What caught my eye this week.

I was a big fan of real-time strategy computer games in my frugal but otherwise misspent youth.

You know – those games in which you’d martial digital resources and deploy armies to expand your burgeoning industrial-military complex (or gold based goblin empire).

At their best, real-time strategy games gave you a glimpse of what it was like to be Napoleon or Marcus Aurelius – commanding legions!

At their worst, they were invariably broken by glitches that threw the whole illusion out of whack.

For example, weapon combinations whose lethality escaped the game’s bug testers and made your troops invincible.

Or technology tree choices that exponentially repaid whatever you put into them, giving your faction near-infinite riches while your computer opponent was still rubbing two sticks together.

Triple-lock turns the screw on UK finances

I thought of these glitches when considering the fuss over the triple-lock for pensions. As Simon Lambert noted in ThisIsMoney (my bold below):

The government made a deal in its manifesto to stick with the triple lock, which raises the state pension by whichever is the highest of consumer prices inflation, average annual wage growth, or 2.5 per cent.

It uses September’s inflation figure but July’s average earnings number, and this week the UK’s public finances watchdog, the Office for Budget Responsibility, warned that the latter could trigger a shock £3billion bill.

This would come from pensioners getting a bumper rise due to a quirk from the coronavirus crisis.

Average earnings figures are temporarily being distorted by furlough, lockdown job losses and a comparison to pay cuts in the depths of the crash a year ago, meaning that average wage growth is currently coming in at a high level and rising.

Annual wage growth climbed to 5.6 per cent in the three months to April, according to the latest official figures, and the crucial three months to July figure could hit 8 per cent.

That’s a very nice uplift for doing nothing different if you can get it. But the triple-lock wasn’t meant to occasionally throw up three melons on the slot machine of financial life like this.

An 8% rise after everything we’ve been through looks like a classic glitch.

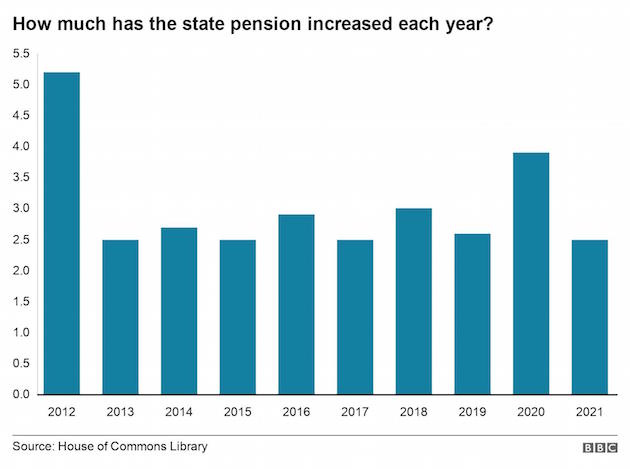

Still, it’s worth remembering the triple-lock has otherwise delivered roughly what it was meant to.

The State pension has increased ahead of average earnings since the triple-lock was introduced in 2011. This halted an ongoing decline in relative terms that was previously making pensioners ever poorer.

And that outpacing has come even though in most years the State Pension has only increased by 2.5%, as cited by the BBC:

That’s the great thing about guaranteed increases from a mechanism like the triple-lock, at least if you’re not the one who has to pay for it.

That’s the great thing about guaranteed increases from a mechanism like the triple-lock, at least if you’re not the one who has to pay for it.

You always get some cream, without ever suffering a sour year.

Screw who

With that point conceded to the triple-lock, an 8% rise does look dumb.

David Willetts, the president of the Resolution Foundation think tank, argues the annual earnings link should be replaced by figure that better reflects workers’ experiences of pay increases and declines:

“The Covid crisis has laid bare the design faults of the triple lock, with a severe jobs crisis last year inadvertently contributing to an unnecessary and unjustified 8% rise in the state pension next year.

The chancellor should take the opportunity this autumn to replace the triple lock with a smoothed earnings link.

This would mean the state pension would rise in line with the living standards of working-age people – a change that would be fair to all generations.”

You may remember Willetts was the unusually bold former Tory minister who in 2011 published The Pinch – a book highlighting potential inter-generational fallout from the good fortune of the Baby Boomer generation.

Since then Boomers have only gotten richer, and pensioners could now see an 8% uplift to their state income in the wake of millions of their grandkids being (rightly) ordered to stay at home, in large part for the sake of the elderly.

True, the UK’s State pension is not especially generous. Those who rely on it are not the same people that Willetts and others finger for hoarding an undue proportion of the nation’s wealth.

On the other – other – hand, one can argue today’s pensioners already had their chance to save during three decades of prosperity.

In contrast, today’s young now have to save for their future – at a time of financial crisis, lockdowns, globalization, Brexit, and near-zero interest rates, with houses unaffordable to most to boot.

But how many hands have you got? Because yet another point is that pensioners vote.

Something their favourite newspapers have pointed out repeatedly in calling for the 8% rise to sail through.

Pick your pension poison

It seems to me the 8% uplift is clearly a bug caused by unforeseen circumstances. In software terms, it needs a patch to update it.

However it’s also true the triple-lock was introduced to stop the state pension becoming inadequate over many decades of longer retirements and rising living standards. We all know that story.

Pundits who’ve never seen a state benefit they didn’t want to double argue we should all want to retain the triple-lock, because today’s young people will benefit from it in their old age, too.

Whereas ironically, many young people suspect they’ll never get a State pension – partly due to its high cost funded by a shrinking pool of workers.

A cost that could be made even worse – to the tune of £3bn forever – by this glitchy 8% uplift!

Finally, we have speculation – see my links below – that chancellor Rishi Sunak is looking to claw back money by further reducing the amount you can put into a private pension or by cutting the tax relief you receive.

You don’t need to be Daniel Kahneman to see that all this tinkering with the rules that govern payouts that you won’t receive for decades is deeply sub-optimal.

