Financial journalists were just about the only winners in 2008. Whether it be Robert Peston on the BBC, the bookworms of The Economist, or the gorgeous anchor babes on CNBC, business reporters have had more front pages than Madonna.

Now they’re squeezing every drop from 2008 with their end-of-year roundups.

No time to read them all? Here’s what they’re saying in summary:

The BBC: A year to forget or learn from?

The equity market losses globally have been astonishing: in the US, on the Dow, General Motors (-89%) Citigroup (-79%) and Alcoa (-74%) are the worst fallers. Only Wal-Mart (+13%) and McDonalds (+0.5%) have made gains which tells us something about the evolving tastes of the credit-crunch generation.

The Times: The markets in 2008

This year will go down as one of the toughest on record. In the UK the FTSE 100 index of leading shares has fallen by 33 per cent. American stocks have dropped by 33 per cent, while shares in Europe and Japan have fallen by 44 per cent.

Bloomberg: Americans least favourite year

“It was the year we wish it wasn’t,” said Harvard University professor Kenneth Rogoff, a former International Monetary Fund chief economist. “The global scale and magnitude” of the financial crisis and recession “is much greater than those we’ve seen before.”

The Financial Times: The year the god of finance failed

A clean-up is overdue. Yet, in cleaning up, we must remember deeper truths: human beings will always believe what they want to; and so regulation will always fail. We know, too, that nothing better than the market system is on offer, however flawed. Financial markets fail. They are also indispensable.

CNBC: Famous Last Words of 2008 (slideshow)

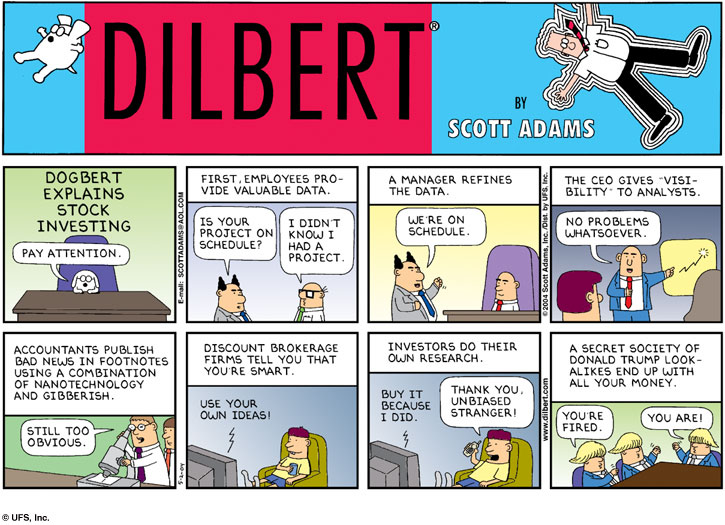

Everybody says dumb things. But this past year has seen more than its share of spectacularly bad calls from CEOs, government officials and market pros. Much of the blame goes to the financial crisis, which escalated so quickly that some statements were out of date almost as soon as they were made. Still, even the so-called experts made plenty of boneheaded comments.

Briefing.com: 2008 Year in Review

While the financial sector was clearly the focal point of 2008, the bursting of the commodity bubble led to significant declines in commodity related groups as well. This is notable because commodities acted as a safe haven area in the early part of 2008, offering investors a temporary place to hide from the fallout in financials and the rest of the market.

Fortune: 21 Dumbest Moments in Business 2008

We don’t know whether to laugh or cry. Our annual list of the year’s most laughable moves proves that, even in moments of crisis, stupidity lives on.

The Scotsman: Chill wind of recession blows the year away

The year began with Northern Rock being nationalised, and ended with the biggest financial scam in the history of the world. In between, one of America’s Big Four investment banks, Lehman Brothers, was allowed to go to the wall by US regulators in September; Bank of America swallowed Merrill Lynch the same day; and a stricken Royal Bank of Scotland has been left with the UK taxpayer as a 59 per cent shareholder.

Barron’s: Good Riddance

What made the pain all the more searing was that even as Wall Street metamorphosed into Woe Street and the economy plunged into the abyss, we had it on the highest authority (and don’t ask us what he was high on) not to worry because, fundamentally the economy was strong. Which is a bit like telling a parachutist whose chute fails to open as he hurtles toward the earth how lucky he is to enjoy such a great view.

Kiplinger.com: Lessons learned from 2008

Some of the toughest questions came from retirees who had lost a chunk of their retirement savings and were struggling to figure out what to do next. And I continue to hear from many people who have lost their jobs — or whose companies have gone out of business — and who need information about their employee benefits, health-insurance choices and ways to cut their living expenses.

The Wall Street Journal: Hard times, told in rhymes

Stocks, commodities and private equity too,

It seems every sector has stepped in the poo.

The New York Times: Yes, History Has Much to Say About This Market

You can view the markets’ behavior since mid-2007 as a textbook illustration of a statistical pattern uncovered years ago by two finance professors, Lubos Pastor of the University of Chicago and Robert F. Stambaugh of the Wharton School of the University of Pennsylvania. They found that the financial markets are always vulnerable to what they called a liquidity shock — a sudden tightening of credit. Aside from the current crisis, two recent examples are the market conditions during the market crash of October 1987 and the wake of the near-collapse of Long-Term Capital Management in the fall of 1998.

