Good reads from around the Web.

The Budget was kinder to the typical Monevator reader than might have been expected, though you probably wouldn’t guess it from the frosty reception some of you have given to Lifetime ISAs…

But remember what we dreaded? The end of pension tax relief as we know it. Higher capital gains taxes. Maybe even lifetime restrictions for ISAs!

Then consider what we got.

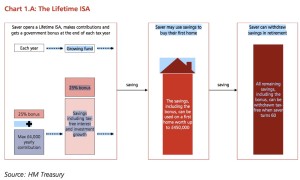

For starters those pension reforms have been postponed again, and for now we have a carrot instead with Lifetime ISAs for the under-40s. (Surely not a coincidence?)

Meanwhile capital gains tax rates are to be cut, not raised, and everyone’s ISA allowance is headed up to £20,000.

It could have been a lot worse (and it was for some unfortunate people, as we’re seeing reflected in Cabinet rows this weekend).

Certainly there was nothing as horrific for me as the upcoming increase in dividend tax rates, which will likely cost me six-figures over the rest of my working life.

Lifetime ISAs – the missing link?

Treasury documents state the Lifetime ISA is still being finalized in conjunction with industry feedback, and to be honest I’m not surprised.

To me the Lifetime ISA looks like something that was left on the chopping block after the Chancellor threw away his more ambitious recipe for a radical overhaul of the pension system.

The 5% charge on taking money out before 60 – unless you use it to buy a house – is a big departure from the normal ease-of-access ISA ethos, and it smacks of a legacy of some sort of Pension ISA plan.

As for buying a home with the Lifetime ISA, that’s great – but it does make the Help to Buy ISA seem a bit redundant, since when you buy you can only put money from one of the two Government top-up ISA schemes to work.

Given the Help to Buy ISA has a maximum and fixed Government bonus – and it’s only received at the end, on buying – I’m surprised at this additional complication, versus just letting the two bonuses from each ISA scheme be lumped together.

The government could have reduce the maximum annual Lifetime ISA bonus to say £800 if allowing both together was really not affordable.

Then again, the writing is probably already on the wall for the Help to Buy ISA.

There will be a one-year window from 2017-2018 in which savers can move their Help to Buy ISA money into their Lifetime ISAs, which I imagine many people will want to do.

And by 2019 Help to Buy ISAs could be gone, anyway, as that was the furthest out the commitment to making them available was made.

Tallying the Budget

Perhaps the mixed reception is reflective of how fiddly the whole system has become. It’s hard to know if you’re a winner or a loser until you’ve spent a few hours studying the detail.

That’s hardly tax simplification, let alone socially cohesive policy making.

I remember when Budgets were boring, but in recent years they’ve had the same “It could be you!” drama of the National Lottery draw on a Saturday night.

Were you a winner? Here’s a roundup of the roundups:

- Budget 2016: How it affects you – Telegraph

- What the 2016 Budget means for you – Guardian

- How to benefit from the Budget changes – Telegraph

- BBC budget calculator – BBC

- Lifetime ISA: Four pros and two cons – Guardian

- Pension reform by carrot and stick – FIRE v London

- Budget tax implications for the very wealthy [Search result] – FT

- Merryin S-W: Wider benefits of lower CGT rates [Search result] – FT

- New £1,000 allowance for online entrepreneurs – This Is Money

- Web traders tax breaks explained – BBC

- As I’ve said before, personally I agree with I.D.S. on disability cuts – BBC

- In-depth analysis of the budget by tax experts, with comments [PDF] – CBW

If you think we’ve missed out any important Budget news, please share your thoughts in the comments below.

From the blogs

Making good use of the things that we find…

Passive investing

- Would it help? – A Wealth of Common Sense

- Interview with Vanguard’s Jack Bogle [Podcast] – Barry Ritholtz

- We have organic food. We need organic finance – T.E.B.I.

- Passive investing – I doth protest too much – Pragmatic Capitalism

Active investing

- Why BP’s dividend remains highly uncertain – UK Value Investor

- The poor odds of investing in Unicorns – The Value Perspective

- Paralysis by analysis – The Irrelevant Investor

- Thoughts on crafting your investment policy – Abnormal Returns

- The traitorous eight and the birth of Silicon Valley – Investing Caffeine

Other articles

- Building an IKEA portfolio – The Psy-fi blog

- Is there Life on Mars? Life after retiring – SexHealthMoneyDeath

- Interview with Mother Earth on climate change – Mr Money Mustache

- Negative rates: Impossible, unnatural, or just unusual? – M.o.M.

