Saving is the rocket fuel of investing. You can achieve big goals quickly if a hefty slice of your income is being invested and put to work for future you.

Simultaneously, your ability to live lean reduces the strain on your investments to deliver a massive crock of gold at the end of your rainbow.

Win-win.

Living on less is a badge of honour for me these days, but most people I talk to view the word ‘less’ as if it’s mortal peril.

What do they see? Misery, poverty, a fall from social grace? In a world of boundless choice, imposing limits feels like being clapped in irons.

But Thoreau said, “A man is rich in proportion to the number of things which he can afford to let alone.”

The reality is we can’t cope with all the world makes available to us. We will only ever taste a fraction of the goods and services on offer at Department Store Earth.

Not spending your money on one thing means you are creating an opportunity to use it for something of greater value. The trick is working out what is truly valuable to you.

This means practising the art of substitution.

Nay, the martial art of substitution!

At times it feels like ninja assassins emblazoned with the logos of Apple and Starbucks are coming at me with shuriken stars and Kendo sticks. They beat my brain into wanting their stuff. Hell, even my local pub wants to up-sell me to a three-course meal every time I fancy a quiet drink.

But the art of substitution is not just about liberating a few pennies by buying own-brand soap.

It’s about discovering what you really want. It’s about scraping off the layers of make-up slapped onto your face by consumer society and uncovering who you truly are.

The simple life

When you were a kid you were happy playing with a stick in the mud. My baby niece just wants food, cuddles, and someone to play with.

Much of what we bolt onto the list of essentials comes from a growing and fearful consciousness of our place in the pecking order.

Driving a BMW, ordering a latte with heart-shaped foam, skiing the same slopes as Martine McCutcheon, they’re just ways to reassure ourselves that we’re not a failure.

Never mind whether we’d be happier with a Seat, caffeine independence, a few days in Devon, and financial freedom.

It’s strange isn’t it, that everyone loves a bargain but when you pick up the own-brand items in the supermarket, the very packaging seems to be mocking you.

It literally makes me feel unhealthy, cheap, unable to provide. But it’s designer humiliation and it is a trick. A trick to make me hand over my money so that I can ‘win’ another round of the social comparison game.

Conspicuous consumption makes me feel like I’m winning when what I’m actually doing is surrendering. Surrendering my limited life’s energy to meet someone else’s values, expectations and prejudices. Half of which I’m probably imagining because of my own insecurity.

The only way to win is to disconnect your self-worth from your consumption.

There are probably sophisticated techniques to help you do this. I don’t know what they are, but they must work because apparently these guys are among the happiest in the world…

I’m not advocating poverty as a route to bliss. But this famous graph tells you everything you need to know about whether money buys you happiness:

The only technique I know is to remind myself every day of simple truths that make sense to most of us but that we sometimes find it hard to remember:

Independence, purpose, love, respect and social interaction is what really makes us happy.

Goods like these can be acquired in large quantity remarkably cheaply. But mostly they’re bought through a barter system where you give of yourself in equal or greater measure. They can’t be bought with trinkets.

I don’t have that much time left to make a difference to myself and the world.

No way I’m going to squander it on stuff that doesn’t matter.

Take it steady,

The Accumulator

Comments on this entry are closed.

Ironically if a large body of people actually behaved like that our service based economy would collapse into a long deep depression

A very philosophical post for a Tuesday morning!

Very sage words for the early half of the week!

For me this is reality: since downshifting my life (over 4yrs ago now) I have to make do with less as my salary going part time dropped significantly. With the spare days I am able to enjoy more hobbies & time with family/friends than ever before, & the family finances have been significantly sharpened so that I actually save more in £ terms now than i did too…. the benefit of more time to reflect on how (if at all) to spend the hard earned pennies perhaps.

@Accumulator chapeau! wise words from the sage of monevatorville..

Nice post, I liked your quote about what makes us happy, which reminded me somehow about some sage advice from Mr Burns on the Simpsons. “Family, religion, friendship. These are the three demons you must slay if you wish to succeed in business.”

