The plan is to be financially independent in a decade. I can see now that it can be done. And I can see how it will be done.

The thought of it is making me tingle. This will be the biggest and most rewarding challenge of my life.

In my case, becoming financially independent (FI) requires all the things the gurus said:

- A stupendous saving rate: 67% of after-tax income.

- A moderate annual expenditure: £20,000 for the two of us.

- A final ‘retirement’ pot that can sustain a 3% withdrawal rate (the standard 4% is too risky in my view, for many reasons).

- A decent spurt of growth from my portfolio over the next decade: A 4% real return a year will do it.

The growth rate is out of my control, so let’s not worry about it here. The final pot is negotiable, which leaves the savings rate and annual expenditure target as the twin keystones of the plan.

Hitting a 67% savings rate without pauperising ourselves means the near removal of Ms Accumulator and I from the tax system.

Tax ghosts

Part one of going off the tax grid is to stick to that £20,000 annual income figure.

From next year, the income tax-free personal allowance is £10,000 each, updated annually in line with inflation.

Split between the two of us that means our entire year’s worth of spending ducks the taxman’s net. £1 of spending over that line actually costs us £1.25 – once you deduct 20% income tax.

Going tax dark part two means stuffing every spare penny we have into our pensions.

Famously, pension savings are taxed at your marginal income tax rate when you withdraw. In other words, if we each spend £10,000 a year from our pensions (in today’s terms) then we will pay 0% tax.

But the beauty is that every penny we save attracts 20% tax relief at the basic rate and 40% at the higher earner’s rate. 1

That means every £1 saved is actually worth £1.25, or even £1.67 at the higher rate.

Which means that £10,000 saved is actually worth £12,500 or £16,700 and is returned to us un-gouged by HMRC, if we live within our personal allowances. 2

I can’t emphasise this enough. We get an instant return of 20% or 40% from saving into our pensions (not including company matches) and, if we’re careful, it’s never taken back because we’ve danced clear of income tax.

An ISA can’t compete with that

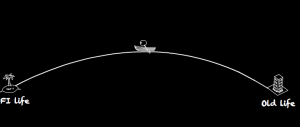

It should take us 10 years to hit financial independence (FI) using company pension schemes and SIPPS. It would take over 13 years if we maxed out our ISAs instead.

If I was trying to hit FI in my 30s or 40s then, yes I’d be all over my ISAs. But that boat has sailed for me.

We’re in our early 40s, so we’ll be within sniffing distance of our pensions by the time the 10 years are up.

If progress is slower than I hope, then we could easily be 55 – the age at which you can begin to make withdrawals from a pension – by the time we hit our FI bullseye. In that scenario there won’t be any hanging around.

Sure, if things go spectacularly well, and I hit my numbers early, then I could be like a pirate becalmed off treasure island – so close to his booty but unable to touch it.

I’m fine with that. I intend to work on for a couple of years anyway to build up a juicy tax-free lump sum. This will be slipped into ISAs to create an emergency fund / extra tax-free income generator / travel-the-world slush fund, depending on the mood at the time.

Final thoughts

It took being able to smash my mortgage before I was able to think clearly about FI. (If you can cope with two things at once then you won’t have this problem…)

You can add even more tax relief gas if your company pension scheme supports salary sacrifice. That will spare you another 12% in National Insurance Contributions (or 2% for higher raters).

At some point in these discussions, somebody will always say:

“The Government can change the pension rules, spanner your personal allowances, or even confiscate your pension.”

To which I say: Yes, you’re right to point out the risks. 3

That risk is one of many I’m taking to achieve something big in my life. I’m also entrusting my wealth to assets scarier than cash, believing I have a long and happy life ahead of me, counting on the UK not to suddenly turn into Argentina, and so on.

By all means be aware of the risks, but don’t be paralysed by them. Play the game in front of you.

There’s a good chance that any adverse pension rule changes:

- Will happen early enough for me to change course.

- Will happen late enough that I’ll be exempt.

- Won’t happen as foretold.

My chances of being left high and dry are small.

When all is said and done, the key is being able to live happily on £20,000 or less.

My prescription: Fall in love, maximise your tax allowances!

Take it steady,

The Accumulator

- I’m not too worried about the 45% rate. Are you?[↩]

- i.e. Save no more than our annual salary into a pension scheme, or our pension annual / lifetime allowance, and withdraw no more than our personal allowance in any given year of retirement.[↩]

- Only last week Ed Balls gave notice of his intention to end 40% tax relief on pensions if Labour are elected. Though most will be better off if reports of a new 30% flat rate relief for all are to be believed.[↩]

Comments on this entry are closed.

I think the biggest risk here is if one of you loses your jobs. Then you are instantly on 10k a year of tax free income (unless you can shuffle payments?).

I presume once money is added to the pension it becomes inaccessible. So if one/both of you lose your jobs, you might not have the money to last until that date. But i guess that would instantly mess up any retirement plans anyway.

The only other real risk i can see is not having a large enough emergency fund to support you over the next 10 years while you are on 20k a year.

Good luck. 🙂

My plan is not too different to yours and good luck! I too am in my early 40’s and am hoping to retire by 55.

Our savings rate is rather low while we do up our house but should improve greatly next year when we get the funds to finish it. Living down here is a lot cheaper than London, although we had a lot of visitors (from London!) over the summer…

I have a limited company so stay below higher rate tax and plough the remainder into my pension, keeping a healthy reserve of FU money. In my view, even if I choose to invest this in risky assets I still get the benefit of both NI and higher rate tax relief, whereas in fact it is in a relatively safe ‘lazy’ portfolio.

We still have a substantial residential mortgage although this is 80% offset by equity in B2L property, some of which we plan to liquidate next year while it is (<3 years rented) CGT free.

In the meantime we'll be building up some ISA pots to offset the mortgages – at least while rates stay low. It'll be interesting to compare notes around 2025!

Hi there, something did not make sense to me:

“If I was trying to hit FI in my 30s or 40s then, yes I’d be all over my ISAs. But that boat has sailed for me.

We’re in our early 40s, so we’ll be within sniffing distance of our pensions by the time the 10 years are up.”

Did you mean you are in your early 50s ?

