Bonds are a notoriously hard asset class to understand when you scratch beneath the surface. It doesn’t help that the bond world speaks in its own unfamiliar language – one festooned with special bond terms that are hard to learn if you’re an outsider.

Our remedy is this quick guide to the main bond jargon you need to know. We’ll add more over time, to make this jargon buster a companion to our bond articles.

Bond terms to know

Bond market interest rates

‘Interest rates’ in the context of bonds does not refer to the central bank interest rates we’re used to. Instead, we’re talking about the rates that prevail within the bond market.

Each and every bond is subject to a ‘market’ interest rate – which is the return investors demand for locking up their money in that particular bond at that time.

Investors express their demand through their decisions to buy and sell.

Market rates fluctuate in-line with economic data. Changes to inflation expectations, a bond’s credit rating, its maturity date, and yes, central bank interest rates – all this and more feeds into market interest rates.

Principal

A bond’s principal is the original value of the loan made to the bond issuer. When the bond matures, the principal is paid back to whoever owns the bond on that date.

Principal is also called par value, nominal value, or face value. The standard face value of a UK gilt is £100.

Coupon rate

The fixed interest rate paid by a bond. For example, a bond with a 4% coupon pays £4 per year on its principal of £100.

Maturity date

The day the bond debt is finally cleared. On that day the issuer pays the bondholder the face value of the bond. The parcel of debt it represents is cancelled out – the bond is redeemed.

Yield-to-maturity

Yield-to-maturity (YTM) is a bond’s expected annualised return if you hold it to maturity (ignoring costs). This yield takes into account the bond’s current price, and assumes all remaining coupon payments are reinvested at the same yield.

An individual bond’s yield-to-maturity continually adjusts to reflect market interest rates as investors trade.

The mechanism is:

- When a bond’s market interest rate rises, its price falls. (Investors require a greater incentive to hold this bond – hence prices drop.)

- When a bond’s market interest rate falls, its price rises. (Investors are more willing to hold this bond – hence they’ll pay more.)

- When a bond’s price falls, its yield-to-maturity rises. (The price fall causes the yield to increase to match the higher market interest rate).

- When a bond’s price rises, its yield-to-maturity falls. (The price rise causes the yield to decrease to match the lower market interest rate).

This piece helps explain what happens to bonds when interest rates rise and fall.

YTM is the go-to metric to use when comparing similar bonds (for example gilts) that vary by price, maturity date, and coupon.

There are many types of bond yield. But we’re usually talking about YTM when we use the term ‘yield’ in an article on Monevator.

Nominal / conventional bond

The standard type of bond that pays back a fixed coupon rate and a fixed face value. Nominal bonds contrast with index-linked bonds that make payments in line with inflation. Index-linked bonds are also called inflation-linked bonds, or ‘linkers’ if they’re gilts and TIPS if they’re the U.S. equivalent.

High-grade bond

A bond with a credit rating of AA- and above (or Aa3 in Moody’s system). Typically the highest-quality bonds are government bonds.

Credit rating

This is a guesstimate of the financial strength of the bond issuer. That means for example the UK and other governments for government bonds, or the issuing company for corporate bonds.

AAA is the top-notch rating. BBB- sets the floor for investment grade. Below that is termed ‘high-yield’ or less flatteringly ‘junk’.

The higher the credit quality rating, the better. It means there’s less chance the issuer will default on payments, according to the bond rating agencies.

Of course you’ll usually have to accept a lower yield for a (less risky) higher credit rating.

Duration

Modified duration is an approximate guide to how much a bond will gain or lose in response to a 1% change in its yield.

For example, if a bond or bond fund’s duration number is 8, then it:

- Loses approximately 8% of its market value for every 1% rise in its yield

- Gains approximately 8% for every 1% fall in its yield

Macaulay duration is the average time (in years) it takes to receive all of your bond’s cash flows (coupons and principal). It also tells you how long it takes to recoup a bond’s price.

Macaulay duration in particular is a complicated concept for non-financial wonks to wrap their heads around. But happily, you don’t really need to.

