What caught my eye this week.

The Bank of England is hellbent on crashing the economy, having recklessly raised interest rates by 0.25% to 0.75% this week.

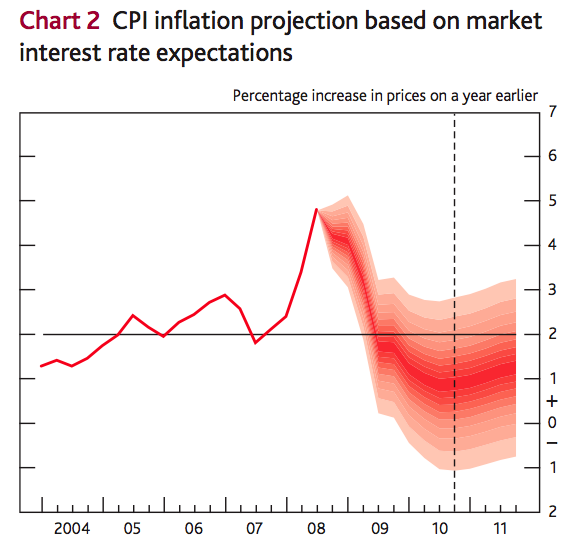

No, that’s not my opinion. But it was a view sounded by many commentators in the wake of Bank Rate rising above 0.5% for the first time in a decade. Critics even included one former Bank Rate setter.

Really? Let’s remember that with inflation running at well over 2%, we still have a strongly negative real interest rate. (‘Real’ means inflation-adjusted, remember).

Even after this latest rise, the real Bank Rate is still MINUS 1.55%.

And that’s before we take into account the impact of all those rounds of quantitative easing, the point of which was to effectively lower real interest rates in the market.

Money remains historically very cheap.

Borrowers still blessed

It’s true that several million people on variable rate, tracker, and discount mortgages will see their monthly payments inch up a tad.

But many such homeowners have seen their mortgages being paid off by a decade of negative interest rates. For all the austerity felt by the poor, it’s been a super time to be a middle-class homeowner. Few should complain too loudly about a 0.25% rate rise.

On the flip side, some of the rate rise will be passed on to savers, though as we slowly return to something like normal rates we should expect this to lag.

UK banks never took the interest rates paid to ordinary savers below 0% in the financial crisis. Instead there was a compression of the spread of rates that banks usually profit from. This will have to be unwound, and so I expect savings rates to rise more slowly than mortgage rates.

I’m inclined to think that if the economy cannot take a slightly less negative real interest rate – fully ten years after the financial crisis and with employment and with house prices at an all-time high – then we ought to find out sooner rather than later, as opposed to speculating.

Star power

With the rate rise expected by everyone, perhaps the more interesting thing to come out of the Bank was an estimate what its wonks call r*. (Pronounced “r-star”).

r* is shorthand for the ‘equilibrium real interest rate’ – and if you think that mouthful is reason enough for the shorthand, wait until you hear the long definition:

The ‘equilibrium interest rate’ is the interest rate that, if the economy starts from a position with no output gap and inflation at the target, would sustain output at potential and inflation at the target.

Okay, perhaps that’s not too confusing. But then I have been reading the Bank’s deliberations for the past couple of hours, so perhaps I’m inured to banker-speak.

You can get up-to-speed on r* for yourself by reading pages 39-43 of the newly-published Inflation Report [PDF].

Basically r* is the Goldilocks interest rate – neither too hot (that is, a rate that’s too low) to stoke the economy and push up inflation, nor too cold (er, a rate that’s too temptingly high) to incentivize savers to move their money out to work fueling the engines of capitalism, as opposed to leaving it all sitting in a bank in cash.

Unfortunately, there’s no way of knowing exactly what r* is at any particular time.

Instead, policymakers have to infer it, in the same way that you have to try to figure out if he or she is really in love with you.

Various factors may weigh down – or boost – the equilibrium real interest rate. In the medium to long-term though there’s presumed to be an underlying trend rate – confusingly also called R*, though note the capital – which is where real interest rates could sit if the economy never fluctuated and Bank officials could spend their time at the beach instead.

Sadly in the real world, things do impact the rate – an impact that the Bank labels s* (where the ‘s’ supposedly stands for short-term but which I think stands for shit stuff happens.)

When s* would heat things up, r* would need to be higher than it otherwise would be (R*).

When s* is a drag, r* would need to be lower.

Right now the Bank believes we’re still in a sticky patch for ‘stuff happening’, what with the Brexit uncertainty, talk of trade wars, the lingering impact of the financial crisis, and also perhaps rates around the developed world being similarly measly.

This belief that r* is low is why Carney and Co. have been keeping Bank Rate so low, and why the Bank is raising rates so slowly.

The Bank’s assessment is that R* would be too high a Bank Rate to keep inflation on target at 2%, given the headwinds.

It believes r* is lower, and hence we still get low interest rates.

R-stars in their eyes

If you’re not asleep by now, no doubt you’re screaming: “Great, but what should R* be! Surely that’s the important bit!”

