Want to do the unspeakable deed? The following guest post by Auld Tattie Bogle, a Monevator reader, explains that it even if you’re convinced it’s right for you, it might not be so easy to transfer a final salary pension.

I have almost reached my half-century, and along the way I have enjoyed a fairly long career in IT with a variety of different employers.

This scenic route through the workplace had resulted in me acquiring several relatively small pensions.

Most were defined contribution schemes. But one was a defined benefits scheme.

Following the pension freedoms that came into effect on 6 April 2015, many people may have been tempted to transfer money from such defined benefits scheme – also known as final salary pensions – into a more flexible money purchase scheme, also known as a defined contributions scheme.

Now for most people, undertaking such a transfer is likely to be a bad idea. This is because a final salary scheme guarantees a certain level of income in retirement risk-free, provided the scheme doesn’t go bust.

Worse, for a significant minority a transfer could present crooks with a great opportunity to defraud them out of a large portion of their pension savings.

So let’s be careful out there!

Yet despite these risks, I decided to transfer my sole small-sized defined benefits pension pot into my primary SIPP.

As things turned out, making this difficult decision was the easy bit. Actually getting the transfer done was the real challenge!

I thought I would share the logic behind my decision and my experience in case others find themselves in a similar situation.

One pension pot to rule them all

Some years ago I decided to consolidate the money from all of my previous defined contributions schemes into my employer’s scheme.

However I had hitherto left my defined benefits scheme alone.

Received wisdom was that these schemes were valuable, increasingly rare and the gold standard for pensions that shouldn’t be messed with.

But as time passed I became increasingly curious about the possibility of cashing in this defined benefits scheme and transferring it into my SIPP.

As I mentioned, I knew making such a move would be very much counter to the standard advice.

Why then did I do it?

Here are the main reasons I decided that transferring my defined benefits scheme into my SIPP was a sensible course of action for me:

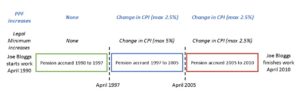

- I am not convinced that defined benefits schemes benefit ‘deferred’ members with short periods of employment.

- My defined benefits scheme was a very small percentage of my overall pension provision (around 10%).

- I plan to retire early.

- I plan to take a tax-free lump sum.

- I plan to use flexible drawdown rather than to purchase an annuity.

- My wife’s primary pension is a defined benefits scheme, so between us we would still be covering the bases.

- I like the idea of having visibility of all my pension funds in one place. (Sad I know!)

Decision defined

I ought to explain my thought process behind the first bullet point above.

Final salary schemes benefit most those members whose salaries increase over their careers.

This is because a member’s final salary at retirement can be far higher than their average salary.

Thus being frequently promoted has the effect of inflating benefits without increasing previous contributions, which means high flyers can receive a Managing Director’s pension on a Post Boy’s contribution.

However as a deferred member, my salary is permanently fixed and I therefore have no opportunity to increase my benefits in this way. Hence the relative lack of appeal to me.

In an attempt to sanity check my logic, I approached an IFA I’d previously used to review some financial plans for some informal advice.

I explained my situation, and why I believed that a transfer was the best course of action for me.

Off the record, his response was ‘that sounds reasonable’, so I set the wheels in motion.

Computer says no

After waiting for ages, my defined benefits scheme administrator provided me with a binding Cash Equivalent Transfer Value (CETV).

I looked over the figures. To me it seemed a fair price for the guaranteed future entitlement I was giving up, so I approached my SIPP provider to initiate the transfer.

First problem!

My SIPP provider said that as the transfer was to come from a defined benefits scheme, they could only process my transfer if I had received advice from an IFA.

Then things got rather Kafkaesque. My SIPP provider added that they could accept the funds even if the advice from the IFA was that the transfer was not the right thing to do!

This struck me as an insane position to take.

Do not pass Go

Second problem – I went back to my IFA who told me he could run the numbers for me, but that it would probably cost around 10 per cent of the fund’s value!

I politely declined his offer; I am a firm believer that minimising professional fees for advice or management is one of the best ways to maximise investment returns.

I mused on the possibility of finding an accommodating IFA who would say ‘don’t do it’ for a nominal fee of £50. I could then present this negative advice to my SIPP provider, and they would presumably initiate the transfer.

After all, if the IFA said ‘don’t do it’ and I did it anyway, surely I couldn’t sue them? What would they have to fear?

Equally, the SIPP provider presumably felt that as long as there was a tick in the ‘client has received advice from an IFA’ box, they couldn’t be held liable if the transfer turned out to be a poor decision?

To be honest I was slightly offended that my SIPP provider would not accept my decision, despite the fact that I had thought the issue through quite thoroughly and decided it was the best course of action for me.

It was as if I was not qualified to make my own choices and accept the consequences.

Instead I had to pay some professional to tell me what I should do and to accept legal liability for that advice.

I did approach a couple of IFA’s and cheekily suggested my £50 for an immediate ‘Don’t do it’ report, but they weren’t keen for some reason. Presumably because it was more profitable for them to ‘run the numbers’.

A roundabout solution

Having seemingly exhausted my options, it looked like I wouldn’t be able to affect a transfer – even though I genuinely wanted to.

Clutching at straws I approached my company pension provider.

It transpired they were far less squeamish about accepting money from a defined benefits scheme.

All I had to do was answer some questions over the phone about my understanding of the risk, which was presumably recorded and filed under ‘in case he tries to sue us later’.

Hey presto! The money was transferred into my company scheme for a few months while I finalised the timing of my resignation.

Then, once I had left, I simply transferred the whole lot – final salary part and all – into my primary SIPP.

Job done. Hurrah!

Have you transferred (or given up on transferring) a defined benefits scheme? Did you go through a similar rigmarole? Or perhaps you think it’s never right to trade in a final salary pension? Please share your (polite, constructive) thoughts in the comments below.

Comments on this entry are closed.

A final salary pension scheme only has value if you believe in the entity making the promise

I think bailing out of final salary can make a lot of sense for private sector employees with dodgy former employers

The government guarantees for final salary only go up to a moderate pension value

Many years ago I was contracting for a (then) national family controlled retailer

There were three cousins on the board, the nerdy one had transferred his (millions pounds) pension fund out of the company scheme, while the other two had not

The retailer went bankrupt, one cousin’s pension was safe (although he lost millions of pounds of equity value), the other two lost the value of their shareholdings and almost all of their pensions

Thanks for the post. I have a small deferred pension pot from being a University lecturer and had been going through a similar thought process as my salary at the time wasn’t great. The USS scheme has since moved from final salary to defined contribution so I need to spend some time understanding the impact. My feel is to push it all into the SIPP where I have control.

@james white – I think the new USS scheme is a combination of defined benefit (based on a career average rather than final salary) and (optional) DC schemes.

@vanguardfan – you are right. I’m unclear how that affects the performance for deferred members. Either way I’m inclined to put it into Vanguard funds (of all places).

I went through an identical process last year so did quite a lot of mugging up.

If the defined benefit scheme is valued at less than £30k it can be transferred without obtaining any advice from an IFA. If the scheme value is greater than £30k one must be advised. Legal requirement in both cases. There are not that may advisors doing this work and a 1% fee seems to be typical. It’s too high but it’s regarded as high risk advice.

