With Trump tariffs feeding fears of a US economic slowdown and concerns rising about an AI-fuelled stock market bubble, now may not seem like a good time to invest.

Perhaps it’d be best to keep your financial powder dry? To wait until things calm down and the world feels a little more stable?

That makes perfect, intuitive sense – until you step back and look at the bigger picture.

In the long run, equities go up

The bigger picture looks something like this: the most reassuring chart in investing…

Data from JST Macrohistory 1, The Big Bang 2, and MSCI. August 2025. Real total returns in GBP.

The chart shows inflation-adjusted, World stock market returns surging through 125 years of upheaval, transformation, and occasional catastrophe.

Anyone who remained invested throughout that period would have earned 6% per year on average (over and above inflation).

That’s despite suffering the massive financial shocks that periodically interrupt the rise of equities.

The World’s worst stock market crash was the 52% real terms decline that unfolded during the 1973-74 Oil Crisis.

World War One and the Dotcom Bust inflicted similarly large losses.

But each setback was temporary. Progress resumed, just as it did after the Global Financial Crisis and Covid.

Investing is one damn thing after another

But what about now? Doesn’t the incessant drumbeat of uncertainty and looming peril suggest it would be better to stay on the sidelines for a while?

Time will tell. But the world is always troubled.

Here’s a catalogue of threats that menaced investors in the years that followed the Global Financial Crisis:

- 2010 – Greek bailout, The Flash Crash

- 2011 – EU debt crisis, double dip recession, US debt downgrade

- 2013 – The Taper Tantrum, US government shutdown

- 2015 – Chinese stock market crash

- 2016 – Brexit referendum, Trump election, Fed rate hike jitters

- 2018 – US-China trade war, quantitative tightening

- 2019 – Inverted US yield curve, Great Stagnation alarm

- 2020 – Covid, running out of Netflix shows in lockdown

- 2021 – Covid, Evergrande liquidity crisis, global energy crisis

- 2022 – Inflation surges, Russia invades Ukraine, the energy crisis deepens, rising interest rates prompt recession worry

- 2023 – Financial contagion fears triggered by Silicon Valley Bank collapse, stagflation warnings

- 2024 – US-China tensions, S&P 500 overvaluation disquiet, US election uncertainty

- 2025 – Trump tariffs, AI bubble anxiety, government debt concerns, currency debasement fears

Despite all that, World equities grew 251% in real terms from 2010 to 2024, and the market reached new highs in 2025.

Here’s how that looks if you bought and held a World equities ETF from 2010 until the time of writing:

Data from JustETF. August 2025. Nominal total returns in GBP.

(Note: the ETF chart shows nominal returns. The real return measures how much your wealth has grown after stripping out the impact of inflation.)

The World equities real return averaged almost 9% a year over this period. In other words, the past 15 years has been an incredible time to invest – even though you had to endure constant worries and some painful downturns to profit.

Stock market returns are often earned the hard way.

Pain is why you are paid

It’s because equities have proven resilient over time that long-term investors stay in the market, regardless of short-term wobbles.

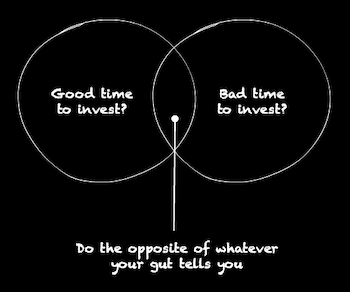

Trying to predict the perfect entry point often means missing out on growth because there is never a ‘safe’ time to invest.

Indeed, many of the market’s biggest opportunities have followed its most dramatic falls.

Prices rocket when investors eventually realise they overreacted to the last shock.

But human psychology guarantees you’ll fail to grasp those moments if you don’t upgrade your mental firmware from the basic Fear & Greed 1.0 package.

Greed sucks us into rising markets. Think 19th Century Gold Rush or 21st Century Crypto Bubble. We’re like moths to the money flame.

Then we get burned. Fear takes over and instructs us to: “Freeze! Just chill for a while. Let’s wait and see what happens.”

And then all of a sudden the market marches on without us. We miss most of the rally…

…until eventually greed overwhelms our fear again. Dragging us back into the action, because nobody wants to miss the last train to Fat Stacks City.

This is the chimp version of scissors, paper, stone. Greed beats fear. Fear beats greed. We flip-flop in time to the market’s beat, but out of tune with the opportunity.

