What caught my eye this week.

After compiling this list of the best money and investing reads for over a decade now, it’s rare I come across anything super new.

But I loved this fresh idea from Pete The Planner on how to borrow money from your own emergency fund.

Hold up – borrow your own money?

That’s right. Sort of.

Pete explains it’s down to one of those endearing tics of being human. Many people would rather borrow from a lender – and pay interest – because they prefer to see a repayment schedule in place, rather than raid their own emergency fund that they’d diligently saved for a rainy day.

Even when it starts to rain!

One reason is they don’t trust themselves. But research provides a possible solution, says Pete:

In a lab experiment, researchers found that when subjects were given the option of taking money from savings and entering into a “pay-back” agreement, they were more willing to use their savings rather than borrow money.

So simple. See Pete’s blog for a quick example with numbers.

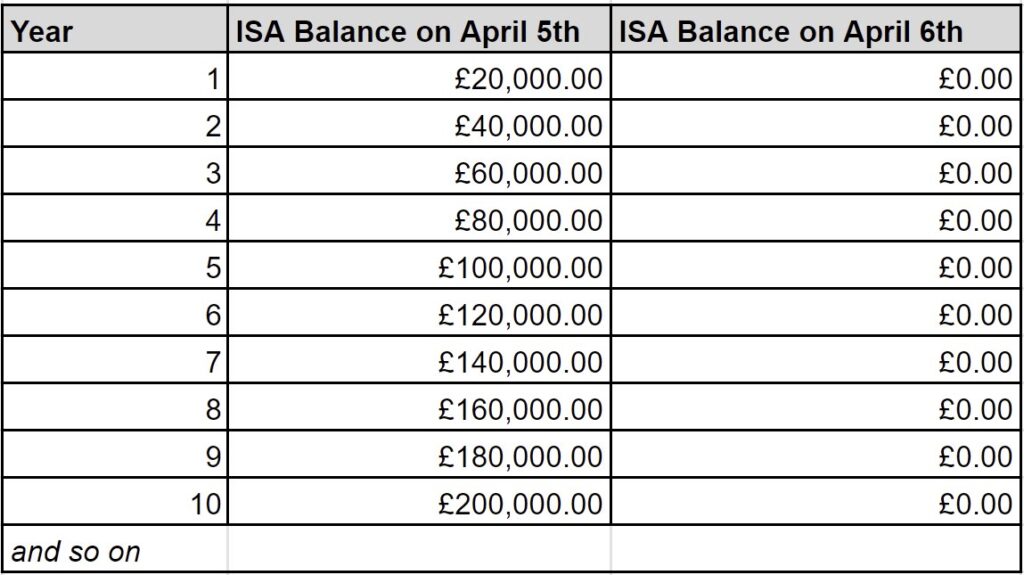

As somebody who got a mortgage because I couldn’t bear to spend the money I’d socked away in ISAs for this very purpose (okay, and to lose the tax wrapping) I can relate.

Anyone else found any leaks in their mental accounting buckets?

Let us know in the comments below.

From Monevator

The stock market is wilder than you think – Monevator

Get out of debt to unleash your inner money maker – Monevator

From the archive-ator: Why factor return premiums can be disappointing – Monevator

News

Note: Some links are Google search results – in PC/desktop view you can click to read the piece without being a paid subscriber. Try privacy/incognito mode to avoid cookies. Consider subscribing if you read them a lot!1

Brexit: ‘Very little progress’ in negotiations with the EU, UK says – Sky News

Coronavirus furlough scheme extended to end of October 2020 – Which?

UK scheme for self-employed signs up 440,000 workers on first day – Guardian

London congestion charge comes back Monday, with a price rise from 22 June – BBC

Opening of English housing market catches estate agents on the hop – Guardian

Housebuilding to fall by a third as construction sites reopen with strict distancing rules – ThisIsMoney

Seven out of ten dentists could go bust by the end of summer without state aid – ThisIsMoney

Strategists query sudden ‘sprint’ in US stocks. Bear rallies over the past 150 years have been gradual and often rocky, says SocGen [Search result] – FT

Products and services

Bounce back loans: How to apply for this helping hand from government – Much More With Less

Help to Buy ISAs vs Lifetime ISAs: which will get you on the property ladder first? – Which?

Mortgage rates drop to their lowest ever average level – ThisIsMoney

Sign-up to Freetrade via my link and we can both get a free share worth between £3 and £200 – Freetrade

Market-leading easy access savings rate slashed from 1.2% to 1.05% – ThisIsMoney

Homes with income potential [Gallery] – Guardian

Comment and opinion

Nothing fails quite like success in the stock market – A Wealth of Common Sense

Is it indefensible not to take out a pension? – Indeedably

Why liquid net worth is so important for your finances – Of Dollars and Data

The people who beat the stock market – Banker on FIRE

The Long Road to Financial Independence: Kat’s Journey – A Chat With Kat

The stock market is [not] ignoring the real economy – The Reformed Broker

Larry Swedroe: Is it really stocks for the long run? – The Evidence-based Investor

We need to talk about ergodicity – Behavioural Investment

Naughty corner: Active antics

Ichigo Ichie – All Star Charts

Can stocks and bonds both be right about this crisis and the global economy? – CNBC

Tips for stock pickers in a coronavirus world – UK Value Investor

A deep dive into the Herald Investment Trust – IT Investor

The stock picker who delivered a 2,550% return: Marlborough’s veteran UK small cap fund manager Giles Hargreave to step down after 22 years… – ThisIsMoney

…while Invesco dumps Woodford protege Mark Barnett after he fell 30% behind the market – ThisIsMoney

It could be a good time to buy Buffett’s lackluster Berkshire Hathaway – Tiho Brkan via Twitter

The illusion of alpha in active bond management – The Evidence-based Investor

Wall Street heavyweights sound the alarm about stock prices – Bloomberg

Why the most futuristic investor in tech wants to back society’s outcasts – The Hustle

Is (systematic) value investing dead? – AQR

Covid-19 corner

Where Covid-19 is rising and falling around the world… – Visual Capitalist…and up-to-date graphs of case rate rises and falls in different countries – End Coronavirus

The risks – know them – avoid them [Excellent] – Professor Erin Bromage

A summary of all the major vaccine and treatment contenders – CNBC

Covid-19 ‘R’ rate for various areas of England, compiled in real-time – PHE/Cambridge University

Public Health England approves Roche’s antibody test as accurate – Guardian & BBC

Without a vaccine, herd immunity won’t save us [Includes a cool interactive tool] – FiveThirtyEight

App shows promise in tracking new coronavirus cases, study finds – New York Times

‘Weird as hell’: the Covid-19 patients who have symptoms for months – Guardian

The co-morbidity question – The Actuary

Dutch official advice to single people: find a sex buddy for lockdown – Guardian

Kindle book bargains

The Basic Laws of Human Stupidity by Carlo Cipolla – £0.99 on Kindle

Digital Transformation: Survive and Thrive in an Era of Mass Extinction by Thomas Siebel – £0.99 on Kindle

Money: A User’s Guide by Laura Whateley – £0.99 on Kindle

The Hating Game [‘The very best book to self-isolate with’] by Sally Thorne – £0.99 on Kindle

Off our beat

“I got fired over Zoom” – The Atlantic

The virtual reality winter [On the technology] – Benedict Evans

How the coronavirus turned a pilot shortage into a surplus overnight – Abnormal Returns

And finally…

“The hungrier one becomes, the clearer one’s mind works— also the more sensitive one becomes to the odors of food.”

– George S. Clason, The Richest Man in Babylon

Like these links? Subscribe to get them every Friday!

- Note some articles can only be accessed through the search results if you’re using PC/desktop view (from mobile/tablet view they bring up the firewall/subscription page). To circumvent, switch your mobile browser to use the desktop view. On Chrome for Android: press the menu button followed by “Request Desktop Site”. [↩]

Comments on this entry are closed.

Pete the Planner – pure genius and something I’ve been guilty of before. The emergency savings are just that, but maybe not THIS emergency.

@TI – blogging complete by 10.30? A couple of weeks ago it was 7.30. Anybody would think you’ve nothing else to do…

Thanks as always for the links. I’ll have an explore now.

I wouldn’t trust myself not to default.