Pensions 2.0

I’m not especially old, and I’ve seen big pensions changes in my lifetime, myriad tweaks, and annual speculation that this allowance will be chopped or that relief will be scrapped.

That’s not even to get into the shifting age limits as to when you can get your hands on your money.

It’s pretty ridiculous.

Indeed I’m starting to wonder if we shouldn’t do a hard reboot towards a system so simple that everyone understands it – making it harder for future politicians to meddle with – albeit at the cost of more turmoil today.

I haven’t attempted to cost out the following idea, but in theory it could sweep away a lot of this ongoing nonsense in one go.

We evidently believe as a society that old people should have a minimum standard of living.

We also believe younger people should know they have a comfortable future to look forward to, for all kinds of good reasons.

Finally, we understand it’s incredibly difficult to make any forecasts and commitments about the far future – financial or otherwise.

Funding your retirement been described as the hardest problem in finance, due to all the uncertainty.

But perhaps the one entity that can make firm commitments is the State, backed as it is by taxpayers.

So – maybe we should set a universal state pension at a much higher level than today’s payout. Say 50% of a median workers earnings.

That would deliver a State pension of about £15,000 a year right now, compared to less than £10,000 under the current system.

Wow, right? But how do we pay for it?

Well for starters we then scrap the entire artifice around private pensions and tax relief.

All of it. Everything.

People could still save and invest whatever they liked in the usual way, of course. There would be no prohibition on aiming to be a multi-millionaire in your old age.

But the government wouldn’t help you get there.

So there’d be no private pensions. No annual allowances or tax-free lump sums. No crystalization events or similar. No tax wheezes at the margins.

All gone, at a huge (though possibly not sufficient) saving to the government of time, money, and bureaucracy.

Possibly ISAs could remain. We’d have to do the sums. But before you get too indignant, remember you’d be getting that far bigger state pension, too.

Don’t worry, be happy

Obviously the lower-paid and poorer would gain the most though from this system. I’m not sure that’s a bad thing, given the direction of travel of society over the past 20 years.

But richer people like most of us are (or will be) would benefit, too.

Our retirement plans could be built on stronger foundations. Difficult choices about whether to lock money away and what would happen to it would be replaced by simply saving as much as you could and wanted to.

Billions would be saved in accountancy costs and other fees.

One snag would be it would make the Boomers even richer. The wealthiest cohort of society would suddenly get a far higher State pension despite not paying much towards it. (They’d pay something – they pay tax, remember).

Perhaps we’d need a windfall wealth tax to smooth the transition? If that meant Boomer retirees short on liquidity moving out of their mostly empty five-bedroom homes to release capital or whatnot, that’d probably be a good thing, too.

Now as I said I haven’t costed out my alternative pension system.

Why bother? Even if I was an elected MP there’d be zero chance of it being implemented.

But I think it’s worth thinking about big alternatives to this ongoing muddle.

Otherwise we will battle on for years with shifting rules and benefits and a future target that looks more like a swarm of bees than a bullseye.

More patches and glitches – and the occasional threat of a crash – forever.

Good business for financial planners, politicians, and tax specialists. Not bad for money bloggers, either.

But a pretty dumb way to encourage people to plan their way through life.

Have a great weekend everyone. Stay hydrated!

From Monevator

A guide to personal finance for immigrants to the UK – Monevator

Emerging market bonds and your portfolio – Monevator

From the archive-ator: Life insurance and protection: a primer – Monevator

News

Note: Some links are Google search results – in PC/desktop view you can click to read the piece without being a paid subscriber. Try privacy/incognito mode to avoid cookies. Consider subscribing if you read them a lot! 1

UK inflation rate hit 2.5% in the year to June, highest in three years – BBC

Petrol prices at an eight-year high, says the AA – BBC

Average UK house prices surge 10% year over year – Sky News

Child benefit tax ruling sparks widespread concern [Search result] – FT

Total household wealth increased by 6% (£900bn) in pandemic, but richest 10% did far better, finds report [PDF] – Resolution Foundation

Revolut becomes a £24bn tech giant on latest investment round [That’s more valuable than Natwest] – Sky News

The mutual fund structure is giving way to ETF dominance – Yahoo Finance

Hong Kong’s exodus is real, diminishing its importance as a global hub – Bloomberg

The quest for the investment Holy Grail: an index of everything [Search result; 60/40 returns cited seem off] – FT

Products and services

Get £100 cashback when you switch your ISA to Interactive Investor [Promotional offer, ends 31 July, terms apply] – Interactive Investor

Buy-to-let mortgage choice is improving for landlords – Which

How Apple and Klarna are cutting up credit cards [Search result] – FT

Sign-up to Freetrade via my link and we can both get a free share worth between £3 and £200 – Freetrade

The promise and peril of Ethereum – Morningstar

Homes for sale in seaside hotspots, in pictures – Guardian

Comment and opinion

How does a raise early in your career affect your finances? – Of Dollars and Data

Five threats to your pension [Search result] – FT

What have you got in your ‘too hard’ pile? – Morningstar

Too smart – Morgan Housel

Transactional costs don’t matter much nowadays – Morningstar

Home bias and the best time to diversify – Compound Advisers

The language you speak may impact your financial decisions – Klement on Investing

A FIRE-ish update from a long-lost money blogger – The FIREStarter

Maladjusted money mindset mini-special

Frugality is a means, not an end to itself – Enso Finance

Choose both – Humble Dollar

Why do we always focus on the bad stuff? – A Wealth of Common Sense

Naughty corner: Active antics

Put down the dividends, and slowly walk away – Validea

Building a long volatility strategy without options – Factor Research

Covid corner

One in a hundred people in the UK likely have Covid right now – BBC

England’s Covid unlocking a ‘threat to the world’, warn 1,200 scientists – ES

Lockdown didn’t save lives from cancer – The Spectator

Hygiene theatre: how excessive cleaning gives us a false sense of security – Guardian

