What caught my eye this week.

Josh Brown is concerned. The financial advisor and TV pundit behind The Reformed Broker blog sees a new kind of fear and greed out there:

The type of fear that now drives most market activity (because it drives most market participants) is something different than the fear we’ve been accustomed to from reading about history.

I would label this type of fear Insecurity. The fear of being left behind and looking like a fool.

Every couple of years Josh – a hyper-connected poet of the markets – sticks a pin on the tail of the donkey of our times.

I think he’s done it again.

Sonic boom boy

It’s true a strange new operating system is running the show these days.

If you spend the unhealthy amount of time that I do taking skin burns from exposure to market radiation, you see it in everything from fallen hedge fund titans bemoaning day-trading nihilists to the world’s best banker getting befuddled about Bitcoin to meme stock madness and the endless back-and-forth shouting of crypto and story stock tribalists.

Not even the purist passive investor can completely duck the fallout. Monevator’s voice of sanity, my co-blogger The Accumulator, has written candidly about his own brush with FOMO:

How do you respond when someone invents something fundamentally new (hello, crypto) that could be a game-changer or a ponzi scheme? […]

If you’re The Accumulator you sit on the sidelines like a hunter-gatherer who can’t believe this farming lark will ever catch on.

Meanwhile, you torture yourself with crypto-millionaire fables – because even a caveman has to have a hobby.

Of course @TA is too chaste to be possessed by the zeitgeist. Instead he just gets the odd hot flush wondering about what might have been if he’d only acted a little crazy, like everyone else.

Boom Shack-A-Lak

Are we at a crescendo of craziness? A decade of gains in the dominant US market has sent its equity valuations into thin air. Meanwhile bonds look priced to do nothing more than fleece your pockets behind your back.

Perhaps we didn’t need overnight crypto billionaires, zero-cost stock trading, and a global pandemic that locked us in front of our computers to whip up this frenzy. But we got all that and more.

No wonder there’s a bit of a riot going on.

There will come a time when all this has passed. The thing to be seen doing will be to shuffle through the virtual town square bemoaning disruptive growth stocks, calling cash king, and flagellating yourself for claiming to have understood how Bitcoin works. Everyone will say never again and some will even mean it.

Eventually memories will die and a few on the fringes will hear a new beat. But that’s a story for another day.

First, last, and always

Indeed I don’t think today’s climate is unprecedented – batshit bonkers though it may feel at times.

It reminds me very strongly of the late 1990s and the Dotcom boom.

I sat that out as an investor. But I was in the mix as a recent-ish graduate with a tech background and exposure to people getting rich quick:

Visiting an old friend at the company, I was amazed to see that many of these formerly artistic types, from the secretaries to my friend in management – now had shortcuts to stock tickers on their desktops.

They were entranced to see themselves become richer by the day and they watched their share prices like parents cooing over a new baby.

Now let’s be clear: I don’t think we’re in an identical tech bubble right now.

The best companies today really are technology firms. They’re flush with cash and their profits are still galloping higher in a way that textbooks said was near-impossible.

I talked about this reversal on Monevator many years ago. Even today my active portfolio has more in tech than will probably seem wise in retrospect. The shares are expensive, but the companies are genuinely changing world.

No, it’s more that desperate edge to the missing out that Josh identifies that reminds me of the late 1990s.

Your investments are going up, but someone else’s are very publicly doing so at light speed. And that guy you knew from college is already a millionaire on TV. (Or more likely YouTube or TikTok nowadays).

Don’t stop ’til you get enough

Here’s a tiny anecdote from the Dotcom boom that seemed like a bad dream just a few years later, when the West was bogged down in a war in Iraq and we were 36 months into a bear market.

The scene is a beer garden with a couple of mates in West London in 1999. There I am making the case – again – for us quitting our jobs and starting a tech firm.

We’d been in the right place at the right time for what seemed like an eternal four or five years. And everyone was getting rich except us – but that wasn’t actually the worst of it.

No, what I remember feeling was exactly the existential insecurity that Josh talks about in his piece.

It wasn’t so much that there were big opportunities to make money that we felt we were missing out on.

It was a dread sense that this might be the last chance to get ourselves out of the doldrums and into the class of wealth generators apparently being airlifted to a new economy all around us.

History tells us the feeling was mostly nonsense. Lots of those paper fortunes evaporated. I knew founders who were back in a day job by 2001 and I wasn’t even especially startup-adjacent.

But the future didn’t feel like that in that pub in 1999. It was now or never.

Maybe the Dotcom boom was more localized than today’s global mania, which is why I feel this callback where Josh doesn’t.

Do I have antibodies lingering from those times? I hope so!

