What caught my eye this week.

For most of the week, my Weekend Reading links included articles warning that Rachel Reeves was finally going to cut the cash ISA allowance at her Mansion House speech next week.

The rumours had run for months. At last reality was at hand!

Yet by the end of the week, it was all change.

From the BBC:

Rachel Reeves was thought to be considering reducing the allowance for tax-free cash savings, in a bid to encourage people to put money into stocks and shares instead and boost the economy.

But strong opposition from banks, building societies and consumer campaigners mean any such move has been put on hold.

The Building Societies Association said it welcomed the Treasury stepping back from making any “hasty decisions” on ISAs.

So, we’re finally out of the woods on this one?

Not so fast. That same BBC article quotes a Treasury spokesperson as saying:

“Our ambition is to ensure people’s hard-earned savings are delivering the best returns and driving more investment into the UK economy.”

…and it adds that changes have not been ruled out for the future.

Similar pieces in The Guardian and the FT tell the same on/off story.

Stranger than fiction

Perhaps you blame the media for this.

After all, nothing gets a certain class of drive-by readers clicking and sharing like a threat to their personal wealth.

That was my co-blogger The Accumulator’s initial take.

TA compared the early cash ISA rumours to the annual ‘Pension Allowance to be SLASHED’ bogeyman that’s brought out every March – apparently almost in concert with wealth-gathering (and advertisement-running) financial services firms – only for things to stay the same most years.

But I judged there was more substance to the cash ISA threat. And by Thursday I was readying myself for some modest but smug satisfaction at being proven right.

Foiled again.

Smoke and fire

There are reasons why I don’t entirely blame the media for the ISA story however.

Firstly, many people want to hear about this stuff. Even if it is all rumours.

When the threat to cash ISAs flared up for the second or third time earlier this year, I ignored it in these links. I felt it was time to wait for concrete news from the Chancellor.

Yet readers asked me afterwards why I’d not included the story. Some even sent me links to it themselves.

The more important reason not to shoot the messenger however is it’s the Government itself that is cranking the handle on this rumour roundabout.

That’s why all the main outlets ran with the ‘no change’ story within hours of each other on Friday.

The official word had come down from on high that cash ISAs were to be left alone. So could they please mention this ASAP to their readers?

Make up, break up

For decades now government policy has been more and more determined by focus groups, public relations concerns, and the electoral calculus, as much as by what the country really needed.

And for the past 15 years or so, this strategy has included a much more explicitly open dance to trail potential policies in the press to see how the public reacts.

Whoever is running stuff up the flagpole in Downing Street must have severe tennis elbow by now!

Of course, politicians have rarely ever given us entirely what we needed, unencumbered by worries about the democratic popularity contest. Perhaps unity governments during wartime were the exception.

But with the present crew the situation is getting out of hand.

We saw it before Rachel Reeves’ first Budget. Her doom-laden stocktake on Labour winning the General Election raised more questions than it answered, leading to months of speculation. From an early mood of relief and even optimism, Britain fell into almost a paralytic stupor waiting to find out what Reeves would axe, or where taxes would rise.

And now savers have endured many months of wondering about their cash ISAs – thanks entirely to trial balloons being floated up from Whitehall.

Ask the audience

I understand why they feel the need do this.

Much of the electorate has lost all interest in evaluating policies. The Overton Window to make outlandish pronouncements in opposition about everything from immigration to taxation to nuclear submarines is wide open. But that same fact-free tribalism narrows the freedom to act when in power.

On top of that, judging by last week’s welfare U-turn Labour can’t even predict how a few hundred of its own MPs will respond to its policies. The electorate must be a black box by comparison.

However making up legislation as you go – based on how much furore your hints caused on the Internet and whether you think you can handle any further backlash – is no way to run a country.

Many of us despair at the US president’s reality TV show-style decision making.

But this policy-by-public-plebiscite experiment we’re running is arguably only a more genteel version.