Kindle book bargains

A Colossal Failure of Common Sense: The Collapse of Lehman Brothers – £0.99 on Kindle

SAS: Leadship Secrets from the Special Forces by various authors – £0.99 on Kindle

Ultralearning: Accelerate Your Career, Master Hard Skills, and Outsmart the Competition by Scott Young – £0.99 on Kindle

The $100 Startup by Chris Guillbeau – £0.99 on Kindle

Environmental factors

Trains far greener, but much more costly to take than planes – Guardian

Amazon rainforest now releasing more carbon than it can absorb – CNBC

Yet another future of work mini-special

The future of work has arrived on Wall Street – Politico

The five-day workweek is dead – Vox

Four-day week? Not if it means a pay cut, say British workers – Guardian

Your boss secretly wants to quit. Leaders can’t take Covid-19 work life anymore – Globe and Mail

US cities are now marketing to remote workers, not companies – Axios

Community – Josh Brown

Off our beat

How your personal data is being scraped from social media – BBC

Can people still play the same video games as they get older? – Wired

And finally…

“I have lived with several Zen masters – all of them cats.”

– Eckhart Tolle, The Power of Now

Like these links? Subscribe to get them every Friday! Note this article includes affiliate links, such as from Amazon and Freetrade. We may be compensated if you pursue these offers – that will not affect the price you pay.

- Note some articles can only be accessed through the search results if you’re using PC/desktop view (from mobile/tablet view they bring up the firewall/subscription page). To circumvent, switch your mobile browser to use the desktop view. On Chrome for Android: press the menu button followed by “Request Desktop Site”.[↩]

Comments on this entry are closed.

Young people have born the brunt of the epidemic only to see the older generation enriching themselves. This is not a good look. Hopefully Sunak has the balls to do the right thing.

Someone said the Covid epidemic allowed “the middle class to stay home while the workers kept working “

Things are certainly in flux.A gradual realisation is dawning that life is not going to return to that which we knew before all this happened

As this existential fact begins to be understood by people -the last to get it will be our more privileged classes which includes our current crop of leaders

We (almost ) have a war scenario in progress with the end point unknown

Tin hats everybody!

xxd09

> Possibly ISAs could remain.

Generous (!). Rather glad you’re not Chancellor (gulp!)

The main problem with this is you’re assuming everyone is happy with it and agrees not to tinker with it in future. But one cannot make promises on behalf of future generations because they can always decide to reverse it. This is inherent risk. So your proposal wouldn’t work regardless of whether it’s a good idea or not but simply because it isn’t practical. Or workable. Maybe you think people would riot or something if the government reneged on it… Who knows.

I agree that the pension system is convoluted, prone to political whim, tax reliefs are subsidies to the pension industry etc. But rather like democracy, it’s the least worse system we have unfortunately.

Personally, having just received a £14k higher rate tax rebate I don’t need for pension contribution relief, I think abolishing higher rate relief seems perfectly reasonable on the surface. The problem with that is that basic rate relief alone isn’t enough to yield a decent pension in these days of near zero yields and this is the “dirty little secret” of the pensions industry these days + you simply need to save a lot lot lot more now than 10-20 years ago.

I notice wryly you don’t seem to mention NI which originally ostensibly was supposed to fund exactly this sort of thing (smelling similarly of “fairness”, the politics of which I won’t go into) but look how that’s panned out over the decades….

Nonetheless I do agree with your premise here that older generations have a duty to the young and to give opportunity and prosperity (ideally more than they themselves received), and not to the pull the ladder up behind them.

@TI. Love it. A higher State Pension that goes hand in hand with a total scrapping of all private pensions (both DC and DB) is something I’ve always liked the idea of.

I’ve never understood why a doctor, say, deserves a large tax subsidy to get a higher pension when retired than the cleaner in the same hospital. The’re both just retirees. What you did before should be irrelevant. You want a better retirement? Just save for it. You don’t need a tax subsidy.

But you don’t go far enough. At the same time get rid of ISAs, VCTs, EIS, EA, daft IHT allowances. None of these are needed. Put CGT (with indexing) at income tax levels and get rid of principal residence tax exemption. You could destroy swaths of accountants’ careers in one fell swoop. What’s not to like?

It doesn’t need, however, to make current retirees richer. Simply don’t give them any benefit. The state pension can be increased as a function of how many years you did not have the opportunity to pay into a private pension.

Cutting private pensions give the govt £40bn+/annum in increased tax revenues. Number of people above 67 is < 12 million. So that gives you over £3k/annum already and you wouldn't be paying that out for decades if the pension increase was on a sliding scale. To make it credible, the money saved by the govt would need to be ring fenced in a wealth fund. Otherwise they would spend it now creating a massive forward liability.

Continuing with your RTS metaphor, the best systems allow for some measure of getting ahead through good strategies while punishing bad ones and at least have an illusion of “choice” through tech trees and tactics (Zerg vs Protoss anyone?)

I hate to say it but “simplification” will massively disadvantage those whose efforts actually grow the economy. No more higher rate relief means higher earners driven ever more into less benign tax avoidance loopholes (SEIS, VCT) and outright evasion. meanwhile, the immediate beneficiaries would be the already retired. I don’t have any answers and suspect neither do successive governments in Thrall to the grey vote and the press.

But if you scrapped everything, how would the government of the day bribe various sections of society into voting for them next time?

@zxspectrum – doctors will have paid vastly higher sums for their pensions than the cleaners. You could equally say why should somebody that has saved 1mill into a DC pension get more pension than somebody that has saved 500k?

Consultants pay 33% of their gross remuneration into their salary. If they opt out of the pension scheme (as is often required for tax reasons) then they donate the employer contribution back to the hospital with no flexibility.

Thanks @TI, most other discussions about the impending triple lock anomaly haven’t taken in the point that an increase over regular inflation was a design intention, to restore State Pension to a civilised level without it creating an economically unattainable step change in government expenditure.

