I tend to ignore most of the doom and gloom you read on the Internet.

Peak oil? Piffle.

China crisis? Chortle.

The only catastrophic fear that reliably gets me going is environmental degradation, because there are so many ways for us to screw up.

We could avoid planetary collapse, say, but still see the Earth turned into a giant pig farm. Perhaps the planet will ‘support’ 10 billion human beings, but only a few hundred thousand wild animals.

That would be failure to me – but our descendants might watch old David Attenborough TV clips while eating Quorn burgers and think life is not so bad.

Capitalism: endangered

In recent years however I’ve been vexed by another popular apocalyptic grievance.

That’s the so-called crisis in capitalism.

Just like the daily damage we’re doing to the environment, it’s hard to deny Western economies have taken a turn for the worst.

And what makes this brew especially potent is that not everyone is suffering equally.

Given how the wealth of the richest has risen ever higher above the rest of us in the past two decades – and how we now seem to lurch from one systemic crisis to another, which I suspect is related – I wonder what capitalists from the 1950s and ’60s would think, could they see us today?

Would they reach the same gloomy verdict as a biologist might on visiting a pitiful 5,000-acre ‘Real Amazon Rainforest Experience’ in Brazil come the 22nd Century?

Would they find capitalism just a shadow of its former self?

Free markets rule, okay?

The reason I’m not worried about most of the ‘big’ problems is because I think human beings are ingenious creatures who haven’t begun to fully harness the resources around us.

This is why I am also a capitalist, despite its recent traumas.

I believe that free markets with transparent pricing, private property rights, and the profit motive of ambitious individuals are together pretty good at allocating resources and eventually solving problems.

This doesn’t mean I think we should give into winner-takes-all ideologies, or that all taxation and redistribution is wrong. Capitalism without checks and balances is feudalism with price tags.

But I do believe the evidence is capitalism is more effective at improving the lives of more people than the alternatives.

And yes, I believe it’s better for me, too.

I also think well-functioning capitalist societies are freer societies – because they need to be to work. Not perfect by any means, but demonstrably fairer and freer than the Soviet and Chinese experiments in communism were.

Some on the left dismiss those repressive regimes as hijacked by dictators. But I suspect the low value put on an individual freedoms in those economic regimes was no accident, given their over-arching credo.

Coffee chain socialists

Given my beliefs, then, I’m dismayed to hear well-educated friends increasingly writing off capitalism as broken and corrupt.

In my view, most of our progress in the past few hundred years was facilitated by free markets – and capitalism is the only hope I see for tackling the big problems of the future.

I listen in disbelief as intelligent friends report back from a community farm in Hackney to tell me that one day all our food will be grown on shared allotments in Acton and Ealing. What did they smoke there?

Another friend regularly lambasts the post-War medical system, saying it’s “never done anything for patients, just profits for companies”, ignoring the multiple successes against everything from heart disease to AIDS, and the enormous R&D advances in Europe and the US (research which incidentally the rest of the world, including the poorest, effectively gets a big subsidy on).

Other frightening things overheard at recent dinner parties:

- “Western economies are the reason people are starving in this world.”

- “You’re delusional if you believe money has any real value anymore.”

- “Who cares about greedy shareholders?”

- “You should be ashamed of yourself for reading the FT“.

These comments might have been standard fair in a 1970’s university common room for students still a few years away from having to test their principles in the real world.

But that they are being made by intelligent grown-ups with houses, pensions, jobs, and holiday plans to far-flung locales – everything that capitalism can buy – is to me deeply worrying.

These friends of mine see no connection between their everyday well-being and the economic system that supports them. It’s as if the demise of communism has left them free not to believe in capitalism, but to indulge in dangerous fairy tales.

And their complaints are getting louder. I’d say the majority of my University-educated liberal friends will ‘Like’ anything on Facebook that includes a rant about the evils of the market system or of trying to balance the nation’s books.

Sometimes I wonder if I’m living in a Truman Show designed to rile me. Perhaps these friends really do spend their days sabotaging the best efforts of their capitalistic employers, and maybe their conspicuous consumption is some sort of ironic political statement.

Or perhaps they’ve just been infantilised into hypocritical posturing.

The new Marx brothers

How have we got to this miserable state of affairs, where smart individuals raised and doing well in capitalist societies are apparently calling for its downfall?

Do my friends have some great solidarity and empathy with, say, the vast swathe of young Spanish people jobless in the wake of the financial crisis?