Love the blog!

Goodness me Accumulator, you’ve gone all Mr Money Mustache on us!

I think my problem is the basic one of not feeling I am able to ‘live comfortably’ on £20,000. Do you have any pearls of wisdom on that front? I always thought MMM’s $25,000 budget was unrealistic in the UK, so I’d be interested to be proven wrong!

Of course, I am supporting two children, which do have a habit of increasing one’s expenses somewhat. Particularly if you want to take holidays abroad (school holiday prices for four really are eyewatering, compared with our pre-child May and September habits) Minus my holiday spending (which, along with a weakness for books, is my main area of profligacy) I think we spend about £40k per year. There is for sure quite a lot of discretionary in that, but I have to say I enjoy being well off enough not to have to count and worry about pennies, just to be reasonably sensible and moderate and know that I will still keep comfortably within my means.

Do you have a plan for what you will do with your time, come FI? Sometimes I think that is an even bigger challenge. Of course while I’m working I can think of gazillion things I’d rather be doing. Then when I contemplate leaving I realise I need something else that will give me some structure and purpose to my life – and some stimulating company. I sometimes hate my but I really like a lot of my colleagues!

Re pension rule changes, I wouldn’t put Argentine style confiscation in the same risk category as the minimum age being raised again. I think your strategy is sound if backed up by already accumulated £100k in ISAs as that would give you 5 years of expenses to live off should the government increase the age to 60 with only a couple of years notice.

hate my work that should say! (not so much I dare not speak its name)

Agree with BTS about teh likelihood of minimum pension age being raised. Though they’d be wise to look closely at employment rates in 50s and 60s before they did that or they may just create an army of benefit claimants who can’t find work, or who are no longer physically fit enough to work, but can’t access any pension either. I think the figures suggest that many people who ‘retire’ in their 50s had actually plan to work longer.

@BTS and Vanguardfan –

are you talking about a raise in the state pension age?

I thought that pension providers had to honour the terms agreed when a member joined the scheme (i.e. I have told my stakeholder pension provider that I plan on retiring at 55)?

Are there historical precedents for private/employer pension schemes moving the goalposts in this manner?

The original age at which you could access the money in your SIPP was 50, but this was increased to 55 in 2010.

There are also significant controls over what you can do with the money – currently you can only withdraw a maximum of 25% cash as a tax free lump sum. The rest can only be used to produce income from certain classes of assets and in prescribed ways.

@vanguardfan

I was like you in a former life, and didn’t count the pennies, though I didn’t go into debt (bar repayment mortgage, which I repaid).

Looking back, it has become tragically clear to me that I wasted a shocking amount of money on spending that, fundamentally, didn’t give me a decent return on investment. No spending tastes as good as financial independence feels…

I retired in my 50s, I had originally planned to retire at 60, the NRA for my firm. I became truly pig-sick of the vile management practices dreamed up by MBAs, which is where I applied myself to finding out what I could do about. That involved looking where those damned pennies were going, and I was dumb enough that too many of them were going down the drain of consumerism rather than into my pension. So I stopped doing that. I didn’t have foreign holidays or many of the other trappings of a ‘well off’ life. I bought my way out of debt slavery with that.

I have no desire to work again – because something else I realised was that every day my life is getting shorter by 24 hours. I’m gonna make those hours count and work for me not flush them away jumping when The Man says jump. BTDT.

Consider counting the pennies, just to make sure you’re getting true value for them. I spent far too many of mine compensating for doing something eight hours a day so that I could earn the money…to make myself feel better about spending eight hours a day…

What’s with the common worry about filling your time – the world is plenty interesting enough and gets more interesting when you have the time to pay attention to it. I’ve learned more about stuff and people in the last year and a half than in the previous 10 – I meet a much wider range of people and social backgrounds as an early retiree than I did at work!

@TA firstly, the best of British luck to you, and also hopefully you will find that your goal comes quicker than you think. That £1.67 for ever £1 you save is a fantastic lift, you’d kill for a ROI of 67%. I never looked at it that way, I always thought of it a gain of 42% (tax+NI) so it mounted up a lot faster than I expected.

£20k p.a. is a big ask. We get along on a basic a bit bigger than that, but then along come repairs and maintenance for the house, replacement kitchen equipment, new mattresses … To manage on £20k I think we’d need to trade down to a house with lower Council Tax, cheaper heating bills and in tip-top condition. But we like our house and garden, we like having space, we enjoy fitting in visitors without upheaval ….

Hell, the car is nineteen years old and will therefore need replacement in the next decade or so.

Still, you’re young enough to do all the repairs and so on yourselves.

Hello Folks,

For most of the time that 6% of my gross salary was deducted to pay into my employer’s occupational pension scheme I thought the returns seemed pretty low.

Now that I’m actually being paid that pension in a time of low interest rates and poor stock market returns I’m astonished by how good an investment those deductions were (on a risk adjusted basis). 🙂

So saving both into a pension and an ISA is a kind of diversification against “event” risks.

From personal experience over the past three and a half years it is perfectly possible to live within £10,000 a year outside of London – but then I’ve never been a rash spender.

Bob 🙂

Living on below £400 pw is going to probably no holidays in hotels, no car and probably very few nights out

I would suggest you might consider putting some of that extra time into a promotion or the beloved “side business”, as an extra £5k a year will feed nearly direct into your spending money after only basic rate tax/NI and the extra money each week would enable quite a few things to make the next decade more enjoyable

Judging by the income figures you are talking about you are both paying very little higher rate tax at the moment and the nos. you are going through on pension contributions really give out big returns when one or both of you is in the £50-100k earnings bracket and normally liable for lots of higher rate tax

I appreciate it might not seem worth it when in your minds you are only 10 years from retirement, but you can’t really predict when ill-health would happen and you would be kicking yourself if scrimped and scraped for a decade only to find you spend your retirement ill

The Accumulator… If you hate your job that much, why not get a new one… or set up an alternative business? Or move to Thailand…?

I don’t mean to rain on your parade dear chap (love the articles and all the things one writes at this point) but at 55 you likely only have 20 years good health left. At 40 you’re 15 years away from 55…. and they are certain to be 15 healthier years.

