Investing is a swampland of hidden costs, semi-hidden costs smeared with camo paint, and costs hiding in plain sight shouting “I’M A COST” – but, alas, everyone’s too exhausted by the world to pay any attention. FX fees (foreign exchange charges) are of the semi-hidden variety.

FX fees are invariably buried deep in your broker’s Costs & Charges pages. They occasionally turn up in your transaction history but as often or not just aren’t mentioned – like an embarrassing uncle who exposed himself to the neighbour’s budgie.

The issue is FX fees are not only charged when you trade international shares or if you like to pick ‘n’ mix FOREX1 funds.

You may well find a slice of your income lopped off every time your apparently bog standard global or US or emerging market ETF pays dividends.

And some brokers charge a ridiculously high amount for FX conversion, making like a wealth mosquito that won’t quit harassing its favourite cash cow.

But there’s good news! You can squish FX charges.

Some brokers offer very competitive currency conversion rates. Moreover you can cut FX fees out completely by choosing the right ETF.

When are FX fees charged?

There are two main instances:

- When you trade in an ETF, fund, share, or other instrument that isn’t priced in sterling.

- When you receive dividends in a foreign currency.

In both cases, your broker will convert your money into the appropriate currency and take its cut.

Sounds fair – except that like a currency exchange machine in a hotel lobby, your platform may not be incentivised to give you the best rates.

How can I avoid FX fees on dividends?

This is easily done with ETFs by choosing the accumulation version of the fund.

The accumulation variety of an ETF automatically reinvests your dividends back into the fund for you.

Because the dividends aren’t paid into your broker’s account, you don’t incur FX fees.

However ETF providers aren’t always great at listing the accumulating versions of their ETFs.

I mean, why make it too easy?

Vanguard is particularly bad at this. The company’s consumer-facing site typically lists the distributing versions of its ETF range.

The simplest way I’ve found to uncover accumulating ETFs is via justETF’s Screener page:

Drop the name of your ETF into the search bar.

It’ll list all the ETFs different incarnations. (They are all clones in terms of what they hold, so don’t worry that there’s any intrinsic inequality between versions.)

You can usually tell how each version treats dividends by scanning the variations in the fund name.

It’ll be an accumulating ETF if its name contains any of the following abbreviations:

- Acc

- A

- C

- Cap

Whereas the ETF pays out dividends to your broker if its name is tagged with any of these tell-tales:

- Inc

- D

- Dis

- Dist

Sometimes an ETF’s name refuses to divulge its secrets. In that case click on the screener’s Use Of Profit filter on the left-hand side of the page. Choose the Accumulating option and you’re away.

See our fund names explained post for more on decoding index trackers.

How can I avoid FX fees on trades?

You can dodge FX fees on trades if you choose an ETF that’s priced in pounds on the London Stock Exchange.

This time it’s not as simple as checking an ETF’s name to see whether it mentions GBP.

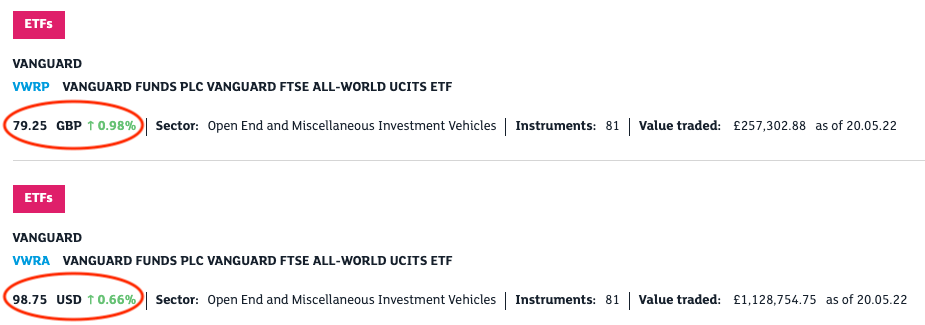

For example, Vanguard’s FTSE All-World UCITS ETF (USD) Accumulating trades in both:

- US dollars – using the ticker VWRA

- Pounds – via ticker VWRP

Choose VWRP to trade in pounds and so skip foreign currency conversion costs.