Duration as used to describe interest rate sensitivity is the more important of the bond terms here for everyday investors because it provides insight into how wildly your bond or fund’s price may change as rates fluctuate.

Macaulay duration becomes relevant if you practice duration matching – which we’ll cover in an upcoming two-parter.

Interest rate risk

Here the risk is that an adverse move in bond interest rates causes losses. This risk decomposes into two elements:

- Price risk

- Reinvestment risk

Price risk

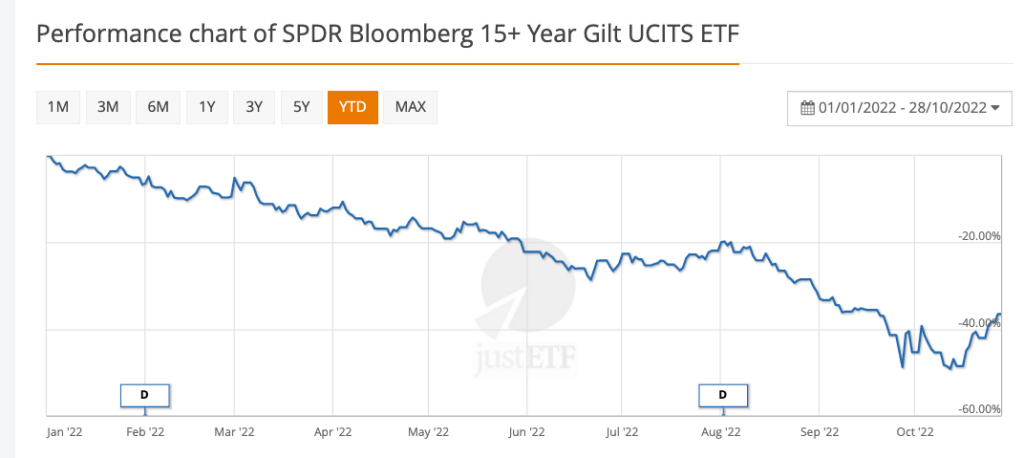

Price risk materialises when bond interest rates rise and cause your bond’s price to drop, inflicting a capital loss.

Reinvestment risk

When market interest rates fall, bond yields fall. Reinvested cashflows now earn a lower yield which erodes your annualised return over time.

Other bond terms that confound YOU

Time for a bit of crowdsourcing! We know that many readers are confused by bonds, so is there any particular jargon you’d like to see included in this guide?

Let us know in the comments below and we’ll add it to the guide.

Comments on this entry are closed.

Unvexing convexity would be good!

Where can you find regularly updated data on medium and long dated (UK) linker real yields?

US real yields seem to be readily available, as here: https://tradingeconomics.com/united-states/30-year-tips-yield

Ditto for both convexity ( and why it matters), and how to get real ytm for index linkers.

@Onedrew @Mr Optimistic — Thanks, though “why it matters” is getting into article territory. Anyway please keep them coming.

@Paul @Mr O — Sign up at Tradeweb, it is still free I believe.

Interesting FT article linked below on who buys GILTs, and why there may be upward pressure on yields ahead.

https://www.ft.com/content/6446220c-41e8-4937-9860-8d075d297aa8

For US Tips data, this is very useful,

https://www.wsj.com/market-data/bonds/tips

“When bond interest rates rise, bond yields fall.” – do you mean when bond prices rise?

@Jon B — Oops, horrible typo. I think we meant to write when market interest rates fall, bond yields fall. I’ll change it to that pending @TA’s word.

Thanks for the spot.

Thank you for another helpful article. My question which may only reveal my lack of understanding is: does Macaulay duration take account of inflation, ie, is the price recouped real or nominal?

Bond Index funds.

How do they work compared to single bonds.

I believe it is complicated!

Bonds!

I bought a linker 3 years ago . It’s just matured, I really had no idea what to expect to be paid into my brokerage account on maturity. I got the full value back plus £500. With 3 years of intrest payments too. Over 3 years I held it, my return was 2% pa.. Considering bank intrest over that time was next to nothing I did ok with it. Not buying another..I’ve put the money In a cash isa at just under 4%. Still don’t understand bonds!!