I don’t think so. Besides, if you want to find real injustice in the world you need to go a lot further than Spain, which is the architect of much of its own misfortune.

A lot of the world’s population never had the luxury of a functioning capitalist economy to screw up. Many Africans and Indians live in near post-apocalyptic conditions, for example – exactly the sort of dire scenario painted by comfortable Westerners who cheerfully muse about imminent economic collapse and growing their own carrots in a bucket.

Clearly it is partly a knee-jerk reaction to the last few years of economic tumult. I think people are also looking to the endlessly infuriating bankers, the Flash crash in the stock market, riots in Greece and Italy and even the UK, and are scared by a system that has at times seemed out of control (as it always was, of course. Which is, incidentally, why it works).

But I think the most important factor for my friends’ incoherent ranting is that in the post-Soviet era, a well-articulated counter to rampant capitalism has been conspicuously absent. The sort of crisis predicted by communists has come and gone, but there are no communists left to – ahem – capitalise on it.

The centre cannot hold

Without the checks that the fear of ‘the Reds’ put on Western capitalism, unions have collapsed, left-wing politics has morphed from productive redistribution to doling out windfall taxes to buy votes, and a centrist politician in the US like President Obama is derided as a ‘socialist’.

Few young people seem to know much about economics and politics anymore. You might say I’m an old (30-something) fogey ranting, but the benefit of growing up with Thatcher versus Kinnock and Reagan versus Soviet Russia was that almost everyone took some sort of political stand, prompted by real conflict.

Today, my friends happily claim “the Tory’s have slashed NHS funding and are sacking 50,000 doctors and nurses”, when the tedious reality is real terms NHS spending fell by 0.02% (by accident) and Labour would have had to take the axe to spending, too. The distinction between the UK parties is more rhetoric and rounding errors than real policy differences, yet the charges of “wrecking the NHS” or “bankrupting the nation” from either side remain as loud as ever.

The trouble with this phoney debate is that nature abhors a vacuum, and my well-educated middle-class chums effectively calling for some sort of Mad Max collectivism – with hot showers and foreign holidays – demonstrate it’s not just in Greece that people will believe almost any nonsense in the face of tough decisions.

Meanwhile, back in the boardroom…

In the absence of alternatives, like a bell, today’s Western discontents have nothing to hit out against except themselves.

The irony is that there is a political spectrum worth debating, but it’s been crowded out by right-wing ranting in the US and left-wing, well, lying, here in the UK. Rather than invigorating politics, these radicals render it impotent, stretching the fringes even as the centre becomes crowded with focus groups, working parties, and career politicians.

The lack of proper political debate – and I’d count the mainstream media as part of the problem – means the average person today seems to have no idea that you can have more ‘humane’ versions of capitalism, such as that historically practiced in Scandinavia, or the cultural traditions in places like Germany and Japan where bosses are rewarded far more handsomely than their workers – except it’s arithmetically more (10-20 times as much, say) rather than geometrically more like in the US (200-400 times more) and increasingly in the UK.

That alone is one massive choice about what sort of system we want to live in – and yet it stops far short of deriding profit as evil, or similar counter-productive dinner party nonsense.

Indeed, perhaps it’s the most important choice: I think the growing chasm between the very richest and everyone else is a big part of what ails Anglo-Saxon capitalism.

Income inequality is getting more extreme, with the US leading the way as this graph from The Economist reveals:

Anecdotal asides are even more shocking.

An article entitled America’s dream unravels in the FT reveals:

[Among America’s hyper-rich] there are the retail kings, such as the Walton family, owners of Walmart, whose combined assets equal that of America’s bottom 150 million people.

When I read statistics like that, I’m not quite so surprised that I’m regularly defending capitalism in the pub, or that half my conversations now involve persuading old friends I’m not a robber baron for buying shares.

My friends aren’t on the lunatic fringe. They are (mainly) serious people with proper, well-paid jobs, who have come to believe the entire financial system is a rigged game run for the benefit of insiders, and I think the distortions at the top of the income and wealth scale are a big part of the reason why.

Will capitalism eat itself?

Much of this post has been sitting in my draft folder for a year. I’m not happy with it even now; I feel inarticulate. I am sure something big is happening, and that people’s lack of faith in the economic system is more dangerous than just sour grapes in a downturn, but I struggle to say why.

Meanwhile, in the time I’ve been avoiding writing about it (as hinted at in my post-Libor scandal banker post) the Occupy / 99% movements have bubbled up and income inequality has moved to the mainstream.