You’re right, like the Bank of England I’ve deliberately buried the lead.

After stressing that its best guess is just that, the Bank estimates that R* – the long-term trend real equilibrium rate, you’ll recall – is currently somewhere between 0%-1%.

What’s more, it estimates R* has plunged from around 2.25%-3.25% back in 1990!

This is all hugely significant.

Remember, R* is a real interest rate. Add the 2% inflation target onto it, and we get to where the Bank Rate would be in a perfect world (to over-simplify).

What the Bank is estimating is that absent those short-term / stuff happens factors, Bank Rate would now be at between 2-3% (as opposed to 0.75%).

In contrast, if R* was still where it was in 1990, the equivalent ‘normal’ Bank Rate would be 4.25-5.25%.

Clearly this has big implications for both savers and borrowers.

It suggests anyone waiting to get 5% – or even 3% – in a standard savings account shouldn’t hold their breath.

Similarly, mortgage holders shouldn’t have too many sleepless nights worrying about rates leaping back up to 5-7%, at least on current forecasts.

Playing for ratings

Of course if R* can come down then it can go up again.

The Bank thinks that the aging population, slower productivity growth, and the impact of more cautious financial regulation has likely pulled down R*.

Set against that, it believes the requirements of younger foreign savers and even the rise of the robots could affect R* in the future.

But it doesn’t expect anything to happen very quickly, to either r* or R*.

Absent some huge shock such as a Hard Brexit or a surprise election-related run on the pound, the bottom line is interest rates aren’t going much higher anytime soon.

From Monevator

How to open an online broker account and start investing – Monevator

From the archive-ator: They don’t tax free time – Monevator

News

Note: Some links are Google search results – in PC/desktop view you can click to read the piece without being a paid subscriber. Try privacy/incognito mode to avoid cookies. Consider subscribing if you read them a lot!1

Bank of England raises UK interest rate to 0.75% – BBC

Five things we learned from the Bank of England’s deliberations – BBC

UK house prices hit new record average high of £217,000 – ThisIsMoney

Job-switching workers enjoy fastest pay growth in a decade – Guardian

Inheritance tax hits record high: What are the thresholds? – The Week

Interesting series of graphs show how America divvies up its land – Bloomberg

Products and services

It’s happened: Fidelity unveils the first no-fee index funds (in US) – Investment Week

Yorkshire Building Society offers 10-year mortgage fix at just 2.49% – ThisIsMoney

Savings banks and mortgage lenders react to the rate rise [Search result] – FT

Got £1,000 spare? Ratesetter will pay you £100 [and me a cash bonus] if you invest it with them for a year – Ratesetter

George Soros-backed firm unveils superfast broadband rollout in UK – Guardian

Online shoppers to face extra security check, via smartphone [Search result] – FT

What to do if HMRC makes a so-called emergency tax raid on your pension cash – ThisIsMoney

Comment and opinion

Charley Ellis: Indexing and its alternatives [Podcast] – Capital Allocators

Willing losers – A Wealth of Common Sense

Four lessons from the richest woman in Wall Street history – Of Dollars and Data

The (other) problem with active fund management – Behavioral Investment

How to make your child a pension millionaire by 43 – ThisIsMoney

Why even winning investors and tennis stars often feel like they’re losing – The Value Perspective

Last Chance U and financial independence – Young FI Guy

Be rich, not famous: The joy of being a nobody – Financial Samurai

Farmland as an asset class [Podcast] – Meb Faber

The top 1%, corporate version – Morningstar

Blockchain hype is fading fast – Streetwise Professor

The role of shorting stocks in delivering factor2 returns [Geeky] – Factor Research

You still benefit from global equity diversification, but less so nowadays for bonds [Research] – SSRN

Kindle book bargains

Nudge: Improving Decisions About Health, Wealth and Happiness by Richard Thaler – £1.99 on Kindle

Liar’s Poker: From the author of the Big Short by Michael Lewis – £0.99 on Kindle

Freakonomics: A Rogue Economist Explores the Hidden Side of Everything by Steven Levitt & Steven Dubner – £1.99 on Kindle

PostCapitalism: A Guide to Our Future by Paul Mason – £0.99 on Kindle

Brexit

What would a No Deal Brexit mean for your finances? [Search result] – FT

Carney: No-deal Brexit risk ‘uncomfortably high’ – BBC

London Stock Exchange has triggered its No Deal contingency plan – Business Insider

Not drinking bleach is ‘Project Fear’ says Brexiteer – The Daily Mash

Off our beat

No, you probably don’t have a book in you – The Outline

SpaceX’s secret weapon is Gwynne Shotwell – Bloomberg

The sadness of deleting your old Tweets – Wired

Goop’s haters made Gwyneth Paltrow’s company worth $250 million – New York Times

How Silicon Valley became a den of spies – Politico

The death of the author and the end of empathy – Quillette

And finally…

“The grim irony of investing, then, is that we investors as a group not only don’t get what we pay for, we get precisely what we don’t pay for. So if we pay for nothing, we get everything.”