Reuters: The business year in pictures (slideshow)

A look back at the memorable moments from 2008 in the world of finance.

The Telegraph: Financial review of the year 2008

The plan to borrow Britain out of recession will leave the country’s deficit at 8pc of gross domestic product – the highest level in post-war history. Experts remain divided on whether the government’s gamble on the public finances will crucify the currency next year or help limit the pain.

Views from the financial blogosphere

Slate/The Big Money: The Five Worst Days of 2008 (video)

You know it’s been a bad year when you’re arguing about what the five worst days were. Between the massive market fluctuations and the biggest banks going belly up, it’s hard to know where to start.

Saving to Invest: Global Stock Markets in 2008

The worst performing major index was the Hong-Kong Shangai Index which was down almost 50%, reflecting the slow down in China and other Asian economies. Resource rich countries, Australia and Canada, were hit by the global commodity demand slowdown and saw their equity indexes fall by more than 40% for the year; wiping out most of the gains from the last 5 years.

Amateur Asset Allocator: How accurate were my predictions?

At the time, I suspected we had reached capitulation or close to it. It seemed as though the market was regularly shrugging off bad news, which is sometimes a sign of a market bottom. Well, it wasn’t. As of right now, the Dow stands at 8,391.

Financial reflections: 2008 By The Numbers

It’s been a wild year. A 700 billion dollar bailout, a 50 billion dollar Ponzi scheme, the Big 3 auto makers begging and stock indexes dropping like a rock. I decided to take a look at a how a few key numbers changed over the year to help see just where we are — and how far we’ve fallen.

My Dollar Plan: 2008: A year in review

With the year winding down, it’s always fun to look back and see all the things you have done during the year. It’s also a good way to make plans for the new year.

The Digerati Life: The top financial stories that shaped 2008

I have never seen so many ill-behaved corporate leaders in my life. But maybe stories like this come out of the woodwork much more often when things go south. When things go sour, many more truths are unmasked, and vulnerabilities and imperfections are easily exposed. It’s just too easy to look the other way when things are going well.

Million Dollar Journey: What have I learned from this bear market?

As some of you know already bonds in a portfolio help reduce the volatility without sacrificing too much of your returns. However, for those young investors with long investing time frames, it’s not uncommon to see portfolios with 100% equities to squeeze out every available percentage point. For those of you sweating buckets due to seeing all the red in your portfolio, it may be time to revisit your asset allocation.

Get Rich Slowly: The best of 2008

The past ten months have been amazing: I quit my job at the family box factory at the beginning of March to become a full-time writer. Since then, I’ve worked harder than I ever have in my life. I’ve had a lot of fun, but I’ve also learned a lot about myself, and about running a business.

Saving Advice: 2008: What I have learned

A year ago, I was gainfully employed working for a $2 billion company. I held a respected position and was highly paid. As this year ends, I am unemployed and trying to find a comparable position in an economy that is far from healthy and where layoffs are far more common than hiring. My home is worth at least 20% less now, as compared to a year ago and probably close to 40% less than it was at its peak value about 2 years ago. My retirement account is worth about 60% of where it was back in April and the stock market is still not showing signs of revival.

Let’s hope the next 12 months makes for happier reviews, eh? Don’t forget to stay up-to-date for free with my latest articles in 2009. Happy New Year!

Comments on this entry are closed.

It seemed a harsh time to be invested back in 2008. Having recouped it’s losses from 2000-03, the market then did a plausible impression of a camel’s double hump, with the rise and fall from 1995-2000 and 2000-03 being mirrored in 2003-07 and 2007-09.

Yet 2008-09 was actually the best of times to be an investor.

With a tailwind of falling rates, 2009-21 produced what in retrospect were truly marvellous total returns in both US large caps and bonds.

The rally was hated in that, for year after year, nobody seemingly quite believed that it was actually real, even though securities’ prices told a different story.

And far from sparking hyperinflation, QE and ZIRP saw low levels of demand and inflation.

However, productivity growth was poor and labour took an ever smaller share of output vis a vie capital. If anything, QE and ZIRP actually looked underdone, and both needed countercyclical spending, not Austrian school of economics’ austerity, to compliment their intended effects.

Whilst markets soared onwards and upwards, albeit in their ever volatile, unpredictable fashion; disillusionment with the status quo set in, leading to revolts (the Arab spring and the Syrian civil war), to the general entrenchment and emboldiment of national strongmen (Modi, Putin, Xi, MBS, Orban, Erdogan) and to a rise of a corrosive and hateful populism (Trump, Grexit, Brexit, Voxi, AfD, Farage).

It was at this level of mass psychology that the events of 2007-09 took their greatest toll.

The belief in democracy, technocracy and meritocracy, in pluralism and openness, in globalised free trade and in free markets; were tested and frayed.

Markets healed quickly, but the minds of the masses were left scarred, more open to misinformation and conspiracism, and less receptive to reason and to pragmatism.