Playing the market this way only increases the risk of buying high and selling low.

But wading in when your instincts scream “Danger! Danger!” will increase your odds of buying low and selling high.

As Warren Buffett puts it: “be fearful when others are greedy and greedy when others are fearful.”

Is now a good time to invest?

Now is as good a time as any to invest because for the vast majority of people it’s time in the market that counts, not timing the market.

In retrospect, the historic traumas charted above proved brief downward squiggles on the great graph of historical returns.

Progress is not inevitable, of course. But we shouldn’t lament the lack of guarantees either.

Uncertainty is the gunpowder that propels our future returns. It’s exactly because of the risk of loss that investors demand the prospect of higher returns from equities.

No-one gets paid for betting on a sure thing. But buying a stake in the continued progress of humanity – and its main engines of productivity – has paid off for the past 300 years.

If you believe we’re not done for yet then owning a diversified portfolio of equities is a wise investment, alongside other useful asset classes.

Use techniques like pound cost averaging to work your way into the market gradually and to benefit from the dips.

Check out our guide on passive investing to develop a strategy that works for you.

Take it steady,

The Accumulator

p.s. This article updates an older version from a few years back. We’ve left the existing comments below, as they provide interesting perspective and context as time goes by. But please do check the dates before replying.

- Òscar Jordà, Katharina Knoll, Dmitry Kuvshinov, Moritz Schularick, and Alan M. Taylor. 2019. “The Rate of Return on Everything, 1870–2015.” Quarterly Journal of Economics, 134(3), 1225-1298.[↩]

- Dmitry Kuvshinov and Kaspar Zimmermann. 2021. The

Big Bang: Stock Market Capitalization in the Long Run. Journal of Financial Economics,

Forthcoming.[↩]

Fair enough, but for balance, should we not mention Japan (from 1989, when it made up 50% of the world index) and then fell for c. 20 years?

Or the very high correlation of extreme valuations (e.g. on the CAPE) to subsequent zero or negative returns?

These long-term charts are all very nice – but I don’t know anyone who’d be happy (or able) to wait 10 or 20 years in a severe downturn.

Perhaps you have to have lived through the 1970s to know how painful that is.

Re: “Now is as good a time as any to invest because for the vast majority of people it’s time in the market that counts, not timing the market.”

Agree, but is this not somewhat dependent on your time horizon? That is, what makes sense for an averagely healthy person aged 30 may not necessarily apply equally to a sprightly nonagenarian.

@Paul — You were debating the merits of otherwise of CAPE / valuation / passive investing on this site in the years following the financial crisis, talking of bubble conditions in 2013 et cetera. In the end it became wholly disruptive to the site and I had to ask you to stop commenting, along with some enforcement (deleting etc).

I’m leaving your comment on here because that was now many years ago but I would ask you to please just say your piece and leave it rather than restarting those debates.

If I judge (in my wholly arbitrary and personal opinion) that your comments are likely to imply some kind of forecasting capacity that I don’t judge you (or most others) have or that will overall do readers much more harm than good then I’m afraid I’ll start deleting again.

Sorry if this sounds harsh to you (or new readers who haven’t got any memory of those days) but I’ve only had to ask/stop 4-5 people from commenting on this site in 17 years and I’m afraid you were one of them so I’m stating this now. Life is too short. 🙂

If you quite reasonably feel that this isn’t a place you want to share your views given this posture, then I quite understand and no hard feelings. 🙂

Cheers!

Obviously none of us have a time frame the length of that graph- we will inhabit a section only, however we also are rarely investing just the once. This potentially reduces the risk of us only investing before a big downhill. @TI linked to this a few years ago and I found it very comforting:

https://ofdollarsanddata.com/even-god-couldnt-beat-dollar-cost-averaging/

Windy

When you have spoken sense like this before in the last 12 years TA, it has paid me to listen. I’m glad to say the mindset may be sticking as I was ahead of the article this time!

I confess this was more from thinking about inflation where 10% nominal (0% real) kicks the ass out of -9% for not having it invested.

Nice to hear the reassuring mantra of “just keep investing” as the steady stream of news reminds us that somewhere in the world, it is going to hell in handbasket again.

If you’d like to read some of my gloomier stuff then fill your boots:

https://monevator.com/investing-biggest-falls/

https://monevator.com/bear-markets/

https://monevator.com/bear-market-recovery/

I’m planning a piece on Japan 1989. It’s an extraordinary crash we’ve referenced many times but most of the horror stories assume you were 100% invested in Japanese equities, invested only at the peak, and didn’t cost average before or after the crash.