Yet even now, business people and private investors – the very people who should be figuring out what’s gone wrong and selling the benefits of what’s more often gone right with our system – seldom seem to have anything to add. They leave the airwaves to the extremists.

As I discovered in my banker bashing days, if ordinarily successful private investors comment at all, it tends to be to stand up for the grossly-inflated salaries of the ultra-rich elite, the bankers and the directors of big companies – an income skew that I think may eventually be too much for our system to bear.

True, we’ve had the so-called Shareholder Spring. But as the BBC’s Robert Peston recently wrote, it’s a myth that this has restrained executive pay:

The disclosure that FTSE100 chief executives were last year awarded average total remuneration of £4.8m, a rise of 12%, will be seen by many as shocking.

It comes at a time when earnings for the vast majority of people are stagnating and represents a record of just over 200 times average total pay in the private sector of just under £24,000 (on latest figures from the Office for National Statistics).

[…]

[Yet] there have been just four defeats so far of companies in votes on their so-called “remuneration reports”, and only one of these companies has been in the FTSE100 list of biggest businesses. That does not represent an exponential increase in shareholder rebellions.

Personally, I think a world where top CEOs earned say 30- to 50-times the average income is still plenty aspirational. In fact it’s the 1950s and ’60s – what many would regard as the golden era of Western capitalism.

Suggest it though, and you’ll hear you’re a communist who wants to reward people for sleeping in bed and to punish the successful.

Investors of the world, unite!

There could scarcely be a more important topic than the growing distortions that threaten capitalism, but whenever I discuss it with my financially-savvy friends they lecture me about football stars and Simon Cowell.

I suppose it’s like the omertà code of the mafia: The fear is that if you engage with the argument at all, it will lead to some re-energised union leader or lefty politician taking your own toys away. (I also suspect people think they themselves are knocking on the door of the rich club, when most are not.)

Yet to say nothing is to let the hysteria grow.

If for no other reason, debate it for naked self-interest! Western economies cannot grow without consumers, and polarising inequality means ever more money is compounding at the top. There’s only so many private jets and country mansions the super-rich can buy.

I also think there’s a strong argument that it was stagnant wage growth for the masses in the US that set the scene for its borrowing binge and sub-prime mortgage bubble. People attempted to keep up with the aspirations of their parents, but without the growing pay packets to do it.

Now I don’t deny there are structural issues at play, too, such as globalisation (which I favour) and growing network effects.

But whatever the ultimate answer, I believe it’s a responsibility of all of us who support free markets – let alone those of us who hope to profit from them via investing – to stand up and be counted, and to be sure we can justify any aspect of the system that we defend, rather than indulging in fantasy politics of any persuasion.

I hope we do not come to regret not doing more to defend capitalism – including from itself.

Comments on this entry are closed.

At least one investor (the worlds richest investor) agrees with you. Warren Buffett told US hearings in the US that…

“While the poor and middle class fight for us in Afghanistan, and while most Americans struggle to make ends meet, we mega-rich continue to get our extraordinary tax breaks. These and other blessings are showered upon us by legislators in Washington who feel compelled to protect us, much as if we were spotted owls or some other endangered species. It’s nice to have friends in high places.”

Funnily enough I made a similar points to an article on the ft yesterday “The New Depression”. I link the article and copy my comment below:

http://www.ft.com/cms/s/2/a941cd5e-d5a8-11e1-af40-00144feabdc0.html#axzz22NxoPx7K

hotairmail | August 1 12:23pm | Permalink

There are many striking similarities in various symptoms between now and 1929. And it all goes back to ‘why do we have credit money’?

The beauty of bank lending is that it allows a core element of original money to generate activity. ‘Money’ can be hoarded, like gold or paper money, M0 even (for a clearing bank). But once inside the banking system, we can stop this harmful behaviour of faiing to trade in balance with other entities by pushing it out again via bank lending. And by the wonders of leverage and reserve ratios, it can be pushed out in multiples of the original sum deposited.

It basically allows us to stop harmful hoarding of money and allow those bearing debts to earn the money to help repay them. And not only that, but by the multiplier effect, we can reduce the value of the money via the wonders of inflation.

Unfortunately, the system is not perfect, because the very wonder of inflation makes the rich richer via asset inflation. And secondly, perhaps more importantly, the system only fails once the weakest, most indebted borrowers fall over and start defaulting. Default and tax transfers are perhaps the most important ways we can bring the system back into balance. Default is not being allowed to work as it is considered to be ‘too damaging’ and we all know that the lack of capital controls means a vast amount of money is being hidden from the taxation re-balancing mechanism.