I do not doubt you can live on £20K pa… some people live on far less… but why resigned when still so relatively young? For the first time in reading the notes of my fellow “Monevator” blog readers I find myself nodding along with that generally pessimistic grump “Neverland”… at the least as he says you could find a hobble…

TA,

I need 3k per month net to be comfortable. I regret putting significant savings into my SIPP. Pensions are too inflexible and I Dont trust the government. I would max out my ISAs and wouldn’t even bother with a SIPP if I started from here.

I wish you much success TA. It all sounds very possible to me. Let me prove it.

My savings rate is a little more aggressive than yours with a target of 60% of gross earnings (defined as earnings plus employer pension contributions). Like you I also have a portfolio where I expect to return a real 4% per annum.

My personal journey started in early 2007. The first 2 years contained plenty of learning and mistakes so you’re well ahead of where I started. That should give you a nice jump start. Today, 6.75 years later, I have already accrued 72% of the wealth I’ll need for FI. If my savings rate and the investment world does nothing better than be “average” over the next few years FI should appear in 3.5 years.

Total duration from waking up and smelling the roses to FI = 10.25 years. Exactly your target.

Cheers

RIT

Well done, Focus on building your income and it’ll happen quicker. I’ve previously had consultancy jobs on top of my full time job made so easy quick money but it started making me feel washed out from working too much.

I’m a lot younger than you guys and i’m 29% of the way there. My biggest problem will be having too much money in pensions and not enough in ISA’s (i’ll spend the ISA cash before 55) and too big a house. I suppose it’s a nice problem to have. I’ve previously had consultancy jobs on top of my full time job made so easy quick money but it started making me feel washed out from working too much. My employer contributes a decent amount to my pension so i save in it. Tax relief isn’t much compared to an employer putting in 9%. I could downsize my house and release 100k at least but until closer to the time I can’t be bothered moving.

I’m sure you could have a look at your expenditure. Do a detailed breakdown and get it lower. Do a SOA on a debt free board (e.g. MSE or fool.co.uk (pretend you have tons of debt first – otherwise they may feel exploited) and ask them to critique it.

The best thing about your plan is assuming a 4% withdrawl rate is unsafe by leaving the large margin for error you will be pleasantly suprised when proved wrong (you will earn more, spend-less and should find it adequate to produce more income than you require)

Another great thing about your plan is that if you ever change your mind then at least you will have loadsa money for consolation.

Another thing I can think of is good luck – everyone gets it now and again inheritance, windfalls, bonuses at work – things that you can’t really predict other than they happen every few years. Add that to your plan and it’s turbocharged. But you can’t plan these things so in ten years you’ll end up thinking your original plan looks rather pesimistic.

Can i ask are you planning to retire with 660k in assets? I’m assuming 20k is 3% of 660k. Does that include a house or do i assume if you have a house you will liquidate it? I’m thinking you are putting a lot more margin in that a 3%WR if you are leaving out 25% of your assets in this equation.

I’d seriously suggest taking a visit to earlyretirementextreme forums as I think you could do it a lot earlier.

Learn to love porridge is my usual tip for anybody and everybody

Ramble over

Sounds like a plan to me – very much similar to our own experience!

Assuming you have a job and a house, living on £20k should be possible – we did it with a family of 4, including holidays. Frugal living is really a key because it helps to build up what I call a Money Snowball – and you learn to live on less for your (hopefully) long retirement.

http://www.the-diy-income-investor.com/2011/01/money-snowball-and-compound-interest.html

If you analyse your expenditure you will probably find that food is your biggest item. My tip is to start a lifelong ‘game’ of only buying reduced items. Get to know when your local supermarkets do their reductions (e.g. Waitrose does them at 3-4pm and Tesco Local at 7pm). We routinely buy for a quarter of the original price or less. We have never had any bad effects. The main challenge is how to use the more unusual items (e.g. celeriac).

Once you start looking, special offers seem to magically appear in unexpected places – we recently bought Walkers crisps for our son for 10p in…Superdrug.

I’m in quite a similar position. I’m 45 years old and am looking to retire around 55 – voluntarily or not. I’m only saving around 44% of my income into a pension. Complicating factors for me are firstly that I have a young family so I’m likely to be responsible for some fairly big financial commitments post-55 and also my wife doesn’t work and probably won’t return to work until our kids are much older. I haven’t fully thought through the implications of the latter yet. Clearly although the pension will be in my name I’ll also need to ensure that she’s FI in the event of my death. Not sure how best to plan for that.

As an aside I do take a perverse pleasure in seeing my neighbours washing their huge BMWs on the weekend whilst between them sits my old Passat. The consumer society really is self-inflicted slavery.

Interesting comments. My situation is unusual, in that until 2 years ago, early retirement was not on my radar. My plan was always to retire at 60 (which now seems to have become ‘early retirement’ as my state pension age increased to 67…) and to that end we were and still are saving about 30% of gross income into pensions. A large and very unexpected inheritance means that we could now be FI, at least at the level of spending TA is proposing – but probably not at our current level of spending. However, faced with the reality of this choice, we have so far changed rather little about our lives. So, why haven’t we told The Man to b**** off yet? A few reasons include: 1. realisation that there are things I get from work that I need and enjoy, and a feeling that I have skills and expertise to offer – I haven’t worked out (yet) how to replicate these things if I give up my job; 2. feeling that it would be better to continue work while our children are living at home, partly to set an example and partly because I suspect I woudl spend too much time on chores (bad for me) and on hovering and organising their lives (bad for them) if I had a lot more time on my hands now; 3. I feel it would be unwise to destroy my earning power when I may still live for 50 years; 4. I haven’t worked out what other things I would like to do with the time; and 5.I do not want to reduce my spending from its current level. and 6) I can’t really imagine not working when many of my peers are working hard to make ends meet – I guess I would feel slightly guilty, particularly since we have not earned our nest egg. So, for now we sit tight, and contemplate exit at 55 when the children leave. I do monitor our spending though, and try to spend consciously on the things we value – we find our household bills are a bigger spend than food (we could live in a smaller house, of course, but we like this one…). The holiday budget is our big luxury 😉

I don’t understand the business of washing cars. The rain does it for ours (bar the windows and lights, which we do wash from time to time). Nor do I understand the business of keeping buying new ones. After my motorbikes and old bangers era, and ignoring three spells abroad, since 1974 we’ve owned a total of three cars, and even then we had to replace one only because it was stolen. We have, I admit, bought four bikes in that time. Jolly good things, bikes.

