There’s a tipping point in your investment life when you realise you’ve got a lot of portfolio to protect. Going to the moon is yesterday’s game. Derisking your portfolio is the order of the day.

It’s not purely a rational shift – like reaching a certain number on a spreadsheet. There’s an emotional phase change, too.

You’re no longer that carefree youngster who could cheerfully stomach 100% stocks. You can no longer easily makeup for losses with fresh contributions. You don’t have decades of investing ahead of you anymore.

You might have less than ten years until retirement, say. If you play your cards right.

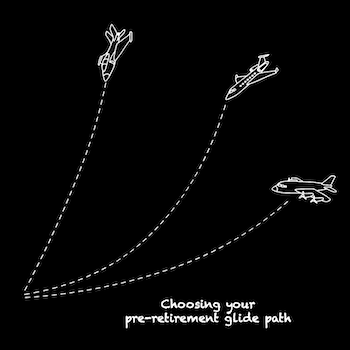

The question is: how do you play your cards right? What asset allocation glide path should you take that keeps your portfolio powering towards the finish line? While also reducing the risk of blowing up the engine before you cruise home?

A number of readers have asked about this tricky problem recently. And though I’ve been through it myself, I see now it’s quite a dark area on the DIY investment map.

Your mileage may vary

There are lots of rules-of-thumb you can follow – and also contradictory viewpoints aplenty. It’s hard to find a comprehensive guide that clearly discusses the many levers you can pull.

Late-stage accumulation is almost as difficult as the thorny subject of decumulation because:

- There are lots of moving parts.

- You’re exposed to many of the same risks as a retiree.

- There are trade-offs to make, and the ones you choose will likely depend on both your financial situation and your unique (read ‘utterly freaky’) psychology.

- There isn’t a single, optimal, battle-tested strategy to suit everyone.

It’s hard! So I’ve decided to write another 500 words on the magic of compound interest instead.

Not really. The world doesn’t need that! What the world needs – surely – is a Monevator mini-series on derisking your portfolio before retirement.

This first instalment will be a bit groundworky. We’ll survey the landscape so you can place yourself on it.

Then later, when we walk-through the strategies you might adopt in forthcoming episodes, you’ll hopefully then have a clearer idea of whether this or that one is for you.

Let’s roll up our sleeves and get into it.

The central dilemma

Late-stage accumulation presents wannabe retirees with a predicament: the larger your portfolio, the more investment losses (and gains) affect the pound value of your retirement pot.

Say your financial independence target is £600,000 and your portfolio balance stands at £500,000.

In the retirement game of Snakes and Ladders, a 20% gain sends you shooting up the ladder to the final square!

Now you can declare victory! Direct ‘Loser’ signs at your boss. Enjoy a template email thanking you for your many years of service, whoever you are [insert name here].

Not so fast…! What if a 20% loss sends you slithering back down to the £400,000 square?

AAARGH!

In this way gains and losses can dwarf your annual contributions in the final years of accumulation, adding or subtracting years from your journey on a roll of the market dice.

The limits to the old slice and dice

The existence of sequence of returns risk helps explain why optimal glide paths don’t really exist.

Firstly, your path to glory is incredibly sensitive to late-stage market returns – in other words, you’re in the sequence of return risk zone-of-much peril. Equities are so volatile over short periods that it becomes meaningless to run the numbers and apply the law of averages to your situation.

Your returns – in the final handful of years that count the most towards your end result – are unlikely to be average. (As investment writer Ben Carlson has noted, few years are.)

It just doesn’t make any sense to me to take comfort in the mean result generated by 5,000 spins of a Monte Carlo simulation or even one hundred years of historical data. Though I will link you towards the research that’s out there in case you disagree.

Secondly, our individual attitudes to risk vary almost as wildly as stock market returns. What’s more, there’s reason to believe that disparities in risk tolerance not only exist between people but also between different versions of our discrete self.

As in, I know for a fact that the older me is more risk averse than the younger model. Not just financially but athletically, too. I also drive more slowly than I used to and no longer accept Dolly Mixtures from strangers.

Moreover, I’ve read articles suggesting people are more risk tolerant during bull markets than bears. That’s the investing equivalent of: “You only sing when you’re winning!”

And, well, that’s no great surprise, is it?

If you’re concerned for your portfolio now, then how would you feel when the market is 42% down? When you are two years out from retirement?

What’s that Mike Tyson quote again?

Would you like to play a game of Risk?

The problem with the standard rules of thumb is they take a simplistic view of risk.