@MrO. Remember that duration, D, is just the rate of change of the price with respect to yield. It’s only the first derivative and a linear term. For a small yield change ∆Y, change in price ∆P = -D∆Y is a good approximation.

For large changes in yield, however, this linear approximation can fail. As yields fall substantially, the bond price rises by more than would be implied by using just duration. As yields rise, the bond price falls by less than would be implied by using duration. That’s because the bond price-yield relationship is actually non-linear. Convexity measures the curvature of that relationship (duration measures the gradient). Formally, bond convexity is the second derivative of the bond price with respect to yield. It’s a function of the yield change squared, and, as such, a non-linear term.

To see the impact, consider the following (rather extreme) example using recent market events. On the Sep 28, 9.30am, the index-linked Gilt, UKTI 0.125% Mar-2073 had a real yield of 2%. The price was £40 and the price value of a basis point (essentially duration) was 21p per basis point.

Imagine the BoE hadn’t intervened (about 11am that day) and the real yield had jumped to 4%, 200bp higher. Based on the duration, the price would be 42 points lower (200×0.21) putting the price at … err … -2 ! Not possible. Duration is clearly a very poor approximation here. The actual price would have been 16 due to positive impact of the convexity. Now the BoE did intervene (after 11am), and the real yield went to 0% by Sep 29. Based on the duration the price should be 82. In fact, it was 106. Another large convexity adjustment.

Take special note the payout profile: 200bp higher, lose 24 points in price but 200bp lower make 66 points. That’s 2.75 to 1. If the yield has risen 300bp, the price would have dropped 29 points but if the yield went 300bp lower the price would be 134 points higher. A payout ratio of 4.6 to 1. In reality, it rallied 270bp, to a -70bp real yield, by Sep 30, almost 4x the value two days prior. The price value of a basis point (duration) at that yield was around 70.

Under the assumption that yields are normally distributed and that you had no view on the market (50:50 whether yields go up or down), you should have been buying these Gilts at 2% because this bond was demonstrably offering a profile heavily skewed in your favour. It’s essentially offering a option-like payout without taking leverage or buying an option.

[MythBustingRant]

As no one has commented on the disinterested observer’s claims of an easy money making opportunity in gilt markets, so I thought I probably should.

The analysis is of course flawed.

The first point I would make is around the “assumption that yields are normally distributed”. They are not, the distribution is skewed. In general it is worth running a mile from anyone making a claim about anything to do with financial markets being normally distributed. There are people who have lost a lot of money making false assumptions about normal distributions. This is no exception.

The second point I would make is about the remarkable observation of asymmetry in the expected price movements during the recent volatility resulting from Trussonomics. The fact is, this asymmetry exists ALL THE TIME in bond markets. It is a very widely known and understood feature. What is more, the asymmetry increases with decreasing yield, so if the logic is to be followed, buying gilts during the Covid crash would have presented an even greater opportunity as the odds would have been even more “heavily skewed in your favour”.

The idea that a feature of the bond markets, known by everyone, presents a buying opportunity is quite absurd. But ignore me and try it if you want to. Who knows, you may get lucky.

It is good to try to understand the ins and outs of bonds and bond markets, but best to ignore any claims about likely quick buck money making opportunities arising from your acquired knowledge or spurious claims you might read on the internet. Bond fund managers, who are most definitely aware of the asymmetry feature, have no better success in beating bond markets than equity fund managers do in beating equity markets, so a good question to ask is yourself is “why do you think you do?”.

[/MythBustingRant]

I often used to explain bond duration and convexity in terms of a Taylor series expansion for those with a mathematical education. Once that simple part is understood, other aspects lead from there. This explanation might help some out there who grasp the maths, but get confused by the jargon and waffle. Sometimes the waffle is wrong or misleading as well, just to make things even more confusing.