From a personal perspective I have already made the conscious decision to opt out of consumerism and now live well below my means. I’ve been doing this for 7 years although I admit the first 2 were fine tuning the skill. IMHO it really is a skill that needs mastering in the early days as the influence from Corporate marketing departments and the general consuming populous is strong. Once you have the skill though it becomes very easy.

Financially this has allowed my savings rate to increase to 55% of GROSS earnings. This bit isn’t the surprise as it’s just simple maths.

The personal side has been the surprise. Since I jumped off the competitive merry-go-round I’m both happier and healthier as well.

A win win.

Nice one, of course it’s not so easy for those with children (between myself and my partner we have 5 !!!)

But i’ve certainly downgraded my outgoings in recent years – the only thing is my ‘lady’ partner sometimes thinks she’s living with a tramp.

Well, what’s the point in ‘poshing’ up if you’re just sat here writing !

“When you were a kid you were happy playing with a stick in the mud” – and I probably would still be 🙂

It’s interesting as I have never really bought into material possessions, at least not from the point of view of keeping up with the Jones’. My normal reaction is to do the opposite. Driving round in a 1997 Skoda, despite having a good job seems to attract a lot of suspicion as it’s not the done thing. Up until this year I spent money, not really on material items to show off, but on hobbies. And it probably amounted to the same.

Having trimmed back since last summer I can say I don’t miss the spending, have cut back on the number of hobbies I do (and it’s far better focussing on a just a few, I still would like a carbon Time Trial bike, but I don’t need it 😀 ) and am enjoying seeing my investments grow. (@Accumulator – Thanks for the Tim Hale recommendation again BTW)

Mr Z

I really like how you re-frame “winning” at the social status game as surrendering. I also think there are many people who aren’t over-spending so much because they are trying to “keep up” with others, as they just haven’t thought very hard about finances. They are just doing what they’ve always done, thinking income is the main problem, and not thinking outside the box about all the ways to save without actually being deprived at all. Being content with what you have while questioning the “essentials list” as you said are keys to really winning financially.

Great advice, but I think the key to it is deciding what you want to do. Some people who talk about frugality and saving make it an absolute moral, rather than personal, decision and that worries me.

When I was much younger and in my first house, my wife and I decided only to buy a mattress and put it on the floor (we were flexible then!), and then bought an expensive camera. This shocked our parents, but it is what we wanted to do and we derived great pleaseure from it.

Now we buy branded or own-brand stuff in supermarkets depending on what each offers us. Sometimes one, sometimes the other. I rarely ‘order a latte with heart-shaped foam’, but I have bought high-end astronomical equipment.

It’s all about those choices. The crime is to spend the money and then not to notice what you have bought.

It seems I live in the most unaffordable city in the world, behind Hong Kong; looking for ways to trim budgets is a blood sport.

I’ve been reduced to watching my oil stocks, and cuddles 🙂

I think not being a drinker and a smoker are a big key in what you spend/waste. ruins your health and sometimes career and relationships. loose loose ! also no mortgage.

being a women is more expensive than being a man as we love grooming ourselves with new cloths, skin products hair and nails treatments etc

im completely under control with all that, fancy expensive brand names don’t impress me . I have everything I need including 2 hols abroad each year and still save 50 % of my money. abundant mentality! not many women like me ! . I know people the complete opposite, what I call poverty mentality! . your are right . people don’t need STUFF to be happy and until they get to this point they will never be REALLY be and stay happy as it will always take something else for yet another brief high, so debt , money shortage and no/ very little pension will result. plus they moan a lot.

Oh dear…

http://www.telegraph.co.uk/finance/personalfinance/investing/11348222/Do-I-have-enough-to-retire-in-my-50s-on-50000-a-year-plus-luxury-holidays.html

Truly magnificent post by the Accumulator!!!!!

To old eyes,

That’s a great ‘balancing’ comment

I guess it is fair to say that a focus only on building a long term escape plan for freedom from work (to avoid the hell of today perhaps?) is kinda missing the problem.

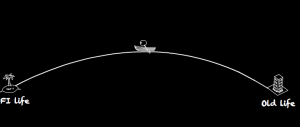

As i describe in my book – at the other end of the ideas spectrum a lot of people argue that saving for a traditional full-stop retirement is a waste of time, because if we’re healthy and happy in our work, we can continue working throughout our lives.

