The normal minimum pension age (NMPA) is increasing from age 55 to 57 on 6 April 2028. Some people’s pensions protect them from the increase but the benefit can be lost if you transfer out.

Yet others could be caught out by a weird time-glitch.

The legislation as written will allow some to access their pension at age 55, but then lock them out again because they won’t be 57 when the pension age rises!

This piece of bureaucratic madness could affect over one million people according to former pensions minister, Steve Webb, who sounded the alarm in This Is Money.

It’s yet another pensions minefield and – if you’re not following the Department for Work and Pensions award-winning communications campaign – you might not know what’s going on. [Sarcasm is the lowest form of wit, y’know – Ed]

In this post we’ll cover who’s liable to lose access to their pension, and how to tell if your scheme offers a Protected Pension Age (PPA) of 55 or 56. 1

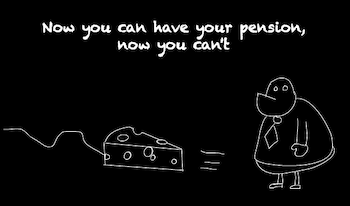

Now you see it, now you don’t

Up to 5 April 2028 most people can tap into their pension from age 55.

Overnight, from 6 April 2028 the minimum pension age rises to 57.

Critically, there’s no transitional arrangement in place.

So if you’re not 57 on 6 April 2028, you will generally not be able to access your pension. Even if you were doing so because you were over-55 before that date!

In the case of someone born on 5 April 1973, they will have precisely 24 hours to enjoy their pension before it closes for another two years.

If that’s you, I recommend using a pension provider famed for their speedy customer service.

You might think such a ludicrous situation would be cleared up. But currently this is the state-of play – despite warnings from both within and without government.

Anyone born after 6 April 1971 but before 6 April 1973 is stuck in this bizarro world loophole.

The obvious solution is to allow anyone who started accessing their pension before the magic date to carry on as they were.

But that isn’t happening.

The law as it stands simply snaps shut your pension pot again until you’re age 57.

What does the Government say?

The Treasury referenced the problem in a July 2021 paper:

The Government also acknowledges the importance of establishing a clear position on the transitional arrangements. For example, members who do not have a PPA and have reached age 55 but not age 57 by 6 April 2028 and for whom a transitional issue may arise.

The Government will provide further advice on the proposed transitional arrangements and provisions in due course.

No such advice has been published. The change in the NMPA was written into law by the Finance Act 2022.

Since then, silence.

What does HMRC say?

Essentially: “Nothing to do with us, guv.”

If you search around the issue, you’ll find this query on the HMRC Community Forums where someone asks if they’ll be stopped taking their pension.

Three HMRC respondents duck the question by either linking to information that doesn’t help or offering a bureaucratic dead-bat:

Sorry, we cannot comment on future events as legislation may change.

What do others say?

Some pension providers are flagging the problem.

As you’ll be 55 before 6 April 2028 you’ll be able to take your pension benefits at any time from your 55th birthday up to 6 April 2028.

It’s currently unclear whether you’ll have to stop taking pension payments after 6 April 2028 (such as regular pension drawdown payments) until you reach the age of 57.

While government-backed financial educator Money Helper cautions:

People born between 6 April 1971 and 5 April 1973 may be caught in a transitional phase, possibly accessing their pensions at 55, then losing access from 6 April 2028 until they reach age 57.

This is definitely a thing

I’m personally caught up in this. And I must admit I’d assumed some kindly government fixer would close the loophole.

It just seems nuts. But there’s a reason why political satire has such a rich tradition.

And now there’s less than four years to go. The planning window is perilously short if nobody does anything about this.

One option is to take enough cash out of your pension to cover the period when it’s padlocked again.

A 5 April 1973 baby will need to withdraw an extra two years of cash to get them through the tax years 2028-29 and 2029-30.

That’s likely to mean a big tax hit, unless you use your tax-free cash.

Check out this piece on the pension drawdown rules to understand how to use phased drawdown to take the tax-free cash you need without overwhelming your ISA allowance.