Platforms vary in their willingness to take the transferring scheme whether advise has been transferred or not. HL very sniffy (or fearful of of any perceived liability) but AJ Bell accepted it readily enough. One can always transfer it on from the accepting platform if one wishes.

As for the merits – I ticked most of the boxes I thought I needed to tick – eg, other assets, unmarried, financially literate so went ahead. It helped that the CETV offered was over 30% higher than the £ pot I would need to buy an annuity providing benefits equivalent to the final salary pension I was foregoing.

@James White

I am in a similar position with the police pension scheme – however in our case the salary built up under final salary remains linked to final salary and any future contributions are ‘career average’

In my particular case (I’ve 11 years out of ’30’ on the final salary side) remaining ‘in’ the pension scheme until retirement appears considerably more worthwhile than becoming a deferred member…for a whole host of reasons including:

The final salary link for a proportion of my pension

The ‘protected pension age’ (although I doubt I’ll be able to make full use of this ;0) )

The ‘career average’ portion is uprated at CPI +1.25pc for members, but at CPI for deferred members!!

I would say not one in thirty of my colleagues fully understands any of this. Maybe bite the bullet and have an FA take a look ?

@James White

Sorry, in summary, are you sure the change to career average affects you if you’re a deferred member ? And even if it does, the way its uprated and age it can be taken may make it worth hanging onto ?

@James White if the change to the USS benefit structure happened after you left, it won’t apply to you. Your benefit will be linked to your salary when you left, revalued by reference to CPI

what surprises me about the initial post is the concept of a SIPP provider who would be willing to accept the transfer where the IFA advises against. Lots of them won’t, in spite of the argument that they should be safe from legal action because it is the IFA (if anyone) who should be liable. The pensions misselling scandal of the early 90s is casting a long shadow over this. I am not at all surprised that you can’t find an IFA who will be willing to breach all their professional rules and take a major reputational risk for a measly £50

One point, shouldn’t you be seeing if the value offered in the transfer looks likely to be enough to pay for the benefits you are giving up?

If it isn’t then your other reasons could still be reasons to transfer, but at least then you would know if you were paying a price for them (or to reduce exposure to a particular employer)

It’s quite common to meet your future spouse at work, so many married couples must have deferred or active DB pensions with the same scheme. Then diversification might be a good reason for one of them to transfer out.

Im sorry, huge Monevator fan, but this is by far the worst article ever published on this site. I feel I have to comment.

You decided that a transfer ‘was a sensible course of action’ before you had even received the CETV? So rather than sensible analysis you thought you would just transfer based on a few flimsy preconceptions.

You havent mentioned what ill-health and death benefits you gave up by transferring? Did you look into those? What annual return on your investment did you need to match the benefits offered?

Having a guaranteed index linked income in retirement is massively useful to cover basic living expenses.

You mention income drawdown as a reason for cashing in, if you are sensible you would keep a few years income as cash to avoid drawing down equities if there was a downturn, this cash will have next to no return, you would have been much better off using the defined index lined income to serve this purpose rather than cashing in.

You are now paying fund and platform charges. You wernt before. You are now suffering investment risk. You wernt before.

Im sure your decision will look wonderful as we enter a bear market.

A lot of greedy people will be complaining soon, im sure, that nobody stopped them making this unreversable error.

I have a S&S ISA, SIPP and AVC to supplement my DB pension, but I would never cash it in.

And to the Policeman wanting to cash in, unfunded public sector schemes like yours do not permit transfers to DC schemes.

I had a similar amount of grief in transferring my defined contribution AVC fund to HL. In the end I had to pay £500 for the financial advice to be able to cover HL. Since that was less than 1% of the total I sucked it up. The cost of the advice was slightly softened by HL offering me a £100 transfer in bung.

I can see that platforms may not be keen on transferring in a DB pension for fear of litigation, but going the IFA malarkey over DC funds transfer to a DC SIPP seems a bit like jobs for the boys to me.

A 10% DB component to your pension planning would make some of the challenges of decumulating a largely DC pension easier, and decumulating the DC component faster ahead of the DB pension age of payment is a way to address early retirement. I personally would have retained it, but each to their own.

I wholeheartedly agree that individuals should be able to take decisions like you have done. However, if it all goes Pete Tong (only time will tell on that front!) those same individuals will no doubt want to blame someone for not warning them not to do x, y or z. Not surprising you couldn’t find an IFA willing to put his livelihood on the line for a measly £50.

Remember the stipulation to take advice is a legal requirement, not one imposed by the FS industry or IFAs and whilst the average Monevator is better informed than Joe Public, remember that these rules were introduced for the masses not the minority.

I know IFAs have a bad name, but there are some good guys out there who can add real value to people not as committed to personal finance as your typical Monevator reader. Fee charging financial planners who practice life planning are a good place to start.

Great article, I’m in a similar position – 53 yrs old, retired at 50 and living off savings.

My DB schemes’ FS values increase by min of RPI or 6% so I’m leaving them in until 60 and then transferring out to SIPP.

I’m in FP14 and am very close to the 1.5m limit so have to be careful on fund growth so crystallization and scheme depletion before age 75 are my main issues.

I monitor CETV on my 3 DBs annually and have had some interesting discussions, I’m happy(ish) with a 25 * annual DB multiplier.

iii offer very low fixed rate platform charges rather than %age based fees, but we have an “interesting” relationship on my current SIPP holdings, time will tell come transfer time.

@ James White

The move from final salary to career average at present applies only to those members who joined USS on or after 1 October 2011. If you joined before that, your pension will still be worked out on the basis of your final salary uprated by inflation each year since you left the scheme (i.e. higher than the annual salary as specified on your last payslip).

From April this year, the future contributions (i.e. from April 2016 onwards) of all USS members will be career average, up to a threshold of c.£55,000 (can’t remember exact figure); in respect of salary over that amount the contributions on that slice of salary will go into a DC scheme. That means that anyone who joined USS before 1 Oct 2011 and is still there after April 2016 will eventually have some pension payable as ‘final salary’, some payable as ‘career average’, and – if they earn over the £50K+ threshold at any point before retiring – some payable as DC.

But none of that seems to apply to you!

Whilst it’s very often the case that people should leave their final salary benefits where they are, there are occasions when it can make sense to consider a transfer, some of which you’ve highlighted in your article. HM Treasury agrees there are circumstances when a final salary transfer can make sense. A copy of its consultation entitled “Freedom And Choice

In Pensions” can be downloaded from this page, which also explains why final salary transfer values are currently likely to be as high as they have ever been – https://www.sippclub.com/final-salary/

The lack of analysis that went into this transfer from a supposedly clued up Monevator contributor is concerning.

The list of reasons given for the transfer are all ancillary. No mention of the value of benefits being given up and the replacement cost.

Ill health benefits?

Spousal/dependent benefits?

It’s been over simplified & is precisely why the requirement to receive advice exists.

I also enquired about transferring a DB pot into my SIPP, earlier in the summer.

I was aware of the pitfalls, the foregone benefits and the risks, but would rather be in control of my money. It’s a little awkward running with different assets spread across multiple providers, with different maturities and risk profiles, and I am comfortable taking on the investment risk element of the game.

It would particularly help me in two ways:

1. I am hoping for modestly early retirement – mid 50s – and it would be cleaner not to have funds coming on tap several years later (if the state pension does come along, and is not means tested, then that will be a bit of a bonus at 67). I know that one can generally ask for DB ER, but the actuarial adjustments never seem to quite work in one’s favour.

