Fair warning: Feel free to skip this LONG post. I have tried to focus on the investing ramifications of the general election. However I do make statements that will strike some as political, if not excessive. That is the nature of politics currently, which I really would love to fade from this website.

Today I’ll explore what stance investors should take post-election, given where we are and where we seem to be going.

I won’t be rehashing (much) how I believe the country should have voted in the Referendum or in last week’s election, though inevitably I’ll reference both.

Remain is lost. The Tories have won a big majority.

If you applaud this outcome then I’m not going to change your mind. And if you’re a Remainer who has watched the rise of Leave, Boris Johnson, and what it represents with dread, it’s still time to take stock and be prepared.

Hard Labour risk off the table

It’s already clear from the data that Brexit was the biggest of several swing factors that won it for Johnson.

However from the market’s perspective, taking a Jeremy Corbyn Labour win off the board is by far the bigger win.

That’s true from the perspective of the individual personal finances, too, for anyone with chunky assets and/or a good-to-high income.

Catastrophic defeat for Labour and Corbyn means no outright nationalisation issues, no State-forced dilution of shareholder assets via 10% share giveaways, far less regulatory threat, probably a stronger pound, probably stronger gilts (and thus cheaper government borrowing), and no windfall or wealth taxes or outright Tobin-style taxes on financial transactions, or anything similar that Corbyn and McDonnell might have come up with.

UK shares warrant higher multiples

All of that is very good for UK markets. Britain looks set to remain an Anglo-Saxon style capitalist country. Shareholders will enjoy strong property rights, and other ongoing regulatory and legal protections.

The immediate beneficiaries are obviously those companies that were directly in Corbyn’s sights – utilities, travel firms, and telecoms for instance.

But all UK shares should be marked higher on this risk going away, to whatever extent a potential Labour win had previously weighed them down. A multinational that earns only 5% of its revenue in the UK and was thus fairly immune to the UK economy, say, still faced outright threats from some Corbyn proposals. That risk is now gone.

With that said, the bounciest companies in the immediate post-election rally were UK domestics, such as housebuilders and UK banks.

This is also logical, but only so far.

On the one hand it makes sense if you feel that Corbyn’s domestic agenda threatened such company’s profits as well as potentially hitting their assets directly through, say, mandatory share distributions.

Higher unionism and government regulation loomed larger under Corbyn, for example.

Many will feel too that UK economic activity will be stronger under a Tory government than under Corbyn’s version of Labour. I’d say that’s true, leaving aside thorny longer-term issues about generational inequality or wealth distribution.

Remember though that any State stimulus-driven boom that happens under the Tories would have been equally enjoyed under Labour.

Moreover the Conservatives come with far higher Hard Brexit risks baked-in. That to my mind remains a big danger to the UK economy. (See below).

On balance I’m minded to continue to hold slightly more UK assets than before the likely result of the election had become clear, but fewer than if Hard/no-deal Brexit was finally ruled out.

Remember a UK home is a UK investment and an asset. If you’re a homeowner with an average-sized investment portfolio, you’re already very exposed to the UK economy. Even more so if you have a job here.

Tax shelters, personal allowances, and pensions – as you were

There is little reason to believe the UK’s very generous tax sheltering regime is going away under this Tory government.

ISA allowances, higher-rate relief for pensions, and the ability to put large amounts of money into those pensions will almost certainly all remain intact, if not improve.

Capital gains tax allowance shouldn’t change, either.

In the election run-up the Tories talked about revisiting the annual allowance taper. This problem is most acute from a societal perspective in the NHS. However it would be more coherent for a Conservative government to ‘fix’ this problem universally. So if anything, the potential of pensions as wealth-amassing vehicles could get even better.

I can see inheritance taxes being simplified, too. The main residence nil-rate band is confusing. Illogically to my mind, most people hate inheritance tax (IHT) even if they don’t pay it. But anyway, the number who do pay has been rising. Perhaps Johnson will use his majority to scrap the current system and instead aim for the £1m IHT-free threshold the Tories mooted a few years ago.

Personal tax allowances should rise a little, but I wouldn’t hold your breath for big income tax cuts. Not given the likely scale of State spending. Possibly the additional rate band could be scrapped as a simplification measure. That would make some sense.

Bottom line is if you have assets and you’re an average-to-high earner, you’re alright Jack.

Wealth preservation should be straightforward (ignoring currency fluctuations!)

What if you’re just starting out?

If you don’t have assets or a decent income, you need to try to fix that if you can. Pronto.

State spending increases will be directed towards infrastructure and investment, rather than welfare payments or even in-work benefits. I see little respite for the bottom rungs hit by austerity over the past ten years. So get off those rungs if you can.

Talented individuals of any age and class should do better financially in a looser and probably more vibrant Tory-run economy than under a Corbyn Statist equivalent. But the aggregate wins will continue to be skewed towards the haves, rather than the have-nots – continuing what we’ve seen post-Gordon Brown.

Run this forward ten to 15 years, and there’s a case for Monevator readers making even more self-provision.

For instance I don’t believe Johnson intends to dismantle the NHS – I’d argue there’s even more of a consensus around it being a public good than in the 1980s – but I could see nips and tucks. If you are concerned about NHS waiting lists today, I don’t see the situation improving. It might be worth thinking about private healthcare, or at least self-insurance in the form of a far higher-than-otherwise emergency fund.

Ditto education, vocational training, your kids’ university courses, and similar state provisions. I’m not hysterically claiming state support for such is going away tomorrow. However there’s no reason to think it’ll be improved much, beyond some catch-up anti-austerity spending.

What about housing? Well, if you’re young, you’re not already a home owner, and you’re not likely to be a high-earner, you’re probably screwed re: housing. At least in the more prosperous areas of the country where most of the best jobs tend to be.

The Conservatives say they’ll build more homes, but I don’t expect them to build in their core voters’ prosperous backyards. Also, it won’t be social housing, it will be new homes for the next generation of young professionals. So anything the Conservatives do to deliver their million home pledge will likely be done through relaxing planning or further boosting incentives and support for builders and buyers. We can probably also expect some sort of new Help to Buy type scheme eventually.

This means house prices will go up – assuming no hard Brexit.

Again great for those of us who own a home already, not so much if you don’t.

Honestly, if you’re a 20-something Remainer – especially if you’re in a non-high-paying field (say teaching, nursing, general admin) – then it might be worth moving somewhere like Lisbon or Valencia or maybe non-mega-city Canada or Australia and building a new life there. It could be a big quality of life arbitrage.

Brexit isn’t done yet

Okay, let’s dial up the controversy a tad. I’m still trying to look at this from a practical perspective, but clearly it will reflect my views.

We are going to leave the European Union. However I believe this becoming a certainty with Johnson’s elevation didn’t have much to do with the immediate rise in the pound or the relief rally in UK assets, despite the spin. I think that’s nearly all about Labour being out of the picture.

With that said, the size of the Conservative majority is important. We now have a government that can get through its legislative agenda without fear of internal revolt or external coalitions.

For investors, the multi-dimensional problem of Brexit politics has become easier. It’s now ‘only’ about what the Conservative party and the EU each want and will accept. Other hitherto important players (opposition MPs, soft Brexit Tories, Remainers at large) have at a stroke become irrelevant to the calculus.

This should make it easier to assess the trajectory of Brexit than before – but note that easier does not mean easy!

For instance, just last week I was opining in the Monevator comments that Johnson’s ego would encourage him to sidestep a very hard or no-deal Brexit, if he wants a strong economy for the next five years.

Even if you’re a Leaver who believes in national economic benefits from Brexit – superior trade deals, reduced regulation improving competitiveness – such alleged benefits won’t be front-loaded. (I am setting aside any ‘pent-up demand’ business or foreign investment we might see over the next few months, which would have happened with-knobs-on if we’d instead had the certainty of Remain.)

So avoiding a no-deal Brexit remains short-term important, from an economic perspective, even you’d think for Johnson. But already it’s been cast back into doubt.