The article also covers the emergency tax issues associated with drawdown and the disadvantages of taking uncrystallised funds pension lump sum (UFPLS) payments.

Personally, I’m not keen on incinerating tax-free cash that can be used to grow your future tax-free space in ISAs, if left invested. Especially as it seems likely that taxes will rise in the future.

But everyone has their own priorities. Some may decide to take the tax hit at 20% but use tax-free cash to avoid tipping over the higher thresholds, for example.

Is your pension age protected?

Some pensions can be accessed at age 55 even after the 6 April 2028 NMPA rise.

This Protected Pension Age (PPA) benefit applies to:

- A pension scheme that gave its members the unqualified right to take benefits at age 55 under their scheme rules on 11 February 2021.

- You also had to be a member of the scheme before 4 November 2021, or in the midst of a transfer.

- An ‘unqualified right’ means that you do not need the consent of anyone else (for example, trustees or scheme administrators) to take your pension benefits.

It’s best to check the status of your pensions directly with the scheme administrators.

I didn’t think any of my pensions qualified. But then I discovered that Fidelity’s SIPP offers a PPA of 55, providing you held it before 4 November 2021.

Stick or twist

You can lose your PPA if you transfer your pension. A new provider doesn’t have to honour your protection, so check that they will if retiring at 55 sounds nice.

But there’s a twist:

- Money transferred from your protected scheme is ring-fenced once it hits your new pension.

- Only that money benefits from your PPA in the future.

- The rest of your pot (including ongoing tax relief, employer contributions and investment growth) will only be available from age 57.

But there’s… a twist within the twist!

The above rules apply if you arrange your transfer as an individual in a move known as – wait for it – an individual transfer.

But under a block transfer your past and future contributions qualify for the PPA even if the new scheme doesn’t offer any such protection.

(Ever get the impression that HMRC is run by the puzzle-loving fiend, The Celestial Toymaker?)

A block transfer involves two or more members of a pension scheme transferring to the same new scheme at the same time.

Alright, I feel like I’m addressing an ever dwindling proportion of the population with each passing sentence, so let’s finish this bit up.

Money transferred from a non-qualifying pension can gain protection if you shift it to a qualifying scheme that you joined before 4 November 2021. The People’s Pension makes this clear in their explanation of the rules. (Hat tips to Monevator readers WinterMute and PhilosoFIRE for pointing me in the right direction on this).

All the same, please ask your scheme’s administrator to confirm this in writing to you. Don’t rely on all pension schemes applying the rules the same way – the system is full of quirks and kinks.

Apparently a pension in drawdown can transfer without the loss of your PPA. But please double-check this too, as I only found one single source making that claim.

Minimum pension age rising to age 58 and beyond?

The original government plan was to tether the NMPA to the State Pension Age. The idea being that your private pensions could be ransacked no more than ten years before the State Pension.

However, this link wasn’t included in the Finance Act 2022. Perhaps it’ll be legislated for by a future Parliament. Perhaps it’s gone to the Happy Policy Unit in the Sky.

Either way, it’s not a thing for now.

What a state

Well, it’s great to see that the Government has learned the lessons of their last failure to properly inform people of looming pension changes. [Second sarcasm violation! You’re on a final warning – Ed]

I get that the time-limited pension issue only affects a thin slice of the population. But it could have quite a serious impact on those it does catch – especially as many people’s pension plans are touch-and-go anyway.

Moreover, I’m quite pessimistic about the chances of anyone bothering to solve the problem. I have a feeling it may not be the top priority of the incoming government – whoever that may be. [Fired! – Ed]

There’s one final takeaway here for anyone who’s made it this far down the page. [Hmm, still here? – Ed]

The government machine is continually screwing things up and often finds it easier to move the goalposts than to properly fix them.

So if you’re planning for the long-term, make allowances. Make your plans as generous as possible with as much wiggle room as a pair of Victorian football shorts.