@vanguardfan — There’s a wide spectrum of possibilities, isn’t there? Personally I don’t intend to ever ‘retire’ in the way that T.A. (and ermine on his blog) describes it. I’m much more in the Money Mustache school where ‘early retirement’ means ‘retirement from *having to work* tomorrow, not retirement from the enterprise of making money, let alone of doing productive work. I’m also somewhat concerned that full on retirement can be bad for your health.

But very much each to their own on this, I think. The key is to get the F.O. fund in place if possible, and then do what you like! 🙂

The trick is to come retire to Spain

‘ if we each spend £10,000 a year from our pensions (in today’s terms) then we will pay 0% tax’. Until you get your State pension. That will be £7000 a year. So any private pension over £3000 a year is going to be taxed. The State pension seems a long way off now, but it won’t when you are in your 50’s 🙂

Interesting comments here.

I agree that ‘retirement’ doesn’t necessarily mean stopping all paid work – as a contractor already, I’m perhaps better prepared for this than some and already have a limited FU fund.

I see it as taking odd jobs here and there if I want to, but not needing to work five days a week or even at all. I have colleagues who are ‘retired’ but take on the odd contract to keep the grey matter going and as a top-up to their pension.

Another thing mentioned above is the house choice – ours is larger than necessary and we’re adding to it now but we fully intend to downsize at some point after retirement and maybe even live abroad (Juan – nice idea!).

Interesting points about saving money – we have the Sainsbury’s card (4.5% off everything), a 2005 car and living here removes a lot of temptations but bills are big despite shopping around.

Here in Spain we are just coming out of a Real Estate bubble. The house prices are falling and so are the renting prices. In a nutshell, we have built too many houses that now need owners/renters.

The lower cost of life would benefit retirees from more expensive parts of Europe (a bit like Florida in the US), who could in turn help solve some of the bubble’s excesses. A win-win situation

@Juan — A question: How do you feel local people would take it if there was a big flux of overseas money coming in and buying properties cheap from hard-up Spanish people and so on? Would it be welcomed as much-needed, or maybe not?

I know Spain has a long history of welcoming foreigners, especially in the past 20 years, but do you think there would be any resentment? I have some connections on the coast, love the country and like the people (even if we do sometimes wind each other up!) and do sometimes toy with moving there…

I think they will feel mostly relieved.

I don’t think they would see European purchasers as a threat.

Sometimes foreigners moving to a retirement country, perhaps due to some cultural clash issues, tend to form small (or not so small) “colonies”. They cluster together and relate only to their own fellow-countrymen, trying to totally exclude locals from their territory, hotels or leisure places. I’ve heard examples of this with Germans in Mallorca. Some people get annoyed with that.

I live in Pamplona though. An East-coast Spanish should know better about this topic, “los guiris” haha!

Really, a bit of integration always helps. Learning some words in Spanish works miracles.

@Juan — Ah yes, they have joked with me about the guiris before. Because I am one. 😉 But not quite a lobster. 😉 Too classy for that.

I like Northern Spain, too, and indeed linked to this article a while ago:

http://www.independent.co.uk/news/world/europe/happiness-is-a-hamlet–all-to-yourself-in-rural-spain-8760036.html

A friend actually mentioned this last night and wondered if he should set up a dotcom incubator place by buying one and doing it up?! (His wife is Spanish, even though they live here in London). I said I wondered if it even had phone lines… 😉

I’ve always been told to live in the present and plan for the future. Do you think that you have got it the wrong way around? Are you perhaps planning for the present and living in the future? By all means make provision for your retirement, but not with too many sacrifices in the here and now. Find a happy medium, otherwise with hindsight, you might regret it.

Interesting discussion. Aged 49 with 100K in ISA savings, mortgage paid off, I took it in to my head to leave that 60K a year job and final salary pension at 61 and move to NZ to enjoy life – but still work FT to pay the bills. Part of the motivation was to enjoy life whilst still able to partake to the full so whilst retirement on 20K a year is nearly feasible until the pension kicks in back in the UK we’ve spent 4 years exploring NZ, Australia and the Pacific generally so have had a great lifestyle. Not so much on the FI savings front – and my timing sucked with the financial crisis just at the right time to be buying shares we were spending on emigrating.

We shop carefully, own a 6 year old Toyota and use GrabOne a lot! Oh, and invest in trackers/ETFs – not easy in NZ – although a few UK IT’s are registered over here too (Bankers, F&C, City of London, Henderson Far East income) as there are rules around tax and overseas investments and dealing is far more expensive. Must get around to that rebalancing you keep posting on but my plan was to gradually feed equity income in to buying bonds and gilts whilst still retaining the value and income shares – my parents are still alive and have nearly 30 years on me so that’s a lot of potential growth! Also the NZ Gov is selling off assets – power companies at the moment – to add a little interest.

Maybe we will regret it further down the track or maybe I won’t be here next year anyway but right now sitting front of a log fire with a scotch…and it’s spring here. Bliss. FI can wait…a little.

PS Love your blog – log on every weekend – first posting though

@Vanguardfan

I think I’m technically FI too although like you I haven’t put it to the test.

My ‘not watching the pennies’ monthly spend is 1.5K , watching the pennies spend was about 1.2k last time I did it. I’ve 2 kids, live in a 3 bed house in the south east, run a car (occasionally) and go on holiday as and when (not really a big fan). So yearly outgoings 18 – 20 K.

Assuming people on average live within their income then this puts us smack in the median of household income/outgoings.

https://en.wikipedia.org/wiki/File:British_household_income.jpg

So considering we have no debt to maintain, we live pretty comfortably by UK standards.

Over a period of time I sat down and reflected on the things that gave me pleasure and satisfaction in my life, The work place didn’t feature particularly highly, time with family did. I was particularly aware of time not spent with my children as a contrast with time spent commuting and effectively doing nothing at (rather pointless) work.