- Big media is running out of time – REDEF

Product of the week: The Telegraph weighs up the pros and cons of Santander’s new 5% regular savings account. It’s not the highest interest rate in the category – that’s 6% – but if you’ve already got the required Santander current account and you have an extra £200 a month to put away, it looks an easy way to increase your savings. (Although weirdly, you can only apply via phone or in person, not online.)

Mainstream media money

Some links are Google search results – in PC/desktop view these enable you to click through to read the piece without being a paid subscriber of that site. 1

Passive investing

- How the US government launched the ETF industry – Bloomberg

- ETF performance tool [US but interesting] – Morningstar

Active investing

- Some ethical investment ideas – Guardian

- The case for being an angel investor – Forbes

- The DIY quants who ditched Wall Street for the desert – Bloomberg

- Bill Ackman has blown up a hedge fund before – Business Insider

A word from a broker

- The most popular tracker funds in February – Hargreaves Lansdown

- From Monday: London Stock Exchange intra-day auctions – TD Direct

Other stuff worth reading

- Care about your returns, not some benchmark – Motley Fool (US)

- Exploitation, Exploitation, Exploitation [Satirical video] – Guardian

- …it’s enough to turn the young healthy! – Guardian

- Is Blairs’ £27m property empire relevant to the crisis? – Guardian

- Landlords threaten to raise rents [Er, it’s a market guys] – Telegraph

- Pizza delivery: The robots are coming – Mashable

Book of the week: There are countless start-ups seeking funding to achieve their modest aims of ruining the billion pound banks and revolutionizing finance. Well, why not? Seems as good a time as any – everyone but bankers still hate the banks, and mobile phones and other technologies are providing plenty of ammunition. But I’ve found it hard to pump in any of my pennies, as every potential winner I’ve looked at seems as much a nailed-on loser. Perhaps I need The Fintech Book. Out in April, its authors are active in FinTech worldwide. Although, books date and the whole point is the sector is a tumult? Maybe it should have been an app.

Like these links? Subscribe to get them every week!

- Note some articles can only be accessed through the search results if you’re using PC/desktop view (from mobile/tablet view they bring up the firewall/subscription page). To circumvent, switch your mobile browser to use the desktop view. On Chrome for Android: press the menu button followed by “Request Desktop Site”.[↩]

Comments on this entry are closed.

The last few budgets have had a huge impact on how I plan for my family’s financial future. I agree that the new Lifetime ISA will form part of a pensions overhaul at some point. Free money won’t last forever so grab it while you can!

I thought “Exploitation, Exploitation, Exploitation” was funny. The other day my brother mentioned that the 3-bed house next door to where my mum grew up, on a typical suburban London council estate, was up for sale at £300k.

It’s bonkers but of course I’ve been saying that for a decade and so now everyone thinks I’m a crazy perma-bear. Hopefully I’ll live long enough to be proven right!

The Santander regular eSaver reverts to 0.25% after 1 year. Seems like not a lot of gain for the effort…

I’m not quite sure what all the hoohaa about tweaks to PIP is all about as government spending on the PIP for disabled people is going to go up, from £16.2 billion this year, to £16.7 billion by the general election and £17.2 billion the following year. Sounds like extra funding to me, but I’m not in politics.

Good news about no more pension meddling just yet and the new ISA limit will be handy. The Lifetime ISA comes too late for our daughter as she’s just bought he first home but would have been handy before then.

“Some savers will be able to avoid higher-rate tax altogether, even if their earnings are above the threshold, by making sufficient contributions to a pension. As the annual limit on pension contributions is £40,000, from next year you will be able to earn as much as £85,000 and still pay no higher-rate tax.”

That’s from the second telegraph article. Does anyone have more info on how this might work? What if I earn a bonus and so income is uncertain? Probably just being slow here, a simple link would suffice! Thanks

William III – The higher rate tax point increases to £45,000 next year. That plus a fully funded £40,000 put into a pension is £85,000.

Good to see the Psy-Fi Blog back http://www.psyfitec.com/2016/03/building-ikea-portfolio.html back, and thanks for all the other links.

> As the annual limit on pension contributions is £40,000

It wasn’t this year due to the “mini PIP” and care is needed next year due to taper. It really is a minefield.