Henry Thoreau (an American author and philosopher) went much further when he said, ‘This spending of the best part of one’s life earning money in order to enjoy a questionable liberty during the least valuable part of it reminds me of the Englishman who went to India to make a fortune first, in order that he might return to England and live the life of a poet.’

Thoreau’s advice is essentially, ‘Don’t bother saving for your later years – live for now’, or, as our teenagers today would say, ‘YOLO’, you only live once.

That strategy was okay for Thoreau who enjoyed the financial support of others including a rich friend (Ralph Waldo Emerson) who provided his accommodation from where he was able to sit and read and write. And Thoreau’s ideas on the pointlessness of saving worked for him because he died in 1862, at the age of 44. He didn’t need any funds for his later years, because he didn’t have any!

But the world is different today – life expectancy has improved significantly due to advances in health, working conditions and medical science since the 1850s.

In 1900 a new-born child had a life expectancy of less than 50!

[See Hicks and Allen, 1999.]

Today, that life expectancy has risen to around 80.

So what’s to be done?

I think the answer is in balancing the needs of tomorrow with finding more happiness in our work today – and in continuing our learning so that we might continue our ‘earning’ in our later years too.

This is absolutely how my husband and I approach life. We’ve found that once you free yourself from the never-ending carousel of consumerism, you can find true joy in living simply and frugally.

We don’t feel like we’re missing anything by not spending money, we feel like we’re gaining the riches of a fulfilling life that’s not based around what society tells us we should buy.

Hmm. My problem is that all the things I really want to do with my time instead of working, do actually cost something. I can go out walking – but to enjoy it I need a modicum of decent kit (boots, waterproofs) and I need means to get there. Cycling? I need a bike! I can see friends – but some of that will involve eating, or drinking, or doing an activity, and I have to find a way to get to them too (they are not all on the doorstep). Reading? ok I could work harder at getting to the library, or buying second hand (although I’m trying to reduce use of amazon). And as for travel, which I am really hoping to do more of some day… So I’m a bit sceptical about the idea that living can be done for nothing. I hate to say it, but one big advantage about work is that not only does it keep you out of the shops, but it actually gives you money as well!! Its the only thing I do that is actually reverse consumption!

@vanguard fan

actually those things you like to do are not what id call expensive

boots ,waterproofs and a bike. once bought they will last you years.

you have to live for now and enjoy some of your money, living cannot be done for nothing.

I think what monevator is talking about are spending excesses

I need, I need, I need, to be happy

my hols are not what id call expensive. 1 week HB hotel ,flights in Tenerife £500

12 night cruise , flights & hotel in Rome £800- inside cabin and booked direct, cut out travel agent and save £100,s.

I spend but not over spend and I don’t fall for the hype and I don’t need to impress anyone. I have a new car but its not a flashy statement piece just a citreon c3. so what !

One of your most inspiring posts yet, Mr A (which is all the more impressive, given how inspiring most of them all). Like others, I esp liked your line about “That’s not winning, that’s surrendering”. Spot on.

One small tweak if I may…saving is even better than you say, as £1 saved is worth £1/(1 – T) earned, because the latter gets clobbered with tax at T per cent. So if a higher rate payer saves £1, that’s equivalent to earning an extra £1.67….not a bad bonus for being frugal.

@vanguardfan tell me about it – if i had the time my hobby would require me to cart 100s of kilos of excess baggage around the world in the form of windsurfing gear to places like maui, perth, fiji, south africa, canaries, cape verdes – the list goes on

I’ve done it a bit in the past and its good fun – but it isn’t free for sure

caffeine independence? is that when you grow your own coffee, so you don’t have to buy it? 🙂

as old_eyes suggests, we all have different priorities. the key is working out which spending is worthwhile for you.

IMHO, it works better to start from the assumption that you should spend virtually nothing, and then start adding back spending that is clearly worth it. rather than starting by spending about 90% of your income, and then wondering how you could possibly spend less.

an awful lot of ppl assume that raising income is the only way to improve their finances (even xkcd: http://xkcd.com/947/ ). in fact, both raising income and ruthless eliminating unnecessary spending make a big difference. if you only work on 1 of them, you’re probably missing a lot of low-hanging fruit on the other 1.