Take it steady,

The Accumulator

- Only a few schemes explicitly offer a PPA of 56. So we’ll just refer to a PPA of age 55 for the rest of the article.[↩]

How truly bonkers. Commiserations on getting caught up in this SNAFU!

That was me who emailed Steve Webb after discussions on the MSE Forums.

It is indeed madness and I can’t believe it hasn’t been properly addressed. But what with all the other shenanigans going on in government over the last few years I can see why.

So until we hear otherwise it will be one UFPLS withdrawal of £16,670 for me and then wait two years to access again!

I’m 55 on 31st March 1973. Although I have a SIPP and an old deferred DB pension most of my pension is in the Teachers Pension Scheme which is very strangely affected by the rule change. The old final salary pension has been replaced by a career average salary scheme. The final salary part is protected so can be accessed at 55 but the career average one isn’t so will only be able to be accessed at 57. However, if you access your pension early you have to take both parts but you won’t be able to do this. Teachers Pensions are allegedly waiting for further guidance. It’s a good job I’m not planning on retiring full time before I’m 60!

Thanks for this update regarding the changes in pension age. Fortunately, it appears that I have landed on the non-affected side by a matter of days for access to one pension, however, my second pension I cannot access until SPA unless I take a large hit. Pensions are excellent products, however, they can be complex and not helped by constant changes.

Can anyone help clarify something for me? I am in my mid-30s and have an Aviva pension that is age 55 protected (where my employer contributions go). I also have a separate SIPP running alongside this which is not protected and will only be accessible at 57.

My question is: can I simply leave a nominal amount in my Aviva pension (say <£10k) to keep the lights on for the next 20 years. Then when aged 55 transfer part of my SIPP (enough to bridge from age 55 to 57) to my Aviva pension, such that I can then access it at 55?

Would this work?

I can feel a complicated flowchart (or two) coming on! Recall similar issues when they switched from 50 to 55 NMPA some years ago, though not sure if they resolved some of them in a less unsatisfactory way at the time.

Bit tangential but does anyone know the rationale for why the NMPA is linked to the state pension age and not, say, 50? I assume that it is because the state wants (a) to keep us working and thereby paying tax and (b) to avoid the risk of having to pay more benefits, if we spaff our pots and come looking for help from the state? If so, this is a bit frustrating for those of us that have paid ample tax already and are adult enough to avoid pot spaffing

@Andy #7: yes and yes to (a) and to (b).

For a while the excuse was rising life expectancy, but then that started falling…

All: Good God what a mess eh?

Dysfunctional doesn’t begin to cover it. Another symptom of Broken Britain.

This should be easy enough to fix though.

DWP (and not HMRC or HMT) are the lead department here. They administer the SP.

They should be introducing remedial primary legislation, in the form of some clauses to clear this up, for inclusion in the first next available Finance Bill.

We can only hope that this happens, and that legislation then takes effect, well before 6/4/2028.

I don’t understand how this has not been fixed already in the past 2 years, notwithstanding that it has been a pretty colourful time in terms of competing priorities and problems.

All in all, it’s something that belongs in a plot line for a Monty Python sketch or in Terry Gilliam’s film “Brazil” 😉 :

https://en.m.wikipedia.org/wiki/Brazil_(1985_film)

@Jp

I recall when the age was about to change from 50 to 55 the poor old chap next to me was almost picked up and thrown out the building, in order to “do him the favour” of preserving the age 50 retirement, with no actuarial reduction for early retirement/redundancy. It was a huge shock to him and I’m guessing it took a couple of years for him to see the kindness of the rapid /rough exit.

@DF

I think it was to help manage the risk of “spent it all, can I have benefits please”.

We’ve seen this one before….the pension age rose from 50 to 55 in 2010. I qualified in late 2008 but the opportunity vanished in April 2010…and reappeared in late 2013.

(un)Happily as a Feb 1972 baby I shall be caught up in this.