– John Bogle, The Little Book of Common Sense Investing

Like these links? Subscribe to get them every Friday!

- Note some articles can only be accessed through the search results if you’re using PC/desktop view (from mobile/tablet view they bring up the firewall/subscription page). To circumvent, switch your mobile browser to use the desktop view. On Chrome for Android: press the menu button followed by “Request Desktop Site”. [↩]

- Aka Smart Beta. [↩]

Comments on this entry are closed.

Was looking for a UK version of the Bloomberg map and found this:

https://www.sheffield.ac.uk/news/nr/land-cover-atlas-uk-1.744440

I suspect the BOE is only raising rates so they have somewhere to go when the next crash comes. Smoke and mirrors. Nothing to see here. Move along.

I’m always amazed by the amount of hubris and pretence of knowledge required for a bunch of ivory tower central planners to decide what the equilibrium interest rate should be.

Always worth a read, he and I are in broad agreement and both of us have predicted what was going to happen with orders of magntitude more accuracy that Carney has managed

https://notayesmanseconomics.wordpress.com/

Not only would Carney be out on his ear if I could make it happen but I’d sue him for damaging the economy.

I can’t believe the uproar in the media about the impending doom for mortgage holders due to a 0.25% in rates.

10 years ago IRs were 5% higher and they’ve saved tens of thousands of pounds over the years. If they can’t afford things now, they are living beyond their means but for the emergency negative interest rates.

I always read articles about job switching accelerating pay increases with interest. I have to say, this hasn’t been my experience – not in terms of total pay.

The main problem in the City is that bonuses are about 30-40% of your salary, and they are discretionary. So if you’re on 6 months’ notice, even if you give your notice on the day the bonus payment hits your bank account (usually end of March. Because: otherwise for your employer it’s not tax deductible in the financial year to which it really relates and the companies want to pay them as late as possible for obvious reasons), then you still have to wait for 6 months (till the end of September) before you join the new company.

The new employer will prorate your annual bonus for the time worked in that year, hence in the year in which you switch jobs you’re down to 3 months’ worth of bonus. And it will likely be lower as % of your base salary because you can’t properly earn your stripes in 3 or 4 months until they start divvying up the pie.

Add to this SAYE bonus lapses, any share options not yet vested, and soon it becomes apparent that moving jobs is bloody expensive. If your base salary goes up by 25% when you switch (it’s not worth doing it for anything less than that), you need to stay in your new job for at least 2-3 years before you break even…

You can ask the new company to buy out your bonus and shares, but from what I’ve seen nobody does it anymore nowadays. They might throw in additional 10 grand on your salary, and that’s about it.

I wonder if anyone here has had a different experience with bonus / share plan buy-outs by the new employer and (more importantly 😉 ) how did you pull it off?

For those of us not subject to significant bonus payments, my experience was that in your younger years it pays to switch jobs every 3 years or so. As my current employer has amply demonstrated, new recruits come in at market rates whereas employees get pay rises only in line with policies and various internal appraisals.

As you get older and take on a family, geographical constraints and general risk averseness start to add clay to your feet.

–“10 years ago IRs were 5% higher and they’ve saved tens of thousands of pounds over the years.”–

Yep, don’t we know it. I worked in France 1989-1998 and, on looking to buy a house there, we were offered a fixed rate mortgage of 10%. Luckily, I took the variable and the rates slowly decreased. Moved back to the UK and any savings rate under 5% seemed laughable. Strange how times change. The problem starts when people become used to cheap interest rates – isn’t there a term for this…recency bias or something? No doubt the tabloids will have plenty of articles about ‘Outrage’, ‘Going viral’ and ‘Anger’ as mortgages become slightly more expensive, while as usual, failing to give any context.

@hosimpson: for the fair sex there’s also the question of maternity leave rights. Some employers only get generous once you’ve been there a couple of years.

@dearieme that’s true, however shared paternity benefits are also watered-down for fathers in a lot of companies. If you haven’t worked for X number of years, you don’t get as much or as long.

Of course, often paternal leave is tacitly frowned upon and often is a career limiting move. Companies may say that they are supportive, but the reality is different.

@hosimpson As a fellow who spend 23 years working on one place my experience is limited and a quarter-century old, but I would agree with the premise in general – job-switching in your early career is very well worth it, and worked for me – I did all by job-switching in the first eight years of my career. Employers anchor on the salary you started working for them, but your skillset increases rapidly, so you get more valuable, and you realise some of that by jobswitching.

Even within a large organisation, job-switching can have its benefits. In my experience work gets a less important part of life as the sands run through the hourglass, and of course for many people other factors ‘start to add clay to your feet’.

Your industry may be atypical, which the very large bonus component, though there’s been a trend to non-consolidated reward generally over time.

@hosimpson My experience is that buying out bonuses and unvested shares is still very much standard when IBs hire. At least in technology roles – I can’t speak for other departments though.

Also – I see ThisIsMoney is at it again – “How to blow through your Lifetime Allowance by 43”, but I’m wasting my breath on this, aren’t I?