I like to spend on experiences like soccer matches, eating out, foreign holidays with family, concerts (watching simple minds and fleet wood mac this year). Big house, fancy cars and stuff is a waste. I think you have to live in the here and now as well as plan for the future. As Buffet said its like saving up sex for your old age.

But how can you spend ‘virtually nothing’ when almost everything costs something – water, housing, heating, eating, getting anywhere more than a couple of miles away…even browsing the internet 😉

I have been tracking my spending to try and work out how we spend what seems to me a crazy amount of money, hoping to find the low hanging fruit that we can cut out without even noticing…ha ha. Our basic household spending for a family of 4 comes to an annualised £32k. Thats without including anything that underpins the good stuff in life – no clothes, no entertainment, no meals out, no holidays, no books, no gifts, no kids activities. And no mortgage. Just groceries, bills, house and transport (and excluding work travel costs). I think newspapers and haircuts slipped in there too, which I guess aren’t strictly speaking necessary 😉 No, I don’t understand it either, although a large part of it must be living in a large house in a cold part of the country. Or maybe life is just quite expensive in the UK? I certainly can’t see how it would be remotely possible to live well (I mean that in the sense of a good life, not loads of stuff) on £12k a year….Although now I think about it, I suppose 12×4 is actually 48…

Since pretty much rejecting much of commercialism, I can’t say that I’ve missed all that spending on ‘stuff’.

There’s still some spending that I won’t give up on, eg my holidays, my gym, my social life, but I’m not extravagant, nor so frugal to the point that my friends have noticed me being different.

But in between, I’m living quite a simple life, cut back on unnecessary costs, making do with the ‘stuff’ that I’ve bought in the past, which will only be replaced when they no longer do the job they were bought to do.

I sometimes think “commercial awareness” should be part of the school curriculum. It’s important to know that you are a target, as much as it is to learn the skills to exploit demand for products and services later in life.

Anxiety is a major problem today and I can’t help but think a large factor is the pervasive marketing to every facet of our lives. There is no area large or small of life that doesn’t have a product and a campaign designed to make us feel unfulfilled, or guilty for not addressing it. You need a kind of armour to passively resist that pressure.

i’d say browsing the internet does cost virtually nothing, if you look at it in terms of cost in £ per hour’s entertainment (for a home internet connection, paid for monthly). even books are not very expensive in cost per hour, assuming you buy new paperbacks and read them once (though perhaps children’s books are more expensive, on that measure?). cost per hour gets really high for (most) events with a ticket price for entry, or eating/drinking out.

£32k with no mortgage does seem quite a lot me. but then i don’t have children, and i gather they’re quite expensive (to support – not human trafficking :)).

have you figured out roughly where it’s going? apart from housing / utilities, areas where some ppl bleed a lot of money (and which you haven’t already ruled out) include:

cars: how many? how expensive they are in running costs, and in depreciation (i assume you haven’t bought on credit, which would be much worse)? and are you living in the wrong place, so that you have to commute too far (this can be a trade-off with housing costs)?

groceries: not just the obvious choice of home cooking or ready meals. there can be a lot of scope to cut costs without compromising quality: bulk-buying things that keep, planning ahead, not buying junk (like crisps) at all, but paying for quality where it does make a difference.

£32k for 4 with no mortgage is very high, you must be bleeding money somewhere! Our basics are £20.4k for 2, but that includes a six figure mortgage being paid down over a compressed timeframe (we’ve gone from 25-16.x years in 2.5 years).

I’m on £20k for a family of four, that covers everything (but no mortgage)

I save 30% – I could save more if I wanted to, but I do love shoes, suits, shirts, ties and other ‘gentlemanly’ items. I get a lot of pleasure from it.

It’s all about moderation, and certainly no CC debt.

@TA Spot on

Rule#1 on page one of the book of personal finance it seems, was called out by the Delphic Oracle in antiquity, and it holds still –

Know thyself

Know who you are, what you stand for, what you want.