Deal or no deal

There are consequences everywhere – but at Monevator our concern is with people’s finances.

On the one hand, MPs and mandarins alike lambast the public for not thinking long-term about their investments, or for not putting enough money towards their distant retirements.

Yet at the same time ministers fiddle with our savings and pensions vehicles with every other Budget – and threaten to make twice as many changes in between.

Enough is enough. This government started with five long years ahead of it and a big majority. Plenty of time to do what it thought was right upfront, and then to manage the consequences in the aftermath.

Pull the bandaid off if you’re going to do it. Picking at it will just make it worse.

Have a great weekend.

From Monevator

The Slow and Steady Passive Portfolio update: Q2 2025 – Monevator

Time to move into prime London residential property? – Monevator

From the archive-ator: The snowball and the paper trail – Monevator

News

Bank of England rolls out looser mortgage rules to help first-time buyers… – Guardian

…with Reeves set to launch a permanent mortgage guarantee scheme – FT via MSN

UK economy shrinks for a second month in a row – Sky

Forcing pension funds to buy UK assets ‘a form of capital control’, says Lloyds boss [Paywall] – FT

Triple-lock pensions to cost 3x more than originally forecast… – BBC

…while some benefits claimants take home more than minimum wage workers – City AM

Monzo fined £21m for customer sign-up check failures – Guardian

SpaceX set to be the world’s most valuable private firm – Semafor

London home sellers forced to knock thousands off asking prices – Standard

Real men burn stuff – Paul Krugman

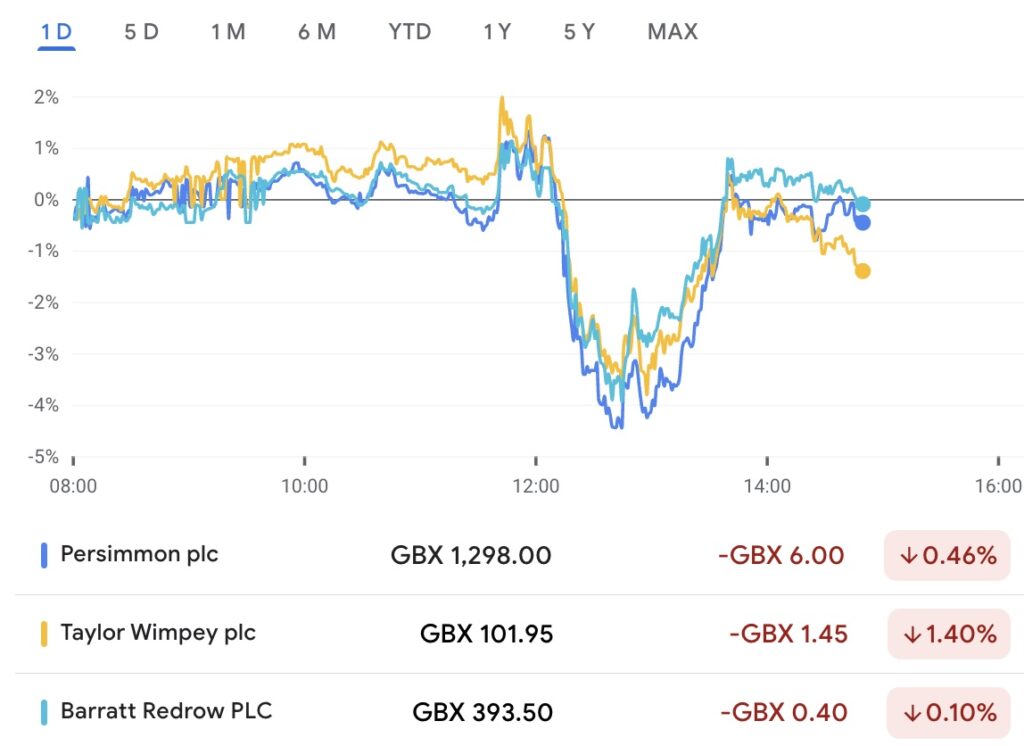

London stock market in peril mini-special

These charts show the scale of the London Stock Exchange’s decline – City AM

Looser bonus rules and tax breaks needed to save LSE, says the CBI – Guardian

Products and services

Major banks cut mortgage rates – This Is Money

Eight ways to save on holiday spending and cut card costs – Guardian

Get up to £1,500 cashback when you transfer your cash and/or investments to Charles Stanley Direct through this affiliate link. Terms apply – Charles Stanley

Revolut now offers stocks and shares ISAs – City AM

Fintech Moovable launches new rent-a-bedroom service – Standard

Life insurance: the three key questions to ask – Which

Get up to £3,000 cashback when you open or switch to an Interactive Investor SIPP. Terms and fees apply, affiliate link – Interactive Investor

Free days out with MSE’s SuperSaverClub – Be Clever With Your Cash

