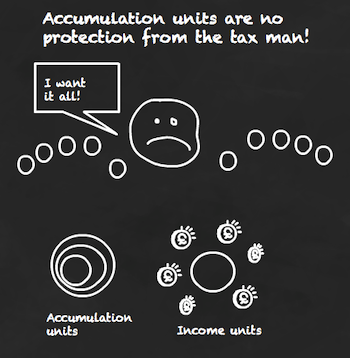

Are reinvested dividends taxable in the UK? Sadly, yes. Fund accumulation units attract income tax on dividends and interest at the same rates as their more transparent ‘income unit’ cousins.

Which means that you owe dividend income tax (or income tax on interest in the case of bond funds) even though you don’t physically receive a payout to your bank account.

Indeed the taxman still wants his cut despite many accumulation class funds showing zero dividend distributions on their webpages.

But it gets worse. Some investors are probably paying tax twice on their accumulation unit income! That’s because they don’t properly account for the effect of dividends on their capital gains tax bill.

Let’s sort this mess out with a quick summary of the reinvested dividend tax rules.

++ Monevator minefield warning ++ Everything below applies equally to dividends and interest but we’ll mostly only refer to dividends because life is short. It also equally applies to accumulating / capitalising ETFs, as well as the accumulation units of OEIC and Unit Trust funds. We’ll pick out the occasional exception where it exists.

What are accumulation units again? And how do they reinvest dividends?

Many investment funds come in two varieties (or share classes) that differ only in the way they treat dividend payments:

- Accumulation units are the share class that automatically reinvests dividends or interest straight back into your investment fund.

- In contrast, income units cough up dividends directly, paying you cash like three cherries on a fruit machine.

You can tell how a fund deploys its dividends by checking its name:

- A fund name that includes the abbreviation Acc indicates you’re looking at accumulation units.

- A fund that features Inc in its name comprises of income units.

Reinvesting dividends increases the capital value of a fund composed of accumulation units. That has implications for capital gains tax. We’ll show you how to work this out below.

At the same time, dividends reinvested into your fund’s accumulation units are known as a ‘notional distribution’.

The notional distribution is taxable – in just the same way as income units.

Tax on accumulation funds – HMRC’s view

Some people think you don’t have to pay tax on reinvested dividends in accumulation units. And some claim you don’t owe taxes on accumulating fund distributions until you sell.

However, here’s the HMRC proof that shows you owe tax on accumulation funds just the same as if they were income funds:

Amounts reinvested are taxed as income accruing to investors in the same way as if they had been distributed.

The reason for this treatment is to ensure that tax is not a factor which might distort investors’ choices and it prevents investors delaying payment of income tax through long-term accumulation of income.

Tax on accumulation funds – when do you not have to pay?

You owe income tax on ‘accumulated’ dividends unless:

- Your (notional) dividend income is covered by your tax-free dividend allowance. Any dividend earnings above the allowance are subject to dividend income tax, regardless of the fact they’re rolling up in an ‘Acc’ fund.

- Dividend income can also be reduced by your personal allowance. HMRC should use your personal allowance to effect the maximum reduction reduction in income tax. My thanks to helfordpirate for sharing this example from HMRC that makes this clear. Dividend tax is indeed a form of income tax.

- Interest income can be sheltered by your personal allowance, your ‘starting rate for savings’ and your ‘personal savings allowance’. (Ever wondered why accountants like our convoluted tax code?)

- If your accumulation unit funds are held within an ISA or SIPP then they’re legally off the taxman’s radar.

Any investment vehicle that has over 60% of its assets in fixed income or cash at any point in its accounting year counts as paying interest, not dividends.

Meanwhile anything less than 60% means distributions count as dividends.

Do you pay capital gains tax on reinvested dividends in the UK?

You do not have to pay capital gains tax on reinvested dividends in accumulation units. You’re already paying income tax on those.

So when you come to fathom the capital gain on your accumulation funds (and as your resultant psychic scream reverberates around the universe), make sure you deduct any notional distributions from the total gain. Otherwise, the reinvested dividends inflate the value of your fund and you’ll overpay CGT.

Here’s the formula to correctly calculate capital gains tax on accumulation funds:

Capital gain = Net proceeds 1 minus original acquisition cost minus accumulation income 2 plus equalisation payments

Here’s a worked example for an acc fund sold for £20,000. It’s accumulated £500 income over the years since it was purchased for £10,000:

Net proceeds: £20,000

Less acquisition cost: £10,000

Less accumulation income: £500

Plus equalisation payments: £100

Capital gain = £9,600

If you haven’t received any equalisation payments from your fund then ignore that step. See below for more on equalisation.

Equalisation payment effect on accumulation units

You’ll notice in the example above that accumulation income reduces your capital gains tax bill. Meanwhile, equalisation payments raise it.

Equalisation payments may be made by your fund when you purchase units between dividend payment dates.

They’re paid because part of your purchase price included dividends that inflated the capital value of the fund – before those dividends were distributed (or reinvested).

You weren’t entitled to the dividends that accrued before you invested. The equalisation payment is effectively a return of your capital. It cancels out the extra you paid on the purchase price due to the embedded dividends.

So you don’t owe income tax on equalisation payments.

With accumulation units, treat equalisation as per the capital gains tax formula above.

The effect of dividends you weren’t entitled to is then cancelled out from your fund’s capital value.

Where are my equalisation payments?

Equalisation payments should show up on your fund’s dividend statements via your broker – after the distribution or at the end of the tax year.

You’ll receive multiple equalisation payments if you invest regularly in a fund with an equalisation policy.

Note: not all funds make equalisation payments.

Vanguard has published a guide on how to work out equalisation payments on its funds.

Also, please see Monevator reader @londoninvestor’s excellent comment on the confusing way that some brokers layout the relevant information on their statements.

Accumulation unit dividends – how to find them

Of course you can only make the necessary accumulation fund tax calculations if you’ve been recording the dividends you’ve received over the years.

And who doesn’t do that…? Right?

The problem is accumulation unit distributions are more stealthy than income unit payouts. You don’t get to do a little dance every time those dividends turn up in your trading account.

So where can you find out about them?

- In your dividend statements from your broker, if you receive them. You’ll only get these if you hold your accumulation funds in a taxable account – that is not in an ISA or SIPP. Many brokers provide this information as an annual tax certificate.

- Trustnet keeps a good account of accumulation unit distributions. Put your accumulation fund’s name in the ‘Find A Fund‘ search box. Then click the dividends tab.

- In your fund’s annual report. Or its income report if it’s an offshore reporting fund. See our post on excess reportable income.

- Using Investegate’s advanced search. Set categories to ‘dividends’. Set the timespan to ‘twelve months’ or whatever suits you. Search for the company name of your fund. Enjoy!

Note down the amounts you’ve received in accumulation unit dividends on your tax form. Don’t include any equalisation amounts.