2. I have another 18 years before the DB pot kicks in. That’s a lot of time for inflation to eat away at any miserly uplifts in my entitlement.

I searched around and found NO IFAs would touch me, even though I work in the industry and could fully articulate the risks and benefits around leaving vs transferring. None. They all seemed to be waiting for a bit of clarity on what the long term liability / impact of giving any transfer advice might be.

I reluctantly decided that I can afford to wait a year or two, and then follow up.

The amount isn’t huge: I’m estimating it will be less than 10% of my at-retirement pot – so it’s not going to make a material difference to my financial outcome.

[I did manage to transfer into my SIPP a small £5k CETV-value DB entitlement a few years ago, without advice, but had a lot of manual disclaimers that I developed with the SIPP provider, to cover their backs. There wasn’t a standard process then, other than to flatly refuse, but after talking to a couple of senior bods they agreed that it was reasonable for my circumstances]

Speaking as one, I don’t think IFA’s with the requisite “pension transfer specialist” qualifications are being difficult here! DB (“final salary”) transfers have given rise to a raft of problems in the past, especially when far too many people transferred out in the late 1980s and early 1990s with little more than a “sign here, mate” and thanks for the 5% commission. We then had the Pension Review instigated by the then regulator which took years to complete and cost £millions to resolve.

Whilst I am quite sure that for many people taking the transfer is, in fact, the right thing to do, certain regulatory hoops have to be jumped through and these are there to protect both consumers and, to a lesser extent, providers. Aside from the obvious matter of data collection by way of obtaining the CETV (“Cash Equivalent Transfer Value”) and projection of potential benefits from the scheme (which can take weeks) your IFA is then obliged to obtain a Transfer Value Analysis Report (TVAS) from an independent “number cruncher” and I have to pay for these and they cost between £250-750 for each CETV.

The TVAS looks at the “certainties” offered by the DB scheme compared to, say, a SIPP making use of drawdown and/or annuity purchase and produces what is known as a “critical yield” which attempts to show the rate of return required to at least match the DB benefits given up expressed as an annual percentage return required on the CETV. The TVAS also gives a comparison of the death benefits. The death benefits and the new “inheritability” of SIPP and personal pension funds has been a key driver in client decisions in my experience since 6 April ’15 when the new rules came into force.

The FCA insists on the TVAS as do, importantly, professional indemnity insurers. My small firm carries nearly £2m of PI cover and that costs me £9k for 17 month’s cover. The excess on most investment business is £5,000, but the excess for DB transfer business is a whopping £15,000. That’s a lot for me to cover should there ever be a claim against my firm about DB transfer advice given (whether the transfer took place or not!). There is no “long stop” for IFA’s so, in theory, a complaint could arise in 40 years time and, unless I’m dead, the claim might be upheld.

So, IFA’s are clearly circumspect as far as DB transfers are concerned and these must be documented clearly to protect both their clients and themselves. Over the last year I have transacted some DB transfers for clients for a variety of reasons and also advised that taking no action seemed to be the best choice; there is rarely a clear-cut “green light”, but serious ill-health is certainly one.

Indeed, I recently completed a case where the individual was, most unfortunately, within sight of the end and his DB scheme offered death benefits of £20,000 per annum pension for his wife and a return of his personal contributions as a lump-sum – that was £10,600. He took the transfer value of £1,036,000 into a SIPP, all of which will be available tax-free (in most circumstances) to his wife and children should his prognosis prove to be correct. My advice charge was £6,000 as I spent around 60 hours on the case and I need to be paid for my time and expertise and be cognisant of the ongoing risks to my firm, however slight, and the significant increase in costs to my firm when undertaking this type of (albeit fascinating) work.

Similar considerations apply to other “safeguarded rights” such as GMP (“guaranteed minimum pensions”) and guaranteed annuity rates or guaranteed maturity funds in older personal pensions.

Any IFA with any sense will not possibly be in a position to merely “sign off” a DB transfer without complying with the relevant protocols for much less than £2,000 and I’m really not a greedy so-and-so!

@oh dear

I know that – and I wouldn’t dream of cashing in even if it was available. Prob best to read comments before replying ?

Like you, I was a deferred member of a defined benefits scheme. As I had left the company I could not draw the pension until I was 60 and I wanted to start to take a pension at 55. I also wanted control of both the investments and the pension amount drawn so a draw-down SIPP was my preferred course on action.

This was about 5 years ago (and I am sure it is harder now), A financial adviser (for no fee but a hope of some business) agreed it was sensible to transfer based on the fact I could drawn-down at 55 and that I was unhappy with the performance of the PLC behind the company pension.

I approached 2 SIPP providers, one wanted to see the advisers report the other was happy if I ticked a box to confirm that I had received advice, other than that both providers offered similar competitive deals. So I transferred.

Four years later I started to take a pension.My natural yield from my portfolio is very similar to the pension I would have got but because I can just draw the amount I need I don’t have to pay tax and can keep reinvesting the surplus until I need more. I have the flexibility to adjust it again when I get my state pension at 66.

Other plus points for me, my wife will get 100% of the income when I die (rather than the scheme 50%) and the kids will after her……

So far so good, I have learnt over many years that its the income from the portfolio that matters not its capital value!!

Hi All and thanks for the many insightful comments. I will try to respond to everyone in a single post for efficiencies sake.

@Neverland – You make a good point highlighting something omitted from my post i.e. the risk of a final salary pension scheme going bust, which is slight but real. I was not particularly worried about that possibility myself as the company in question was a global pharmaceutical giant who I felt was unlikely to collapse in spectacular fashion. The problem for armchair investors is how you go about calculating the likelihood of such a failure of the scheme to which you belong, and then integrate that risk into your overall assessment … rather tricky!

I assume that in the UK the Pension Protection Scheme would kick in and assist, to some degree, those beneficiaries who have suffered a failure of their defined benefits scheme … although I don’t claim to know the details.

@Poplo – I would have been caught by the statutory obligation to get IFA advice as the CETV was around the £40k mark. Curiously enough I now wonder why my company pension provider accepted the transfer on the basis of a recorded telephone conversation, when my SIPP provider insisted on IFA advice?!?

I was especially interested to read that you calculated that your CETV was 30% higher than a pot required to purchase an annuity for the guaranteed amount. When considering my options I contacted an old colleague who was a member of my pension’s board of trustees. He was originally an employee representative on the board, but has subsequently retired. In our discussions he indicated that the scheme adopted a totally neutral opinion on transfers out. Meaning that they would neither fiddle CETV values up nor down, to encourage or discourage scheme members to transfer. Instead the schemes actuary would simply calculate, with a straight bat, what the guaranteed liability was worth at that point in time.

@David – I did a fairly quick and dirty assessment of the CETV against the prevailing annuity rates to confirm that there wasn’t a shortfall against the guaranteed pension amount I was giving up. I was comfortable that it was a fair exchange. Clearly for some this sanity check was recklessly amateur 😉

@Oh Dear – indeed … the decision to transfer was based on multiple factors. It is entirely reasonable to decide on a subset of those factors to investigate the option further before a CETV is provided. Once the CETV is know then you may decide to continue with the transfer or to stop, as it no longer makes sense because of the deal offered.