Johnson is apparently looking to impose a new ‘cliff edge’ at the end of the current transition period. While this will give the UK some negotiating leverage, it does the same for the EU, who can now test the UK’s tolerance to go through with a no-deal Brexit by dragging their feet.

The result is the stakes have been raised again.

Brexit uncertainty is certain to continue for at least the next year. You can see this in the pound, which has already slipped back to where it was before the election!

And this is not to even go into future Union-related issues concerning Scotland or Northern Ireland.

Most observers, including me, still believe it’s likeliest we’ll have an extended transition period and a long debate about a trade deal, which could go on for many years. This is economically perhaps the best outcome from here (leaving aside a soft ‘Brexit in name only’) but it will still be an indefinite economic friction, which will continue to see the UK economy trading below where it would otherwise.

Judging by the past few years, the electorate won’t care politically, but they will remain a bit more hesitant, and this will continue to dampen consumer spending, house prices, and so on.

The question will be how much the enthusiasm for Johnson and his new Tory government and also Remain being off the agenda – and the spending the Tories are likely to unleash to reverse their own austerity – can be translated into what we used to call a ‘feel good factor’ that will rev up animal spirits to counter that ongoing Brexit drag.

Active versus passive responses to ongoing Brexit gyrations

Personally as an active investor I’ll be nimble in the face of these Brexit shifts. The past week or so was great for me – I was up about 5% in a week as I’d tilted heavily towards the result I didn’t want but seemed inevitable – but even as the rally roared I started dialing back that tilt, selling some UK property assets to buy international earner Diageo, for example.

There is a cost to this. Not just trading costs, but also the opportunity cost of continually trimming winners, adding to losers, hedging against increased or decreased political risk and so on.

I have done fine in 2018 but I have lagged my benchmarks. I see this as the price I have paid for avoiding a No Deal calamity, if we’d seen it, while retaining the opportunity to benefit from other outcomes.

Passive investors are well-advised to stay clear of all this. Just owning global trackers and some bonds and letting Brexit shout itself out in the corner has been a boon since the EU Referendum.

True, you will be thwacked if we do see a deal reached and the pound truly rally. Your overwhelmingly overseas holdings will fall in value.

But remember two things:

First, they were previously juiced up by the collapse in the pound after the Referendum.

Second, it’s anyway extremely difficult to trade the existential politics of Brexit to post a net gain that’s worth your time.

It’s easy to look in a paper and say “I saw that coming!” But you probably didn’t, and even if you did you often won’t get the market reaction right. And even if you did see that, are you sure you know where you’d be all told if you’d steered clear of trading altogether?

For example the UK domestic shares that have rallied so much in the past few weeks were in the dumpster just a couple of months before that. That plunge was what set the stage for their recent sharp recovery.

What does Johnson’s government stand for?

Okay, from here it’s big picture navel-gazing – possibly the most important questions, but also the muddiest answers.

Like most of the developed world, Britain is going through convulsions.

As best I can tell it is being driven by technological change, the advent and polarization of social media, globalization, the financial crisis and its uncertain, austerity-dominated aftermath, a backlash against the overreach of identity politics, and decades of self-selecting regrouping around people who think like us and our particular friends – aided by moving (or not) to a few big cities, marrying our peers, and the waning of all sorts of mixed social spaces, from churches to old-style ‘you get all sorts in there’ local pubs.

However unlike most of the rest of the world, the UK hasn’t been the calm one carrying on, as we might have expected.

Instead it’s embraced Brexit – overturning its long-established political and trading relationships, and voluntary casting overboard various rights enjoyed by its citizens, in exchange for less ‘foreign’ oversight of those citizens.

And it’s now delivered a general election that’s smashed our preconceptions of class and the political geography of this country.

The best that can be said is that if the world is changing, we’re doing something about it rather than passively sitting back. (Albeit I think the wrong thing.)

One might also argue that the swing to the Tories in Leave-voting towns – and the evident disquiet if not disgust in many of those places for what Corbyn’s Labour represented – shows a final flowering of Thatcherism. After all, Thatcher – whom on balance I admired – wanted working class people to throw off preconceptions of where they came from and aspire to be middle-class types, just like traditional Tory voters.

Haven’t they done just that? Well that discussion is for another day, and another website.

From my perspective here, the issue for our net worth is the country is in flux and it’s not clear where we’re going. To me the UK is ‘in play’.

The new government will set the tone, of course. What can we say about its ideological convictions, beyond ‘getting Brexit done’?

I believe Boris Johnson’s only absolute conviction is Boris Johnson. Before you shake your fist, consider that we knew him first as the globalist, liberal-ish London mayor. He then went on to recast himself as the leader of a nationalistic and subsequently populist project, and latterly he’s been trying on the robes of a one nation ‘King of the North’.

If you find these shifts consistent, you’ll reach your own conclusions. I don’t and so I’m inclined to discount anything he says. I’d rather look at what he seeks to gain, which is re-election, in assessing his motives.

Dominic Cummings has been cast as the closest this Conservative government has to an intellectual wing. What does he stand for, and how should we prepare?

The short answer is read his blog. You’ll find long screeds against government and paeans in favour of technology, science, cleverness, and the markets. If you’ve less time on your hands, this New Statesman article is reasonably non-partisan.

My take is that Cummings is more an arsonist than a firefighter. He seems angry, he’s against a lot of things, and so far we’ve seen how effectively he can take things down but not what he can build. I think he believes the market, science, and data can do a better job of coming up with solutions than government anyway, and he has expressed a deep antipathy towards establishment politics.

In more normal times I’d actually expect to sit more on his side of the room. But we’d be on the fringes, where radicals belong, gestating ideas to be cautiously cherry-picked, not at the heart of government, swinging an axe.

So there’s the potential here for disconcerting levels of change – as if Brexit wasn’t change enough for a generation.

You might say bring it on, after all you wanted Brexit. But what if the next institution the axe targets is your legal protections through the courts, or mandatory vaccinations, or the BBC, or national service, or food standards, or the House of Lords, or the armed forces, or the benefits system, or the promise of a state pension?

I’m just throwing out examples, not making predictions. The point is revolutionaries are by definition agents of change. You might not get the change you wished for.

Incidentally, the defeated Labour party manifesto shows traces of the same trends. In place of the pragmatic social democracy of Blair and Brown, we had a Hard Left manifesto from the early 1980s, albeit stripped of the guff about state control of car makers and so on.

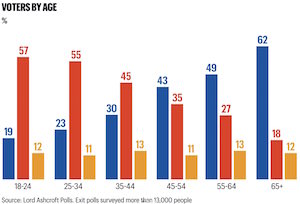

Remember, something like half of people under 45 voted for Corbyn’s Labour manifesto.

Tory voters are dying, Labour voters are still being born.

So again, be careful what you wish for. Who is to say the next lurch won’t be back from a harder right-wing government to a harder left one?

As someone who believes this election was hugely influenced by Leave/Remain, I certainly don’t write off Corbynism. Nor will Johnson, so we can expect to see some efforts to shore up his new base in the formerly Labour-voting regions.

A tinfoil hat bit to conclude: Have a ‘bug out’ plan

The point for me is that you need a Plan B. I believe there’s a non-trivial chance you may want to get out of the UK in the next five to 20 years.

Before I get screamed at – or this post referenced in ten years as ludicrous – I’m only talking perhaps a 5-10% chance as things stand. So it’s a small chance, but it might happen. That’s the way probability works.

Probably we won’t spiral down into some hard-right / hard-left Dystopian nightmare. Perhaps having these modest populist convulsions today will see off deeper problems that other countries will need to face in the years to come? That was one argument made by some Leave voters, who felt we’d be more flexible outside of the EU.

The point is this prospect of national calamity was effectively non-existent 20 years ago. The UK was one of the most politically stable countries on the planet. This is no longer the case.