To discover which currencies an ETF trades in, go to the London Stock Exchange’s home page.

Put your ETF’s name in the search box top-right.

If the search box waterfalls a list of candidates then tap on Show all instruments.

Each ETF’s trading currency is listed in its entry on the Instrument page. See the red circles in the pic below:

If you’re not sure, then click through to the ETF’s page and check the currency listed in the ‘Last 5 trades’ section. That will confirm whether it trades in GBP, USD, or whatever.

To completely eliminate FX fees, choose an accumulating ETF that’s priced in pounds on the exchange.

That’s because a distributing ETF that trades in pounds can still pay dividends in foreign currency.

Explain!

A fund’s currency status can be confusing:

Underlying currency – this is the currency in which the fund’s holdings are traded. If you hold a S&P 500 ETF then the underlying currency is US dollars – because it holds US shares. Whereas a FTSE 100 ETF’s underlying currency is pounds – it owns British shares. An All-World ETF has multiple underlying currencies because it trades in securities priced in dollars, euros, yen, baht…

This currency classification determines the nature of your currency risk. You are exposed to the pound’s exchange rate, versus every currency that the fund’s underlying securities are traded in.

Base currency – this is the currency a fund reports its Net Asset Value (NAV) in. It distributes its dividends in this currency, too.

The ‘USD’ in Vanguard FTSE Emerging Markets UCITS ETF (USD) label tells you its base currency but nothing else. You aren’t exposed to currency risk against the dollar because it doesn’t invest in dollar-traded equities. Base currency may also be called denominated currency or fund currency.

Trading currency – the currency in which a fund is bought and sold. Most ETFs will be available in a pound-priced variety on the London Stock Exchange.

Currency hedged – This is how you protect yourself from currency risk. If an ETF is GBP-hedged then it uses a financial instrument (such as a currency swap) to neutralise the effect of exchange rate fluctuations on your investment return.

Look out for the term GBP hedged in an ETF’s name or its documentation.

How can I avoid broker FX charges entirely?

You can avoid egregious FX fees by first finding a platform that enables you to hold foreign currency in your account with them. Then you can convert your currency using a more competitive service that will transfer your overseas readies to your investment account.

Good currency brokers should be able to beat your stockbroker or bank’s transaction costs as comfortably as Usain Bolt could beat me at the 100m.

But it’s worth knowing that you can’t even hold foreign currency in a Stocks & Shares ISA.

You can hold foreign currency in a SIPP. But your cash contributions must be made in pounds.

It’s probably less hassle just to choose a broker with a competitive currency conversion fee.

How bad can broker currency exchange fees be?

The worst rate I’ve seen is 1.5% on top of the spot rate (that is, whatever the market is offering at the time on the pound versus foreign cash).

Generally 0.5% or less is about as good as it gets for a platform aimed at regular Jo/Joes.

Some specialist share dealing brokers offer rates at a tiny fraction over the spot price.

But these are typically aimed at semi-pros. They may encourage portfolio churn, and there can be other charges such as non-fixed trading fees.

Such complex platforms don’t hold your hand. They’re suitable for the extremely confident and disciplined only.

Fish in the Zero commission platform table of our broker comparison page if you want to optimise FX fees.

Final warning

Beware: some brokers make it very difficult to uncover their actual currency exchange fees.

Either they neglect to mention them. Or force you to spelunk their T&Cs to find them. Or they pop a little table on their fees page but make you read their Foreign Exchange FAQs to find out their cut is on top of the spot rate.

Be careful out there.

Take it steady,

The Accumulator

- Foreign exchange. [↩]

Comments on this entry are closed.

@TA:

Watch out for minimum charges! I am not sure if anybody does this with FX but they certainly do it with other transactions.

Due the enduring and deserved unpopularity of the FTSE100/250 maybe the FX costs is something that should be added to the excellent Monevator broker comparison table?

With your semi-retirement maybe you have the time now 🙂

I needed to cover a negative GBP balance in my SIPP, held with ii, yesterday. I had enough dollars in the account to cover the shortfall, but the offered FX rate was abysmal, amounting to a £12 hit per $1000 converted (ccy mismatch intentional), when compared to Revolut.

