What caught my eye this week.

Here’s a tenuously introduced quote from one of the greatest films ever made, The Matrix:

Agent Smith: It seems that you’ve been living two lives. One life, you’re Thomas A. Anderson, program writer for a respectable software company. You have a social security number, pay your taxes, and you… help your landlady carry out her garbage.

The other life is lived in computers, where you go by the hacker alias ‘Neo’ and are guilty of virtually every computer crime we have a law for. One of these lives has a future, and one of them does not.

What a movie! What a two-hour paradigm shift!

My only excuse for quoting it here is that I’ve found it popping into my head recently whenever I’ve read about the storming performance of the US stock market over the past decade.

Because as a British investor – where the FTSE 100 is barely higher than it was 20 years ago – who reads a lot of US investment blogs, one can feel like a bit of a Mr. Anderson.

Source: Bps and pieces

In one life, it’s party time!

In the other, the Brexit-aggravated boondocks.

British steal

Yes, that FTSE 100 return doesn’t include the hefty dividend stream an investor would have received over the two decades, which would appreciably boost the return.

And yes, the wider UK All-Share has done a little better.

No, a private investor shouldn’t have all their money in the UK market anyway – arguably only about 5-10% – so this isn’t the last word on the fate of Monevator reader portfolios.

Granted, all of it. But that’s not what I’m writing about here.

What I’m talking about is a US stock market performance that is edging into the euphoric.

Albeit one where there’s been enough consternation about valuations over the past few years to perhaps work against a classic late-stage market mania – so far.

American markets made great again

The US market experience really has been exceptional, even as it’s crept up on us. As Michael Batnick writes at The Irrelevant Investor:

Looking at the numbers, one can easily make the argument that we just lived through the best ten-year period ever for U.S. stocks.

Surprised? Check out his graphs for a glimpse at investing nirvana.

The danger always is to extrapolate the recent past into the future. As I say, plenty of people have been burned by actively steering away from highly-rated US equities over the past few years – including many commentators on this website. But their misfortune at missing out only increases the chances of a can’t-lose mentality taking US equities to bubblicious heights, as ever more people throw in the towel and belatedly chase performance.

Incidentally I’ve missed out, too. I’ve been underweight (though far from zero-weight) US equities for years.

Like bonds in the aftermath of the financial crisis, the maths tells you to be wary. Then the subsequent returns inform you that you were an idiot.

That’s stock markets for you – making the majority of people feel like dummies since the 17th Century.

Smorgasbord investing

Happily, my nervousness at US valuations (particular in my beloved tech sector) has mostly been tempered by a hard won humility as an investor – as well as a respect for momentum in markets.

Hence I’ve always kept a varying-sized slug of US equity in my actively-managed portfolio, rather than bailing out entirely, despite my queasiness.

Most of us will do better to invest passively in a broad global tracker specifically because it hides what’s in the sausage from all but the most curious. Smart passive investors know enough to know that they don’t know better…

Either way, it’s paid to keep exposure to the US, and it’s cost you to be invested elsewhere.

And carrying that opportunity cost is just fine.

I often rail against what I call ‘in or out’ thinking, where someone will say they are avoiding equities because they’re too expensive or that they’ve no money in Europe or the UK because they hate the politics or they’re putting all their money into gold or Bitcoin.

All are fast track paths to being a terrible investor – and that’s true even if your hero call pays off in the short-term. Because nothing lasts forever, and I don’t believe anyone has ever proven their ability to perfectly switch all-in bets ahead of slumps and booms. (Remember the patchwork quilt of annual asset class returns?)

Indeed it’s at times like these that it’s most important to remember why some of those laggards in your portfolio got into the mix.

Comparing out-of-favour assets to the underappreciated human appendix, Phil Huber writes:

…certain aches and pains are part and parcel of owning a diversified portfolio.

The biggest mistake an investor can make is to put their holdings on the operating table and remove the very thing(s) they might need or want the most when the anesthesia eventually wears off.

In other words, there’s hope for my UK value stocks yet!

Have a great weekend.

