Some thoughts on inflation, followed by some good money reads.

For most of the past two years, it’s been wrong to be worried about inflation. It’s also been pretty lonely, as the world has piled into bonds and bought gold much more as catastrophe insurance than on fears of an inflationary spiral.

When I thought US government bonds looked absurdly overvalued in late 2008, for instance, I was right from the perspective of the poor value they offered compared to equities, but wrong to fear they’d soon suffer at the hands of inflation. In fact, deflation remained the mood music in the US throughout 2009 and most of 2010.

In late 2010, however, the musical chairs have been shifting. A strange alliance of hedge funds, ancient investors like Jim Slater, and money bloggers seemed the first to worry about inflation. As the year ends it now seems every newspaper, fund manager, and man in the street is an inflation hawk.

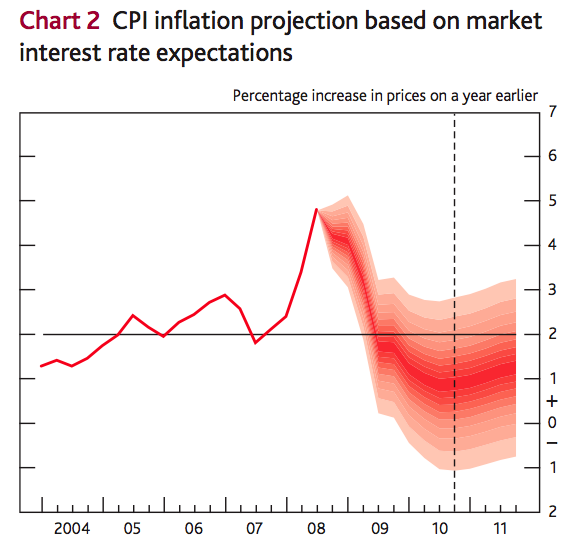

Perhaps the shift has come about because after years of overshooting its target, the Bank of England now says it fully expects inflation to stay above 3% throughout 2011, too.

Bank insiders can give all the interesting speeches they like about why this is consistent with policy [pdf] but the suspicion is growing that keeping interest rates at record lows in the face of inflation 50% above target isn’t just a matter of needs (i.e. raising the rate would only hurt the nascent recovery, and it wouldn’t reduce input costs) or even musts (i.e. we can’t afford to crash the housing market) but actually a deliberate action to solve these problems by inflating away the UK’s personal and private debts.

This is dangerous stuff. Normally a growing consensus in investing is a reason to consider doing or thinking the opposite, but inflation isn’t like that – the whole danger is that consensus expectations for higher inflation get embedded in the system, leading to a self-fulfilling prophecy as people take steps to prepare for it.

True, the Bank and others are surely right that with unemployment high and the debut of true austerity Britain a mere two weeks away, workers aren’t in a position to bid up wages en masse.

But these things can quickly change, and pressures are already showing up in domestic areas like rising rents (see this graph – at the bottom of the page).

Also, not worrying about rising inflation because the consequences lie down the line is a bit like not worrying about higher blood pressure because you’re too young to have a heart attack. The time to take action is when you first spot the symptoms, not when you’re 60 and short of breath.

On balance, I’m not yet persuaded the UK authorities have decided to debauch the pound to inflate away our debts, though I’m sure all concerned are happier with inflation at 3.5% than at 0.5%.

But as an investor, I’m trying not to take any chances.