The date you received the dividends determines which tax year they fall into.

Are accumulation units worth the hassle?

The main advantage of accumulation funds compared to the Income variety is to skip the cost and effort of reinvesting dividends.

This cost saving is rendered superfluous if your fund isn’t saddled with trading fees or a high regular investing minimum. In that case you can just reinvest the dividends yourself.

With that said, accumulating funds mean that your income is reinvested straightaway, without time out of the market or you having to lift a finger. So they might still be worth your while if you prefer the hands-off approach.

Some people prefer to hold income units when investing outside of a tax shelter for other reasons, too. The dividend payouts can be used to rebalance, or to pay tax bills without you having to sell units and trigger capital gains woes if you breach your exemption allowance.

Whichever way you go, just remember that any accumulation units in your unsheltered portfolio are not immune to income tax.

As (nearly) always, making full use of tax shelters – by investing within your ISAs and pension – saves you hassle as well as money, by enabling you to sidestep all the above malarkey.

But where that’s not possible, start recording those reinvested dividends.

You could do it just for the fun of seeing what you’re earning in income. Even if you don’t have to pay tax on them!

[Note from The Investor: You might well have a different definition of ‘fun’ to The Accumulator…]

Take it steady,

The Accumulator

This is a really useful article. I have plugged that people read it in v1.1 of the Monkey with a Pin book.

Pete

Much obliged, Pete. Have got Monkey With A Pin on my ‘to read’ list.

Thanks for explaining this. It did spur me to think of a question however. If one had money in a fund with no fees for investing or withdrawing money (as I believe is the case with the HSBC trackers) then would it be possible to avoid income tax by selling shares in the fund just before the dividend paid out and purchasing them back afterwards. Given that the share price moves to reflect the dividend amount the fact that one has not received the dividend payment should not matter.

I am assuming here that this would all take place within one’s capital gains tax allowance and not incur any charges in this way.

Hey, LearnFrench. That sounds like a cunning ruse, but I worry that your shares could freefall after you’ve bought them back and you end up making nothing at all. Or, for whatever reason, the market spikes up before you get a chance to buy back and your short-play backfires on that count. I haven’t looked into this myself but my gut-feeling is that the real world makes it not worth the hassle. That said, I’d be very interested to hear from anyone who had tried this.

Somewhat cunning but I did think that it seemed rather too good to work myself. Does the ex-dividend fall in share price actually equal the whole dividend amount or is it perhaps a bit less to take into account income tax losses? Although given that there are different income tax rates I imagine that this could get complicated.

I’m new to investing (to date I’ve been a cash-ISA only man) but having had a good look at this website I’m really excited by the prospect of being a little more creative with my savings.

However! I must confess I’m still confused by the tax treatment (and since I’m a tax lawyer that’s a little embarrassing). I understand that the accumulation units (or shares in the case of OEICs) might pay out dividends and automatically reinvest them for you out of convenience. If that’s the case then surely you would have to pay tax on the dividends, you would have more shares / units in your portfolio, and your base cost would increase (so although you get taxed on the dividend, at least you don’t have to pay capital gains tax on that element further down the line).

But is that how all OEICs work? I’m specifically looking at the Vanguard Lifestrategy range of funds at the moment. Why would they pay out a dividend, and trigger tax, and reinvest it, when the money could simply stay in the fund and be reinvested without a tax charge on the individuals, which would then increase the capital value of the shares on which you pay CGT when you finally cash out.

Even after looking at the Key Investor Info for one of the Vguard LS range I’m confused. It uses phrases like “income from the fund will be reinvested” which to my mind is ambiguous.

Can anyone help?

I think I’ve answered my own question, but for the benefit of anyone who’s interested:

The key is that legally OEICs have a special tax regime.

It seems that if you have an equity fund (and painting with very broad brush strokes, this is a fund which doesn’t hold at least 60% of its assets in cash / gilts / similar approved investments, and very definitely not shares) then all of its distributions are treated as dividends for tax purposes AND (crucially) any income amount which is available for distribution by the fund (i.e. income from underlying investments) is automatically treated as if it were actually distributed, whether or not cash goes out to the shareholder. So this is why the fund doesn’t actually pay out a dividend and then reinvest it. The income is allocated to reinvest in the capital of the fund (without ever leaving the fund company) but is still treated as though distributed for tax purposes.

So that’s satisfied my curiosity. Anyone who is similarly curious can have a flick through the Authorised Investment Funds (Tax) Regulations 2006.

My understanding is that with ACC units, the number of units does not change, but the base cost should increase by the dividend amount. Was wondering if this increase is the net or gross dividend. And would the effective date of that increase be on the Ex or pay date? Any answers appreciated.

Very useful article. I have been investing small monthly amounts into an accumulating tracker fund since 2002, for the purpose of creating a college fund for my darling son. These were the days before junior ISA’s and child trust funds. I have kept the statements and tax vouchers, but never really understood the importance of the vouchers. It now seems that I have been a tax evader and if I want to offset capital gains tax when selling my fund ,when my son is 18 next year, I will have to tell the tax man about the accumulated dividends over the last 13 years.

Any thoughts on that ?

Your article says to deduct reinvested income from gain – I understand this but am not sure how much of reinvested dividends from accumulation fund can be deducted if only part of fund has been sold – and how much of these dividends have to be deducted from gain from future sales. Any help on this would be much appreciated.

In order to take advantage of the new £5,000 dividend nil rate band for both me and my spouse, I would like to transfer to my spouse’s trading account, as a gift, some of the holdings in my own trading account. I am thinking to transfer shares in Vanguard FTSE U.K. All Share Index A. The income version of this fund will next pay a dividend at 31 December 2016. My accumulation version has this dividend reinvested. What I want to know is: what do I need to do to be sure that the tax on the dividend is owed by my partner, rather than me. Does it make any difference whether I transfer the fund to his account early in the year, say 10 April 2016, or later in the year, say at 10 November 2016?

I am new to investing in the UK and have not yet seen how a UK tax reporting statement from my platform will look, so I do not yet understand how this works – if one owns shares in an accumulation shares of a fund for X% of a tax year, does that mean that one owes tax on X% of the annual dividend, or is it the case that the person who owns the shares at a certain point in the year (say when the income version goes ex-dividend) owes the tax on the entire dividend for the entire year? I hope you understand the question I am asking.

@ Richard – we could take our best guess but we’re not tax experts and I think that’s what you’d need for a definitive answer. It seems reasonable to me that your partner would be liable as long as the units are in their name by the time the dividend is paid (and the divi is announced for the acc fund the same as for the inc version) but that doesn’t mean HMRC would agree.

I am looking for the answer to Richard’s question (March 31 2016) – just wondering if he ever found out? Hopefully he might get an email if he is subscribed to posts on this page. If anyone else knows, would appreciate any pointers. Thanks.