So I added cash to my SIPP instead.

Beware.

Some of the USD dollar ETFs do not attract noticeable FX charges but others do , interactive investor I am looking at you !!!

I am going to be far more careful after getting caught out the other day… timely article

My biggest gripe with Hargreaves Lansdown is the 1% FX charge on ETF dividends. I don’t think they even list this in their charges anymore and it is not explicitly broken out on dividend payments. We pay more in FX fees than we do in SIPP account fees. I would hold accumulating ETFs but we mostly hold US listed ETFs which pay dividends without withholding tax. The tax saving is greater than the FX charge.

Vanguard do not publish their FX charges either, but I was pleased to learn it is zero for ETFs in their SIPP, which is just as well as for some reason they don’t offer the accumulating versions of their ETFs to SIPP holders. I don’t have a Vanguard account but got a relative to ask the question.

X-O use a “house rate” for F/X. I tried to get a better explanation from them but got nowhere.

Wow. Thank you for this article. I bought some VEVE, without being able to find an accumulating version and without really appreciating the FX ramifications down the line. It is listed in London so never occurred to me that dividends would be paid in $.

VEVE is Vanguard FTSE Developed World UCITS ETF Distributing and I have now found Vanguard FTSE Developed World UCITS ETF Acc. Now the million dollar question – should I sell and then buy the accumulating version… Don’t worry, it’s more of a rhetorical question but any views are welcome!

Please moderate this if this is not the right place to ask but does anyone know the implications of accepting Freetrade’s new Ts&Cs regarding securities lending? Tks

Spurred on by this I checked my USD dividends paid by SEMB ETF by iWeb. They do not appear to charge a conversion fee of 0.15% -checked daily rate of dollar in case it was hidden in the exchange rate.

As this article said this is not very clear what the 0.15% FX fee applies to in Iwebs T&Cs. Maybe because it is a London listed ETF in GBX, even though it pays divs in USD?

For easier tax accounting reasons I would rather have a distributing ETF.

Good article as this is a not very clear area.

Fortuitously for simplicity’s sake always been in Acc units in my 3 Vanguard OEICs ( one a bond fund) -now on a Interactive Investor platform

OEICs shows my age -ETFs weren’t available when I started out on this investment journey

Apparently dodged this bullet more by luck than good guidance

Could be a largish sum involved over the 50/60 years of a pension investment!

xxd09

A similar thread on FX expenses running on Lemon Fool which invalidates the Acc units work around-sadly

Worth a link?

xxd09

I wrote to ii recently to confirm if they applied their foreign fee of 1.5% to dividend payments that are paid in dollars and then automatically converted to pounds due to the account being an ISA. The response was that they did NOT apply any forex charges, it is very difficult to confirm though whether this statement is correct though. Has anyone confirmed that they do apply the 1.5%?

——

There are two main instances:

* When you trade in an ETF, fund, share, or other instrument that isn’t priced in sterling.

* When you receive dividends in a foreign currency.

——

And interest from a foreign bond fund?

@ Neverland – good point. I’ve flirted with the idea before but held back because the table is so complicated already. I think you’re right though, it’s time.

@ DaneJames – check out the dividend declaration for your investment (e.g. on Investegate or via the firm or fund itself) and see if anything’s gone missing by the time you get the payment. ii’s T&Cs may also be worth a look.

@ xxdo9 – please do post the link. I’d be interested to read it. BTW, I would expect some FX charges at the accumulation fund level, just not at uncompetitive broker levels. There’s a competitive pressure on acc index trackers to offer reasonable rates otherwise their tracking difference will rise. Note, that you can check the returns of acc and inc funds with dividends reinvested. They’ll typically be identical on a good tracker. That shouldn’t be the case if a significant proportion of the acc dividend is disappearing in FX fees.

@ Ali – they’ll receive money for securities lending. Securities lending exposes you to counterparty risk i.e. the chance that the short-seller defaults on the loan of your securities. Counterparty risk is relatively standard among fund managers but it’s still a risk. It’s not standard among brokers, so you can avoid it.