Thoughts:

(a) I now watch the budget live and clear an afternoon (and have brokers, online banking and liquid cash to hand that can be used via debit card or wired via faster payments) – most unexpected changes are applied from midnight on budget day.

(b) Financial planning is becoming a proper job. It is starting to take up huge amounts of my time and the complexities and nuances just get more and more pronounced.

(c) Capital accumulation not PAYE earnings is the reinforced message (earn up to £100K, then salary sacrifice into SIPP, then reduce working hours on PAYE, move to 4 days per week if desirable or necessary to avoid the traps).

(d) Begin to diversify your investment vehicles and look for opportunities (ISA, JISA, LISA, SIPP, Close Investment Company, Personal Service Company, EIS, SEIS, VCTs and Dealing Account).

(e) Entrepreneurs Relief of 10% CGT on first £10M of gains being extended to unquoted shares is a big bonus, it essentially gives you access to founder tax breaks without the commitment and effort, providing you can find suitable companies looking for investment, doesn’t even need to be first stage funding.

(f) Never put yourself in a position of forced transactions (e.g. seller of assets, withdrawals from investment vehicles), be patient and wait for favourable conditions (e.g. CGT 18% -> 28% -> 20%, new pension freedoms).

@gadgetmind, the ‘hooha’ about the PIP changes is because they mean that around 370,000 disabled people will lose an average of £3500 per year (according to the IFS). Trying to justify this by saying that overall spending on disability is rising is confusing the spend on the group with the impact on individuals – a bit like if you cut the state pension and claimed that spending was rising because there were more old people…

It seems that people have claimed that as they have to sit on their bed to put on their socks that the bed is “an appliance” and they need money from the tax payer for it.

As a result of this an many other abuses, average payouts per person have risen by 14% over what was expected, and overall costs have therefore soared.

Claiming that trying correct these payouts back to long term averages is “taking money away from people” is a political distortion.

Disability allowances are relatively new, in the macro sense. Just look at the surfacing of mental health issues out out the pond of unfair stigmas. More people claiming doesn’t necessarily mean any one is playing the system. The government overestimated the scroungers and is surprised by the percentage passing fitness tests. YoY numbers mean little to me. I wish social care was more holistic and we offered real help to those in need. Not just welfare payments and free health, but investing in the design of our culture and workplace such that those with minor disabilities could happily partake in everyday work and life.

As a country we are still spending a lot more than we raise in taxes.

The grand plan appears to have been make the ‘easy’ cuts – and raise spending on everything else lower than the rate of inflation so taxes eventually overtake spending…

…all the ‘easy’ cuts have been made. There is hardly any inflation. So from here the Chancellor is faced with raising taxes or cutting things we’d all rather not.

The problem with raising taxes is it discourages the taxed activity. We all know this to be true – yet we tax work like its a sin.

It is quite possible for a person earning in the high 40’s to have very little wealth…certainly within the M25 no hope of owning a pleasant home, yet the govt. takes 40pc of every marginal pound they earn (if earning through PAYE I know a lot of you with PSC’s sometimes struggle to emphasise) to give it to someone else… That’s just not right. Let them keep more of their own money so they can buy homes, save for their future etc…

So spending has to fall.

The interesting thing is that the current governments ability to secure a working majority in parliament seems to have ended (cf Sunday trading liberalisation)

I doubt this will return after a bitter EU exit campaign mostly featuring blue on blue violence with a conservative leadership election coming up and the conservatives losing a few by-elections

I wouldn’t expect much contentious legislation out of the rest of this parliament

What would that mean?

– current pension legislation left more or less intact

– no further fiscal consolidation until after the 2020 election

– no big house building initiatives

– probable that further public spending cuts won’t be progressed in the event of further weakening of the economy

– no further major income tax cuts or band expansion are fundable

@Neverland… You’re assuming we stay in? In the event of brexit all bets / predictions etc are off 😉

As for ‘major’ housebuilding programs…

Many of the LA blocks surrounding Whitechapel station are being built upwards…eg 3 story blocks are becoming 5 story. The developers are small private developers cashing in on the boost to demand in the area from the upcoming Cross rail station.

Take a look on rightmove you’ll see all sorts of what would previously seem ridiculous things on there :

Including the expansion of a building above the 24 hour McDonalds on Commercial Road where a 615sq ft 2 bed flat recently sold for 415k !!! To live above a McDonalds !!