Simply trying to kickstart credit by continually lowering the cost of credit and raising asset prices seems to have a limited life to me and only really benefits the rich who don’t have to suffer default or taxes whilst their assets magically rise.

After nearly thirty years of this policy in one way or another, we have pretty much completed the destruction of capitalism that demands a yield, an interest rate, a return to help us decide where investments should be made so that real world resources can be allocated in the accountant’s wake.

Coming back to the similarities between now and the Great Depression – extraordinary increase in credit over prolonged period – tick; record gap between rich and poor – tick; scale of international trade (aided by recycling surpluses back into deficit economies) – tick; scale of financialisation of the economy and wages of financial employees – tick; assets backing the lending in bubble territory – tick.

Time to put the entire jigsaw together at last I think.

“Will Capitalism eat itself up?”

or

will it be able to reinvent itself?

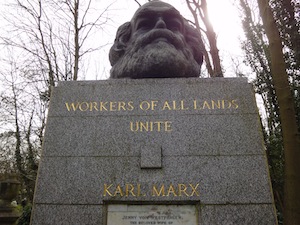

I’ve seen quite a few go and re-read Marx’s works lately (lovely quotes here by the way: http://www.goodreads.com/author/quotes/7084.Karl_Marx ).

But this has happened before, and it’s just normal to believe that we are in front of something absolutely new (read the beginning of “Tale of Two Cities”).

I think in 10 years we will be very happy we have invested in stocks and shares in these turbulent times.

As for the Spanish young jobless, it is a great loss for the country. Thousands are fleeing to other places with or without job contracts. For those that stay, fortunately family is still very important here. They might not be able to buy a house, will they will definitely inherit more than they can live in.

Good job Monevator!

Alex

In my mind the difference between Capitalism and Socialism is the ability to choose or not choose what you do with your economic and working potential. Both are extremes and both are discomforting extremes – compare the Soviet Union and Victorian Britain.

What seems to work for us is a balance. You have a percentage of Socialism (called taxes) and a percentage of Capitalism (the rest). Those taxes bring the important things: a safety line should all go wrong (unemployment benefits), free health care for all (even if yours is a major illness that would require large insurance premiums), a fair start in life (education) and a fair chance to compete (law and order). These are good things from Socialism.

I call this balance Necessarianism. You get your necessities ensured through Socialism if needed (the tax system) and then you get motivation from Capitalism that feeds the Socialist system. As a system this works because the Capitalist side drives you to be economically productive, whilst the more productive you are the more money flows into the Socialist side. This is the state of the UK now.

We all know that bad things can be solved by money and a 10% of income donation by the Waltons will match a 10% donation by 150m, but ideally we’d want to see both. You can say that the Waltons have more to give up, but till you do the deed you recommend you cannot correct others on not performing that deed.

It is important for wealthy to use their wealth positively to enhance the human race. Similarly it is important for those who can afford to to use their wealth positively to better the human race. Capitalism leaves us with both choice and incentive.

Ultimately, people want a better society with more goodness. This is a spiritual and moral consideration. Hence, the failure of Capitalism (the system of choice) is ultimately not the failure of a system of economics, but a failure of humanity.

The Waltons created their wealth (at least Pap Walton did) in fair competition. Premier league footballers are paid ludicrous amounts but they are at the top in a highly competitive business and if the world throws vast sums of money at them it is hardly their fault.

The problem is with people who seem to be in the position of deciding their own pay (CEOs, company directors etc). Does a CEO (banker or otherwise) really deserve those pay levels. There doesn’t seem to be any way of judging it. I think that is where the real resentment comes from , the feeling that some people are just helping themselves to the honeypot without doing anything to deserve it. So far they have played the “if you tax us we will move elsewhere ” card very successfully. I suspect if this drags on much longer a populist government will decide that this is a risk worth taking.

One big can of worms you are opening.

Resources are limited

Wants are infinite

…Whats the issue here?

Mainstream culture…Greed, Envy, Jealousy.

How do you change culture? Pft.

I dont think the West is particularly “free market” or capitalist

Think of all the rules in a country such as the UK that regulate who gets what: taxation of income, capital gains or inheritance, land ownership/uses, employee/consumer rights, permits for businesses to be carried on etc.