Does anyone have info on Mervyn’s question from 2014 as I have the same question. I have accumulation units within an ISA and get info on accumulation fund distributions, but the number of units held does not increase. Just to complicate things I am in Canada and ISAs are not tax-free here. Am I correct to believe I have to declare distributions as income (income tax payable) but when I sell units the base cost should be increased by the value of all distributions made during the life of the units, although the number of units is unchanged?

Hi Sarah, you are right that the number of units doesn’t increase, they increase in value by the amount of the dividend. Accumulation dividends do count as taxable income if not tax sheltered. But you pay that’s liable to income tax not capital gains. Therefore when calculating any CGT liability, the reinvested income should be deducted from the apparent gain to work out the true capital gain. If you don’t do that then you are taxed twice. Nasty.

Rob asked above if I had found the answer to my own questions. Yes, here are things I have discovered.

Firstly, so long as I transfer the fund to my spouse’s ownership before a dividend is paid, then that entire dividend will accrue to my spouse’s tax liability, even if I had been holding the fund for most of the previous accounting period. (My spouse will go forward with the same capital gains basis that I had.)

Secondly, funds (income and accumulation) can have their dividends paid with a so-called “equalisation” amount. This happens only in your first year of ownership of the purchased shares in the fund. The equalisation amount is a return of capital. It reduces the disadvantage of buying accrued dividends. The practical effect is that for an income fund your taxable dividend in this first year is decreased by the equalisation amount, and your cost basis (for your future capital gains tax calculations when selling) is also decreased by the equalisation amount. For an accumulation fund your taxable dividend in this first year is decreased by this amount, but the cost basis is unaffected.

Not all funds operate an equalisation regime. For example, Fundsmith Equity does not, whereas Vanguard FTSE all share does.

ETF and company shares also do not operate any equalisation. So if you buy an ETF/share just before its ex-dividend date, you are effectively buying the next dividend, which will be returned to you in just a couple weeks. This means you will incur a small amount of dividend tax on money that has not really been invested at all long. The equalisation regime operated by funds helps eliminate this infelicity.

Does anyone know how to find the tax reportable income for a Vanguard accumulation ETF such as “FTSE All-World UCITS ETF (USD) Accumulating (VWRA)”? One the Vanguard web pages I can find only information for the income version of this ETF, named VWRL, IE00B3RBWM25. Is one supposed to simply add up all the income reported for VWRL? See https://global.vanguard.com/documents/institutional/vf-plc-excess-reportable-income-30-june-2019.pdf

Hi Richard, I recommend asking Vanguard directly. They may tell you the Accumulating ETF doesn’t pay dividends.

Some Acc ETFs report distributions, some don’t. Why the non-reporting ones don’t, and whether that’s OK with HMRC is a mystery I haven’t got to the bottom of.

Investegate have a useful tool for discovering dividend announcements:

https://www.investegate.co.uk/AdvancedSearch.aspx?qsArticleType=news

Company news > Advanced Search > Article type = Announcements, All Categories = Dividends, search by company name e.g. Vanguard.

Highly interesting article however I am confused.

I have owned units in the Vanguard Lifestrategy 60% Equity Accumulation fund for the past 12 months. I have used the following notional distribution per unit figure (https://www.trustnet.com/factsheets/o/acdq/vanguard-lifestrategy-60-equity) and thus calculated the gross distribution applied to my holding on 31/05/2019 (fund distribution date). I have subsequently used the notional distribution per unit figure as an off-set against gains when selling.

I spoke with a Vanguard representative to double check the notional distribution per unit figure from the Trustnet website. The representative could not provide this figure and thus requested that I contact my broker. Upon contacting my broker they too could not provide a figure however they did state the ACC fund class is not subject to dividend taxation. Is the broker correct?

I would be highly appreciative of anyone who may offer some clarity on this!

LearnFrench, isn’t there a 30 days rule as well if you sell and buy the same asset within 30 days it would tigger income tax not capital gain.

@Ramzez. It’s complicated. It depends whether you’re deemed to be carrying out a “trade” of dealing in securities. Trade = income tax (assuming not incorporated), non-trade = capital gains, except for dividends / coupons etc.

https://www.gov.uk/hmrc-internal-manuals/business-income-manual/bim56860

I suffered a bit doing the old tax return this time round as had to square away CGT on accumulating units (also had to muck about with ERI on ETFs which I begrudged as numbers turned out tiny). It was doable but not super pleasant.

I was lucky in that I got a bit of help from this community and an IFA mate to add some confidence that I was ‘doing the right things’, but what I did note while scouting around for assistance was another mate (20 years in investment banking) who confidently told me just buy acc units then you don’t have to worry about any dividend tax. There is a lot of confusion out there, even from those who you’d expect to have a handle on it.

@The Rhino — Absolutely. I didn’t actually know about this until @TA brought it to my attention all those years ago. I thought he was just being finickety! Set against that, who knows if/how often HMRC actually tracks anyone in the small fry category for non-payment. Also I’d hope most people have now got most of their funds in ISAs/SIPPs by now, so it’s clearly a minority concern.

For that minority (older, had a lot of assets perhaps in the old generous dividend allowance days, or anyone who comes into a lot of wealth suddenly) it remains a live issue though.

And yeah, aside from the fact that everyone should be paying their taxes due when they’re due (after taking any legal mitigation steps) you wouldn’t want to find HMRC calling after 20 years of compounded Acc unit reinvestment and asking to see your sums. The bill due might be less painful than the paperwork/hassle! 🙁

I always thought the easiest way to go was:

a) for DC/SIPP/ISA’s – use accumulation units; and

b) for taxable accounts e.g. GIA – use income units.

Tax reporting is then relatively straight-forward and any income needs can be met from dividends and/or selling units. If/when there are no income needs any dividends can be re-invested as and when and they may also assist with any re-balancing required.

What have I missed?

It’s exactly that reason I recommend to a) avoid Accumulation flavour b) avoid mixing up Dividends/Interest in the same fund (i.e. Lifestrategy) in GIA accounts or when investing through a limited company.

I find that Vanguard when investing directly (not via the online website) gives some very decent reporting by post. There’s a £100k minimum/fund though.

This is such a great and important article, thank you. I am fairly up on tax, but still struggle with this.

For a while I used to get the Acc Divis on my TR, but would forget to deduct them on Capital Gains.

I suppose if one wants to be really comprehensive (though it’s a separate issue from this), there is sometimes also Equalisation to deal with – for most people it will be a tiny sum, but I think this should be deducted from the Acquisition Cost when doing CGT calcs.

It is also not helped by the fact that so few online brokers do Accumulation Divi reporting (and even fewer do Excess Reportable Income…). It really should be mandatory.