The reality behind those €1-to-buy Italian homes – Guardian

All financial products will be on-chain, Franklin Templeton exec says – Blockworks

Pastel-coloured homes for sale, in pictures – Guardian

Comment and opinion

Why Lifetime ISAs divide opinion – BBC

How to invest your enormous inheritance – The Economist via Elm Funds

Room to manoeuvre – Humble Dollar

It could be worse: South Korea’s ‘peak wage’ system punishes the elderly – Guardian

Different kinds of rich – A Wealth of Common Sense

How Section 899 was scrapped from the Trump’s big US bill [PDF] – Raymond James

Evaluating the bucket retirement strategy after Covid lessons – Think Advisor

The children sitting on six-figure Junior ISAs – This Is Money

How to make more money without working more hours – Of Dollars and Data

Long gilts mini-special

Buy long-term gilts ahead of potential tax hikes, says UBS – This Is Money

What ‘vulnerable’ UK finances mean for gilts – Interactive Investor

Should you lock in a 5.38% rate for 30 years? – Motley Fool via Yahoo

Gilt traders seize control after Labour’s retreat on welfare reform – T.I.M.

Naughty corner: Active antics

Investing in bruised blue chips – Rebound Capital

How to get and keep a job at a multi-strat hedge fund [Podcast] – Odd Lots via Apple

A new twist on an old Buffett bet [Free to read] – FT

The latest US jobs report raises the risk of recession – Bonddad

Where have all the risk premia gone? – FT

Kindle book bargains

The Tipping Point by Malcolm Gladwell – £0.99 on Kindle

Chip War: The Fight for the World’s Most Critical Technology by Chris Miller – £0.99 on Kindle

The Everything Store: Jeff Bezos and the Age of Amazon by Brad Stone – £0.99 on Kindle

Essentialism: The Disciplined Pursuit of Less by Greg McKeown – £1.99 on Kindle

Or pick up one of the all-time great investing classics – Monevator shop

Environmental factors

Zonal pricing is dead. Now let’s be less absolutist on 2030 goals – Guardian

World’s most porous carbon-trapping powders hit the market – Nature

[Incorrect] Reform councillor calls man-made global warming a ‘hoax’ – BBC

Britain and Europe need to get serious about air conditioning [Paywall] – FT

Reintroduced Golden Eagles are struggling in Ireland – The Conversation

Why the Texas floods were so devastating – BBC

The environmental impact of agricultural crops – Klement on Investing

Robot overlord roundup

A deep dive into the Waymo vs Tesla robotaxi battle – Forbes

Not at the dinner table

From dollar dominance to the slop machine – Kyla Scanlon

Statistical evidence of the decline in political discourse – Klement on Investing

