After we all spent months anxiously awaiting the start of Rachel Reeves’ Budget 2025 speech, it was the Office for Budgetary Responsibility (OBR) that broke first.

Like a twitchy sprinter in the 100m who jumps the starter’s gun, the OBR went early and published its assessment of the budget – complete with most if not all of the contents of Reeves’ speech – more than half an hour before she got up to speak in the House of Commons.

Of course it was probably a computer glitch rather than sheer excitement on the OBR’s part. But where is the colour in that?

Either way, the unprecedented leak caused market-moving mayhem such as this for homebuilders:

Source: Google Finance

And this for UK gilts:

Source: Google Finance

The chancellor stood up just after 12.30pm. So you can see from the graphs when the details leaked – and the bungee jump that assets made on the news.

It’s curious to ponder why, say, builders moved like this.

One possibility is some naive trading algorithms responded to news of taxes on property, without taking into account other offsetting factors in the budget.

More likely though (or as well) is that these moves reflect trading entities caught offside by not expecting any news until 12.30pm, and then new money piling in on the leak overwhelming those prior strategic positions.

But I’m just speculating and I’m looking forward to reading more about it.

Hot takes on the budget 2025 announcements

Anyway, emboldened by the OBR, I’ll also not wait. Below are my first takes on the major points in the budget, unsullied by the opinions of others. (Well, not counting the last three month’s worth of pundit pontifications…)

I won’t go much into the economic and fiscal upgrades or downgrades.

But I will note that where the budget’s impact is disinflationary (such as reducing household energy bills) that should dampen inflation and gilt yields.

In turn that should bring down gilt yields – and by extension government borrowing costs. A good thing!

Timed to imperfection

In fact, this budget is arguably a missed opportunity to make deeper upfront moves to shore up the public finances, and so curb borrowing costs sooner.

“No one likes us and we don’t care,” sing Millwall fans. Given nobody currently likes Labour either, perhaps we might have seen bolder cuts and hikes.

Being tough now could have injected more life into the UK economy – not least through lower mortgage rates. That could even have seen Labour in a better position ahead of the next election, rather than seems likely with this dispiriting status quo.

Politically, however, both Reeves’ backbenchers and the electorate-at-large seem to have little patience for either welfare cuts or explicitly higher taxes.

Hence this stealthy muddle. And also a gilt market left to guesstimate how much of the back-ended higher revenues will actually materialise.

Why meeee?

Let’s also acknowledge it’s hard to cheer a tax rise that affects oneself. Or to be too viscerally concerned about benefit cuts for others.

Monevator readers are – like me – drawn from a certain slice of the population. Like most of you I don’t love the trajectory of public spending. I’d also prefer a focus on growth to get us out of the debt trap.

But realistically nothing in this budget will move the dial like the economic damage from Brexit, nor Reeves’ foolish decision to hike employers’ national insurance contributions in the last budget.

This budget is mostly just fiddling at the sides. It’s driven by politics and the kind of spreadsheet maths familiar to anyone who has ever tried to make a holiday rental property add up.

So from that perspective, here are my first takes on the most Monevator-adjacent bits. I look forward to reading yours below!

Note: bullet point summaries are from the budget document where possible.

Tax thresholds frozen for three more years until 2031

- The government is maintaining personal tax thresholds and the National Insurance contributions (NICs) secondary threshold from 2028 until 2031. And also the Plan 2 student loan repayment threshold from 2027-28 until 2029-30.

The showpiece tax generator. Reeves says is worth an extra £7.6bn a year by 2030 from income taxes alone. With NICs some £8.6bn by 2030-2031.

There are pros and cons, besides its tax-raising and political efficacy.

The biggest plus is it effectively postpones the pain versus a straight tax hike. Given the economy remains lacklustre at the moment, that’s no small thing.

For me the big negative is it’s stealthy and confusing. It also feels somehow more anti-aspirational than, say, increasing the basic rate of tax by 2p – even if it’s ultimately less costly to most taxpayers.

It’s also a strangely unprogressive move for a Labour government.

Millions more unspectacular earners will be paying higher-rate taxes by 2030. Indeed according to Hargreaves Lansdown over six million more people are paying income tax compared to 2021 when the freeze was first introduced. It says that’s worth an extra £89bn in income taxes a year.

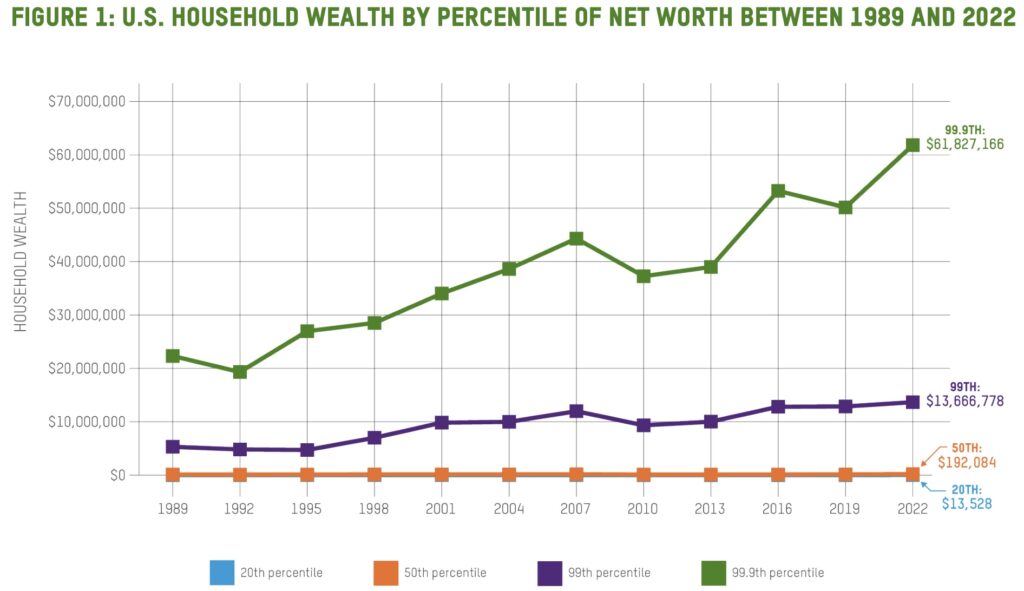

Broadening the taxpaying base doesn’t seem the worst thing in the world to me. We’ve all seen those graphs showing how most income tax is paid by the very highest earners.

Still, I’d rather see a comprehensive revamp and simplification of the whole tax regime.

Cash ISA allowance curtailed to £12,000 a year

- From 6 April 2027 the annual ISA cash limit will be set at £12,000, within the overall annual ISA limit of £20,000.

- Annual subscription limits will remain at £20,000 for ISAs, £4,000 for Lifetime ISAs and £9,000 for Junior ISAs and Child Trust Funds until 5 April 2031.

- Savers over the age of 65 will continue to be able to save up to £20,000 in a cash ISA each year.

At least there’s no silly Dad’s Army ISA. But this is still a needless complication that won’t do much to boost investment.

I haven’t seen the small print – and there will be plenty – as to how cash-like you can get in your non-cash ISA. If you can hold Money Market Funds or short-term gilts, then for Monevator readers this will be a nothing burger.

Years ago though there were rules against that sort of thing in stocks and shares ISAs, so we’ll have to wait and see. Nothing happening until 2027.

Interestingly, shares in wealth managers rose today. Optimistically you might think that’s because they’ll see more money coming from banks’ cash ISAs.

But maybe it just reflects how average punters will be yet more confused about ISAs, and so more likely to hand their money over to St James Place.

Anyway, as someone who has been explaining ISAs here and offline for nearly 20 years, I know this move will confuse people.