Okay boom-er

I’m not silly enough to predict an imminent crash. Markets can stay bananas for ages.

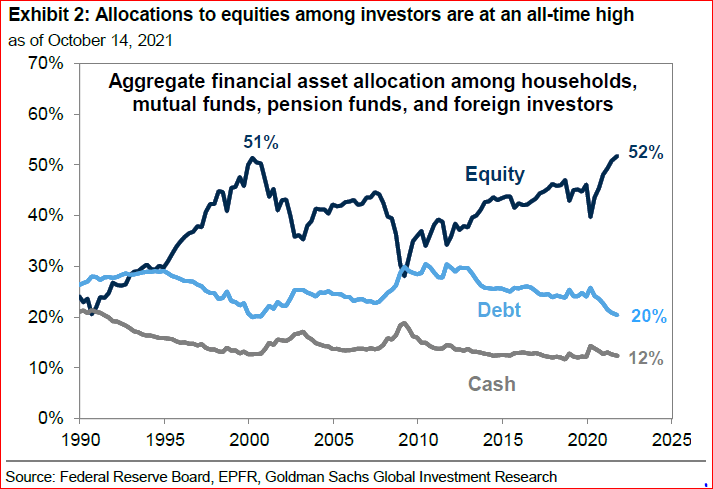

But this graphic from John Authers at Bloomberg shows we’re all-in on this together:

If this is your first time around the block, know that markets are bewitchingly cyclical. The next bear market will begin the day most people have forgotten they ever happen.

Enjoy the boom while it lasts, but have a plan or an asset allocation ready for the day when it’s done. (As a very active investor my plan is basically to run for the exits when the time comes before everyone else. I strongly you suggest you have a more sensible one!)

The important thing in the investing game is to keep compounding over the decades. It all adds up eventually. Never risk getting wiped out.

Meanwhile if this is not your first rodeo then you don’t need me to remind you these best of times won’t juice our returns forever.

Except, of course, you probably do…

Have a great weekend!

From Monevator

Oops! I’ve gone over the Pension Lifetime Allowance – Monevator

The 60/40 portfolio: what the warning signs are telling us – Monevator

From the archive-ator: Recency bias, standard deviation, and cumulative gains – Monevator

News

Note: Some links are Google search results – in PC/desktop view you can click to read the piece without being a paid subscriber. Try privacy/incognito mode to avoid cookies. Consider subscribing if you read them a lot! 1

With city workers back in work, rents are headed up – ThisIsMoney

State pension to increase by 3.1% – or up to £289 – in 2022 – Which

The shortages hitting countries around the world… – BBC

…including a surge in second-hand car prices – BBC

HMRC to send ‘nudge’ letters to crypto asset investors – Yahoo Finance

Don’t expect ‘Britcoin’ anytime soon says BOE’s fintech chief – Which

Ignore the price, remember the dividends – Of Dollars and Data

Products and services

NS&I’s new Green Bonds pay just 0.65%, fixed for three years – ThisIsMoney

UK petrol prices predicted to hit record high within days – Guardian

Open a SIPP with Interactive Investor and pay no SIPP fee for six months. Terms apply – Interactive Investor

Facebook is planning to rebrand the company with a new name – The Verge

Sign-up to Freetrade via my link and we can both get a free share worth between £3 and £200 – Freetrade

Yolt budgeting app to shut down to 1.6m users on 4 December – Which

Homes within easy reach of a school, in pictures – Guardian

Comment and opinion

Reaching for returns – Compound Advisors

“It has been hard, unsurprisingly, to detect any benefits of Brexit. If there are some, it appears they may be accruing to non-EU exporters wanting to sell into Britain. I don’t remember that on the side of the bus.” – David Smith

Investors should prefer camels to horses – Behavioural Investment

Q&A with Robin Power, co-author of Invest Your Way To Freedom – Abnormal Returns

It all started with a giant computer in a Brooklyn apartment [Excerpt from Trillions, the big new book about the rise of index funds] – Institutional Investor

Is there survivorship bias in US stock market returns? – A Wealth of Common Sense