From Monevator

The Slow and Steady passive portfolio update: Q2 2019 – Monevator

Defined Benefit to Defined Contribution pension transfers – Monevator

From the archive-ator: Tax relief upfront is the same as tax relief later – Monevator

News

Note: Some links are Google search results – in PC/desktop view you can click to read the piece without being a paid subscriber. Try privacy/incognito mode to avoid cookies. Consider subscribing if you read them a lot! 1

Inheritance tax: Major shakeup mooted by Office for Tax Simplification – BBC

London house prices slide for eighth quarter in a row – Guardian

Boris Johnson could scrap stamp duty for homes under £500,000 – Yahoo

Peer-to-peer lender Funding Circle warns on revenues amid Brexit fears – Guardian

Watchdog puts Amazon/Deliveroo tie-up on ice – ThisIsMoney

The ‘green bond’ market leaves wildlife behind – Ozy

How wealthy are you? – BBC

Products and services

Barclays offering up to £708 in rewards for current account switchers – ThisIsMoney

Sign up and invest £2,000 with Zopa by 20 July and you’ll get £100 – Zopa [Affiliate link]

SmartSave launches one-year table-topping fixed rate savings account – ThisIsMoney

Your state pension: are there missing years in your contributions? [Search result] – FT

Not just Woodford: six of seven star fund managers who went solo recently under-performed – ThisIsMoney

Hargreaves Lansdown drops Lindsell Train funds from its buy list, citing conflicts of interest – ThisIsMoney