So much advertising is trying to get you to outsource your values onto somebody else’s space and values. One of the biggest wins I got was using ad-block plus on the internet and reducing, then icing the TV. I know where to get bread and circuses if I want to. I don’t need to surrender hours of mindspace to other people’s agendas.

@PaulClaireaux

The do what you love, love what you do mantra always gets me going. Steve Jobs was one in a million, and probably a sociopath to boot 😉

That if is a big if. When I look around there are fewer and fewer people that seem happy in their work now. The entire PF universe wouldn’t be obsessing about financial independence if they were happy chuntering away until they hung up their keyboards for the last time on the way to the crematorium. There’s also something a little bit tragic about Work being the point of Life – it’s a means to an end IMO.

Maybe I was unlucky in both choice of company and peer group, but compared to decades ago the world of working for an employer sucks big-time. Once upon a time middling level jobs had a decent amount of autonomy and intellectual challenge but this seems to have dropped away into the fewer ‘lovely jobs’ and lots of lousy jobs.

The pressure of having to make money sucks the joy out of all sorts of enterprises. Too often it makes people into chiselers and two-faced hypocrites saying whatever to get the job, ‘cos otherwise their kids have to come out of public school, or they don’t get to holiday in Sardinia, or some other calamity of consumerism will happen.

I think what we’re probably bleeding is heat into the atmosphere…we have invested a lot in double glazing so hopefully next year’s fuel bills will be lower, but it depends a lot on winter temperatures. I don’t have the breakdown here but will look closer tonight and report back…though I think the kids use as much food, heat and water as we do even now – and in the next 5 years the food bills will increase as they out-eat us too!

But, the broader point really is not whether other people can live more cheaply but for me to work out whether/when I can afford to do without my salary – if that is going to entail living on less than now, I need to work out how that is going to be possible – what can I spend less on without impacting quality of life too much? I don’t want to retire to surf the internet ;-)- that’s about as healthy and productive as playing x-box or watching cable TV all day, much though I enjoy it! Its likely that the activities I replace work with will cost something, and certainly more than being at work which is revenue producing! I think our life reasonably sensible – one car, 10 years old for eg – and we don’t go out much (less than I’d like to if I stopped work) so I’m disappointed that our core living expenses seem to be so high. I’d far rather spend less on them and more on books and walks! (I tend to go for non-fiction which are a bit more expensive/less available second hand). Anyway, more later…

I think also our pattern of spending would be completely different without the kids – it totally drives how we spend our time. So really hard to compare across with households with two adults – or to second guess what we will do when we become such a household!

@ermine – agree fully about the degradation of middle class jobs. I feel more and more like a production worker in a widget factory, and my job is probably the most archetypal independent/autonomous profession (or used to be) that you could think of. The worst thing is the bleeding of work into every hour of every day with the tyranny of email and smartphone -so you can’t even just sell your soul 9-5 and keep the rest.

@vanguardfan – you need one of those money mustache makeovers!

£32k for one old car, no mortgage and not including all the actual expensive things in life seems huge..

have you got the records to delve into where its actually going? there is a hemorrhage somewhere for sure

oh.. Im feeling it for Vanguard fan. I think we all are.

how long before the kids start paying ‘keep’?

@ermine

‘There’s also something a little bit tragic about Work being the point of Life – it’s a means to an end IMO. ‘

Work takes up too big a chunk of the waking hours to allow it to be a means to an end. Hence that view is also tragic.

There is probably a happy medium somewhere between those two extremes where you could aim for. Its too much time not to put a lot of effort into getting it right (or at least less wrong)

From a philosophical viewpoint – your work should contribute in some part to getting you where you want to go. Say for a stoic – it would have to help you towards development of the virtues.

@The Rhino

I think we all seriously screwed up somewhere along the way between Keynes’s Economic problems for our Grandchildren which was also the expectation still when I was at school. We have the whole bizarre consumption racket of weddings costing stupendous amounts of money symbolic of the consumerism consumption ratchet which goes through kids birthday parties, public school etc etc. Houses get bigger – when I was growing up siblings would share a room which is unheard of and probably against the law now. And yet as TA pointed out with his chart, we don’t seems to be getting a lot of enhancement of quality of life for all that mindless spending.