I work perhaps 3 months a year freelance now. I still have some interest in what I studied and it keeps my options open. Over the last 4 years the structure of my life has changed as I became progressively less concerned about maintaining my income and relearnt how to spend time on other things. Unlike life structured around working that structure evolves slowly but constantly.

My better half is a teacher who finds (not unreasonably) meaning in her work. Our joint income is such that we still maintain a savings rate of 30%, so the stash still grows.

We’re not income constrained, I’ve just no idea what we’d spend more money on. We’re both free to either work or not work as we please and that is what makes the difference in our lives.

We are born free into a culture that tries to tie us down with pointless crap, by having the time to potter about and see how people live I realise that a healthy minority of people have always refused to toe that line.

I’m late to the party but I hope to set an example to my kids too 🙂

Another vote for annual spending under £20k without feeling like sacrifices are being made. And that’s with child, dog, car and holidays (not in hotels though, Neverland!)

Nathan, BTS – thanks. Yes I do keep thinking that it should be perfectly possible to live well on less than we do. Time to spend a bit more time with my budget spreadsheet I think and work out what I’m doing wrong 😉

I would very much like to be able to work less, and I’m sure we could manage, but it would be difficult in my current role which does not lend itself to freelancing (I know that sounds like an excuse!). So it feels a bit like an all or nothing decision.

My rule for thumb is to only put earnings which would have been taxed at 40+% into a SIPP (via salary sacrifice to get 2% NI saving + top up 8% from employer of the 13.8% NI they save by doing this), and then any other savings (upon which only 20% tax has been paid) into ISA’s.

This means that in younger years when not a higher rate tax payer, savings go into ISA’s, but in later years earns approaching retirement age proportionately more goes into the SIPP.

This reduces risk by:

1) operating across two tax regimes- SIPP rules/ISA rules

2) by placing ‘young’ money in the ISA it remains accessible for the greater part of your working career and acts as a cushion were you to find yourself redundant ; if only to temporarily draw income from the ISA

3) using higher rate earnings for SIPP helps to ensure you get the marginal rate 40% in v 20% out benefit on contributions.

4) by placing contributions into the SIPP near retirement increases the annualised rate of tax benefit e.g £100 in 1 yr before retirement gives 25% tax free in 1 yr, but £100 in 10 years before retirement, only gives 2.5% tax free per annum

5) The employer leverages the SIPP contribution by, say, 8% via salary sacrifice

6) By using salary sacrifice the adjusted earnings are kept below 50K so ensuing maximum child benefits are maintained. With two children this effectively adds an extra 20% to the contribution made from in the 50-60K earnings band.

7) by using earnings taxed at 20% for ISA contributions, the tax cost of buying the tax free wrapper is only 20% rather than 40%

PS: This may change for the next generation who will repay 9% of their student loan on earnings above £21K as will be make salary sacrifice so compelling by boosting the pension contribution by 9% that earnings which would have otherwise been taxed at 20% become 29% coupled with employees lower band NI 12% + some the employers 13.8% if you are lucky (say 8%), giving 20%+9%+12%+8% = 49% tax relief on entry versus ISA’s tax-free on exit.

Plenty of food for thought in the original post, and comments above.

I think aiming for FI before 55 is going to be very much harder these days that it was for the babyboomers, house prices alone mean anyone typically under 40-45 has a bigger hill to climb, while those at uni know have a mountain in comparison.

I’m also early 40s so sit between the boomers and endebted grad generation. The difference between people of my age group who bought property in the 90s rather than mid 2000s is huge, even for those on similar incomes.

I echo the thoughts on not postponing your life until 55, but giving your life to a corporation to pay for stuff you don’t really need is equally bad. Clearly there is a balance to be struck.

As for me, I will stop adding to my SIPP pot once it is looking like providing an inflation-linked 10k pa at the most pessimistic growth forcast. Any income over that will come from ISAs, BTL and perhaps 3 months a year IT contracting or running a part time business. That would be a happy, balanced semi-retirement/semi-FI that more achieveable that stopping work entirely.

SemiPassive – I agree with all your points although it’s tempting to take the SIPP a bit higher for the tax and NI advantages. I too was lucky enough to buy property in the 90’s and this did help a lot. We’ve got the child benefit going into an ISA for our child which will probably go towards his first deposit one day.

My perspective on the work/life balance changed quite a bit when I moved out of London – lowering the cost base helped a bit too. I saw too many people there working so hard to pay off their mortgages that they didn’t have time to see their young children and then at weekends they were too exhausted to enjoy them.

IT contracting does give an easy route for semi-retirement but it may well be harder for permanent staff and in people in other industries. Contracts outside the cities do pay a lot less but hopefully similar rates relative to living costs.

One of the IT managers I worked with was made redundant in his early 50’s after over thirty years’ service, so with a substantial pay out. He was quite despondent about what he was going to do and talking about contracting, more to fill in the hours than for the money. However when it came to it he really surprised himself at how much he found to do without working and how much fun it was.

@SemiPassive

That’s an interesting comment. I’d also be interested to know what level of pension pot you’re assuming will provide an inflation-linked £10K.

Apologies for all the semi-literate typos in my post above.

WestcountryEscapee, there are plenty of things to do once you don’t have to work for a living, thats a damning indication of corporate institutionalisation that the manager is suffering from. Quite sad really.

Drone, the Monevator crew will have a link on that already somewhere I’m sure. If not please can they do one.

Its a fair old chunk of money though, whether you are going the annuity route or more likely income drawdown.

My current SIPP target is £333k, I have no idea if I will make that by 55 as there are so many variables. But that relies on a 4% withdrawal rate (250k left invested, and the 25% lump sum reinvested into ISAs) that may make it tricky to fully keep up with inflation.

Then again the state pension should kick in at 67, not a huge amount but it all helps.

Most people are going to need a total net worth of 1 million including their home, assuming they live in a typical UK house, certainly in the south east. Its obviously easier if you live in a tent somewhere.

How you split that 1 million net worth is interesting, for instance I know a few people with million pound houses (some with a lot of equity but still very hefty mortgages) and practically zero pension or ISAs. It baffles me that some could be much closer to FI if they simply moved out of London.