OTOH, if you were a yen cost-averaging Japanese investor diversified across world equities and bonds you were fine over time. Not laughing, you wouldn’t have enjoyed it, but you were fine.

And that’s the point. If you can’t endure a lost decade then you probably shouldn’t invest. There’s a very good chance you’ll experience one. There are four in that UK chart alone.

Stay invested, stay diversified, buy equities on sale, and you’ll be OK.

I think whether or not now is a good time to invest will become academic to many people, as they won’t have the disposable income to invest regardless.

Bleak times.

If feels somewhat that the question isn’t whether it’s a good time to invest but whether you can afford to stay in cash for any surplus you may be throwing off notwithstanding some better rates for semi locked in deposits.

I believe one of the biggest threats to the markets – and wider spheres – is the climate crisis. We’ve just had COP 27 which failed to support a phasing out of fossil fuels so it’s very likely that we will see warming go beyond the 1.5C which the climate scientists have warned against for many years. I think investors have had a good run these past few years but I fear the risks are now much higher going forward.

I am investing now. Most of it in my pension, quite enjoying the discounts at the moment. Currently contributing 39% (29% from salary and 10% from employer).

Next few years will be rough when the mortgage is up for renewal so will have to substantially reduce my contributions to meet living costs.

diy investor (uk) your message struck a chord as I’ve been thinking exactly the same thing. Climate change is the elephant in the room that everyone seems bizarrely oblivious to.

Like many here I keep on plugging funds into a global equities tracker via my SIPP, ignoring the bumps. I have recently found myself pondering whether it might be time to start ‘diversifying’ into residential property and various other ‘essential’ asset classes. People have to live somewhere and have food and water etc. It’s becoming clear to me that humans are not going to cut emissions anything like fast enough to prevent a catastrophe. I’m sure behaviour will change dramatically when a catastrophe happens, and who’s to say when that may be, but by then it’ll be too late. I’m not sure the value of tech companies and a lot more besides will matter all that much when one in five people on the planet are living in the sea.

A lot of the solutions already exist, but commitment from earth’s inhabitants is severely lacking, and accordingly I’m not sure I want all my eggs in a global equities tracker, just in case.

There’s always an existential crisis looming behind humanity. Not minimizing the climate situation at all, but the chart includes two world wars and a nuclear cold war.

An escalation of warming would put many firms out of business but uplift many more (biosciences, carbon capture, electric cars etc). even within memory of this blog, petro firms made up 15% of the S&P by market cap in 2008 and are now at 3%.

If we’re taking about doomsday scenarios then the usual caveats apply ie your investments will be the least of your worries. If not, I’d keep DCA’ing and seeing how we adapt to a warming world.

@ His nibs – you’re right to hedge – to think about your economic lifeline should the world truly go to hell.

True diversification though is found in behaviour that currently looks extreme:

For example, the billionaire class purchasing New Zealand retreats and decommissioned nuclear missile silos in the Mid-West. Or the prepper fringe learning survival skills.

I can’t see the case for residential property ownership during a civilisational collapse, though an adequately defended farm might come in handy if food supplies are threatened. OTOH, it’s liable to be requisitioned by your local neighbourhood warlord.

There is a very smart ex-blogger out there who believes our current trajectory is unsustainable and has quietly spent his time learning skills such as carpentry and growing his own food. It helps that he enjoys it.

@ Mr jetlag – I subscribe to your view. In the 1950s many people thought nuclear war was inevitable. Not much point investing for the long-term if that outcome was nailed on.

I don’t want to minimise the climate crisis either – I am extremely worried about it. But it’s not clear to me that humanity can’t navigate it. We’re acting too late, too slowly, putting too many people in harms way, but it’s a big call to say we’re doomed.

mr_jetlag and The Accumulator: you make valid points but the world wars and the cold war were both of human origin and so was the solution.

Climate change likely will, and possibly already has, reached a point where changing human behaviour will not affect the outcome, unlike the examples you mention. It can speed it up or slow it down, but not reverse the overall trend. It’s why climate scientists are so adamant about 1.5C; wherever the critical threshold actually is the point is that you can’t exceed it with the intention of bringing it back under control later. It’s not like the budget deficit that keeps getting kicked down the road to be sorted out later.