So get your F-off fund. In a worse-case scenario you may need to deploy it against more than just an unpleasant boss. Consider using some of that fund to explore and if needed secure the potential for a life in an alternative jurisdiction.

I made sure my Plan B was solid in the weeks after the Referendum. I suggest you do, too.

Think I’m being hysterical? As I said, I’d guess it’s only a 5-10% chance I’ll need it, gut feel. But it’s the sort of thing that if you need it, you really need it.

While I don’t claim to be a fortune teller, I’ve long warned there’d be societal consequences from the financial crisis, such as in this post back in 2012.

We are certainly not yet off that train. I’m not even sure we’ve left the station.

——–

Note: If you’d like to comment please try to focus as much as possible on money and investing consequences. I understand I’ve strayed a bit above, but that’s my prerogative as this blog’s owner and waffler-in-chief! 🙂 For the sake of a good conversation, if you like the Johnson agenda it’d be better to focus on what tax and spending benefits you see. If not so much better to focus on what practical steps you’re taking to mitigate any downsides.

Please stay polite. I didn’t delete a single comment on the post-election Weekend Reading, and it’d be great to avoid doing so again today.

[Source and larger version of voting poll in top-right: Paul Lewis via Twitter.]

Comments on this entry are closed.

A thoughtful piece as usual. As often seems to be the case, as soon as one set of concerns (sort of) clears itself up then a new set emerges.

It’s going to be interesting to see how the Labour leadership campaign pans out, and whether the prospect of much higher taxes on investment recedes or remains on the table. I’m still minded to ‘defuse’ some potential CGT gains as you like to say over the next few years.

I turn 55 soon after the next election so although my plan is to move into drawdown at that point, I’d prepared for the fact that may not be an option or an attractive one once tax issues are considered.

Does anyone know if the age mix of people voting has changed much from previous elections? It would be interesting to see it in the context of turnout as well. My assumption would be that more and more people vote as they get older and, by and large, these new voters tend to favour the centre or the right.

@ITInvestor, I read that the average age at which people pivot from Labour to Tory fell eight years last week. The Boris effect? Also Tories now more likely than Labour to be on low incomes and without degrees. Socialism as a Veblen good?

Good analysis from an investment pov.

I’m not sure the demographics analysis is correct, the average age you’re more likely to vote Tory is going down, 39 at the last election (down from 47), and the electorate is getting older, not younger, as we live longer.

RE: Electoral/demographic analysis, note that I said “half of voters under 45” not “half of all voters”. Just eyeballing the graph top-right suggests more than a 50% vote share of under-45s went to Labour.

Of course this is based on a poll, not real votes, albeit the well-regarded Ashcroft’s poll. We’ll no doubt get more accurate and granular data in the months ahead.

Who knows what is going to happen -if we ever did!

Life is going through one of its frenetic moments -once again!

A Global Equity Index Tracker Index Fund plus a Global Bond Index Tracker Fund hedged to the Pound-for me -plus a year or two,s expenses in cash

Cheap,simple and easy to understand

I am old and have fortunately made my pile so 30/65/5 Asset Allocation for me

I honestly think 65/30/5 and every permutation in between would do as well -over the long term-20/30 yrs

Make your choice on how much volatility you can handle -more equity if you are young and in work?

Perhaps live a little more frugally

Once setup -leave your investments alone and concentrate on your day job where you have some control

Probably half your investment portfolio growth will grow from savings earned from your own work

Myself- now in retirement 17 yrs- the above has worked for me-so far

That’s it

xxd09

“Tory voters are dying, Labour voters are still being born”

“One born every minute comes” to mind

Voters are turning Tory at a younger age, staying Tory and living longer.

Labour’s vote is also be squeezed by class, with the Tories winning every class grouping.

This election was a Labour and Liberal Democrats rout, with nationalists winning in both England and Scotland.

Thanks TI. I’d guessed, and hoped, there might be a follow up piece.

Given that the election result coincided with the start of when we might often expect a “Santa rally” I jumped into UK equities with both feet last Thursday. Although I read today that on a PEG basis the FTSE 100 is actually more expensive than the S&P 500.

In terms of derisking according to our individual fears about what may happen to the UK we can be thankful that our investing universe seem to have widened so much in this digital age. When I first started investing (around 20 years ago) I went to an IFA whose idea of diversification was five different funds but all UK focused. It is now so easy to get a cheap world tracker and the ups and downs of the UK market fade into near irrelevance.

Away from finance there are others things I’ll do like finally getting round to sorting out an Irish passport. Not for me but because I enjoyed the opportunity to seamlessly work in the EU and I’d like my kids to have that same opportunity. And before anyone gets upset, yes, it’s quite possible that a future relationship with the EU will still offer that but I’d rather not take the risk.

@Fremantle — That comment is pretty much the definition of not even trying to focus on money or investing.

Please let’s not go down this road, otherwise I will start deleting, which is a waste of everyone’s time.

One thing is that the Lifetime allowance is not really the problem with the NHS pensions.

The bigger problem is the Annual allowance and the way contributions are calculated on final salary pension schemes.

The combined effect of which can result in effective taxation of well over 100%

On Cummings, this too is worth a read: https://www.lrb.co.uk/the-paper/v41/n20/james-meek/the-dreamings-of-dominic-cummings

I’d be shocked if the additional rate goes… Boris will want to keep those seats he’s just gained. More likely the tapering of the personal allowance and issues around pensions you identify are removed.

I’m hoping you have it wrong in house building. If enough homeowners can’t see a future for their children there will be a swing to building. I own a home which I live in and am not sure the value matters? The relative value ( to my next home) matters a great deal but if all house prices in the country dropped uniformly by a third I wouldn’t be any worse off in any meaningful way would I ?

I don’t blame youngsters voting for Corbyns manifesto. It must be heartbreaking to leave uni with 50,000 of debt and houses worth 20 times incomes. Building more houses likely to see off the threat though.

I’m not sure if this qualifies as being allowed… but I don’t think they’ll lose as many votes from a downturn as they would from going for a soft brexit. And if I think that, you should consider it a problem. Plus nobody knows the size of ERG now, but we can be fairly sure there aren’t many soft brexit Tories. That is pure politics, but I’d be betting on a hard brexit with the very simple deal ( ie aviation) at end of next year so that they can get it out of way with years to go until election. I guess we’ll know what way the wind is heading at the substantive cabinet reshuffle in February

Pretty harsh suggesting young people without family wealth or an elite profession leave the country.. but then I did just that – twice. Unfortunately it seems like every western city of reasonable size (say >= 1M residents) has similar inequality and housing issues. I don’t know how we ever get back to sustainable housing. (Genuine apologies if too off-finance; after savings, location and housing are the biggest levers in life so it’s a fascinating topic.)

Very interesting analysis – thank you.

As an NHS doctor, the combination of the NHS Pension Scheme rules, annual allowance / tapering and complete inability of the NHS Pension Scheme administrators to provide information about my pension in a timely fashion (a year of badgering them means my pension is now up to 31/3/15) makes all the macro-political stuff almost trivial to my finances. In fact, this seems to be the case more and more- it’s the micro stuff that seems to matter most, though perhaps that’s just how it feels because the counterfactual is more obvious.

A good assessment; double good as it aligns with my thoughts and actions. Actually I have two alternative jurisdiction exit plans, as each has some uncertainty; first is “oven ready” (sorry). Biggest problem is a lot of UK property, that has made money, is monevated to make more *but* is terribly illiquid.

I’ll need to re-read this article again, in case I’ve missed anything. It’s exactly what we need. How about quarterly updates ?

All this is pretty small compared to 2008 I think, and that happening again would be a bigger risk than either corbyn/brexit, we should really be focussed on diffusing the next crash. 2008 was after all the trigger for austerity which led to both corbyn and brexit populism as a backlash. Remember the uk is only 6%(?) of the developed world, the risks are more for uk residents than uk investors.

