The CAPE ratio is widely considered to be a useful stock market valuation signal. So if you own a globally diversified portfolio then you may well be interested in good CAPE ratio by country data that can help you understand which parts of the world are under- and overvalued.

To that end I’ve collated the best global CAPE ratio information I can find in the table below.

CAPE ratio by country / region / world

| Region / Country | Research Affiliates (30/09/25) | Barclays Research (30/09/25) | Cambria Investment (08/10/25) | Historical median (Research Affiliates) |

| Global | 29.4 | n/a | 19 | 23 |

| Developed markets | 31.5 | n/a | n/a | 24 |

| Emerging markets | 18.9 | n/a | 18 | 15.2 |

| Europe ex UK | 20.7 | 21.4 | n/a | 19.2 |

| UK | 16 | 17.6 | 15.9 | 14.8 |

| US | 39.3 |

39.1 |

38.1 | 16.5 |

| Japan | 23.4 | 25 | 23.5 | 31.1 |

| Germany | 18.8 | 24.5 | 19.3 | 17.4 |

| China | 16.2 | 18 | 16.5 | 14.9 |

| India | 34.6 | 31 | 36.2 | 22.7 |

| Brazil | 9.6 | 12 | 10.3 | 13.5 |

| Australia | 19.2 | 22.9 | 20.6 | 16.8 |

| South Africa | 19.6 | 22 | 19.7 | 17.9 |

Source: As indicated by column titles, compiled by Monevator

A country’s stock market is considered to be overvalued if its CAPE ratio is significantly above its historical average. The converse also holds. Meanwhile a CAPE reading close to the historical average could indicate the market is fairly valued.

You should only compare a country’s CAPE ratio with its own historical average. Inter-market comparisons are problematic.

There’s more countries and data to play with if you click through to the original sources linked in the table. All sources use MSCI indices. Cambria uses MSCI IMI (Investible Market Indices). Research Affiliates derives US CAPE from the S&P 500. You can also take the S&P 500’s daily Shiller P/E temperature.

But what exactly is the CAPE ratio, what does it tell us, and how credible is it?

What is the CAPE ratio?

The CAPE ratio or Shiller P/E stands for the cyclically adjusted price-to-earnings ratio (CAPE).

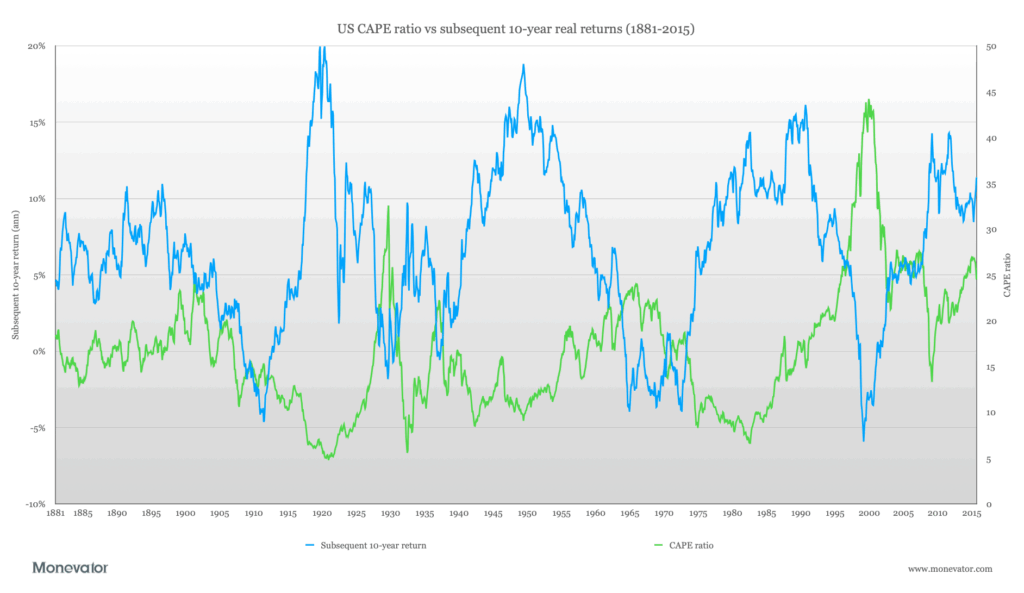

CAPE is a stock market valuation signal. It is mildly predicative of long-term equity returns. (The CAPE ratio is even more predictive of furious debate about its accuracy).