Talking of complications, there is talk of a new ‘simpler’ ISA to support home buyers. It will replace the Lifetime ISA. More to come in early 2026.

The High Value Council Tax Surcharge (aka Mansion tax)

- The government is introducing a High Value Council Tax Surcharge (HVCTS) in England for residential properties worth £2 million or more, from April 2028.

- This charge will be based on updated valuations to identify properties above the threshold. It will be in addition to existing Council Tax.

- New charges start at £2,500 per year, rising to £7,500 per year for properties valued above £5 million.

- It will be levied on property owners rather than occupiers.

I suppose it could have been worse. The government says fewer than 1% of properties will affected.

Otherwise, after many months of speculation about such a measure – which has already slowed the property market – we’re all familiar with the arguments.

The main pro, if you believe in this kind of thing, is it taxes wealth that is growing disproportionately at the high end versus the general population.

The cons are multiple. The cost and faff of valuation, the cliff edge introduced and likely shenanigans around it, the difference between asset-rich and having the cashflow to pay a surcharge, and the arbitrariness of hitting property.

On at least the latter point – I’ll live.

The tax system is riddled with cliff edges and arbitrary measures. I spent 20 years as a renter who invested my money instead – with a limited annual tax-free sheltering capacity – while friends made six or even seven-figure sums tax-free from their homes. Meanwhile I paid capital gains tax on relatively modest unsheltered share gains.

Also, UK homes are in limited supply and, as just stated, gains on your own home have hitherto been tax-free. So there’s an argument UK property is a special case worthy of a wealth tax. This in addition to the practical fact that a house can’t go anywhere!

On the other hand, people will rightly fear this could be the thin end of the edge, as we saw with dividend taxes (see below).

Once the medicine has been swallowed, who’s to say a chancellor won’t eye up homes worth over £1m next? In much of London that doesn’t get you anything beyond a 900 sq ft Victorian terrace or a nice flat. Hardly a mansion.

At least we won’t have issue of prices shooting up above the £2m threshold for a while. The property market has been going backwards in real terms in the South East for over a decade. This is hardly going to spark a revival.

Salary sacrifice curbed to £2,000 limit

- The government is to limit the value of salary sacrificed pension contributions that can receive employee and employer NICs relief to £2,000 per year from 6 April 2029

I liked Finumus‘ initial take: “Now I know my retirement date.”

As a site that promotes self-reliant saving and investment, there’s no way Monevator can applaud this move.

Something immediately attractive – an income today – was being traded for future security – a pension.

Isn’t that what the government wants to encourage? Remember there are other restrictions on pension contributions and the like, to curb any alleged excesses.

Thus it looks like a short-term tax grab aimed at relatively wealthy workers. Politically understandable but yet another example of moving the goalposts and fostering a fundamentally unstable and hard-to-track savings regime.

I do not commend it to the house.

Dividend tax, property, and savings tax hiked

The government is:

- Creating separate tax rates for property income. From April 2027, the property basic rate will be 22%, the property higher rate will be 42%, and the property additional rate will be 47%.

- Increasing the ordinary and upper rates of tax on dividend income by 2 percentage points from April 2026. There is no change to the dividend additional rate.

- Increasing the tax rate on savings income by 2 percentage points across all bands from April 2027.

I don’t see anything to like about the dividend and savings rate increases. But I would say that, wouldn’t I? The only mitigation is the £20,000 ISA allowance remains intact. So for a lot of people most of their savings should be sheltered.

Still, the way dividend taxes were hiked years ago and an initial and relatively low dividend allowance slowly whittled away has been insidious. I used to write a lot about this, as I knew of people with large unsheltered portfolios who had eschewed using ISAs and SIPPS when they had a chance.

That’s the trouble with rules changing under your feet. But I suppose the bulk of that generation has passed away by now.

Another issue with dividend taxes is it effects those operating through limited companies. Again, little love from the mainstream for such people, but it all reflects a climate in which entrepreneurialism or running a small business is less attractive than it was a couple of decades ago. Is that what we want?

As for property, there’s only so much coshing the rental sector can take.

Two-child benefit cap scrapped

- The two-child limit in the Universal Credit Child Element will be removed from April 2026.

Clearly one for the Labour party faithful. But I do find it hard to get worked up about this. In fact on balance I think I probably support it.

Yes, I understand the argument that, effectively, middle-class strivers are paying for other people’s feckless decision to have more kids. I linked to a Telegraph article last week that directly correlated lower incomes with larger family sizes via a striking graph.

But let’s be honest, middle-class families could have more children if they wanted to. That’s provided they were prepared to live more like a family on benefits, in a crappier part of town, in insecure or council-owned property, and with a lower standard of living. Perhaps not for the marginal edge cases, but certainly for most Telegraph readers.

No, they don’t have more kids because they don’t want them nor the lifestyle impact of paying for bringing up larger broods in the manner they’ve become accustomed to. I totally understand that too – I have no children, and it’s no accident – but let’s not pretend the decision turns on an extra £17.25 a week.

And perhaps it is true that throwing more money at poorer large families could deliver a return for society, if it means better educational outcomes and more productive workers 18 years hence.

One thing is certain – the only person who doesn’t have a voice in all this is the third or fourth kid in that large poor family.

If extra benefit helps the helpless achieve better life outcomes, then isn’t that what a welfare state should be for?

Fiddling while Reading burns

Whether these relatively modest moves warranted the three months of will-she, won’t-she debate we lived through is – ahem – debatable.

We’ve had prime ministers that were in and and office in much less time than we’ve kicked all this around.

On that point though, some good news! We’ll only have one ‘fiscal event’ trigger a year going forward.

From Reuters:

Britain’s Office for Budget Responsibility will check if the government is meeting its budget rules once a year instead of twice, it said on Wednesday, according to its outlook unexpectedly published ahead of finance minister Rachel Reeves delivering her budget.

The OBR will continue to publish two sets of forecasts annually to accompany the government’s spring and autumn fiscal statements.

But, they will now only look once per year at whether the finance minister is on course to meet her targets for the public finances.

The International Monetary Fund had recommended that the OBR assess the government’s progress towards its fiscal rules only once a year to reduce speculation about what measures might be needed to stay on track.

You might argue this amounts to less oversight on the government.

But watching the forecasts oscillate about and, again, the endless speculation about what might be done in response has not been edifying. Nor, I’d argue, has it been good for businesses, households, or the economy writ large.

Hence I’m all for this change.

And there’s more…

For the rest of the budget details, check out summaries from:

You want to know the nerdiest details about capital spending allowances for widget makers or whatnot?

- Read the official budget document via the Gov.UK website

I look forward to your groans and hurrahs (only joking) in the comments. Please let’s keep the discussion as constructive as possible. 🙂

Re the dropping two child benefit cap

> In fact on balance I think I probably support it.

I admire your beautiful soul, sir. The Ermine heart of darkness couldn’t quite get there. But hey, leastways I’m not paying 2% more income tax rate for this largesse

No changes to CGT as far as I can see. Not so much of a hurrah for that, but a ‘phew’ of relief.

what’s your take on taxing electric and plugin vehicles? thought we wanted to be green country….

Dropping the two child benefit cap is actually nothing to do with child benefit, which is odd as it’s always phrased that way across the media.

It’s actually to do with the two child limit in universal credit which is effectively an extra £292.81 per month for each additional child. So much more significant than the £17.25 a week child benefit we are more familiar with in these parts.

There are overall benefits caps in place that also vary based on any disabilities etc, so it’s not a simple case of large families making bank. However it’s easier to see how it can hopefully bring 450k children out of poverty, when we are actually talking about £1000s a year extra in the pocket of some of the poorest families in the country.

