What caught my eye this week.

Despite our gloomy warnings about pricey stock markets and how every investment can fail you, we’re actually a pretty jolly crew here at Monevator.

Why wouldn’t we be?

For my part I long ago cracked the code of escaping the worst of the work world without giving up the income. And my co-blogger The Accumulator is forever chasing cows.

Happy days – so I think it’s high time we had a bit more fun about the place.

Yes, it’s mandatory Christmas party time!

Your Christmas party outfit sorted

Now, nothing says Yuletide office party like a Christmas jumper, right?

Even more so when you’re retired or working from home, and you want to stand out on a Zoom call.

Which is all a laboured way of revealing that my girlfriend has designed a special Christmas jumper – well, sweater really – that you can now bag at the Monevator shop.

Bulls, bears, and little tinsel decorations that look like share price graphs, it’s got it all.

How could you not want to be wearing one of these bad boys when the boss treats the team to a Christmas Nando’s:

There are two colours to choose from – blue and green – and again note that these are sweatshirts, not knitwear. (You can’t produce knitwear products on demand. Call me pessimistic but I wasn’t going to pre-order 1,000 in advance…)

So go grab one now to wow your friends, family, neighbours, and the postman.

(Note: wowing is not guaranteed, your mileage may vary.)

How to potentially win a Christmas sweatshirt

The forced fun doesn’t stop there. Because what’s an office party without prizes?

Yes, we’re going to give away three of these seasonal sweaters.

Full terms and conditions below (red tape in the UK? really?) but here’s the gist of what you need to do for a chance of winning one of the three Christmas sweaters we’re giving away.

Become a Monevator member

Sign-up to become a Monevator member between now and the end of Friday 12 December and you’ll automatically go into a random draw to win a Christmas sweater.

Refer someone who becomes a member

Back in June we launched a referral programme, where members can get discounted – or even free – membership by referring others who sign-up for an annual subscription.

That week saw a flurry (well, a handful) of referrals. But nothing since. I suspect our relentless focus on sub-optimal Monevator monetisation strikes again…

So I’m flagging the referral scheme once more. I’ve made it more generous, too.

As for this competition, refer a member who signs up for annual membership between now and the end of 12 December and you’ll go into a draw for a sweater.

Scroll down my previous post for details on how to refer someone. Note: you need to be on an annual membership for referrals to count.

Give some advice on investing

My girlfriend may be a talented designer of pixellated investing-themed Christmas sweatshirts, but she is not perfect.

In particular: she is insufficiently obsessed with investing.

So what inspiring advice would you give a 30-something who saves into her workplace pension but otherwise takes no interest in investing? Despite her boyfriend running a leading blog about investing?

Share 50-100 words on saving, index funds, retiring early, financial freedom, or any of the other topics we cover on Monevator (okay, maybe not leveraged ETFs) and you’ll go into a draw for a sweatshirt.

I will use a selection of these comments to create an article that I’ll then print out and leave conveniently in her make-up draw or in her car’s glove box.

She’ll surely be delighted!

Only initials or first names will be published if your advice is included.

You can either comment below, clearly stating a bit of investing advice, or get in touch with the comment form or with a reply if you’re reading this post on email.

Again, entries by the end of Friday 12 December please.

Now for that regulatory small print.

Monevator free prize draw: terms & conditions

1. Promoter: Monevator (monevator.com).

2. How to enter: You can enter the draw in any of the following ways:

(a) Sign up for Monevator membership;

(b) Refer someone who signs up for membership;

(c) Share some inspiring advice about investing via a comment, email reply, or the content form.

All valid entries receive one entry into the draw. No purchase is necessary because option (c) is free.

3. Opening and closing date: Entries open on 6 December 2025 and close at 23:59 on 12 December 2025. Entries received after this time will not be included.

4. Eligibility: Open to readers aged 18 or over. One entry per person. Monevator contributors and their close family members are not eligible. (Sorry!)

5. Prizes: Three winners will each receive one Monevator-branded sweatshirt. No cash alternative.

6. Winner selection: Winners will be chosen at random from all eligible entries within seven days of the closing date.

7. Notification: Winners will be contacted by email. If a winner does not respond within seven days, we may draw a replacement winner.

8. Data: We will only use personal details supplied for the purposes of administering this draw and citing any advice chosen for an article.

9. Use of comments: We may publish a selection of submitted comments in a future Monevator article. Comments will be published anonymously or using first names or initials only. By entering, you agree to this.

10. General: We reserve the right to withdraw or amend the promotion if necessary. Our decision is final.

Again, that’s three different ways to win one of three Christmas sweatshirts.