It’s perhaps obvious to say but I’d compare it to the analogy of a snowball rolling downhill; it reaches a point where stopping pushing (aka adding more harmful emissions to the atmosphere) makes no difference because a critical threshold has been reached. The journey for humanity to stay within 1.5C requires us to stop pushing the snowball, from now, and to work as hard as possible to slow it down, also from now, to overcome it’s momentum. When I think of it like that I’m not quite so confident!

Point taken regarding residential property, I might struggle to get the rent paid unless I up my warlord ante.

nibs, the climate crisis is a great litmus test I believe of people’s baseline values and beliefs.

I believe a solution will be found to halt AGW, at the same I believe it will be hugely disruptive and painful and cause the collapse of governments and industries. Both of those things can be true.

If I believed it was out of human control, how does that change my behaviour in the here and now? I prefer to believe that we do control the outcome to some extent and that we will muddle through this in some way as we have through all the other crises past.

I emphasise belief since economics is the sum total of human behaviours which in turn is driven by human beliefs. There is no law of physics for GDP or stock returns. You can choose to believe we’re doomed, that’s ok. But I’ll keep DCA’ing, just in case.

@TA – wish I could edit comments, as I forgot to add, one of my good friends is a prepper with a house in the hills, shed full of tins, the works. He said his parents always have a good chuckle when they visit, as “they lived through the Cuban Missile Crisis” and didn’t think a shack in the woods would be any good when the world was on fire…

@mr_jetlag — I have a similar friend here in the UK. The problem in most breakdown scenarios isn’t the nukes, it’s that whoever got the guns first comes and takes what they want from you. 😐 (Okay, so you can have your own guns in the US but still works for ‘whoever organizes into a militia/mob with military weapons first’).

Regarding the edit button, I do consider it from time to time. I’ve seen problems in the past with forums with editing capabilities where people change their posts out of recognition to change their story etc. This can be solved with a timer, but that’s fiddle. Anyway noted, but this is off-topic for this post so I’ll leave it there. 🙂

@ Mr_jetlag and TI – like knowing a good car mechanic it’s always handy to have a friend like that 😉

@ His nibs – ha! I didn’t think of becoming my own warlord! One step up from becoming your own landlord.

More seriously, I think mr_jetlag is right when he says what are we to do from an investing perspective. I agree with you both that the change is likely to be tumultuous. But it’s far from clear it means the end of capitalism, much less the end of Western liberal society in some form, much less the end of humanity itself.

Perhaps if there is an analogy with the events in the chart then it’s with the eve of World War One. The prevailing international system seemed entrenched – four years later four empires had collapsed, the UK’s time as global hegemon was up, and Europe was in convulsions.

By the time yours truly arrives on the scene, some decades later, that version of society appears part history lesson part fairy tale.

Climate change is bigger in scale and more protracted in scope. I agree that to some extent it’s out of our hands. But so are world wars. They escalate beyond the ability of presidents, prime ministers and emperors to control them. Until catastrophe forces the change they could not will beforehand.

In other words, humanity will swing into action and hopefully it won’t be too late. Maybe our great-grandchildren will look at an upward pointing stock market chart in the future and wonder what the hell all that was about.

mr_jetlag and The Accumulator: I am inclined to agree with you, especially the painful/tumultuous part. It’ll be interesting to see how it plays out.

How it affects our behaviour and investing is very much down to the individual I think. It could mean redirecting retirement monies in some way, as I am contemplating. Maybe you decide you won’t fully retire and will instead explore other opportunities at and beyond traditional retirement age. Reassess lifestyle, health and ‘carbon’ footprint as these all feed into the investmemt approach. Explore different asset classes, different allocations, or place emphasis on only sustainable businesses.

This invites the question ‘what is sustainable?’ And who decides? A recent program revealed that Drax receives billions of pounds from the taxpayer in the form of grants for being ‘green’ and creating energy using biomass. All well and good until you realise they’re bulldozing primary Canadian forests to turn into pellets that are transported to the US east coast and shipped across the Atlantic. The green hypothesis is that the forest is replanted but that’s not happening and biomass is more carbon intensive per KwH of energy produced than the fossil fuels it’s replacing. Honesty and transparency is urgently needed if we’re to tackle this challenge collectively.

‘We’re doomed’ is far from my current standpoint (even if it reads differently!). I’m excited by lots of the developments I’m seeing. As suggested, this is a test of human behaviour. So far, as I see it, our collective behaviour isn’t reflecting the magnitude of the challenge, but I remain optimistic.