From the financial blogs

- Cool charts showing long-run US investment returns… – Get Rich Slowly

- …and reasons not to be overly reassured by them – Oblivious Investor

- Love and investing – The Psy-Fi blog

- Investing: Coin flip or skill – Investing Caffeine

- The tyranny of fund league tables – The Munro Fund

- UK inflation outlook if this time isn’t different [PDF] – Bank of England

- US Treasuries vs historical inflation – Henderson

- Hurricanes: Radical solution to US housing woes – Capital Chronicle

- Repressive democracy – Stumbling and Mumbling

Mainstream money media

- Globalisation: The redistribution of hope – The Economist

- Dutch pension savers 50% richer than fee-ravaged Brits – Telegraph

- HMRC targets tax evasion to boost revenues – Telegraph

- Cash savings guarantee limit lifted to £85,000 – Guardian

- How to invest in Facebook and Twitter – Motley Fool

- Vanguard concerned over emerging market inflows – FT

- Early access to pensions being mooted – FT

- Wealthy should get into VCTs while they can – FT

- How to invest in English fizzy wine – FT

- Crystal balls from various fund managers [on 2011] – Independent

- Investing in junior oil companies – Independent

- Buying US repossessed homes – Independent

- How to curb bank bonuses – BBC

- How the ordnance survey makes money – BBC

Subscribe to get this roundup every weekend.

Comments on this entry are closed.

It’s meaningless chatter from people who’s theories completely failed to predict the Great Financial Collapse. Why are we listening to these idiots?

The CPI at constant taxation is 1.6% and that is where it will return once the tax changes drop out of the system.

What is bizarre about this conversation is the complete lack of understanding of how money works. CPI is higher due to taxation and duty rises. Taxation withdraws spending from the economy and depresses demand. And that’s before we get onto government spending cuts.

So we have the situation where nutty commentators are clamouring for interest rates to rise when tax on front line spending has been hiked by 5% on every transaction

There is very little econometric evidence supporting Inflation expectation theory, any more than there is any evidence supporting the Ricardian Equivalence nonsense. People just aren’t that sophisticated in aggregate.

Inflation is a general systemic rise in prices, not some prices going up due to a commodity bubble and a bad harvest.

With the thick end of 5 million people without work and demand for a further 2 million full time equivalent positions from involuntary part-time workers, if we have inflation at this point then we have serious structural issues with the UK economy.

What we need to ask is what benefit do the vested interests get from Interest Rates going up and throwing more people on the scrap heap.

.-= Neil Wilson on: How to remove Old Ubuntu Kernels in a single command =-.

1. As ever, thanks for your sterling work here.

2. That ‘Independent’ article with forecasts for 2011 is interesting. On 2010, it states: “The lesson is clear: those who strayed out of trackers into the right managed funds could have made profits up to three times as much.”

3. But what YTD returns are being compared here? It’s the FTSE 100 Index vs “31 fund sectors”. Not only does the article give the impression that trackers only match the return of the FTSE 100 Index. But also it seems to say that the only way to invest in any of the fund sectors is via a managed fund.

4. Scary stuff. Or, have I got this wrong?

Neil,

I’d agree with your analysis if the UK were a closed economy implementing autarky. However, we consume a lot of goods and services from abroad, so UK inflation doesn’t just depend on UK taxation and unemployment.

And yes, we do have serious structural issues with the UK economy.

We live beyond our means individually (witnessed by the high levels of personal indebteness) and collectively – as shown by the annual deficit.

Some external pressures are inflation due to the devaluation of the pound over the last couple of years making imports dearer. I just about recall as a child not being able to work out what was wrong with Harold Wilson telling us that a 14% devaluation “does not mean that the pound here in Britain, in your pocket or purse or in your bank, has been devalued.”. We found out he was bulling us in the 1970s.

.-= ermine on: On living differently =-.

I first made the inflation call back in November of 2009 (http://retirementinvestingtoday.blogspot.com/2009/12/uk-inflation-november-2009-update_28.html). Since that first post I’ve stated many times that the Bank of England have no interest in meeting their inflation target of 2% and instead intend to ‘steal’ from the prudent while saving the reckless. They keep talking about downward pressure on inflation from things like spare capacity however these ‘experts’ have been wrong for so long that if they were employed by my company they would have lost their jobs long ago.