Free market economics is working surprisingly well in Argentina – Noahpinion

The tariff beatings will continue until morale improves – Paul Krugman

Ode to America – Net Interest

In modern Britain, any sort of protest can lead to jail – Guardian

Off our beat

How fake-will fraudsters stole millions from the dead – BBC

A guide to visionary architect Norman Foster – Wallpaper

How smell guides our inner world – Quanta

US measles cases hit highest level since declared eliminated in 2000 – John Hopkins

A radical 1960s experiment left thousands unable to read – Guardian

Wimbledon economics – Economics Observatory

What a mid-life crisis means for Millennials – GQ

“A difficult person who is waiting to die”: Patricia Highsmith’s final days – Guardian

American science is about to face its largest brain drain in history – Big Think

Why is everyone partying less? [US but relevant] – Derek Thompson

And finally…

“Progress happens too slowly to notice, but setbacks happen too quickly to ignore.”

– Morgan Housel, The Psychology of Money

Like these links? Subscribe to get them every Saturday. Note this article includes affiliate links, such as from Amazon and Interactive Investor.

Just give me an additional 20k U.K. ISA allowance and I will happily put 20k a year into UK stocks, even mid cap if that was mandated. I thought the Tories were on the right track with that one, but I’m one of those weirdos that thinks LISAs are not complicated at all and great savings vehicles.

Cash ISA limit speculation probably just some government chaff to distract commentariat from what’s coming.

What do you reckon:

Autumn:

– BR/HR/AR thresholds frozen upto at least 2030, from 2028 now?

– AA reduced £60k to 40k

– Bye bye to £500 divi allowance

– Bye bye triple lock

Later, as things detriorate again (with the Treasury find more new black holes than Stephen Hawking):

– Pension tax relief restricted to BR?

– AR increased to 50%, with the threshold then alingned with the loss of Personal Allowance from £100k?

– CGT allowance gone?

And then, when Reform gets in, in 2029:

– AR abolished?

– IHT threshold raised £325k/500k to £2 mn?

– BR threshold raised £12,570 to £20k

– HR threshold to rise with inflation after 2030

– Triple lock restored

Allegedly to be paid for by DOGE 2.0 and no interest on BoE institutional deposits?

On the subject of long gilts (and relevant to long index linked gilts), the OBR ‘Fiscal risks and sustainability report – July 2025’ chapter 2, that came out this week is a very interesting read

https://obr.uk/frs/fiscal-risks-and-sustainability-july-2025/

Amongst other things it talks about the supply and demand issues for gilts up to 2072 for example discussing closed defined benefit pension schemes and their reducing need over time to hold long term gilts. They actually try to put numbers to it all, and they talk about the effect this will have on yields if (and it is a big if) that isn’t already priced in. They mention how increased overseas demand if yields increase might limit the scale of yield increases, and how the government might move shorter in issuing debt. While it’s all guesswork it’s still illuminating that they’ve made this attempt in a non waffly way. Of course active quantitative tightening is relevant here although that isn’t really discussed much by the OBR here.

TR49 is priced to give a real redemption yield of about 2.3%pa at the moment. CPIH over long periods is expected to be 0.4% higher than CPI according to the OBR although there is considerable scope for that to vary over even long periods. The OBR assume that owner occupier housing costs (that forms a part of CPIH but not CPI) go up in line with earnings rather than prices which is where the 0.4% comes from.

So TR49 for example is potentially an available 2.3%pa real return and arguably a realistic potential of a 2.7%pa real return over CPI price inflation to 2049 (2.3% + 0.4%). And that’s ignoring that the indexation is RPI and not CPIH up to 2030.

Interesting re your comparison with over the water -Atlantic that is

Many wars been stopped-India/Pakistan (potentially nuclear) ,Congo,Israel/Iran …..

Seems to have good approval ratings from the voters for his policies-borders etc

Economy -jobs and stockmarket performing well etc etc

I feel that Mr Starmer would give a lot to be in a similar political position

Time of course will tell -as always

xxd09

PS I believe that the US Treasury even had a surplus in June

Snowman: move from DB to DC, with consequential reduced institutional gilt holding in favour of equities (covered in TIM link), could reduce demand & lead to lower prices and higher (real) total returns for both linkers and conventional (even before factoring in any stagflation risk).