In brief:

- A high CAPE ratio correlates with lower average stock market returns over the next ten to 15 years.

- A low CAPE ratio correlates to higher average stock market returns over the next ten to 15 years.

The CAPE ratio formula is:

Current stock prices / average real earnings over the last ten years.

To value a country’s stock market, the CAPE ratio compares stock prices and earnings numbers in proportion to each share’s weight in a representative index. (For example the S&P 500 or FTSE 100 indices).

But company profits constantly expand and contract in line with a firm’s fortunes. National and global economic tides ebb and flow, too.

So CAPE tries to clean up that noisy signal by looking at ten years’ worth of earnings data. For that reason CAPE is also known as the P/E 10 ratio.

What can I do with global and country CAPE ratios?

The CAPE ratio has three main uses:

- Some wield it as a market-timing tool to spot trading opportunities. A low CAPE implies an undervalued market. One that could rebound into the higher return stratosphere. Conversely, a high CAPE ratio may signal an overbought market that’s destined for a fall.

- Similarly, CAPE – and its inverse indicator the earnings yield (E/P) – may enable us to make more sensible future expected return projections.

- High CAPE ratios are associated with lower sustainable withdrawal rates (SWR) and vice versa. So you might decide to adjust your retirement spending based on what CAPE is telling you.

But is CAPE really fit for these purposes?

Well I think you should be ready to ask for your money back (you won’t get it) if you try to use CAPE as a market-timing divining rod.

But optimising your SWR according to CAPE’s foretelling? There’s good evidence that can be worthwhile.

How accurate is CAPE?

It’s certainly more predictive of negative energy than being told by a woman in a wig that you’re a Pisces dealing with a heavy Saturn transit.

But the signal is as messy as mucking about with goat entrails.

The table below shows that higher CAPE ratios are correlated with worse ten-year returns. Notice there’s a wide range of outcomes:

Source: Robert Shiller, Farouk Jivraj, The Many Colours Of CAPE

The overall trend is clear. But a market with a high starting CAPE ratio can still deliver decent 10-year returns. Equally, a low CAPE ratio might yet usher in a decade of disappointment.

When it comes to hitting the bullseye, therefore, the CAPE ratio looks like this:

Portfolio manager Norbert Keimling has dug deeper. His work showed that the CAPE ratio by country explained about 48% of subsequent 10-15 year returns for developed markets.

Source: Norbert Keimling, Predicting Stock Market Returns using the Shiller CAPE

You can see how lower CAPE ratios line up on the left of this graph with higher returns, like prom queens pairing off with jocks.

There’s no denying the trend.

Not all heroes wear a CAPE

Strip away the nuance and you could convert these results into an Animal Farm slogan: “Low CAPE good. High CAPE bad.”

However animal spirits aren’t so easily tamed!

Keimling says the explanatory power of CAPE varies by country and time period. For example:

- Japan = 90%

- UK = 86%

- Canada = 1%

- US = 82% since 1970

- US = 46% since 1881

Despite such variation, however, the findings are still good enough to put CAPE in the platinum club of stock market indicators. (It’s not a crowded field).

In his research paper Does the Shiller-PE Work In Emerging Markets, Joachim Klement states:

Most traditional stock market prediction models can explain less than 20% of the variation in future stock market returns. So we may consider the Shiller-PE one of the more reliable forecasting tools available to practitioners.

But I wouldn’t want to hang my investing hat on World CAPE’s 48% explanation of the future.

Nobody should bet the house on a fifty-fifty call.

Don’t use CAPE to predict the markets

Let’s consider a real world example. Klement used the CAPE ratio to predict various country’s cumulative five-year returns from July 2012 to 2017.

As a UK investor, the forecasts that caught my eye were:

- UK cumulative five-year real return: 43.8%

- US cumulative five-year real return: 24.5%

The UK was approximately fairly valued according to historical CAPE readings in 2012. The US seemed significantly overvalued.