In line with another comment are you sure this article is correct ? It seems ridiculously too complicated and impossible to enforce in reality surely below is the tax position

Income shares : you pay tax on the dividend in the tax year it’s paid out

Accumulation shares : you pay CGT only when you sell . The difference is simply the value you bought off the value you sellleaving the profit which includes the rise in share price plus any reinvested dividends ? Is the issue perhaps when you sell shares you don’t know this amount ? In my H&L account I get a read out of what they cost versus any profit or loss as total and percentage (which would include share price increase and reinvested dividend ) if I had £10k which had gone up by 10% would my cgt not simply be 10% of whatever I sell ?

My long term objective has always been to have the majority of investments in an ISA, to make life simple for myself in future especially as I get older. I don’t want to be doing CGT calculations and unnecessarily complex income tax returns when I get in to my eighties. I have just spent 2 weeks solid doing the CGT calculations on a relative’s portfolio after finding the ‘financial adviser’ had not ensured that my relative fully understood the possible CGT implications of selling the entire portfolio, which had remained static for a decade, and reinvesting in completely different funds. To make matters worse, units from one fund were sold each month to pay the horrendous fees and then the platform gave a rebate which was reinvested in the same units triggering the 30 day rule multiple times. The only plus point is that the platform did provide excellent transaction and tax records for the whole period. Not something that I would ever wish to repeat!

Interesting article and thread – thanks. I hold non tax sheltered acc units in funds (Vanguard LS) but given the complexity, potential for accidental mistakes and to make sure I avoid any CGT I tend to churn investments under the annual CGT allowance (and therefore don’t worry about the dividend adjustment in the CGT calc) for me and my wife with some then going into annual ISAs and some (if need be) going back into unsheltered funds. Obviously may mean a short time out of the market but incidental in the scheme of thing imho. This together with divi allowances and personal allowances (as mentioned) works for me. May not work for those with much bigger portfolios / gains / divi income of course.

@Lesley

I’m afraid that being “ridiculously too complicated and impossible to enforce in reality” doesn’t always stop something being written into the tax rules.

I came to the same conclusion as others, if only for the sake of simpler book-keeping: acc units in the ISA/SIPP; inc units in taxable accounts. Are there any major snags with that approach?

Very interesting article.

Is it OK to sell my unsheltered Vanguard Global All Cap (accumulation) and immediately buy Vanguard Global All Cap (income) or do I break the Capital Gains 30 day rule?

Are they classed as different funds or am I pushing my luck?

@David C

Possibly excess reportable income which TA mentions. For example, Vanguard declared for VWRL an amount of $0.1147 per unit in their June 2020 report. See https://www.vanguardinvestor.co.uk/content/documents/legal/vf-plc-excess-reportable-income-30-june-2020.pdf

@February I think this is set out in https://www.gov.uk/hmrc-internal-manuals/investment-funds/ifm16210, which seems to depend on whether it is a reporting fund or not. I researched this some time ago but never actually needed to rely on it. Something like pruadvisor or old mutual may have a more intelligible interpretation.

@February. There’s been lots of discussion on this elsewhere (https://forums.moneysavingexpert.com/discussion/comment/73461090#Comment_73461090) so I’ll let you read the arguments. In short though, maybe, maybe not. I wouldn’t. Can you bed and spouse?

I can’t see HMRC scouring trustnet to check that everyone’s telling the truth, if it’s hard for us to know or our brokers to know you can imagine what it must be like for hmrc. So as wrong as evasion may be you can bet that people are doing it, knowingly or not, if hmrc wants to collect on this (and to save us the hassle of checking) then they should regulate to make brokers keep track of dividends and capital gains (carried forward when switching) and tell both us and HMRC what incomes or losses were involved in a sale in a gia, then it can be down to us to declare anything else. If it’s automatic it might overall save hmrc manpower in investigating

I have a query. I have one fund in an unsheltered account.

I chose an income fund, based on advice from a previous post here, so this should simplify things.

I invested with a flat fee broker. From reading @FM’S experience with the platform selling to pay fees and the 30 day rule, I may have got lucky here with my choice of platform.

My choice of fund was LifeStrategy 80, chosen mainly so it didn’t need to be rebalanced. I’ve started to get a little concerned about the UK bias and I’ve realised I could have rebalanced by adjusting my ISA holdings to balance across the two accounts (GI/ISA).

My query is whether I’m likely to have tax return headaches with the split of equities/bond (dividends/interest) in the LS fund as briefly mentioned by @Foxy. Although @Matt the Newbie did mention that this was only an issue if bonds/cash are 60% or greater in with the fund. Do I also have to account for interest or just dividends?

Any thoughts/comments/experiences are greatly appreciated.

Thanks, J

Just trying to nail down how to handle accumulating ETFs…

If I hold some VHVG (Vanguard FTSE Developed World UCITS ETF GBP Accumulating) I’m looking for the (notional) dividend and any ERI. Where do I look?

I have managed to find some data for the USD version (ISIN IE00BK5BQV03) in their UK Reporting Fund Status document (https://www.vanguardinvestor.co.uk/content/documents/legal/vf-plc-excess-reportable-income-30-june-2020.pdf) which shows no income but ERI of 0.8994 (presumably USD).

The equivalent distributing fund shows distributions of 1.1304 and ERI of 0.0733.

Is there effectively no dividend for the accumulating fund just the ERI? Or do I need to look somewhere else?

@Matthew and others, brokers statements cannot be relied upon and it would be impossible for them to properly work out your tax situation unless they knew everything about you. Simple example, lets say I hold an investment with 2 different brokers. When I sell part of a holding, what is the CGT liability? The broker cannot know that unless they know the combined cost of the holding across both brokers and any other gains made in the financial year. If the investment was then bought back at the other broker within 30 days, the calculation would be within the 30 day rule, which neither broker would know about.

Personally I prefer to hold income paying ETFs outside tax shelters instead of OEICS as OEICS have the extra complexity of equalisation payments to deal with. Excess reportable income does still need to be taken account of for income tax and CGT on disposal though. Swings and roundabouts, but that way I only have one type of anomaly to worry about.

@Tim Hughes, yes $0.8994 per share is your income, considered to have been paid on 31 December 2020. You need to convert that to pounds, which you can do using the official HMRC exchange rates here

https://www.gov.uk/government/publications/hmrc-exchange-rates-for-2020-monthly

Remember as well to add the excess reportable income into your cost of purchase to reduce your eventual CGT liability. With accumulating ETFs this may make a material difference.

In case you did not already know, these ETFs are offshore investments, so strictly speaking you need to include them into the offshore pages in your tax return. It makes no difference to your tax liability though as there is no withholding tax.

Thanks @Naeclue.

I have no problem handling the GBP/USD conversion, the ERI increase to base cost for CGT, and the offshore-ness (already having to cope with these for other investments…).

Just wanted to check there were no “internal” dividends as you’d get with Vanguard accumulating funds.

I think this article is wrong with regards to equalisation payments when it comes to calculating capital gains tax.