Block on withdrawals from Neil Woodford fund extended – Guardian

Mobile banking to overtake High Street branch visits within two years – Guardian

Comment and opinion

Why things break: easy causes of business and investing failure – Morgan Housel

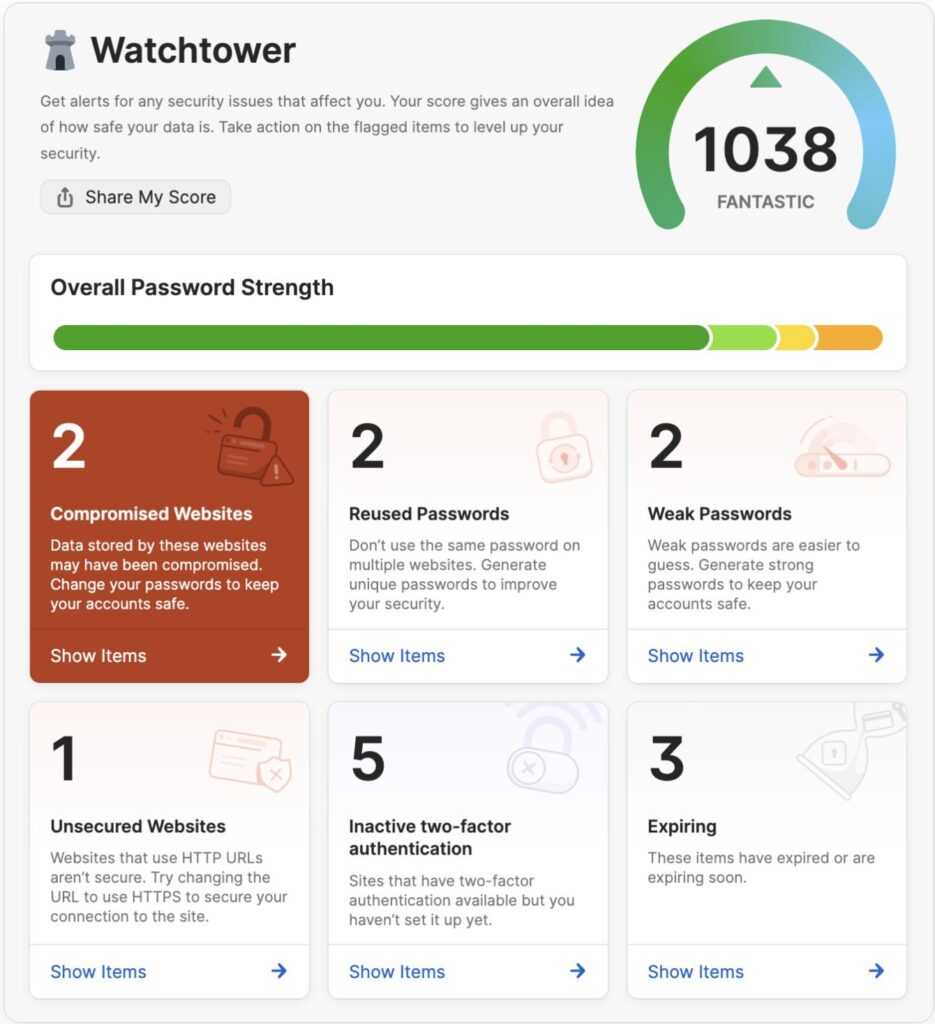

Leave nothing to chance: 11 steps to securing financial accounts – Humble Dollar

An alternative history of the ETF – Abnormal Returns

Points to consider when investing a lump sum – Rick Ferri

With emerging markets, bonds may beat stocks – Morningstar

I have heart disease. GOOD. – Early Retirement Dude

Stockholm: The city where spending £100 in 24 hours is impossible – ThisIsMoney

The sacrilegious diaries: On the benefits of portfolio turnover – Albert Bridge Capital

If active management is skilled, then who benefits? – Larry Swedroe

What killed (or wounded) the value factor? – The Capital Spectactor

One hand clapping [On the recent problems at UK active funds] – Mutual Fund Observer

Selling Vodafone: Mistakes made and lessons learned – UK Value Investor

The earnings mirage: Why corporate profits are overstated [PDF, Geeky!] – OSAM

Why isn’t CAPM being retired? – Institutional Investor

Brexit

Ann Widdecombe’s political exhumation adds insult to ignorance in Strasbourg – Marina Hyde

In turning their backs, Brexit MEPs behaved like attention-seeking toddlers – Guardian

Kindle book bargains

#StandOutOnline: How to Build a Profitable and Influential Personal Brand by Natasha Courtenay-Smith – £0.99 on Kindle

How to Give Up Plastic by William McCallum – £1.99 on Kindle

Talking to My Daughter: A Brief History of Capitalism by Yanis Varoufakis – £1.99 on Kindle

Flow: A Handbook for Change-Makers, Mavericks, Innovation Activists and Leaders by Fin Goulding and Haydn Shaughnessy – £0.99 on Kindle [Note the paperback version might be worth paying up for given the fancy design, not sure?]

Off our beat

Martin Wolf: Liberalism will endure but must be renewed [Search result] – FT

How Britain can help you get away with stealing millions: A five-step guide – Guardian

Hack your holiday with behavioral economics – The Big Picture

The mind-blowing potential of planting trees to tackle the climate crisis… – Guardian

…but at the moment the Amazon is losing a football-sized area of forest every minute – BBC

How a video game community filled one child’s final days with happiness – Guardian

When passion for work leads to burnout – HBR

And finally…

“No matter where you are in life, you’ll save a lot of time by not worrying too much about what other people think about you. The earlier in your life that you can learn that, the easier the rest of it will be.”

– Sophia Amoruso, #Girlboss

Like these links? Subscribe to get them every Friday!

- Note some articles can only be accessed through the search results if you’re using PC/desktop view (from mobile/tablet view they bring up the firewall/subscription page). To circumvent, switch your mobile browser to use the desktop view. On Chrome for Android: press the menu button followed by “Request Desktop Site”.[↩]

Comments on this entry are closed.

Quoting Sophia Amurosuo is bizarre. NastyGal just copied designer clothing blatantly and spent other peoples money v. freely, a prime example of internet 2.0 b******. Now apparently she “lectures young entrepreneurs” and has a TV show. I just hope she never stands for US president…

Gulp. Over the last month I’ve been selling down my HYP and buying a 50:50 mix of Vanguard USA and Vanguard whole world.

I simply despaired at the low HYP overall performance, and I’ve come round to the view that passive whole market investing is best. Over half my portfolio is passive now.

Shame I didn’t do it 10 years ago!

Decided many years ago to buy theWorld Index in Equities and Bonds

I reasoned that I wanted US exposure and this was the easy way to get it

UK stock market was about4% of world Index -Equities and Bonds-risky?