But as you say, Covid has created a bug the system wasn’t designed to address. The “patch” doesn’t need to be complicated, just-re-run the calculation across two years and use the annualised rates.

I am sure your solution could be made to work, but it does depend on a world where everyone has a similar interest in saving for their future as readers of this blog. I don’t think that we are a representative sample! There are many who only save because of the incentive of pension tax relief and ISAs, and because of compulsory enrolment. It would be OK with a high enough rate of state pension, but politically unacceptable to introduce the correspondingly high rate of income tax required.

The cynic @TA got it right, a lot of the less logical concessions have been past “bribes” to favoured sections of the electorate, and you can bet your life that a year before the next election is due your new system is undone with another such sweetener.

Young people as a group should welcome the triple lock, since the compounding effect with a 2.5% floor will have longer to take effect for them. Pensioners might only have 10 years before they die, younger people might have 40 years. Of course, future governments may fiddle with the state pension, but you would rather they mess with it from a higher baseline.

On the topic of ‘mad economic ideas that might actually be good’, one I heard a few years ago that I keep coming back to is ‘0% income tax, 100% inheritance tax’. Encourages spending, maybe the increased VAT makes up the difference in income tax and eliminates generational inequality.

I wonder if the Investor ever played the Red Alert RTS games. Still 20 years on I am ashamed to admit I play them online. Wonderful games.

The reality is that the UK State Pension is the most miserable in the developed world.

The cost of maintaining the triple lock in the upcoming circumstances is £3 Billion. That’s chicken feed.

The answer to a lot of this is to have a Universal Basic Income.

> On the other – other – hand, one can argue today’s pensioners already had their chance to save during three decades of prosperity.

Except that in the majority of cases those who only have the state pension to live on are typically from areas of the country which didn’t experience three decades of prosperity such as mine which is one of the ten poorest in Northern Europe and where house prices have barely risen since 2008, where it’s still possible to buy a decent flat on NMW wage without exceeding a 3x multiplier income with a 10% deposit.

@Ducknald Don.

I was under the impression that the old had borne the brunt of the epidemic, by dying in droves.

1) – Millennials and Gen Z will hopefully benefit from the same triple lock system in the future.

2) – Massively upheavaling people’s reward packages could trigger inflation/ worker shortages/ price changes to make up for lost pension

3) – People have built plans around the system so neither Tories or labour would be keen to means test for example.

4) – Larger state pensions might undermine our country as a private shareholder of foreign assets – our private pensions bring money into the UK and help make London the financial capital it is – something some of Europe doesn’t have because they rely on big state pensions. It changes our nation’s risk tolerance and consumer habits and ownership of global assets.

5) – Pensioning off the older might open up job opportunities for youngers

6) – C&C generals the best 😉

Bear in mind, the announcement on NHS pay is likely to be September now after summer recess although I imagine that next year England will be brought up to Scotland’s pay at least

On the ‘worst among OECD’:

Using OECD figures to compare pension “well-off”ness head-on among countries is disingenuous at best.

In various countries, the state pension is “THE” pension and it would even be hard for people in some countries to grasp the concept of “state” vs “workplace” pension as they are one and the same.

Taking as example Portugal, your full ‘pension’ is funded by paying Portuguese national insurance, and a complicated formula based on years worked, contributions over the years, ‘treasury defined sustainability’ and other adjustments dictates the value. You may also pay tax in retirement (though that wasn’t the case before the IMF crisis).

At best (but still naively) you’d have to compare value for money and advantages of:

– PPR Vs SIPP products (this ones’s easy, SIPP more generous by far)

– Portuguese state pension Vs (British state + ‘typical’ company pension)

I am coming up to pension age and agree that the triple lock is unfair, it should be linked to inflation or the average working wage one or the other, not cherry picking the best one each year.

I would like to know the where the evidence comes from that the average baby boomer has all this money. I and most of the people I know of a similar age have stock market based pensions and are not in company final salary schemes.

For most of us it will be touch and go whether we have enough money in retirement especially when the next 10 years future growth is predicted to be very low and there will more than likely be a crash coming up with the market so over valued. Also any one over 60 trying to get back to work if after furlough their job is not there will have a much harder time getting other work.

I have to say when reading the comment about making older people on their own sell their 5 bedroom houses I though I was reading the daily Chinese communist newspaper.

However, having said all that I think it is totally unfair that younger people have been stopped from working and the comments mostly from older people that lock down should continue does not take into account that younger people will be paying for this for most of their lives and not them.

I’m on the fence on the tripple lock. Hopefully they don’t throw the baby out with the bathwater.

> Put Down the Dividends – And Slowly Walk Away

I think Warren Buffett has largely convinced me that making your own dividends is better. However, the GBP2000 tax free dividend allowance is a good way to extract value given certain circumstances. I also plan to help set up some sort of income account for a retired relative who wouldn’t sell of their own volition.

@Hak – There’s also a free tribute game called OpenRA for the frugal who want to indulge in a bit of nostalgia.

Great post.

The UK pension system is complex and can benefit you massively over time or leave you living in near poverty if you rely only on the state pension.

Much of the defence of the indefensible triple lock 8% is that many pensioners are poor but the unspoken truth is that after 40 years of compound growth, gold-plated DB, inbuilt privilege and mad house price gains, the gap between the winners and losers in net worth terms is massive.

Chances of having a fairer system are non existent. Pensioners are not going to vote for unfavourable ideas like making the tax on work the same as that of unearned income and include national insurance into the mix too.

@ZXSpectrum48k and @TI: Hey guys, I vote for you. When will you candidate for UK minister jobs? Lets reset the system, even if 10-20 years in the future (baby boomer natural extinction) some rules may be partialy reversed.

In Austria the pension is not fix % indexed, but lower pensions are helped more than the bigger ones. Ex: from 1000 up to 3000 eur/month is increasead by 3.6% tapped down to 0%, then at 5000+ eur/month is just fix amount 90 eur only. This in year 2020. Because in 2017 was just 0.8% increase for lower pensions, etc.