Trump should have invested in the S&P 500 – Validea

Bitcoin is back mini-special

Bitcoin hits an all-time high above $66,000 on US futures ETF launch – CNBC

Four charts on BITO’s First day – Morningstar

The case for (and against) Bitcoin as digital gold – Morningstar

Did Bitcoin kill gold’s monetary utility? – Pragmatic Capitalism

Why the Big Short guys think crypto is a bubble – NY Mag

From the archive-ator – Should Bitcoin be in your portfolio? – Monevator

Naughty corner: Active antics

Using the reverse mental model to invest better – Tomasz Tunguz

This disturbing S&P 500 stat actually makes the case for index investing – TKer

The big work reshuffle mini-special

Overworked and over work – Buzz Feed News

Folie à deux – Indeedably

The biggest opportunity of 2021 – Banker on FIRE

Working multiple jobs: the high-achiever version – Fred Wilson

Covid corner

Daily new Covid infections in UK top 50,000 for first time since June – Sky

Brits increasingly lax on masks and social distancing – BBC

Rees-Mogg: Tory MPs don’t need masks as they know each other – BBC

Kindle book bargains

How Money Works: The Facts Visually Explained by DK – £1.99 on Kindle

Island on the Edge: an extraordinary journey from city life to rural idyll by Anne Cholawo – £1.29 on Kindle

Quit like a Millionaire by Kirsty Shen and Bryce Leung – £0.99 on Kindle

Back to Nature: How to Love Life and How To Save It by Chris Packham – £1.99 on Kindle

Environmental factors

White truffle prices are soaring, and one truffle exec predicts extinction – Business Insider

COP 26: what’s it all about? – DIY Investor UK

London drivers ditching cars six times faster than rest of the UK – Guardian

Off our beat

Inside the John Lewis nightmare [Search result] – FT

China is watching you – The Atlantic

Quantum algorithms that speed up banking operations 100x are here – Sifted

Zero percent market share – Seth Godin

And finally…

“We never had much, but we always had enough.”

– Dave Grohl, The Storyteller

Like these links? Subscribe to get them every Friday! Note this article includes affiliate links, such as from Amazon and Freetrade. We may be compensated if you pursue these offers, but that will not affect the price you pay.

- Note some articles can only be accessed through the search results if you’re using PC/desktop view (from mobile/tablet view they bring up the firewall/subscription page). To circumvent, switch your mobile browser to use the desktop view. On Chrome for Android: press the menu button followed by “Request Desktop Site”.[↩]

Comments on this entry are closed.

Arguably, the billions (trillions???) Of wealth created by crypto see demands some form of destruction elsewhere or at least some form of economic response (inflation anyone?)

Bad news if you hold cash (I don’t) but the world is unpredictable

@theinvestor thanks for hijacking my brain for the weekend! What a great article!

You’ve got me sat here now pondering whether to sell everything equity related in my ISA, batten down the hatches and sit in cash. Maybe this is it, market highs don’t result in further market highs, maybe I will need that cash sooner rather than later, do I need to be in equities in my isa, should I just take the equity risk in my pension pot which I cant touch for many years.

Poured a glass of self doubt over what I previously thought was a strongly held conviction in what was right for me and my family!

Any reflections from anyone slightly further along on “the journey” than late 30s on this? Is this self doubt common or should I just pull myself together!

Thanks as always for the stimulation and challenge! I love this website, thank you.

Hmm. In 3 years’ time will we see this post as Monevator calling the top?

Re. John Lewis article in the FT – I would have been sympathetic, but then they closed the Sheffield store. Now they can do one. (Bitter? Moi?).

Trouble is, if not John Lewis, and I won’t shop at Amazon, where does one buy an oven or a camera these days?

@cant see the woods for the trees

Yep, I mentioned on Monevator a couple of weeks ago about being nervous of the high valuations.

I’ll probably retire in 2/3 years with a mortgage outstanding, thinking of using some of the SharesISA to pay some of the debt down due to high valuations.

Thoughts?

In my opinion, for a couple of decades here in the UK, the property market has been the primary culprit in exacerbating these insecurities.

I’m fortunate enough to have an income that puts me well in to the top 1% of earners, but I *still* live with the anxiety that me and my partner will never be able to own a good home, be able to afford to start a family, live comfortably, and then retire at a sensible age.

Over the last 18 months I’ve taken on career risk by changing jobs, and been rather reckless risks with the money I have allocated toward our target (20%) mortgage deposit by putting it all in the stock market. I have no emergency cash fund. I’m all in.

Investing over the last 18 months has boosted our deposit pot by ‘only’ 13% (due to it being a steady contribution rather than a lump sum investment at the beginning of the pandemic). When you think of that 13% gain as a % of the broader 20% deposit, it’s a tiny 2.6% contribution. On the other hand, doing so has probably brought forward being able to actually meet that deposit target by 6 months… which feels like a huge win considering there are stories in the media almost single day about property prices going up at a relentless rate.

Recently I did the math, and assuming I meet my monthly savings target we’ll have that 20% deposit by mid-April. I’m now thinking it’s too risky to have the pot invested for the sake of another 6 months of gains.