I would have preferred the 2p on income tax even though it would have almost certainly been worse financially for me. Fiddling around with pensions, savings and taxes involving house prices seems so much stress and admin, versus receiving a slightly smaller amount each payday.

@Darren #4 in all fairness TI phrased this exactly right

> The two-child limit in the Universal Credit Child Element will be removed from April 2026

and I summarised it badly, because grr…

@ermine #6 I’m not so sure, the mention of £17.25 a week in the body of the section is what triggered my alarm bells.

Our company pension changed to Salary Sacrifice last year (whole thing, not just AVC), so that’ll all change again soon. Sure the HR team will be miffed

I echo Finimus’s assessment.

Great podcast here from the IFS that explores the case for and against scrapping the two child benefit cap: https://www.youtube.com/watch?v=PSSEifz6q7o

It helped me understand how complex the issues are, well worth a listen.

+1 Darren’s comment

I’m with Jon B. The faff and stress and admin parts – I really loathe that stuff. The extra 2% on property income (combined with the renters’ rights act) has made me decide not to rent out my empty property. The amount I’ll get after agent’s fees and tax isn’t worth the stress and the risk of the cost of an eviction if required especially if the court backlogs get worse. I’d say it’s only worth if for people with multiple properties now.

There will be added faff associated with having separate cash and S+S ISAs, especially when it comes to transferring previous years inputs.

And once I’ve got my next (and hopefully last) mortgage, I plan to drop a day or two a week of work because I get paid a lot less on Friday than I do on the other four days (and this will only get worse for even more years now). I’d rather have my free time now for that amount of lost money.

I’m intrigued by your joke about holiday rentals. I did look into this recently but didn’t get as far as a spreadsheet as I couldn’t find anyone who had achieved much more than breaking even with it. I didn’t find any good articles on the subject either. Just saying…

I doubt the salary sacrifice changes will ever see the light of day. No implementation for well over 3 years and a nightmare to administer.

They will instead deliver the 2028 budget announcing a scrap of the policy and applauding themselves on the future tax saving for all.

A whole lot of fiddling and kicking into the long grass, still no real vision from the Government. But I’ll take it over something worse – net impact to me rounds to £0, aside from the slow bleed of long-frozen threshold. If the spending helps with investment, growth, productivity, and/or alleviating dire poverty, that’s all good for the country, although I’m sceptical about any big positive impacts.

Agree with Alex, dreaming of a holiday rental via a spreadsheet sounds more fun than analysing a fiddly mess of a budget.

Over on Propegator I had told @TI that at least they couldn’t make life worse in the Budget for London landlords (prime central gross yields 2.4-2.5%, adjusted gross 1.7-2%, net pretax 1-1.5%, after tax 0.5-1%).

I was wrong.

2% extra IT and upto £7,500 extra p.a. to find as a ‘mansion tax’ (hello to wealth taxes all).

Whether this is a good or a bad thing, it is a thing. I can’t see this helping the parlous state of the central London market.

Today felt like an intergeum. Next year, after the local election fallout, it will probably not be RR at the dispatch box delivering the 2026 Finance Bill, Sir Kier as PM, or Badenoch for His Majesty’s Loyal Opposition. And I doubt anything today much alters the odds of Farage entering No. 10 in 2029.

Guess the 2% increments to IT for savings and property income is a softening up option to raise BR, HR and AR on earned income by at least 2% IDC.

At least the 2% rise in dividend income rates for IT purposes has some rational basis in a partial equalisation with earned income (and not creating, as with property and savings now, an excess rate, akin to the – admittedly much higher – unearned income surcharge rates Labour brought in the 1970s).

The whole thing seems to be a non-event…

Generous ISA and pension allowances remain. We only contribute to pensions from the 40% or 45% tax band, so the salary sacrifice limit changes little – either 2% NI on top now, or nothing at all.

Am I missing something?

(Employers always pocket their NI savings from salary sacrifice, in my partner’s experience and mine.)

More tax on EVs is probably inevitable, given the probable reduction in tax on combustion cars from road tax and fuel duty (wonder how it compares to tax on electricity per mile). However, a tax per mile? Seems like more admin overhead when they could’ve just done a flat £200 a year or fixed amount based upon original purchase price etc.

No doubt there’s some optimum of lease an EV via a salary sacrifice scheme but then drive your ICE vehicle.

I’ve already asked this question over on Ermine’s SLIS blog, but I’m now also doing so here for any further insight.

From the Budget Red Book:

“Ordering of income tax reliefs and allowances – The government is changing income tax rules so that reliefs and allowances deductible at steps 2 and 3 of the income tax calculation will only be applied to property, savings and dividend income after they have been applied to other sources of income. This will be legislated for in Finance Bill 2025-26 and take effect from 6 April 2027.”

Any thoughts on the meaning and implications of this? Is it to remove a believed current taxpayer discretion to apply reliefs to income in a different order to the conventional one used by HMRC, as suggested by Al Cam over at SLIS?

The context is, of course, the 2% increase in tax on interest and property income (from 2027) and on dividends (from 2026).

Oh, and on the EV thing:

Using a cost of electricity of 26 p per kWh (although many have a tariff that makes this much much cheaper), my car costs about 6 p per mile to run. So proportionately speaking, an additional 3 p per mile is a lot. Then add the new vehicle tax for EVs. The trade off for the higher purchase price of an EV was the cheaper running costs. How long before government takes so much that it isn’t worth it? (Although I suspect prices of new cars will start to fall sooner or later.)

I will also be penalised for living in a rural area as public transport to work is just not an option (that argument always comes up when pay per mile is discussed).

I recall reading somewhere that the average EV does more miles per week than the average petrol car, the implication being that they were more likely to be purchased by regular commuters.

Make of all that what you will, but I will certainly be looking carefully at the numbers when it comes to replacing this car. I think it would be a terrible shame if taxes caused a reversal in the take up of EVs.

Excellent summary. But tbh, not much to summarise. So much noise for such a damp squib. Was that really worth knocking elements of the economy into neutral during Q3 while this hapless shower soft market tested opinion through endless leaks and u-turns? Can they really be the best of a bad bunch? Terrifyingly and almost unbelievably, quite possibly. _Sigh_

Re: Holiday rental spreadsheets…

…perhaps my joke didn’t land properly, but this is what I meant. You start inserting things like “I’ll rent it out for six weeks in peak summer” and playing with the rates, and assuming you can take two years off your depreciation schedule or whatnot, all to spit out your desired number at the end. (I could have inserted any number of spreadsheet modelling antics here I suppose… see discounted cashflow valuations, for example 😉 )

Re: the two child matter (see what I did there 😉 ) I am all for readers who know more getting into the weeds, cheers! I’ll excuse my incomplete knowledge on the several degrees of separation from me and raising children… 😉

Will try to heck out the podcast!

Thanks for the super quick write up TI. If it’s of interest, I’ve added a ‘2029 mode’ toggle to the salary sacrifice/pension section of my salary calculator. The Jury is out on exactly how HMRC plan on implementing this, so I’ve applied some creative thinking to how I think it’ll be done, indexing on fairness.

https://salarytools.co.uk/salary-calculator

Another “fiddling while Rome burns” type of budget. How many is that now?

The most interesting part of this budget is the political angle. The pain on the taxpayer is being heavily backloaded. That’s the opposite of what a political party would typically do. No attempt at applying pain now to create a large warchest into the next election.

Implies that Starmer/Reeves are now so fearful of a challenge post local elections that the next election in 2029 is not even part of their strategic thinking. Just survive for the next 12 months. Hope that the economy improves enough by 28/29 that not applying these deferred tax rises will be considered a win by the electorate?