Whereas other things that have gotten better over the last 30 years and really do contribute to quality of life (cars, communications of all sorts, keyhole surgery and other medical stuff, fertility treatments and contraception, computers, TVs, coffee in the UK which used to be disgusting, indeed food and drink all round) seem to be cheaper in real terms or virtually free like the Internet.

Agreed work consumes too many waking hours, and arguably more of your day what with the always on bits vanguardfan mentioned. But it probably consumes less of your life. Most people here are after FI and retiring early or winding down early. I worked for roughly 30 years, it would not be unreasonable for me to expect to live another 30. My Dad worked from 16 to 65 and lived about 20 years from then. Arguably Keynes had a point, but the extra leisure tends to get saved towards the end. The whole point of all this personal finance jazz is get that shifted in your favour.

> Its too much time not to put a lot of effort into getting it right (or at least less wrong)

The trouble is that it is not entirely within our control. I started work long enough ago that for most of my working life I was competing with people in the developed world. As a result I found my way towards a position which had enough autonomy and intellectual challenge to be diverting and pleasant, I was privileged and lucky enough to LWYD for a shade over 2/3 of my working life. But as globalisation took hold the workplace changed, and not for the better from my POV. I was simply competing with that many more people, and I’m simply not brilliant enough/enterprising enough/dynamic enough to want to keep on crawling up the greasy pole. Work also got less important a part of life as I get older, partly because there’s less to play for and partly because I’ve seen all the initiatives and Next Big Things too many times before to believe in them.

DWYL-LWYD is Calvinist victim-blaming, effectively if you aren’t loving what you do there’s something wrong with you. It needs to get called out as such, because elementary observation shows it applies to much less than half the workforce. The top slots of the pyramid are simply too few and far between. It’s great for the chiefs, but there are always more grunts, who have to settle for LWYD outside work.

@ermine if you enjoyed 2/3 i think you did alright as it goes

with the benefit of hindsight are you glad you stuck out the last 1/3 or might you have chopped and changed once you noticed you weren’t so into it – given something else a craic (i.e. another job, not retirement)?

I certainly appreciate the desire for financial freedom, and a cheerio-to-the-boss fund. Although I still maintain there are other ways to get the freedom we crave, which anyone who is capable of ploughing through all the syllables and punny metaphors in a Monevator post is more than capable of exploring.

All that said it strikes me that there is something rather first-world-problem-ish about our complaints. We do get paid for going to work. That is supposed to be a compensation for the fact we’d rather be elsewhere, either at a more interesting rival employer or else walking in the sun over a heath / cavorting with persons of easy virtue, depending on your personal taste.

Perhaps the big issue isn’t that work is boring but that to try to get that extra bit more out of us, employers and “The Man” (i.e. the commercial/industrial/media complex that drives our society through Adam Smith’s invisible hand, as opposed to Big Brother) started telling us it should be fun?

Maybe if we expected it to be rubbish, we wouldn’t be so disappointed when it is.

@ All – thanks for such a wonderful thread. Very enjoyable to read.

@ Old Eyes – love your comment: The crime is to spend the money and then not to notice what you have bought.

Completely agree that you have to know what you want first and what you value.

@ Vanguardfan – no-one is saying you can live without spending, though I guess this is just your frustration showing through? Are you tracking your spending? I didn’t really get hold of my finances until I put it on a spreadsheet and worked out where the money was going.

Old Grey G Sock’s idea about starting from 0 and only putting back the spending that really matters to you is a great idea.

If spreadsheeting your finances sounds horrendous then The Firestarter recently recommended some software to ease the pain:

http://thefirestarter.co.uk/track-finances-ease-introducing-money-dashboard/

@ The Investor – the issue becomes how much The Man wants in exchange. There’s an exercise in the book Your Money Or Your Life. Take your salary, work out how many hours you really work including commuting, CPD, after-hours activities, subtract additional costs e.g. clothes for work, second car for commute, professional fees and eventually you have your ‘real’ hourly rate. Then decide whether that’s really worth it.

@The Rhino actually I’m being terribly unfair to The Firm. I worked for 30 years continuously in all, though for other companies in the early days, and the problems started to show four years before the end and got really bad three years. Before then, in the words of a colleague, it was a great place to work gone bad.