So my understanding is that a “total dividend” payment is split into 2 parts. The first part is the “real income” on which you pay dividends tax and the second part is the “equalisation payment” on which you don’t pay dividends tax.

“Real income” increases the cost basis of your purchase.

“Equalisation payment” decreases the cost basis of your purchase.

So:

total_income = real_income – equal_paym =>

real_income = total_income + equal_paym

Therefore you calculate your capital gains tax the following way:

CG = Disposal_value – Total_Cost

= Disposal_value – (Acquisition_cost + real_income – equal_paym)

= Disposal_value – (Acquisition_cost + total_income + equal_paym – equal_paym)

= Disposal_value – (Acquisition_cost + total_income)

Hence for Accumulation funds you only need to remember to add the total notional income to your acquisition cost (which should also include transaction fees) and you can completely ignore equalisation payments.

Equalisation payments are only relevant for Distributing funds where you don’t add the “real income” of a dividend payment to your cost basis (since you actually receive the money).

In your example you essentially subtract the equalisation payment twice ending up paying an additional £100 in capital gains tax.

The following article agrees with what I said above as well:

https://techzone.abrdn.com/public/investment/Guide-Taxation-of-Collectives#anchor_7

Eh, I shouldn’t be typing when half asleep. I obviously screwed up the maths above since “total_income = real_income + equal_paym” !!!

However, the other article I linked to suggests that equalisation payments can be ignored on accumulation shares since you never receive the income. So I’m confused at this point.

Hi Illias – I read that piece along with several others including some very dull HMRC tax manuals when researching this piece.

It’s wrong to say “In your example you essentially subtract the equalisation payment twice ending up paying an additional £100 in capital gains tax.”

If you look at the income unit example in the article you link to they add the equalisation payment to the cost of purchase to increase the capital gain upon which tax is paid.

That’s because the equalisation payment is a return of capital that negates the part of the purchase price that was inflated by dividends to which you were not entitled at the time of purchase. The payment is designed so you pay the proper amount of capital gains i.e. more, not less because your purchase price included dividends you hadn’t earned because you didn’t own the fund as those divis rolled up.

There are a number of different ways of showing how it works which all get to the same place. I think the Abrdn example is just confusing because they just disregard the equalisation payment for acc shares. It makes life easier for whoever wrote that piece but I can send you links to alternative pieces that include fully worked accumulation fund examples for anyone who’s received notice of an equalisation payment for their acc fund.

As I say, there are different ways of calculating the same thing that all get to the same piece. I chose the one that I thought was clearest. Let me know if you’d like me to send you some of the links I mentioned.

@Accumulator

You are absolutely right and I am wrong. And I think the accumulation example in the Abrdn page I linked to is wrong as well. They can’t just completely disregard the equalisation part.

A quick example I can think of to verify this is the following. Say you bought shares of an Acc fund just before the Ex-Dividend date and then you received a notional dividend of £100 a few days after that, where 100% of this dividend is the equalisation payment (since you bought just before XD date). Then you sell all your shares (assume the price didn’t move at all). If you disregard the equalisation payment and do the math the way the Abrdn link suggests (only accounting for notional income) then you could claim a £100 capital loss! Which of course doesn’t make sense. If you do the math the way you suggest then your capital gains is exactly £0, which makes sense.

The way I will be thinking about it is this. The book cost of your shares is increased by all notional income you received and decreased by all equalisation payments you received (which is exactly what you say in your article basically xD).

Please do send the links you mentioned!

@ Illias – your example is excellent and really helps illuminate what the equalisation payment is for. Thank you for that.

Here’s some links I found helpful. What complicates matters is that not all funds opt in to ‘full equalisation’ and HMRC guidance on accumulation units is vague.

https://www.adviser-edge.bmogam.com/wp-content/uploads/2021/03/4.-understanding-equalisation-payments-final.pdf

https://www.jameshay.co.uk/media/1579/capital-gains-tax-on-investment-by-individuals-in-uk-stocks-and-shares.pdf

https://www.vanguardinvestor.co.uk/content/documents/general/ga-uk-reporting-fund-guide.pdf

https://forums.moneysavingexpert.com/discussion/2370299/cgt-calculation-for-accumulation-units

Here is an example which hasn’t been covered to date and for which ‘I” have been unable to find a definitive answer or example for online.

Scenario

Given that when this article was first posted online, the person who took out and sold the unit trust in the example you gave was still alive. I don’t know if that person is still with us but I know that persons cousin. He too took out a Unit Trust at the same time but unfortunately has now passed away. His personal representatives now have to figure something out and were hoping you could help. The details of which are laid out below:

Unit Trust Fund (Acc units) taken out by cousin of that person (now deceased)

– Dividends re-invested automatically after tax deductions.

– In possession of statements and Tax vouchers.

– Equalisation not applicable

– Unit Trust cashed-in(100%) during administration period by personal representatives

– No increase in the number of units

– Purchased for £10,000

– Date of death value for Probate is £16,000.

– IHT has been paid and the Unit Trust formed part of estate

– Net proceeds: £20,000

– Accumulated Income(net) till date of death is £3000

– Accumulated Income(net) from date of death till cash-in(100%) is £500

For your formula:

Capital gain = Net proceeds minus original acquisition cost minus accumulation income plus equalisation payments

– Original acquisition cost: is this £10,000 or £16,000 ?

– Accumulation income: Is this £3500 or £500 ?

1. How to calculate the Capital gain for this product by the personal representatives?

2. How to determine if CGT is due or not on gains on disposal of this Unit Trust ?

I think this article’s claim that “if you switch from accumulation to income units then that is a chargeable event” is wrong; it’s actually considered a “reorganization of capital”. Useful Reddit thread at https://www.reddit.com/r/UKPersonalFinance/comments/5eqkxz/tax_capital_gains_tax_on_converted_fund_from/ includes some links to HMRC guidance explicitly saying so. And here’s an MM article https://www.moneymarketing.co.uk/analysis/paul-kennedy-cgt-and-the-platform-sunset-clause/ which while it’s more about how swapping to clean priced units doesn’t trigger a chargeable event, it also mentions that “exchanges between accumulation and income classes of the same fund” are not disposals either. You do not necessarily have to have a platform or fund provider do a “switch” either; selling and re-purchasing is fine, so long as it’s done without unnecessary delay.

I think some of the confusion here comes from how brokers represent the information on tax statements.

As @TA says, the basic formula is:

(1) Capital gain = Net proceeds minus original acquisition cost minus accumulation income plus equalisation payments

Importantly, “accumulation income” here needs to be interpreted as the sum of the full dividends across the period you held for (i.e. the dividend that a long-term holder would have received, even if we’re talking about the first period that you held the fund).