Yet if that signal caused you to overweight the UK vs the US in 2012, you’d have regretted it:

Source: Trustnet Multi-plot Charting. S&P 500 vs FTSE All-Share cumulative returns July 2012-17 (nominal)

From these returns, we can see that the ‘overvalued’ S&P 500 proceeded to slaughter the FTSE All-Share for the next five years. (In fact it did so for the next ten.)

As a result, CAPE reminds me of my mum warning me that I was gonna hurt myself jumping off the furniture.

In the end she was right. But it took reality a while to catch up.

Using the global CAPE ratio to adjust your SWR

The CAPE ratio is best used as an SWR modifier.

Michael Kitces shows that a retiree’s initial SWR is strongly correlated to their starting CAPE ratio:

A high starting CAPE ratio 1 maps on to low SWRs. When the red CAPE line peaks, the blue SWR line troughs and vice versa.

William Bengen (the creator of the 4% rule) concurs with Kitces’ findings:

And Early Retirement Now also believes a high CAPE is a cue to lower your SWR.

However all these experts base their conclusions on S&P 500 numbers. Can we assume that CAPE ratio by country data is relevant to UK retirees drawing on a globally diversified portfolio?

Yes, we can.

Keimling says:

In all countries a relationship between fundamental valuation and subsequent long‐term returns can be observed. With the exception of Denmark, a low CAPE of below 15 was always followed by greater returns than a high CAPE.

Likewise, Klement found:

Shiller-PE is a reliable indicator for future real stock market returns not only in the United States but also in developed and emerging markets in general.

Michael McClung, author of the excellent Living Off Your Money, also advises using global CAPE to adjust your SWR.

The spreadsheet that accompanies his retirement book does the calculation for you. You just need to supply the World CAPE ratio and an Emerging Markets CAPE figure. Our table above does that.

Incidentally, one reason I included three sources of CAPE ratio in my table is to show there’s no point getting hung up on the one, pure number. Because there’s no such thing.

Meanwhile, Big ERN has devised a dynamic withdrawal rate method based on CAPE.

Conquering the world

Finally, if you want to use Bengen’s more simplistic Rules For Adjusting Safe Withdrawal Rates table shown above, you’ll need to translate his work into global terms.

Bengen’s over/under/fairly valued categories assume an average US historical CAPE of around 16.

You can adapt those bands to suit your favourite average from our CAPE ratio by country table.

Bengen’s work suggests that a CAPE score 25% above / below the historic average is a useful rule-of-thumb guide to over or undervaluation.

A base SWR of 3% isn’t a bad place to start if you have a global portfolio. Check out this post to further finesse your SWR choice.

Take it steady,

The Accumulator

- The CAPE ratio is labelled Shiller CAPE in the graph.[↩]

Looking at the table, and with the understanding that CAPE is not a failsafe market timing device, could one do a long-term “pairs” bet, where you buy Japan (undervalued CAPE) and sell US (overvalued CAPE) so that you profit if Japan outperforms RELATIVE to US? Can anyone with a bit more wisdom and experience advise if this is a) possible b) sensible ?

Great summary of CAPE @TA. I had not appreciated McClung used CAPE (need to re-read) does he just use it just for initial withdrawal or for EM (dynamic withdrawal) too?

I must admit I’m still leaning towards using ERN’s method for dynamic withdrawals, principally because it uses CAPE. However you still need too make a decision about, setting the intercept. Using CAPE of 23 (latest All Country CAPE from RA) and an intercept of 1% would give a dynamic withdrawal this year of 3.2% (which seems OK number to me). Although I am tempted to push the intercept a bit more because of state pension.

As an anecdotal indication of CAPE affecting SWRs, when I started out over ten years ago the market had a fright with the GFC, and FI/RE people were talking about a 5% SWR. It sort of drifted down to 4% and here we are at 3%.

In other words, ten years ago you needed a capital sum of 20 times your desired annual expenditure, now you need 33 times. Ouch.

Hi, interesting article (as ever).