US technology could be in a bubble and uk housing is vulnerable if interest rates jacked up in response to inflation – but I think the BoE would print to save house prices/bail out banks/bail out government even if rates increased

https://www.google.co.uk/amp/s/www.indy100.com/article/crossover-age-vote-conservative-election-labour-9250471%3famp

This may be of interest to you

Well, I was disappointed in the election result, but the silver lining was avoiding Labour plans for CGT and dividend tax.

I’m certainly planning to use the annual Capital Gains allowance now.

I would lbe interested to see an article on Bug Out planning.

nice article. I second third and fourth the aspiration to reduce the politics from this blog. It’s your (excellent) blog and we all have our views but I read this for investment views tbh

I would be interested in your Bug Out Fund. Do you have it (a) based in UK – I would think it needs to be abroad (b) invested in global equities / global bonds – presume needs to be non-UK assets and given it would be for liquidity purposes (?), I guess it would be inflation linked bonds or even gold (?). Is it a large part of your portfolio and for what purpose – if living expenses for 12 months then manageable but presumably can’t be enough to set you up for life overseas. Also how to integrate it to your overall asset allocation is interesting. If its large it will impact overall returns, so presumably needs to form part of the overall allocation and could impact your returns.

For what it’s worth I like this idea. A non UK passport would be useful (I am lucky enough to have this) to ensure you can access it. The Sh*t would really need to hit the fan so a 5% probability seems about right. My point is if the Sh*t really does hit the fan, having it in a UK based stock trading account isn’t going to provide the necessary safety. My thought process is to set up an overseas trading account and start putting some investments in it. Part of my overall asset allocation. Haven’t figured out exactly what I would put in it but I suspect it would be equities unless I transferred my bond allocation to it.

@Matthew — “US technology could be in a bubble and uk housing is vulnerable if interest rates jacked up in response to inflation – but I think the BoE would print to save house prices/bail out banks/bail out government even if rates increased’ —

But why? When we bought our first house, the bank offered 10% fixed, and I phoned my Dad who told us to go for the variable, which proved to be the best choice. Why on earth should a government have to be involved? What is it with the UK and this obsession with house prices??

Thought-provoking and worth reading as always. In plotting our financial journeys important to remember that we are always at the mercy of politics, and agree that the current era of volatility looks here to stay.

One issue surprisingly not covered, however, is the financial impact arising from the potential collapse of the British Union which, after the Tory victory, now looks significantly more likely over the next decade. Ignoring the clear will of the Scots and Irish people to stay in the EU has inevitably strengthened support for Irish unification/Scots independence and a cliff edge Brexit at the end of 2020 will only intensify those movements. We could end up with a Catalonia style stand-off between Sturgeon and Johnson, which is unlikely to encourage confidence in the UK economy by international investors.

Irish Unification I suspect would have rather limited economic impacts on the UK (rather more problematic though for the Irish Republic for which there are parallels with German reunification in 1990). However, Scots independence and the creation of a border across this island for the first time in 300 years, not to mention the difficulty of dividing up the spoils in terms of assets, debts and defence, could well make leaving the EU look like a cakewalk.

Difficult to see how this would not be negative for sterling and inward investment. For UK based firms the disintegration of Britain could be an additional medium-term negative in terms of red-tape, uncertainty and disruption, following the potential no-deal Brexit cliff edge at the end of 2020. The rump English state, weakened by the loss of the North Sea hydrocarbon industry, the loss of tax-raising revenue from Scotland, and facing the relocation costs of its defence assets, might well face more expensive borrowing costs and a serious downgrading of its credit rating. In the long-term, Scotland rejoining the EU single market might be positive for its economy, but it will also face serious readjustment costs in the meantime.

Difficult to predict the full scale of these impacts on personal investors, but to my eyes the negative risks facing UK based assets still look substantial over the short and medium term.

@TI

Apologies. I missed the weekend reading festivities and the “one born” line was too tempting.

As I said on the weekend reading comments, I’ve a ten year plan to secure a Spanish passport for my children. I hope it’ll never be necessary, but even with a open trading framework post-Brexit, I’m not sure I want to be part of this inward looking 1950s imperial fantasy.

With regards to changes to my asset allocation, I’ve trimmed the equities and gone for 15% bonds and 5% cash. But this is more because retirement is more real as I only have 13 months until I can access my SIPP rather than Brexit and I don’t feel comfortable with 100% equities anymore despite expecting a small DB from the civil service and a full new state pension.

@SeekingFire – that’s a thought. I was just about to lock up £20k for a year with Metro Bank. Maybe I should move it to a Spanish bank. I’ll have a quick search online. We are planning on buying a house/flat in the next year or two inorder to get started on the citizenship thing, so we’ll need it then anyways. All my accounts are UK based, so I really ought to diversify.

All this researching and planning is quite liberating after the weekend’s despondency!

Would the Scots after we leave the EU then vote for Independence and sail off into the wide blue yonder alone?

Remember the Scots were the first to do serious tactical voting ie voted for Union and then returned mostly SNP representatives to Holy rood and Westminster-presumably on the assumption that SNP would bat best for Scotland

Our electorate is very sophisticated now-remember how when it did not really matter they sent mostly Brexit MP,s to Brussels

I find it all very reassuring that the common man(and woman) is so switched on

Do our “educated” elite really think that they would be allowed to overturn a basic fundamental raison d,etre of our democracy -a democratic vote

Good luck with that!

xxd09

PS I am a Scot

Sorry if my first paragraph above was not financial, I’ll be more mindful.

I’ve a Starling account which I opened before getting my Spanish resident permit. It has a Euro account option with very competitive exchange rates and is fully covered by UK compensation. So that can act as my bridging account.

Does anybody know what happened to the European Citizens’ Initiative (ECI) about UK citizens being able to keep EU citizenship?

I agree the Scottish and Northern Irish issues are important and I do name check that in the article. For the purposes of this discussion I think we can lump them under the category marked “UK in flux.”

We will all have opinions about the politics of it, likelihood etc but let’s please keep things on the personal finance topic. 🙂

E.g. At some point the physical location of some companies and their headquarters might become share price sensitive again, as it did in the last Scottish referendum.

A Scottish passport opportunity might be the “new Irish passport” for bug-out preppers too, especially as one reason Scotland wants to stay in the EU is it wants/needs inward migration to top up its population.

For the avoidance of doubt, in my view bug out prep isn’t only about liquid wealth, gold, direct investment overseas. It’s primarily about having a passport or some other rock solid right to live somewhere else. Agree you’d want to move before getting cash out was a problem, which is the reason to think about it now, while the likelihood of actually needing to still looks much less than a one in ten chance.

Glad to see everyone’s confident of no changes to the pension tax regime. I worry that the tax relief cost will be too tempting for a government with a big majority that needs to find funds for its plans to reverse austerity and invest in the North. We could see changes proposed presented as addressing the NHS scheme problem and widening tax relief whilst removing the higher rate relief. Given most of the higher rate relief is claim in London and the South, I believe. It could even be presented as redistribution to the Northern seats who’ve just voted him in.

+1 to a plan B – I was lucky enough to be able to get a second passport, but a second language would also be a good investment (and fun) so is something I’ve started on.

While my portfolio is passive – its construction has a UK bias – so I’m in the process of switching it to a two fund global equity / bond mix for all the reasons in this (and previous) articles.

Our financial prospects have been dominated by Brexit uncertainty and as that begins to resolve I suspect the whole climate change debate is going to take centre stage. I think this will happen very quickly – I think climate change awareness has passed an inflection point and become mainstream. The impact of climate change on government policies and our personal finances is far from clear but I’m slowly reducing my holdings of oils and miners.

@Steve21020 – the theory I read once is that if house prices fall significantly some people in negative equity would choose to default on their mortgages rather than move (bankrupsy better than excessive debt) – and in 2008 it didn’t take much to render the banks illiquid – if the banks go bust then transactions can’t happen and the economy seizes up, and it undermines the credibility of putting money in the uk – banking is amost up there in national importance as defence, so Brown (always a frown) had to bail out the banks – but doing so was extrordinarily expensive because banks are so leveraged, and with rates so low we are vulnerable to another property shock.