Hope is not a good strategy.

This was a very useful summary, thank you.

RR’s last budget. The government (aka Starmer) will soon foresee a need for a reset if it/he is to survive and RR will be shifted out. She lacks presence and is no figurehead.

As for the budget,what about growth, reskilling, education…

Grubby, low brow, petty, ineffective, a word salad. Just about sums up our ruling class.

Still, didn’t cost me much money.

At the election we were offered a return to growth lead by serious politicians. Where are the promised adults in the room? This is the end of any hopes of KRS taking on the mantle of Blair. Reeves has shown her true Brownian colours by extending the scope of the client state. If it does anything this budget rolls the pitch for the return of Ed Milliband, heaven help us all.

Seems pretty dull and uncreative all round. I think ZXSpectrum48k is on the money – this was likely the last chance to make a decent go at making some proper changes and they’ve wimped out of it.

re the frozen tax bands – by 28/29 will we see enough people stopping at the cliff edges of the marginal rates from childcare/losing tax-free allowance that they finally change or eliminate those? Present situation already seems a bit ridiculous, see e.g, https://taxpolicy.org.uk/2025/11/12/the-budget-2025-tax-calculator/ and https://taxpolicy.org.uk/wp-content/uploads/2025/11/Picture-1-2-scaled.png

The new International Student Levy is barely registering in the mainstream media, but it is a significant, unwelcome, and strangely counter-intuitive move, given that much of the HE sector is very visibly financially sick. Following up that punch in the gut, the cap on NIC relief for salary sacrifice will serve as a cheeky upper-cut to the chin, affecting salaries from c. £33K where I work, which is hardly a fortune these days. That said, some of my colleagues won’t have jobs next year, so they will have more pressing concerns.

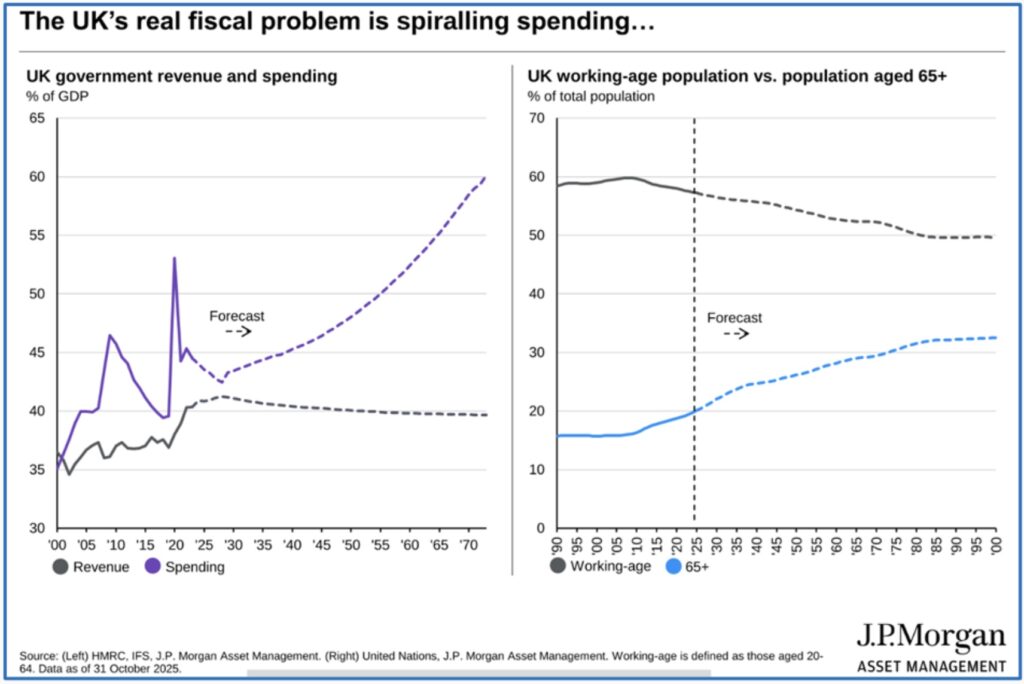

A lot of talk about helping reduce inflation in order to reduce borrowing costs, but the reality is most of the tax rises are some point in the future while extra spending starts straight away. The fiscal rules are a bit of a joke, they made sense coming out of the Great Recession but now governments are gaming them for political purposes. The bond markets see right through it, hence the UK’s higher borrowing costs compared to other countries.

Regards extra landlord income taxes, these are only for landlords owning property in their own names, ie not those owned in a limited company. It means the tax intake is short term and will reduce over time as old rental properties are sold and new ones are bought in limited companies. The logic the government used to increase the tax (ie tenants shouldn’t be paying more income tax than their landlords) was incoherent given they’re not increasing tax for limited companies. There’s also the slight problem that most of the tax will just get passed on (indirectly through reduced supply) to tenants – do Labour really want to effectively tax tenants more? Seems a bit daft, a bit like taxing supermarkets more and being surprised when food costs increase.

Overall I was disappointed by the budget. The chancellor could have been much bolder, eg completely reform council tax for example, reduce stamp duty to get the housing market moving, sort out the income tax cliff edges, make CGT inflation linked, and so on and so on. I had high hopes for this Labour government but they are running out of time and this budget isn’t going to improve their fortunes in my view.

All rather passed this ancient (79) pensioner by -they even left my ISA allowance intact-useful as I use instant access cash ISAs as my cash flow buffer

Is it because we oldies always turn out to vote?

xxd09

Overcomplex and underambitious. Will create public sector jobs to process the added complexity and extra consulting contracts for the big 4 firms to badly design the stuff that hasn’t been worked out yet. What is the time interval between sacking a Chancellor and then the PM resigning/being pushed out?

The Westminster talent pool looks to be empty right now. It only took 9.7M votes to get this lot in with a thumping majority out of a UK population of 60M? Happy that CGT was left alone this time.

The vehicle tax regime is crying out to be simplified to a universal one on weight. Not CO2 bssed, not if it cost over £40k for 5 years (VAT is already paid ), not if it is a EV costing under £37k (subsidy but not even linked to the £40k existing ‘luxury, figure), not fuel duty for ICE and Hybrid, not ppm charge for hybrid and EV (driven abroad!!). The complexity is madness. Also introduce an annual digital vignette to drive on UK motorways for foreign registered vehicles. Fine payable at the port on exit if you don’t have one.

The productivity strategy was conspicuously missing, unless “closing your eyes and wishing really really hard” now counts as a supply-side reform.

On the child-related measures, we’re talking about it as if the money goes to the children. It doesn’t. The transfer is to adults, and outcomes depend (inconveniently) on the adults.

I’m not denying that some kids are going to school hungry. I’m saying many of them do so while the mother weighs 15 stone. The issue isn’t just the absence of money but also the use of it. As a friend in social work put it, parents who don’t notice their kid’s shoes no longer fit are rarely transformed by an extra few quid. For some families the extra money will help; for others, nothing will change except the mum will get a better phone.

Many years ago I travelled through southern Africa (South Africa, Zambia, Namibia, Botswana). These countries were obviously very poor, yet the children were immaculately turned out. I suspect their families lived on far less than Universal Credit, with both parents working and none of the protections or services we take for granted. The difference was the seriousness with which people took the responsibilities that came with being a parent.

Some sharp eyes have already spotted that there is a commitment to increase the council tax surcharge every year in line with inflation (CPI, not house prices)

But there’s no indication the thresholds will see the same treatment…

Toxic combination given the house price growth environment.

@xxd09

I think it’s more a recognition that your annual force of mortality is greater than the Equity Risk Premium!