There was a benefit to my spouse of something like 50% of the pensionable value. However as my wife stands to inherit 100% of my SIPP and any income derived from it this didn’t seem like a good reason against the transfer … or have I missed something?

As for the required return to match the defined benefit there is a simple answer – Inflation (it could have been measured by RPI or CPI … I’m not 100% sure which was used). As I was a deferred member my entitlement was simply going up in line with UK inflation and the scheme had no incentive to try any harder than that.

Suffice it to say that I disagree with your comment that I would “been much better off using the defined index linked income” to protect against downturns in the market. I believe that I have adequate provision to ride out this type of event. How you would know what my retirement funding plans were from the article and whether I did, or did not have a sufficient liquid buffer without requiring this index linked DB income puzzles me 😉

I pay £25 a quarter for my platform charges and whatever the FTSE 100 / 250 physical tracker rate is … just checked and it’s 0.35% … and yes I realise that there are cheaper trackers the best I can find is 0.07% 😉 This equates to an overall management charge of 0.17% for my SIPP … which I think is quite good. The suggestion that I wasn’t paying any management charges for my small DB scheme is disingenuous at best. I accept that when you are part of a company scheme some charges are discounted and others are hidden from view, but to suggest that I have gone from not paying to paying is simply fallacious.

As I write the markets are down about 20% from their last peak … and everything looks fine thank you 🙂 I’m not sure that this forum is the best place to try to FUD people into purchasing opaque and expensive guarantees using the spectre of market volatility … but I could be wrong.

The fact that you would never cash in your DB pension is self evident. Furthermore I wouldn’t try to convince you otherwise, as I don’t know your personal circumstances. You obviously “believe” I have made an “irreversible error” … although not surprisingly and for the reasons outlined in my piece I remain unconvinced.

@Ermine – I totally agree that IFA approval to support a DC to DC transfer between providers seems like money for old rope! Perhaps I have underestimated the difficulty of “deculmulation” of my DC pension? I would be grateful if you could expand on what problem you perceive and why a small DB pot would be an ideal solution for it. You may convince me that I should have held onto it yet 😉

@Mikkamakkamoo and others – You have all made the point that IFAs wouldn’t risk their license for £50. I will admit that the whole “I’ll bung you £50 for you to tell me that I shouldn’t transfer my DB pension to a DC pension” was a slightly tongue in cheek response to the “even if they say No we will accept the transfer” … point taken. I agree that there are good IFAs and I have used some … but in this instance I am glad that I didn’t have to spend the money.

@Mr P – I’m envious of your position … I think I’ll be lucky to get anywhere near the current threshold!

@Mark Meldon – Thank you for a very fulsome, “fact rich” and though provoking comment. It goes a long way to explaining why this is a tricky area and charges are necessarily higher than for other financial advice. I’m almost considering engaging you to review the facts surrounding my circumstances, so you can settle the disagreement between myself and @Oh Dear and @Stoozbet. You may also yet convince me that I should have held onto it 😉

Phew … I don’t think I’ll refresh again just in case there are other comments. Sorry that I don’t have anything to say about the Universities Superannuation Scheme thread, but I haven’t got a clue about it and other readers who do seem to have picked up the gauntlet.

I’m very heartened by the response to my musings … and I’m especially proud of the Comic Book Guy – “Worst Monevator Post … Ever!” comment … thanks to everyone for your input 🙂

haha thats not actually too much of an insult – the standard here is just unusually high, if mark meldon of moneybox fame guest posts it can’t be long before the monevator crew are appearing on R4. I wouldn’t be surprised if its already happened..

@ATB … I don’t know if this was the ‘worst post’…but it’s probably the most specific …a whilst everyone has different incomes/ wealth/ time to invest/ aspirations…a good deal of the posts are applicable to all…

Transferring out of a deferred DB pension is like as not only going to suit a tiny fraction of people…and of-course not all DB pensions are the same they’ll have different uprating, different normal ages, different minimum ages… Thanks for your time.

A couple of thoughts

1) personally I would have said 10% of total pension wealth in a DB pension is a good diversification. In theory this is safe money. No one could scam you out of it as you go senile, you know it will always be there, covering the bills. So you die young and lose it, that’s only 10%. No guarentee that we won’t have Japan style stagnation for ever more either.

2) Not sure what you mean by ‘not working for you’. The benefit you would receive is usually calculated as years contributing/max years allowed. So 1/80 as an example. So the pension has already done all of the work up front. The real question is what growth rate and for how long would it take for the transfer money to to equal the DB pension as drawdown.

3) also worth factoring in how long you can defer the state pension for in either scenario, as this can be great value

4) of course there are good reasons to transfer and each to his own. Good luck with it ! 🙂

@ Mark Meldon – I paid a more than £6,ooo for a similar sized fund transfer so that looks reasonable value to me. A lot of money no doubt though.

@ Auld Tattie Bogle – the IFA I hired put my CETV value through the TVAS and came up with some interesting stats. In my case it said that provided I secure a real return of no worse than minus 1.5% real I can match the scheme benefits . Alternatively, if or rather pointlessly I could take the CETV and buy an annuity as I say above. Six months post transfer I’m doing worse than – 1.5% so far!

I believe a lot of these transfers are being driven by a desire within the pension funds to free up regulatory capital and shedding final salary liabilities is apparently a reasonably cheap way of doing it (for reasons I don’t begin to understand). Some are extremely generous for that reason and accordingly something of a win win for both parties.

“a desire within the pension funds to free up regulatory capital and shedding final salary liabilities is apparently a reasonably cheap way of doing it”: in which case it’s time for DB schemes to start making capital offers to pensioners in return for forgoing their pensions already in payment. I wonder whether The Great Pension Liberator will ever get around to legalising that.

Thanks for this discussion – although it’s rather late for me it’s at least assuaged some feelings of trepidation on taking this step some time ago.

Not sure if anyone here has transferred out of the UK?

People have already covered off several factors they have considered but for me it was the fact I’ve emigrated to New Zealand and therefore currency exchange risk, and a whole different countries’ RPI/CPI and tax regime, could impact on a UK NHS pension. In addition my benefits have, and will, only grow by UK CPI (And despite market conditions my fund is growing above inflation).

And looking at the UK plc and NHS’s austerity program from the inside made me believe pensions could be a target.

I’ll be eligible for state pension in two countries at retirement (still 65 in NZ!) although the NZ one gets reduced by the UK one…..but it’s still bigger!

Death in service benefits no longer applied and I have forgone the 50% widows pension but the life insurance element that the whole of my pension fund going to dependents on my expiry saves another insurance bill.

The transfer gives the opportunity of early retirement at age 55 – which I can take from now.

The CETV seemed generous due to the low annuity rates – and I’ve been a long term, if small time, investor in IT’s and ETFs (many thanks for this blog BTW!) so I can withstand a little uncertainty……

I’d be taxed at NZ rates for any UK final salary paid in sterling but the scheme is Tax Exempt on draw down, although income earned is taxed – there is no CGT in NZ on shares. Plus the NZ tax authorities only give you 4 years to sort all this out before they start taxing transfers, as income paid in to NZ pensions is after-tax and there is nothing like SIPPs/ISAs here. It would really not make any sense to do it at the rates they charge after 6 years or so.

And right now HMG have stopped all transfers out of NHS schemes AFAIK.