Whats happened is that special interest groups within the population of the rich western nations (including the wealthy and the financial sector) have bought the political system and manipulated it to their own direct benefit

So I would say the aspects of “capitalism” you rage about is just as much of a sympton of the same problem as a single mother in a £500k council house, the French factory worker entitled to 10 years salary if he is made unemployed or a policeman retired at 50 with a £50k index linked pension

The end result has been growing inequality, a huge annual government spending gap, growing government debt levels careering like a brick wall towards the reality of a rapidly aging western population

The only three ways I can figure out that this can be addressed are:

– default on private or public obligations to reduce burdens on parties unable to pay, government or private. Obviously this hits the parties directly concerned, hard, whether they are culpable or not

– inflation to inflate away otherwise unpayable burdens, a soft form of default that hits the poorest hardest

– increased taxes and reduced government spending to move governments into annual surplus to reduce their total debt burden over a very long time

Interestingly the three major western economic blocks we think about here are each taking a different route:

– the US I think went/are going through a default route, in the private sector at least

– the UK, to me, I think we are going down an inflation route

– the EU is at least trying the third route, although default through a Euro break up is always the shadow in the background

The interesting thing is we get to see what works…maybe

I’m “Going John Galt” today on FS. Have you heard of the term, or do you have such a character in England?

All about benefitting from the government and no longer always giving!

@FS

No Ayn Rand is almost unheard of Europe

I think there is a fountainhead movie coming out in 2013, but I suspect its probably won’t travel well

The UK and the US might share the same language but we’re actually two quite different countries – actually comparing your blog to this one illustrates that point quite well

Thnx Neverland.

I’m definitely more into the UK style of socialist government now that I’ve retired. I want to finally start receiving some benefits back.

Heard a great many things about the UK, Belgium, France and stuff. The US can have all their inventors of great companies. All about kicking back now with you guys!

Cheers

Finally, somebody mentions Ayn Rand. Now we’re talking!

The most recent thing I read was about her having to sign on for Medicaid, I guess the inference from those that highlighted this fact was the dichotomy between her writings during the ‘good’ times and her actions once life takes a turn for the worse.

But that misses the point about providing a safety net or providing a lifestyle above that of a large percentage of the working population who are paying for it.

@ Romford Dave

From what I’ve heard Ayn Rand’s philosphy is only a little bit behind Scientology and Mormonism in popularity in the US…

…so you better hope the Ayn Rand Institute don’t have a militia wing :/

Good article.

I ran a survey on my site this week and asked readers to rate their level of optimism on the global economy over the next 5-10 years, and I was surprised to see a fair amount of optimism. On the scale of 1-5 I provided, I expected to see a lot of 2’s and 3’s, but instead I saw a lot of 3’s and 4’s.

I think to a certain extent, capitalism is kind of on autopilot. With the widespread use of index funds actively managed mutual funds, investors give up their shareholder voting rights to the fund managers. Funds often abstain from many types of shareholder votes.

Wow. You’ve provoked a hornet’s nest! Yes, extremes will always be extremes, but (to respond to Mr Neverland) the things we say are not ‘pure’ capitalism — are they not the things that will make us human (sorry if that turned gushy).

The ‘rules’ are the ‘rules’ that we make. If Mr Buffett is prepared to give up 20% extra tax and still live happily with his remaining billions then I think the rest of very rich can (if I hear about the true entrepreneurs giving up when down to their last £200 million I’ll be worried, but I also think I’ll be waiting a long LONG time!)

So what do you guys all think about all the people who pay the majority of taxes to kick back to make things more equal?

@FS

Personally I think its quite a difficult call

I think in the UK and US the top 1% of EARNERS pay around 33-40% of total income tax receipts already

That sounds fair enough and you could argue that this burden is high enough

I don’t think there is a particularly high correlation between high UK tax payers and the most wealthy people who live in the UK however, partly because of life style habits and partly because of high income taxes

Personally i would like to see income tax rates reduced, but most deductions eliminated and taxes on wealth, capital gains and unearned income equalised with income tax rates

In the UK taxes on capital gains, inheritances and unearned income generally are much lower than income taxes (partly because of arguments about double taxation)

Judging by press reports on Mitt Romney’s tax return the same is true in the US? 🙂

Great feedback, thanks for adding to the debate all.

I read Ayn Rand as a student (I read *all sorts* as a student!) but I wasn’t particularly moved by it. (In contrast there’s a whole generation of US politicians and top flight economists who seem to have got their crib notes from Atlas Shrugged). I concur that she’s pretty much unread in the UK. It is indeed ironic that she ended up dependent on social security and Medicare, but I think her writing should be able to be judged aside from that — Nietzsche ended up in a lunatic asylum.