@Wephay 27

I don’t think this labour Govt have the mandate for any of that…or even the nous. They’re hanging on for dear life and desperately need an ex Deus machina to dig them out. They’re very much in a ” do no harm” situation.

I admire your optimism for having “high hopes’ for a labour government though. I thought that was a rite of passage for a younger cohort that one generally grows out of.

There’s an article in the FT this morning about how the salary threshold for student loan repayments will converge with the minimum wage by 2030.

I can only assume that either these policies have not been thought through properly or that Labour already acccept they won’t get another term.

I can’t get my head around the complexity of stopping £20k being put into a S&S ISA and then a transfer request being made to move it to a cash ISA. Currently as the financial service accepting the inbound transfer I don’t believe you know or care about the history of the money that’s being transferred to you.

If I was a risk averse financial service provider, and I have liability for checking, perhaps I just block all inbound transfers from S&S ISAs. That would create an interesting market for a “laundering” cash ISA provider that would accept S&S ISA transfers before you bounce to the cash ISA provider you actually want.

Is there a potential to reduce S&S ISAs by incentivising moving all ISAs to cash before this is implemented to “clear the slate”?

“Employers always pocket their NI savings from salary sacrifice, in my partner’s experience and mine.)” – This isn’t my experience, my employer pays the full 15% employer NI into my pension, so this is a big change for me, hence my comment about retirement. My marginal tax rate on pension extraction is going to be 40/45% anyway (maybe more?) – so without the NI kickback there’s no point making contributions. Currently the kickback effectively reduces the tax rate on my top slice of income by about 10%, which is around the margin at which it’s not worth it anymore (thus my comment about retirement).

Overall I’m (again) disappointed that they’ve not used their large majority to significantly overhaul the whole tax system, to make it simpler, fairer, and more growth incentivisisng. I guess that ship has sailed now.

And naturally I agree with @TI on the two-child benefit cap, although this is a highly controversial view in my real world social circle!

I have no skin in this game but the Student Loan changes seem very under reported and potentially damaging for Labour. They were originally conceived as having an interest rate more or less the same as RPI meaning that depending on your income they behaved like an interim tax increase while the loan was paid off. With the higher interest rate there will be large numbers of people who earn enough to pay the effective tax but are never able to pay back the principle (growing with compound interest faster than inflation) condemning them to punitively high tax rates for their whole working life. This is regressive (higher earners / people with wealthy parents pay back the loan quicker), a significant disincentive to working and generationally unfair. I am not part of it but I can’t believe Labour’s core electoral base in the public sector and university towns are going to be furious when they realise what the budget has done.

It looks like the Lifetime ISA is also seeing its death. It will be interesting to see what closure options they unveil.

If they allow a 20% penalty and transfers to regular ISAs I’ll be happy, which would seem only fair since the £4K allowance was never on top of the £20K overall ISA allowance.

@Finimus:

Re: “Currently the kickback effectively reduces the tax rate on my top slice of income by about 10%, which is around the margin at which it’s not worth it anymore (thus my comment about retirement).”

Yup, as discussed before, that is the calculus that really matters. It is also the reason why all the noise about tax foregone in pensions relief is IMO largely a load of nonsense*. I suspect a lot of folks do not get it yet though. Time for another post on the subject?

*especially for early retirees/pension takers who might have got tax relief for say some 30 years but pay tax for more years as a pensioner!

@Finumus. Yep, my ex-employer gave us the employer NI saving too. Made salary sacrifice a bit of a bonanza….money for nothing. I agreed with lifting the 2 child cap too.

Labour don’t have an effective large majority owing to the divisions in their party.

“I haven’t seen the small print – and there will be plenty – as to how cash-like you can get in your non-cash ISA. If you can hold Money Market Funds or short-term gilts, then for Monevator readers this will be a nothing burger.”

You can already hold ERNS, CSH2, and gilts of any term in S&S ISAs – I do (AJBell) . I can’t see them forcing holders to switch out.

This creates a real opportunity for providers to market an S&S but effectively cash ISA taking 20k.

@Graybear — Yes you can. The point is they might be banned as investments in stocks and shares ISAs in the future, under this new regime. In the past you couldn’t hold cash-like instruments in a shares ISA (including e.g. bonds with less than five years to run) IIRC.

Turns out that ‘VCT reform’ includes cutting the upfront tax relief from 30% to 20%:

https://www.trustnet.com/news/13464410/utterly-nonsensical-and-stupid-vct-tax-relief-cut-clouds-chancellors-growth-message

I think some of the expenditure numbers are interesting. OBR assumes pensioner spending rising from £151bn in 24/25 to 195bn in 30/31, basically 30% higher in 6 years. Disability benefits from £41bn to £65bn, up 59% over the same period. Yet child benefit from £13.1bn to 13.9bn, up just 6%, even 2 child cap being removed. It’s not the kids who are costing the money!

I’m not sure that logic re: pensions really holds. Even without the NI kickback, pensions still have a clear advantage: you defer tax on everything — the income going in, and all the compounding inside the wrapper. Dividends, interest, realised gains when rebalancing… none of it is taxed until you actually draw the benefits.

In a GIA you crystallise gains every time you shift allocations and you pay tax on distributions in real time. That’s cash leakage now, and the drag adds up.

So the idea that “there’s no point contributing anymore” feels a bit melodramatic. Losing the employer NI uplift is annoying, yes, but it doesn’t suddenly make taxable accounts more efficient than a SIPP for retirement saving.

Looks like the gilt market, currency market(GBPUSD) and stock market don’t seem too fazed by the budget – in fact they seem to have taken it quite well – so far at least.

I’ve not seen the financial affect on families of the removal of the two child universal credit benefit limit explained clearly anywhere, although Darren above is broadly correct. I’ll oversimplify a bit to keep it simple

Universal credit (UC) is a welfare benefit for working age households who have less than £16,000 in savings and have low incomes.

There is a standard amount of UC to which is added additional elements for housing, disability, childcare and most relevant here responsibility for children. At the moment that additional child allowance is normally capped at two children. And it is this two child limit is being removed.

Child benefit is currently paid for the third and subsequent child and this is not changing.

If the household income is less than the standard amount of UC plus these additional allowances, then the universal credit paid equals the standard amount plus these additional elements.

If the household income is more than the standard amount plus additional allowances then for each £1 that income exceeds the standard and additional allowances, £0.55 of universal credit is taken (tapered) away until UC reduces to zero.

The additional child element in UC is currently £292.81 per month.

So someone, with more than 2 children, currently earning just below the amount needed to qualify for any UC at all will typically get an extra £30 per week for the third child (= 292.81 x 0.45 x 12/52) and £30 per week for the fourth child etc.

Someone with more than 2 children currently earning below the standard amount plus additional allowances will get an extra £68 per week for the third and subsequent child (= 292.81 x 12/52).

If their combined employed income is less than £846 per month and they are in the relatively small number affected by the overall benefit cap (set vaguely with reference to median household earnings) then they may not benefit from this change as the overall benefit cap still bites.

If the change means someone qualifies for UC when they didn’t previously, then they qualify for an amount of UC of less than £30 per week depending on how close they are currently to the cut off.

Clearly there are other scenarios here. But we are talking about an extra amount of UC or new UC of up to £68 per week per third and subsequent children, but typically nearer £30 per week per third and subsequent child.

It would be good if there was some data showing the mathematical distribution of extra UC payable but I’m not aware of any such thing existing.

I volunteered for 12 years for a charity who amongst other things gave welfare benefits advice. The typical person we advised on universal credit and affected by the two child limit would be a working person on a low income, or someone who had been a worker but where someone in the family had now been affected by ill health. They might have given up work to become the carer of that person.