Note that the BoE also used QE to suppress gilt yeilds – in other words government borrowed too much, that debt got too expensive, so BoE refinaced it for cheap and handed the money back. The BoE wouldn’t let government go bust just like the government wouldn’t let banks go bust.

They couldve let it all collapse, but would we be in a better position? I don’t actually know, but it is possible to recover from the current state

On the bug out fund. Agreed on the need for a 2nd passport. On the fund, I can’t see how it can be located in the UK or with a UK institution. Needs to be abroad otherwise capital controls could be a problem (e.g. Malta / Greece). Also need to think about location. if there’s a 5% chance of a extreme sequence of events occurring in the UK over the next 5 – 20 years, what’s the chances of something occurring in your chosen destination. For those reasons, would think Switzerland, Andorra, Liechtenstein are better bets for the fund to be located. Also it needs to be meaningful enough for you to ‘bug out’ rather than going on an extended holiday. Which means it could be seriously expensive insurance unless invested in productive assets. So either part of your bond portfolio or globally equities allocated. At which point tax and investment costs become a consideration. If this all sounds a bit preppy, remember 95% chance of no need and intention is not to impact the returns your FIRE fund generates.

On working abroad generally – Portugal is low cost and has an attractive ten year tax rate for ‘managerial’ expats. Spain has something similar for five years. If you can find the work.

Bug out fund – already working hard on this. It’s not the short term effects that worry me but the long term – being buffeted between the US and Europe is going to make us a very unattractive place to invest and grow, plus (as someone above said) I don’t think 50’s Imperial nostalgia a great mindset for the mid 21st century.

Looking at moving to Ireland (spouse and son have Irish passports). What’s so infuriating is disentangling assets from the UK. Seems they don’t have ISA’s at all, and whether the double tax treaty will treat ISA income/transfers as already taxed – can’t find any info.

You can transfer a pension although lots of caveats and potential pitfalls – details here: https://www.gov.uk/transferring-your-pension/transferring-to-an-overseas-pension-scheme

@steve – re climate change I wonder if the greta thu’umberg effect gets old and wears off, she won’t be a school striker forever. Environment policy won’t be unwound I think but I don’t see overall urgency, since some permanent change is tolerable. As for effects on investments, disasters will weigh on buildings insurers and the uninsured companies of less developed markets, farming will gain in some places and lose in others – change itself providing opportunities, shipping lanes will open up, demand for water might increase and present an opportunity to provide it, and suplier of all things environmental might do well, but oil isn’t dropping in a hurry, certainly not faster than an index deems appropriate, and all these other expectations will be priced in so I suggest don’t deviate from vanilla indexing.

Re £$: after the fall of the quid post Brexit vote in 2016, we switched 2/3 VWRL 1/3 VGOV to 1/3 each VWRL/IWDG/VGOV (switching VGOV to AGBP last year and latterly a bit of VAGBP to get a better iShares/Vanguard split).

Happy so far and may stick with it for a bit of forex diversification when the pound gets back to whatever normal may turn out to be.

It’s not the cheapest, though VWRL cost has dropped recently.

Anyone doing something similar?

@all — I’ve deleted a few comments, on my mercurial tyrannical whim. One is telling me what I should write on my own blog, politely enough but I can’t be bothered with it today. If anyone doesn’t like this site they are very welcome to read/write elsewhere. 🙂 The other two were mostly political opinion — one balanced and articulate but pure politics and I try to be even-handed, the other was a nicely-written polemic.

Thanks to everyone else for staying on topic! I reserve the right to rant about purely politics again in the future; if/when I do (polite) counter-rants will be more than welcome if anyone wants to write one. 🙂 But let’s continue to try to dial into investing implications here, albeit inevitably tinged with the political over-shadowing, for now. I think we can see it leads to a better discussion.

@all — I had a brain slip my essaying and wrote “lifetime allowance taper” above originally — thanks to those who emailed/Tweeted corrections, it should of course be “annual allowance taper”. Corrected now.

On the investing ramifications my view is that the UK is now a better place to be invested because of the decisive outcome with both the Brexit stalemate and the Labour threat removed. Having reduced my UK exposure to 50% I am now cautiously increasing it.

I have Canadian citizenship and I’m looking at getting a passport for my plan B should things really go south (and who knows with BoJo and Cummings at the helm). But I’m heavily invested in property so I’ve been quite conflicted recently, I’d have liked us to Remain but who knows what McDonnell would have done as chancellor with his right-to-buy plans for renters (personally I thought a Lib Dem/Labour coalition would have been alright but never mind).

I reckon house prices will go up, the Tories are too self interested to allow anything else, but I don’t want to bring children up in a country where public services, health and education are crumbling so… I’ll give it a few years and see how things go. If ‘The 18 Year Property Cycle’ is correct then house prices are about to rocket for the next 4-5 years before a crash in 2024, so maybe I’ll sell up in 2023 and flee abroad (!)

@TI

What are your more detailed thoughts on House builder stocks? Even though Help to buy is coming to end surely the government will do something else and continue to leave house building up to the private sector, although I wonder if tighter regulation might impact profits.

I myself feel UK stocks overall could do well in coming years, plus I dont feel comfortable putting new money into overseas stocks with the £ behaving in such a perky way on forex markets.

I am interested in hearing more about ‘bug out’ plans. Not the prepper sort (though they are entertaining to read about). I’m thinking more the UK going into a deep and sustained recession. E.g. like the 1970s. I hear they were a pretty grim time. If we got something like that again – which does not seem beyond the bounds of possibility, especially if we have a coincidence of a big global recession and a hard brexit – I think I’d be moving overseas.

I’m aware of capital & currency controls (UK had these as late as 1979). What else might hamper moving money overseas?

I have most of our assets invested in world trackers, so asset values should be largely unaffected by a collapse of the UK economy. But all are held via UK platforms, so I expect they would be hit by capital controls and the like. Is it possible to hold a SIPP or ISA with an overseas broker? I don’t think so. So keeping a large part of ones assets beyond the reach of UK govt would incur a significant cost in tax in good times, let alone the extra fees. The one exception I’ve read of is to keep precious metals overseas – since they generate no income, there’s only capital gains tax to worry about and that only when they’re sold.

Most of my savings are in two SIPPs. Its really complicated to shift a SIPP overseas even in good times. I hate to think of doing it in a crisis.

Most of my wife’s assets are a DB pension and this is in GBP and inflation protection is capped. I figure this pension would be pretty much a writeoff if the UK economy really tanked and we moved overseas. Could it be rescued somehow?

ISA should be easier – funds could be sold and moved overseas in a few days. Though I am aware that when currency controls are introduced you don’t get advance notice.

I have the 2nd passports bit sorted already. Though I am beginning to wonder about country #2 as it seems to be mostly on fire at the moment.

Overall, I think the very small probability of calamity in the UK versus the certainty of steep costs of keeping a lot of assets overseas means I’m just going to cross my fingers and hope that if things go badly in the UK it will happen slowly enough that I can move money at that time.

Plus one for a bug out article, acquisition of a second passport, best comparative countries to retire or work. Would be very interesting.

JimJim

If trump gets impeached I think we’ll see a big surge on hopes of a trade deal, eyes to america…

I think the quickest and easiest option is to buy somewhere abroad for cash and to try and make it pay for itself and then to prepare to liquidate any ISAs and move the cash abroad. It doesn’t have to be all or nothing, a 3 or 4 year survival fund and try to find work to stretch it out?

Beyond that, well, we’re into the UK equivalent of US survivalists.

Trouble with US trade deals is that Congress control trade deals, not the President or Senate. So all those farm and pharm fingers in the pie.

And not sure Trump being impeached is a good thing as anything with his finger prints on it might be suspect.