It seems like I should be able to get cash out in time to use the Personal Allowance for each year, access in Feb 27 at 55 to get 2026 / 2027 PA, anytime in 27/28 to get that years allowance and then in Feb 29 to get the 28/29 allowance. Will need some faffing to do so and some borrowing from ISA.

An irritating faff though.

I am thinking that I’d take all my tax free cash out against the chances that the option is removed at somepoint. Then reinvest it in ISA / GIA / Living.

I think that I’d assumed that if you had started drawing then you were Ok though.

So we had WASPIs (Women Against State Pension Inequality).

What will those unfortunately caught in this fiasco be known as?

PAPANs? (People Against Pension Age Nonsense).

This is yet another example of the risks to pensions due to the unholy trinity of constant government meddling, botched implementation and unintended consequences. How is anyone supposed to make plans for their long term future in this environment? Although Monevator has made a clear argument in the past for the value of pensions over ISAs, that case is surely being eroded by the constant legislative churn. Who would bet against the new tax free lump sum allowance going the way of the capital gains tax allowance and being reduced eventually to near worthless? It’s ISA all the way for me. Of course the government could, and probably will, come after that as well at some point but hopefully for now they will keep their snouts firmly in the massively larger pension trough.

@bownyboy

I am in the same boat. If you take one UFPLS withdrawal of £16,670 won’t you have to pay emergency tax of £4,005.01?

Payment after deduction of emergency tax: £12,665.00.

Payment includes tax-free amount of £4,167.50

Ah, the wonderful world of pensions, where the answers are rarely straightforward.

One point above which I’m not sure is quite right is where you say “Money transferred from a non-qualifying pension doesn’t magically gain protection if you shift it to a qualifying scheme. Nice try.”

My understanding is that if you’ve got a protected pension age (PPA) of 55 in a scheme by virtue of meeting the entitlement conditions in that scheme in 2021, then that PPA of 55 should in principle apply to all benefits in that scheme, including any built up at a later date (e.g. through contributions) or which you transfer in from another scheme (regardless of when you could have accessed benefits in the transferring scheme). I think the reason for that is because the legislation works so that where you met the eligibility conditions in 2021 the PPA then applies at the level of the scheme rather than being attached to specific benefits you had within that scheme at a point in time.

By contrast, if you do an individual transfer from a scheme with a PPA to one without, then the PPA in the receiving scheme would just attach to the specific benefits transferred (i.e. they’d have to be ring-fenced by the receiving scheme and any other benefits you had previously or subsequently build up in the receiving scheme wouldn’t benefit from a PPA).

In terms of sources to back that up, I’d point to this abrdn article (https://techzone.abrdn.com/public/pensions/Tech-guide-pension-age#anchor_4) which says the following:

“Transferring into a scheme with a low pension age

Perhaps surprisingly, any benefits transferred into a pension scheme that has a protected low pension age can also be paid from that special low pension age – even if they came from a scheme subject to the normal minimum pension age.

However, as mentioned above, this doesn’t apply when transferring into a scheme that has age 55 or 56 protection derived from an individual transfer. New monies coming in will go into a separate pot to which the NMPA will apply.”

Similarly, Fidelity’s page on NMPA (https://www.fidelity.co.uk/normal-minimum-pension-age-nmpa/) says the following about the PPA applying to future contributions after 2021:

“If you opened a SIPP with us or applied to transfer your pension to us before 4 November 2021 – you’ll benefit from the Protected Pension Age of 55. This applies to any transfers or contributions you made to your pension on/before 3 November 2021, as well any future contributions.”

For anyone who can face it, the relevant bit of the Finance Act is here: https://www.legislation.gov.uk/ukpga/2004/12/schedule/36/paragraph/23ZB

It’s potentially a surprising result, but if the legislation and guidance stays as-is then there’s arguably more flexibility than you’d have expected in terms of moving sums into a scheme with a PPA of 55.

This isn’t financial or legal advice (and shouldn’t be construed as such), and people should check with their individual provider before making any contributions or transfers, as ultimately what matters is what the providers will do in practice.