When you see the circumstances of claimants from first hand, you fail to understand the stereotypes created by people who have never had that first hand experience. I’m sure there are some people gaming the system or making fraudulent claims but they didn’t seem to come in to us for advice.

Not surprisingly I agree this is a good change

As others have said so much of this is delayed to the end of this Parliament on the hope that growth will pick up – but there’s virtually nothing in the budget supporting growth that I’ve seen at headline level.

Hitting universities with an international student levy is stupid in the extreme – the majority of the sector 80% has had redundancies over the last two years and are ongoing. Hitting students loans further another bad idea.

I think I’m correct in saying that thresholds were first frozen in 2021 so that will be a decade with RR announcement yesterday – imagine the howls if we were to do that for the state pension – instead it stays on a ridiculous escalator.

+1 to what Snowman said.

I had previously commented “meh” and I suppose TI deleted it. Perhaps I should expand on it. The budget is “meh” because once again the can is kicked down the road.

Without meaningful tax reform, one can only tinker around the edges. Each tinker adds more complexity and makes the tax system less sustainable. Each tinker adds edge-cases, weird effects and potential loopholes and complications cf the ISA and pension SS changes.

Those changes are an administrative headache. They’ll take ages and cost lots of money to implement.

In the long-run, everyone will agree that they are an unnecessary complication and should be removed see Innovative Finance ISA or the LTA. Sure, the changes might be around for 5/10 years, maybe even longer. But I doubt in the grand scheme of things any of the measures will move the needle in the long-term (even the two child cap has barely made it past 10 years for example).

For me, there’s little much to say on the budget. Maybe I was being facetious with my ‘one word’ comment. But I feel like this budget is hardly worth many more words.

Just wanted to critique the article. But some very good comments from the commenters.

You mentioned the problem of ‘cliff edges’. These numbers are pretty arbitary in the tax code. I agree they’re arbitary and could be more ‘scientific’. But they had to pick some round number in the end. If you have a £2m pound house, the budget is basically irrelevant anyway. You’ve already ‘exited’ the game. You probably started the game as a winner and a private education.

The thing on dividends. And I say this as a former IR35. Corp taxecuts and various allowances have cut the tax rate by effective 50-60% over 50 years. No boost in investment from biz. They just pay more divs. So you might as well tax it if they wont invest or hire. Obviously some morons will say, we need to cut corp taxes/increase writeoffs even more to ‘encouarage growth’ (of where? Which country? Monaco?)….tax divs is fine. God knows our beloved rulers wont let you really go near trusts.

Maybe small businesses should get a lower corp rate.

No other criticisms. New subscriber.

Haha. While i was typing i thought about Sir Jim at Man U. beloved Sir Jim. Wants subsidies for his remortgaged chem biz and his remortgaged football club. Doesn’t want to admit remortgaging to become a billionaire has a price.

Well, he wants us to pay the price.

Pays divs for 25 years. Limited liability shield/bailout if the remortgaging gimick doesnt work out.

We need more mon–ehhh! You know, some of that internet money!

@Finumus – makes sense. For us, higher-rate relief plus tax-free compounding plus 25% tax-free payout is good enough to compensate for the political risks with pensions.

It seems to be the exception that employers pass their NI savings from salary sacrifice to the employees. We tried on a few occasions and it was always a resounding NO from HR who’d rather offer a higher base salary. Presumably because the NI wheeze is a non-standard process that means extra work (the horror!).

According to Perplexity there are no direct statistics about how UK employers handle this, and “A UK government‑commissioned qualitative study on employers’ attitudes and behaviours towards salary sacrifice for pensions reports that most participating employers did not explicitly use their employer NI savings from salary sacrifice to enhance pension contributions.”

Also, interestingly only “roughly half of UK private‑sector employers now offer pension salary sacrifice”. So the 2k cap levels the playing field for all those who don’t have the privilege anyway.

Hard to be civil about this budget. A desperate chancellor trying to keep their head above water, without any vision or strategy guiding them. Nothing for growth or productivity or investment. No ideas to reign in public spending. Stealth instead of honesty. Aspiration and diligence punished. More complexity added to the tax code instead of radical simplification. Disappointing, must try harder. Grade: D-

(Oh, and the 47% tax rate on savings interest, should be a crime punishable by firing squad, in an ideal world.)

Just FYI I did a much better job of the budget, according to the guardian budget game.

Tax thresholds frozen for three more years until 2031

Ouch. Could be worse though. I’d suggest taxing everyone at 25% from the first pound to the last. Easier to understand for everyone, harder to dodge, incentive to earn more = work harder = be more productive = higher GDP. *disclaimer – I’ve chosen 25% as number, but am not committed to it.

Cash ISA allowance curtailed to £12,000 a year

What the hell is this all about. This complicates things, and may discourage saving. How about going full throttle and scrapping cash isas only and encouraging more S&S isas.

The High Value Council Tax Surcharge (aka Mansion tax)

Seems shady. I know a large number of people with houses nearing this £2m, who are asset rich and cash poor. Also don’t forget all the optimists who took massive mortgages at joke rates a few years ago and are consequently struggling. And as said it’ll probably drop down to lower values eventually. This is a London/south east tax.

Salary sacrifice curbed to £2,000 limit

As someone who doesn’t work for a company progressive enough to offer and salary sacrifice I don’t have much of an opinion on this, but having done a little reading the cost to employees is not great. Seems like more hassle than its worth though.

Dividend tax, property, and savings tax hiked

Tax on savings is criminal in my opinion.

I’m surprised at the lack of concern for what comes next. This budget could have been in a email. What matters is what it sets up next.

At any point there are two questions to usefully ask:

– What are the rules of the game? Ergodic (Gaussian) or non-ergodic (power law distribution or Russian roulette)?

– How can I aim for where the puck is going to be? (As Wayne Gretzky put it)

Nothing yesterday helps with the first question.

But we have been given a useful update yesterday to our priors on the second one, i.e.:

– We now have a defacto (for property, for the time being) wealth tax.

– We now have full ‘differential geometry’ within the IT rates between earnt income, property income, savings income and dividend income (as opposed to previously, when it was just a distinction between the first and last).

– We now know that RR is not capable of putting in place a budget to promote growth, to reduce benefits spending, to avoid an unacceptable (to backbenchers) outcome in next year’s local government elections, or to put Labour in a position to win the GE in 2029.

Therefore, the issue now is what will a government led by (or having significant involvement from) Burnham, Milliband or Rayner do in the budgets in 2026, 2027 and in 2028 (the last one before Farage)?

I think we can already see an outline.

Red meat has been thrown to the backbenchers in the mansion tax and the additional rate on savings.

It won’t keep the wolves from the sleight.

But it does roll the ground for tax policy for a further left of centre near future front bench.

It was a bit of a nothing burger from a personal impact perspective. Agree with Sparschwein that “It seems to be the exception that employers pass their NI savings from salary sacrifice to the employees”.

Out of 3 employers that had salary sacrifice pensions two of them passed on nothing and one put just under half of their NI savings in.

I will likely retire by 2029, and while a 2% NI saving is insignificant and the bulk of my pension contributions are from the 40% band , it is nice to have the option of SSing even more.

I certainly wouldn’t SS under £50k income if only getting 20% tax relief instead of 28%.

I know some colleagues near retirement who SS right down to the minimum wage, and treat it as a kind of sport or duty to deprive Labour and the International Welfare State industrial complex.

Anyway, 2029 is far enough out to not matter. It is younger people who should be incensed about this. No wonder so many are considering emigrating.