Also every worked year you get 1.78% (= 80% /45) increase of pension, so at 65 age if 45 worked years then get 80% of your past average salary.

@Conor: Right! Not all houses have increased in real value, if ever, in the last 30 years. And not all pensioners are a lucky to be house owners.

Fortune for London should not dictate unfortune for rest of UK.

In democracy, the rich pays/helps the poor/disables/unskilled. In wild capitalism, the poor pays for the poor, and the rich lives happy (playing the tax system).

@all — Thanks for the comments. I just wrote a 2,000+ word reply to everyone individually, and then my own blog spam/security system ate my comment and said I was potentially a threat! (Has anyone ever had that with their own comment? I presume it is because I was commenting via the site, rather than the admin dashboard, and my comment was very long. Or maybe it was some sort of bug.)

Anyway I haven’t the will to spend another 30 minutes retyping it all – I’m using my willpower not to throw this laptop against the wall in a huff – so apologies for the lack of reply!

Perhaps I’ll regather my strength by tomorrow. 😉

@TI, to be honest Monevator has never swallowed my comments though other places have done. (At least until the first draft of this, but that was because I forgot to put my email address in).

@Matthew, thanks for the insight about the role of pension funds in underpinning equity markets – those planning pie-in-the-sky revisions to the status quo need to bear in mind the law of unintended consequences.

@Keith Taylor, Gentlemen’s FF, I think you are coming from the privileged position of having an occupational pension/SIPP when you discount the importance of uplifting the standard state pension through the triple lock. There are a lot of people on pensions who retired 20 years ago whose low income situation resulted from the way things were run in the 60s/70s/80s who deserve better but can’t now change their lack of an occupational pension (which was likely never offered).

Pegging pension obligations to any statistic will only cause that figure to become political and then get fiddled. Same happened with official inflation numbers.

Scrapping private pensions, which have a lower access age, and introducing a higher level state pension that you still have to pay in to for 30 years (full stamp book) basically kills the whole concept of FIRE in my view.

For us millennials, retiring early on just ISA contributions seems implausible unless you want to live very frugally until the age of 70-75 when we expect to get a state pension.

The state pensions is a Ponzi scheme, not real investment. As long as the rate of people entering the work force lags retirement rates, it’s doomed. If the government wants long term sustainability it needs to get the price of housing down, boost productivity and get wages up so people can start having kids younger.

@TI – Very fair proposals – and the key issue here is surely fairness? BTW have you been looking at NZ’s public pension scheme (aka the Super)?

Criteria for paying Super are not based on complex calculations or whatever tax/NI you’ve paid and it’s paid from age 65* – and is not means tested.

The after-tax NZ Super rate for couples (who both qualify) is based on 66% of the ‘average ordinary time wage’ after tax. For single people, the after-tax NZ superannuation rate is around 40% of that average wage.

After tax it’s around $35k for a couple (about 17k sterling). Seemples!

NZ has no tax free accounts like SIPPs or ISA’s and CGT is applied in an interesting and varied way……..

* are over 65;

are a New Zealand citizen or permanent resident;

usually live here (ie, New Zealand, the Cook Islands, Niue or Tokelau);

have lived in New Zealand for at least 10 years since you turned 20; and

have lived in New Zealand, the Cook Islands, Niue or Tokelau for at least five years since you turned 50.

Here are some wild ideas of my own:

– Make financial literacy and education mandatory for year 10 and 11 year olds. Pensions, markets, loans, nature of money, starting a business, everything.

– Discourage personal debt early. Change the law so you cant get a credit card or any other unsecured debt until you’re 21-25. Or perhaps, cap total unsecured debt allowable in young age groups.

– Scrap the *state* pension (and therefore NI tax) for all 16 year olds leaving school now. There’s no state sovereign wealth fund backing it. It’s bollocks. Just be straight with people now.

– Set a legal minimum contribution to your workplace pension scheme of 10% of your gross salary. Make opt-out impossible unless you transfer to a SIPP with identical minimums, and legally cap scheme costs to 1% on workplace schemes to 1%.

– Start a state backed equity release service with best in class rates, similar to NS&I, but instead of having the government sell the houses off when the owner dies or goes in to care, convert them back in to council houses. Continue to offer incentives for people to improve the quality of their housing.

– For small (<10 people, some turnover limit) businesses:

– scrap corporation tax completely

– tax dividends at 75%.

– cap CEO pay to a sensible multiple (10x?) of the pay of the lowest paid full time employee. For one man bands, cap it at £150K/year (adjusted annually)

With regards to fairness, a key concept of capitalism though is that ultimately in the long term even the poorest in an unfair capitalist system still generally do better than they would in a more socialist system.

A pension is merely part of a pay package. The tax construct of pensions and terms might distort the relative prices of labour but through that tax lens that they ultimately then find a market price/wage which is enough to recruit and retain. If you change the parameters you change what price is necessary to recruit/retain, and if you then cap pay, you ultimately cap supply, which is why socialist price controls cause shortages of things.

To assess fairness for labour (or anything) in a way other than market value would create inefficiency in matching supply to demand, which would over time compound into a significant difference – no wonder people want to migrate here from former socialist countries!

@Andrew. From my perspective, scrapping the State Pension and relying on private pensions would be a totally unequitable. You’d make the quality of someone’s retirement a function of how well they were paid during their work life. What you are paid is mainly a function of luck (who your parents were, genetics, right place right time etc) and not merit. We have no free will anyway, so it’s just not under our control. I’d much prefer UBI. Pay everyone the same, whatever they do (or don’t).

I would agree though that the current State Pension being an unfunded forward liability is ridiculous. The current size of that liability makes the national debt look small. There has to be a state wealth fund backing it.

@TI

Minor typo alert:

“….. without every [sic] suffering a sour year.”

@Matthew

> “A pension is merely part of a pay package. ”

Really? A woman could work ZERO days in her life, take “NI credits” (3 children, one every 10 years) and get a FULL UK pension. Q.E.D.