SemiPassive – I gave this as an example of early retirement being quite a gamble for people with a stable corporate work history. Personally I find it very hard to squeeze work in between the loads of other stuff I want to do!

You’re right that people could take one step closer to FI by just moving somewhere cheaper – one of the aims of my site is to show people how easy this is, either by working from home or ‘downsizing’ to a less well paid job but in an area with a lower cost of living.

@ All – Thanks for your many illuminating and enjoyable comments, as ever. Apologies for my late reply, have been absolutely flat-out at work.

@ Frugal – that would be a blow, but not fatal as long as one of us can work.

@ WestCountry – sounds like you’re well on your way. Look forward to toasting our ‘retirement’ in 2025.

@ P Desai – I’m not so old, I don’t remember my age 😉 I meant that if I was trying to ‘retire’ in my 30s or 40s then I wouldn’t be stuffing everything into my pension. I’m 42 + 10 years = 52. I’ll have another 3 years to go by then to access the pension. Ms Accumulator around the same. If I’m FI by 52 then I could go very part-time to earn my living expenses, or keep ploughing on for a bit longer to build up the funds.

@ Vanguardfan – heh heh. Yes, I do enjoy reading MMM and ERE. The picture they paint a compelling picture of a life of frugal freedom.

Like you, I don’t think the American budgets map accurately to the UK and I could never be as extreme as Jacob (of ERE) and don’t earn the large salary MMM commanded at his peak. Our biggest advantage over you is no kids, but I doubt that fully explains the gulf in budgets.

Breaking the association between spending money and ‘quality of life’ is crucial. The best times of my life are had cycling our bikes on quiet country lanes, or walking in the woods. Activities that are essentially free. The Investor recently shared this text from his Dad: “Facing the Atlantic with the sun on our back and half our tea left. It doesn’t get better than this.” The Investor’s Dad was right.

Tracking expenditure on a spreadsheet is also vital. Some people view this as a penny-pinching infringement of their civil liberties but it’s actually liberating. It enables you to see where the money goes and whether it’s really being spent on stuff you value or just being frittered away when you’re out of control.

Once you begin to break free of the all-consuming mindset of the mainstream, you start to enjoy not spending money. Not for its own sake but because you know you’ve found a better way: a way of living a more fulfilling and purposeful life.

What to do with the time? That’s an excellent point and one I’ve only started to sketch out. There are probably some excellent books on the subject (anyone have a recommendation?) but I reckon a 7-day week will fill up pretty quickly:

1 day doing whatever the hell I like / reading / exercise / seeing friends

1 day learning a new skill

1 day community / charity work

1 day doing some kind of paid work to keep my hand in

1 day taking care of all the chores that need doing

1 day pet project

1 day out and about with Ms Accumulator

I’d like to spend more than one-day a week on some of those, so I’ll need a longer week, please.

Here’s a few Monevator links below on living frugally (including one from Jacob of ERE fame).

http://monevator.com/living-frugally/

http://monevator.com/saving-tips/

http://monevator.com/big-savings-quality-of-life/

http://monevator.com/how-to-stick-to-saving-goals/

@ Neverland – we have a car and go away up to 5 times a year, stay in hotels, cottages, villas etc. And that’s in school holidays because Ms Accumulator is a teacher. We go abroad every other year. You’re right we don’t have many nights out, we’re home bodies, but days out on the other hand…

Here’s some ideas for holidays, also check out airbnb.co.uk

http://monevator.com/staycation-holidays/

On current projections our income will get a major boost once we hit 67 and the State Pensions kick in. That should cover us in our decrepitude. I very much agree with your comments about earning a little extra income for as long as possible and I fully intend to do that. I think I’d barely notice if I worked 2 days a week, in comparison to my current hours.

@ Old Pro – I don’t hate my job, but I love my freedom far more. Trust me, I’m not wasting the years in the meantime. I expect that’s a reference to the 20K per year… we enjoy life more now than we did when spending three times that amount. That’s the joy of it, living frugally doesn’t mean living miserably because you spend money on the things you love, and not on things that don’t really matter.

As for retiring at 55, that’s my own fault for not having cracked the code sooner.

@ RIT – cheers!

@ vilerodent – good thoughts, yes, I’m hoping I’ll be proved pessimistic. Yep, £660K in assets and then I’ll work on a bit longer to secure some tax-free cash that will go on other things. Haven’t included the house as I plan to live in it. Sounds like you’re doing very well – all power to you. Great tip about the porridge. Learned to love it last year!

@ DIYincome – you’re absolutely right about the food. But then I’m famed for my piggery.

@ Vanguardfan – part 2 – just read your 3rd comment. I suspect you could replicate everything you like about work by working for charitable / community causes. Still, no reason at all to give up work as long as you get something out of it. Work is a valuable thing and a human need. Would be interested to here from someone who carried on working once they are FI. I can’t help think I’d enjoy it more once I was bullet-proof because there’d be no need to put up with the politics.

Re: point 5 – “I do not want to spend less.” Stated this baldly, it seems like that’s a point of principle for you. The principle being that spending = pleasure / status / self-worth, whatever. Breaking this link made a big difference to my flexibility and the possibilities open to me. I’ve met plenty of people who can’t even begin to curtail their spending because to do so amounts to a failure in their own eyes. This is a manacle, clamped to their ankles by society. Chances are they’d be happier if they broke it.

@ Tortoise – quite so, and that’s no problem at all as my income will be going up.

@ Britinkiwi – You make a strong case!

@ Nathan – great post. Says it all.

@ Vanguardfan – Here’s a great post from ERE. This sort of post helped me a lot (especially as in a surrogate support group sense), hopefully it can do something for you too: http://earlyretirementextreme.com/can-i-retire-young.html

@TA that post from ERE helped me too 😉 In particular a light bulb went on when I understood what he meant by

I wanted to be wealthy, not rich. When you are wealthy you don’t have to put up with people being able to push you around; when you are rich you have lots of shiny Stuff/experiences/what-have-you but people may be able to still push you around, particularly if you become attached to the lifestyle.