1. Track the indexes and/or pick better companies

2. Save more money to invest

3. Invest for longer. Time in the market – not timing the market.

This guy rams home the point only today (recommend playing at 2x speed, as sounds better, and saves time 😉 ):

https://youtu.be/TsptUaOqG-o?feature=shared

I love the way that this one (above link) uses a clickbait thumbnail to then deliver the exact opposite ‘stay calm and just carry on’ messaging.

I get it. I really do. And I am not particularly risk averse, but ask yourself 3 questions.

1. What is your time horizon?

2. Are you in accumulation or deccumulation phase?

3. Why has Warren Buffet sold over the last couple of years and – in the main – not bought? Indeed he is sat on his biggest cash pile ever both in monetary terms and as a percentage of BH wealth.

Something to think about.

Thanks for the timely reminder. Although as a recently retired person, with 40% global equities, 30% money market fund,2 0% global bonds, and 10% cash for possible future investment and emergency fund, it does feel a little scary at the moment given that the S&P500 is at nose-bleed levels !

@AtlanticSpan

Through various circumstances – rather than by design – I’m in not a too dissimilar allocation to you (but higher MMF’s as a bond proxy). I’m not actually too worried. That’s the advantage of the ‘safe bucket’. There will be a crash or reset of sorts possibly sooner rather than later. Then I’ll invest. Call it timing the market if you want – although I do keep abreast of certain indicators – but until then I’m happy picking ip over 4% tax free.

This wouldn’t make for a great title, but I wonder if this article is really making the case for having at least some of your portfolio in (a diversified portfolio of) equities, and that that proportion should not be related to current valuations? What proportion you should have in equities should depend on your circumstances and attitude to risk, not valuations.

That seems reasonable. But for some reason I thought the decumulation portfolio that gets updated on Monevator is based on a strategy that does take account of valuations (can’t remember the name of the book that details the strategy). Might be misremembering though!

Now is always the best time to start. I made the choice in 2004 when the graph was similarly peaky to today. I took my DC pension out of the company scheme when I became redundant and parked it in a section 32 buyout policy, the condition was that it couldn’t be added to. Since then the value has grown three fold from the original sum. That’s the benefit of dividend reinvestment and time in the market. I transferred to a SIPP when the rules changed, it was always held in global equities and has only recently been diversified to hold equities, cash, gilts and gold, rather than growth focused, because of the impending IHT changes.

Monevator has been a great source of valuable advice, support and expert opinion throughout. Many thanks, and yes, I will be signing up.

Bit of an aside initially, but a good story is that of Druckenmiller during the tech boom. He’d sat out the whole tech boom and took it on the chin when everyone else was beating his returns. But eventually just couldn’t handle being beaten, was talked into the merits of tech and bought $6bn of tech stocks. 6 week’s later, he’d lost $3bn and left Soros, having hit the bubble bang on the nose.

He had a clear strategy, he’d stuck to that strategy, and then that little voice in his head convinced him to break from that strategy.

So if you’re strategy is to consistently buy, then I personally don’t see the issue with buying in a potential (or probable) bubble – overall it might pay better to keep to your strategy, than to allow yourself to wander and potentially Druckenmiller it up.

You might be investing dumb money right now – but at other times you might be buying in dips, while others are staring like rabbits in the headlights. And if that is your strategy, that is your strategy.

Timelessly good advice.

Can’t argue with the logic that multiples are high and the market could be vulnerable. Equally there isn’t a lot of euphoria to be found.

The defence against the uncertainty as always is discipline and strategic asset allocation.

Global equity index is up ~45% since you last published on this topic on November 22, I distinctly recall that didn’t feel like a good time to buy either!

Self-criticism as an investor:

(i) I timed a complete sale of our equities and their replacement by gilts and convertibles: end of 1999. Pats own back. Once those bonds had matured I’ve not bought bonds again. Long fixed interest bonds frighten me.

(ii) I have never learnt to time the buying of equities. Gloomy face. So the modest, roughly constant stream of surplus income I paid into pensions should probably have been invested according to TA’s recommendations.

(iii) I have the self control not to keep checking prices. Usually I check once a year; occasionally every six months; one time I waited two years. It’s a good way to avoid fretting and fiddling with investments and, it seems to me, it’s consistent with (ii).

(iv) We’ve done quite well out of ETCs of precious metals (Aar, Jim lad!). Luck? I claim no special insight into gold or silver so it must have been at least partly luck.