Downside is that charges are higher than having a SIPP and will make you wince on this blog – I pay a tad over 1% and this was the most competitive (to UK eyes) available. This is about on-par with the pensions schemes which everyone can take part in – Kiwisaver – which is a deferred savings scheme paying out at age 65.

Finance markets over here are very much caveat emptor.

Only time will tell is this was a negative, neutral or positive move.

It’ 28 degree C today so I hope you are all toasty too!

Very interesting reading. I also have a small DB pot from a stint working for a global pharma company. But recently my pension has been transferred to a much smaller pharma company because the big one sold that bit off. So the risk of it going bust has probably increased. Also when I look at the small print I can see it only goes up by RPI capped at either 2.5% or 5.0% depending when you made your contributions. So we only need a few years of higher than normal inflation and it will become worthless. Good reasons to transfer out and manage it myself perhaps?

Very interesting article.

I’m very relieved I transfered my defered annuity into my SIPP a few years ago, while I was still allowed to with being forced to pay for advice. I did my own research and I’m still happy with that decision for many reasons.

What really tipped the balance was that a SIPP won’t disappear when I do, and that my deferred annuity was being uprated at RPI and at the time the Government where making noises about changing the formula (which would have lowered RPI.)

(It should go without saying that I’m not suggesting this will suit everyone ..)

@Auld Tattie Bogle: “Curiously enough I now wonder why my company pension provider accepted the transfer on the basis of a recorded telephone conversation, when my SIPP provider insisted on IFA advice?!?”

This has also confused me?! The legal requirement to take independent advice is on the ceding scheme not the receiving scheme where the CETV is over £30,000. This applies to transfers from DB (or safeguarded benefits) to DC arrangements which I assume your company pension is.

Therefore, either your DB scheme has been a bit naughty letting you transfer away or there’s some wrinkle in the legislation that I’m not aware of.

I too looked very closely at transferring out my bank pension into my SIPP. There are a number of key benefits which people seem to lose sight of when throwing their hands up in horror at the mere suggestion. Of course everyones circumstances are different and each must be judged on its own merits, but these were the key benefits I identified for myself:

1. Ability to take more income earlier. I don’t want to be the richest pensioner in the care home. My income needs will vary and likely drop significantly once I get to mid-70s, but my Bank pension is fixed. If I plan to retire in my late 50s I need a lot more income then than I will in my 70s.

2. Lump Sum tax benefit. As an example my Bank pension would give me a tax free lump sum of £60K, but if I had transferred it out I would be able to take nearly £100K tax free.

3. Death benefits.

I think most people are risk averse though. Considering that most DB schemes were in surplus in the 90’s and now are in serious trouble, why should most people think they could do better if they took on the risk and invested somewhere else?. There is a reason companies are closing down DB pensions and trying to offload them onto us. They know they will have to pay through the nose to fulfil their promises, as growth predictions are no longer what they once were. For the individual it is risk vs reward, if you have tons of cash and will easily cover retirment then a transfer makes more sense. I bet most people will have just enough to get by in old age and any miscalculation will be devastating (probably not readers of this blog). You can see why the government force people to take advice to prevent them gambling their future (esp if there reason to transfer is to get their hands on £££££).

Personally I have always felt that DB pensions have a part to play in a diversified pension plan. With pension freedoms, I would not want all of my pension in one. In fact I would only want a smallish percentage. But as a key baseline to keep me in old age I think it will be valuable. My thinking is the state and DB pension will cover my basic living costs from around 70. DC plans will cover the time between early retirement and 70 (with any extra being spent on fun…..).

What if all your pension is in a DB plan? Then I can see a stronger case again to move it. Though if you have time, I would also look at packing a DC pension with as much as you can so you have options and diversification!

This is something I would definitely consider if it were allowable as I’m not convinced my DB pension will be able to deliver what it promises when I get there, and like others, retiring early would mean I’d need the income earlier in any case. Some of the benefits are also less relevant to me – spouse’s pension for example (I’m unattached and planning to stay that way!).

I believe there is a chance that the valuation mechanism for DB schemes may increase from 20x annual pension to 30x, which I imagine would significantly increase the transfer value, so I’m not doing anything imminently (although I am not an IFA myself so may be wrong about this). Of course that might be one reason why they would not go ahead with the valuation change – everyone would be heading for the exit!

I think the 20x multiplier is for calculating the value of a DB pension for the Life Time Allowance. It’s nothing to do with the transfer value (except that logically they ought to be the same).

The biggest factor in the transfer value is probably the level of long term interest rates, which implies an expected future rate of return.

Thanks for the clarification, PC.

@Richard. … Not likely, the ‘ever decreasing lifetime allowance’ puts me off piling into a DC on top of a DB pension … I don’t think my pension will be 50k in today’s money…But I definitely dont think the lifetime allowance will keep pace with a fraction of wage inflation… The government loves the pockets of the working man

There is another thing about DB transfers to consider. Whilst it is true that over the last 5 years or so CETVs have increased, often by rather more than 100%, because of the collapse in gilt yields and the general level of interest rates (and sometimes because sponsoring employers are offering “enhanced” transfer values as a “bribe”!) that simply isn’t always the case.

Not very long ago I looked at a case where everything pointed in favour of taking the transfer. The client had independent means of income, substantial investment and property assets and, frankly, the DB scheme was a relatively minor component of her overall “net worth” as the phrase goes. Her view on risks and loss was also compatible with the transfer proceeding. Just as importantly, there was 10-12 year “time horizon” between now and the likely time that benefits might be drawn from her existing SIPP into which the transfer would have gone.

I say “would have” because I really couldn’t advise her to proceed, despite her clear intentions to do so. The reason? Well, the DB scheme under inspection was significantly in deficit and her previous employer had long ago just survived liquidation and been taken over by another business that promptly closed the DB scheme to future accrual (that’s never a good thing). That meant, in my opinion, taking the transfer was an even better idea as her eventual benefits were, effectively, “frozen” (not completely, but nearly). I still advised against the transfer because the scheme had imposed an “actuarial reduction” on CETVs of 28%!

Nor my client nor I have any way of knowing as to whether the 28% reduction in the CETV will get worse, reduce, or simply go away, but my suspicion is that it will persist as virtually all of the underlying fund is allocated to fixed-income investment in an attempt to “match” the DB liabilities the whole scheme is exposed to. It happens that around four-fifths of the scheme members are female and, despite “gender neutral” legislation concerning things like life cover premiums, it remains the case that the average woman is likely to live longer than the average man, thus forcing the scheme to be very conservative in it’s longevity calculations.

My client and I have agreed to review this “hold or fold” decision annually and it will be interesting to see whether or not the “bird in the hand” approach is ever taken.

If we agree to “hold”, then she does know, unless the scheme falls into the Pension Protection Fund, that a pension of £xxx will eventually appear as a sort of “ballast” to her other sources of income in retirement.

Thank you Monevator for publishing the original article and Auld Tattie Bogle for taking the time to write it.

Learnt a lot from many of the feedback contributions; specially Mark Meldon. Thank you!

I am in a similar situation and contemplating tangible (in £ terms) and intangible benefits of exiting my very small DB pot which at last look was about 5% of my total pension pot.