US about 50%-Equities and Bonds

If US goes down we all go down so not taking any more risk

The great John Bogle of Vanguard Index fame-advised US investors to only hold US stocks and bonds

It has proved to be a successful policy

Via Index Funds (with 2 Funds only-Equities and Bonds)- cheap,simple and works

xx09

That Guardian piece

“How Britain can help you get away with stealing millions: A five-step guide”

Is illuminating to say the least, the last few paragraphs about who they took to court is shocking

@Brodes

Funny, I was starting to think all this talk of underperformance was a contrarian buy signal.

Conversely all the talk of the US doing so well, with decreasing talk of recession/crash seems like a sell signal.

@Ben

I hear you. And investors fleeing Woodford’s income fund is a contrarian signal too. And the depressed pound.

I still have around 45% of the folio in HYP shares: ulvr, RB, BAE, AZN, GSK, BATS, IMB, RDSB, BP, BLT, AAL, DGE, Pearson. Smaller holdings in IG group, greene king. I sold all retailers, and most of the stuff with mainly UK business. The above international companies seem like a reasonable bet. But I will probably trim them too. Starting with the miners, bank, and oileys. Will keep the consumer goods cos, and tobacco seems very contrarian right now.

@brodes.

I have actually already put some money into the Woodford Patient Capital Trust. I thought I should, rather than armchair opining about it.

The rest of my investments were passive already. I’m telling myself that I havent fallen off the passive wagon A) by labelling it a bet/example rather than an investment. B) I espouse not worrying about the daily gyrations of the market, by buying the most unloved stock and forgetting about it I am leading by example.

I’m under weight in US too.

I read about 4 yrs back an equities allocation and it just felt right so I’ve stuck with that.I figured as long as you’ve exposure all over the world, your covered. I’m all indexed. Sold my individual shared as I couldn’t be doing with all that.

I’m 40% UK ….yes but I’m semi retired so don’t want exchange rate risk.

15% US

15% Japan/Asia

15% Europe ex UK

15%EM.

And this just sits comfortable with me.

Every time you buy petrol you have exchange rate risk.

@Dawn

I have zero equity exposure to the UK as I work here. Since 2016 it seemed (and still seems) like a very specific country risk to diversify away from. Currency risk scares me a lot less then Brexit.

@Neverland You saved me the trouble of going to Sophia Amoruso’s site, but as far as the particular quote is concerned, she’s on the money, don’tcha think?

A quick reminder about voting in the Nationwide AGM, for anyone still with nostalgia for mutual building societies: https://www.thisismoney.co.uk/money/saving/article-7219593/Your-chance-vote-AGAINST-Nationwides-fat-cat-pay-deals-building-society-cuts-rates.html

My Vanguard ‘personal rate of return’ showed -7% return in December (opened a year earlier). Now showing +17%. That makes me nervous!

Risky US assets (equities, property etc) have outperformed to some extent because they were at the heart of the crisis in 2008. In was similar after the previous big crisis. EM bonds were big outperformers in the following decade because they got totally trashed in 1998 due to the Russia default. So to an extent this is mean-reversion.

I think it’s difficult now to comprehend how bearish people were in early 2009. With the S&P down at around 700, a 10-year call option on the S&P, with a strike of 1400, cost 40 points (i.e. you had the right, but not the obligation, to buy the S&P index at 1400 for 40 points in 10 years time, so you needed the S&P to be 1440 to breakeven). The option was basically saying that the probability it would go to 1400 over the next decade was around 20% i.e. pretty low. Given that the S&P had been around 1400 only one year earlier this was utterly bonkers. If you’d put your ISA allowance at the time of £7.2k in such an option, you’d now be sitting on around £280k or a 40:1 payout.

Does anyone know if the “passive investing” theoreticians have data on where the benefit of diversification kicks in? We are told, with credible justification, that we can avoid excessive risk by spreading our investments among asset classes (bonds and shares, but also businesses in different sectors) and geographical markets. But then is having over 50% of investments in a single country counteracting some of that benefit?