Ho ho ho! Have a great weekend.

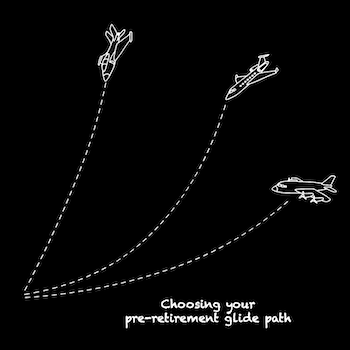

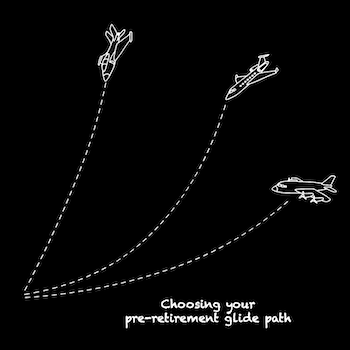

Okay, so you’re late in your career. Perhaps ten to 15 years from retirement.

Your pension pot is sizeable. But you’ve still got a way to go before it can support your ideal retirement lifestyle.

The problem? A major stock market crash would set you back years – creating a hole that can’t easily be repaired by new contributions.

This is dubbed the Retirement Red Zone by researcher Michael Kitces. Here sequence of returns risk looms largest over your road to freedom.

Once you’re in the red zone, your wealth outcome depends more on future returns than on future pension contributions.

A run of good equity returns in the next decade or so can speed you to the retirement finish line. Think of it as like a Boost Pad in Mario Kart.

Unfortunately, bad returns could lurk around the corner like banana peels. Hit one and you could spin off your retirement track:

- A sequence of poor returns will postpone your FU day 1 if you’re intent on hitting your original target number.

- If your retirement date is fixed, a large reversal means settling for a smaller pension than you’d planned.

Shifting your asset allocation from equities to more defensive assets is the tried-and-trusted way to reduce such risks.

The quandary is that the historically average investor scored the highest average returns by sticking with 100% stocks. So derisking is likely to reduce your long-term returns.

N of one

The key point to grasp: you’re not an average.

I don’t mean you’re a beautiful snowflake.

I mean you get one shot at this.

You’ll only ever travel along one foggy route to retirement. And we can’t know in advance whether it’s paved with Boost Pads or banana peels.

So how long can you stay pedal-to-the-metal in a high-risk, high-reward portfolio?

When should you ease off the equity gas, such that you can still reach your destination on time while lowering the chance of skidding off on the final bend?

Derisking your portfolio pre-retirement series Read part one of the series for the scene-setting explainer. It covers the central dilemma of derisking and runs through the risk modifiers that could influence your strategy. Note, this series assumes you intend to live off your portfolio. Some people have other options and can afford to ignore the Retirement Red Zone. If that’s you, and you’re willing to bear the risk of 100% equities, then best of luck!

Give yourself time to recover

One way to think about when you should derisk is to consider how long it takes to recover from a bear market. These are the stock market carve-ups most likely to derail your plans.

The average bear market recovery time for a 100% world equities portfolio is six years and six months. That’s an inflation-adjusted figure, which is what really matters since your cost of living will rise over time, too.

Recovery here means you just about get back to where you were before the crash. You’ve still got to reach your actual target retirement number.

Scare bears

The average bear market recovery for world market equities masks a range of fates:

- The shortest recovery time was one year and 11 months.

- The longest was 13 years and nine months.

And even that lengthiest global market bear was outdone by a terrible 16-year recovery slog found specifically in the US stock market record. This dream-crusher was formed from two bears that arrived in quick succession. Merge them into a single event and equities were underwater (aside from two months of real-terms recovery time) from December 1968 to January 1985. 2

As this chilling example demonstrates, you really can be battered by multiple bears in your final years of accumulation.

On the other hand, you might avoid a bear market completely.

Moreover, the timing matters.

Derisk early or late?

Imagine your portfolio as a civilisation that’s learned there’s such a thing as killer asteroids.

You know these cosmic collisions can vary from extinction-level events to flattening a bunch of trees in Siberia.

Sadly, your telescopes, astronomers, and computers can’t predict when the next Big One will be. They only know it will definitely happen at some point.

As the President of Earth, you order up a planetary defence system.

If you move enough money into the project then you could have a pretty good ‘iron dome’ operating in short order. Maybe even a golden dome!

But that’s expensive and it interferes with the other priorities of your United Earth global government. Such as maxing out growth!