It depends how you see “state” pension. Is it a “safety net” for anyone (not mean tested, for stupid/ill/disabled/unskilled)? Or is it a delayed payment for work, proportionally with contribution you deposited in UK coffers?

> “unfair capitalist system still generally do better than they would in a more socialist system.”

Shame that glory of capitalism is then: better than nothing.

The state pension was designed by Bismarck of Germany (in 1950?) to keep you alive from 50 age (finish work) untill 55 (death), not for tens of years.

How to correct this unfair Ponzi scheme (inter-generation help), fast by shock/riots or slowly (maybe the subjects died anyway before your action)?

And the tax implication of state pension did not foreseen the big global mobilty (pension taxed to destination/residency – DTT, but work taxed at source).

RE cost of state pensions:

It is not only the fact that the rate at which people are retiring is exceeding the rate at which people are going into work. It is the fact that the cost of servicing these liabilities (per retiree) has also increased markedly in recent years. Real yields are the measure for this cost. And we know they have fallen into negative territory. Thus, the cost (all else equal) can only be reduced through:

1) default/restructuring (already has been happening to some extent due to raising the age)

2) tax the hell out of everything

3) economic growth (i.e. reflation) resulting in tax revenues increasing – real yields rising would be a reflection of this, lowering the “PV” of the liability

You can not inflate your way out of inflation linked liabilities – so for all those who think the answer to all this debt is through inflation – dream on! The UK has the vast majority of its total liabilities (in PV terms) as inflation linked.

I think 3 looks hard to accomplish, unless there has been so much technological improvements that is about to (in the next 10 years) unleash a huge wave of productivity without requiring the labour (due to the demographics). I can’t see how that is possible, where is the evidence?

So 1 and 2 are the only feasible things to do, both of which are clearly the pathways to lower living standards over time. It probably won’t impact the boomers much (they are the voters after all). They truly have, as a cohort, milked the tremendous generous economic/political system of the last 40 years.

@Andrew

> law so you cant get a credit card or any other unsecured debt until you’re 21-25

That’s going to be a problem for buying online or amounts larger than you can do with a debit card or cheque. Cheque guarantee cards don’t exist any more and even when they did only went to £100.

@ZXSpectrum48k

The state pension is toxic. People don’t like to think about retirement because the state pension seeds the idea that it’s “taken care of”. I see people making much less private pension provision than they could, even when they can afford it. I see it at work (well paid professionals putting in the minimum 3% because it’s the default) and I see it in my own family. There’s already a parrotted idea there that the government only ever punishes savers and bails out the irresponsible, so why bother?

My uncle is in a traditional trade with his own business and is buying himself a £30K Range Rover at 60 while simultaneously whinging about how his state pension is going to be paultry and he can’t afford to retire. My gran (his mum) *lives* on a state pension so he should *know* this stuff.

I see equal disinterest in my partner. She won’t put more than 5% (the full match) in her workplace pension despite the tax incentives and being able to afford it.

Even pre-pandemic the government has been spending ~£40bn/year more than it took in in taxes. The pandemic £300bn budget deficit has just brought the real problem 10 years closer…the country isn’t productive enough.

I really don’t see how reducing at least some real investment in to capital markets (via DC private pensions) and increasing wealth redistribution further is going to dig us out of the hole of slowing growth, an aging population, and labour and sectorial changes over the coming decades.

Morrisons are now trialing “staffless” stores. Amazon already have AI powered grocery stores in London where you don’t need to checkout. I tried one and it worked amazingly well and was a great experience. In 20 years I would not be surprised if all the big chains lacked checkouts, self service or otherwise. Put that alongside massive warehousing and home deliveries and an entire sector of the economy is changing.

Crypto isn’t going away. The existing coins might be garbage but the genie of asset backed tokens being traded in a decentralised, anonymous and permissionless way is out of the bottle. The technology means the government couldnt do anything about it if they tried. Just like the music industry, which wasted a couple of decades trying to fight internet piracy, they need to accept it and find the iTunes and Netflix opportunities in finance.

Defined benefit pensions aren’t coming back.

Retail bank branches aren’t coming back.

Post offices aren’t coming back.

We should be educating kids in school now about the economics of the last 70 years and the trends ongoing… not whispering sweet reassurances in their ears that a bankrupt government is somehow going to finance a comfortable life for them in old age.

@BeardyBillionaireBloke

You can buy stuff online with a debit card just fine, and businesses like Klarna are already disrupting things. In our low rate world the DFS model of 0% installments over 3-6 months is becoming the norm online. Hell, Amazon are offering it now on their own products without a credit check.

I also see secured lending becoming more popular. Lending against physical assets is expensive because valuing, taking custody, and liquidating those physical items is expensive. This isn’t true for digital assets. Today you can get a credit card, without a credit check, that lets you borrow against your Bitcoin, Ethereum or Gold holdings.

I also see things like credit cards and overdrafts being “reverse offset” against your mortgage with the same bank in the future. The banks will drag their feet of course, why kill a credit card business taking in 20% APR when mortgage rates are 2-3%? Eventually though the equity release continuum will reach this far. We already have trading of shares in individual properties on proptech sites, so the ingredients are there.

@John Smith – In your example the lady getting NI credits for raising kids is essentially doing work of future economic value – just not formally paid. You could argue that the work done by a mother of 3 should earn more NI credits than a mother of one, or that spacing your kids out shouldn’t earn someone more, so clearly not perfect by nature of state support. Nevertheless it somewhat reduces the need people have to save up a pension, therefore maybe allowing people to tolerate lower paid jobs/ spend more since the state has made up some of the remuneration – like with universal credit making low pay more ok.

The theory being that at the extremes if 1) people had no state pension, they would feel a lot more sudden concious urge to save and persue higher pay, or 2) if the state pension/ benefits generally was really high people wouldn’t bother so much with saving or getting better jobs.