We can rewrite this as:

(2) Capital gain = Net proceeds minus original acquisition cost minus (total accumulation income minus equalisation payments)

Adopting terminology from @Ilias, let’s define “real income” as the income subject to income tax. Then:

(3) Real income = total accumulation income minus equalisation payments

And so:

(4) Capital gain = Net proceeds minus original acquisition cost minus real income

Now, the source of some confusion I think is that some brokers’ tax statements tell you the “real income” and not the “total accumulation income”. Lloyds do that (and so I’d assume that Halifax and iWeb probably do too) and HL also do it. Not sure about other brokers.

**If** your broker has already calculated the real income for you, then as formula (4) shows, you don’t need to use the equalisation amount in your own calculations. In those circumstances, it’s sort of true that “equalisation payments can be ignored on accumulation shares” and that’s where that idea probably comes from.

Another thing that surprised me when I first learned it. The equalisation calculation isn’t personal to each investor – it’s common to everyone who acquired units during a dividend period.

At each ex-dividend date, unit holdings are classified as “Group I” (those that were held before the previous XD date) and “Group II” (those newly acquired since the previous XD date). A given investor (for example, someone who’s investing into the fund regularly) might have some units of both types.

Group I units receive all the income as “real income” (in the terminology used in earlier comments). Group II units get a mixture of “real income” and equalisation – but that mixture is the same for every holder of Group II units, whenever they were bought.

So let’s imagine we have a fund that goes XD on 1st March and 1st September. Eddie Early bought 1000 units of the fund on 2nd March, and Lisa Late bought 1000 units on 31st August.

On 1st September, a dividend of £1 per unit becomes payable. For Group II units, the fund manager calculates it to be split into 60p of real income and 40p of equalisation. Now, both Eddie and Lisa will receive £600 of real income and £400 of equalisation. In some sense, Eddie should have “earned” virtually £1000 of real income and Lisa should have “earned” virtually £0 – but that isn’t taken into account in the calculation.

(I should thank Hargreaves Lansdown, who patiently explained this to me in a situation where I was Lisa Late.)

All my OEIC holdings are in accumulation units and I wonder exactly when they reinvest the dividends. Is it on the ex-dividend dates for the OEIC? If so then there is the downside of ‘dividend drag’ where cash is held for a while within the OEIC waiting to be reinvested. Could you clarify this for me please?

The horror, the horror…

I dutifully started declaring Acc dividends on my tax return as soon as I spotted them on my platform’s tax certificate.

Now I’m checking the impact for capital gains after a disposal of some holdings of an Acc fund several years later. The thing I can’t figure out now is how to do this calculation when I have held different numbers of units in different years and have only sold part of the holding now.

Not sure how to allocate the dividend income and equalisation from different periods. I thought about working out the per unit dividend and equalisation for each payment (thankfully this is Vanguard LS 60% so annual) and then using those.

That seems to make sense since it’s the equivalent of how base/book cost is worked out, but I haven’t seen any source explaining how to do it.

Additionally complicated by gifting some of the holding to my wife before disposal – aagh!

I don’t think I’ve underreported any tax, but it does illustrate the point that Acc funds (aren’t they meant to be the easy, leave them alone class?) are a problem because of our arcane tax system tail wagging the dog.

I thought I’d switch to income class with automatic reinvestment only to find that for the majority of my current funds, ii does not do automatic reinvestment (don’t know why yet).

Yes, of course, it should all be in ISAs and SIPPs, but these go back a ways and it’s now harder than ever to dispose of them tax efficiently to move funds into ISA etc with capital gains allowances rapidly going the way of the dodo.

I think I found the answer to my question above by reading this all again, the comments and following a few links to relevant act (Taxation of Capital Gains Act 1992 as amended by various Finance Acts since).

Tim D makes a really interesting and valuable contribution above highlighting that switches between fund classes are not usually a chargeable event (see his links and section 103F of the Act). I say “usually” because there’s of course some detail in the language which could conceivably mean this doesn’t always apply.

The Reddit link explains that to work this out, you treat each income taxable dividend (even if you didn’t pay tax because of other reliefs (see the 103F and 127 of the Act)) as an additional expenditure on the distribution date.

So in answer to my question, the base cost of my fund holding increased each time a dividend was issued and my per unit base cost can be recalculated on that basis….I think.

Good article. On the broker statement my wife gets, income paid and equalisation are indeed separate but I still have nagging doubts.

First off, does the income paid include the equalisation (I don’t think it does).

Second do you subtract equalisation from income paid for tax purposes ?

Any help would be appreciated……

With thanks to @TA for updating this very useful piece (& my further thanks also to @londoninvestor #48 for his very clear breakdown and explanation).

Per @Stuart B #51, 52: detailed intricacies of this (tax manuals, TCGA treatment) are indeed enough to recall the closing words of Joseph Conrad’s “Heart of Darkness.”

As @Al Cam #24 notes perhaps the easiest way through this is to try and avoid the complications entirely. Building upon that:

– Max out your ISA and SIPP and fund these as required (subject to CGT exposure) by selling GIA holdings.

– If you still need a GIA (above and beyond ISA and SIPP) then use it for non dividend and non income producing investments like Commodities, Gold and many (non dividend paying) listed PE trusts.

– A partial exception is ILGs. These are free of CGT and although the coupon is taxed (at highest marginal IT rate) their coupons can be tiny (e.g. 0.125% of par value, although distribution yield to redemption may be higher for ILG’s whose clean price is below par value).

– If this still should leave any unsheltered dividend paying investments where dividends are >£500 p.a. (the allowance for unsheltered divis); then (as @Al Cam suggests) go for income over accumulation units in the GIA.

Keep It Simple, Stupid. KISS in this case equals going for income vs accumulation. Plus, manually reinvesting my dividends is about the only pleasure I get these days. I invest them into one bond and one equity income fund which I don’t put any other money into, so watching them grow is a nice concrete indicator of compounding at work.

@ Paul – the equalisation payment is not income i.e. dividends or interest. It shouldn’t be counted as such, so yes if you receive a wedge of dividend plus equalisation payment then there’s no need to declare the equalisation payment element on your tax form. Usual caveats apply about me not being a tax professional etc

@ B. Lackdown – I very much enjoy the simple pleasure of watching dividends roll in too

Useful discussion – I think so many people believe ACC income is not taxable.

However, I think your explanation of the order of taxation and its application to the various personal allowance is not correct. Yes – the order of income is non-savings, savings and then dividend. But you are entitled to apply the personal allowance to each of these income types in any order you want – indeed the legislation in S25(2) Income Tax Act 2007 specifically says …

“At Steps 2 and 3, deduct the reliefs and allowances in the way which will result in the greatest reduction in the taxpayer’s liability to income tax.”

HMRC give an example here…

https://www.gov.uk/hmrc-internal-manuals/savings-and-investment-manual/saim1110

where, despite high non-savings income, the tax payer allocates some of their PA to dividends and interest such that the residue is exactly covered by their personal saving and interest allowances.