I am not convinced that UK stocks are going to produce good returns going forward. I have been reducing my exposure since the referendum and now hold only about 4% in UK stocks. There are in my opinion too many politicial situations going forward, trade deal with the EU, Scottish independance, N Irl joining the ROI. Then there are the trade deals which are going to be negotiated with other countries, what benefits will the UK get from these. The UK market is still in wait and see mode and will be for some time in the future.

https://www.amazon.co.uk/Emergency-This-Book-Will-Save-ebook/dp/B001NLL9P0

A bit extreme for me, but an interesting introduction to bug out plans, 5 flags (passports) etc.

B

On Bug out (Fund). Last few comments have highlighted the issues with this. A second passport obvious critical. But then you need to think what your going to do when you get there and where you are going. If you don’t have (a) significant amount of funds overseas (b) ability to work then it’s not much good going with just the shirt on your back. You probably need to budget for a five to ten year period being out of the UK or permanent move. On (a) as the UK has very advantageous saving allowances, most people will either use (i) ISA (ii) SIPPS (iii) dividend allowance. If you don’t make use of these fully in order to hold assets overseas in preparation for a tail risk event then it’s going to cost you significantly in tax. If you have filled all these allowances up then you are in the minority. As someone above said it could be cash, ST bonds or gold, low yielding equities which can be held outside those wrappers overseas. But if you don’t keep up with inflation it’s costing you. Ideally holding a property overseas would be very good. Again that’s for the minority and comes with frictional costs of ownership plus you need to be confident on where you are going. So unless you have a substantial amount of wealth I’m not sure it’s worthwhile bothering about. On (b) human capital – language & transferable skills are key. On location, I struggle to see Ireland as such a ‘bug out’ option given it’s interdependence on the UK – if we’re going down the tubes they’re collateral damage. If you are planning on holding all your assets in the UK well capital controls are a key issue and probably negates your plan. Recent history indicates people are unlikely to forecast such an event (Greece / Malta)- would you really liquidate your entire ISA / SIPP when things are getting bad for something that might not happen?! ISA / SIPPS are so good, they are great ways of locking you in. To be clear, I think this is a <5% probability and I wouldn't interfere with my FIRE / Retirement planning for it. The key is seeing if you can integrate it a little into your FIRE / Retirement planning. Maybe it can be a second passport and 24 months of liquidity whilst you set yourself up. Interested in other views as my own opinion only. P.S. Pleased the investor is deleting overtly political 'trolling' comments that are designed to divert attention away from the very useful focus of the blog.

As usual, a thought-provoking post. Though you are asking whether we can foretell the future and plan investments on that basis. Isn’t that a departure from your usual Monevator advice that there is nothing we know the market doesn’t already know, and we should simply diversify at low cost?

Personally, it hasn’t occurred to me to change our strategy of using well diversified index funds for equity investment. We don’t have passport rights anywhere other than the UK as an insurance, but what we have done over the last year is bought a small French holiday apartment (we think of it as our “Brexit backstop”). It can’t be accounted an investment in the usual financial sense, though it might increase in value long term that will depend on exchange rates which are anyone’s guess as well as covering the significant transactional costs. But it is an investment in future personal pleasure – including being able to spend part of our lives in Europe and think “sod you” to the small-minded government that cannot see our commonality of culture and values.

But to be fair, it would have been a big gamble to put a significant chunk of our previously liquid assets into an overseas property if it hadn’t been following the death of my mother (herself a Francophile): once her home is sold and tax affairs sorted out the money used will be replenished.

In reality the risk of a Labour government was miniscule. I was hoping and voted Labour for a hung parliament. That gave a chance of a much less damaging Brexit or no Brexit at all. In a hung parliament there was no chance of Labour’s daft programme being implemented, so I was fairly relaxed with the possibility of the damage they might cause and taxes they might levy.

As for going abroad, I doubt I would ever do that. When you look around the world, you soon realise that we live in a very benign environment when it comes to tax, particularly for those of us who live off investments. No NI to pay, low dividend taxes, low housing costs for home owners, tax free growth in ISAs/SIPPs, control over income/income tax for those drawing down pensions. Even if my net tax rate went up another 10%, I would still pay comparable tax to what I would have to pay in costs and taxes were I to emigrate.

If Scotland were to vote for independence, an action even more daft than the English voting to exit the EU IMHO, I might be tempted to move back there. I have lived in London for far longer than I lived in Scotland, but still consider myself a Scot and would be tempted to do my bit to make a foolish independence vote work. Assuming I could persuade my wife, I would move back to Glasgow, buy a plot and put some houses on it, live in one, sell the others. Probably never happen

“[UK investors in global indices] … will be thwacked if we do see a deal reached and the pound truly rally. Your overwhelmingly overseas holdings will fall in value”

Well… perhaps not true, for those of us who hold currency hedged versions of global indexes (e.g. IGWD for global equities and TI5G, LQGH, UBXX etc. for bonds).

My own view was that whichever way the election went there was going to be high volatility in Sterling; and as a passive(ish) investor I didn’t fancy speculating on which direction that volatility might take. I’ve nothing against currency speculation per se – it’s just not something I want intrinsically built in to me investment portfolio.

Naeclue – Scots wanting independence from UK did seem daft, but wanting Scotland in the EU despite England’s desire to take them out not so much. The balance has changed.

But for Northern Ireland, the feeling that this is part of an evolutionary process of dissociating from the UK and becoming closer and eventually joined to RoI (and EU) makes sense in the bigger picture. There will be regrets, but the voting pattern did point that way.

I realise TI may obliterate this post as too political despite following up previous.

@Jonathan @all — Yes, let’s leave the Scottish motivations pros/cons there please. Financial impacts fine.

For example, I agree with others that say that property overseas is a really good part of a bug out plan. It wouldn’t even need to be in your passport destination, as long as you had no reason to suspect you couldn’t leave here (X), sell the property in Y, and move the money to Z.

I’ll reiterate I’m talking a low probability event here. But I have, for example, a friend of Asian ethnic heritage who feels much more exposed post-Brexit, for right or wrong. I mean fearful, outside of London and a few other big cities. He’s had experiences I’ve not had (and don’t want to) so I won’t judge.

The on-topic point is he had the opportunity to easily pursue a Plan B after the Referendum, didn’t despite my urging, and now it’s much harder (he says) with certain family members having died and a property being sold. I don’t know if that’s true etc, entirely, but the point is why not have the Plan B.

Because the risk is still very low, I wouldn’t divert vast amounts of money towards it. Perhaps an ideally self-financing overseas property on a 50% mortgage, some certain liquidity, some gold sovereigns or whatnot, maybe £5-10K in gold somewhere like Bullion Vault.

I’m not an expert at all, so would need to research a lot to do a post. This thread is a useful discussion! 🙂

p.s. Oops, meant to write after “for example” that an affordable Scottish buy-to-let bought if independence was looking likely or shortly after might be an easily managed overseas Bug Out asset. But a lot of ifs there.

A second passport does bring other financial risks, even if they feel remote for most places. You are now at the whim of a second regulatory regime and could see taxes imposed on you even when living overseas (happens to some overseas US citizens, quite pricey to then renounce that passport).

Overseas property was raised in a thread on here before, but it also comes with additional risk. In a developed country, the risks are more likely to be selecting a decent property and the added complexity of taxes in two countries.

Not sure the risks are so high as to make this worthwhile. Yet. Unless you have a lot of wealth to protect (and to get advice) or you can easily ‘retire’ somewhere else – but then it probably makes sense Brexit or not.

@Naeclue. With regards to your wishes for a Labour hung parliament I concur. I also wanted a swift end to Brexit which a hung parliament may not have been able to deliver unless an agreement on a second referendum or confirmatory vote could have happened… No breath held on that one. I for one would move away, not just for financial reasons, just because it’s another adventure, my daughter looks like she may end up in California or Oregon at the moment and early retirement is on the horizon. I live more like a hippie than a millionaire and we love to travel. Each to his own. An outward looking country with good and cheap air travel in a central location would be on the cards. As it stands the U.K is great, but moving away from my ethos hence the desire for knowledge of the possibility of leaving. I also am finding little of use on the web about acquisition of a second passport for a Yorkshire Tyke born and bred for more generations than I can find.