Obviously spreading investments according to market weighting has a certain logic, even if it gives the US 56% or whatever it is of the total. But the markets only cover a proportion of global economic activity with the US probably over-weighted (I suspect most other countries have larger segments of their economy in nationalised or privately owned businesses). And of course the dominance of the US economy means that even anyone owning no American shares at all will be sharing their risk anyway since a US downturn would adversely affect everyone else – though you could say the same for the Chinese economy which would form a rather small proportion of a global market-weighted portfolio.

If anyone has back-tested to see if diversification benefits are maximised with a limit put on individual components – say at 25%, or 33%, or 50% of the whole – it would be interesting to know.

The diversification benefit of adding additional asset classes or countries can be quantified using principal component analysis (PCA). PCA can be applied to a data tensor (in 2d terms think of a matrix which is a time series of returns for each country say). PCA will generate synthetic eigenvectors which represent orthogonal (i.e. uncorrelated) return series and eigenvalues which are the relevant weightings for those eigenvectors. Using this you can represent a complex portfolio as a series of uncorrelated synthetic assets. The (fractal) dimension of the portfolio can be calculated; this is the effective number of independent degrees of freedom the portfolio has. So you might take a portfolio with the return series for 20 countries and find it has a dimensionality of 4.2 i.e. it acts like there are 4.2 independent, uncorrelated, countries in the portfolio.

It’s usually found that there is a fairly rapid limit to the benefits of diversification but equities aren’t my area so I cannot comment on specifics. I can give an example from fixed income, however. In the early 2000s, JPMorgan’s EMBI+ was the dominant index for EM US$ bonds. At the request of clients, JPM introduced a broader index called the EMBIG to improve diversification. While the EMBI+ only has around 14 countries, the EMBIG had over 30 (now 60+). The problem was that the dimensionality only increased very modestly, from say 4 for the EMBI+ to around 5.5 for the EMBIG. The reality was that many of the new countries had low market-cap weightings and were still pretty highly correlated with bigger EM countries and US Treasuries. So to increase diversification, JPM introduced a 10% max cap on the weighting of each country. This reduced the weighting of big countries and spread this into the smaller countries. This diversified the portfolio and the dimensionality moved up toward around 8 i.e. doubling the effective diversification. This 10% capped index is now the standard for all institutional investors in EM fixed income.

How fantastic to get a quick response from someone who knows, at least in outline. Thanks.

While Principal Component Analysis goes beyond my maths education, I easily get the idea of reducing multiple components to a smaller number of orthogonal vectors. I think it is similarly to me thinking (simplistically) in terms of the additional volatility of US shares because a currency conversion is involved being modelled as a Pythagorean triangle with the hypotenuse being the net volatility arising from the separate volatilities of the market and the exchange rate on the other two sides – as long as those are independent which they probably won’t be entirely.

So it does sound as if theoreticians would be well set up to do that sort of analysis on a set of global index funds, and come up with an approximate proportion of the largest component beyond which the diversification benefit becomes undermined. In my self-justifying mind it makes sense of why Vanguard Lifestrategy is over-weighted in UK shares (also bringing no additional currency risk) leaving US shares somewhere under 40% of the equity component.

Thanks for the links this week TI, good reading.

As a diversified investor you must necessarily look at your portfolio and think “phew, I’m glad I wasn’t more in that dog last year” simultaneously with “oh I wish I’d lumped on more in that star”. This is not an investing problem. This is a psychological problem. And you don’t fix your psyche by adjusting the portfolio, so keep away from the trade button… The ftse100 I have increasingly come to think of as not really a serious index and I’d now no more think of investing in it than I would the Dow. It is not really exposed to the UK economy and is heavily extractive and financial based. (Incidentally then, while I appreciate Brexit is the root of all evil around here, I don’t think I could in all conscience agree with the idea that it has suppressed ftse100 performance – indeed the Brexit currency fall alone must have been a boost – the small and mid caps would be a better indicator of UK economy).

Interesting to read Rick Ferri on lump sums. I’d liked the dca approach until I read (here) the argument that if you believe the market gives an overall positive return then the cost of waiting exceeds the reward of time diversification. There may be benefits in lower volatility but not higher expected return – not a calculation that Rick claims to make, however.