(As an aside, a few liberal types have claimed I’m just like some character or another in Atlas Shrugged, over the years. Perhaps I should re-read).

Regarding excessive taxation etc, if you look at the graph above — and tonnes of other similar research on wealth as well as income — you can see that in the US (and to a lesser extent the UK) the very rich have been doing very well compared to everyone else. Sure they pay more taxes in terms of total revenue then everyone else, but that’s simple maths. If you’re earning £20,000 a year, your ability to pay as much as someone earning £250K is clearly curtailed. 😉

Obviously, as has been said, we get into the issue of what’s ‘fair’. I have a lot of sympathy with the view that UK government tax/spending became bloated and wasteful; I’m less certain (and admittedly less well informed) that’s the case in the US. The stats I repeatedly see show that tax rates are lower than in the Clinton years, and I don’t remember the rich being punitively treated then…

Further, if we’re going to talk fair do we really think the 1% “deserves” the far greater share of income growth it’s received? Is it really adding that much more value? I think that’s highly doubtful; bankers and lawyers and so on were bankers and lawyers and so on in the 1950s, and seemingly a lot less rapacious. As for entrepreneurial activity (where I’m very sympathetic to rewarding success) the US was already very entrepreneurial four decades ago. If it was a graph for world income, I could imagine it might fairly reflect other countries copying the US system and accepting its inequalities in return for overall higher growth. But it’s not — I think it clearly reflects the rich getting richer via network effects, compounding, and favourable government policy from the 1980s to today.

This isn’t necessarily (lobbying and gaming aside) the rich’s ‘fault’. There are forces at work — principally globalisation, perhaps also financial disintermediation and the sort of network effects that mean David Beckham today earns vastly in excess of what George Best earned in the ’60s — that are difficult to counter, and perhaps undesirable to counter, too. So it’s reasonable I think to assume that growing income inequality will therefore persist.

The question then becomes what do we do about it? Do we just shrug our shoulders and say fair enough, the middle classes can bump along the bottom, let alone the poor, and we’re happy for a ruling class of super elites to rise above us? Or do we say — without hysteria, without singing “The Internationale” — that perhaps we need to look at which of the causes are iniquitous (e.g. the unearned super incomes in the financial sector resulting from deregulation and taxpayer backstops) and what consequences might be addressed via government (e.g. taxation).

Even Sam’s John Galt-ists *might* agree to, say, removing all income taxes up to a certain threshold – say £15,000 in the UK. (The coalition is already shooting for £10K) rather than explicitly taxing the rich more and redistributing through potentially wasteful and vitality sapping social spending. I’m a bit wary about the democratic consequences of vast swathes of the population paying no income tax, but it’d be one response.

As a European flavour of capitalist, I wouldn’t mind even more *highly targeted* Government action / redistribution in some forms, funded by higher taxes on the wealthiest — stuff like free university education for science, maths and engineering students or anyone with triple As at A-level, for example, or more vocational training (obviously not for useless flim flam degrees!) — whereas I’d be against just hiking basic rate benefits, and I’m all for the Coalition’s attempts to look at some of the unintended social consequences of, for example, housing benefit.

Finally, we have the truly divisive issue of inheritance tax. I’m comfortable that Pa Walton got somewhat wealthy from founding Wal-Mart. Conrad Hilton started with one hotel and built an empire — good for him. I could even see a case for saying Bernie Ecclestone deserves his billions for taking F1 to the current level. Then we have the Steve Jobs and Bill Gates of the world that almost nobody would argue deserved to be very highly rewarded for their success (though how many billions does anyone really need?)

But Paris Hilton? The Ecclestone daughters? I just don’t see that they did anything at all to earn the bulk of their fortunes. It’s a difficult issue, but in theory I’d be all for inheritance taxes going up substantially after, say, the first £1 million or so.

I’d rather not tax a young kid starting a technology company or a building firm or whatever from nothing than reward the child of a rich bloke for coming out of the right womb.

@Investor

Inheritance tax sounds like a good idea but in reality its nearly impossible to impose

First of all farmers and family businesses will want an exemption

Then you get avoidance through wealth transfer before death (why do you think all those grand houses in Notting Hill and Chelsea are being sold to foreigners right now?)