@JimJim – This Yorkshire Tyke is now settled in NZ with a newly printed (and legit!) kiwi passport – although to be fair the decision to settle in NZ was taken before THE referendum. So we upped sticks and moved here pre-2016. And whilst still in full time work at the moment we are FI right now and thinking about the (RE) bit next year. Our portfolio still has ~10% in the UK – mainly IT and FTSE 100 companies – and, to be honest, I don’t see a major reason to sell up and shift out of the 5/6th largest economy and companies that are listed in the UK but span the globe. I don’t share any view that the UK will tank in the medium to long term although fully accept that uncertainties will create fluctuations in share prices – when did they not?

We’re internationally diversified but with a leaning towards NZ and Australia (there are tax advantages – NZ has a capital tax on other share holdings) and there is always currency risk.

As for looking at settling out here – please reconsider! We have enough pressure on house prices and health, transport and other services without more folk coming……(does this sound familiar?). Although the NZ immigration service does have a very informative website.

@TI – thanks for your observation on my comment on free shares a blog or two ago – if you are ever out this way….?

@britinkiwi, We looked into living in N.Z. in 1994 when we had the points to get in. Nelson was tempting and we loved the people and the potential of the place. The only reason we did not shift continents is the distance to all the other places we like to travel to otherwise we would had been in! On reflection, I think either way would have worked well for us.

I just want to make it clear for the record (since I’ll still be here fielding comments in ten years, while readers may come and go 🙂 ) that my personal motivation for having a Plan B is only in small part economic.

I’m not saying the economy will be ruined due to Brexit and it will be necessary to move for a higher quality of living. I am saying the culture/politics *might* transition into something genuinely nasty. (Low probability but direction of travel is clear. This is true if you voted Tory, too, incidentally, and disliked Labour’s harder left tack. We seem to be polarizing.)

My expectation is, as ever, that even after the big shock of a hard Brexit, the UK economy will continue to grow — just more slowly than otherwise for as long as is foreseeable, with the size of the impact depending on the terms of the trade deal and the UK’s response (e.g. protectionism, Singapore-on-the-North-Sea, whatnot).

Apologies all, appreciate this is a shade political but I felt it important to clarify my thinking on economics here as I will be held accountable for it in years to come! 🙂

I understand that the present arrangements whereby UK and Irish citizens can freely live and work in each others country will continue after Brexit.

After the HMRC qualifying residence period abroad, is a Brit living in Ireland treated for tax purposes in the UK as a non-resident?

We have Hong Kong resident status as a potential bolt hole but the increased cost of living would cancel all or most or any tax advantage. I also had one grandparent born in Ireland so am theoretically eligible for an Irish passport.

However, at 75 I am unlikely to flee the coop. Just inquisitive.

TP2.

@TI, I have to say I think you are being a bit silly about people wanting to leave the UK in a few years, even at 10%. Still, it would make an interesting situation with the fleeing people in their boats passing would be asylum seekers coming the other way mid-channel. Perhaps we could set up an immigrant/emigrant credit system and net them off to save the effort?

Boris needs to get on to that Universal Credit nonsense and scrap it for a start. That would set a happier tone. And make NI payable by everyone working. And free prescriptions only for POM medicines, and then only for those over state pension age. And scrap the heating allowance, bump up pension credits instead ( disclosure, I get free prescriptions and heating allowance, why?). Scrap the lifetime allowance, freeze the ridiculous 20k ISA allowance ( I’d halve it), scrap as many IHT loopholes as you can, reduce the annual pension allowance to 25k with 3 years carry forward.

On a more positive note, I have no idea where to invest now. What I would like is a cheap global tracker ex S&P 500. Any ideas?

I said 5-10% and I said over the next ten years (from memory). That means in 9/10 to 19/20 ‘runs’ of history people don’t feel the need to leave the country. So it’s not a high probability.

But people who think you can lurch into populism and jingoistic nationalism and trashing institutions (Judiciary, Parliament, the EU, the BBC) and not *risk* a continuing march towards somewhere unpleasant either lack imagination, or are at a far more conservative/right-wing/reactionary end of the spectrum than me (and other people like me who can imagine wanting to leave).

Historically speaking, peace and relative stability are the exception, not the norm. We’ve had a long period post-WW2 (at home, at least) due to a post-war consensus, the cold war, nuclear weapons, and wise international cooperation via e.g. the EU and NATO. But sadly, again, the trends are in the other direction.

I’ve left your comment up despite it’s political aspects because I know a chunk of people feel like you (I’ve deleted a couple more pointed ones) and I feel it’s right to air that view in this thread. Similarly, I’ve responded.

But further politics here will be deleted. I’ve deleted several political posts — on both sides of the spectrum, and most of them pretty articulate — because I think this blog needs a break! 🙂

@Mr Optimistic – I like it 🙂 A pretty radical but logical list that might appeal to the working-class Tory but not, I think, to traditional home Counties set. Remember the to-do over May’s social care proposals?

You could create your own world ex-US tracker: VEUR, a Japan fund, a SE Asia fund and an EM fund if you want. Mix and re-balance to global equity proportions. It’s what I’ve done (but with a US fund) as I under-weight the US (which has hurt my returns but hope will come good) and it’s cheaper than a global fund. A tinnsie bit, but probably not worth the hassle. I think, given my under-performance, I would just chuck it all in a global tracker and let them deal with it. I’m only 8% exposed to the UK, so don’t think Brexit will really move the dial. What will is that I’m 100% UK based.

And for those thinking of Spain for their bug-off cash, €8-10 per month for a current account? Hmm… Though BBVA have a free account if you pay in €600 or a pension. And there’s a wrinkle that it’s free if you have 1000 shares too. Not sure what the charge is to hold shares is though. Maybe BBVA have a scheme to buy and hold their shares without commission. I’ll look into it. There’s a whizzy new app called Freetrade. It’s quite new but I wonder if they’d allow it? Anyone heard of it? 🙂

N26 and Openbank (part of Santander) currently offer free current accounts in Spain.

@Mr Optimistic – for some of us there may be a genuine (financial) need to relocate in addition to all of the reasons given by The Investor.

Depending on what happens next some financial services roles may relocate to the EU and so some of us may need to consider relocation for this reason. Having a plan B (in particular a second passport, additional language, relocation fund) could be an incredibly useful thing to have.

Freetrade – yes we’ve heard of it. You must have missed TI’s plug and free share offer for opening an account there on 6 December. Plenty of us trying it out.

Free shares still available! 🙂 See link below.

Incidentally, while many readers now have free shares (and a few reported what they got in the comments to the article below, which was cool!) I’ve learned a few people signed up / created accounts but haven’t gone on to claim their free share.

If that’s you make sure you’re funding your FreeTrade account (only takes £1, which you could withdraw later if you want) and ideally fill in the W8-BEN form (a 20 second job, just tells the US tax authorities they don’t need to tax you).

https://monevator.com/weekend-reading-grab-a-free-share-by-signing-up-to-freetrade/

@Fred – S-W-E-E-E-E-T!!! Thanks.

@Passive Pete – Sorry, I know. I was being silly. My free share was Alliance Trust. Currently up 4.36% as I type! I’m thinking of using it to sweep any money I have left at the end of the month from my current account into a Global ETF and use the 4pm(?) free trading to buy a few shares. Or create a racy active portfolio based on the new “The Investor’s Forensic Active Responsible Traders” (TM) subscription series.

I’m afraid I’m left slightly cold by all this talk of ‘plan B’. Seems like the ultimate in ‘I’m alright Jack’ responses. I’d rather stay and contribute what I can, along with the many many people who show up to try and make their community a better place. I would also never choose to permanently settled in a country where I felt less than a full citizen – for example if I couldn’t vote. To me, these factors are far more important than protecting my wealth – a fulfilling life is surely much more than what’s best for your bank balance, no?