Not looking at the news may actually be key to avoid the roller-coaster of anxiety, particularly when you have news stories like these just 1 day apart:

“U.K. Banks Under Pressure to Start Raising Mortgage Prices” – https://www.bloomberg.com/news/articles/2021-10-22/u-k-rate-surge-pressures-banks-to-start-raising-mortgage-prices

“Traders Start to Doubt the U.K. Rate Hikes They Just Predicted” – https://www.bloomberg.com/news/articles/2021-10-23/traders-start-to-doubt-the-u-k-rate-hikes-they-just-predicted?srnd=premium-europe

‘Sonic Boom Boy’ by Westworld was on the first record I ever bought (Now 9).

While I’d never give personal advice, I’d strongly suggest never going “all in” or “getting out” completely of either major asset class (with the caveat that I’d accept cash or premium bonds or whatever as a bond substitute right now.)

Markets are confounding and the best investors are right about 60% of the time. Which means two times out of five they’re wrong!

Just think of the long long litany of failed calls for a massive crash over the past dozen years or so…

That doesn’t mean doing nothing. I see excess in the current market for sure. But for me that’s a reminder to check my own allocations, biases, and emotions, and to tweak accordingly.

Even if I was minded to sell a huge proportion of my shares (which as a naughty active investor I do from time to time) I’d want to see evidence the tide has turned first… for example a decline and a break in momentum etc. And even then you have to be ready to turn on a dime and suck up the transaction costs if you’re wrong (which you usually will be) and the market heads up again.

The vast majority of people are best tinkering around the edges of a 60:40 portfolio +\- 20% to those core allocations depending on their age, situation, emotions, and only then perhaps their read on wider sentiment. 🙂

Let’s be careful out there!

It definitely rings true to me that there’s a lot of “fear of missing out” going around currently – whether it’s meme stocks, SPACs or crypto it feels like the same sort of underlying psychology which is driving things, pretty much independently of the underlying ‘fundamentals’ of the asset (whatever they are).

I’d be interested to know if anyone has done some research on how the modern media landscape impacts these trends – obviously mass speculation/mania isn’t remotely a new phenomenon (the South Sea Bubble had its own equivalent of SPACs I think), but my guess is that the shift towards social media makes us collectively more susceptible to bubble-psychology, because it’s a way of generating and spreading memes that are particularly ‘catchy’ more efficiently than before. Or maybe that’s just my FOMO talking, who knows…

You comment that technology firms have “profits … still galloping higher in a way that textbooks said was near-impossible”. I am not sure the textbooks ever denied the abilities of monopoly suppliers to keep expanding margins. The clever thing that most of the tech firms have done is create their own monopolies – certainly that has been what Microsoft, Apple, Google, Facebook, Twitter have done.

To be fair the way we rate them is also due to survival bias, more obvious with tech companies like Amazon and Netflix where it looks like early investment drove dominance in and expanding market.

The question is whether this monopolistic/dominant behaviour can continue unabated. Probably not in the long term, but as investors we have to hope they don’t all start declining in unison given their high relative representation in most passive funds (and indeed active portfolios).

The NS&I green bond rate was a great disappointment. I had kept some funds in their direct saver account for a while to be ready to switch in quickly as soon as the bonds came on sale. Have now withdrawn it all and will hold it until something better comes along in an easy access account paying the same interest as the three-year green bond lock-in rate would have returned

@monkeys on a rock. For evidence of the impact of modern social media and mass hysteria see 2020 and covid. Something which was not much more dangerous than the flu, mainly killing people who are past the average age expectancy and the world went absolutely bananas!

As for cash I’m holding too much atm and have been for a year. It is annoying and you do get fomo watching inflation errode it away. I’ve started to regularly drip some into an all market tracker in my isa but i can’t go all in at once for fear of getting wiped out if there’s a correction. Bring back the simpler days of 2010 ish when everything was more predictable!

I found the Of Dollars and Data article a little numerically creative. “Almost All Long-term Investment Gains Come From Dividends”. Sorry, but no they don’t.

The article provides figures of a 791% price return over 40 years for US market, 2417% with reinvested dividends. That works out at about a 5.6% rate of return without reinvested dividends and 8.4% with reinvested dividends, implying approximately a 2.8% contribution from dividends.

e.g. after 1 year price rises 5.6%, dividends of 2.8% are paid. Reinvest those dividends and the next year the return is again 5.6% price increase, 2.8% dividend…

@Jim, your comment on Covid really is ridiculous, it was clearly much more dangerous that flu (average flu).

Being on the wrong side of homeownership makes me largely indifferent to the sharemarket. Home prices where I live have increased by more than my entire portfolio, in just 12 months. Orders of magnitude.

A 20% equity market drop would barely register.