In my case, the key drivers: 1) most DB & DC schemes have been in deficit for at least a decade – mind boggling numbers too – and as most of the DB pay-outs are largely funded by current employee base, it is hard to imagine how long this situation can go on. 2) flexibility and control I need to have over my hard earned pension pot. 3) only dependent I NEED to cater for once I’ve departed is a disabled sibling who won’t benefit from my DB pot.

On the whole, at the very least considering the option to bail out of a DB scheme is not as daft as some contributors have made out here ;). As many have pointed out, how much weight you put on a given risk factor depends entirely on personal circumstances and genetic constitution.

To-date, I haven’t had much luck with finding a good IFA but that is not to say they don’t exist. However, in this instance being forced to go through the process of consulting even an average IFA, I think, is quite right.

REASON – it is a fail safe step. At the very least by consulting an IFA who has to follow a predefined process to crunch numbers you are forced to think /talk through all known risk factors. If the IFA concludes “NO” & you choose to override, then at least you have made an informed decision or consciously decided to ignore certain risks. And that is just as it should be.

I thought the following statement from a broker re BT may be of interest as anecdotal evidence to back up comments in my earlier post.

Extracted from the broker’s report ……. “The pension fund deficit improved by £700m to £4.9bn at December 31 2015, due to lower expected increases to pensions in 2016. The company has promised dividend growth of 10%-15% for Full Year March 2016”

My point: large companies like BT are going from strength to strength; admittedly some at a slower pace than others. Increasing profits and therefore dividend payments (which is obviously good news) and yet running mind numbing deficits in the pension pots. Key reason – “due to lower expected increases to pensions …..”

I have 2 ex-employers who send out similar updates every 3 years with equally alarming deficit numbers.

Couple this with the fact that employment profile in this country is changing fast with increases in short term contracts and self-employed.

How long can this situation be sustained is the only open question in my view.

I believe the next big mis-selling scandal will be the fees that IFA’s charge to provide these suitability reports.Unbelievable that they will not provide a written report for 99% of clients even if the client signs a waiver stating they will not sue them in the event they end up being worse off after transferring from a defined benefit pension( execution only or insistent client route they could easily do) 3-5 % of the transfer value is criminal.By charging these extortionate fees they are exploiting the new pension freedoms.There are many cases ( shortened life expectancy aside) where experienced investors should be easily transferring these pensions to their sipps etc but are being prevented by greedy , paranoid ifas.

Just thinking out loud, but say you get offered a CETV equivalent to a 30+ multiple of a deferred defined benefit scheme that would otherwise grow only by inflation (ignoring supplementary benefits like life insurance, etc.) Now a 30 x pot may seem like a lot, but it could be risky trying to make this last a lifetime at a withdrawal rate of, say, 3%. However, if the person taking the transfer is 43, with 17 years until the pension would have become payable, and the pot achieves a CAGR of 2.5% (real, after costs) for those 17 years, it then effectively becomes a multiple in the region of 45 x the original pension, which may be a lot more attractive than the original guaranteed pension.

Fees for IFA. I am just n the process of deciding whether to shift6 DB to SIPP drawdown. If anyone is interested the fee seems to be in 2 bits – a lower sum for doing the background work and writing the necessary report and getting the (hopefully) agreement to recommend, and a higher sum for the transfer process itself. It comes to approx. 1% of the overall fund (which I thought was pretty expensive as I already have a drawdown SIPP already set up). I think someone else has mentioned 1% earlier in this conversation – does that seem about right? I presume the money is the set aside for the anticipated PPI…

Regarding an IFA’s fees. I have never like “ad valorem” percentage fees, as I mentioned, I think, above. So, “1%” is to broad a brush when looking at costs. Remember that “objectivities” have to be dealt with in the form of a detailed Transfer Value Analysis Report and these are not free. Depending, then, on the “subjectivities”, it will be agreed to “hold” or “fold” as far as the DB fund(s) are concerned.

This all takes time and expertise and this has to be paid for, even if the outcome is to “hold”.

I’m off to see a client with a deferred pension of £35,000 a year, due next spring, which is nice. However, he isn’t very well, unfortunately, so he might decide to “fold” into his existing SIPP and end up with a private pot of just under the £1m mark which can then pass tax-free to family members should he have the bad-timing to expire sooner than he had hoped. The fund needs to be invested, should he fold, and that takes time and expertise, too (despite Monevator’s valiant efforts on self-determination!). As I have a long journey to make, my fee for “hold” is likely to be in the region of £1,750-2,000. Should we agree to “fold” into the SIPP, nearer £4,500 -£5,750 to reflect the extra time and risks involved. That’s not so much from a £1m fund, really, and the fund can pay the fee.

That should give you a rough idea, but, be warned, that this process has to be undertaken for each and every DB transfer value!

Thank you – so helpful. Do you think it is possible to do any part of this myself to minimise cost? The IFA has said the certificate cannot be released without commitment to the two part process I mentioned.

I doubt it very much Elsie

As the current rules stand, it is pretty much impossible to “DIY” defined benefit transfers. They have to be “signed off” by an appropriately qualified pension transfer specialist. You can find one near you by looking at the FCA Register on-line. Be prepared to pay up though, as this is complex, time-consuming and risky work for both sides of the desk, so-to-speak. Don’t forget, you can agree to have the pension fund pay fees with your IFA in most cases, by an agreed deduction from it.

I’ve literally just finished my process from switching an old Barclays final salary pension to my sipp.

It cost me 0.9% of the transfer value which was by far the cheapest from a reputable IFA based in St Albans. The report was deemed unsuitable ,however AJ Bell will accept an ‘unsuitable’ transfer into their sipp ,unlike Hargreaves Lansdown.!!! AJ Bell and Barclays just want to know that you have taken advice and need proof by way of the IFA’s company and individual registration numbers.

Gosh – thank you all. Very helpful – Mark – to know DIY isn’t a goer and even more so , Julian , to be forewarned about HL being unlikely to accept and unsuitable transfer. The IFA I’ve started speaking with thinks my application IS suitable. If I get the necessary certificate is HL obliged to accept the money into my existing SIPP or can THEY deem it unsuitable themselves?

Hi Elsie

Hargreaves will accept your transfer if the suitability report is in your favour.. Good luck

Many thanks helpful people – my first go at using a blog in this way. I feel much more secure in what Im going to do now.

“I am not convinced that defined benefits schemes benefit ‘deferred’ members with short periods of employment.”

Typically they haven’t, but that’s not the choice you’re being offered, which is between future pension benefits and a lump sum transfer.

A simple test is whether the future benefits are worth more or less than the transfer value on offer. Often it isn’t enough to purchase those benefits.

Fees – I understand why the fees are so large if the ifa recommends a transfer, time taken to gather all the data, time to do the calculations and indemnity insurance in case he gets sued afterwards.

But my plan is to transfer my final salary to a sipp and then withdraw all the money and burn it in the back yard, why does it cost thousands to tell me they do not recommend this ? (Obviously I will not go through with the actual burning bit).

@DaveK – I’m not sure it needs to cost thousands if an IFA doesn’t recommend you transfer your pension. This service seems to do the assessment for a few hundred quid if the recommendation is no. They only charge the balance of their fee when they accept the liability of issuing a positive certificate of recommendation for their advice – https://www.sippclub.com/final-salary/

Rene – you got me all excited but they will only issue a report if they recommend the transfer and you pay 1%. I am still waiting for my cetv but I believe that would mean I have to pay approx £5,000.