@ Cat – one note of caution. You could incur taxable gains if you’re making a sizeable trade outside of tax shelters.

@ Naeclue – thanks for the extra info on Vanguard. Sounds like you should be charging all these relatives who come to you for financial advice 😉

HL specifics are in their T&Cs.

@ Alex – Yes, good point, for dividends read ‘dividends and interest’.

FWIW, AJ Bell are transparent about FX fees whenever they pay me dividends – I can see a little slice lopped off in conversion charges. Which is nice.

Best I can do re link is refer to a current topic at Lemon Fool posts as “SIPP versus DC Pension and Drawdown

An example given is-200k in US shares at a 1.6% dividend generates £3200-£480 of this is lost in tax to IRS

Whole thread is worth reading-Ted Swippt is particularly good

xxd09

I think this is the Lemon Fool link:

https://www.lemonfool.co.uk/viewtopic.php?t=34796&p=507161

Great article! It prompts a few queries:

1. The article only mentions this as a concern for ETFs. Is there something inherent in funds (ie, index funds in the form of OEICs) that ensures this problem never happens? Are OEICs only traded in GBP and do they only pay GBP dividends?

2. Am I right to think that I ought to be more concerned about FX on trading the ETF than on dividends? If I buy $10k worth of an ETF, a 1.5% FX charge means the platform has sliced $150 off my investment (on top of the explicit £5-10 commission they charged). And the same again when I eventually sell it. (ignoring any change in value).

Assuming a 2% dividend yield, dividends would be $200 pa, so the FX hit is $3 per year. Over 10 years, $30. (Again, ignoring any change in value)

I’d rather not suffer either hit, but my priority would definitely be to avoid the hit when I trade.

3. In cases where the ETF has, say, USD as the base currency, but there’s a version of the ETF that trades in GBP, how can we be sure that the conversion does not have a loading in it? I’m guessing there is nothing to automatically lock the GBP version price to the USD version price, since both are exchange traded. But arbitragers will pounce if the relative prices move even a tiny amount out of sync with the spot FX rate, so in practice the conversion is at spot (or as close as algo traders care about). Is that right?

4. How does the ETF manager work out what assets underlie each version of the ETF share? Is the GBP version share worth the same fraction of the portfolio as the USD version share, so it is identical other than the currency in which it trades?

5. Am I right to assume the same issues would arise with shares or investment trusts that are traded in other than GBP? I do dabble a small part of my portfolio in investment trusts. Do any of them not trade in GBP?

@xxd09

The Lemon Fool thread is talking about US withholding tax and I think is correct to say that acc ETFs will suffer just as much tax at source on dividends paid by foreign companies to the ETF as on list ETFs. It isn’t talking about the question of FX charges on dividends paid by the ETF to you, the investor.

I meant “dist ETFs”, but auto corrected to ‘list ETFs”

@ xxd09 and Ivan – cheers for the link. I’ve given it a quick read but it’s about withholding tax rather than FX fees. I’m not implying in this piece that accumulating funds workaround that. It’s a common misconception that somehow you can pay less tax with acc funds but it’s not the case. Agreed, Ted Swippet is amazingly helpful and knowledgeable.

@ Ivan – funds and shares are caught up in this too. I mentioned that (ever so briefly) near the beginning but then made all my examples about ETFs because it was easier to illustrate. I don’t know if it affects ITs.

@TI – do you know?

There’s only so much we can know about the inner workings of investment vehicles but whenever I’ve compared different currency classes of the same index tracker the returns are identical. That implies they are the same in all important respects.

This piece tells you how to compare classes of the same fund on Trustnet:

https://monevator.com/comparing-funds/

Oops. Cheers Ivan. We crossed streams 🙂

Regarding investment trusts, there are (or were) some that trade in different currency classes. Think exotic stuff like listed hedge funds and private equity. From memory also some non-vanilla fixed income trusts (one of the corporate floating rate funds?)

The sometimes mentioned Brevan Howard Macro Global (BHMG) definitely used to come in different currency classes; it had a couple of flavours that underwent a merger in recent years so perhaps they tidied that up too, I’m not sure.

