Many Monevator readers will be reaping generous tax breaks on their pension contributions made available through salary sacrifice schemes.

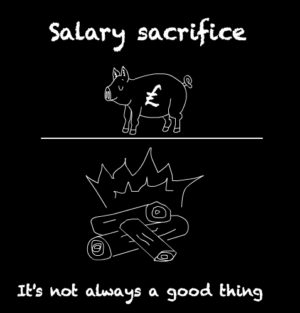

But what’s less widely understood is that salary sacrifice can work against you if it lowers your salary below critical thresholds, or if your employer hasn’t been transparent about what your salary officially is.

Badly administered schemes operate in a grey area that leaves employees in the dark about potential downsides – such as the risk of reduced redundancy pay, sick pay, and other benefits – whether by accident or unscrupulous design. (Delete as applicable, although we can do without either in the midst of a worldwide recession).

What is salary sacrifice?

Salary sacrifice schemes are a contractual agreement between you and your employer to give up part of your salary in exchange for a non-cash benefit such as pension contributions, childcare support, bicycles, and ultra-low emission cars.

The upside is you do not pay tax or National Insurance Contributions (NICs) on your foregone salary.

Your employer doesn’t pay National Insurance on your sacrificed salary either. They can pass on their savings on to you, or they can sneakily trouser it for extra profit.

HMRC doesn’t seem to mind a bit so long as certain boundaries are observed.

What is the downside of salary sacrifice?

The downside of salary sacrifice is that it lowers your salary – and you’ve signed a contract saying that you agree to it!

Reducing your salary can reduce your entitlement to a slew of benefits that are related to your earnings level, including:

- Redundancy pay

- Notice pay

- Pay rises

- Overtime and bonuses

- Holiday pay

- Sick pay

- Employer pension contribution levels

- Life cover

- Maternity / paternity pay

- State Pension

- Unemployment benefits

- Incapacity benefit

- Mortgage borrowing levels

- Credit card borrowing levels

All of the above depend on your earnings level to some degree – or to your earnings clearing certain thresholds.

Your employer is under no obligation to measure those benefits against your pre-sacrifice salary (unless they’ve contractually agreed that with you).

In some cases it’s entirely out of their hands anyway. You shouldn’t be on a salary sacrifice scheme if it drops you below the National Minimum Wage (unless you’re exempt). It may also not work out for you if you’re subject to the tapered annual allowance. Hint: HMRC are alive to this caper and sacrificed salary is just added back to calculate your threshold income. It’s like shooting at the Borg.

Salary sacrifice: how it could cost you

Everything is okay if your employer clearly explained the issues to you before you signed your new contract sacrificing salary.

(Yes… of course they did.)

Alternatively, everything is groovy if your employer is completely trustworthy and not prone to doing over its own employees when cashflow is tight.

(Is it just me, or is it suddenly a bit hot in here?)

Things are still on a relatively even keel if your employer explained that you would retain a notional salary or shadow salary. In this case your pre-sacrifice salary counts when your employer calculates your right to contractual benefits that it controls, namely:

- Redundancy pay

- Notice pay and holiday pay

- Pay rises

- Overtime and bonuses

- Contractual sick pay

- Employer pension contribution levels

- Life cover

- Contractual maternity / paternity pay

If you don’t have a notional salary agreement then employers are perfectly within their rights to use your lower post-sacrifice pay to calculate these amounts – although they should have mentioned it before signing you up to salary sacrifice. I say they’re within their rights – obviously you work for ScuzzBucket plc if your employer does this kind of thing… can I interest you in a prospectus?

State benefits are calculated using your post-sacrifice salary and that’s the end of it. These include:

- Statutory sick pay

- Statutory maternity / paternity pay / adoption pay

- State Pension entitlements

- Incapacity benefit

- Parental bereavement pay

- Jobseeker’s Allowance and Employment and Support Allowance

You can ensure you don’t come a-cropper with some of these benefits (such as State Pension) by ensuring your salary doesn’t drop below the lowest threshold for National Insurance Contributions, or that you’ve built up a sufficient record of payments already or through credits.

A particularly generous employer can make a non-statutory ‘top-up’ payment to employees, if they’d like to make good any shortfall in statutory pay entitlement.

(Good luck with that!)

Salary sacrifice: can I change my agreement?

You can change your salary sacrifice agreement, but your freedom of manoeuvre is limited.

Your contract should specify your cash earnings and your non-cash benefits. Non-cash benefits are benefits that your employer pays for.

Your contract needs to change whenever your salary sacrifice agreement changes, and if you switch between cash and non-cash benefits too frequently then you lose your tax advantages.

The Government has outlined certain ‘lifestyle changes’ which justify a swift opt-out of your salary sacrifice agreement.

Example events include:

- Changes to circumstances directly arising as a result of coronavirus (Covid-19)

- Marriage

- Divorce

- Partner becoming redundant or pregnant

It’s also worth noting that your employer can’t force you into a salary sacrifice scheme, just in case you were wondering.

Salary sacrifice: does it reduce my pension annual allowance?

Salary sacrifice should not have any negative impact on your annual allowance although, as always with tax, seek more qualified advice if you’re worried about this.

The problem goes something like this:

- Your pre-sacrifice salary: £40,000

- You salary sacrifice: £25,000

- Your post-sacrifice salary: £15,000

Does that post-sacrifice salary limit your annual allowance to £15,000 (less than you’re contributing!) because your tax relief is limited to 100% of your relevant UK earnings per tax year?

(I’m excluding those who’ve triggered the money purchase annual allowance (MPAA) or the tapered annual allowance.)

Your £40,000 pension annual allowance for defined contribution pensions consists of:

- Your personal contributions

- Your employer’s contributions

- Third-party contributions – anyone else who kindly chips in for you

If the combined total of those contributions goes over your annual allowance and your carry forward, then you’re in for a tax charge.

You get tax relief on your personal contributions up to 100% of your relevant UK earnings or your annual allowance, whichever is lower.

Your employer’s contributions are not subject to your relevant UK earnings limit, only your £40,000 annual allowance limit.

Old Mutual puts it succinctly:

Personal contributions can be limited by relevant UK earnings but employer contributions are not.

Meanwhile, salary sacrifice converts your salary into an employer pension contribution as explained by Pru Advisor:

An employee could also save income tax, and National Insurance Contributions (NIC), by using a salary sacrifice agreement.

This is where they have a contract with their employer to exchange some of their gross salary (before tax) for a non-cash benefit, such as an employer pension contribution.

So it’s okay if salary sacrifice reduces your salary below the level of your total pension contributions – because your sacrifice is classified as employer contributions, and those do not attract tax relief.

However, personal contributions above your post-sacrifice salary will not gain tax relief either.

All of this is apparently confirmed by the Government’s own pension annual allowance calculator which does not ask how much you earned during the tax year. It’s only interested if you exceeded the £40,000 limit or if you tripped the MPAA or tapered annual allowance.

Salary sacrifice in a crisis

I’ve been happily maxing out my salary sacrifice for years in order to hit financial independence. I didn’t know about the downsides, nor was I made aware of them when I signed up.

That makes me deeply uncomfortable about what will happen should I catch a bullet. Maybe it’ll be alright, maybe not.

I don’t like grey areas and – given we face a recession of biblical proportions – I’ve cut my salary sacrifice to the bone.

Take it steady,

The Accumulator