Its a rip off I tell you, a complete and utter rip off.

I had a report done for mine recently by an IFA, it was not deemed suitable but AJ Bell were happy to take the transfer providing I had taken advice whatever the outcome.Unlike Hargreaves Lansdown who would only take the transfer if it was deemed a suitable report.Struggled to find an IFA at first who didn’t charge the earth but found one in the end in St Albans who charged a flat fee of 1800quid plus Vat. He has done two reports for friends as well recently.

Has anyone got a report done for 0.5% or less? Or a flat fee?

1800+ vat flat fee was the cheapest by far and I checked with loads of ifas

Julian – £2000+ just to write a report telling me it’s a bad idea to burn my money seems crazy to me, but I suspect you are right and that’s what it’s going to cost…can you send me the details please ..davidkear1961@yahoo.co.uk

Julian, would you care to name the IFA?

Thanks

Hi I used a guy called Gary Cretton at an IFA firm KDW associates based in St Albans. He charges 1800 plus vat. As I said earlier my report was deemed unsuitable however AJ Bell were willing to accept the transfer providing I had proof that I had taken professional advice.Hargreaves Lansdown wouldn’t take a transfer full stop unless it was deemed suitable and IFA’s are really reluctant to issue suitable reports for fear of future lawsuits.

Good luck

Julian

This has been an extremely informative blog and has helped put my thoughts in order. CETV has been obtained twice in the last 15 months (most recently received in December quoting the value at September date of enquiry – yes I know, 3 months to answer!) in furtherance of an impending pension sharing order. I have an overwhelming need to transfer my share, (my ex has no option so, should be free of the IFA requirement – happy to be corrected) the 25% tax free now is half the cost of a urgently needed home. This summ is substantially more than can be liberated from the final salry scheme. The remaining 75% invested in a moderate risk portfolio would still give me a better return than the proportion of deferred final salary or a purchased annuity. I am still contributing to my current employer’s Company pension scheme portfolio so feel I shall have sufficient funds in 4 years time. I shall then be 66 with the option of working reduced weeks at consultant day rate while letting my investments grow further before taking drawdown.

Given the above it does seem hard to have to pay an IFA upward of £3000 to tell me what I already know. Surely a simple test of financial literacy combined with binding expression of wishes contract isn’t beyond the whit of the FCA to introduce?

I’m a financial adviser and I do actually agree that people should be allowed to make a decision on their own pension fund. Yes, defined benefit schemes can be complicated to understand but I agree with Phil, who suggests a financial literacy test could be used to indicate someone’s understanding of the benefits before they giving them up.

The reason we can’t just issue a letter for £50 and say ‘don’t do it’, is that we have to provide that advice based on your own personal circumstances. Two people could have exactly the same CETV and receive different advice recommendations. Obviously, in order to be able to make the recommendation, we need to under more about your circumstances, existing pension and future plans. We are then required to write a report detailing the reason for, or against the advice. So unfortunately, £50 wouldn’t cover the time attributed to the exercise, but I am empathetic to the red tape you face.

If anyone wants to chat, I can provide advice for a flat fee of £1900 (I don’t charge VAT).

Having recently gone through the process myself recently, one suggestion I would make is always check with the SIPP provider you intend to transfer into what statement they will require from the IFA who has undertaken the review. Then check with your IFA whether they would be prepared to provide this statement. A recent example is as follows:

“I can confirm that in accordance to the client’s attitude to risk I have advised them to transfer the benefits of the above named scheme into xxxx SIPP and I accept full responsibility for the advice given”

I recently bought a house.

Solicitor did a whole lot of checking into the history

Performed ‘searches’ involving writing to a number of 3rd parties etc

checked title , deeds etc

Completed all the legal paper work etc

Cost was £400

Did a good job.

Just saying.

Lots of interesting views and fees !! , my experience was as below.

DB transfer for my Scottish Power pension to AJBell Sipp , total cost

Report and confirmation letter from correctly authorised IFA = £795 no vat

£10 to the post office for a certified passport.

Job done.

Oh come on, don’t tease. Care to give more detail on what seems to be a cheapest in class option from my searches? Would be cheap at twice the price!

Phil , I used a company called Annandale Finance based in Dumfries in south of Scotland ,they have a website.

I only used them for the transfer last year and have had no further contact , it was a summer romance.

Having been listed in the subject of this forum I am pleased that we have provided a service which has been considered to be helpful by our clients but i find that i will have to expand upon how and where we may be of assistance to individuals requiring advice on the transfer of Defined Benefit Schemes.

Annandale Financial Services will not provide a report only option due to the complexities of these potential transfers. we will require face to face meetings with individuals concerned in order to asses their needs and expectations as well as their views on risk and reward.

It is impossible for us to provide a report only service as required by some of the enquiries and i am afraid although we have always tried to assist and navigate our many clients through this complex process we are not in the position of dealing with enquiries of this nature.

Can i please draw attention to the following document produced by the FCA

https://www.fca.org.uk/news/news-stories/advising-pension-transfers-our-expectations

Not only does this indicate that we cannot undertake comparisons using hypothetical receiving schemes but a transfer should not be conducted based solely on critical yield.

We have therefore taken the decision many years ago that pension transfer advice will only be conducted on a face to face and full recommendation basis.

Pension Transfers from Defined Benefit schemes cannot and should not be conducted on an insistent client basis

I am sorry if this does not meet with potential expectations of how advice should be provided by members of this forum but we do only have the best interests of our clients at heart and seek to ensure that we fully comply with FCA requirements in this area.

By setting out our requirements i hope that we can avoid disappointment for future enquires.

Many thanks

John Coutts CertCII DipPFS

Senior Partner : Annandale Financial Services

I’ve been researching this subject a lot over past months for personal reasons, what seems to be clear is that it Financial Advisors need to be specialists in Final Salary Transfers and hold a G60 or equivalent qualification, the following guide http://pensionhelp.co.uk/final-salary-transfer-guide/ gives some quite indepth detail into how you can benefit and how it work, its a good 8 pages thou.

I’m not sure it needs to cost thousands if an IFA doesn’t recommend you transfer your pension. This service seems to do the assessment for a few hundred quid if the recommendation is no. They only charge the balance of their fee when they accept the liability of issuing a positive certificate of recommendation for their advice – https://www.sippclub.com/final-salary/

@all — Just as a note, in general I’d rather people didn’t reference specific companies for this sort of thing as if it happens a lot it’s going to be hard for us to distinguish between genuine company recommendations and spam.

With fund platforms or major fund houses or peer-to-peer services, say, that’s not such an issue. But with individual small solicitors and the like we can’t hope to police it very effectively.

That’s no reflection on John’s company at all, just a general point to be aware of if you find you’ve referenced a company and your comment does show up or is deleted.

*General* advice and principles for how other readers can make progress is of course very much welcomed! 🙂

I wished to transfer a defined contribution fund to Hargreaves Lansdown. There was a complication in that it was part of a two leg pension fund whose other leg was a small historical final salary scheme. HL at first insisted that I provide them with independent financial advice – even though I was not transferring the final salary fund! Their reason was that the scheme rules allowed any lump sum payable in connection with the final salary scheme to be paid out of the money purchase fund – and that therefore my proposed transfer was depriving me of a valuable right relating to a final salary scheme. I had explained to HL that I had no intention of taking the final salary lump sum as my objective was to maximise income from the final salary scheme. After an internal technical review they wrote to say that as I did not intend to take the final salary lump sum, they did not in fact require me to take financial advice. I suspect I saved myself at least a couple of grand in fees.