This is only the beginning, according to the ‘Whitechapel Plan’, 3,500 homes will be built there by 2020.

And look how people now live in Stratford, and along the route of the DLR and London Overground.

The government should concentrate on building Underground Railways and let the housing follow

@JonWB: how does this translate to our case? Couple, both 29yrs, my income recently gone up from £45 to 70k, she’s on £45k base + founding director of commercial property investment vehicle with chance of public listing in 4yrs. We pay London rent £2k pcm, no desire to buy at current prices, if prices might drop parents can help with deposit. We’ve each got about £15k in sipp, each a £10k ISA (liquidity), I’ve got £20k in an EIS scheme. I’m wondering how to allocate my increased earnings across asset classes and tax wrappers.

@acorn

In terms of the eu exit referendum we had two referenda (is that a word?) in the last parliament and the status quo won

Forget the noise: look at the bookmakers odds

The bookies had a Tory majority at 7/1 !!

@William III … Respectfully, you sound like a candidate for paid advice.

@Planting Acorns, I think Neverland was referring to the bookmakers odds on the EU referendum. Paddypower will give you 4/11 on staying in and 2/1 for leaving.

The bookies don’t often get these things wrong: immediately before the Scottish Independence Referendum, when all of the media chatter was about how it was too close to call, I checked the bookmaker’s odds and warned my partner, an ardent supporter of independence, to prepare for disappointment.

The fundamental problems with our tax system are:

a) Wealth is taxed far too lightly and income taxed far too heavily.

b) The tax and benefit system (including the triple lock on pensions) is skewed in favour of wrinklies like myself at the expense of struggling youngsters.

c) Complexity

Another issue which I have is that when efforts are made to reduce the deficit by changes to taxes and benefits, no consideration seems to be given to the net effect on the economy. As an example, if you reduce taxes on the lower paid and/or increase benefits, they must have a greater propensity to spend than the wealthy who already have income well in excess of that needed for basic living expenses. This means that the net cost of reducing taxes or increasing benefits to the lower paid is not as high as as the raw figure since extra consumption will generate economic activity, higher VAT receipts and various duties.

@Grumpy … The bookies were wrong with the general election, they’re not infallible 😉

And on the second point – exactly ! Both taxes and benefits should be lowered if we want the economy to grow.

Whether people agree with this or not it was the mandate the Tories were elected on…it seems undemocratic if people can campaign on a platform, win, then have every decision blocked by special interest groups

‘I remember when Budgets were boring, but in recent years they’ve had the same “It could be you!” drama of the National Lottery draw on a Saturday night.’

This is so, so true, these days you can’t afford to ignore them because you don’t know how they might change your world overnight, like the recent revolutionary pension changes. I feel sorry for normal people, by which I mean the majority who either don’t understand it all or have little interest in these matters. They end up not being able to dodge the bullets or see the loopholes.

A young friend with little experience with officialdom or finance in general, just got a nasty shock when they found out by accident they discovered they had serious cumulative late filling penalties from HMRC. This had only occurred because the relevant mail had been sent to an old address with no option to be sent onwards.

I know people will say you have to expect that, but in London a lot of the population have to move almost every year, so this is a real likelihood. And yes you don’t have to live or work in London, but it’s a fact that most people are there because most jobs are there and most people need jobs to live before FI.

@William III, @Planting Acorns – RE: “How does this translate to our case?”

Paid for advice is a good route for you. But rather than deal with the professional wealth planners / wealth management industry, I’d suggest you start here: http://theescapeartist.me/coaching/ [Apologies to Monevator if a plug breaks the rules]. A caveat. I haven’t met The Escape Artist. I base my recommendation on what he has written on the blog.

I find it hard to feel sorry for someone not prepared to at least read a summary of the budget and work out how it affects them.

It usually takes me a couple of days after each budget to work through the detail and update my spreadsheets, so surely they can glance at the headlines?

And if they can’t understand it, well perhaps paying attention at school might not have been that bad an idea!

@FI Warrior …”you don’t have to work/ live in London”… It’s such a silly retort isnt it 😉

Thanks for the link, will investigate. I’m already doing most of what this blog recommends but perhaps an adviser can sense check our approach!

@gadgetmind – I absolutely agree with you that understanding basic financial matters is not as hard as people think and they should have a responsibility to themselves to do so; we are on this site exactly because that is our mindset. But equally, I think most people would agree that some very important aspects like pensions, insurance and taxes for example can be needlessly, fiendishly complicated.