Had to borrow recently £15k and was embarrassed by the rates offered – I ended up with a double digit interest rate!

Loan paid off already within 2 weeks but I do wonder how my rate was not the 2.9% Apr (typical) that was advertised.

Wow, I can’t believe you featured my post, thanks! I looked at my stats this morning and didn’t know what hit me 🙂 I’ve been following your posts for a really long time, there’s always so much value here.

Pete’s article is great and I’m definitely reluctant to use my emergency fund. Seems anticlimactic after putting so much effort into building it up.

I think borrowing is a habit. If you never do it, then it doesn’t occur to you to start.

@Kat — You’re welcome, hope a few of your new visitors stick around. Glad you find our site helpful — thanks!

@Brod — Yes… I’m starting to wonder how life will be like when we fully leave lockdown! My usual life isn’t wildly different on any given hour, but there’s typical 4-8 more social meetings in it than presently, including most Friday nights something I’m late for due to Weekend Reading writing… 😉

Re: Brexit negotiations, if we were all fatigued with it before….

Remember last Summer/Autumn when there was the ongoing No-Deal saga, and many were stockpiling? (well, it did come in handy, at least, in the end!)

Well, this new chapter appears to be taking a very similar course. Adversarial, arrogant, hubristic – on whatever side you choose to denigrate.

But are the general population really going to be tolerant of having the threat of disrupted food chain supply again, a second time around and in the midst of ongoing challenges with COVID-19?

GBP/USD hasn’t collapsed again yet, so perhaps the markets think the current situation is all just bluff and bluster? Or perhaps they just can’t really believe we’d do anything so idiotic during a genuine crisis as self-inflict another one? How naive these markets are!

So, I don’t know. Does anyone feel that they could just possibly revert to being grown-ups? I just can’t see it though.

Loved Charlie Brooker’s antiviral wipe this week on BBC. A great satirical review of coronavirus news for anyone in need of a laugh.

“The stock market has also taken a battering. Some economists fear it may have set capitalism’s destruction of the planet back by up to ten years.”

Chris Whitty as “Tintin prematurely aged after watching his dog drown”

https://www.bbc.co.uk/programmes/m000j4bl

I liked the “Of Dollars and Data” post on liquid net worth. It goes back to a debate we had a while ago here on whether your home should be included in your assets or not, and explains my thinking better than I did at the time.

Liquid net worth is what you manage on a reasonable time horizon, and what is available to use in the short term. I don’t know the value of my home, and can’t access it quickly. It is obviously an asset, and is for example included in my will, but is not a number on my spreadsheet because it is (probably) big and distorting, and does not help me make decisions about the rest of my assets and spending plans.

So yeah, liquid net worth is a useful distinction for me.

@Far_wide. Yes, it is off the front pages, but the Brexit clock keeps ticking. If there was any real desire for a ‘good’ trade deal with the EU, you would think that people would recognise that an extension is essential while we (all of us) deal with coronavirus. But apparently macho posturing is the order of the day. When the tactics are so much at odds with the claimed desired outcome of the negotiations, it is hard to understand what they are playing at.

Obviously the big brains are working at a level way too subtle for me.

@old_eyes , yes, I’m not even petitioning for a common sense deal, just an end to the posturing. Yet, I have a horrible suspicion we’re in for a ‘Brexit bingo v2.0’ at some point.

“With this virus, Germany needs us to buy their cars more than ever” etc

When it resumes, I’m going to follow my strategy of reading the bare minimum to stay abreast, and unfollowing anyone on social media who talks about it frequently. That did my sanity no end of good last year, after reading countless “Can you believe X said that?” type things.

The one possible salvation on that front is that the Conservatives have been thus far keen to keep it off the front pages (no election, no point I guess, plus of course Brexit is already ‘done’). But if they continue down this line, that’s not really going to be achievable.

Depends what you call an emergency, if you lose work and have to tide yourself over, then you have no choice – i was eyeing up my wedding savings when my work was at risk due to health in 2018 (saved by new medication), but I could survive without a car, boiler, etc – and if you lose work totally you should be entitled to free council tax and food bank, so really for bare bones needs its just about paying the mortgage if UC &food bank &council tax benefit wont do it

I’m paying down my 0% cards now for credit rating going into a new mortgage soon, it’s not free if it costs your rating, although its worth having the liquidity

An offset mortgage works for me. In effect in provides a flexible source of liquidity for all sorts of reasons including (ahem) leveraged investment.

As always, a highly enjoyable read and a great selection of articles. I’ve been following your blog for a long time now so it’s extra special to be included on the list.

On a separate note, I’ve received a few pingbacks on my blog from websites that seem to be scraping your content. Very disappointing – shoot me an email and I’ll send you the links. Think there may be a way to take them down.

@ TI – thanks very much for posting this one: https://www.erinbromage.com/post/the-risks-know-them-avoid-them

Extremely helpful to know. Confirms that I am going nowhere near the office for a while, means we can be less neurotic about the supermarket (maybe) and Mrs Accumulator can stop being worried about being overtaken by zippier cyclists.

Liked seeing an article about ergodicity. Commentators have really bought into a whole bunch of guff about rational agents, efficient market hypothesis, risk-neutrality etc without ever really considering that many of these idea rest on dubious assumptions of orthodox economics. When these ideas are challenged, people rapidly argue it’s behavioural “irrationality” when actually it’s the theory assuming the system is ergodic when the reality is that it’s not. It’s manifests itself so consistently in the inherent probability distributions investors assign to various scenarios. Tail too high, centre too high, mid-wing too low etc. Long may it continue!

@ZXSpectrum48K

Yes, I enjoyed the ergodicity article. I had come across the topic in signal processing, but was not aware of its use in economics. It makes a lot of sense and explains why rational behaviour for an individual is not necessarily the same as for a large group.

I have periodically tried to make sense of classical economics, but every time I end up metaphorically throwing the book against the wall and shouting “but people!”. It seems to me that in a desperate desire to be a proper science (you know with laws and equations and everything), some economists have decided that the problem is that reality does not accord to their models and should be changed.

In real science, we are accustomed to our models being wrong and deploy them carefully. As G E P Box said, “All models are wrong, but some are useful”. We joke about saying “consider a spherical cow” because it is important to know when you have made a gross simplification and what the implications might be.

Like @nearlyrich I have an offset mortgage which correctly or incorrectly I treat as our emergency fund. It also raises the interesting question of what represents good debt, as I think discussed on this site last week

Fully drawn it would represent LTV of around 30% based on my depressed estimate of primary residence value. It’s a tracker at 1.5% /base and expires in 2029. I drew down a third of it in March just in case the lender (HSBC) had liquidity problems.

I have a 70/30 portfolio (the bond element is nearer 35% if based on the ringfenced equities I hope we can leave to the kids).

I often wonder why I have bonds in my portfolio when the offset gives me 5+ years of emergency funds if all other income sources dried up. There is also the issue of the fact that the risk on the bonds is correlated with mortgage risk (interest rates).

Would be very interested to find out what others thought particularly the (lucky?) others with an offset.

Always great to read Monevator articles and the erudite comments by other readers – thanks.

I was fired over Zoom recently too. Tip: if you join an all-hands and Zoom is in presenter mode so you can’t see the other participants.. be afraid!

It is hugely disappointing and frustrating. There was no consideration of other measures to avoid layoffs at this uniquely terrible time in history, no pay reduction or even furlough with health insurance, they just picked 1 in 5 to be sacrificed and the rest remain whole. /vent

Compare to the previous round of layoffs a year ago. It was unpleasant but it was not long before those who left were happily talking about all the job offers they had received, with easily negotiated higher salaries and often a title advancement.

Now, it’s a different world. The lucky ones will quickly find a job comparable to their last. The unlucky ones will go backward and take a long time to recover. The emergency fund is currently being drawn on, by necessity, for rent and groceries.