@TI – I’ve heard people throw cold water on the idea that you can use valuation metrics like CAPE to quasi-time the market by shifting allocations between growth and defensive assets. But that seems counterintuitive to me.

In a Bayesian sense, our “priors” on likely future market behaviour are by no means completely flat! Most people would agree that we’re likely to be much closer to a market top than a market bottom.

Intuitively, we should be able to act on that information by shifting more into defensive assets.

If you *do* shift away from equities at a time like this, there’s a chance that you’ll miss out on the last part of a bull run. But does this even matter to the long-term investor? If asset prices are pumped up to ludicrous levels near the top of a bubble, isn’t this just paper wealth unless gains are crystallised before the ensuing crash?

It seems to me that the worst thing to arise from shifting into defensive assets in an environment like today’s would be missing out on a period of dividends, because a run-up in equity valuations near the end of a bull-run would be undone by a crash. Or am I missing something?

@Naeclue, your comment on Covid really is ridiculous, tune-out of MSM for a month, DYOR and you’ll soon see…

@Algernond, I don’t know what MSM is so likely have never tuned in.

It really doesn’t take a lot of research to demonstrate that Covid was much more dangerous than flu:

https://www.health.org.uk/publications/long-reads/one-year-on-three-myths-about-COVID-19-that-the-data-proved-wrong

Let’s not forget either that these deaths occurred even with lockdowns, etc. and don’t include those suffering long Covid.

That link is a perfect example of manipulating statistics to fit an agenda. Without wishing to hijack the comments with covid it is a fact that in the UK the average age of death with covid is higher than average age of death in males, pretty much on par with average in females. I see a times article published 21.10 stating average age of vaccinated covid19 death is 85 with 5 underlying health conditions on average.

@Wodger, you might find this Kitces article interesting on good and bad uses of CAPE

https://www.kitces.com/blog/shiller-cape-market-valuation-terrible-for-market-timing-but-valuable-for-long-term-retirement-planning/.

@Jim, “manipulating statistics to fit an agenda”!

Oh the irony..

@wodger, whilst I see your logic, the things you’re missing are that:

a) No-one really knows if we’re close to a crash, or still have another year or few of topsy turvy happenings. So you could be foregoing decent returns in the meantime.

b) Unless you’re exiting for good, there’s a part deux, of course. When do you get back in? The March 2020 crash was instructive of how hard this can be. I recall that on March 24th VWRD rose by something like 8% in a single day. Most people probably thought that looked a bit preposterous at the time in the circumstances of a newly unfolding pandemic, and waited for it to head lower once again before buying back in. They’re of course still waiting or have had to make a painful buy.

Or you could have chosen to buy back in when it started to rise again, and then it really could have carried on plummeting over months and months. At the time it seemed anything could happen…

@Naeclue

Both ways of looking at the dividends statistics are correct. 2.8%/yr extra juice works to 3x your pot over 40 years, regardless of price inflation.

Dividends do matter. The FTSE 100 has a bad rep, and it *has* lagged behind the global market in terms of total return, but even so the absolute *worst* 25 year period since 1984 to 2019 you can have held a cap weighted fund of FTSE 100 shares would have still yielded a 6.4%/yr return.

https://www.ig.com/uk/trading-strategies/what-are-the-average-returns-of-the-ftse-100–200529

Covid already killed 0.2% of the US population. In a bad flu year, 0.1% of those infected by flu due from it in the US. There is no comparison possible between covid and endemic flu.

0.1% die from it, of course.

@Andrew, I am not saying dividends don’t matter, they absolutely do, but the slant in that article is OTT. Consider this, if there was no price appreciation those reinvested dividends would have grown at 2.8% and without dividends the growth rate would have been 5.6%. Which was more important, dividends or share price performance? I know which rate of return I would prefer.

I respect your decision about coming out of the market by the way. Missing your April target just for the chance of hitting it in February or March makes little sense.

@TI thank you, definitely not seeking personal advice, but always value reading the experiences of people who have been through cycles previously, particularly what they were thinking and how they were feeling.

The March 2020 sell down was my first real experience with anything invested. At the time seeing the value of my hard earned saving reduce was tough. Not selling and investing further was tough, particularly when at the time no one knew whether we’d have a V shaped recovery, bath shaped, K shaped or whatever else was being used to describe the potential shape of the future!

I took a 50/50 view then, invested 50% of what cash I had at the time over a few days at the end of March and kept 50% in cash in case it fell further.

As I’d read on this site would be the case, the actions I took during that uncertain time have now been some of the best returns I have.

Now we might be at the top, who knows. I think il probably take a 50/50 approach again – nothing more scientific than that!

Thanks again for all who contribute to this site. It’s such a valuable source of information and experience.