While it’s an nonsense to have no transitional rules surely that’s emblematic of the general disregard paid by governments to pension stability.

It would appear to be absurd that DB pensions can potentially be in payment then stopped so you’d expect some sanity to prevail closer to the date. As for FIRE types isn’t it only really an issue if you turn 55 too close to the wire for your pension provider to act? Otherwise you would hope your TFLS out of a DC pot is enough to tide you over to 57 without needing to drawdown during the newly locked period.

For those younger can see benefits in playing the PPA game.

And I may just be a horrible sexist but I’ve never had much sympathy for WASPI women. There’s loads of personal finance impacting stuff that slides by in Budgets. You have to pay attention. The state isn’t responsible for their life choices in making inadequate personal pension provision or their assuming that despite greater average lifespans they’d continue to enjoy a material pension advantage over men.

@ bownyboy – Nice one. At least you generated some publicity for the issue.

@ David – What a farce! I wonder why on Earth you have to take both parts early? My partner is a teacher but a little older, and also not planning on taking her TPS until in her 60s.

@ Onealo – PhilosoFIRE and I have uncovered conflicting advice. Your best bet is to ask Aviva directly. Perhaps not mentioning the bit about “keeping the lights on.”

@ Andy D – currently the NMPA isn’t linked to the State Pension. That was the plan, which is why the NMPA is jacking up to 57 as the SP goes to 67, but they haven’t legislated for the link to future rises in the SP age. Apparently one reason they’ve paused on that is because of falling life expectancy, as referenced by Delta Hedge.

@ Weenie – Like it. We definitely need some kind of snappy acronym to make this newsworthy.

@ PJ – It’s surely worth diversifying across the two types of account? I don’t think ISAs are invulnerable. A good case is made in the paper: Tax Uncertainty and Retirement Savings Diversification

I ported the idea to the UK’s tax-free account environment here:

https://monevator.com/sipps-vs-isas-best-pension-vehicle/

@ PhilosFIRE – that’s very interesting, thank you for sharing. The Abrdn advice conflicts with what I found over at Royal London:

https://adviser.royallondon.com/technical-central/pensions/benefit-options/increase-in-normal-minimum-pension-age-in-2028/

Transfer from a scheme without an unqualified right to take benefits at age 55 to a scheme that does. From 4 Nov 2021:

Not possible unless the individual was in the process of transferring when the rules changed on 4 November 2021.

I think the Fidelity guidance is ambiguous as future contributions doesn’t necessarily mean future transfers.

I hope you’re right as this is potentially one way for people to solve the problem on their own. If anyone hopes to pull off this manoeuvre, then I’d definitely first check whether it’s possible with your scheme’s administrators.

@Bababill yes you will have to pay a chunk of tax but its easy to claim it back by filling out form p55 online and it takes about 4 weeks to credit back to your bank account.

You can also check the progress of your refund in your online personal tax account.

@ BBBobbins – the Parliamentary Ombudsman ruled in favour of WASPI women and they’ve probably looked into it a bit more deeply than either of us?

https://www.theguardian.com/money/2024/mar/21/thousands-of-uk-women-owed-pension-payout-after-ombudsmans-waspi-ruling

How hard would it have been to write to those affected and let them know? Given the female retirement age hadn’t changed in decades and knowing the poor state of pension literacy in the country at large.

I came across a similar issue with nurses who unwittingly transferred themselves out of the NHS pension and onto inferior private pensions. It happened to nurses who worked at GP surgeries when they were no longer deemed to be employed by the NHS but directly by their surgeries. The nurses weren’t informed, their jobs hadn’t changed at all, and they were left with large pension shortfalls.

It’s hard for people to keep track of everything, huh?

Agree it’s hard to keep track but equality of pension age was a known thing since the 90s. There was a transitional period when changes were accelerated.

It’s a universal that no one communicates specifically and with enough notice to enable people to reflect and do appropriate research and reflect. I do not doubt DWP could have done more. Anyway not really on topic.