You missed the Indy was panicking food prices would go down and effect farmers due to brexit ( quite the difference to what we were promised by remain during the campaign and your studies about the benefits of trading with those just around you )

Also missed Nissan is considering shutting their Barcelona plant and moving production to Sunderland… doesn’t fit the narrative that the single market is valuable i suppose

Be lovely in three or four years time when the Eurozone is trying to come out of this latest recession and U.K., japan , US and the rest are growing again… lot of hard brexiteers going to be able to say ‘If membership of the single market is so valuable why is it so many members of the single market are doing so badly’

Oh hang on, we’ve been saying that since summer 2016

This recent govt. viral update – https://www.youtube.com/watch?v=TzriCFzM5Ys

doesn’t seem terrifying and in any way a justification for lockdown(s). As for the oft-cited distraction point of ‘profit over lives’, well, economic suicide leads to all manner of social ills that end in the destruction of lives anyway.

It is broadly this principle that makes credit unions so successful. You save (which can include payroll deduction to force a regular savings habit) and then when you need money, you borrow against it. It is true that you will pay interest on it, but usually less than if you didn’t have savings, and it allows you to compartmentalise your savings and expenditure.

The successful credit unions also pay a dividend on savings balances. My own pays 0.80%, which is close to being a best-buy rate for instant access.

@johnathan m – I don’t really get what is good about credit unions – if you’re paying interest for the privelege of borrowing your own money, what is superior about that? You could borrow unsecured at 40% or so which’d be cheaper than a payday lender, but not cheaper than a standard bank – if someone went to payday lenders because of poor credit, should they be lent money at all? And if they went to payday lenders because they saw a flashy ad on TV, how can a credit union beat that?

0.8% on savings isnt bad if it’s a permanent rate – again not market leading but not the pits if someone wasn’t shopping around

Thanks TI – bueno selection!

I’m glad to see as well that the media is starting to report more on the struggles of coronavirus.

“There is growing evidence that the virus causes a far greater array of symptoms than was previously understood. And that its effects can be agonisingly prolonged: in Garner’s case for more than seven weeks.”

I too have been in this group, relapsing 4 times, whilst just being confined to the house (bought air filters, plants and dose up on vitamins, plus scrub the house daily). This experience isn’t so dissimilar to a colleague of mine who operates abroad and was the first at our firm to fall sick. I get the economy needs to open, but more should be done to present the known facts about the disease to the public and more should be done to make busy places safe, cleaning streets, handing out ppe at stations…. etc…. there’s a lot more deaths to come… stay safe!

@merlotman 65:35 me too! I struggle to categorise my offset but I do know it’s a very useful facility to have available. It’s certainly a leverage if only because it avoids having to hold cash in one’s portfolio and at those easily serviceable tracker rates (1% over base in my case) it would be rude not to. In my case it’s a debt secured against my house and invested across my 65:35. If I hold it until I eventually sell up/downsize then you could say it’s an equity release and an argument for considering my main residence as part of my portfolio …but I don’t. Nor do I by the way consider the annuity I receive as (bond) component of my portfolio but I should because I had the option to transfer instead. In your case you could consider your offset as your ‘dry powder’ for rebalancing as well as your emergency fund. I’ll not complicate matters by mentioning gold, but certainly a bit of both worlds with the offset used alongside your bonds would enhance the diversification in your portfolio so perhaps the answer is a ‘Bernstein-style’ 50:50?

@Blimp More than a narrative! The Single Market is very valuable. Nissan are being forced into moves they hate namely to try and sell more tariff-free Sunderland cars in the UK and more tariff-free Renaults in the single market. All being planned and forced against a back-drop of a trade deal uncertainty i.e. which end of year does Boris mean. Let’s hope for the sake of Sunderland jobs they increase their UK market share sufficiently.

Thanks for the Erin Bromate link. Really good.

Not sure I am much atuned to ergodicity. Are processes stationary is more of a concern when studies look at back testing then project a probability for future outcomes.

“Be lovely in three or four years time when the Eurozone is trying to come out of this latest recession and U.K., japan , US and the rest are growing again…”

@BBlimp you do realise the UK isn’t and has never been in the Eurozone.

@Vanguardfan. It’s worse than that for me. Not on lying do I hesitate to borrow from the rain day fund. I hesitate to use the toilet roll and chilli con carne from the stockpile.

@bob – re food, i think this crisis proves that we’re pretty much not going to have zero food in the supermarket in any concievable crisis, and that rationing helps, at most just keep the food you’ll need for quarantine

I came close to running out of bog roll and was unable to buy it for 3 weeks, so I take that to be approx the necessary stockpile, but in the Olden Days(tm) they used newspaper and managed, or could use a flannel – if you didn’t have toilet paper it might be gross but it’s not death

It may be worth keeping a petrol can too for different crises, as long as it doesnt spoil(?)

Re rainy day fund, consider what you would call a “rainy day”, if it really is rarely needed you might consider filling its place with unused cards, or consider the opportunity cost of cash vs what loss you might be willing to take on it if you hypothetically invested it – credit with it’s set cost can in a way put a cap on what hypothetical maximum losses you might experience if in the worst case you need the money during a crash

I enjoyed this youtube rant of an interview with David Starkey. Suppose it depends which side of the fence you sit on. https://www.youtube.com/watch?v=8S8Js-tEmlg

Jim – The side of sanity, which is the same side he is on 🙂

Re: @Merlotman (and @nearlyrich)

Similar query here from the opposite starting point, I have no bonds currently in my portfolio and considering swapping some of my offset mortgage savings for bonds. Between my offset mortgage savings and smaller amounts in various other accessible cash accounts I have the amount needed for emergencies plus non-equity portion of my portfolio (72/28%).

To date I’ve never held bonds, mainly through not really understanding them, and when I’ve tried to educate myself I came to the conclusion of why not ust hold cash (despite the various Monevator articles on the subject). Looking again today I still can’t see the point even though everyone says you should hold bonds (bonds are not cash). Not sure if I’m reading the data right but UK (nominal?) bond yields seem to be no higher than 0.64% (http://www.worldgovernmentbonds.com/country/united-kingdom/) and even 6 months ago were no higher than 1.3%, in comparison with my offset mortgage which is 2.05%. What am I missing? Can anybody educate me?

(offset mortgage is fixed for another 3 years so perhaps the recent ‘good debt’ conversation is applicable for what would happen when that ends).

I’m fine with borrowing and lending from myself, but perhaps I’m unusual in having been a money market trader in a previous life. I’m only doing it in a small way – lending my personal money into the interest only current account mortgage for a nice tax free return. Tax gets in the way of me doing this on any scale – I’ve got money built up in my limited company that will stay there until I close it down. I’ve got money built up in my SIPP which I could use to pay off my interest only mortgage but I choose not to.

@Far_wide (7), actually GBP has deteriorated recently against USD and EUR, in direct proportion to no deal uncertainty and that risk escalating.

@Learner (19) trust you’re aware of what employment rights you may have, aside from notice. If 20+ redundancies, collective consultation was required. If 2 years’ service (or 1 dependent on start date), unfair dismissal. What you describe may not meet fair redundancy requirements including selection, consultation and consideration of alternatives. An additional factor is an employer needs to demonstrate why it chose redundancy without furloughing. They’d arguably need to show the job cuts would only be delayed not avoided by furlough. A factual question they’d have needed to assess and communicate their reasoning to staff in the consultation. Good luck.

@Ian (34) your post about bonds reflects exactly one I posted here several months ago. I still don’t understand them sufficiently, unlike equities and funds, active versus passive etc, although I have a basic grasp from reading here and elsewhere. But, I decided recently, in spite of my uncomfortable lack of comprehension, to follow the orthodox advice of buying a UK gilts (Vanguard) tracker and I’ll continue to add that water to my whisky. Plus I would expect ongoing equity market volatility. I also noted there are differing views on whether to get inflation linked ones or not. So I was comfortable to toss a coin on that, as that was as likely to be right as taking a more informed view (imo). But I fully expect UK gilt prices will probably now fall (!)

@Jim @Algernond — I’m not secretly David Starkey, but based on that interview I’d be happy to be mistaken for him. He’s quite right throughout.

If I’m reading some of the comments right, people take out mortgages to buy stocks?

This makes them fragile to an economic downturn such as now, that simultaneously affects house prices, job security, ability to re-mortgage, and stock markets. Limited upside, potential catastrophic downside. Anyone considering this may want to read Nassim Taleb’s books and then think again.

Re bonds, they hardly yield as much as mortgage interest (and if they do, then it is a reflection of risk). Why would one *pay* to take rate risk and default risk?

I do see the sense in taking out a generous cash buffer. Liquidity is underrated imo.

