s horse in the bet is a low-cost S&P index fund, and Protégé’s is the averaged returns to investors (after all fees) of five hedge funds of funds that the firm carefully picked for the contest.

The hedge fund partner who made the bet, Ted Seides, seems like a good sport, and by now he’s probably older, wiser, and ruing his foolishness.

Still, you have to wonder whether all publicity is good publicity, given the massive lead Buffett’s chosen tracker fund has opened up over its hedge fund rivals:

At the end of 2013, Vanguard’s Admiral shares — the S&P index fund that’s carrying Buffett’s colors — were up for the six years that began Jan. 1, 2008 by 43.8%.

For the same period, Protégé’s five funds of funds, on the average, gained only by an estimated 12.5%.

The index fund is beating the hedge funds by an extra 30% of return.

Oops!

I cannot tell you how many smart and sophisticated investors told me I was a simplistic fool for recommending tracker funds as the best vehicle for the investing majority six or seven years ago.

That doesn’t happen so much these days. Buffett’s bet is probably one reason.

Of course some hedgies will argue their funds reduce volatility, and that the price paid is lower returns.

But that only makes this bet a dumber one. It’s also not a good strategy for their clients, since as we often discuss here on Monevator, a good dollop of cash and government bonds will reduce volatility far more cheaply and consistently than an expensive hedge fund.

There may be times when the more exotic hedge fund strategies can deliver uncorrelated returns, which is indeed a useful thing.

But few people will ever invest to see it, and none of them are likely to be reading this website. (More likely a 1%-er who spreads his money across 10 invite-only small new hedge funds, and strikes it lucky with the 10th.)

In any event, I certainly wouldn’t bet on a bunch of hedge funds ever beating cheap index trackers over the long haul.

And I’d never bet against the master odds-juggler, Warren Buffett.

p.s. Some passive investors may be surprised to see Warren Buffett – perhaps the greatest investor of all time – touting index funds. Isn’t he the poster boy for the enemy? In fact Buffett has often said that for most people index funds are the best way to invest. Buffett’s advocating of passive investing when he could wax lyrical all day about genius active management is just another mark of his class as a money manager, in my view.

Wealth Warning: HMRC is reporting a surge in bogus emails claiming to offer a tax rebate. It’s a scam. Let’s be careful out there!

From the blogs

Making good use of the things that we find…

Passive investing

- Emerging markets: Boom, bust, repeat, yawn – Rick Ferri

- John Bogle celebrates The Bogleheads founder’s 90th – Bogleheads

Active investing

- Business is complex – Oddball Stocks

- Grantham’s latest quarterly letter [PDF] – GMO

- A simple formula for investing success – Clear Eyes Investing

- What’s bad for emerging markets is good for US stocks – Investing Caffeine

- Jim Chanos thinks it’s time to start shorting again – Value Perspective

- Volatility: An investor’s guide – Under the Money Tree

Other good reads

- The right-on nihilism of one article in the US version of The Guardian winds up Mr Money Mustache – Mr Money Mustache

- By 2035, there will be almost no poor countries – Bill Gates’ Annual Letter

- How much work can you withstand? – Simple Living in Suffolk

- Having kids versus retiring earlier – Can I Retire Yet?

Product of the week: The 0% 1 balance transfer credit card war is on, and Barclaycard has upped the stakes. It’s increased the 0% term of its leading card from 30 to 31 months, after Halifax matched its previous 30-month offer. MoneySuperMarket calculates somebody with a balance of £2,500 who is paying the standard 18.15% APR would save £1,275 by switching to the new card. The best use of the card is to help you get rid of all your credit card debt forever, by enabling you pay it off sooner.

Mainstream media money

Some links are Google search results – in PC/desktop view these enable you to click through to read the piece without being a paid subscriber of that site. 2

Passive investing

- Don’t be fooled about returns by a trick of the calendar – Vanguard

- ETFs aren’t ruining emerging markets – ETF.com

Active investing

- Hargreaves Lansdown drops unpopular investment trust fee – HL

- The global economy: A worldwide wobble – The Economist

- Emerging market haven hunt turns up few bargains – FT

Other useful articles

- Can solar panels really replace your pension? – Telegraph

- 300,000 people pay 30% of all UK income tax – Telegraph

- Your marriage is probably making inequality worse – Slate

- Rate fears prompt surge in fixed rate mortgages [Search result] – FT

- Don’t bet the house on price rises persisting [Search result] – FT

- Labour: Give local buyers first refusal on new properties – Guardian

- Why America stopped driving – Morgan Housel: Motley Fool

Book of the week: Intrigued by Buffett’s bet? Larry Swedroe’s Think, Act, and Invest Like Warren Buffett cunningly uses the master’s mass-market appeal to sell the virtues of passive investing.

Like these links? Subscribe to get them every week!

- Excluding sneaky fees![↩]

- Reader Ken notes that: “FT articles can only be accessed through the search results if you’re using PC/desktop view (from mobile/tablet view they bring up the firewall/subscription page). To circumvent, switch your mobile browser to use the desktop view. On Chrome for Android: press the menu button followed by “Request Desktop Site”.”[↩]

Comments on this entry are closed.

If Warren Buffett and Jack Bogle both advocate this type of investing,who are we mere mortals to argue!

Hi. I’ve just tried clicking on the link to the Economist article but it takes you to the “Why America stopped driving” article.

@Andrew — Thanks for that, fixed now.

Good article by Rick Ferri on Emerging Markets: an antidote to most recent UK media discourse on Emerging Markets and the investing case (or not).

Interesting you note Bill Gates’ annual letter amongst the links.

My favourite economist, John Kay (author of book “The Long and Short of It”, which every UK private investor ought to take a look at) wrote rather a competent rebuttal of Gates’ opening: http://www.johnkay.com/2014/01/29/9250 (“The world’s rich stay rich while the poor struggle to prosper”).

Thanks for the weekly roundups, I look forward to their arrival each weekend.

I’m not surprised that Buffet is winning, though there’s 4 years to go yet…