The GP nurses thing sounds terrible. Communication obligation on their succeeding employer?

@BBBobbins #16 “….. a material pension advantage over men.”

For information, when I divorced my wife having by that time moved out of the public sector after 20 years there, my public sector pension entitlement was divided under a standard pension sharing on divorce arrangement. This arrangement made an actuarial adjustment for life expectancy, resulting in my ex-wife receiving a lower share of the pension than I do.

@Onealo #5, @PhilosoFIRE #15, @TA #17 :

I’ve been trying get some clarity on transferring in to a PPA SIPP from a non-PPA scheme ever since this was announced in 2021! The Mrs & I got two Fidelity SIPP’s with 55 PPA and thier customer care always came back with the canned reply that they’re waiting for clarity on the legislation. There are some reddit UKPF discussions where people claim that Fidelity confirmed to them in writing that they have PPA for transfers in too.

Another pension provider’s view:

“If you joined before 4 November 2021, any pension pot transferred to us can be accessed from age 55 after 6 April 2028.”

https://thepeoplespension.co.uk/minimum-pension-age-change/

If anyone get confirmation about PPA from any of the providers, please update us. Cheers!

Thank you WinterMute. The People’s Pension guidance couldn’t be more clearly written. I’ll adjust the copy but with a necessary note of caution to check with your provider. My thanks to you and PhilosoFIRE.

I have some personal experience of this process as I have a company pension that I joined in 2000, one that included the normal pension age of 50. Access from 50 was preserved following the change to 55 in 2006, it also survived during a company-initiated block transfer completed a couple of years ago. I also transferred in a SIPP I had running alongside for a few years with no additional access conditions applied during the process.

It should be possible to do the same again for the latest change, it might also work for anyone who still holds a pension that also retained the normal pension age of 50 prior to 6th April 2006.

I only stumbled across the protected age a couple of years ago, contained in a footnote in one of the annual pension reports. It really was a gift as it enabled me to bring my FI plans forward considerably. Definitely worth checking out if you think it may be applicable to you.

RE:

“If you opened a SIPP with us or applied to transfer your pension to us before 4 November 2021 – you’ll benefit from the Protected Pension Age of 55. This applies to any transfers or contributions you made to your pension on/before 3 November 2021, as well any future contributions.”

For anyone who can face it, the relevant bit of the Finance Act is here: https://www.legislation.gov.uk/ukpga/2004/12/schedule/36/paragraph/23ZB

I can’t see how you could read Fidelity’s statement from 23ZB.

(4)Where—

(a)a recognised transfer is made on or after 4 November 2021 in execution of a request made before that date, and

So a request would be required before 4 Nov 2021, even if it hadn’t been actioned

I read through 22, 23, 23ZA as well and couldn’t see anything that would imply you could transfer now and gain age 55 access.

Which is a pity for me as I opened but never contributed to a Fidelity SIPP back in 2016.

@Dazzle – it’s a fair question, I don’t think the legislation’s especially clear. My reading is as follows:

Let’s imagine I’m a member of Scheme A, and before 4 Nov 2021 I had an unqualified right to take my benefits from age 55 (and the rules as at 11 Feb 2021 conferred that right).

Para 21 says that if para 23ZB applies, the relevant Part of the Finance Act 2004 has effect in relation to the member and the pension scheme as if references to normal minimum pension age (NMPA) were references to the member’s protected pension age (PPA). Note that this is referring to “the pension scheme”, not to a specifically identified set of benefits under the scheme.

Para 23ZB then says that it applies in relation to a scheme and a member of the scheme if the “entitlement condition” or the block transfer condition are met.

As we’ve stipulated that I’m a member of Scheme A, and before 4 Nov 2021 I had an unqualified right to take my benefits from age 55 and the rules of the scheme on 11 Feb 2021 included this right, I meet the “entitlement condition” under 23ZB(3).