In addition to each individual’s resources and commitments, it is worth occasionally reminding ourselves of one factor determining perceptions of financial safety, namely personality and psychology. It can be a spectrum from those 100% in shares to the others solely in cash, safe government bonds or gold to hoarders of bags of rice and shotgun shells. It is, of course, risk tolerance and we are all somewhere on that axis. Our position, like our personalities, doesn’t change all that much with the state of the markets. There is really no right or wrong in any approach and what seems prudent to some may appear reckless to others. We should remind ourselves of this when evaluating “ideal” recommendations which seem to abound at the moment.

Just saying.

TP2.

Re risk tollerance I think theres a difference between how much risk someone can stomach and how much risk they can survive – you may be horrified seeing a huge pot girate wildly but if it’s not needed anytime soon it may be ok, the oft quoted opposite would be a cashflow problem for an otherwise strong stomach

I think it helps to put things into pots mentally – I have different risk levels for different things

And it helps to be flexible, to have a plan b, to be willing to work longer if necessary or live on less if necessary. We do only get 1 life and it might feel then that we can’t afford to stake that on the offchance of not getting an average result, so risk above & beyond capital preservation is a sign of desperation/not being rich enough already to not need that risk

On the other hand, if you’re rich you might simply enjoy making money for sport/ego and not be in the business of capital preservation

@Sparschwein (@Tony, @Ian, @Merlotman)

I understand your concerns re financing stocks with debt and it’s good stuff from Nassim Taleb. However there is a case for gearing/leverage in the right circumstances and that for me includes a cast iron ability to service (or repay) the debt whatever events may bring plus attractive borrowing costs. I’d also highlight the interesting work by Demonetized on the leveraged Permanent Portfolio.

I am certainly not advocating the use of an offset to finance short-term bonds; just the opposite in fact because it’s a better return to leave your cash offset. I’m suggesting an offset mortgage, which is a bit like a large overdraft, can be used as an emergency, but serviceable cash facility so avoiding the need to hold a cash buffer,or short term bonds which are often equated to cash anyway. Long bonds are a different matter and deserve their place in a portfolio for their ability to zig when stocks zag as The Accumulator demonstrated in his recent article. They definitely do not equal cash. The UK Gilts Vanguard fund VGOV is pretty long in my book by the way with a duration of about 12 years.

Slightly off-topic for this week.

I noted this from Monevator on 06/01/2018:

“And finally…

“A mighty bubble of wealth is blown before our eyes, as empty, as transient, as contradictory to the laws of solid material, as confuted by every circumstance of actual condition, as any other bubble which man or child ever blew before.”

– Edward Chancellor, Devil Take the Hindmost”

Finally got around to buying it, and eventually finished it yesterday.

Dense, but an excellent read as he ranges from markets in slaves in the Roman Empire through tulipmania and the South-Sea Bubble to railway manias, the Great Depression and up to the Long Term Capital Management debacle. It finishes in 1998 so misses the dot.com bust, Enron and the global financial crisis, but is nevertheless worth following.

What you learn is that people don’t change much, herd behaviour is always ready to break out, and ‘cleverness’ is frequently fatal. It is always true that ‘this time it is different’! The capacity for self-delusion is ever-present and a warning to those of us who think we are being rational. The same mistakes crop up over and over again, made by the same people for the same reasons. The wrapper and presentation may change, the complexity more compelling, but he draws many parallels between the complex derivatives of today and some of the ‘interesting’ products on offer centuries ago.

Definitely recommended.

@Tony Edgecome … I guess that’s why my comment was discussing the value of single market membership and not eurozone membership.

That must have passed you by…a bit like the Nissan story and declining food price stories. It’s a good time to believe in hard brexit, but not half as good as it will be in 2025, don’t worry, I’ll be back to compare our performance with the eurozone at that time 😉

@Nearlyrich – You seem to know very well what you’re doing. No doubt this makes sense for you and has some advantages, e.g. diversification and reduced cash buffer. The key phrase being

> a cast iron ability to service (or repay) the debt whatever events may bring

People tend to overestimate their job security. Many buy into the narrative that “stocks always go up” while few understand risk. For the average reader, stock investment on margin may be financial Russian roulette. (Back to the ergodicity article…)

The David Starkey link is great, hard to disagree with much – thanks for sharing.

I see the pound is under pressure again now people are focussing on the omni-shambles that is brexit (I’m no hard core remainer fwiw) coupled with us possibly being more affected than some other countries due to the service nature of the economy and our current account structural deficit. Somewhat not on topic but related to some of the comments – I keep a sterling mortgage and also keep the bulk of our liquidity in gold and $ TIPS beyond some sterling cash given I have a perma bear view on sterling outlook. Somewhat validated when David Davies gave an interview a while ago saying how sterling depreciation was the way forward to offset competitive friction from leaving the single market. Yup, I suppose if I offer to cut my salary by 20% my employer will see me as more valuable too. Just so happens I’ll be 20% poorer though but let’s keep that on the back burner shall we.

We’ll muddle through this in spite of the current crop of politicians who are as bad as ever seen on all parts of house but I suspect in a few years time the UK’s positioning relative globally will have declined further…hence the diversification away from £. But I don’t know of course.

Sparschewin comment is bang on the money. It’s worthwhile thinking about your finances from a what if scenario both positive and negative, associated likelihoods – recognising we generally think tail events are less likely to happen than they are and try to position accordingly to cover the bases if you can – what if i lose my job, what if things go well in the global economy, what if the UK economy goes down the gurgler, what if tech companies don’t continue to outperform, what if tech companies do continue to outperform, what if value never comes back or does, what if bonds fall over, what if rates go really negative, what if my partner dies, what if my partner lives to >100 etc etc etc.

@seeking FIRE 46

The answer to all those what if’s is ‘work till you drop’. Assuming you can. There is no silver bullet that can shoot every problem in the world. Preserving optionality and resilience always come at a cost. In the FIRE universe, that cost usually translates into ‘working longer’

@nearlyrich @Tony @Sparschwein @Ian

So to the question of why I hold bonds when I have an adequate emergency fund available via an offset for my part it is because 1. I am looking for bonds as a hedge for when equities lurch down again (start of Q2 reporting season my guess) and I might sell some bonds at this stage 2. I didn’t want to move cash out of ISAs /SIPPS because I want to keep the tax shelter, didn’t want to increase equity exposure but wanted at least some sort of return 3. I want to have a mortgage albeit manageable for IHT planning.

Nevertheless I am wary of bonds in the longer term particularly given where interest rates are currently.

@Tony (#36) Thanks – excellent info and useful summary for the UK (and EU?), hope others are aware. Unfortunately, like the Atlantic author, I’m in the US now where no such protections exist. Glorious freedom eh.

@all — Thanks for the solid comments this weekend! Been reading (/checking!) but having a break from the discussion this weekend.

@Grand — Sorry to hear about your troubles, sounds a right pain. Hope you get permanently better soon.

I’ve started to wonder this weekend if I’m getting recurring Covid-19 symptoms. As I’ve discussed before, I believe I probably had the virus in late Feb / early March. My symptoms were a sore throat that persisted for a couple of weeks (very rare for me), several days of headaches equally rare, thankfully), and a couple of days of tiredness where I even had to sit on a wall for five minutes to regain my strength in the middle of a 40-minute walk (for context as recently as last summer I did multiple 2-4 hour hikes over rough ground without stopping once).

The sore throat / headaches were ‘funny’, they didn’t feel like they normally do for me, to the extent I even mentioned it to people. At the time I wasn’t thinking Covid-19 though. It was only towards mid-late March when I got a sense of how rampant the infection had already been that I realized that was probably it.

I’ve had the sore throat 2-3 times since then. It’s been back for 3-4 days now. Also had a headache out of nowhere last weekend.

I’m not convinced it’s still Covid-19 (and it’s not a big deal, presuming it eventually goes away and isn’t a sign of worse underlying) but does make me wonder!

This is a deeply thoughtful article on the future of our economy from a casualty actuary, working in insurance forecasting: https://ourfiniteworld.com/2020/05/13/understanding-our-pandemic-economy-predicament/

The whole thing is fascinating, but 3 broad points jump out in conclusion. Despite all the spin in the world, the global economy runs on surplus energy and growth is only possible with a continuous supply. We had a comparable pandemic within living memory, the global response was radically different and with the benefit of hindsight, we therefore already know what the first response results in.