On equities: struck by this line in the FT link on valuation and risk factors: “given that most stocks end up losing money, all that really matters is buying the ones that sustainably grow their earnings”.

The Cash ISA debate seems overblown to me. I’d expect most savers with Cash ISAs are unlikely to be earning interest over their personal savings allowances. So it’s really just a waste of a tax wrapper, which could be better used for assets that actually grow.

Thanks TI and agree with your sentiments!

Further to the Gilt Special I saw this on linkers and thought of you and TA this week…. Paywall unfortunately

Britain is broke: how inflation-linked debt costs us £60bn

https://www.thetimes.com/article/ba95b251-3d62-4614-8200-967ad58e1257?shareToken=4008c1b9b1bc091f9007220fcd271e63

On ths OBR’s current Fiscal Risks and Sustainability report (link in comment#3): what are the OBR smoking?

So, DB scheme assets in gilts fall “from 26.7 per cent of GDP today to 5.6 per cent of GDP in the early 2070s” but, elsewhere in the same report, the membership of DB schemes is only projected to fall from 17 mn now to 12 mn by the 2070s.

Hello OBR. They’re not going to be any DB schemes left – in the private or public sectors – by the 2070s.

And if I’ve read the current Fiscal Sustainability report correctly (and my apologies if not), then the OBR seems to assume that the ratio of the National Debt to GDP can be kept near to its current 100% level over that period.

If that’s so, then it’s a complete fantasy.

The deficit hasn’t grown less than GDP for ages.

The OBR’s own 2024 base case is that public sector net debt reaches 274% of GDP by 2074, with state spending equivalent to 60% of GDP by then; but at the same time acknowledging in 2024 that this assumes productivity growth will average around 1.5 per cent per annum over the period to 2074, and that if that figure is actually closer to 0.5 per cent annually then the National Debt will hit 647 per cent of GDP in 2074.

Do the OBR seriously expect us us to believe that overseas buyers are going to snap up all that extra the gilt issuance at 274 per cent, less still 647 per cent, of GDP over the next half century?

If it can’t happen, then it won’t.

>There are reasons why I don’t entirely blame the media for the ISA story however.

I do. Just take a look at the headlines leading up to the Autumn statement. There was almost daily fear mongering about what the Chancellor was going to do and almost none of it came about. I find it difficult to imagine it didn’t have an impact on people’s decisions and the wider economy.

w.r.t. Cash ISAs – I can (and used to) hold £50k in Premium Bonds tax free. What’s the point?

@Brod

If it is a straight choice between Cash ISA and Premium Bonds then there are two major advantages to Cash ISAs:

(i)

The rates on Cash ISA can be (noticeably) higher than the expected return from Premium Bonds.

(ii)

ISA are a “use it or lose it” type of investment.

So by putting money into a Cash (or any other type of) ISA you have an extra tax-free allowance forever that can be utilised for, say shares, later on.

Of course if you are are Higher Rate taxpayer than Premium Bonds in addition to Cash ISAs are great.

@Ducknald Don — Evening! You write:

Absolutely the media does do that, and with a partisan bent too when it comes to most.

But as the rest of my article belaboured, in *many* cases this speculation isn’t pulled from the air. It’s an active symbiotic relationship with the government, which is presuming to govern this way. (Not just the current incumbents, measures have been being leaked and walked back for years now.)

Agreed! 🙂

@xxdo9 Trumps current approval rating according to The Economist is -12%, in comparison to +8% for Biden and +12% for Obama at the comparable stages of their presidencies. In fact Trump peaked at +3% in February and has been losing ground steadily since.

Lies ,damned lies and statistics!

