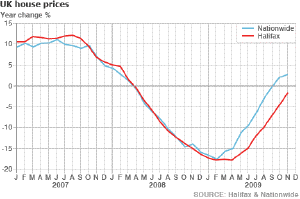

I have rounded up a bunch of house price predictions for 2010, to follow up my article on the likely fate of some first time buyers after the great UK house price crash stopped crashing (as shown in the BBC graph to the right).

These predictions aren’t wildly useful. It takes years for bearish sentiments to play out (Capital Economics was looking for a UK house price crash in 2004, as I recall), while the big banks are loathe to predict anything worse than stability (predicting losses implies more writedowns).

However, predictions can be thought provoking if not actually useful, as well as a bit of fun – we can tune in next year to see who was closest, and perhaps over a few years find a decent soothsayer.

| Prediction | Source | |

| Jonathan Davis (HousePriceCrash.co.uk) | -10-15% | BBC News |

| Capital Economics | -10% | PropertyWire |

| Savills | -3% | Channel 4 |

| Hometrack | -1% | The Guardian |

| Halifax | 0% | BBC News |

| Nationwide | 0% | BBC News |

| Centre for Economics and Business Research | 2-4% | The Guardian |

| John Charcol (Broker) | 4-9% | BBC News |

| Council of Mortgage Lenders | Abstain | BBC News |

All predictions are for movement in the UK average national house price. The ‘source’ column links to where the prediction was cited. No predictions are more than three months old.

My own gut feeling would be for an increase of around 5%, based on only mildly rising base rates and a strengthening UK economy (I think unemployment is probably very close to peaking).

I’d say though that the risks are more to the downside, because of the potential for an interest rate shock.

Got a prediction to share? Tell us below, with a link if it’s not your own. 🙂

Comments on this entry are closed.

You’re jumping the gun here – it’s high interest rates/inflation that will do for people. I was there in the early 1990s – 14% mortgage interest rates anyone? It’s happened before.

Inflation helps people with mortgages if it boosts their earnings once they’ve bought the hosue. This helped my parents who bought their house in the early 1970s for £5000 and saw wages rise over the next 10 years, but globalization and the shift of economic power eastwards from the indebted West will probably limit future capacity for wages to keep up with inflation. Be afraid…

I agree ermine, but I’ve been arguing about money illusion and expecting a big drop for 4-5 years. I still think rates will bite eventually, but I’m a six-figure sum down because of under-estimating the UK housing market before.

14% rates were a technical blip caused by us clinging on to the ERM. That said it would probably only take base rates of 8% or so to do the deed today.

Thanks for your thoughts!

14% rates may have been the technical blip caused by us clinging on to the ERM last time, but the technical blip this time is in the form of £200bn of printing money – it’s going to be an interesting year, particularly after the election.

You guys have a Zillow.com type online appraisal site? The data points here are that prices have rebounded quite quickly like the equity markets.

.-= Financial Samurai on: Taxing All Big Banks Is A Double Standard And Is Unconstitutional =-.

@Sam – I haven’t heard of Zillow, I’ll have to look at it before I can answer! 😉

Well now that we are over half way there the picture is still no clearer. One predicts a rise another predicts a fall. It is still on the rise according to most educated analysts.

.-= Housing Market on: Garden Delight =-.

How did your 2010 prediction fare? And, what are the experts picking in 2011?

At SimplyFinance, we’ve seen a pick up in activity around first time buyer, next time buyer, and buy-to-let in 2011. Not sure if this will translate into higher real estate prices, but it looks like the mortgage market is beginning to thaw.