@Rui N. – I preusme you are referring to a no. which reports mortality of those with a ‘postive Covid test’.

Like I said,, best tune out of MSM, and DYOR.

@Algernond, what do you mean by DYOR? I cannot see how any individual can get better stats than the ONS, so what are we supposed to do? Look at the information provided by conspiracy theorists and other cranks?

@Naeclue – these so called ‘conspiracy theorists’ were talking about ‘health’ passports, Social Credits Score systems, CBDCs and a quickening of the descent into technocracy as soon as this all kicked-off (March 2020). Now look where we are.

As for ONS, the only stat. you can trust is overall / excess mortality; not what the cause of the excess in April 2020 and Jan 2021 was.

I propose an amendment to Godwins law – (a) Bodwins law (b) Codwins law – being the universal law that a monevator weekly column eventually descends to a Brexit or Covid back and forth. I do think the CV deniers are a little crazy but hey imo only.

So interesting weekly column. I’ve not a clue where markets will go (that puts me one up on the people who think they do know where markets will go) although I do buy into the premise that starting valuations are a decent predictor of long term returns. So it’s not looking too pretty here. What I always find odd though is how many people make comments that equities or risk assets are expensive etc without looking at the other side of the coin being the risk free rate of return. In 1999 10 year treasuries were yielding circa 6% – now they are throwing of circa 1.6% which is deeply negative in real terms today. So yeah, I think that’s pretty relevant and fundamental. I feel the biggest determinant of market valuations across most risk asset classes is the trajectory of interest rates. Which could be rubbish but you have to asset allocate somewhere and cash is losing you 4 – 5% a year at the moment. I’m betting they will stay very low for an extended period of time. On that basis I’m heavily tilted to risk assets with enough liquidity to ride out the storm, if necessary for years, if necessary alone 🙂

Being wrong is not a strong trait in Humans. We are terrible at it. Two rational people can peruse the same evidence and draw different and opposing conclusions. That, is not where the problem lies, both may be valid but need further exploration. It is the anchoring to those conclusions that then leads to irrationally searching for contradictory evidence to the outcomes that then present to us to justify why our original finding were ‘correct’.

Bull or bear, Brexiteer or remainer, Covid sceptic or epidemiologist. All can be guilty of it. No one is immune. As TI has just said, “… the best investors are right about 60% of the time. Which means two times out of five they’re wrong!” We all can be

Peace and love (Just that way out tonight)

JimJim

@Seeking Fire, good points. The comparator really has to be the cash earnings which are mostly less than 1% nominal and negative in real terms (though not by the 4-5% you suggest). Investing is still likely to be do better despite clear risks in both share and bond pricing, more so than the last several years. Reacting to possible future risks to share prices by changing your investments (but which?) or bonds (but which?) amounts to active investing which on average doesn’t outperform a clear strategy of passive investing.

As you say, the spat between a couple of other posters is one of those things that @TI may choose to curtail. But I can’t help but point out to @Algernond that the UK has seen well over 100,000 excess deaths over the last two years, with the only difference being the emergence of Covid. Flu has never caused that sort of number.

I think it was Fidelity that found that customers who’d forgotten they had accounts had the best performance ?

And I heard on the Malvern money podcast that the worlds best banker, Templeton, found that despite his fund producing something like 15pc annualised the average holder took no profits… I don’t know if that’s true but bearing in mind the Fidelity findings I can believe it.

The Youinvest portfolio tool tells me my selection of funds worst ytd was October 2008-09 at 48pc. Ofcourse, had I been invested in September 2008 and held until now I’d be far the richer for it…

I think my plan is just to log in on contribution day each year and never sell (except to rebalance on the one day a year I log in)

If I can do that, investing will make me richer eventually: where’s Lars when you need him ?

Ps – I think debating covid vs flu below the line is pointless. It’s like brexit – people have taken a view and that’s that. I’m obviously not saying don’t do it – it’s not my blog and it makes no odds to me – just do so fully in the knowledge there’s no hope of convincing the other side of your POV

@all – let’s leave the covid commentary there for now please. As BB says it’s futile and while I’m not above a futile debate this isn’t the post for it.

Further “all a con” theory stuff will be deleted, at the least, but I’d rather both sides left it there on this thread to keep the conversation on track. Cheers!

Disappointing to see the COVID deniers on here. Please stick to Facebook.

@JimJim. There is a oversight in TI’s statement that “… the best investors are right about 60% of the time. Which means two times out of five they’re wrong!”. It’s true they only get it right 60% of the time, but it’s the asymmetry in the return profile, the ability to win big and only lose small that is the biggest driver of a great investing strategy.