@SP “I know some colleagues near retirement who SS right down to the minimum wage, and treat it as a kind of sport” – haha yes that was me for many years, but I was one of the lucky few getting full employer NIC kickback. My marginal tax rate was about 4%

“No wonder so many are considering emigrating.” – but question is where? Is there an obvious answer? US is mad, but pays well. Dubai no tax but leave any morals at the door. Europe, better weather perhaps but otherwise same old problems as us? Australasia, well you’re never seeing your family again as it’s so bloody far.

Have been asking every LLM I can why the disparity between dividend, income, CGT, property and interest tax rates. None of them know. Is there a reason why you shouldn’t just make them all 20% then 40% and be done with it. Mega simple.

Yep 20% 40% nothing more progressive than that. General principle that you never have to give up more than 50%. Same across the board for all income types. HRT kicks in at 2x median salary. Job done. Rhino for exchequer.

Salary sacrifice used to be a special arrangement for a handful of employees who were highly motivated to cut their tax and NI bills. I was one of them, in fact the only one at the whole company where I worked. My employer and I shared the NI saving 50:50.

I think many more employers now offer this benefit at standard. I also know one large company which has restructured the pension arrangements for their whole workforce so that they are technically paid via salary sacrifice. Workers receive the same pay packet as previously, and the employer pockets the difference. This seems to be a common scheme which is being actively promoted.

If I understand correctly, payments made directly into pension schemes which were never part of a ‘reference salary’ aren’t salary sacrifice so won’t be subject to the NI charge/limit. If true, this means that those who don’t need a high salary – for example for mortgage borrowing – can negotiate a new job which offers a lower salary but higher employer pension contributions.

I’m interested in the idea of simplifying the tax system even if the push starts with little things. For instance the 10% bingo tax. Don’t increase it to 15% or reduce it to 5%. If you don’t like it just abolish it: quite right. (God knows why, though: a Coronation Street version of how to buy votes in the Red Wall?)

Similarly Salary Sacrifice: don’t reduce the thing to £2k p.a.: just abolish it. What silly billies they are.

The absurd National Insurance give-away to people living abroad who may have had minimal time in Britain anyway: abolish it. They have: well done. And I say that though it does hit part of my family.

What other bits and bobs could usefully be eliminated?

I think it was a smart and sensible budget.

Jam today. more pain tomorrow, welfare spend increases, bit of a nod to taxing wealth further.

If your primary objective is to eek out a few more years in power and stave off local election disaster that is…..

@Dearieme — You write:

“What other bits and bobs could usefully be eliminated?”

Hmm:

— the personal allowance taper above £100K (fiddly, stupid marginal rate, anti-aspirational)

— the savings allowance (fiddly, poorer people should just use easy access cash ISAs)

— starting rate for savings interest (ditto, use ISAs, if too much cash then that person is not a priority right now)

— stamp duty on all property transactions (I expect it’d be revenue neutral given the huge boom in economic activity, if not then increase council tax as was mooted)

— stamp duty on share trading (totally pointless and petty, doesn’t exist in other countries)

— um, the £12,000 distinction for cash ISAs they just introduced (fiddly, confusing, won’t achieve anything)

— Lifetime ISA (confusing, Janus-faced, yes it has a use case but so could a million other things, doesn’t justify them)

— fuel duty escalator (I love it in principle, CO2 is killing the world, in practice it’s a sham that’s waived every year)

Even more ambitiously I’d have a flat rate of 30% on all income from all sources probably. Perhaps including capital gains, but I’d need to see it costed out I guess.

Apparently HMRC has confirmed it will introduce anti-cash-like measures for stocks and shares ISAs:

https://www.telegraph.co.uk/money/budget/hmrc-to-punish-savers-who-try-to-dodge-cash-isa-crackdown/

Sigh. Whilst I understand in principle why RR/HMT will want to avoid savers using cash holdings in a S&S ISA to circumvent the new £12k limit, how the h*** does this map onto basic asset allocation (you always need to hold some dry powder), cash dividend receipts and the need to maintain cash within the tax wrapper to pay platform fees? As for any suggestion of moves against holding short duration Gilts – do HMT/No. 11 have some sort of death wish for the UK’s deficit funding here? They need people to buy every single duration that DMO issues, regardless of how it’s held. You don’t make that harder for anyone in any way, or any less attractive in any way, if that’s what you need to do. Oh. And they’re kicking the teeth out of CBs to boot. Nice touch that…Numpties. I despair 🙁 The spirit of Gordon Brown is strong in this lot.

While petty & inconvenient, I suppose there are ways around the cash-like investments being penalised in ISAs, or at lease it won’t make huge differences to portfolio returns.

I’m really quite worried though about when plans to (effectively) tax Gold & Silver in ISAs will be announced.

@Delta Hedge #63 > does this map onto basic asset allocation […] and the need to maintain cash within the tax wrapper to pay platform fees?

I presume by banning the payment of interest on cash in a S&S ISA? I have some vague recollection this is how it used to work. It’s always a slight surprise to me when I have to key in interest on cash, and I don’t hold large amounts of cash in the ISA because I view cash as a deadbeat anyway.

I share Algernond’s #64 concern on

> I’m really quite worried though about when plans to (effectively) tax Gold & Silver in ISAs will be announced.

here you go folks:

https://www.gov.uk/government/publications/tax-free-savings-newsletter-19/tax-free-savings-newsletter-19-november-2025

“when plans to (effectively) tax Gold & Silver in ISAs will be announced.”

Oh well, people will presumably buy shares in the miners.

To eliminate:

— the personal allowance taper above £100K Agreed

— the savings allowance Agreed

— starting rate for savings interest Agreed

— stamp duty on all property transactions Agreed

— stamp duty on share trading Agreed

— the £12,000 distinction for cash ISAs Agreed

— Lifetime ISA Agreed

— fuel duty escalator Agreed

Flat rate of income tax: well worth investigating.

And I add: CGT – return to the system of calculating gains after inflation-linking. Then discuss the tax rate.

The cash ISA limit won’t matter for anyone a bit more experienced. Plenty of workarounds if we really want to hold more cash. Shift some stock ETF from the SIPP to S&S ISA and buy a money market fund in the SIPP. Or short-dated gilts in a GIA.

I think the limit may nudge those in the right direction who haven’t invested at all. Hopefully they’ll take their advice from Monevator.

I just hope RR et al are ready for all the calls for compo from folks who were forced into equities the first time they face a market reset! HMG seem extraordinarily stupid in the way they are pursuing this and probably could not have picked a worse time to start either.

Eeejiiits the lot of them!!

The state pensions triple lock has just become quadruple locked: State pensioners with no other income will not pay tax.

https://www.bbc.co.uk/news/articles/cev8ed9klz1o

Just why !

Why create all this complication… are we now not allowed to manage our risk profiles in a S&S ISA …?

This is just daft..

”

The following rules will be introduced to avoid circumvention of the lower limit for cash ISAs:

no transfers from stocks and shares and Innovative Finance ISAs to cash ISAs

tests to determine whether an investment is eligible to be held in a stocks and shares ISA or is ‘cash like’

a charge on any interest paid on cash held in a stocks and shares or Innovative Finance ISA

“

Thanks ch (#66) for the link. As I’m over 65 it appears that, in principle, these new constraints won’t apply to me. However, if platforms have to adapt their rules to comply with the general constraints, I wonder how many will be able to accommodate exceptions for over-65s? I suppose it should mean that my existing ISA ‘cash-like’ holdings will be safe, but will I be able to add to them after April 2027?

Oh great, so they’re going to tax interest earned on cash within S&S ISAs. Surely can’t be long before they start to tax dividends and capital gains within S&S ISAs too (with an exemption for pensioners of course).