Financial independence is about freedom, not necessarily about lifestyle IMO 😉

i think i’m probably FI as well at 35. my portfolio is 2/3 property, 1/6 cash and 1/6 equities. current outgoings are just over 20k in total for me, the missus and 2 kids – portfolio is approx 30x that. frugality is easy for me as it is baked in from childhood – still have some awesome holidays though, latest was a windsurf road trip along the moroccan atlantic coast. currently have a job that i love though, so i think i’ll see how it goes, if that ceases to be i don’t think i’ll bother looking for another one as such – certainly not in the traditional 5 day a week sense.

Bit late to the party, but have been mulling this post over and over…..

Good luck is the order of the day as i wont deny anyone his right to any goal he chooses and Mr A does seem like a very reasonable chap!

I guess my slight thought echoes a couple of comments already and I think slightly harks to Mr Investers thoughts too ……. it seems a shame to focus your life while you are young in this way, so when you are old you can be free…. surely finding a way to be free now is just as important….

Some people my may find the lifestyle of designer Stefan Sagmeister interesting…. instead of working until retirement then living an old free life for a few years, he takes a year off every 7 years instead….

http://www.ted.com/talks/stefan_sagmeister_the_power_of_time_off.html

Also all the savers and dare I say it anti capitalist scrimpers, don’t forget your lovely investments would be doing pretty badly if it wasn’t for people buying into things and creating growth…. each to their own and people make their own choices, but if we all didn’t spend I’m not sure what world we would be in……

Many thanks TA for your excellent blog and this post in particular. Your blog is always thought provoking and is a constant source of enlightenment and inspiration for me on my path along the cobbled road to FI. I find it helpful to consider not only the size of the required pot but also (as you have illustrated) the tax treatment of that projected income stream. I am 45 and aim/hope to have reached the tipping point in 10 years’ time. I am working on the basis of a recognition of the benefits of tax relief on SIPP contributions as a HRTP but balanced with hefty S&S ISA contributions. The intention being to have a flow of tax free income from the ISA’s allied to pension income. It seems desirable to achieve an equilibrium between these two regimes rather than rely solely on pension income, for the calculations of the tax treatment of income that underpin your plan.

Best wishes Jim Lad

@ Rhino – certainly sounds like you’re FI if you want to be. A great position to be in. All power to you.

@ Geo – you make some excellent points and there are many examples of this type of thinking. The 4 hour work week brigade, Old Pro’s idea of living in Thailand, Jacob’s willingness to live in a motor home, there are many ways that a life can be redesigned to live more meaningfully.

Thing is I don’t believe I’m sacrificing my ‘youth’ (not much of that left) in order to buy freedom when I’m ‘old’. If I’d started this journey at 21 and was FI by mid-30s, then we probably wouldn’t be having this conversation. Mr Money Mustache is the living embodiment of someone who is living their dream.

I’ve just shifted that journey to a later phase of my life but I had 15 years of spending to the hilt and I can tell you that I’m enjoying life more now than ever. Beyond a moderate limit, there is no link between money and happiness in my view. I don’t get happier the more I spend. I get happier the more I live life on my own terms. The more I live a life with purpose. The more I’m in control. This is one way in which I’m doing that.

It’s not anti-capitalist. Sure, if the mainstream was less obsessed with consumption then my returns and global GDP would come down a few notches. In all likelihood capital, lives and employment would be reallocated in different sectors according to the prevailing values of that new world. I think there’s a strong chance it would be a better place to live in ways not easily captured by economic theory, but that world does not exist.

@ Jim Lad – Thank you for your kind words and may you hit FI soonest. I can’t argue with your logic. It’s entirely possible I’ll swing back to ISAs later on if things go particularly well and my SIPPs can 100% fill our personal allowances and max out a tax-free lump sum on top. Or if the regime shifts in favour of ISAs. I acknowledge though, I’m taking a calculated risk.

@ Ermine – agreed! Though there are many definitions of lifestyle and they don’t all have to depend on disposable income. Have you ever read the ERE book, btw?

@Geo

Your last point may be factually true but is a bit like saying you can’t have a retirement plan which is to have a short career as a well-paid dentist because if everyone did the same thing then earnings from dentistry would fall too much.

Realistically not everyone is going to follow the Accumulator’s plan. This is a niche blog after all, and even on here not everyone is in agreement.

Hey guys, i didn’t want my comments to come across crass…. your notes are very true, i think its how people read things sometimes….

I think sometimes the MMM movement can come across as slightly smug sometimes, laughing at their neighbours because they are going on holiday in a car, whilst hiding away eating their porridge and counting their pennies from investments that their neighbours lifestyles to some (small) degree contribute….

Anyway I’ll probably get shot now so will duck and run for cover..

Best of luck to all in what they choose as long as you’re nice to your neighbour 😉

@ Geo – I didn’t think your comments were crass, they were all points worth making. I just enjoy the debate!

I view those aspects of the Mustachian movement as no more than local colour invented by MMM to make his blog a more enjoyable read.

It’s worth bearing in mind that anyone who goes headlong for FI is swimming against the mainstream. As a non-conformist you’re up against a great deal of social pressure. Under these circumstances, minorities often invent strong identities in order to hold fast to their beliefs.

Hi all,

Very interesting postings. Just wanted to raise a different perspective which is how best to shelter accumulated pension/assets from the tax man in retirement.

Has anyone considered emigrating to tax friendly countries, eg Belize, Cyprus, etc, to enjoy higher pension receipts than the £20k pa without a tax loss.

It’s one thing to get to FI but it would also be nice to enjoy the benefits of the years of saving without having to mange the tax take when in retirement.

A 4% withdraw rate and a 20K per year target will need a pot of around £500,000. Assuming someone was starting form scratch they would need to be saving around £3,500 every single month and get an average return on that money.

Half of UK workers earn 25K per year or less – 2K per month.. doing this in ten years will not be possible for most. If these save £500 every month they might hit the 500K pot after 35-40 years.

You’re right oll. It’s not for most people. Many who earn a much greater amount won’t be able to do it because they want a greater income or aren’t prepared to save enough. Sadly, many won’t be able to put enough away because finances are too tight.

Remember though that’s £20K for two. And Jacob shows on Early Retirement Extreme how to live on much less. He was so determined he chose to live in a trailer park.