The error was mine – I failed to raise my eyes to the horizons and look around at the wider picture of globalisation. The change came rapidly, amplified by the the crash. Looking back, I’m glad I sweated the three years and got out rather than look for another job in the teeth of the recession.

But there is a bigger narrative to the human life-cycle – towards their 50s for parents often the last child is beginning to fly the nest, and people begin to ask themselves different questions and seek meaning in different area. The process of individuation often begins to happen in midlife, and perspective changes.

Sometimes, perhaps often, it precipitates a midlife crisis, as people wrestle with new topics and stumble, happiness research seems to indicate that the 40s to 50s is a low-water mark in happiness, but those who make it past that without making a hash of things begin to seek fulfilment on terms that are sometimes more internally referenced than work, and often invested in raising children who are by then young adults. Life is a cycle. There is a personal aspect to personal finance – and since TA’s lovely is a post about the personal rather than the finance aspects it’s good to acknowledge the varying aspects of the human life-cycle.

@TI – the economy is a human construct, and I venture it is there to serve humanity. Sure, there are boundary conditions, and let’s salute the common effort that has given us the means and the ability to discuss such First World problems. But shouldn’t we raise our sights a little higher than accepting work is rubbish – indeed that in some ways it is becoming more rubbish for a lot of people? We flush away many years of our life to it. Why are we making houses so damn expensive – everybody is born naked and needs shelter from the cold and rain. Why are we making it so expensive and hard for people to have children – 80% of women still have them, it’s also a common thing that people existentially want to do.

In my primary school in the 1960s they seriously thought/intiated there was a good chance that people would have far more leisure time, maybe work about 2 or three days a week. I still feel cheated. Imagine if we had got there, rather than the lucky few of us saving our three days a week and using it for a longer retirement. People would see their children grow up. Our communities might be stronger. Why did we surrender the opportunities to Be in favour of to Have? That flatlining happiness in the face of rising real income is a dreadful indictment of misallocated effort since those 1960s drams of building a better world…

@ermine @ta — I am borderline playing Devil’s Advocate.

As T.A. might even rightly suspect from his knowledge of me and my ways, I’ve probably made myself borderline unemployable (in terms of a regular 9-5) these days so it’s all rather academic for me. 😉

Still, I’d say that for most people throughout all of human civilization and many today, work was there to serve an end, normally to get just enough food to eat. For maybe 30 years for a professional class of overwhelmingly well-educated males largely in the West, it was perhaps that bit more.

Maybe for doctors and other similar vocations it’s always had an extra meaning to it (though in my experience they privately complain as much as any office drone) but for the vast majority of grunts its been clock in / clock out grunt work. (And I include white collar office workers in the grunt category of course).

I get the feeling from limited observation that in India or Africa, the typical office worker doesn’t berate his or her lot to this degree. Seemingly, it comes as nations ascend Maslow’s hierarchy of needs — us individuals get to pick and mix what’s important to us nearer the top… lavish foreign holidays and expensive cars and late nights at the office, or ennui and the right to feel dissatisfied about your daily grind?

Perhaps life is existentially easier when we don’t have the choice, if achingly and spiritually harder. (I’d happily take existential angst over poverty, of course).

Similar, houses are surely more expensive because we have two workers buying them much of the time (or women buying them single alongside men) because of choices we as a society have made about the (re)division of labour, which also answers why it’s so expensive to have children. If half the population understandably enough feels it should be able to go to an office and do pretty much anything else the other half were doing simply by being born with the right part in the right place, and then they (or we — I’m all for personal choice, freedom and equality, even at societal cost) win that right (and also the right to moan alongside the men in 2015 about how rubbish that work they won is… 😉 ) then that’s going to have knock on consequences on house prices on a small island with ultra-limited building and on childcare, too.

Well, at least until the Robot Era dawns, and then it might *really* be a case of be careful what you wish for.

As I say, I’m partly playing Devil’s Advocate. Of course T.A.’s post resonates with me too, and indeed it’s one I might have written at various times in the past.