So we have a reality somewhere between the two. Yes, originally pensions weren’t meant to last that long but most people would like to have some sort of plan for their future selves.

Yet again a feast of entertaining reading. I particularly enjoyed the Morgan Housel “Too Smart” article. Although I am not that clever, there was one part that I felt resonated the most:

“Ninety percent of personal finance is just spend less than you make, diversify, and be patient.

But…You want to spend your time on the 10% that’s mentally stimulating.”

Edit & replace “time” with “investments”, and it is probably a sensible proportion to keep the investments accumulating and the FOMO itch properly scratched.

The state pension is worth circa £400k – if it was via a flat funded state scheme the pension would be a lot smaller (not checked in excel yet).

We recently moved my 80 year old father in law to live in shelterd accommodation near us – he receives state pension and little occupational and some other bits and pieces. I was very surprised to find he was entitled to £61 per week contribution towards his rent. All this talk about how poor our state pension is, v other countries, clearly is not the full picture.

I also like to think the state pension is already means tested, well at least 45% of it!

Someone has said on here a few times – we are living well beyond our means and our economical value in the Uk, and something needs to give. I can’t see it being more freebies (ubi, although arguably pensioners have it already). Unfortunately, to me, it seems like we need to lower our expectations…

B

@Boltt

H&L put a lifetime annuity pegged to the RPI for a 65 year old at around 2.8% or a 3% escalation at a rate of 3.3%. Call it 3% as a middle ground.

That puts the pricate cost of replacing the full state pension income today, with something rougjly equivalent, at somewhere around ~£300K

Is that value for money? For most, yes. Someone on a £30,000 median income pays about £2450/yr in national insurance.

If you’d invested £2450/yr over the last 30 years at 7% in the market you wouldn’t have £300K….but it’s not a million miles away.

The bottom line is I’d you’re on a low income the state pension is a phenomenal bargain… If you’re in the middle it’s so-so, and if you’re earning a higher income it’s a terrible return on investment.

Of courses, this is all a farce because NI tax doesn’t pay *just* pay for the state pension. The government is currently taking in £150bn/yr in NI and payong out only £100bn/yr for the state pension.

The government can clearly afford to maintain the triple lock. The whole thing is, pardon my french, bollocks.

As no doubt some readers will remember, back in May 2017 – Amber Rudd declared in a political debate “there is no magic money tree”. Notwithstanding the budget deficit / QE money printing since 2008, the statement just about retained some credibility given the coalition and the conservative govt. efforts to balance the annual budget, which had just about worked by 2018/19 (ignore all the off balance sheet / forward liabilities and whether it actually made any sense to try and balance rather than investing). Coronavirus has blown that out of the water not that I suggest a different course should have been taken. It seems impossible for any govt to try maintain any sense of fiscal credibility any more. Why bother. National debt is £2.2 trillion / QE is around £800 bn and climbing. What’s another £8 billion here on the pension cost or another £10bn on social care. Public borrowing is expected to be £75 billion still in 2024 / 2025. Of course none of this is sustainable. At some point the wheels may or will likely fall off. But 10 year gilt yields are 0.6% and so it’s clearly sustainable for the foreseeable future. So none of this needs to be the UK govts problem particular as it’s all a vote loser. Spend Spend Spend in the name of recovery and let someone else sometime else in the unforseen future deal pick up the cumulative follies since we fell off the fiscal wagon of sobriety a number of decades ago!

But no one in their right mind would fund a guaranteed inflation linked annuity with a 100% equity portfolio.

Sure, bonds have returned something quite close to equity returns over the last 40 years. But they ain’t gonna do nearly the same going forward, in fact it looks like 0% nominal returns at best. Not even real lol.

And its not even like the NI had even been invested – these are unfunded liabilities. So the market returns do not even matter. What matters is the ability to sustain the NI receipts being at least in surplus vs the SP payments. Given demographics and weak economic forecasts, that does not look like it will be maintained longer term. And the increase in the liability, partly due to the lowering of real yields, is a reflection of this.

It is why the government seems to have come up with an ill conceived idea of importing low skill immigrants. They want to boost productivity but how can you take enough NI (and taxes for that matter) from them given their low wages when you will likely have to fund these immigrants’ state pension as well in 30 or so years? It all smells of a big giant ponzi scheme.

Imagine where we would have been as a country if we had left the EU and all its bureaucracy and laws to force us to be essentially a welfare state for the EU. If we had Brexit 20 years ago or even never joined the EU in the first place plus having the smarts to understand that we need to import talented risk taking individuals that can start businesses, invest in ideas and add so much to the productivity of the UK, we would be in a far better place right now.

Instead we seemed to have let the housing market go crazy as the only source of wealth (not least due to low rates and state support funding the lower end of the rental market), have hardly any innovative home grown businesses to be proud of and have a generation of prime aged working population looking forward to much lower living standards than their previous generation.

@Andrew

Perhaps £400k was a bit toppy.

I’m not sue about your calculation – most people pay NI over 30-45 years and even though median earners may be paying ~£2450 pa Ni today 30 or 40 years ago it will have been a much much lower number. So I’d suggest the current pension for actual paid NI is brilliant for most of the population.

And yes, NI covers other things too.

I see an over generous deal rather than bollocks.

How can a country live beyond its means forever, the shit will hit the fan at some point.

B

I was opposed to the triple lock for many years however not long before the current concern arose I changed my mind. The triple lock isn’t very sensible as a means of index linking state pensions, hence why I opposed it, however the UK state pension is poor by developed country standards and therefore the triple lock works until we are at least comparable to other wealthy industrialized nations. Do some research and you’ll be surprised at the extent and the nations that are more generous than ours.

Ultimately everyone is a pensioner some day so turning the state pension on it’s head is crazy. Especially for those close to retirement. I am unable to work through disability and will not accrue any more wealth. My state pension and my modest SIPP are all I have to support me. This increase will make a huge difference to people like me.