No matter what anybody says the tax increases that are occuring are still inflation no matter how you dress it up. Their remit does not say keep CPI at 2% but if it’s from a tax increase then ignore it. It says 2%. And we still have more of it to come when VAT goes to 20%. I can also confirm that in my industry spare capacity does not exist with us running well over 100% for many months. Of course if you’re an industry that makes chocolate ashtrays your in trouble but IMO your business model was never sustainable and was simply dependent on everyone thinking they can live like kings on credit which was nonsense.

My suggestion would be for some of these ‘experts’ to occasionally come out of their ivory towers and have a look at what is happening in the real world.

It really is easy to fix given how much we import. Push up interest rates which will show the markets that the BofE really is serious about protecting the buying power of the GBP rather than debasing it as seems the strategy today. Sterling rises and many things get a little cheaper and inflation reduces. Job done.

Debasing a currency is never a good strategy (http://retirementinvestingtoday.blogspot.com/2010/12/when-money-dies-and-gold-priced-in.html). I would have thought that even the BofE would have figured that out. Instead they seem intent on doing a Greenspan and fueling another series of bubbles. Let’s fix a credit problem with more credit. Great! All that will do is make the next crash bigger than the last one.

Since that first call I have bought as many Index Linked Savings Certificates as I can get my hands on and I am now very happy with that decision. My gold also continues to do well.

Rant over.

Cheers

RIT

.-= RetirementInvestingToday on: This year my strategy is not adding any value – My Retirement Investing Today Current Low Charge Portfolio – December 2010 =-.

> Since that first call I have bought as many Index Linked Savings Certificates as I can get my hands on

You lucky devil – well called. I’d only just got started on that with a few grand before they canned them

.-= ermine on: On living differently =-.

@Alex – I’m slightly confused as to whether you’re asking about The Independent’s reporting, or about the concept of using trackers given that they were beaten by some sector funds.

On the first point, I included the link for a bit of entertainment/interest, I don’t think these guys can forecast the market any better than you or me on a 12 month run, though these pieces do sometimes point out areas of value or momentum. Whether the value is outed by Christmas 2011 / the momentum maintained is another matter.

On the tracker versus sector funds issue, well there will always be funds that beat trackers in any particular 12 months. The issue is (1) whether you can predict them in advance and (2) whether switching between them all, and the cost of holding them, outweighs the benefits.

The evidence is for both (1) and (2) suggests trackers are best for most people. With a FTSE 100 tracker, you’re basically buying a piece of all styles / strategies / companies, albeit biased towards large caps. Over a five year view, the theory and the evidence is you’ll usually beat hot sector chasers and switchers by buying just a handful of broad market trackers.

On Monevator you have me, who does a bit of the chasing, and The Accumulator, who is a pure passive index man. So we offer views across the menu I hope. 😉

@Ermine – You were either a precocious child, or you’re older than I thought!

@RIT – You can rant here any time when it’s so substantiated by facts and insights. Incidentally, on the subject of index linking certificates, I must admit I’ve forgotten if they abolished them, or simply withdrew them for the tax year.

i.e. There may be a window where we can dive in around April time, albeit tracking CPI now instead.

1. To TI: I’m really sorry to have confused you. I’m very much aware of the differences between trackers and managed funds – and their respective advantages/disadvantages. My portfolio comprises only index funds and ETFs. I am therefore also “a pure passive index man”.

2. Reading my post again I can see it’s unclear. I was trying to say that the article gives the impression that trackers are only available for the FTSE 100 Index – and no other sectors. We’re told that the only way to invest in any of the fund sectors is via a managed fund.

@Alex – Ah, thanks for the clarification. As for the lamentable active fund bias in articles like these, agreed.

Fairly sure if we were flicking through all the active fund adverts in the Independent money section in its newspaper form it’d all make perfect sense… 😉

I found the article on the Independent on repossessed homes in America yielding a decent amount of dosh very interesting. Monevator points out that he expects the price of sterling to go up next year so buying next year may be another oppurtunity especially as the American economy seems to be back on the mend.