The Economist like the Ft,Guardian ,Independent and Bloomberg don’t care for Mr Trump

His approval ratings average seems to be running at 45 % approval-55% disapproval at this particular moment

Ratings that Starmer can only dream of

However its results that count -investment performance is of particular importance to me as a retiree -In that area so far so good but who knows what tomorrow will bring?

xxd09

These charts show the scale of the London Stock Exchange’s decline – City AM

Nothing mentioned about Brexit there, but the UK is really just a small country now. The UK could have provided and been the financial centre for Europe.

Instead, a different path was chosen, a negative for both the UK and Europe. Everything just moves to NY instead. A great shame for all in Europe.

@Lsugi — Agreed, but the rule seems to be that now that Brexit has happened we have to pretend that it didn’t happen and that nothing that has happened since could possibly have any connection to it.

I don’t subscribe to that view as you probably know. But I’m taking a week off. 😉

@xxd09 — You don’t need statistics (which are overwhelmingly consistent and not in dispute, except where his people have dismantled the agencies that create them) to see that Trump is a bad actor and dangerous for both the US and the world in the long run.

You just need to watch the impact of his style of politics both in the US (routine political violence, extreme partisanship, complete disarray with institutions, the normalisation of mistruth as Government policy) and to not be part of the right-wing populist cult that has infected Western politics.

(I don’t say there isn’t a neo-left-wing extreme too, but it’s not a populist one).

Perhaps as an older retiree the demise of the Western consensus, the laughably dated climate change denial and all the rest of it is of peripheral interest to you.

But I know you have kids, so for their sake let’s hope the Republican party regains its sanity before too long.

Re: #16: Whenever there’s elevated economic and sociocultural change populist right wing movements flourish.

As population pyramids invert, climate change creates more migration, and technology transforms (perhaps eventually eliminates) roles; large swathes will push back against dislocation / sense of powerlessness.

It’s never been about the facts or absolute levels of wealth etc.

If it had been, then no-one would have voted for Brexit, and Farage would not be leading in the polls now, even as most people say that we should rejoin the EU.

It’s about narrative and feelings. Does this person look and sound like (s)he’s on ‘my side’.

It doesn’t matter that what they say is nonsense. People still feel that Johnson, Farage and Trump are on their side, and so they vote for them, very often demonstrably against their own self interest.

It’s really more of an indictment of the traditional social dem, liberal dem, Conservative & technocratic tendencies for failing to ‘connect’.

It’s not enough to have the evidence and the answers. It has to be believed. Truth is not a precondition for success in politics, but belief in narrative is.

Interesting stuff if rather removed from investing !

Just a historical point Howard -surely the Russian Revolution in 1917 was certainly caused by economic and sociocultural change and was definitely populist but not conservative-rather the opposite

Perhaps in tough times extremists/populists of all shades get their moment in the sun as the people lose faith in their current leadership

xxd09

They talk about those with the broadest shoulders, then go after Cash ISAs, typically used as emergency cash funds for the little people.

Almost as big a cock up as the winter fuel allowance snatch.

I was actually ok with them tightening up on PIPs and the Motability Industrial Complex, but then I’m not part of the core Labour vote, or likely to qualify for a brand new BMW M3 due to having ADHD, mild depression or constipation.

Anyway, looks like wealth taxes are back on and the latest polling suggests the bulk of the population – both left and right leaning – are OK with that, if it only applies to those worth £10 million plus.

Gary from Gary’s Economics is quite pleased his policy could be adopted.

Also the next budget will probably include some of Howard’s suggestions above.

The basic personal allowance might be the first threshold to be unfrozen if the threat from Reform grows further.

I can’t see the 40 and 45% bands changing. And a CGT hike is on the cards, plus upper band council tax hikes probably more likely than a % based wealth tax which will be tricky to administer.