This is before you even get into wealth hiding through non-UK domicile and off-shore trusts like James Goldsmith, Lord Ashcroft and David Cameron’s father

The only way to tax wealth in this country is attach taxes to the physical manifestations of wealth that are actually in the country, which is mainly land and other physical property, and the things the rich spend on such as expensive status goods, private health care and education

However your chances of that happening under the current government are nil….because most of the cabinet inherited great wealth 🙂

@Neverland – Surely Capital Gains Tax on first homes would be a start? How much extra would this have brought in over the past 50 years or so?

@ Rob

I can’t think of a better example of a virtuous tax on unearned wealth than a tax on property value increases

I would have done it annually through reinstating the old schedule A taxes on imputed rental value of an owned domestic property rather than on a crystalising event like a sale

However thats actually even less likely under the current government that a reform of inheritance tax 🙂

Very interesting set of comments. The temperate tone of the comments is much appreciated and makes a pleasant contrast to many other blogs. In response to a tentative suggestion elsewhere regarding an increase in inheritance tax, I was accused in two subsequent emails of being a communist and a fascist! And I didn’t even receive an apology from either of those great thinkers when I pointed out that members of my own family perished in Nazi Germany’s death camps.

What do people think about a tax on the recipients of inherited wealth?

However, I agree that there’s little chance of any sensible reform because there are so many vociferous supporters of the status quo. I’m over 60 and the number of times I hear oldies say “I’ve paid tax and NI throughout my working life” (typically totalling less than the sum of their annual statement pension plus one year’s NHS use!) and think that everyone else should bear the brunt of the economic downturn. Remember the outcry against the budget changes to pensioners’ tax allowances.

So a follow-up question is how do you go about getting rational discussion about the tax and benefit system going beyond the confines of a very few blogs?

@ Grumpy Old Paul

Looking around at the rest of the world I would say that the only time you get a rational discussion about the tax and benefit system going beyond the confines of a very few blogs is…

…when the IMF are involved 🙂

Monevator, good to hear you have read Atlas Shrugged!

I’ve got to say it feels GREAT to earn below 200K a year now for all the reasons mentioned in my article.

At $200,000, I’m still paying almost $40,000 a year in Federal Taxes alone too, which should hopefully be viewed as contributing my fair share to society. Afterall, the median household income is around $50,000 a year in the US.

It was just when I was paying $200,000 in TAXES a lone and started getting assailed by the public and politicians that I became very agitated.

It feels wonderful to be one of the people again. Power to the people!

its about a level playing field

if all children had the same level of education to 18/then chose how they wished to live/work rest of life–fine

but the world isnt like that–the better educated will always hav the knowledge better paid jobs–catch22

you can surf the tv—some analyst talking about how he made a $1 million killing–then 2 secs later diff channel–a women has to work 15 hour shifts just to feed family.

Thanks for the heads up Neverland, it’s never wise to make an enemy of a zealot, fortunately in this case I could argue I was being heroic by deliberately choosing to make them my enemy, thus forcing them to welcome me in to the fold. Objectivism has its own reward……. 🙂

A view I do share though is having adopted the laissez-faire approach to banking, they should have let it reached its obvious conclusion. The lines on the above graph would have looked very different if the gap between the top and bottom percentiles didn’t have Fed funds propping it up. It would look much more equitable, although investors of all persuasions might not be too impressed with the values of their portfolios.

Perhaps the more manageable size of Western debts could then provide a more sensible filip to investment returns once sensible business practice resurfaced in the world of finance, along with the lower tax rates the lower debt payment required.

We’ll never know now, not now Ben and chums have brought barrow boy style selling to the world of banking. Roll up, roll up, getcha money here, all notes half price!

Negativism is sadly the chasm I’ve fell into, even objectivism would be a blessing of sorts, in an unreligious sort of way………….

Yes, the tone of debate here is very nice – especially given the wide range of views. Rather reminiscent of this blog in fact http://www.golemxiv.co.uk/

Having been raised a ‘working class conservative’ I would now describe myself as a socialist in the sense that I believe that ”the means of production” should be owned by everyone in society – that is to say ”the people” NOT the State (as in ‘Communist’ China or the USSR). This would take the form of employee-owned and managed businesses and workplaces. We already know from the success of high-end co-operatives like Mondragon that this is a viable system.