It doesn’t have to be done in 10 years either. We’re saving 70% of income now which puts us bang on course but I wouldn’t blame anyone for taking things more slowly.

An inspiring read.

Nearly a year on, hope it’s all going to plan!

While saving are you living off the £20k a year? Ms Z and I are aiming for a similar time frame and a similar amount and I think we are living off around that at the moment, which is positive and to be honest we don’t feel like paupers! I say ‘I think’ as I haven’t actually checked properly what our current expense rate is… a task for the weekend I think. But it’s not far off.

Mr Z

Hi Mr Z,

Good on you. We don’t feel like we’re living like paupers either. In fact, it gets easier and easier in terms of mental satisfaction. That said, here’s my numbers in the raw:

2013 – 14 = £21K spent

2014 – 15 = £28K

A big and disappointing jump in a year that was mostly accounted for by capital spending on a boiler replacement and some external works to the house. The only real lifestyle inflation was a food bill that went up 20% after Mrs A and I adopted the paleo diet.

Big on my to do list is the need to more accurately model capital spending over the long term to make sure this doesn’t blow my income assumptions out of the water.

My basic plan is that a reserve fund would take care of major works while I think we could live off more like 17K a year once FI (no work costs etc). I want the flex to 20K to allow for the unforeseen and the desire to travel more, potential health costs as we age…

A bit of part-time work for a few years (say a day or two a week each) would also take considerable pressure off the FU Fund (um, I mean FI) especially during the early years when we’re vulnerable to sequence of return risk. I think a bit of part-time work for a while could be a positive way to wind down from my full-time life rather than an abrupt gear crunch.

Eventually the State Pension will kick in and give us more buffer too.

Thanks for the update.

That’s not too far off then.

I had a look at my expenses and its running at about £11.2k for each of us, so just over £22k combined isn’t too bad. Admittedly we did go skiing in February and that was paid for ages ago and so wasn’t included in my calculations, but it’s not far off.

I hear you on the housing costs, we are going to need some roof work done this summer, which will cost a fair bit. That said, I am going to try and aim for around £10,600 expense rate going forwards and if capital expenditure does take me over that then it would during FI anyway, so best be included in the numbers, right. This article has given me the kick to start the experiment.

I agree completely with your point about not pulling the plug suddenly, could leave you pretty lost for a bit. And I would probably carry on working in some capacity, perhaps in the same job but part time but more likely on something completely new. Say…carpentry. From Excel to carpentry, can’t be too hard.

Thanks for the reply,

Mr Z

A reserve fund is probably a very good idea. We started to properly allocate for household maintenance and improvement about a year ago, 1.5% of the property value annually. Unfortunately the best laid plans are going awry already thanks to the requirement for major electrical works…

Great to see guys.

For me I can’t live off as little as you, two teenage kids and a wife don’t quite allow that but I totally follow your approach and goals.

I think the key messages that I too have been doing is:-

– you can live off much less than you think and you (and in my case my family) soon get used to it and remain at least as happy as before

– saving through tax and NI efficient pension really supercharges your saving plan. I now get to the point that I see the tax a bit like an interest rate on my earnings. Please don’t think I’m anti tax, just I see it as money I could have saved/invested … or a missed opportunity.

– it is just amazing how it soon rolls up and I’m now looking at something that seems very realistic.

For me the whole experience has been really enjoyable and is all about having the freedom of choice to kick back when and how I want to and in general living off less (not like a pauper) has not been negative at all.

Thank you for the great web site and my advice to anyone who wants to give this a go is go for as you enjoy life not as a way of delaying life!

Cheers, Ian. I think that’s spot on. Lots of people take fright at the thought of ‘giving things up’. But it’s freedom that’s on offer in exchange. I wish more people would just give it a try. They can always turn back if it’s not for them. But once you realise that self-worth is not tied to consumption (and in fact the opposite is often true) it’s the new found sense of freedom that’s hard to give up.

@TA

I realise it is a way off, but would be great to get a halfway point update and see how you’re going, lessons learned, things you’d do differently/the same.

Hey Fremantle, thank you for the thought – I appreciate it! I am planning an update, especially as I was pretty low at the quarter-way milestone. Things have changed, although at this stage for the better. Financially I’m ahead of schedule and morale rises every passing year. I’ve also changed my starting assumptions given what I’ve learned since about handling deaccumulation. Once Monevator: The Book is done, I’m hoping to post more regularly and share what I’ve learned. Ultimately, I want Monevator to be as helpful on deaccumulation as it is on accumulation.

Probably very late to the game, but for those of us with student loans, at least under plan 2 who are repaying, salary sacrifice effectively is an extra 9% ‘saved’ on top. I’m firmly of the view that I’d rather what would go to the Student Loans Company come back to me with bells attached a few decades down the line…

Brilliant website, brilliant blogs. I’m curious as to if you’re still looking to have a retirement income of £20k p/a between you? I was thinking £25k between myself and hubby, and we’re tight Northerners 😉

Hi Rachel,

I’m glad you’re enjoying the blog. Inflation has ripped through that number since 2013 and like you we’re now aiming for £25K. I reckon we probably could screw the number down to £20K if we had to, but it’s nice to go out whenever there’s not a pandemic on.

Seven years later, this is the latest episode in the story:

https://monevator.com/i-hit-my-fi-number

Where are you in your FI journey?

Reassuring to hear that. Well, we’re at the start – after a few years of job changes etc we’re finally in a position where things look stable and decent (financially) enough in a while to look towards FIRE.

Just trying to figure out what ratio to overpay on our mortgage, vs hammering our (public sector) pensions, vs ISAs. I’m leaning towards 50%/25%/25% respectively. Still need to do a bit of head-getting-around to take into account pension lump sums and differing ages – husband is older than me! Thanks for asking.

That’s great that you’ll be able to tap into public sector pensions one day.

I did a series on calculating ISAs vs Pensions on the road to FI:

https://monevator.com/how-to-maximise-your-isas-and-sipps-to-reach-financial-independence/

Part 5 in particular will help you incorporate public sector pensions.

Good luck with your journey. The second half will go quicker than you imagine.