So if it is not a person’s forte and they can’t afford a professional, I find it harsh to damn them for it when it didn’t have to be that hard in the first place. Also, a lot of people are just struggling to cope with work, family and other obligations all day long, so wrong though it may be, important financial issues can go on the back-burner, life can be tough.

@ Planting Acorns – People also may not realise that a lot of jobs only exist in London for certain reasons and today not many can afford to be picky with work choices. Another fact that gets ignored because it’s almost too obvious, is that literally millions of people were actually born in London and feel it’s their home, so they shouldn’t have to leave their personal life networks when they need a job or house just because it became unaffordable to stay, through no mistake of theirs.

@FI warrior

One G Osborne set up the Office Of Tax Simplification in 2011

There is a nice chart in the Economist settings out how another chap with a strikingly similar name has claimed the record for fiddly policy and tax announcements being made in a budget with either 84 or 86 in the 2016 budget

I can’t decide if my favourite wasn’t reduced tolls on the Severn Bridge or another lane on the M60 this year

Personally I can’t wait the Autumn Statement 2016 Fried Chicken Levy to plug the hole left by the screeching U turn on disability benefits cuts…

I have high hopes everyone will call it the Nando’s Tax

@Neverland – Oh no, please no, Nando’s is my own personal, secret occasional junk-food crime, (a la secret eaters) don’t jinx it for me. I’ll have nightmares now about having to do a cost-benefit analysis on whether the incoming ‘Fried Chicken Levy’ amount will negate the current savings when I use my loyalty card 🙂 !

@WilliamIII –

Well done. Looks like you’re doing pretty well. Discretionary expenditure of £5k a month is a nice place to be. Your life objectives should be non-financial – stay healthy and happy. The best way to stay happy to ensure your wife is happy. 😉

If you’re going to think about money – you can structure it how you like, but at first glance the over-riding thing that strikes me is you could save a lot more — regardless of where you stick it (ISAs pretty flexible, SIPPs good if you are arbitraging between higher rate now, lower rate when retired and also side-stepping the huge NI bill). As a starter: fill both ISA allowances every year, then start doing the harder thinking, but get your saving rate climbing.

Ensure that if she gets a big payout it’s covered by ER. Also if she has some control in the company then her 45k could be structured to attract very little tax. (Accountant-type advice rather than wealth-manager type advice).

But first — figure out what you want from saving. Kids and houses suck cash out of your life so nice to have some tucked away. Pensions are a good thing if you plan to be old. Whomever you speak with will use your objectives as a starting point, but don’t expect them to have better answers that what you can read here. I interviewed two wealth managers before I decided that Monevator (et al) provided a better DIY view of the world!

I took out a bet on the day of the election at 10/1!

Whilst I’m down here – AWOCS needs to brush up on his actors – “…played by the relatively unknown actor Mark Rylance” — elsewhere recognised to be one of the finest stage actors of his generation. He was artistic director at The Globe, and I recall seeing him open a play by performing a handstand over a barrel of water and then dipping down until his head was submerged to wash his face. This followed by a two and half hour tour de force.

Anyway, I digress. SHMD this week is facing an existential crisis. The point he fails to drive home is that “work” that you want to do and can stop doing is a million miles different from work you have to do and can’t stop doing. He should do something useful, but not necessarily something that is profitable. The irony being that work you don’t have to do can suddenly be extremely rewarding financially as well. I wonder if you can do that at 20 and make it all add up…

@Mathmo …whilst discussing the other reads, made me laugh I’ve invested in two of the five most popular funds according to HL …

@PA – they don’t say whether they were popular to buy or popular to sell… 😉

@Grumpy Old Paul – “The bookies don’t often get these things wrong …..

The prices that the bookies set will only initially be their “judgement”. Thereafter, the prices reflect the actual bets being placed, with the bookmaker’s over-round “tweaking” things in the bookie’s favour. https://en.wikipedia.org/wiki/Mathematics_of_bookmaking

Why bother following the budget? It all gets overturned / changed a few days later. Should look at it as more of a forum to float ideas for discussion 😉

The taxation of labour vs taxation of capital is of interest to those that understand the difference, those that don’t keep working.

@Mathmo – haha ! Although…someone, somewhere must have sold the shares the funds bought up… So I’ll have just have to hope I’m the one making the right decision not the sellers 😉