To start with, the Price P of a bond is function of yield P = f(y). The function is not linear and similar in shape to the function 1/(1+y). When yields are low, the price is high and falls as the yield rises. An approximation of the function f(y) can be obtained using the first few terms of the Taylor series about point y0

P = f(y0) + f'(y0)(y-y0) + f”(y0)(y-y0)^2/2

Duration (modified duration) and convexity are then defined as

Duration D = -f'(y0)

Convexity C = f”(y0)

So for a change in yield dy = (y-y0), you get the approximation

Change in price dP = -D.dy + C.dy^2/2

Note, there are some who talk about convexity in more general terms and incorporate all the higher terms in the Taylor expansion, essentially anything but the linear duration term is convexity, but this is waffle. Bond convexity = f”(y).

For simple bonds such as gilts, duration and convexity are always positive and the duration term -D.dy, is always greater than the convexity term C.dy^2/2, so bond prices always fall as the yield rises, but the fall is not as large as it would be without the convexity term.

Bond duration and convexity vary with yield, which is to be expected – do a Taylor series expansion at different points on a curve and you will expect to get different numbers.

Hopefully that explanation will help some people out there get started with duration and convexity. I know it will not help everyone.

I think this is why many newer investors, myself included, don’t invest in bonds – it just turns them off – there are just too many terms, too much to learn and most of it completely mind numbingly boring.

At least with investing in funds they are straight forward and you can see the point. I know bond funds/multi asset all in one funds are an easier way to invest in them but as the old adage goes don’t invest in what you don’t fully understand.

As I’m older and getting nearer to needing my investments for income, I know I should have them in case of market drops/sequence of returns risk but I just rely on equity index funds and enough cash for around 5 to 6 years which I hope will see me through most bad periods without having to cash in falling equities. I believe I can cope with short to medium term downturns as these don’t really bother me that much and the current situation is not really concerning me. I just see it as the usual bumps in the road before better times, hopefully, as equities have always provided the best long term returns. If it was to last 8 or 10 years – or maybe more in rare market downturns, this could then be a problem but so is holding too much in cash.

It would be useful to know statistically how often equities suffer big drops of maybe 35 to 40% or more – is it every 5, 10 or even 20 years on average and how long on average they take to recover. Then people like myself would maybe reconsider having some bonds. Just that with bonds not doing much lately there doesn’t seem the incentive at this time, as multi asset funds seem to have performed worse than most global equity index funds.

@Doodle, nothing wrong with cash as far as I am concerned, it’s what I hold. I do hold a few short dated gilts though as these happened to offer slightly better after tax returns at the time I bought them than fixed term deposits did. The gilts have the added advantage of optionality. I can sell at any time and either buy other gilts, move the money to fixed term deposits, or spend if I need to.

The important thing to do is to be able to manage what you are doing and be able to sleep comfortably with it. You are very likely to experience big drawdowns in your equity portfolio. You need to be able to weather that, not panic and sell, and rationally manage your expectations if the market is not kind to you in the medium term. ie be prepared to cut spending if your cash buffer runs low and the market has not recovered. An advantage of a balanced fund such as the Vanguard LifeStrategy is that you should normally experience much smaller drops when equity market crashes come along. Some will find that much easier to deal with.

Yields are normally distributed in most developed markets. They are only lognormally distributed in em markets. The yield volatility backbone for most G10 markets is around 0 or even negative. So it’s normal to supernormal. At best its 0.5 and is somewhere between log and normal. Any swaption trader knows this

@Naeclue I don’t know why you dislike me so much but it’s clear you have an issue with me.

@ Doodle – calculating the average time between crashes would be misleading. It wouldn’t tell you anything about when the next ‘Big One’ will arrive.

Markets were headed for disaster in Feb-March 202o as Covid let rip – until the world’s central banks brought out their big bazookas. In a parallel universe the pandemic led to a global depression.

Similarly, what happens if Mr Putin air-bursts a nuke over Ukraine? Even a small demonstration one? Not good news for stocks.

Large crashes are unpredictable – you just have to be ready. Check out the UK stock market graph here:

https://monevator.com/is-now-a-good-time-to-invest/

Decades of growth can be followed by a lost decade and two big crashes (e.g. 2001 and 2008) in short succession.