By their lights, the only risk is a hoofing great stock market reversal – and the answer is a featherbed of bonds and cash.

But this ignores the fact that 2022 showed us that bonds can be hit hard by rising interest rates and inflation.

Cash is highly susceptible to inflation too, though that’s often overlooked.

Hence a well thought-through derisking strategy must also address interest rate risk and inflation risk.

Beyond that, there’s a panoply of risk modifiers that turn on your ability to handle setbacks. In short, the greater your flexibility, the more risk you can afford to take.

The more risk you’re willing to bear, the more equities you can hold in a bid for a faster retirement check-out – or fatter cheque.

But it’s no good just saying “give me more risk then” and making like Indiana Jones in a dash for the exit.

You have to be able to carry that risk – and to sleep at night.

This is not only about sucking down a red day on the stock market. Handling risk also reflects your capacity to cope if the dice do go against you and your retirement is indeed set back – whether by delaying its start or in the living standards you enjoy.

Retirement date

If you can delay your F.U. day by a few years then you can take more risk because you can wait for the market to recover should it cut-up rough.

Additionally, working on reduces the length of your retirement (because, alas, mortality is real) and so the overall amount of pension you need.

Pension contributions

If you have a high savings rate (or your contributions are high relative to your portfolio size) then you’re less reliant on investment growth to hit your target. You can shoulder more risk because – like a younger investor – you can better fill the holes opened up by portfolio losses.

Intriguingly, you could also view this as a reason to take less risk. If you just want to be done with it all, and are less concerned with pushing your pot beyond your number, then you could let your cash money contributions do the work.

In other words you don’t need to max out on equities. So trim back to lower the impact of a stock market bomb that would otherwise blow-up your plans.

Retirement income

It’s one of life’s ironies that the less you need money, the more risk you can accept in pursuit of the stuff. Should the risk fail to pay off – and you still want to retire on time – then no biggie. You can just take less from your portfolio.

You still get the cake. Just not the icing or the cherry you were hoping for.

This option is also super-powerful if you’re happy to work part-time for a spell in retirement. You’re far less reliant on a market outcome delivering to your schedule.

Risk aversion

The more galled you are by market knock backs, the more seriously you should consider the fact that equities could deal you a sickening blow.

Potentially this is the one factor to rule them all. The size of your portfolio contributions doesn’t matter much if a 30% market drop feels like agony to you. The only solution to that is to reduce the risk of it happening.

Watch out for signs that your risk tolerance is in decline. If you’re sweating over small dips or bubble talk then turn down the heat on your portfolio.

Valuations

Stock market valuation signals are like motorway overhead signs advising us to reduce speed.

Sometimes you wonder what that was all about as the hazard fails to materialise. But other times danger genuinely lies ahead.

Currently, the US CAPE and World CAPE valuation metrics are very high. High CAPE ratios tend to correlate with lower ten-year returns, though the signal is noisy.

Meanwhile, expected returns for typically lower-volatility government bonds aren’t much lower than for global equities. So if diversification is the only free lunch in investing then right now it’s coming with a complimentary bag of crisps.

Job and health

The more secure your employment – and the longer you can keep going like the Duracell bunny – the more risk you can take.

I mention these two for completeness. But personally I wouldn’t pay much heed to them, because your situation can change in an instant.

Strategic objective

Your endgame matters. If you want to hit a certain number, by a certain day, then you need to reduce uncertainty in your portfolio.

But the less certainty you need, the more you can venture on achieving a better outcome by loading up on equities.

To that end, the risk modifiers I’ve outlined are additive in some cases. If you’re prepared to compromise on your set retirement date, income, and portfolio contributions then you can make less drastic adjustments to all three if required.

On derisking your portfolio with bonds

It’s important to realise that cash and short government bonds are a recommended part of the risk-off package because they can lower portfolio volatility. Not because they’re expected to contribute much to its growth.

By reducing volatility these assets narrow the range of potential outcomes (good and bad) that could befall your portfolio by retirement day.

If you were burned by longer duration bonds in 2022 then it’s worth knowing that on the risk spectrum:

- Short duration government bonds are more cash-like. Long duration bonds are more equity-like (though not as rewarding over the long term.)

- Hence long duration bonds don’t have much of a role to play for late-stage accumulators.

The exception is if your retirement strategy involves annuities or a liability-driven floor-and-upside approach.

We’ll look at that and more in later instalments in the series. Part two of the series: When to derisk before retirement is available from all good blogs now.

Take it steady,

The Accumulator