But without wishing to cause offense, I read your lament Ermine that you have only been able to retire to a life of doing whatever you like with only nearly-half your life still ahead of you after enjoying most of your working life in an office — a late lament caused by your job not being fun, basically — and I can’t help thinking of MMM’s certain-pants. 😉

But I could just as easily be talking about myself here, too. As I say, I’ve made myself unemployable with my inability to hack office life, so I get the loathing.

The great thing is *we* have discovered the options. T.A. isn’t spending today and that buys him some freedom tomorrow. Ermine, you did similar. I’m trying to find some middle ground of professional pseudo-freelance freedom, though I’d admit my own work/life balance has got well out of whack recently.

But anyway the bottom line is I’m not sure we should get so cross about “the human construct” that is the economy, to quote Ermine, when it gives us all these options?

Of course we should debate it!

I’m just putting in a few words for the other side. Perhaps it’s not really an oppressive boot of unreasonableness stamping on our faces.

@TI hands up. It’s a fair cop 🙂

I do take the point that the sum total of human happiness is probably greater. And it’s a greater number of humans than has ever existed before, so that’s an even more impressive achievement.

But hey, I’m mourning the dreams of Keynes’s Economic Possibilities. Bet you weren’t offered that as a kid. The Spectator tells us Darwinian Capitalism is the best we got. And, looking at the results, it ain’t bad. Well, as long as you aren’t on the thick end of, say, being unlucky enough to have to apply for unemployment benefit these days.

Mebbe I’m just a Sixties kid who wants to believe we can do better. But I have to put my hands up. People in Britain are a lot richer, healthier and we can do a lot more than we used to be able to do, this much I know. It absolutely gobsmacks me still. It’s just that once we used to believe we could change things for the better, whereas we’re now all watched over by machines of loving grace. Ain’t human beings ornery so and so’s 😉

@ermine — Wow, that last paragraph is positively panglossian coming from a cautious Mustelid like yourself. Perhaps I should quit while I’m ahead. 🙂

Thanks for seeing where I’m coming from. I agree working life isn’t a bed of roses, and obviously agree that the work/life balance can get out of whack. (Mine is currently, shamefully).

I think I’m just saying we have choices — that housing costs aside (debatable whether you can put them aside in the South East I know) perhaps Keynes’ dream came true?

Productivity soared and so did the standard of living and so forth.

But most middle-class people (which is what we’re really talking about here; I don’t think someone on the minimum wage has anything like as many choices) have decided to spend the productivity gains – either intentionally or witlessly or perhaps somewhere in between – on lifestyle inflation. Where lifestyle=material goods, not going for walks or working for fewer years.

Which brings us back to The Accumulator’s point, I think? 🙂 That it’s a choice, and he has articulated the strong argument for making a different one, to whatever degree works best for you.

Cheers for the discussion!

@TI did someone buy you a thesaurus for christmas?

We’re feeling the heat from increasing competition and real falls in income. There’s no doubt life can get worse despite increasing access to material goods – we’re status-driven creatures. The sum of human happiness has increased in proportion to the parts of the globe that have been lifted out of poverty and towards a reasonable standard of living, but there doesn’t seem to be much evidence that we’re making headway here.

What’s interesting about Monevator readers is that we’re doing something about it rather than just wringing our hands.

For my own part, I’m trying to upskill myself too – with half an eye on the robo-algorithms that are coming to steal our jobs.

It’s another take on diversification and I’m not going to put all my trust in achieving FI on my own terms.

But for me, it’s changing my mindset that’s helping me cope most with a changing world. Wanting less, increasing personal resilience, anchoring my happiness to firmer foundations.

My father worked 17-64, when he died. He interrupted his career to go and kill Germans. Count your blessings.

The following factors are critical for contentment and good quality of life

Adequate serotonin and oxytocin levels

Good health ( in the wider sense)

Good sleep

humility,

Freedom of choice to do what one wants to without guilt

Being happy to have what you need,

Serving and caring for others but with the autonomy you choose to use as opposed. Being forced to

Having something to do and look forward to all

The following contribute- but are not necessarily imperative unless one chooses them to be

Lifelong learning

Mindfulness

Happy memories

Lovely and loving family

Please note:expensive material possessions are not necessary- they just feed the ego and the ego is only a driving force if it controls yo and you do not manage it effectively.