Finally love the idea of actually seeing the diagonalisation our rubbery-keyed friend describes. Spent a lot of time playing with eigen vectors and while mine were mostly in Hilbert Space, it would be nice to see in a simpler format. Is it written out anywhere for a simple pair of assets (say global equities and barclays bonds? – or probably more practically spy and 10yr treasuries). The reader may assume portfolio values are restricted to the real numbers and the proof is left as an exercise…

@mathmo

“our rubbery-keyed friend”

Took me a while to get that, I thought it was a reference to TIs prose 😛

For anyone under 30, it’s a ZX Spectrum reference btw.

@Mathmo — I’m not saying it’s entirely rational that the UK main market is unloved in large part (not entirely) due to Brexit — I am saying it’s almost certainly so. (Well, there’s no doubt the UK is unloved, but I also think there’s Corbyn risk in the mix — but of course any hope he has of becoming PM hails from Brexit. A non-Brexit crazed Tory party would be having his incarnation of Labour for lunch).

The BofA survey has been showing the UK as the most underweighted market by global fund managers for years now (here’s a recent one if you’re an FT subscriber, https://www.ft.com/content/4f07d622-7631-11e9-bbad-7c18c0ea0201).

I’ve been steadily buying up UK equity income trusts on discounts on and off for the past few months, largely because I agree with you that the UK domestic story is only part of the picture for a lot of these companies. (Corbyn risk is another matter… if we saw capital controls or something equally terrible, well, sayonara… 😐

I calculate that buying £1 of income is now 32% cheaper in the UK than it is globally, and 38% cheaper in the UK than in the US. UK shares may get relatively even cheaper in the short term, but they look worth considering for purchase if you are seeking long term income.

Flawed calculation. Income from equities comes from their total return which is capital gains + dividends. Dividends not reinvested is the same as selling some stock for cash

The question is: For a UK resident, ISA invested [or SIPP or ACC] does it make sense to use Vanguard LifeStrategy 80 ACC or should one just get VTSAX and keep it at 80% and VBMFX at 20%, reinvest divends is not available as ACC fund and keep it balances each quarter or so?

This has got to be a first: a reference to Hilbert Space, eigenvectors and orthogonality. A more rigourous treatment of temporal coherence wouldnt go amiss

@Marco

I don’t think that’s /quite/ right.

Share price and by extension capital gains is decided by the market. There isn’t any fundamental value creation, its based on the expectation of future dividends. Dividends you could argue are what public companies exist to produce, they are the return to the owners, they are the result of the business creating value.

Of course this all gets significantly more complicated when share buy backs get put in the mix.

So while you want to look at both for deciding your total return, they are distinct.

@Marco

Calculation not flawed but calculated result is open to interpretation. I interpret it as UK shares being better value than US shares. Also you can more easily live on the natural yield of the UK market and not be depending on capital gains when in draw down.

Betting against the US seems to has been an unsuccessful policy for many years

xxd09

Anyone re LifeStrategy vs VTSAX 80% + VBMFX 20%?

@Getting Minted

Whats the math you used and is any other shares other than US even worth mentioning?

I say this whilst holding LifeStrategy 80/20

@xxd09

My UK bias has been less successful than a US bias would have been over the last ten years but matches the US (S&P 500) over thirteen years. Who knows what will happen next?

@John

I looked at the dividend yield of selected income investment trusts. These show an average yield of 4.55% for UK trusts, 3.07% for global trusts, and 2.8% for a US trust.

@getting minted

Something happened in 2013 [QE?] because there’s a clear detachment for equity returns vs 80/20 split.

US Stocks are indeed tricky, while incidentally US Bonds far more attractive, if you like that sort of thing.

US PE1 : 22 – not too stretched

US PE10 : 30 historically stretched

The discrepancy perhaps hinges on earnings above or below trend.

Whether we keep US Stocks up to weight may depend on those earnings, so far so good, with the Trump effect kicking in. And Trump clearly has his eye on a booming economy heading into the next election.

This investor has been seriously wrong-footed on US Stocks, and remains firmly uncertain whether to remain underweight.