Tax software such as TaxCalc optimise the use of the PA. HMRC’s own online software did not initially – but may do now.

@ helfordpirate – much obliged to you. You’re correct. I didn’t realise the allowances could be used flexibly in the way your example describes. Will amend.

@ helfordpirate – the gov example seems slightly inefficient to me. Can you tell me what I’m missing? The example shows:

£47,500 income subject to income tax (46K employment + 1.5K interest)

£5,000 dividend income

Higher rate tax kicks in at £50K therefore re: dividends:

£2.5K subject to basic rate tax @ 7.5%

£2.5K subject to higher rate tax @ 32.5%

Use personal allowance to wipe out the latter £2.5K so no higher rate tax.

The basic rate portion of dividend income meanwhile:

£2.5K – £2K dividend allowance = £500 @ 7.5% tax

The example uses £500 of personal allowance to wipe out this liability.

When it could have been used to wipe out another £500 of employment income taxable at 20%.

Am I making an obvious mistake?

BTW, I still agree that you’re right about how the allowances can be used. I’m just scratching my head about why the example seems slightly off.

Thinking about it, it’s not as if you can deploy personal allowance to preferentially wipe out higher rate tax on your employment income first and then work your way down to the basic rate.

So it looks like you have to apply personal allowance to the first part of your remaining dividend income and only then can you extend it to reach the higher rate liability.

Yes I believe the allowances (PA, savings or dividend) have to be applied to the first part of either non-savings, savings or dividend income. You cant just zap the higher rate part unfortunately!

Some more examples here… (2016/17 rates)

https://www.accountingweb.co.uk/tax/personal-tax/any-answers-answered-use-of-personal-allowance

It is ridiculously complicated! But the second example is a very likely situation for FIRE types who have no non-savings income yet and can optimise things to make sure they dont overuse the PA on either interest or dividends and so waste either the savings band or the savings or dividend allowances. This is the situation I have been in last few years.

I wonder if synthetic ETFs are a solution (of sorts) to this headache…

I’m not an expert but I’m guessing an ETF using a total return swap to track an index, as the name suggests, receives the index’s capital and income return in a single payment so there isn’t a dividend to worry about it?

In effect, from a tax perspective the income portion of the index return would seem to become a capital gain as it is wrapped up in the return on a swap rather than being paid as cash on physically held shares.

So practically for someone who wanted an ‘accumulating’ index tracker in an unsheltered account but didn’t want the tax complexity of the dividends, a synthetic ETF would seem to wrap it all up as a capital gain and you just have to worry about CGT when you come to sell.

Interested if anyone has a view on this as I can’t find anything to definitely confirm this understanding is correct. I recalled from one of his articles Finimus is a swap guru I wonder if he would be willing to opine!

@ helfordpirate – Thank you for the examples. I will bend my brain with those at some point 🙂

@ AoI – You make a really good point but if a synthetic ETF pays a dividend then tax will be due. For example, see Invesco’s synthetic, accumulating FTSE 100 ETF:

https://www.invesco.com/uk/en/financial-products/etfs/invesco-ftse-100-ucits-etf-acc.html

You can download the reportable income doc from that page and see that the ETF comes with significant excess reportable income. That’ll need to be declared as dividend income on your tax form (assuming outside of ISA / SIPP).

On the same doc, you can compare Invesco’s synthetic S&P 500 UCITS ETF in Acc and Inc form.

The Inc version distributes its dividends and shows zero excess reportable income.

The Acc version retains dividends and declares a large wedge of excess reportable income.

Hi, I am a little puzzled by the formula in this article which shows an adjustment for equalisation when computing the chargeable gain for ‘accumulation units’ (ACC): Capital gain = Net proceeds minus original acquisition cost minus accumulation income plus equalisation payments. Last year I followed a paper which I found in the Abrdn Techzone: https://techzone.abrdn.com/public/investment/Guide-Taxation-of-Collectives

The title is ‘Taxation of OEICs and unit trusts’. It has guidance on how to calculate chargeable gain in general for investors and then toward the end it gives some specifics for accumulation units and then income units. In respect of ACC units it states that the notional income should be subtracted but then adds:

“There is no adjustment for ‘equalisation payments’ on the notional distributions from ACC units. That’s because the capital has not been returned to the investor and therefore does not alter the acquisition cost.” This strikes me as correct but the Monevator article states otherwise.

Furthermore, in respect of INC units the Abrdn paper advises that “any equalisation payments on the first income distribution are a return of capital and will therefore reduce the acquisition cost. “This also strikes me as correct but is the opposite of the advice in the Monevator article.

I would appreciate your thoughts on these differences.

Thank you.

I’ve got a headache after reading this.

What makes this even worse is on the HMRC forums, their staff say it doesn’t need to be declared:

https://tinyurl.com/32c8dmfr

Look at the question from johngold1 and the reply from HMRC admin!

So for CGT on any accumulation fund, all the re-invested dividends, for which I have paid income tax, can be added to cost, but where on CGT form?

Costs line D or

Incidental Costs of Acquisition line E or

Improvement Costs line F?

A Rookie question that I don’t think has been covered, about transfers to a spouse.

If I transfer all of my Acc shares to a spouse, when they sell them can they subtract the value of the notional distributions of income and dividends made during my ownership when calculating their CGT liability?

Just as @Nige I am a bit confused. Take a look in the Long-Reports of OEICs. Go to distribution tables.

https://www.invesco.com/content/dam/invesco/uk/en/product-documents/icvc/umbrella/annual-financial-report/invesco-global-investment-series_annual-financial-report-2023_en-uk.pdf

(Vanguards reports are the same mostly)

For the Acc (and tbh for the Dis as well) there are group 1 and group 2 investors. Group 1 are already invested before the new tax year of the fund. They only get a Notional dividend (hence they have – in the Equalisation per share). Group 2 investors are however investing during the current tax year of the fund. Therefore they do have equalation per share. Adding the remaining notional dividend will get you the same amount as Group 1’s notional dividend. This is not mentioned in Abrdn’s article.

That means money is returned to you which is not taxable. However stays with the fund (Acc).

The big question is what does the fund manager do with the equalisation payment that is not returned .

1:If they are giving you more units then technically you have to increase your average purchasing price per unit (i.e. reducing your future CGT).

2:Most likely, the price is increased and you get no units then this is just an increase in price and therefore the whole thing is either (a) notional dividend (making Abrdn’s article correct) or (b) a notional dividend plus an increase in Net proceeds (because we add the equalisation) making the Accumulator correct.

Is ultimately simpler to just buy Dis units and deal with the equalisation calculation 1 or twice per year? Plus many brokers do declare it so it is easier to track.

Mind you some Acc UCITs Offshore SICAV/ICAVs dont publish equalisations so doing the ERI once per year for Acc is significantly simpler imho.

What do you guys think? I tend to be more on the Accumulators formula, as it is more tax friendly.