So you decide to hedge your bets, mandating a gradual deployment of resources into anti-asteroid BFGs.

After all, the Big One might never happen.

You are indeed a wise and AMAZING PRESIDENT!!!!!!!!

Even if you do say so yourself.

An inconvenient truth

But wait! Your chief-of-staff cuts the power to your tanning bed to point out a flaw in the strategy.

What if a massive space rock smashes the planet in the next few years? Maybe even next year? While defences are still flimsy?

Yes, in a decade’s time you’ll have low Earth orbit bristling with nukes.

But until then the population will have to make do with hard hats and huddling in tube stations if the joint gets wrecked.

“Insolent cretin!” you sagely respond. “The longer we delay dealing with the risk, the greater our future wealth.”

“The people will rejoice and be happy! Assuming we’re not all flattened in the meantime.”

“It’s more costly to defend a smaller civilisation and there’s less point in doing so. I can’t justify that to the voters / demons in my brain.”

“Hence I’ll strike a balance between jam today and jam tomorrow. Don’t worry. It’s the same principle with climate change and look how well we’re doing with that.”

You pop your shades back on, fire your minion, and dictate a decree ordering a shift of 2% of planetary wealth into defences for the next decade.

Repair job

OK, let’s see if there’s a way to rev up those bear market recovery schleps.

In actuality, six years and six months average recovery time is probably too pessimistic. That’s because investing through the downturn will hasten the recovery, depending on the size of your portfolio contributions.

The table below shows this effect on the last two bear markets, both of which were monsters:

| Bear market | Monthly contributions (% of portfolio size) | Recovery time |

| Dotcom Bust | 0% | 13 years, 9 months |

| 0.125% | 10 years, 4 months | |

| 0.25% | 5 years, 6 months | |

| 0.5% | 4 years, 11 months | |

| Global Financial Crisis (GFC) | 0% | 5 years, 3 months |

| 0.125% | 3 years, 2 months | |

| 0.25% | 2 years, 5 months | |

| 0.5% | 2 years, 2 months |

Data from MSCI. November 2025. Monthly contributions are a fixed percentage of the portfolio’s value at the market peak before the bear market. Recovery times are inflation-adjusted.

As you can see, ongoing contributions can drastically shorten bear market recovery time versus not investing.

Obviously the larger your contributions, the more equities you’re buying at cheap prices. Hence the quicker your portfolio is made whole.

Still, the examples show that there’s a diminishing return to increasing your contributions.

The 0.5% investor only gains three months on the 0.25% investor during the GFC. Even though they contribute double the amount into their pension pot.

Incidentally, the 0.125% investor took over a decade to make good their losses after the Dotcom Bust. That’s because they were still underwater when the Financial Crisis struck.

The larger contributors recovered from the Dotcom Bust only to run slap bang into the GFC within a couple of years anyway.

Easier said than done

Intriguingly optimistic though these results are, I need to run a more comprehensive review of the difference contributions make.

Still, at first blush, it’s fair to assume you can knock years off the longest bears so long as you:

- Invest a reasonable fraction of your portfolio on a monthly basis

- Don’t lose your job during an economic slump

- Don’t sit on the sidelines waiting for evidence the crisis is over

You can still find GFC-era comments on Monevator from people who couldn’t bring themselves to invest at the time.

It was the wrong move, albeit understandable. Nobody knew how bad the losses would be. And there was no evidence the market had bottomed out in February 2009. 3 The aftershocks continued for years.

By the time confidence was restored for some, the opportunity to buy cheap stocks had passed. And while the GFC was bad, the losses were far from the worst even in living memory.

The takeaway: it’s no small thing to decide you can run a bigger risk on the grounds you’ll carry on investing regardless.

What do target-date retirement funds do?

Target-date retirement funds are offered by many of the world’s major fund managers. They put derisking on auto-pilot for mass-market investors.

We can think of target-date funds as:

- Aimed at relatively conservative investors on a standard path to retirement

- Middle-of-the road products engineered to avoid lawsuits and hence defensible in terms of approach

Most target-date funds follow a standard glide path – lowering equity risk for their investors as they head towards retirement.

Approaches vary around the mean but Vanguard’s Target Date Retirement Fund is as good an example as any.

This graphic illustrates Vanguard’s derisking method:

- 25 years before retirement (BR) The move from equities to high-grade government bonds begins. The shift occurs at a rate of around 1.33% per year

- Ten years BR The portfolio is around 70% equities. The glide path now steepens: selling 2% in equities per year and buying bonds with the proceeds

- Five years BR The fund now holds 60% equities with the rest in bonds

- Zero years BR The newly-minted retiree skips into the sunset with a 50/50 equities/bonds portfolio

Vanguard’s fund then continues to derisk for another seven years in an attempt to suppress sequence of returns risk in the early years of retirement.