How much of the change in US CAPE is simply a function of compositional change though? E.g. US Tech is now ~28% of the S&P500 vs ~20% 10 years ago and ~15% 20 years ago. Whilst valuations inevitably rise and fall, I think we can agree that the average dollar of tech (or healthcare etc) earnings ‘should’ be (and is) worth more than the average dollar of several other sectors (e.g. utilities, telecom, industrials, energy etc) given the growth discrepancy? (e.g. Tech might trade at 20x+ EPS vs <10x multiples for the energy sector)

That could suggest that maybe as much as half(?) of the optical uplift in US CAPE over the last decade is simply because the index is full of 'better' companies (as indicated by forward growth projections) rather than paying higher multiples for the same basket of companies that were in the index 10 years ago?

As someone not yet in drawdown, that’s my pain @ermine

However thats the reason why I like the idea of CAPE for dynamic withdrawal, as it considers valuations. I could not find historic All World or Developed CAPE values, but using US CAPE:

At bottom of the GFC in Feb 2009 the CAPE was 12 as you say providing a withdrawal of just over 5%

However that retiree would have enjoyed 8+% growth so portfolio would have still grown

As portfolio grows so does CAPE, in Feb 21 CAPE was 35, so withdrawal drops to 2.4%

I have been monitoring All World CAPE closely for a couple of years as in addition to portfolio size, it too impacts when I can achieve my desired income number. Over last 6 months portfolio has gone down, but CAPE has come down too, so the income is actually pretty static. At least its made me feel slightly better 😉

Just to give example:

Over last 6 months my portfolio has dropped 7.8%, so each £100 is now £92.2 🙁

But All World CAPE in Dec 21 was approx. 27 so WR would have been 2.85% or £2.85. Six months later CAPE is now 23 so WR of 3.17% or £2.92 income. OK so example ignores inflation and my WR examples ignore ERN modifications for Bond Yield, but principal still works.

The high CAPE but low SWR and conversely low CAPE and high SWR probably equates to the same income in retirement…swings and roundabouts.

Market is expensive better be cautious on SWR , market is depressed the income withdrawn as a % can be more generous, as reversion to the mean on valuations is not an unreasonable likelihood.

A historically high CAPE is certainly reason to be cautious about your SWR. Most people would have been able to use an SWR considerably higher than 3-4% but a high CAPE is a definite warning signal. That said, bond yields lifting off from historical lows makes retirements more sustainable now, despite the short-term pain of the capital loss.

@ Young Analyst – CAPE has never been about comparing the same basket of companies. P/E 10 gives you a 10-year view by design so the ongoing march of technology is built in to the metric. There’s no reason to assume the last decade is more disruptive than any previous one. I think you’ll enjoy these links which build on various questions about CAPE:

https://mebfaber.com/2014/08/22/everything-you-need-to-know-about-the-cape-ratio/

@ Dedicated Follower of Trends – it’s a big “if” and my historical example of the US vs the UK shows how you can lose out. The US has been ‘overvalued’ according to CAPE and various other measures throughout the bulk of my investing life. Emerging Markets and the UK have been comparatively much cheaper. But the US has trounced them.

If you want to relate SWR to CAPE ratios, it might actually be better to think in terms of CAEY (Cyclically Adjusted Earnings Yield), which is just 1/CAPE. So at a CAPE of 33, the CAEY is 3%, while at a CAPE of 20, the CAEY is 5% (and consequently the SWR can have a higher “yield” aswell).

Even for a simple equity/bond/cash portfolio, you also need to take into account the yields on bonds and cash, since these can impact the SWR. Clearly as the yield on bonds or cash rises, the relativeness attractiveness of equities would fall, and the CAEY would need to rise.

So the Withdrawal rate would be in it’s simplest possible representation

W= (x1 + x2.CAEY(t) + x3. Bond Yield(t) + x4. Cash Yield(t)). Portfolio (t).

For each country x1, x2, x3, and x4 would need to be determined.

The basic SWR rule W=x1.Portfolio(t) is recovered if we set x2=x3=x4=0, clearly showing that why basic SWR rule is too simplistic.