For a quick reckoner for USS CETV values, see http://www.pdoc.cam.ac.uk/guides/pdocusspensionspresentation

For the last 30 years, I have belonged to a defined-benefit, final salary-related pension scheme. My employer is in the process of changing this to a significantly less attractive Career Average Revalued Earnings arrangement.

I could just accept the consequences (according to the company’s own figures, this would result in a loss of around £100K assuming I live for 20 years post-retirement). Alternatively, I could take the CETV (= 25 x forecast income in retirement) and invest it in my P2P SIPP which is operated on a fixed-fee basis (ie no additional charge for the hefty increase in funds invested). I’m minded to do this because I have been investing in P2P for several years with average returns in excess of 10%.

As with a number of previous contributors, the challenge I face is to find an IFA who is prepared to positively recommend the transfer (as required by the FCA https://www.fca.org.uk/news/news-stories/advising-pension-transfers-our-expectations).

I’d be interested to hear from IFAs who have the necessary qualifications and who (subject to assessment of my circumstances) would be prepared to positively recommend the proposed transfer (brianlom1@yahoo.com).

Re Brian Lomas question:-

Will be interested to hear other comments on this one. I have 2 small final salary pension schemes that will give me £1,800 pa and £2,500 pa at age 65 and the proverbial wild horses tug as they might will never get me out of them. Added onto the state pension they will give me a dependable £12k approx pa index linked at age 66 :- enough for all the basics. My personal opinion is that the 10% pa average historical gains in the SIPP are a very dangerous red herring – you could invest your final salary transfer value in your SIPP one day and the stock market could crash the next day leaving you with losses that could take years to recover. I personally would never be prepared to take that risk, but I appreciate that risk is a very individual thing.

As a newcomer to this website, thanks to all for the useful posts and information. I used the DB transfer route suggested by Julian (February 2017 post) and it has worked for me. Not cheap, but professional and efficient and a fraction of what I was quoted elsewhere.

Boy this is tough. I have had 3 CETVs from my employer of approx 30 years service, and the final 1 was tempting. My thoughts for opting out of works pension (now a career average related earnings scheme – CARE) and transferring into a possible drawdown SIPP, is that my partner would be entitled to everything left in the SIPP should i die. She would only get 1/2 my monthly pension if i stayed with company scheme (granted, it would be guaranteed). I have 3 more years before i reach that magic 55 years of age – and can put transfer into effect – and things might change alot before then.

I was so shocked to read this blog post, which yes, is about taking a gold standard of pensions and trashing it by rolling it into a SIPP. What’s done is done. For readers heading this way and believing this has to be a smart idea, let me express my thoughts.

A) short of bad luck, I’m scheduled to live until I’m 89 years old. If you’re just starting out, you’re be living longer then I will.

b) I’m going to have 25 years of retirement living ahead of me because I hate working now, so intend to retire at 65 and not 67 as mandated by the Govt.

c) A money purchase scheme transfers the longevity risk to the individual from the pension provider, where it rests with Defined Benefit. If I become the oldest living person in the UK at the ripe old age of 112 years with an article in the Daily Mail how I did it, I’ll still be picking up my defined benefit pension without the risk of my defined contribution pot running out.

D) This risk transference also means that defined benefit will also possibly pay out more benefits over the long term then defined contribution ever could. Value is lost potentially through defined contribution.

E) what is not being highlighted is with defined contribution, the charges for drawdown actions are unbelievably excessive. Our fantastic banking industry has found another seam of gold to extract from the unwary public. The charges, £50 for a statement, £80 for a payment, etc, can wipe out any investment gains while retired. I have done a spreadsheet exercise over a 25 year timeline of monthly drawdown withdrawals to match a defined benefits payout, and the charges almost match the entire pots withdrawal and tax charge by HMRC. The charges become a tax by another name.

F) The only viable alternative in my view to defined benefit is not the SIPP, but the ISA.

You’ve paid your tax already, and so withdrawals and *income* derived from an stocks and shares ISA is tax free. If ISAs are here to stay, then that income is tax free in perpetuity, assuming your dividend rate is 4% which matches the recommended drawdown rate of a defined contribution pot anyway. See Dividend Champions UK for ideas on which stocks will last until your dottage

Best wishes

Simon

It would appear that the difficulty is not with the (non advised) Product Provider i.e. SIPP accepting the TV but the current DB provider releasing the funds. Whether the advice is to transfer or not, 2 large UK financial institutions, previous employers, have both requested very detailed and explicit information about the professional advice received, wanting the IFA FCA registration number and a letter from the Adviser.

As a career long employee in the Financial Services industry and suitably qualified, but not practicing, it seems a very difficult hurdle to overcome to transfer a small circa £40k TV at a reasonable cost, to my existing SIPP.

I am in a similar – equally stuck – position although unfortunately without the company transfer option. Having been made redundant and opened my own SIPP I looked at the potential to move a small previous defined benefit pension into this alongside my contributions from my previous pension and on-going contributions. As I already had circa 20 years in a final salary pension this seemed a no brainer allowing me to start utilising the SIPP in my late 50’s until my final salary pension kicked in. Unfortunately with a pot of circa £80K in the small DB Pension most of IFA are just not interested… so at the moment I am stuck!

Hi Phil…I read your comments on Monevator regarding final salary transfers and IFA etc…dated 2017….are you still offering your services…final salary transfer to a Sipp for a chartered accountant with good income stream and property portfolio and well experienced with financial decision making. Regards Jay

@JaySutaria – I think the SIPPclub review service mentioned above is still operating – https://sippclub.com/why-a-final-salary-transfer-could-be-best-now/

Add my two penny worth, I have just had a successful transfer of a DC with a GMP underpin into a SIPP. Cost was 3%.

@Simon T

This may be a naive question but would you mind briefly explaining how you did it. For example, did you use IFA? Who your original DC plan provider/manager was? Is the 3% cost wrt to IFA involvement?

@Kena – sure

I approached a local IFA who was marked on the register of doing DB pension transfers.

After an interview they said they weren’t in the business any more (so why say you – are – well…) but they could introduce me to another specialist company

The specialist company then had a paraplanner that did some initial interview and form filling, then the specialist IFA interviewed me for an hour or so.

There is a lot of form filling.

They did all the leg work, sent me the report which recommended transfer (based on a number of items, the fact that it was a GMP, I am a experienced investor, I need the TFLS earlier due to tax restrictions when I immigrate) then transferred into AJ Bell. (their SIPP of choice)

Unfortunately I had to pay the fees (just took out a cheap loan and will repay back with the TFLS in a few months) as AJ Bell don’t allow the charges to be taken

The fees were 3% (on 180k so around 5.2k). The initial IFA claims back a referral fee from the company

If you went direct you still pay the 3% – this is the company that did the transfer. https://pensionhelp.co.uk

@Simon T,

This is very helpful. Really appreciate you taking the time to respond – it gives me a good sense of the process & costs involved. Also appreciate the link.

Thank you!

In case it helps, this service will charge a maximum of 2% – https://sippclub.com/why-a-final-salary-transfer-could-be-best-now/

@ Rene Lapp Definitely! Thank you.