That’s where investing can be different from some other walks of life. It’s perfectly possible to only get it right only 40% of the time, but if you generate six times the gain compared to what you lose the other 60% of the time, you still come out hugely on top. Doesn’t work like that for a surgeon …

Regarding the top of the market, I have switched the bulk of my monthly savings from my ISA to my DC pension. I was already matching the maximum employer contribution but now I am paying in four times that.

I will not be able to touch it for at least nine years but figure that the tax savings (even at the basic rate) will make up for any market correction.

This increased contribution is locked in for the year.

Quite generously the firm splits the employer NI savings with staff, so I get a 6% pay rise on the money I put into the pension which works out at just shy of £500.

@naeclue #20 & @far_wide #22 – Thanks for links about CAPE. I’d seen them, and agree that it is of limited use for “timing the market” in a strict sense and when used in isolation.

But it’s not *just* about CAPE — a host of other metrics provide similar information about how close markets are to a top. This seems to be actionable information. Logic dictates that we should be able to use this information to dynamically shift asset allocations between equities and bonds across market peaks and troughs.

For example, when everyone is fretting about market peaks, shifting the balance further towards defensive assets seems to be the rational choice. Yes, you could miss out on a period of returns from equities near the top of the, but available evidence suggests it’s the right thing to do.

And rather than trying to subjectively time your shift back into equities during a market downturn, you could use rules-based rebalancing. For example, a fall of a pre-determined magnitude below a recent market peak could trigger a rebalancing event. And if the fall was great enough, this could be coupled with a concurrent shift in the percentage allocated further towards defensive assets.

Has anyone tried back-testing this kind of approach using historical data? I’m curious to know what would have happened if you’d followed this approach through the major market downturns of the past century.

Just noticed a typo in my last post (#40) — I meant to write: “And if the fall was great enough, this could be coupled with a concurrent shift in the percentage allocated further towards *growth* assets.”

If we invest in equities, we expect to have to put up with potentially hairy levels of volatility in order to get a better rate of return in the long term than we would in lower risk assets. During Covid and the GFC central banks and governments have taken measures that have cushioned that volatility pretty heavily. It seems reasonable therefore that prices reflect the expectation that governments will take measures to prop up values in future crises, even though that’s not a given. Valuations may be high relative a previous environment when prices were more volatile, but maybe that’s justified? A 60/40 portfolio may need to be 75/25 or whatever to achieve a similar risk profile in this scenario.

Obviously, the problem is that if governments *don’t* act during the next crisis the fall could be pretty scary

Windy

Oh and I’m so glad I was ahead of the curve on John Lewis – if anyone followed my advice over a year ago to switch to M&S over Waitrose i bet none have gone back. John Lewis reminds me of BA – relying on a brand they built up in the 80s and managing decline amongst customers too set in their ways to shop around

I’ve been buying TVs and fridges, washing machines from Currys for years and I got my aircon from AO, all purchases have been superb – infact the currys installers were ‘happy’ to switch my dishwasher and washing machine around when I inadvertently bought a larger washing machine which didn’t fit in the old space… for ‘slip in standards’ I read ‘worse service and paying more for privilege’

We used John Lewis for a recent car seat purchase. The service was outstanding. We got a full demo of all suitable options. In the end we decided which one we wanted and went away to research prices. From memory they were within 5% of the best price so went with them. The delivery options were good and customer service can be relied on if there’s a problem. Having said that apart from items where you need a demo I can’t see what they offer better than online retailers. I’m certainly not one to shop for leisure!

Can anyone else not fathom the point of “britcoin “. Reading that article it doesn’t sound to have any advantage over cash in a bank account. What an expensive pointless exercise.

@Jim maybe your assistants had gone through the training they’re rolling out to address poor standards 😉

Hi @Jim,

Britcoin? I understand the point of it, but I think expounding on it would break the rule for this post that @TI outlined in comment #36 🙂

@BBlimp – With regards to the mantra, ‘the best investor is a dead investor’ (I think that’s what you are referring to with the Fidelity thing), if we have a once in a lifetime ‘financial reset’, then that rule may be broken…

It’s not really related to this week’s excellent set of links, but has anybody here given any thought to whether CGT rates are about to go up? From media coverage this sounded like a done deal a couple of months ago (and I seem to remember one of our Monevator hosts preparing for the worst on this front ahead of the last budget), but I feel like the wind has changed and we’re now not expecting more tax rises. Any thoughts?

