Some good reads from around the Web.

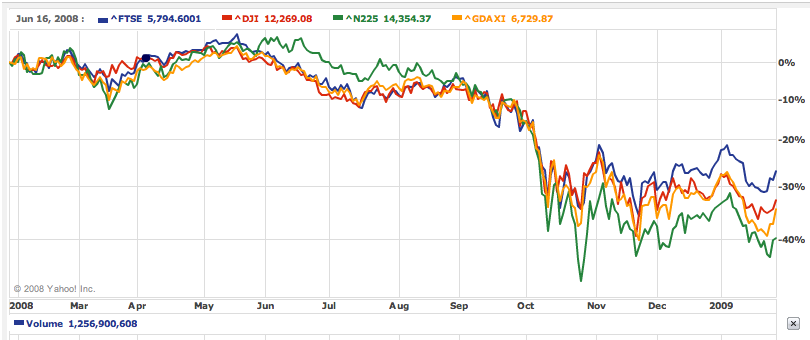

I have dug up an extra great list of links this week, so just a brief intro via a graph from Business Insider, showing one crazy day in Greece.

In normal times I’d argue that equating broad stock market moves with micro-political developments in a country worth 1% of European GDP was risible.

But these are not normal times – I was watching the markets closely on Thursday, and I watched it happen:

Of course, it’s much better to ignore the markets and your portfolio for months at a time. Short-term volatility doesn’t matter when it comes to long-term returns.

Worse, new research suggests that volatile markets can damage your health!

From the money blogs

- How to get better returns without increasing risk – The Wisdom Journal

- Personal loans that reduce mortgage costs – Finance Blog

- An attempt to value Groupon – Musings on Markets

- Groupon, baseball cards, and comic books – The Reformed Broker

- Ending the divine right of bankers – The Psy-Fi blog

- Bond duration: What it is and why it matters – Oblivious Investor

- The 4% ‘safe’ retirement withdrawal rate: A US anomaly? – Wade Pfau

- When social capital beats financial capital – Sawbones Surio

- Geography and income – Econbrowser

- Mr Money Mustache Vs. No Impact Man – Mr Money Mustache

- I’m a former banker, and I’m mad as hell, too – Ian Fraser

- Trading Vs. Investing – Above The Market

Deal of the week: The FT’s Merryn Somerset-Webb tips Safe As Houses? as a ‘must read’. It offers a unique analysis of UK property prices.

Mainstream media money

- The myth of ever-rising house prices – Moneyweek

- Cognitive illusion and active fund management – The Guardian

- 25 things you should know about ETFs – ETF Database

- Spotting bubbles is harder than it looks – Wall Street Journal

- Blending momentum and value strategies – Bloomberg

- Greece is doomed, so buy Greece! – MoneyWatch

- Why the carry trade still yields profits – Swedroe / MoneyWatch

- The value of a Nobel Prize – Felix Salmon / Reuters

- The breakdown of stock/bond correlation [Graph] – Reuters

- The [latest] end of the credit card – Slate

- Tracker funds overpay for new listings – FT

- John Lee: A 12-strong small cap portfolio – FT

- FSA wakes up to structured products [bit late!] – The Telegraph

- Petition to merge CTFs with Junior ISAs – The Telegraph

Like these links? Subscribe to get them every Saturday!

Comments on this entry are closed.

Thanks for that weekend reading! I particularly liked the graph on correlation (or lack of it) between US bonds and equities, which led to:

http://www.the-diy-income-investor.com/2011/11/carry-on-balancing.html

Seconded… and your own hat tip to your own links in your piece before the links. Excellent and diverse reading this week… where do you find the time to find it?

Thanks for the encouragement chaps. There are sometimes Saturday mornings when I wonder why I’m writing an article instead of sleeping in or walking in the sunshine, so it’s nice to get the positive feedback.

To be honest it’s not a big hardship, though, as I’m a voracious reader on financial and money matters. This is just a way of sharing what I discover. And they’re all sites I regularly visit, anyway.