@ZXSpectrum48K using CAEY and bond / cash yields is what ERN does, he credits cFIREsim site for original equation he uses:

https://earlyretirementnow.com/2017/08/30/the-ultimate-guide-to-safe-withdrawal-rates-part-18-flexibility-cape-based-rules/

I think as you suggest considering bond and cash yields is particularly important if following a dynamic asset allocation approach, as many of us are planning. I’m not intending to add separate yields for my property, renewables and infrastructure trusts though, will just consider them equities and use the CAEY.

ERN also combines with a constant % intercept (not certain of reason why, tinkering?) but this makes initial WR more conservative if set at 1%. I’m intending to use this method but in early years with a higher Intercept, if required we can reduce this if (fingers crossed) state pensions are still a “thing” when we get there.

I have just started out on my FIRE journey – will be at least 15 years before I can consider retirement. Does this mean I am doomed to 1% returns over the next 10 years on average then? Would I be therefore better off putting my money in a 1.7% savings account?

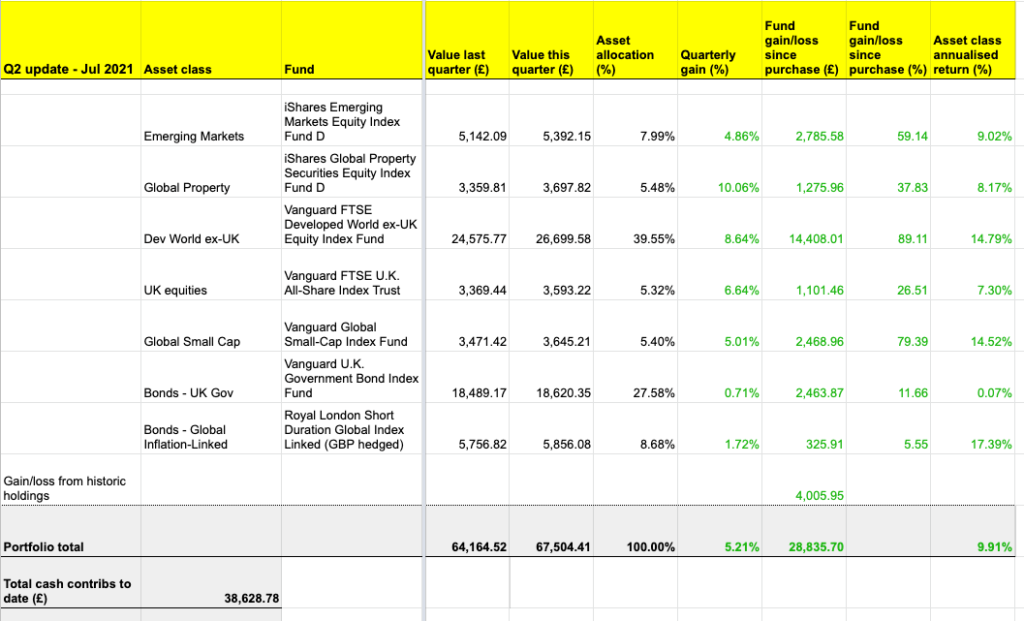

Have just updated the chart with fresh data. Unsurprisingly, most CAPE numbers down after recent market pullbacks.

@ JN_firenoob – check out the chart in the How Accurate Is CAPE section. The numbers are all over the place. Nothing is nailed on. The current downturn has brought valuations down so expected returns are higher. The longer-term view is at least a little rosier than it was 12 months ago.

Thanks for this article – really useful. I’ve found some of the info on CAPE across the globe. EG Siblis https://siblisresearch.com/data/cape-ratios-by-country/ provide some data free but you can subscribe to their database analysis tool if you are aprofessional fin tech type.

What’s more problematic is what to do with the informatiom. I use the earlyretirementnow spreadsheet to guesstimate my reasonable withdrawal strategy (TM), and the CAPE sheet on this is fine, but I think only S&P500 (or whole US – not sure). Ideally it would be good to combine say a small subset of the global CAPE values recorded in this monevator article, say developed world and emerging markets, weighted by their portfolio contribution, and by cash / ‘safe’ bonds – i.e. Lars Kroijer’s basic non-equity portfolio element. I guess you’d only need estimates of the two factors in the model for each equity component and their weightings .