Even if an investor managed to miss unambiguously the worst possible time since 1929 to invest in equities – namely December 1999 to March 2000 – then they’d still have made a mistake if the metric used for assessing this is going to be real terms total returns CAGR, and assuming that they never returned back to shares.

In March 2000 the S&P was a little over 1,500, against 6,300 now, and the Nasdaq was 5,000, against 21,000 now.

Given just over 25 years, and with dividends reinvested, the real total returns of 4%-5% p.a. look quite favourable here, bearing in mind the exquisitely bad timing of being ‘all in’ at what turned out to be a multi generational top in March 2000.

Time heals many wounds, and what seemed like the right decision over a 5 or 10 years’ horizon can turn into a bad one over 15, 20, 25 or 30 years.

Never interrupt compounding.

If you’re going to time the equity market then you need a rules based system beforehand to dictate when (and it is always when and not if) you get back invested.

A decision not to be invested on timing grounds is a decision to be functionally short with respect to the equity market.

For a market (global equities) returning, on average, and over 125 years, 6% p.a. in real terms and 9% or so in nominal annual returns, that’s an expensive and ongoing cost of shorting.

And the worst thing is to see the market which you were invested in then run away from you after you’ve sold out of it.

It’s even more painful than the temporary paper ‘losses’ of drawdowns.

So chose your poison with care.

Being out of the market is not a no cost, no adverse consequences decision.

There’s never such an easy choice on offer.

@DH:

Re If you’re going to time the equity market then you need a rules based system beforehand to dictate when (and it is always when and not if) you get back invested.

Could you possibly say a bit more about what you mean please?

@AlCam: I’d never advocate for trying to time markets by going 100% invested to 100% risk off across a portfolio. But, it might make sense for some investors:

– to permanently trim risk allocation as valuations rise and they age (reducing their investment horizon); or,

– regardless of age, to do 100%/0% but only with a small part of the portfolio (tactical asset allocation) using rules for switching; or,

– to temporarily trim for dry powder, again using rules.

Trim does not mean sell everything. It means trim 10%-40%, usually 10% / 20% / 30% depending on the circumstances, i.e. perceived stretchiness of sentiment / richness of valuations / degree of perceived ‘over brought’ conditions.

In the last scenario, there have to be concrete rules made in advance for when exactly to use dry powder to buy back in.

Indicatively, that could be something like buy back into the market with the dry powder on the earliest of either (if it occurs at all) the market falling 20% from the 52 week high or no later than 30 days after selling to trim the equity allocation.

This then forces getting back reinvested, reducing the ‘missing out’ risk somewhat.

On the whole, I think, that for an index investor, the ‘miss the x number best days’ risk likely outweighs any benefits to trimming.

If market timing worked then everyone would do it and it would then cease to work.

They don’t and, by and large, it doesn’t.

So we probably shouldn’t try it either (or at least if we do do it then we should do so only sparingly, at the extremes of valuations, and in very clearly defined in advance circumstances with a concrete plan to get back fully reinvested).

@DH:

Thanks. I agree with a rules based approach. Also agree 100/100 (or similar) is usually unwise. FWIW, I can think of other situations where you may want to time entry, e.g. receiving a cash inheritance relatively late in life.

A great reminder that the crisis of the day is unlikely to be that significant in the long run!

@DH – I think you’re bang on that you’re only fooling yourself if you don’t have an ex-ante framework in place to govern your trades. Even then you can still be undone as per @Rob’s Druckenmiller cautionary tale.

@Edward – Thank you. The chronological list is my favourite part. It’s such a useful reminder to me that most jitters are noise. There’s the old joke about how economists have predicted 13 out of the 8 last recessions or whatever… Well, I guess that goes double for the media.

@Andrew Leicester – your first two questions are vital! The third not so much. IIRC, Buffett’s advice to regular bods is to stay invested and to avoid trying to time the market.

For me it’s a case of gaining a small 6 figure sum and being comfortable about when to invest. I have gained once by going ‘all in’ and that’s great but I’ve also lost once and even now – some 4/5 years later – 4 of the 5 funds are significantly under water.

I feel the pain of those losses far more than the pleasure of the gains.

I’ve consequently tended to drip feed. Sure I know I have missed out BUT strangely I personally feel missing out is not the same as seeing your initial investments go down by 20-40%.

Where are you Morgan Housel?