Semi Passive. I’ve got £8.1m gross wealth / £7.6m net wealth. I am telling you straight if that starts getting taxed seriously more aggressively as a family we are out of here. I will just move to the EU / US whatever – I can relocate job wise easily enough in my corporate or just go work at another multi-national corporate. I am on the edge of getting out of here anyway due to the total stupidity of behaviour since 2016 and the absolute zero ideas for trying to balance things except for taxing more. Good luck with that suggestion….

The scare stories about reduced ISA allowances will have come from somewhere, and the media concerned will know exactly where even if they don’t divulge it. Similar stories have been appearing for years about various things, and I wonder whether it is just kite flying by the Treasury (officials not ministers) to test what they could get away with.

To be fair, the ISA allowances are amazingly generous compared with the median income. A more logical system would be a lifetime allowance for tax-free savings (whereas that made no sense for pensions for which cash values vary with type of pension scheme). It would though need as solution to the situation where some people including Monevator readers already hold ISAs in excess of any reasonable allowance.

I agree with @SemiPassive that a % based wealth tax would be tricky (read impossible) to administer. The data simply doesn’t exist, particularly for the sort of very wealthy people talked about who have illiquid assets like unique houses and artworks. Ensuring income from those assets (or inheritance) is not taxed less than those on PAYE salaries would be an adequate start. Changes in income tax thresholds is difficult, because while it ought to be done the government can’t do so in ways that reduce the overall tax take without which there will be losers as well as winners. But logically I agree there is likely to be political pressure to increase the basic rate threshold – particularly when the standard state pension hits it – and it would be sensible to remove the clawing back of the basic rate threshold and its marginal tax implications by readjusting the higher and additional rate thresholds. Changes to council tax also sound a good idea, not a revaluation (which would create the same anomalies as now in time) but addition of more bands so that properties assessed as worth more than £320K in 1993 aren’t all charged the same; there are frequent news items pointing out the council tax due on Buckingham Palace is similar to a modest house elsewhere (the other side of that is ensuring central contributions to council finances take account of the mix of properties so areas with low-rated properties don’t have to charge higher amounts for equivalent homes).

@xxd09 #18: my point was generalised, not universal.

Sucessful narratives have emotional resonances, and successful politicans a performative power, which reason and evidence alone can’t counter.

Virality and relatability in ideas is only loosely, if at all, coupled to truthfulness and reliability. Mythos and logos operate on substantially different planes.

Of course, some narratives succeed memetically which are revolutionary, rather than reactionary, and progressive, rather than conservative.

[As to your Russia example, the January 1905 attempted and the March 1917 actual revolutions were both popular and progressive in the capital, Petrograd, but can the November 1917 Bolshevik coup really be said to be a popular movement?]

Blair was broadly correct to caution that left wing populism was (and will be) typically less popular than right wing populism.

As May, Sunak and Starmer have each discovered in turn, whether your right or left, and whether you’re in the right or in the wrong, there’s no substitute in politics for popularity. It’s not much consolation if the facts support the policies but the electorate rejects them.

Perhaps popularity is underrated and often actually used as a term of disdain especially by those that disagree with the popular view -very understandable-it must be very aggravating

However an educated and eligible to vote populace in a democracy deserves at the very least to be convinced by its current leaders that they are pursuing successful policies

Democracy is of course the best of a bad job-the other forms of government-totalitarianism dictatorship,oligarchies,monarchs etc where the populace does what it’s told or else -don’t seem to be so successful or popular but of course are possibly much preferred by those that think they know best

xxd09

@marc1485153 I agree the LISA is a useful vehicle for retirement saving, but the house deposit aspect is shoddily done. Imagine someone saving diligently over several years, during which they meet a partner and decide to buy together. However, by that time, their ideal home is at the £500k level. Our saver is buying a house for the kind of money they never imagined when they started out – good for them. A sensible way to deal with this situation would surely be to allow them to put the money they saved towards the deposit without the government top-up (as if it were a bog standard ISA)? But no! They have to pay a 6.25% penalty to be able to access the funds. This is the kind of unfair scenario that suggests nobody spent more than 5 minutes kicking the tyres of the thing (and is surely a simple fix rather than throwing the baby out with the bathwater).