The press and some politicians have discussed this like “it’s obviously wrong” but the reality is what is obviously wrong is the poor level of our state pension and this increase is a step in the right direction.

Actually the value of the state pension should be more than the value derived using a market CPI linked annuity because these market annuities don’t have the triple lock. So the true value would be market CPI linked value + strip of annual options with payoff max(0, 2.5% – CPI, wage growth – CPI) at each fixing period.

The optionality is worth quite a lot over such a long time period.

@No Free Lunch

Interesting the way you cloaked your xenophobia against EU citizens there in a litany of unfounded Brexitter myths.

In actual fact EU migrants have been more productive than the British born population, more likely to be in work, contributed far more in taxes than they receive in spending, and have included vast numbers of talented risk-taking entrepreneurial individuals that have started many thousands of businesses. But hey, let’s not allow inconvenient facts get in the way of glib prejudices.

Curious also how France and Germany have far higher productivity levels than the UK in spite of having been in the EU for much longer, having much more generous welfare systems and importing at least as many ‘low skill immigrants’ ( the Brexitter catch-all term for those people who make the food, deliver the goods and staff the hospitals that have kept us going throughout the pandemic – i.e. what the rest of us call ‘essential workers’).

Please stop associating Europeans with immigrants. Immigrants have arrived and will come also from non-EU countries (India, Pakistan) always. Eventually criticize the UK government you voted for (EU immigrants could not vote for it). In essence, it does not matter the country, language or skin color, as long as they pay taxes and follow the same laws as anyone in the UK (I would say that a foreigner respects them even better).

The state pension is a big problem in all world countries. All of them printing money from air, and will have an old majority population soon. (Baby boomers born because WW2 catastrophe.). Climate change disaster will force population to migrate. Guess where? To the pseudo-afluent former empires.

Brexit is done! The analysis of the past is good only if it leads to solutions for the future.

@Faustus – Indeed I believe that EU citizens’ ineligibility for benefits as well as how they came here for work are reasons why they very much are taxpaying hard workers, they are competition against our native unskilled workforce in particular, and you can surely imagine the appeal of removing competition, cause a labour shortage and hopefully get wage rises – our unskilled working class already have a hard enough time justifying being unavailable for childcare whilst at work that would hardly pay anything more then universal credit – you can imagine that father’s in particular are undermined as breadwinners and regarded as unnecessary among the benefits class when the benefits system happily steps in to fulfil their role.

Unskilled migration great for business, probably good for GDP, but as always there are winners and losers.

@John Smith – well owing to the skills distribution of the migrant workforce, being able to specify and single out a nationality in this case does generally allow you to cherry pick what competition you want to introduce. It’s not a dislike and it’s all about money I believe.

If we want to help the poor, encourage skilled migration to promote competition for the more professional services we all consume.

@Matthew – As I’ve said before I’m not interested in hosting any more of your speculation about the impact of EU immigration on the wages of the lower paid.

Of all credible studies done pre-referendum, one found one small impact (a few basis points) on the incomes of the lowest decile of workers. The others — the majority — could find no meaningful impact.

This mystifies the sort of magical thinkers who voted Leave for economic reasons who posture on about supply and demand, but it’s pretty simple — more immigration means more demand as well as more supply.

There may well have been other impacts of high EU immigration (eg housing pressures, localized services pressures, social fabric pressures) but Leave faction fabrications about the economic impact have already damaged the country for nearly everyone indefinitely, so I am not minded to allow it be hosted on my website.

Further speculation will be deleted. Cheers!

It seems we are in the realms of brainstorming pensions reform without any regard to political feasibility. What fun.

Bring on the pooled DC defined ambition proposal (more like continental (not always fully) funded approaches pooled for age at death and cohort/SORR) approaches. To be known if introduced here on realistic terms as the “great confiscation” by the more individualistic (and better provisioned) DC drawdown pensioners if forced to participate.

IMHO the underlying issue here is NOT the nature of redesigning around the presence or absence of UBI or tweaking the SP formula for glitches or tidying DC/NI and taxation or IHT reform or a dozen other interlocking tweaks.

We will get nothing sensible out of Westminster without a long term strategy (as per Social Care) and critically a cross party consensus on 1) it being unavoidable and urgent 2) the package of actions to realise such a transition over many 5 year parliaments. Accepting that need adn ensuring it is well communicated to the public – despite it being “party politically inconvenient”. See also domestic green energy transition and stability of assumptions there. The green energy consultation for all its faults – identified the same factor. From the political response – no sign of any listening yet.

And the ongoing stumbles to get social care reform and the attached tax launched. Tories frit. Labour won’t commit to the tax half. Too good an electoral stick. See also death tax and prior IHT woes. Then they reverse roles and repeat the same bullshit. Until all hope is lost of meaningful positive reform.

We need to DEMAND better of our elected representatives – constituency MPs or change them out. What matters is actual long term action (a compromise inevitably) that is strategic in intent, robust of analysis and capable of further adjustment to “events”. We need to be asking for this*

*Although my MP is Esther McVey so I am not particularly hopeful of a rational response. I will just keep trying to vote her out each time I get the chance.

@Marsinblur, about Portugal, it’s true that the state pension is calculated like that – it is indeed complicated, but nowadays you just have to login to the social security website to see how much you can expect to receive.

But it’s not true that state pension didn’t pay income tax before the IMF bailout. What the IMF bailout changed was to greatly reduce the tax break (in form of income tax refund) when you put in money into the “SIPP-like product” that exists in Portugal. But they didn’t change the great fiscal regime that it still enjoys when you take money out of that “SIPP-like product” (it pays a greatly reduced capital gains tax).

Also, there’s plenty of professions in Portugal that have private pension systems.

Completely agree with the suggestions to scrap private pensions and all the other tax advantaged investment products. But why not go one step further by phasing out the state pension by scrapping the accrual of any further benefits? Return the savings to people by lowering the most regressive taxes such as VAT and stealth taxes.