@all — For those more actively-minded who are thinking about taking some evasive action in face of valuations (again, I’d strongly urge tinkering at the edges over ‘in or out’ unless you’ve found yourself in a very over-exposed position on reflection) I myself am trying to remember this is a seasonally very strong few months ahead, for what that’s worth. You could argue it’ll make it easier to sell down into a stronger market of course. But the point is things still seem pretty bullish, and markets can remain irrational for longer than you can remain solvent etc. Of course, as always a crash could begin tomorrow (China: ick!) so if you’re thinking on reflection your 500% levered Bitcoin position is a tad top-heavy (or something far more mild that looks somewhat reckless versus history) then better to act to get yourself in a sensible position I’d say, and suck up any lost gains as the flipside of reducing your vulnerability.

In short (ish) for me, the current circumstances mean it’s not the time for heroic bets in any particular direction. That’s what I’m trying to get across (for what it’s worth, which you may well say is nothing 🙂 ) rather than “crash imminent, sell everything!” etc, to say the least.

@Slemon — I did indeed realize a large capital gain in a moment of weakness towards the end of the last tax year. In my defense (re: ‘tax tail wagging the investment dog’ etc) these two positions had started to represent a big proportion of my (actively managed) portfolio, and I felt that I couldn’t really do much with them as they were so vulnerable to CGT. (I’ve spent my allowances for a decade disposing of other non-sheltered positions, but these ones kept growing, which is a nice problem to have I concede. And I probably held on longer than I would have if not stalled by the CGT liability, so I can’t complain!) Since then one is up a bit and one flat to down, but as you know the CGT rise didn’t come to pass.

I’m pretty intrigued to see what Sunak will announce this week. The rhetoric at the party conference was very much about paying down the debt. The latest figures on borrowing have been a tad better than expected, and they seem set on keeping the economy open if they can. But more tax rises still feel pretty inevitable (I don’t think they should do this, I think they should try to grow the economy they’ve hamstrung with their witless Brexit while borrowing is cheap, but it’s tricky balancing act given our dependency as a country on foreign capital, the latter likely being the reason why Sunak will soon announce more tax breaks for foreign investment to try to offset the fall in demand from companies who’d rather invest more in the EU to get the benefit of very easy access to EU markets we’ve lost).

I’m toying with deferring some of my gains into more EIS investments (note: not recommended!) if CGT stays the same. If it rises I’ll take it on the chin I suppose. We’ll see! 🙂

@Wodger, there are countless numbers of backtesters out there, all looking for ways of dodging the next stock market bullet. There are a number of trend following strategies out there that are not entirely ludicrous. @TA gave a link to a good analysis of Meb Faber’s trend following strategy the other day:

https://earlyretirementnow.com/2018/04/25/market-timing-and-risk-management-part-2-momentum/

FWIW I looked into this strategy several years ago and found that it did not work so well for sterling investors, but did still mitigate some of the larger drawdowns. If I was to go in for trend following, and I am not inclined to, I would do it with part of my portfolio rather than all of it. I certainly would not do it with the investments we have outside tax shelters. I would also use something very simple, such as Meb Faber’s, rather than some of the more complicated approaches that (IMHO) probably give better results because of overfitting.

One warning that I would give is that following any sort of systematic strategy is hard, even annual rebalancing. So before starting I think you need to ask yourself whether you would really be able to commit to a trend following strategy year after year, regardless of the outcome. For many people enthusiasm would wane following a period of underperformance. They would then pack it in and end up worse off than they would have been had they not bothered to start.

My approach is to hold equities for the long term. For the short term (the next 6 years) I hold cash. I do sell equities and did in July, but as part of an asset disposal strategy. We would like to give away excess assets when we can rather than leave everything to beneficiaries when we die.

@JimJim, “Being wrong is not a strong trait in Humans. We are terrible at it. Two rational people can peruse the same evidence and draw different and opposing conclusions.”

Well yes and some people often believe what they want to believe irrespective of evidence. The problem with denialists, Covid, Climate, whatever, is that they will not even engage and think critically about the evidence. When forced to confront overwhelming evidence some go down the conspiracy theory route, as that provides them with a route out other than accepting they were wrong and changing their minds.

Surely a more rational approach is to look at the balance of probabilities? If the bulk of scientific evidence points to one conclusion is it not a rational working assumption that this conclusion is likely to be correct?

It is no big deal to be right 60% of the time by the way. If I say that the stock market will be higher in a months time than it is today I will be right 60% of the time, but there is no guarantee that LTBH is a profitable investment strategy over a finite period of time. As ZXSpectrum has indicated it is perfectly possible to make money even by being wrong most of the time. Most angel investors are wrong more often than they are right.

Your search function keeps generating Google transparency reports so I can’t search for any past blogs. Can you provide a non Google search facility?

@Steve — If I type a word into the Monevator Search bar, I get a string of articles. I don’t even see any ads.

Maybe I’m being slow but not sure what is this problem you’re seeing? 🙂