If you want a set-and-forget strategy then the target-date approach ticks the box. It reduces sequence of returns risk when it’s most concentrated in the Retirement Red Zone.

Stay on target?

Target-date funds typically begin de-escalating risk early on. They implicitly acknowledge that bear markets can last a very long time in extreme cases.

But a chunky equity allocation is maintained into the final decade – complying with the President of Earth’s executive order to balance jam today with jam tomorrow.

Later in the series we’ll present the case for alternative strategies.

But the target-date approach works perfectly well and makes for a good baseline.

Glide paths for early retirees and FIRE-ees

Early retirees and investors gunning for FIRE can potentially afford to take more risk than traditional retirees. That’s because in theory they’re more flexible about their retirement date.

The best effort I’ve seen to put numbers on this is Early Retirement Now’s pre-retirement glide path article.

ERN tested ten and five-year derisking windows and segmented the investor population into four risk tolerances:

- The criminally insane (I’m joking. But not much. See U=Mean on ERN’s charts.)

- The highly risk-tolerant (Pirates, probably. Or my co-blogger The Investor in his pomp. See y=2.)

- Traditional retirees (Relatively conservative. Someone who is happy with a target-date retirement fund. y=3.5.)

- My gran. (But not my Irish gran. She was a whiskey smuggler.) U=Min.

ERN carved up the results still further depending on monthly contributions and, heroically, his chosen stock market simulation method.

I recommend paying special attention to the cyan line in his graphs. It plots equity reductions during high CAPE ratio periods – that is, when the stock market looked expensive. Like now.

Finally, Initial Net Worth = 100 means the portfolio is worth 100 times monthly contributions.

(I suspect that making contributions on that scale is a tall order for most investors ten years from retirement, but it’d be great to hear what your experience is in the comments.)

Here’s Big ERN’s key ten-year glide path chart, graffitied with my explanatory annotations:

Source: Early Retirement Now

ERN’s numbers suggest that even risk-tolerant investors should consider being no more than 60% in equities when ten years from retirement.

That’s judging by past US equity returns associated with high CAPE ratios (the cyan line).

Intriguingly, ERN’s chart also shows that risk-tolerant investors would be justified in sticking with a 100% equities allocation when stock market valuations were more normal (dark blue line).

However, the S&P 500 currently looks extremely pricey according to CAPE readings. That increases risk.

ERN also produced a chart for more cautious investors who want to retire on time:

Again, the cyan line is the one that best corresponds to the current investing environment.

ERN’s results concur with mainstream target-date thinking: get down to 60% equities ten years out, then glide down further by retirement.

As it happens, ERN’s middle-of-the-road investor ends up with 40% equities in the end.

Your mileage may vary

I recommend reading the entire article in full. Bear in mind that Big ERN writes from the perspective of a US-based investor hoping to achieve FIRE.

It’s fair to say he’s also a highly sophisticated investor with a pretty strong stomach for risk.

I mention this because derisking is such a complex and consequential topic that it’s important to weight any research in light of its applicability to your personal situation.

From a timeline perspective, ERN’s research also comes with an important limitation: he didn’t consider derisking glide paths longer than ten years.

Thus his findings don’t conflict with the standard financial industry glide paths that begin derisking earlier.

Risk modifiers

There isn’t an optimal time to start derisking your portfolio because hitting your retirement target number or fixed date depends on many uncertainties.

This means I can only present you with a range of factors to consider or discard at will.

Just to add to the complexity, here’s a table of risk modifiers that could further influence your decision:

| Derisk earlier / more aggressively | Derisk later / less aggressively |

| Your retirement date is effectively fixed by health, job type, burnout, and so on. | You can work longer or part-time if markets are ugly. |

| You have no meaningful safety net outside the portfolio. | You have other sources of retirement income. |

| Your plan doesn’t allow for much discretionary spending. | You’re willing to cut consumption. |

| Your pension contributions are low relative to your portfolio. | Your savings rate is very high. |

| You can’t stand the idea of large portfolio losses. | You’ll aggressively invest in the teeth of a massive bear market. |

| Expected equity returns are low. | Expected equity returns are normal to high. |

Alright, that’s plenty to digest on when to derisk pre-retirement. Next time we’ll look at what to derisk into. There’s more to life than stocks and bonds.

Take it steady,

The Accumulator