Finally, the economy and our lifestyles are in irreversible transition towards simplicity, (probably back to something our grandparents would recognise) mindless consumption and systems designed to waste for maximum profit being no longer a sustainable option.

That article FI Warrior, links to the interesting Thomas Meunier pre-print paper. There is a comment in that paper at the end.

“As a concluding remark, it should be pointed out that, since the full lockdown strategies are shown to have no impact on the epidemic’s slowdown, one should consider their potentially high inherent death toll as a net loss of human lives”

Certainly looking at the UK data it looks like R0 (or more accurately Re) was already below 1 before 23rd March. Thomas Meunier’s analysis, through just looking at the data, is essentially that not only had R fallen below 1 before the full lockdown, but that full lockdown had no impact on further reducing R in a number of countries.

I read a lot of people saying the lockdown worked in the UK, because ‘it obviously worked’ or because ‘the number of deaths has reduced’, or ‘the NHS wasn’t overrun’, but these statements are all assumptions, and not data driven arguments because we haven’t compared what happened with what would have happened if there had been no lockdown.

At the simplest level the UK lockdown was on 23rd March and the death peak was 16 days later on 8th April*. The period from infection to death is on average perhaps 21 days, arguably slightly more, I’m struggling to find good UK data here. And so R0 was below 1 before 23rd March it appears. And if lockdown had added anything then you would expect deaths to fall away much more quickly some time after 13th April (23rd March + 21 days). Note the fall away might be delayed after 13th April, because of secondary infections within households, but it isn’t obviously visible at any point.

This isn’t a point about whether the lockdown decision was a ‘mistake’, it is about whether the lockdown with the benefit of hindsight added anything. I think the answer to that informs policy going forward. I’m not saying absolutely lockdown didn’t add anything, but I am asking for a data driven argument that it did add something.

So I’m still wondering if anyone has any UK data to show that the lockdown did add anything to the behavioural changes and distancing measures etc that had already taken place before 23rd March?

* Hospital covid-19 deaths in England clearly peaked on 8th April, care home covid-19 deaths taken on their own peaked a bit later, but overall covid-19 deaths peaked on 8th April.

UK covid-19 hospital deaths for England see “COVID 19 total announced deaths 17 May 2020” at

https://www.england.nhs.uk/statistics/statistical-work-areas/covid-19-daily-deaths/

Ermine. You are right of course. One almost fail safe way to immunise all those risks is to work until grim reaper minus one day, another way is to have a very conservative withdrawal rate (think <2% in your 40's, 6% in your 80's etc). I was thinking less about removing risks and more about managing risks down to a sensible level without impinging to hard on your current or future self. So for most financial risks (a) a globally diversified equity index (b) a globally diversified bond index (c) cash in your current currency (d) gold (e) proper consideration as to where you place those assets in custody can provide incomplete but good enough solutions to these risks. With the objective not to maximise wealth but minimise risk of running out of money, which is related to wealth of course – the downside of being on the street outweighs the upside of a more expensive glass of wine!

Sounds obvious but I continue to be surprised by the number of people who have large incomes / expenditures and no safety net, people saving for their retirement all in bonds, people holding all their savings in sterling, people not buying a house to immunise rental risk, people not managing their lifestyle to their expenditure, people having all equities in income funds, people thinking the country they live in is a risk free place to be etc etc etc.

@Snowman, I have noticed that too.

The data the government love showing on transport use (largely a proxy rather than direct indication of infection) is quite clear that people were changing their behaviour hugely the week before lockdown. Given that the epidemic was largely driven by London infections at that point, I wonder if reduced underground travel had a disproportionate influence on national transmission numbers and subsequent changes were much less.

Elsewhere in the country the peak was slightly later than 8th April. And in a graph combining NHS data (England) with deaths outside hospitals, although the highest single number fell on 8th April if a smooth curve was constructed it would peak around 5-6 days later. (I looked at https://www.cebm.net/covid-19/covid-19-death-data-in-england-update-15th-may/ for this).

Going back to your point, it seems clear that not all of the restrictions on normal life have equal effect. It seems likely that people being close packed for significant periods on public transport was a big driver of infection, and probably other crowded indoor activities were similar (pubs, nightclubs). But unpicking the differences seems largely to come down to informed guesswork, though the public health professionals may have some other sources of information. It is almost certainly true that 75% of restrictions could be relaxed without a huge infection surge, but with so many of the public frankly being scared (see parents and teachers) the government needs to back up any decision with convincing data.

And on top of that is the suspicion, voiced here by @TI, that uncounted mild infections may mean that enough of the country is immune (in London at least) for transmission rates to be much more easily controllable than they were in March.

The issue with Starkey is that he is assigning the bulk of the economic damage to the lockdown. I see no quantitiative evidence of that. Global economic activity was falling since China admitted they had an issue in mid-Jan. It was decelerating rapidly well prior the UK implementing it’s lockdown on Mar 23. Behaviour had already changed, most other countries had already implemented lockdowns. Moreover, places that didn’t implement lockdowns (like Sweden) are showing just as much economic damage as those that did.

I’m not implying that the lockdown isn’t doing additional excess damage: perhaps an extra 20%. Nonetheless, the narrative being peddled by the libertarian right, that the recession, unemployment etc is being caused by the lockdown, is a nonsense. The recession is simply is due to the pandemic. It was unavoidable. We’ve had over a decade since the last recession. We were overdue and it just needed a trigger. The right just doesn’t like the fact that it’s on their watch and they are trying to find something/someone to blame.

@Snowman, @Jonathan,

Good points made by both of you. However, the ONS stats for the number of excess deaths for the week ending 1st May is 8000. Looking at the daily death trend of Covid-related deaths for the UK it does look as if it is on a downward path and perhaps running at 2/3 the rate of late April. So let’s assume that the current weekly excess death rate for England and Wales is 5000. That equates to 250,000 per year. Does anyone believe that lockdown is causing an increase in net deaths of 5000 per week?

In support of what you both are saying, I adduce this report from the Guardian about the measures introduced on 16th March -https://www.theguardian.com/world/2020/mar/16/what-basis-government-coronavirus-measures . My point is to remind folk that the March 16th government exhortations were extensive and powerful and that date is 23 days prior to 8th April.

Finally, a comment on this year’s deficit which the OBR is forecasting will exceed 15% of GBP. For a historical comparison, it was around 7% in 1975/6, slightly higher in 1993/4 and 11% in 2009/10. Time taken to reduce to zero was 11, 5 and 8 years respectively.

@Jonathan

That’s a great data link, thanks. And so refreshing to see a proper discussion based on the data.

Looks like all those graphs are deaths by date of death, rather than the date the death is recorded, which makes what’s going on so much easier to see.

Are they still using those deaths by recording date and making daft comments about that silly 7 day average line at the press briefings? How can you possibly work out when deaths peaked by seeing their graphs.

If you look at how reporting delays have changed over time you further realise how silly their briefing graph and the daily hospital death figure is; the (England component of) hospital deaths reported on 7th May occurred on average 11 days previously, whereas the deaths reported yesterday took place on average 2 days previously.

The red and blue graph with the NHS and additional ONS covid-19 deaths should definitely be shown at the briefings. OK it’s England data, but you can have some UK graphs also.

Are they genuinely interested in giving clear information to us at the briefings, I don’t know. But expecting us to believe based on ‘faith’ that they know what they are talking about, and failing to publish the data they are using to make decisions, doesn’t work with me.

I’m certainly hopeful that immunity in London is sufficient to really materially have an affect on controlling things there whatever measures are relaxed.

And I think a seasonal affect, which I hypothesise may help us in the coming months, isn’t talked about enough as something affecting R. Look at the data from other countries, it’s unclear and multi-factorial but temperature, humidity, changes to outdoor levels and vitamin D levels in some combination appears to be relevant.

In South Cumbria we appear to have one of the highest rates in the country of people who have seen the virus outside London. I think spread may have started very early here, but there aren’t the mass transit issues so that may be why London has overtaken us some time ago (?)

Irrelevant trivia – David Starkey is from South Cumbria and went to Kendal Grammar school.