The key point for me is less about money than power – the right for everyone to have control over their lives and to not be forced to sell themselves on unequal terms in a labour market. These beliefs would obviously present problems for those who believe in the right of entrepreneurs to set up businesses. Not being a Utopian I can understand that viewpoint if that was a version of capitalism which was closely regulated. It doesn’t for me however provide answers to the questions of rampant inequality (not just within the advanced capitalist economies but globally) or indeed what I consider to be the obscenity and indeed insanity of unemployment. I am often criticised by friends for defending the benefit system to the hilt and my answer is always thus, ”when joblessness ceases to be a feature of our economies we can roll back unemployment insurance”. A full employment economy would seem to me to take care of much of the conservatives’ argument about ‘individual responsibility’ and indeed an economy of employee owned businesses would go a long way to ‘getting the State out of people’s lives’ as the UK Tories are always insisting.

That said, my mind is open to other ideas if they have the welfare of everyone at heart and I am very interested in (the resolutely non-left wing) Keynes’ ideas about a full-employment labour market whose working time expanded and contracted in accordance with the fortunes of the economy. He also postulated that our societies would be as wealthy as they are now but that we would be working a 15 hour week by now… that we aren’t may have some relation to the rampant inequality that we live with.

And finally in response to the author’s thoughts on capitalism as a force for good (hey, even Marx was amazed by its capacity to overcome scarcity) I offer Lord Skidelsky’s thoughts on a post-capitalist world:

http://www2.warwick.ac.uk/knowledge/themes/02/life_after_capitalism/

Thanks

Phil

@all — I very much appreciate the temperate tone of the comments here, too, which I’ve happily come to expect from 99% of Monevator’s readers.

Remember I will and do delete anything abusive the moment I see it. I will also typically delete what I consider to be extreme views from any political standpoint to avoid this site’s comment culture being killed off like so many others have been by extremists. Sometimes that may seem harsh, so I’d ask readers who inhabit the fringes to please keep this policy in mind before they comment.

Monevator is not a democracy, but I hope it is a benign dictatorship. 🙂

I’ve never subscribed to the left’s argument that income inequality is, somehow, an indictment of capitalism. The rich may be getting richer, but unless you’re the envious type, why is that so disagreeable?

Unless capitalism is making the rich richer by making the rest of us poorer — and I assert that is NOT the case — then the income gap argument is a red herring.

As poverty is a relative indicator, isn’t the income gap argument the entire point? If you are purchasing the same basic resource, your income going up one when another purchasers goes up ten is a disaster despite the fact that your income is higher.

@mosschops: My apologies if I am mistaken, but are you trying to say that the income gap is — either directly or indirectly — responsible for poverty? I see no connection. Lowering the income gap will certainly do nothing to eradicate poverty.

In response to your assertion on competition for resources … True, I won’t be able to compete with the rich in an auction for fine art, or buying a large company, but I can’t think of anything that the rich are keeping me from buying because their income is going up 10 times faster than mine that I really need to get by (stuff like food and shelter).

Food is plentiful and inexpensive. Yes, shelter is more expensive, but most rich people buy homes in areas that the average person isn’t even in the market for in the first place — and they certainly aren’t responsible for people living in squalor.

Capitalism is a system that rewards hard work and achievement. Some people will always make less due to less motivation or poor choices in life.

@Len: Well, as poverty is a subjective measurement of wealth/income versus the whole then yes, the income gap does cause poverty. Stick a millionaire in a room with 10 billionaires and he’s the poor one. Personally I think the income gap is probably the most damaging thing out there at the moment, the boom in household debt is in my view a side effect of it. Capitalism at its heart is just a method for distribution of resources, and if the majority of the participants in it aren’t being well served by it I can fully understand the disenchantment with it.

@Moss – I’m happy to be the multi millionaire in a room full of billionaires. I’ll live well and find inspiration.

@All – My question to all is, What are YOU doing about the situation? I’ve decided to kick back in my mid 30’s and pay less taxes to be one of the people. Things are a little more equal now. And you?

What jumps out at me in that chart isn’t the soaring 1% but that it took 15 years for the lower 1/5th just to recover their income let alone increase it. Half a working lifetime. (Old post, I know – just compelled to comment).

Found this paging through some old articles I added in Pocket. It’s a great article and, judging as someone with similar friends in London, just as relevant a few years later as it was then. I think to some extent awareness is rising (more coverage, shows like Mr. Robot), but maybe that’s just my friends. Anyway wanted to send extremely belated thanks for a great article.

I know you’ll pull this comment because it mentions Brexit, but how chillingly prescient I find this article of yours given the upheavals of the last year.