In short: yes investment trusts can come in different currency classes. 🙂

@TI

Thanks. I only dabble in some of the venerable ITs with a capital preservation bias: Personal Assets, Ruffer, RIT, Capital Gearing. They all seem to be GBP. (Or GBX, which I just learned means pence not pounds!)

Also worth noting that even when you buy an Acc. ETF, you can be stung for FX fees on special dividends, such as when the fund closes. Cost me a pretty penny when Vanguard closed their factor ETFs !

This is horrific (at least on big purchases and sales). Some FX charges from a quick trawl:

Interactive Investor 1.5%

…unless your transaction is >£25k (https://www.ii.co.uk/our-charges#full)

iWeb 1.5%, but no dealing charge

(https://www.iweb-sharedealing.co.uk/charges.html)

HL 1% on first £5k, then tiering lower

(https://www.hl.co.uk/shares/share-dealing/overseas-share-dealing-service)

AJ Bell 0.75% on first £10k, then tiering lower

(https://www.youinvest.co.uk/isa/charges-and-rates)

Fidelity 1% on first £10k, then tiering lower

(https://www.fidelity.co.uk/services/charges-fees/fees-more-detail/#tab-link)

Halifax 1.25%

(https://www.halifax.co.uk/investing/start-investing/share-dealing-services/charges.html)

BestInvest ?

(I can’t even find any mention that there is an FX charge, not even here: https://www.bestinvest.co.uk/media/qmbf33ti/keyfacts.pdf)

Out of those, AJB looks like a bargain, but perhaps there are others that are better (and still offer ISAs and SIPPs)?

I think Freetrade is pretty good for FX charges, albeit it quotes ‘spot rate + 0.45%’ which I don’t think many investors are going to be ready to calculate.

https://freetrade.io/pricing

(Disclosure: Freetrade shareholder)

Wow. The total fee calculator comparing AJB, Freetrade, HL & II on the freetrade site is an eye opener…

https://freetrade.io/pricing#calculator

Indeed. 🙂 And anyone wanting to sign-up to Freetrade in hot pursuit of lower FX fees can get a free share when they do so via our affiliate link:

https://monevator.com/go-to-freetrade/

@Kyte

Yes, though it uses data from 18 months ago, so some of the comparisons would now be different. Nevertheless, an interesting option that I hadn’t previously been aware of.

So I have two broker accounts (one GBP and one EUR) and where possible I try and buy securities (ETFs plus some individual shares) in the corresponding ‘Trading currency’ to avoid fees.

However, I wonder if buying a product on a secondary listing means I’m likely buying at a wider bid/ask spread than would be the case if just bought (for example) shares on the NYSE and accepted the conversion fee.

Does anyone know if there’s a material difference in the usual bid/ask between products traded on different exchanges?

That’s a good point Hague. You could try tracking the bid/offer spread for ETFs you’re interested in for a few days, for peace of mind.

The LSE shows price information for ETFs traded in London. For example:

https://www.londonstockexchange.com/stock/ISF/ishares/company-page

I expect other exchanges have the same facility.

@TA – Thank you for the reply.

The problem is that I’m fundamentally too lazy to even contemplate doing such a thing 🙂

Would anybody like to check the bid/ask spread of CUKX.L and SXRW.DE for me? 😉

I’ve messaged Vanguard what are the FX fees for VHYL and the reply was: there is none.

Thanks Peter. Is that in reference to Vanguard’s own brokerage charges? I can see VHYL lists distributions in dollars. At my broker that would mean FX fees, but Naeclue mentioned he didn’t think their SIPP charges for conversion. Would be good to know if that’s true across all their accounts.

What type of account do you hold at Vanguard?

@ Hague – haha. I’ll get right on that 😉

@TA this was in regards to VHYL within S&S ISA. I do not know what is their position on these fees in regards to SIPP.

@TA this was their exact response:

“We do not charge an FX fee for dealing and dividends in foreign currencies. Of course, currency fluctuations may hurt/ benefit the payments that you get in pounds from these distributions.”

So far, I think that Interactive Brokers seems to have the best FX charges. Though it’s not a platform for everybody, unless you’re into more complicated stuff.