@ ZXSpectrum48K

‘Nonetheless, the narrative being peddled by the libertarian right, that the recession, unemployment etc is being caused by the lockdown, is a nonsense. The recession is simply is due to the pandemic. It was unavoidable.’

I don’t follow. In a year with a bad ‘flu season we can expect maybe 20,000 deaths in excess of the annual average of 600,000. This doesn’t cause us or anyone else to suffer a savage recession, so why would 35,000 excess covid deaths have that effect? The global slowdown that predated our lockdown was surely caused by other countries imposing lockdowns; Sweden’s economy is suffering surely because all their trading partners have chosen to smash their economies into a brick wall. If (and it is a big if) going about our business as normal would ultimately make no real difference to the overall number of deaths – and everyone knew this and so hadn’t changed their economic behaviour – why would anyone, anywhere be in recession? Or am I misunderstanding your point?

@Mousecatcher. High frequency European/US/UK data, all prior to their lockdowns, shows that their economies were already contracting from a massive collapse in aggregate demand. That was added to an already baked in supply shock out of Asia. Your concept that people were going about business as normal is simply not true. Businesses and households didn’t wait for the government to impose lockdowns. Instead they were radically altering their behaviour based on risk version, fear, panic, uncertainty etc.

The lockdown is not to blame for the recession. No one is to blame. A pandemic is a major exogenous shock. In a shock you get all the same symptoms, almost irrespective of the cause. Major risk aversion, velocity of money to a standstill, capex stops, credit is not rolled over, supply chains breakdown, aggregate consumption collapses. It leads to recession and lost jobs. End of.

So I have no idea why everyone is acting surprised about the economic damage and trying to reassign blame to the lockdown. The chain of damage was baked in from, at the latest, mid Feb. This has to be the easiest trade to profit from since 2Q13, 1Q09 or early 08. The market offered you 10:1 or 20:1. All time low implied vol, the market totally over it’s skis, still blindly BTFD on every risky asset, while staring at an abyss. And they say the market’s efficient. The only thing that has saved most risk assets is unprecedented co-ordinated monetary and fiscal action.

@Snowman, I tend to follow that website for the data simply because it is based on date of death. It does mean the last week is likely to be revised upward quite a bit; downsides are it is only England and the “other location” data isn’t released daily, so although the Oxford group update the NHS England graph daily the all location graph tends to lag.

I have become less optimistic about the rate of infections naturally reducing in summer, outbreaks so far have little relationship to location and an attempt to look for a correlation with latitude found only a fairly weak effect (https://www.cebm.net/covid-19/effect-of-latitude-on-covid-19/). There are enthusiasts for a vitamin D theory but the USA (where there is supplementation of milk) doesn’t seem to have benefitted. It could be that the main benefit of warmer weather is simply people spending more of their time outside where airborn virus dissipates much better.

Re economic damage being blamed on the lockdown. Covid-19 reporting is so politically charged that we’re better off reading the original studies. Here’s one from Uni Copenhagen comparing consumer spending in Denmark and Sweden.

“Denmark and Sweden were similarly exposed to the pandemic but only

Denmark imposed significant restrictions on social and economic activities. We estimate

that aggregate spending dropped by around 25 percent in Sweden and, as a result of

the shutdown, by 4 additional percentage points in Denmark. This implies that most of

the economic contraction is caused by the virus itself and occurs regardless of whether

governments mandate social distancing or not.”

The not-yet peer-reviewed manuscript is here

https://www.nielsjohannesen.net/

Sweden has a much higher Covid-19 death rate than their neighbours with more stringent lockdown policies. Sweden (much like the UK) got the worst of both worlds: many avoidable deaths AND similar damage to the economy as countries with better policies.

@ Sparschwein – but maybe Sweden will emerge from the ordeal faster having pursued lock down lite? Just postulating – the hospitality sector is interesting – in Sweden everything remained open as we know but people generally went to bars and restaurants a lot less and just behaved with a bit of common sense. Just say, for the sake of argument, that restaurant covers dropped from 80% to 30%. Getting them back to 80% sounds like it’s just a question of confidence – the bars have been open, presumably keeping their head above water financially and will likely recover. Contrast that with the strategy in this country – bars went from say 80% to zero, the population were not regarded as capable of behaving with any common sense and we were, and continue to be, bombarded with messages to the effect that COVID -19 is not far off the black death. When the lock down is eventually relaxed and the bars reopen getting occupancy even back to 30% could take a good while – the messaging will have to be completely different and 80% occupancy sounds a very long way away. One suspects an awful lot won’t even bother reopening, there will be casualties all along the way, and permanent economic destruction will be higher here than in Sweden. But what do I know, I just want to go for a pint.

Separately – with the comments in the press today about the possibility of negative interest rates, a chance of a Noddy’s guide to what it means for a passive investors fixed interest allocation? @ ZK Spectrum – hint hint!

Latest UnHerd video: Professor Karol Sikora: fear is more deadly than the virus

https://www.youtube.com/watch?v=uk2YZfnsOPg&feature=emb_logo

(sorry put this it on the wrong post originally, but it’s a must watch)

Very interesting couple of days of news in treating Covid-19.

Firstly, several medical types I know are getting excited about a stronger connection with blood clots that was previously understood in people who ultimately die of the infection. As I understand it, the excitement isn’t so much that this is news (there’s been talk of blood clots for weeks) but that it’s very easy to treat, as it’s a protocol known in all hospitals etc. (For a start there are drugs, obviously, but also standard protocols used to stop bed-ridden patients getting clots etc).

Secondly, a US company, Moderna, has had a pretty successful first trial of a vaccine in humans, which the markets seemingly went gaga over today (although there’s a lot going on there, too, including Fed comments and an oil price recovery, and the US seemingly coming out of lockdown).

Here’s a link:

“The people who were given Moderna Inc.’s coronavirus vaccine candidate in a Phase 1 clinical trial developed neutralizing antibodies, a promising finding that has propelled the vaccine into the next phase of clinical testing.”

https://www.marketwatch.com/story/modernas-stock-soars-on-compelling-early-data-for-its-coronavirus-vaccine-candidate-2020-05-18

Some interesting comments on the challenge of fighting the right amount of circulating infection in that article, too.

Regarding Sweden, recessions, and full lockdown versus what we had just before full lockdown, I agree with everyone. It’s clear that people were isolating before they were forced to. And the global economy was indeed already slowing — most have forgotten it now but the disruption from China’s situation alone was expected to cause problems. On the other hand there were growth kickers coming, potentially, too, such as the unwinding of some of the China / US trade tensions and tariffs etc.

We also have to factor in for instance a short ‘effective’ harder lockdown (in quotes depending on how much you think full lockdown achieves) versus perhaps a more protracted softer lockdown. There’s not much curve flattening in evidence in Sweden, it seems, so far. Maybe they’ll be in limbo indefinitely?

Set against that you have the comments from Sweden, our own Whitty, and many others, that we can only really tell what worked when we add everything up at the end. Sweden’s scientists believe most countries will end up with a similar number of deaths, to oversimplify, from repeated waves. (Of course faster-than-anticipated treatments could hit that thesis).

Regarding the ‘imported recession’ syndrome, there’s clearly some sort of game theory / prisoner’s dilemma thing going on here. If all countries had pursued a softer lockdown, that’d be a different response to all countries doing a hard lockdown. Also we might say for instance “country X only did 3% worse with a full lockdown versus country Y” but remember 3% worse is a normal pretty steep recession.

As for this, that, and the other being a blindingly obvious trade, well the usual retort is if you’re so clever go make millions in the City. The snag in this instance is the person making it has made millions in the City. 😉

But in general I remain pretty skeptical that everything has played out in a completely foreseeable fashion. The volatility – down and up – tells you it hasn’t. It tells you, among much else, that people were repeatedly on the wrong side of the trade, and had to get out/reposition.

I see your point. But isn’t the contraction that you say was already evident in Feb a symptom of the lockdown mentality, ie a response to being told night and day that the Black Death was on the way? If the message from day one had been, ‘if you’re healthy and under 60 you don’t really have much to worry about’ would there have been this early economic contraction before governments the world over decided to ban billions of people from going to work?

@TI, Moderna’s early data is extremely interesting given the complete novelty of their vaccine. Though by their nature companies tend to err (heavily) towards hype. But to be brutal, no candidate vaccine has actually been shown to protect against infection yet.