That said, you could get by with just cash and equities. Check out this piece which you may find helpful on this point:

https://monevator.com/how-to-protect-your-portfolio-in-a-crisis/

Alsways I was trying to do was explain why duration isn’t a good approximation for large yield moves. At the end of the day, the price is a deterministic function of yield so you never actually need either duration or convexity. They are just the two terms in the perturbative expansion.

Frankly, if you didn’t think a 2% real yield was a decent risk reward for at least some of your portfolio I don’t really know what some people want. If the whole index linked gilt curve was at a 2% real yield, I would argue that for many it would make sense to dump most of their other assets and buy a ladder of those. Far less risk than holding equity trackers. A genuine passive portfolio that takes no view on the market and hedges future liabilities. The fact you could quadruple your money in a week was just a bonus.

But you just stick to that equity market obsession. I’ll stick to lower risk stuff and just make a boring 10-15% per annum. Then again @naclue thinks the laws if passive investing are equivalent to then laws of thermodynamics. Which is rubbish.

Thanks ADO, Naeclue &TI. Will have to read again s..l..o..w..l..y.

I used Tradeweb (thanks @TI) to chart YTM v maturity date for index linked gilts. I naively thought it’d be flat because they are real yields.

The curve rises from -1% for UKGI 0.125% Mar 26 to a peak of 0.3% for UKGI 0.125% Apr 48 (~25 yrs), it then tails off to 0% for UKGI 0.125% Mar 68 (~45 yrs).

Is the shape of the curve, at least to 25 yrs out, dictated by conventional gilts? UKGI 0.125% Mar 24 would be a steal at 0% YTM given inflation today, perhaps why it has been driven down to -2.8%?

Have DB pension funds driven down yields at the far end?

And why are yields on the few UKTI higher than UKGI (are UKTI even tradeable)?

@D, going a bit off topic here as the article is about jargon but I dislike trusting things I don’t understand under the bonnet. For shorter dated stuff how does Tradeweb deal with indexation lag ? I hold 2.5% 2024 and when I used to read real ytms in the FT there were different results for inflation assumptions of 3% and 5% (8 month lag).

I did find this but, guess what, I doubt I’ll get round to putting it into practice! https://www.dmo.gov.uk/media/1953/igcalc.pdf.

Again off topic but I wonder how well passive bond etfs will track rapid changes in yields, so an article on bond etfs v funds would be interesting.

Anyway, apologies for the thread drift. At least I have a grasp of convexity now.

@ Doodle – sorry, you asked for some info about bear market recovery times but I forgot to include above. Here’s a piece on that topic:

https://monevator.com/bear-market-recovery

@TA – Thanks for your wise words and links/information and the effort you, and your co-writers, put into making this site invaluable to investors (including us less experienced beings.)

Yes I can see that these averages would not help or predict any crash as like buses, 3 events could come along together in short order and knowing my luck will do!

Wish I had found this site sooner with the sensible message of passive global investing – I would still be losing, like just about everybody else at the minute, but much less. Wish I also had a reliable clairvoyant to call on 24/7 but again no such luck!

@Naeclue – thanks for your words and wisdom. It’s reassuring that an experienced investor as yourself holds mainly equities/cash.

It’s just you read so much these days about needing to hold bonds, which may be a future option, but they seem to only limit some of the downside and only some of the time if you’re lucky, whilst also restricting equity gains.

I don’t believe I would ever panic sell due to a crash or worry about short term market volatility but it’s mainly the risk of any cash fund running out and having to sell investments at a much lower value (especially if your pensions are also all stockmarket invested DC ones as mine) but I suppose those are the risks you take with investing versus losing due to inflation in cash accounts most of the time.

All the best.

@ Doodle – Thank you for the kind words!

@disinterested, I don’t dislike you, but I do dislike misinformation.

By the way, your ad hominem attacks, goal post moving and unverifiable claims of investment performance all strike me as attempts to avoid admitting you were wrong.

The asymmetry in the up/down movement of prices for a fixed down/up movement in yield exists all the time and increases with decreasing yield, so saying an investment in a bond is “demonstrably offering a profile heavily skewed in your favour” on a yield of 2% because of this asymmetry implies it must be even more “heavily skewed in your favour” when at a lower yield. Why don’t you just admit you were wrong?