Finally as a closing remark, I think the vast majority of investors are clueless of these things. I am pretty sure there are thousands of people reporting this wrongfully (either by not reporting all together of calculating it wrong and getting double taxed). Aligning it with the US standards makes it more efficient (i.e Acc funds have only CGT). Yes there will be some lost revenue, however the current inflation drags and freezing/ reducing of allowances have done way more to increase revenue that this weird notional dividend/ ERI rules.

This year I had to deal with equalisation payments for the first time. Income tax is easy, but CGT was a pain, as it’s not taken care of by (any) platform and there were many trades.

To make long story short, I ended up writing my own CGT calculator, as I couldn’t find any free calculator that handled equalisation payments or notional distributions consistently.

FWIW, anybody can try it on https://lategenxer.streamlit.app/CGT_Calculator

More info on https://github.com/LateGenXer/finance/blob/main/cgtcalc.md

@LateGenXer your post is very timely as I have just run into this issue myself, with Acc units of VLS80 bought over several years, now trying to work out how to calculate the gain on a partial sale and slowly going mad! Anyway the calculator seems to have done exactly what I needed, so thank you many times over, great job.

@LateGenXer a massive thank you from me as well! So helpful. I hope I haven’t generated too many logfiles while debugging my incompetent data entry. Fantastic job.

@Sterlingo, @Dave, I’m very glad to hear you found it useful!

> I hope I haven’t generated too many logfiles while debugging my incompetent data entry.

Ah, the error log spam is not a problem! But you raise a good point: it would probably help the first time user if the formatting error messages were more helpful. (And knowing people are use this gives me the motivation for adding such bells and whistles.)

BTW, the expected “modus operandi” is to work out things in a Excel spreadsheet, then copy’n’paste into the input text area, like normally done with CGTCalculator. Doing so would naturally avoid most typing mistakes.

What happens if you sell your accumulation units after the date when you are eligible to receive the accumulation but before the accumulation actually takes place? You obviously don’t see the notional income but the documentation from my provider is still listing the notional income based on the number of units on the eligible date not the number on the due date which then overstates my income.

@ Mark Norton – your sell price should include the value of accumulated dividends up to that date.

@ Nige – sorry I missed your mention of the Techzone paper back in, um, January. Last time I checked that paper was wrong. It took me ages to get to the bottom of it but that was the conclusion I came to. I’ve got some notes on it but no time to dig out at the mo.

Yes, the sell price included accumulations to date. The issue comes when you sell the units after you’re entitled to a new accumulation but before it’s applied. The accumulation never happens (correct) and my fund mgr is issuing certificates saying it has. Income units (or share dividends) still get paid in cash even if you’ve sold your holding.

@Mark Norton, I’d always add the notional income to the Section 105 pool cost on the date the fund goes ex-dividend (the eligible date.) One will end up with the sort of inconsistencies you described if one uses the dividend distribution date to decide which shares attract the notional income.

@Nige

https://adviserservices.fidelity.co.uk/media/fnw/guides/taxing-calculations-capital-gains-tax.pdf also states:

“Finally on accumulation units, a word of warning. The first notional distribution from accumulation units may include an equalisation payment, in addition to the income amount subject to income tax. This does cause confusion, but trust me, the simplest way of dealing with the calculation is to simply add the net notional taxable income and ignore the equalisation element.”

But I can’t make my mind on how to interpret this, as the language is ambiguous: does “in addition” here means the notional income had already the equalisation payment deducted, or not? Maybe ignoring the equalisation payment (_after_ deducting it from notional income) is also what Abrdn meant..

Accumulation units aside, adding the notional cost and deducting equalization payments seems right as a general rule. There are situations where both unambiguously can arise, for example, ERI plus equalization on Offshore income funds, as seen on Vanguard example on https://fund-docs.vanguard.com/uk-reporting-fund-faq.pdf#page=8

I have found reading through this very helpful as I am trying to realise some of the shares in my OEIC. I have also spoken to HMRC but am not sure that helped me too much.

I have had an OEIC accumulation fund for 20 plus years opened for me with £1k and I have added £50 per month ever since. It has not particularly performed well, and I have got to a point where I really need to get the funds into a Stocks & Shares ISA which I intend to do over the 24/25 and 25/26 tax years to try and reduce my liability for CGT as the allowance reduces.

I do not want to pay CGT if I can avoid it so intend to sell in two tranches where the gain is less than the current £3k allowance. I have transferred half of the share to my spouse so we can use her CGT allowance too.

I would be grateful if others could verify my understanding of the calculations which would seem to be as follows.

Calculate the cost paid per share under the Section 104 rule. This is basically the amount spent divided by the shares held and then deduct the cost of the number of shares sold from the proceeds to calculate my gain for CGT tax purposes.

I understand that I can add the charges made to acquire the shares to my cost paid as well as the accumulation amounts less the equalisatiion amounts.

As I said it is relatively small amounts and the largest amount of accumulation received in a single year is less than £400. I have not paid income tax on these amounts as I assume they are covered in my dividend tax allowance. Does that mean I can still include them in the cost of share purchase?

Prior to 2016 I received a tax credit with the accumulation, which I assume was in line with tax rules at that time.

That is certainly my understanding so far as capital gain is concerned. The accumulations should have formed part of your taxable income but the dividend tax allowance is relatively new. Prior to that, there was the dividend tax credit which, if I remember correctly, covered the income tax due at the basic rate of tax. My memory’s a bit hazy though.

Hi, would love some help tracking down the value of deemed dividends on a Vanguard accumulating fund – VWRP. I’ve held the fund since 2019, but only recently returned to the UK – and will be tax resident this year for the first time.

I want to report the correct deemed dividends for this tax year, but I also want to sell some units, which will attract CGT, and I’d like to minimize this by adding historical deemed dividends to my cost when calculating the gain.

Here’s a bit more info on the fund: VANG FTSE AW USDA (the units I own are denominated in GBP). I think this the ISIN number: IE00BK5BQT80.

@Paul,

VWRP is an off-shore reporting fund, not an UK accumulation fund. One will be liable for ERI, which can be looked up on https://www.kpmgreportingfunds.co.uk/FAQ or in Vanguard reports to investors (see https://fund-docs.vanguard.com/uk-reporting-fund-faq.pdf ).

It doesn’t sounds right to add costs of historical dividends for years one wasn’t tax resident in UK. If one didn’t pay UK income tax on those dividends then one effectively didn’t have the cost.

(Whether you were liable for income tax wherever you lived, an whether you could deduct that, nobody here can tell.)

Your situation seems quite unique and complex. I’d get professional tax adviser. (I’m not one BTW.)

@LateGenXer,

The kpmg site is super helpful – thank you.

Really good point on not adding the cost of dividends when I was not tax resident. I was not taxed on these where I was previously resident, so I will exclude the historical deemed dividends from my gains calc.