Does that soiunds right? Anyone tried to do this?

I was sat on house-sale cash of £200k for the last year – it was earning .1% in Lloyds, just opened a YBS account that will pay 1.6%. Better than a Poke in the eye!

If I helps make anyone feel any better my last batch of pref shares are down 15+% – but at least the dividends are fixed at 6%+ (bar some new-new disaster)

May consider some contracting in the winter to cheer up my bank manager (wife)

Good luck

B

Thanks for this article – really useful. I’ve found some of the info on CAPE across the globe. EG Siblis https://siblisresearch.com/data/cape-ratios-by-country/ provide some data free but you can subscribe to their database analysis tool if you are aprofessional fin tech type.

What’s more problematic is what to do with the information. I use the earlyretirementnow spreadsheet to guesstimate my reasonable withdrawal strategy (TM), and the CAPE sheet on this is fine, but I think only S&P500 (or whole US – not sure). Ideally it would be good to combine say a small subset of the global CAPE values recorded in this monevator article, say developed world and emerging markets, weighted by their portfolio contribution, and by cash / ‘safe’ bonds – i.e. Lars Kroijer’s basic non-equity portfolio element. I guess you’d only need estimates of the two factors in the model for each equity component and their weightings .

Does that sounds right? Anyone tried to do this?

PS – In fact I re-read ERNs article https://earlyretirementnow.com/2017/08/30/the-ultimate-guide-to-safe-withdrawal-rates-part-18-flexibility-cape-based-rules/ and he includes and example of how to incorporate cash and bonds into the SWR calculation from CAPE. I presume by simple extension global and EM CAPE values can be treated the same way.

@ Ian – agreed, the research indicates that global, developed world and emerging market CAPEs can be used the same way.

Personally I just use the global CAPE as my portfolio includes developed world and emerging markets.

…of course the real point of this article is to leverage up your house, family and organs to buy Sweden based on the scatter graph. 😀

@Zero Gravitas — Haha, one of my most successful investments this year has been in a Swedish company. I was shocked when I looked back at its history and saw how consistently it’d been churning out returns of 15-20% since the 1990s. Of course those companies exist in nearly all markets, but this wasn’t a firm I’d even heard of in the past 20 years. I intend hanging on! 😉

Let’s say we perform averagely with regard to above and get 1% returns for 10 years. Would it not also be important to know what the CAPE ratio is forecast to be at that point for different returns? Perhaps this is getting a bit too abstract, but if I had only 1% returns for 10 years, this blow might be softened if the CAPE ratio was down to 10.

@ the accumulator, thanks for your article, very informative!

I see quite a difference between the cape ratios of Research Affiliates vs Barclays? Do you know what causes these differences?

Thanks!

@ Marcel – Thank you! Only Research Affiliates publish their methodology so I don’t know what explains the gap between them and Barclays other than the date difference.

@TA as you indicate difficult to compare, but Cambria Investments global and developed numbers seem to be based on Medium average, this a CAPE. Number should be weighted average based upon size of constituents.

RA did provide an all world number at one point, but seem to have stopped providing this.

I’ve just had another look at Research Affiliates site on my desktop (rather than iPad) the AllWorld figure is still there but you have to unhide by clicking the eye in the sidebar (only possible on desktop). Anyways as of 31/7/23 AllWorld (Global) CAPE was 24.8, as I said above personally I prefer this approach to the Medium average used by Cambria.

The key point to bear in mind about CAPE is that it works for SWR estimation but abjectly fails as an immediate term market timing tool and is doubtful as an asset allocation aid. Going back to the mid 2010s there used to be be a couple of sites at a time always providing free monthly CAPE 10 data at both the country level and for DMs, EMs and AW. Perhaps as a result of both the increased use and general popularity of this indicator, there is now – seemingly – less comprehensive and frequently updated international CAPE information which is not behind pay walls. Asides from the current crop of free to access offerings from Barclays, Research Affiliates, Meb Faber/Cambrian and Siblis; the former cohort of world wide and country by country monthly updated data seems to have dried up.