(Not saying they won’t, I personally am optimistic, but it isn’t a vaccine unless it works).

@Sparschwein, good point, the key thing will be how ready countries are to overcome the current economic downturn. While at one level it looks OK for Sweden, my guess is that like most countries they are so interconnected that they need others to bounce back equally quickly to benefit fully.

And @Snowman, as it happens Sikora was once a (rather senior) colleague of mine. Very clever guy, but inclined to do things that attract accolation.

Thought this analysis was very interesting. Exploiting the observation that proportionately more males are dying of covid-19 than females, is an obvious first attempt at trying to tease out whether the ONS excess deaths not recorded as covid-19 are really undiagnosed covid-19 deaths.

https://wintoncentre.maths.cam.ac.uk/covid-analysis-excess-deaths-updated-15th-may/

‘The lack of a strong sex-effect suggests that the non-COVID excess deaths are not primarily due to under-diagnosis’

@Snowman — That is interesting, yes. This annoying virus/crisis has the silver lining of reminding me how interesting maths/stats work can be.

@TI

My guess is that a major contributor to the excess non covid-19 deaths may be say an older person with multiple health conditions, typically living in a care home, and who is in and out of hospital for treatment that is prolonging their lives.

As a result of the pandemic they haven’t received that ongoing treatment and have died in advance of when they would otherwise have died, not directly because of covid-19 but because of the indirect affects.

There will be other indirect deaths, such as the stage 1 cancer cases that aren’t diagnosed and will progress to later harder to treat stages that Karol Sikora talks about, but these won’t be materially showing up in figures yet.

Week 19 ONS England figures out

3,081 excess deaths over the 5 year average for week 19 vs 3,930 covid-19 deaths for that week.

So more covid-19 deaths than excess deaths!

That’s a complete turn round from previous weeks. Week 18 there were 8,012 excess deaths and 6,035 covid-19 deaths.

I think we can guess what is happening here, but I will wait for thorough analyses

Is there some possibility that in the coming weeks, and in the middle of a pandemic, that we will see total deaths in England fall below the 5 year average for that week?

@Mousecatcher. “But isn’t the contraction that you say was already evident in Feb a symptom of the lockdown mentality, ie a response to being told night and day that the Black Death was on the way?”

You’re rewriting history. Do you write for the Telegraph or Spectator? There was no lockdown in UK/Europe/US in Feb; it didn’t arrive here till Mar23. There was already a massive shock hitting global supply chains from the impact of China (and other Asian countries) locking down. We had the complete disintegration of the OPEC+ agreement on Feb29, causing an oil price collapse. By Mar1, the global economy was going down. It was nailed on.

You’re also you’re implying that people are being irrational about the risks. The Spain antibody study implies an IFR of 1-1.1.2%, the NY study is not much better. There are other studies implying perhaps 0.3-0.4% but they look increasingly on the backfoot. Yes, this isn’t the Plague of Justinian but it’s still bad. Take the counterfactual: nobody did a lockdown at all, no closing of borders etc. The global spread would have been faster, many countries health systems would have been overloaded, media headlines would incite more panic. You really think many people would be going to restaurants, flying, taking the train/tube to work? Yes, at the margin the economic damage might not be as bad but you would still be staring at a huge global demand shock.

@Sparchwein made the point. The Scandis show us that the SEK economy is only doing marginally better than NOK or DKK. That’s why I said the impact of the lockdown (hard vs. soft) is about 20%. Even better look at Australia. Feb23 lockdown, per capita deaths at just 4/million vs. UK at 512/million: 128x better in terms of health outcomes. With deaths at such a low level, it’s so much easier to re-open the economy, re-open schools, to get consumption going. The level of uncertainty, risk aversion is so much lower there than here for valid reasons.

So it’s not economy vs. lives; you can win on both. The UK made a conscious decision to kill more people more in the first wave and, in the process, did more damage to the economy. We lost on both fronts. GBPAUD is 10% lower since Mar23. Investors are voting with their capital. Global policy makers/scientists are just appalled by how badly the UK has handled the pandemic. We keep putting the wrong people in charge of the country. As a country, we’re addicted to self-harm.

Re ONS stats and Winton study.

Week 19 excess deaths over 5 year average is 3,081.

In care homes the number of excess deaths above 5 year average in care homes is 2,247.

An astonishing figure which tends to support Snowman’s hypothesis regarding indirect effects of the epidemic on the treatment of care home residents with serious non-COVID conditions. We need a breakdown of recent non-COVID causes of death within care homes and see how these compare with the 55 year average.

The Winton study is fascinating but, I notice that if you look at the linear graph of excess non-COVID death rates for the 70+ age groups there is still a sizeable gap between male and female death rates. It looks as if there may still be maybe 10-20% under-diagnosis.

@TI. “in general I remain pretty skeptical that everything has played out in a completely foreseeable fashion. The volatility tells you it hasn’t. It tells you, among much else, that people were repeatedly on the wrong side of the trade …”

I’d agree with all that but that is not what I implied. You’re thinking too much in terms of ‘views’ and in terms of ‘delta 1’ trades. What I’m saying is that the implied probabilities for something going wrong were incredibly low even in mid Feb. Take the Russian Rouble. USD/RUB implied volatility was 7% at the start of 2020; so a 67% probability of an 7% move over 1 year or about 1% per week. It moved 20% in a week in March as oil collapsed. A 3m option I bought for 0.3%, I took off for over 12%. Similarly, you could position money market lents or flatteners for a max 5bp loss that ended up making you 200bp. All over the place, the market was allowing you to buy constrained downside structures with very high leveraged payouts to the upside if everything did fall apart. It’s something I’ve only seen perhaps 4 times in 20+ years.

Even at a personal level, it was offering great ways to position. I replaced nearly all my SPX funds with 1-year SPX calls, costing just 4%. For a market that had rallied 30% in 2019 and had dropped 20% in a 4Q18 that is bonkers cheap insurance. It allowed me to redeploy some of the the cash into long-duration USTs, which have made me 25%+ this year. The options themselves, even with only 7 months to expiry and with the SPX down 9%, are still worth about 3% as the positive vega reval has offset some of the negative delta reval.

Comparison of COVID death rates per million makes interesting reading. No wonder the government isn’t keen on them.

Spain 593

Italy 529

UK 513

France 433

Sweden 366

USA 278

Germany 97

Denmark 95

Finland 54

Norway 43

Australia 4

New Zealand 4

Figures are taken from the worldometers website and selected to show a) UK and other large west European countries b) Sweden and other Scandinavian countries c) Australia & New Zealand.

The obvious country to use for UK comparisons is Germany.

@Ruby. We have a good idea what negative rates will do for government bonds since we have the Eurozone as an example where negative rates have been in place for a while. The ECB went negative with their depo rate in 2014, and it’s currently -0.5%. They are also doing QE + TLTROs. We see that 10-year German Bunds never got below about -0.85% (currently -0.45%) while French OATs at the lows were -0.4% (currently 0%).

Now, UK Gilts are at +0.27%. So perhaps another 1% lower might be a stretch target in extremis but that implies Bund-like credit quality and scarcity value. That requires the BoE to be hoovering them all up in some QE++ type programme. More realistically, something like current levels to perhaps -0.25% would seem more realistic. That implies perhaps another 50bp or 5% return on 10-year Gilts.

Of course, they could go lower if, globally, govt bond yields fall further. But I have to emphasise two things. First, even if policy rates go negative that doesn’t mean bond yields have to. The ECB has a negative depo rate since 2014 but French OATs have spent more of their time with a positive yield (typically 0.5%-1.5%). Second, the BoE (and the Fed) are far less keen to go negative on policy rates than banks such as the ECB. Instead they prefer other measures such as QE, yield curve control, credit QE etc.

Right now, I just don’t see a 3:1 or 4:1 payout ratio from being long Gilts. I don’t own any material position in Gilts. In fact, I see Gilts as probably one of the most expensive Govt bond markets in the world. My feeling here is that, globally, the disconnect is that the market sees a strong mean reversion in earning expectations (high projection rate), keeping equities high, while also seeing no mean reversion in policy rates for a decade (low discount rate). Sort of the total opposite of what we had in early 2009. Then the clear trade was long equities vs. long govt bonds. Now, if anything, the trade seems to be short equities vs. short govt bonds.