@Graeme

Allowing LISA savers to put the money they saved towards the deposit without the government top-up (as if it were a bog standard ISA) is a really good suggestion.

It has (almost irrelevant) possibilities to take advantage of the system still, but is far fairer than the current system.

‘Strong men’ have always been poorly named. They are almost invariably weak bullies.

You need to be strong to understand that trading with ‘others’ is beneficial. You need to be confident to build and respect institutions that will stand the test of time. You must be resilient and long-term focused to make deals with compromises for both parties for mutual benefit.

You need to have a capacity for patience and a belief in the best virtues of Western civilisation to seek partners and consensus before resorting to knee-jerk physical violence, just because you happen to have the biggest stick on the block right now.

America was founded on strong principles and has (mostly) been governed by them. These principles opened the world to trade and co-operation across all kinds of fronts. It made us all richer, including people who look to their investments in a politically shaky year and say “oh well, my portfolio is up, must be all good.”

The current administration in the US is like a feckless son who inherited a family fortune. Of course he can still spend lots of money. Yes he can mistreat the servants, and pay less attention for a while to the business interests that made his family rich. Sure he can ignore doing good in his community, what’s that going to get him in the next six months? They should fend for themselves.

We all know this will come back to bite him. The same for the US if it carries on down this path.

And yes there are direct reads for investors who take for granted that they can put their money into a global tracker fund and just reap the rewards of globalisation while mouthing off against it from the sidelines.

Section 899 was a warning shot. Obviously these unilateral trade deals are, too.

Trump is a 18th/19th century zero-sum mercantilist. He doesn’t believe in the things that made the US rich and safe and most of the world richer, too.

Re LISAs

A lot of people believe that if you add 25% to a number and then take off 25% the total you get back to the original number.

Would it be too cynical to wonder if these people work for the govt?

@Boltt — Perhaps more cynically, maybe the people who work for the Government can do the maths…? 😉

Related: I was told many years ago by someone who should have known that the reason spread-betting on shares etc was capital gains tax free was because most people lost money, and hence would in aggregate be racking up carry forward losses.

i.e. Allowing the 20% or so who make money to do so CGT-free was worth it on balance.

We shouldn’t forget that the US of A has had a pretty good run of luck, especially since 1865.

It was (by today’s categorisation) a mere frontier market when its first stock exchange opened in the 1790s, and no more than an emerging one by the end of its Civil War.

The US enjoyed unparalleled geographical advantages.

Access to Asia and Europe from its two massive seaboards, domination of central and southern America, unrivalled cheap riverine transport via the Missippie, huge coal, oil and gas reserves, no threats on its own borders to the north (after 1812) or from the south (after 1846), and a massive amount of varied high quality agricultural surplus.

Usually good governance, stability and relative democracy (at least in terms of respect for property, contracts and due process) all helped lever these advantages to see the country go from backwater to first superpower between 1865 and 1945.

Also, in terms of network effects, something quite special has happened in ‘Silicon Valley’ since the semiconductor industry first established itself there in the late 1950s.

But, despite all of that, America has never been “the Shining City Atop A Hill” which Regan waxed lyrically about.

Trump manifests dark tendencies which have been there in the American project from its beginnings, and which, as we see now, never went away.

There’s no fundamental reason that US exceptionalism has to endure, although, of course, it might (still).

Another vote of (the lack of) confidence in the US in 2025 – the incredibly shrinking dollar:

https://mrzepczynski.blogspot.com/2025/07/the-loss-of-dollar-dominance.html

@TI

Isn’t that the plan? I seem to recall that the primary objective of the ‘Mar-a-Lago’ plan is/was to devalue the dollar while preserving its role as the world’s reserve currency.