@Naeclue – I’m sure you’re up on this, but if you’ve got US-listed ETFs, have you checked they have UK Reporting Fund status. I’m sure there’s a Monevator article on this (isn’t there on everything!), but worth checking. Most US-listed ones don’t, though there are a few on the HMRC list.

@ Peter – thank you very much for following up. That’s great news. No FX fees on Vanguard’s broker platform.

Interactive Brokers have the lowest FX fees, spot rate+0.002% commission, and the account is multi-currency, so once you’ve converted cash to USD you can buy and sell US shares without any further FX charges. If you have a margin account, you can also trade in other currencies without doing any currency conversion – e.g

purchasing US shares with $0 cash balance will create a USD short position (negative USD balance). It’s not the easiest to use platform in the world, though.

I was just looking at my statements from AJ Bell and I see that on dividends they charge 0.5% FX charge. On a £60 dividend they charged 30p.

That’s lower than their rate for purchases, which is currently 1% (on transactions up to £10k) falling to 0.75% from 1 July 2022. Their charges page does not seem to mention the lower rate on dividends. https://www.youinvest.co.uk/isa/charges-and-rates

I wonder if other platforms have a different, undisclosed rate for dividends?

I know this is an old thread but I’ve only become aware of this hidden Forex cost issue recenrtly so thought I’d update what Ive found out.

Irrespective of FOREX fees for other deals, the following say they do not add an extra cut for converting dividends from USD or other currencies into GBP (ie they use spot rate)

– Bestinvest

– Vanguard

– Lloyds

– Iweb

But AJ Bell do (0.5%)

@ Graham – That’s really useful to know, thank you for taking the time

With thanks to @TA for an excellent piece & thanks also to the comment providers for their input, especially @IvanOpinion #26 for the links to platform FX charges. I see Interactive Brokers are mentioned (by @Chris B #40) for their ultra-low FX fees / spread (of 0.002%). Does anyone know if they are on the SIPP transfer ‘system’ and whether the process for moving to them is any different to any other platform? Also, does anyone have any experience which they could share of the pros and cons of using IB, both generally, and in particular for a multi currency SIPP account? I understand their platform user interface might be a bit challenging so any comments on that would be especially useful. Thank you in advance for your help.

Interactive Brokers say that you can transfer a SIPP to them but I haven’t personally done it. I expect it would be fine. I’m a little put off their SIPP by the need to go through a third party. Their TWS software has a learning curve, I’d say the key is to only learn how to do the precise tasks that you want to do. Buying shares and currency is reasonably simple. A lot of the complexity that you hear about is because people are trying to do complex things, like trading on margin, shorting, option spreads etc. The fees for real-time stock exchange data are high, you can get away without realtime data and use snapshots if you don’t trade often. I’d recommend opening a general trading account, cash not margin, and paper trading to see what it’s like before going through the hassle of opening and transferring a SIPP.

Thanks Chris. Very much appreciated.

I asked Fidelity about the FX rates for dividend payments from EQQQ (https://www.invesco.com/uk/en/financial-products/etfs/invesco-eqqq-nasdaq-100-ucits-etf-dist.html) and SPX5 (https://www.ssga.com/uk/en_gb/institutional/etfs/funds/spdr-sp-500-ucits-etf-dist-spy5-gy).

I believe the ‘base’ currency for both is USD, meaning, if I am keeping up, that dividend payments will need to be converted to GBP. However, Fidelity have assured me that they are paid as GBP. Who’s right? Can anyone help please?

@ SlowTL – Fidelity will pay you the dividends in GBP but only after they’ve converted them from USD. The links you’ve posted show that the base currency of both ETFs is USD. You can tell this at a glance because they both report AUM and NAV in USD.

@TA, thanks. That was my understanding. I’ll try a third time with Fidelity.

Please forgive this stupid question, I’m completely new to investing. I have an index fund which is domiciled in the UK rather than an ETF. It’s a world index fund so it includes stocks from various countries. Is there anything I need to know or do regarding FX fees? It’s an accumulating fund, if that makes any difference.

Hi Gavin – Your funds should all trade and pay dividends in GBP so there are no additional / avoidable FX fees to pay.

@TA: Thanks 🙂