The section you’ve flagged (23ZB(4)) is just an alternative way of meeting in the entitlement condition where I wasn’t yet a member of the scheme on 4 Nov 2021 at all but was en route there pursuant to a transfer request made before that date – effectively I’m deemed to have been a member on 4 Nov 2021 for the purposes of testing whether I satisfy the entitlement condition.

Importantly, both para 21 and 23ZB are described as applying to “the scheme” and “a member of the scheme”. I think this is what means that if you’ve got a PPA by meeting the entitlement condition in 23ZB, that PPA applies at the scheme level (as contrasted with the level of specific benefits – see below) and so should in principle apply to any benefits you take from that scheme, regardless of when you built them up or whether you added to them via a later transfer in. As far as that scheme is concerned, your NMPA simply is age 55 by virtue of section 21, so there’s no reason they can’t pay out any benefits to you once you’ve reached that age.

If the draftsperson had instead wanted 23ZB to apply only to benefits built up in Scheme A prior to 4 Nov 2021, rather than talking about “the scheme” they could have used alternative language in 23ZB like saying that the PPA applies to “sums or assets held in the scheme representing accrued rights under the scheme on 4 November 2021” (or something to that effect).

In fact, that’s exactly what they’ve done in 23ZC which applies if I were to take an individual transfer out of Scheme A to a receiving scheme without a PPA – in that case 23ZC(4) specifies that the PPA only applies in the receiving scheme to “the transferred sums or assets…representing accrued rights”, which is why you have to ring-fence those transferred rights in the receiving scheme to keep track of which benefits I can take from 55.

This all turns on some quite specific differences of language between sections, but on the face of things that seems to be how the legislation works. I agree it’s not as clear as it could be though, and hopefully HMRC will issue some more detailed guidance in due course so that people know where they stand.

As before, this is not legal advice and people should absolutely check with their individual provider to get confirmation of what they think before making any decisions.

So either withdraw enough funds in the window or wait until 57 (like everyone younger)?

Messy yes, but not exactly the end of the world!

Two days ago, Fidelity told me that they do not yet know if pensions without a PPA would acquire my Fidelity SIPP’s PPA if transferred into it. They said they are waiting for hear from regulators.

I am caught in exactly this position, turning 55 at the end of 2027, just a few months before the law change. I have already retired so this revelation has certainly affected my decumulation strategy. I have been in touch with my various SIPP providers to try and gain some clarity on this issue. I will post the various replies I receive as I get them.

This reply from Vanguard:

You are correct that there is in fact a quirk in the legislation.

To be clear the Vanguard Pension does not protect the retirement age at 55, so anyone who is 55 but not yet 57 come 6th April 28 will be limited in accessing their Pension.

When I say limited, you will not be able to access any further tax free cash from your Pension until you are 57 however you will be able to continue to take taxable income from a Drawdown pot.

For example if you had a Pension worth £100,000. You could access your 25% tax free cash at 55. This would leave £75,000 within the Pension but where it has been crystallised it would be within a Drawdown pot.

From this Drawdown pot you could continue to access taxable income even after the age increases to 57.

@ Ash – that’s awesome! Thank you for sharing. If you can continue to take the money from your drawdown pot then that solves the problem

@The Accumulator here’s the reply from Hargreaves Lansdown. Sounds like they don’t know!

I can confirm that the HL SIPP does not offer a protected retirement age.

Therefore, if you are under the age of 57 when the new rule comes in on 6 April 2028, you will need to wait until your 57th birthday before taking pension benefits.

People born between 6 April 1971 and 5 April 1973 may be caught in a transitional phase, possibly accessing their pensions at 55, but then losing access from 6 April 2028 until they reach age 57.

This reply from Legal & General. No consistency across the various replies.

At this point in time, we have not been provided with any information on what a transitional arrangement may look

like for members who may have accessed their pension at age 55 but are born within the period of 6 April 1971 and

5 April 1973.

We continue to engage with HMRC to seek clarification on the guidance that they have provided, which is subject to

change (and was changed only recently).

We will be communicating with our members to give them a definitive position on their NMPA position as soon as we

are able to do so.