@pkora94 — Yes, I was wondering about somewhere like Florida but I’m wary of the hassle. To be clear I wouldn’t say I Expect the pound to strengthen to a timetable. I just expect it to move to towards its more usual range eventually. Currencies are notoriously unpredictable and nobody can know for sure. 🙂

@ermine

Thanks. I currently have 18% or so of my wealth in them. I wish I could have had more given what we are seeing today however I have an asset allocation strategy to think about as well.

@TI

They have not abolished them but simply withdrawn all issues from sale. As I detailed here http://retirementinvestingtoday.blogspot.com/2010/07/government-supports-banks-ripping-off.html they withdraw them to prevent starving banks and building societies of funds which would make it harder for them to lend and to rebuild their capital after the credit crisis. Disgusting. How about the banks try the free market like that which I and many others work within. If their not getting enough deposits then put the interest rate you pay up from 0.01% to something competitive and people might deposit some money with you. Strange concept for a bank I know [sic]. Always seems to be heads I win tails you lose with banks from what I can see.

NS&I have however given no indication of when the next issue will be up for sale. Interestingly though if you already have them then when they come up to maturity for the first time they are allowing you to roll them over into another 3 or 5 year period (plus another couple of options from memory).

I too fear the change to the dreaded CPI also. A look here http://retirementinvestingtoday.blogspot.com/2010/05/ns-index-linked-savings-certificates.html suggests that over time they have gradually been reducing the returns available on them. Back in 1992 you could get RPI+3.25%. Cutting to CPI seems to be the next logical move.

.-= RetirementInvestingToday on: This year my strategy is not adding any value – My Retirement Investing Today Current Low Charge Portfolio – December 2010 =-.

@RIT – Thanks for the further info. I’m pretty sure they’ve withdrawn them from sale in previous years though? And I can believe that the demand was overwhelming given the overall fear out there amongst the general populace.

Perhaps I’ll pick a tranche up in April.

> @Ermine – You were either a precocious child, or you’re older than I thought!

I was still in short trousers when Harold Wilson made that speech. However my family was more internationally-oriented because my Mum is German and so she did try and explain why Wilson was conning us as the GBP/Deutschemark exchange rate showed, which mattered to us on going to see relatives in Germany. I think it made sense at the time, though it was hard to get my head round as I had yet to do fractions or division at school.

@RIT > I too fear the change to the dreaded CPI also

Say it ain’t so 🙁 I’ve only just escaped having my pension downgraded to track CPI instead of RPI for now, so I fear this creeping malaise everywhere. It seems an obvious way to reduced the costs of providing Index-Linked SCs and legitimise CPI on the principle that if you repeat inflation=CPI long enough people will believe you.

.-= ermine on: On living differently =-.

I am somewhat surprised that so many in the media have been so quiet on the CPI/RPI debate. Economically, CPI makes better sense but it was devised mainly for internal official analysus. RPI includes, partly, the cost of money which is why economists don’t like it as a consumer measure, but of course it reflects better what a lot of people actually pay. I tend to agree with Roger Bootle

http://www.telegraph.co.uk/finance/comment/rogerbootle/8212758/High-inflation-is-a-cock-up-not-a-conspiracy.html

and think that CPI will peak in late 2011 owing to technical effects, but the outlook for those whose financial life is pegged to RPI will be harsh because the tools used to contain it (interest rates) will for quite a while make it worse.

Monevator, you will benefit from not having a mortgage, though not, sadly, as much as Ermine.

.-= Salis Grano on: Peer to Peer Update =-.

@Salis – One place where there’s been very little comment is company pensions schemes. I think if they adopt the CPI measure it could ease deficits ahead of schedule, which could conceivably be positive for share prices.

As for the mortgage, I have to admit I am tired of being short a house, and have been studying the London market again in some detail for the past couple of months. If prices here had fallen like in the rest of the country, I think I’d buy now with a 5 or 10-year fix.

Monevator, I think it is already happening. BT has surged 20% recently on just such news (plus other pension effects) and with my typical dithering I missed the boat.

.-= Salis Grano on: Peer to Peer Update =-.