@ZXSpectrum48k — Okay, I see what your saying now — that essentially a state-change was extremely likely but it wasn’t priced-in across all/most available ‘securities’ (for want of a better term). The extra detail is interesting.

I really need to spend a a few months boning up on options and getting myself an industrial strength brocking account that let’s me trade them. Despite repeated attempts to revert back to my old long-term buy/hold stock picking methodology, I continue to churn with high turnover (fortunately not unproductively, but it’s like sailing into the wind) and if I’m going to keep that up I really need to get more, er, options and take a scythe to my transaction/positioning costs. Would be useful to get more implied risk with less capital on the line, too, given one reason I think I continue to overtrade is I’m subconsciously fearful re: my ‘hidden’ leverage (my mortgage!)

Then again no sooner have I written that then I think I should cut down on the trading and market-watching and do something more productive and life-affirming instead (/write more for Monevator). Ho hum.

I agree this seems to be what they’re saying/implying — just wondering if you have an idea why?

Do you think it essentially a political issue (i.e. anglo-spheric objection to negative rates) or something structural (e.g. perhaps the Eurozone has to go into negative rates even if the ECB doesn’t want to because of this disparity between different national economies under one currency)?

@ ZK Spectrum – that’s really kind of you, thank you very much.

Please could we have commentary on the recent relationship between bonds and equities. My colleague often says ‘what are the alternatives’, so in response to the suggestion that bonds/ equities are expensive/overvalued today we should ask, in relation to what? It would be good to revert back to investment from Covid and Brexit (yawn).

@Warren Bogle — Been there, done that. 🙂 Have a look at these:

https://monevator.com/what-is-the-equity-risk-premium/

https://monevator.com/the-equity-risk-premium-and-you/

https://monevator.com/investing-for-beginners-uncompensated-risk/

We will have cheaper mirrors, garden shears and pistachios after the brexit transition ends!

Yet more suggestions out there that immunity is greater than that which will show in mainstream serology testing.

https://twitter.com/DarrinMDisley/status/1261598977012752387

And hence the epidemic could fizzle out especially in places like London where infection rates have been relatively high?

Would love to see some proper studies of the immune response especially in those who are asymptomatic, and those with mild symptoms. Perhaps household members of those who have had covid-19 with symptoms, but not had symptoms themselves need to be studied also.

On the Moderna first trial of a vaccine in humans:

It’s a phase 1 trial which is “to assess whether the vaccine is safe in humans and what immune response it evokes”.

There seem to have been 45 people in the trial, but information was released only on the 8 people who developed “neutralizing antibodies”. What happened with the other 37? Three developed more serious side effects when testing a higher dose (though these resolved within 24 hours); so longer-term usage will need testing.

TL;DR: Wait for the paper to be published, and phase 2 results, before reacting like the market.

@Snowman — According to one of my agreeably data-nerdy friends, if you crunch the numbers today’s “new” reported cases is actually negative. Gov says: “revisions to historical data due to further information being made available to support data processing”.

Just an understandable quirk I guess, but reminded me of your prediction about excess deaths a few posts earlier…

@TI

Why does the new reported cases thing not surprise me!

Of the hospital deaths announced today one took place back on 24th March and one took place on 27th March, almost 2 months ago!

But on a positive note we mustn’t forget the ONS have been totally excellent, and I think we can rely on their data being highly accurate.

Lovely to see the pictures of all the people on the beaches yesterday in the sun. Hopefully it is a sign that many are realising it’s safe to come out from behind the sofa now, and the risks aren’t from the virus itself, but from our overreaction to it.

I’m shocked by comments nationally from councillors and other public figures about beachgoers putting local people’s lives at risk. It seems that people saying these sort of things actually want it to be true, and seem unable to rationally enter into a conversation about whether it is true or not, and want to destroy our freedoms.

Fortunately haven’t seen too much of it here in Cumbria. But when Cumbria Police were implying it was morally wrong to come to the area for a walk then we need to resist, and remind them their job is to apply the law not to make morale judgements for people. By all means they can link to other organisations’ thoughts on what constitutes a responsible trip to the area, but they’ve come perilously near crossing a line they shouldn’t be crossing. Not having a particular go at Cumbria Police, they’ve done a difficult job reasonably well, but it shows where well meaning but ill thought out behaviour can lead to.

And NO there is no remote indication that a second peak of death will overrun the NHS whatever media or government scaremongering might want you to believe. And if you don’t belive that, let’s openly talk about that, rather than you just insist that you are right and have the high morale ground here.

To the extent that the virus doesn’t fizzle out there could be some further infection going on regionally or nationally. But if that happens that is the natural course of the virus, and allowing it to spread amongst the healthy who aren’t hiding behind the sofa is in everyone’s interests. Those going to the beach aren’t being selfish. In the unlikely event (based on scientific evidence) they pass on the virus as part of a trip to the beach, then it will be passed on to other beach goers who have also exercised their freedoms to make the beach trip. Those hiding behind the sofa aren’t going to get the virus because surprise surprise they are hiding behind the sofa. And any spread amongst the beachgoers yesterday will mean they can’t pass it on to the behind the sofa hiders at a later date.

Of course there are genuinely vulnerable people out there who are shielding. But it is in their interests that the virus is allowed to run its natural course, so that they can come out again sooner rather than later and see their families and friends.

I don’t expect everyone to agree with me, and it’s a good thing they don’t, but there shouldn’t be any stigma in public figures using science to advocate these sort of views on mainstream media. When we suspend free thought and we suspend open scientific discussion we head into something George Orwell warned us about.

Fortunately the monevator comments space has allowed for a more sensible discussion between those of differing viewpoints.

@Snowman, #89

I’d rather have left this week to the excellent financial discussions (thank you @ZX, learned so much) but I feel this needs commenting.

> I’m shocked by comments nationally from councillors and other public figures about beachgoers putting local people’s lives at risk.

I’d say it’s valid in some areas. If you live in west Wales, where the healthcare provision isn’t (shall we say) the best, where your nearest hospital is 1.5 hours away, then yes, people coming in and spreading the virus to locals is going to be more risky than spreading it here on the south coast of England, because of the care available. I see the risk from ppl moving to their second homes as considerably higher, particularly around healthcare capacity (even number of GPs), but it is there.

> And NO there is no remote indication that a second peak of death will overrun the NHS whatever media or government scaremongering might want you to believe. And if you don’t belive that, let’s openly talk about that

As my professor used to say, “citation needed”, or “show your workings”. For example do you assume that the NHS stays on the current “war footing” or all normal treatments are resumed? Do you think a peak will be lower/higher than the one we’ve just had? Will there be a change in treatment by that time? Or is it more fundamental that in your view there isn’t going to be a second peak, and some other trajectory (slow burn, sinusoidal, random distribution) will be followed?

Without that, it’s hard to evaluate your statement that there’s no remote indication the NHS would be overrun. I could see problems, particularly this coming winter, if we decide to protect the health of those without the virus and continue treating other conditions as we did before, without diverting resources away to enlarged ICUs and covid wards.

> When we suspend free thought and we suspend open scientific discussion we head into something George Orwell warned us about.

I agree with you, but rather than this being the risk I say we’ve had too much free thought (5G causing coronavirus? Contrails spreading it? Government plot? Catch it by walking past someone?) and yet – thanks to the same channels that have allowed such ‘free thought’, a lot more open scientific discussion than I remember happening before.

Right, now back to coaxing my investments to a return that will hire an interior designer. After 2 weeks of decorating it’s (now) painfully obvious that colour and choosing complementary styles is not my strength.

Most people find it hard to admit they were wrong, to avoid looking like they panicked, so they double down on their refusal to believe what their eyes tell them is right in front of them. Denial kicks in and the brain makes up explanations for what you already wanted to believe, like death cult members shifting the end-of-world date every time it never happens. The couch shelterers will come out when their savings have run down, they realise they’re sh*t-broke and reality forces them to accept the world didn’t end and life has to carry on. Then there’ll be tacit mass amnesia, whereby nobody will ever mention the P word, as if it wasn’t all that was crowding out the media for months, like straight after the turn of the millenium, when suddenly all mention of Y2K vanished.