My children may feel differently, of course, and they need economic opportunities more than I do. I’m at a stage in life where I want to preserve and strengthen my social ties in my locality – not try and start over somewhere I know no one.

(No idea whether this comment will be deemed off topic!)

Well there’s two nubile young Europeans imploring me to ‘get started’ with my ‘offshore plan’ on this very page! I seem to be an ad-magnet for Nomad Capitalist these days.

Various splinters of the Rhino ancestral-tree seem to be aiming for Portugal. Bizarrely though, they’re all the oldies (i.e 70+) which makes me think why bother, you’re almost dead – stay put and at least you’ll have some friends/understand how things work/be capable of speaking to someone. Stronger case if you’re young I’d say.

I googled ‘Poland passports’ and what came back top of the list? A Henderson penned Nomad Capitalist article on how to get one! His google-ranking staff are good, very good..

Is this article actually an ad? Is TI the result of a huge decade+ nom de plume effort from Henderson? The pieces of the jigsaw seem to fit! Oh the scandal!

Vanguardfan has a point.

I’m not adding anything of value here – please delete..

Oh, I meant to make one other point. It doesn’t strike me as sensible at all, from either a personal finance or general preservation-of-humanity point of view, to plan for a future lifestyle dependent on ‘cheap flights’.

@Vanguardfan – well, I think there’s a lot of hyperbole on this thread. I doubt anything really bad is going to pass, especially if you’ve an globally diversified portfolio, but what’s the harm in a little insurance along the way? Call it risk mitigation.

But some people knowingly voted on a course of action that, by the government’s own forecasts among many, will make me poorer. Those voters may end up having to bend over and take it, I certainly won’t if I can help it. I’m not a rich fat cat, I’m a state educated lad from Sarf Lunun, which in retrospect, along with being old enough to buy a flat near the bottom in 1997, was stunning good luck. My parents were immigrants and I met my wife while teaching English in Ecuador, so maybe I’ve a more international outlook anyway.

But for me, it’s more about securing the same rights my children had when they were born – the ability to move freely through Europe and find their happy.

@Vanguardfan – absolutely! Even (especially!) if you’re a self-described hippy! My putative destination (Galicia) has trains via Paris. But it does take 24 hours 🙂 On the same note, nor would I go for the Med. In 15 or 20 years it could be unbearable and have water issues.

But this is way off-thread. Apologies, TI, if not appropriate.

As a fairly young person who’s just starting to build up my finances, I’m not sure what options I really have right now. It’s probably a case of keep calm and carry on, make use of pensions, ISAs and other tax shelters, but I feel trying to guess if UK/global shares will go up, down or sideways is a shot in the dark for the immediate future.

I’m a bit buggered to know *where* to build my wealth right now… figuratively and literally.

I’ve been thinking about this ‘voting to make yourself poorer’ thing. It cuts both ways doesn’t it? I have knowingly voted on many occasions to make myself poorer, because of other priorities I have about the kind of society and country I’d like to live in. Sound familiar? None of this is really about economics, is it. Not even thinking about plan B.

@Vanguardfan — You’re a very valued commentator on this site, and I appreciate your views. However I can’t really elaborate much on why I/we/you might need a Plan B without diving into the politics of it, which I had asked others not to do.

And please do remember that I’m talking a small chance (5-10%) and a small cost of making some preparations. That context is very important.

So in my case, it was pretty much near-free re: securing rights in another country, and then maybe I’ll look to allocate £5-10K more over the next year or two explicitly, maybe more in time if/as things deteriorate, rather than improving as I hope and *expect* they will once the Brexit self-inflicted wound and all the associated national pain starts scarring over.

But let’s be clear. Leaders in our country have convinced a slim majority of voters to embark upon a project of extremely dubious benefit and clear demerits in terms of loss of valuable rights for all of us. (I’m being as mild as I can here. 😉 )

Even if you believe in the merits of Brexit, nobody can really argue with a straight face that it wasn’t won without a healthy dose of disingenuity, false promises, populist rabble rousing, and nationalistic overtones. Along the way we saw the judiciary attacked as the enemies of the people, and all sorts of other divisions that if played forward (rather than subsiding as I hope they will) should make us fearful.

What happens when Brexit turns out to solve nothing for people frustrated by globalization / cultural changes in society (loss of blue collar male jobs, women in work, changes in family structure, immigration) and the enormous changes being wrought by technology? What happens when the government’s new ‘points system’ still lets in 150K people a year (say) who all have excellent skills in demand and earn more than many of the frustrated native population promised Brexit glory? What happens when a few thousand fewer Poles and Romanians in the South East does absolutely nothing to appease people concerned about the changes they perceive in this country from their immigration-free village in the North?

Potentially, a further lurch to the extremes, left and right. More populism. More nationalism. Of course in some 21st Century form, initially looking semi-respectable. Maybe special programmes and benefits to ‘support’ the native born over those who at some point moved here? Maybe state involvement in the BBC? Maybe the police not being quite so keen to investigate crimes against some groups then others? Maybe yobs who feel empowered in the streets?

A slippery slope. All sorts of potential unpleasantness.

That is the track we’re on, albeit only currently in the foothills. These tendencies were simply not evident in the 1990s, and arguably not even very evident immediately after the financial crisis, though I suspect sustained rhetorical attacks on elites and so forth was perhaps the start.

Remember how shocking it was when the likes of Farage first got on Question Time and talked about alleged EU welfare scroungers? We’re a long way from that.

I don’t think I’ll need to use Plan B. I think this country has enough institutional staying power and a sensible majority. But country after country in history has shown how things can change.

Perhaps you’d have been glad living behind the Iron Curtain, say, or hanging out in a South American country run by a dictator. Personally I’d rather have gotten out.

Again, 5-10% chance. Low. Nobody needs to say “it probably won’t happen”. We know it probably won’t happen. But it’s much easier to see how it could happen now than 15-20 years ago. And the point of a back-up plan is you make it before you need it.

I felt I had to reply to @Vanguardfan to explain myself, due to that reader’s long-standing association with the site. I guess if people want to talk politics (politely) on this thread from here I’ll have to throw in the towel, given I’ve ended up writing this.

I suppose we’ve had a 70-strong useful comment thread beforehand! 🙂

However honestly I think it’d still be best if at all possible to keep to the personal finance and investing stuff. Cheers.

Ah well, apologies for dragging in too much politics. I just find it hard to compartmentalise money from life.

I do intend to get my kids the EU passport they should be entitled to. Sadly not an option for me.

Now I’ll shut up and go away.

immigration-free village in the North! – have you ever been to Redcar, Bishop Auckland or Tony Blair’s old constituency, Sedgefield? They are neither villages nor immigration-free; but they are the places that have given BoJo a large majority. Those villages you speak of have always voted for the blues.

I agree that it’s sensible to have an escape plan. Know where the exits are in a public building or aeroplane – we don’t need to be concerned about forecasting the black swan event, just that we might need to know where the exit is in the event of a fire, accident or terrorist strike. Same too here, forget the politics, just concentrate on the plan.

I looked at this some years ago when the banks were wobbling. I don’t have a second language or second passport, but I’m lucky to have significant funds so I concluded NZ was the place to head, as they’d let you reside if you invested circa £1m. I think the rules have changed now and the are two levels, £1.5m to be considered and £5m to be certain. However, in the end I stayed put but changed my escape plan to instead have a long term holiday (out of the UK for the tax year or two – while things blow over) – NZ will let you stay 6 months, Oz 3 more, then there’s skiing in Canada and EU for the reminder. Sorry, I realise that my plan isn’t much use for the majority.

If wee Jimmy Krankie manages to break the union, then Scotland would be added to the plan too, I might even buy there as I spend about a month each year there now.

@TI, thanks for the free share! I got JESC. That almost buys a pint… somewhere.