Back to the theme of simplification. Whatever the basic rate of income tax, no sneaky little extra 2%s: I’d like to see the standard income tax rates applied to all of earnings, interest, rents, and dividends.

What if you think the latter would imply too high a rate of tax on shareholdings? Easy: cut the rate of corporation tax to alleviate the effect.

As for the rates of income tax: if a flat rate tax isn’t on, at least simplify again: 20%, then 40% to £100,000, then 45% but with no loss of the Personal Allowance. That ends the absurd effective 60% band for the range £100,000 – approx £125,000.

Or could much of this rigmarole be swept away by replacing income taxes by consumption taxes? Or would the latter be too easy to mitigate/avoid/evade?

How about a Land Value Tax?

Inheritance tax: cut out the daft exemption of £175k for a house left to direct descendants: just fold that sum into the overall threshold, thereby increasing it to £500,000.

@David #72

I don’t think you’ll be able to.

The way I interpret it is:

If over 65 you can pay up to £20k in a Cash ISA. If you pay less than £20k then you can invest the rest in a SS ISA but it cannot be in cash like instruments and it cannot pay interest on cash.

If under 65 you can pay up to £12k in a Cash ISA. The difference to £20k you can invest in a SS ISA but it cannot be in cash like instruments and it cannot pay interest on cash.

So all SS ISAs have the same rules with no differences based on age.

I would like to think any cash like investments already in a SS ISA will be grandfathered, but less sure on this.

@TI 61 re savings allowance – generally, the government/HMRC operates de minimus rules to prevent people being dragged into self assessment for small amounts of tax. This obviously saves costs and compliance issues on both sides. A similar exemption operates for Executors, where a small amount of interest accrues during the administration period. I guess there is a question of what ‘a small amount’ of interest is, but I guess you could argue should be more than enough to cover the cost of using a prof to prepare the tax return. The alternative for savings would be to go back to making banks/building societies charge BRT on all interest. Then the argument would be that many on no/low income would be forced into having to reclaim the tax paid, and these are often people least well equipped to do so. I suspect similar thinking may be behind RR’s suggestion that the government will not tax people on small amounts above the personal allowance when the SP exceeds this in 2027. If I’m correct, the PAYE system does not apply to the SP, only to private pensions, where the tax code assumes SP uses up most of the personal allowance, and issues a tax code requiring pension providers to make PAYE deductions on private pension payments.

I’m not really sold on a flat rate across everything. Two basic reasons.

First, double taxation. Dividends come out of profits that have already been hit with corporation tax. Salaries and interest, by contrast, are deductible for companies. Treating all three as if they arrive on an equal footing ignores that the state has already taken a bite out of one of them.

Second, distortions. Property income is the obvious mess. Corporate landlords can deduct their financing costs; private landlords can’t. Same activity, different tax base, different outcome. And if the argument is that corporate landlords are somehow better stewards of housing… well, the recent mould killing kids stories on the BBC were all corporate and housing-association failures. So let’s not pretend there’s a public-interest dividend there.

A single flat rate sounds clean, but it clashes with the basic principle of avoiding double taxation.

The more I think about the practicalities of changing the ISA rules, the more obvious it becomes that they can’t possibly have thought this through. If they change the rules about short dated gilts and the like, transferring old S+S ISAs to a different provider will also become a headache. If they really must do this (I’m still secretly hoping they’ll give up on it before it’s introduced, like the Tories’ Brit ISA) then they should probably create a new product, let old ISAs be transferred around with investing according to existing rules, and just have new rules for a product with a new name.

I note that Reeves is on the front pages again for lying about OBR forecasts. If they fail to follow through on any other promises (I’m still waiting for LAFRA to be properly enacted) I’ll never vote for labour again. I feel rather disillusioned with this government and I don’t think I was especially delusional about what they could achieve at the outset. I don’t feel adequately represented by any party at the moment.

The ISA rules are just ridiculous…

Over a lifetime of investing as we all know on here we will want to adjust our risk profile depending on our financial situation and timeframes … removing all the options from the S&S ISA that are “cash like” or “lower risk” is just not a good idea … or is it just “tough” if you want to de-risk you lose the tax benefits…… suck it up.

It’s certainly great to have that long talked about ISA simplification!

And why age 65? It’s like the person who put that rule in the Budget at the last minute had to come up with it so quickly they forgot it’s not even the state retirement age any longer!

Hmmm, so we won’t be able to transfer from S&S ISA into a cash ISA, eh? Hold my beer a minute… What if one opens a Flexible Cash ISA, then immediately transfer it into S&S ISA? At end of tax year, liquidate the S&S ISA to re-fund the Flexi Cash ISA, and a few days later revert to S&S ISA again. Granted, the growth exits the ISA shelter, but the option to move from S&S into cash is preserved (with the new limit of £12k/year for new subscriptions). Similarly, 5th April 2027 one can move current S&S into Flexi Cash ISA then back to S&S a few days later and hence have the option to have that value in cash in purpiruity too, just so long as we keep the silly little dance going every tax year thereafter.

Apparently you can blame Martin Lewis for that.

https://www.moneysavingexpert.com/news/2025/11/cash-isa-limit-cut-martin-lewis-budget/

I like Martin Lewis on the whole but I’m not sure he should be negotiating (and compromising) on savings terms with government like some sort of trade union.

As pointed out above.. why a cliff edge at 65 .. it isn’t even going to be the state pension age. Anyway the need for lower risk doesn’t magically happen at 65 .. it can depend on all sorts of things that happen during a lifetime… new baby, divorce, ill health of you or family, elderly parents needing care , losing your job to AI , overvalued stock market… any number of different reasons at different times in peoples lives .. some are transient as well.

It just makes no sense at all.

Oh and whilst on a rant … the salary sacrifice limit is ridiculous as well … just get rid of it if they want to.

For me it is just another NI increase , tax on jobs as in last year’s budget, my employer keeps half of the NI I sacrifice so saves them 7.5% on any salary I sacrifice… which is quite a large percentage for me in my run up to retirement.

Believe me my company really doesn’t need encouragement to move jobs out of the UK to places like India or replace them with AI ..they are already doing it.

RR seems to have no idea what the real world is like ..

If there was any logical consistency to this 65 y.o. special treatment, it’d be linked to retirement ages, with State “Pension age minus 10 years” making the most sense for consistency with pension products.

Simply looks like a rushed concession with little thought behind it. Martin Lewis is notorious for a total absence of investment information dissemination, and his website’s prominent focus on penny pinching and rate tarting is probably one of the key causes of why so many Brits are all in on cash rather than holding diversified investment portfolios! A massive opportunity squandered by MSE over the years, I feel, to really help educate the public about investing…. and now he’s our spokesman?

Not too bad a budget. I’ve long lost interest in them fixing the 100k tax cliff given I get 69.5% tax relief in my pension contribution in Scotland, and have lost all my ambition now anyway.

I’m glad they haven’t touched to starting rate for savings, because we take full advantage of it, but it does seem to be an unnecessary tax giveaway.

I’m planning on 50 to 55 for retirement, depending on how the game plays out, but there’s nothing in this budget to alter my plans.

@Alex – thanks for the link. I didn’t realise that good old Martin had self-appointed himself to represent my interests. While I’m flattered to be called a young person, Martin is welcome to take his views and hold them to maturity, quietly.

As a matter of principle, I don’t think it’s the government’s job to tell anyone how or where to put their discretionary savings. I understand pension incentives (if people don’t save for retirement, the state eventually pays for the shortfall), but ISAs aren’t in that category. If I think the financial advisers that the City’s employers provide as a so-called “perk” at bonus time are useless, I’m certainly not taking guidance from a self-proclaimed economist — who, by the way, has yet to contribute anything in the form of published research (the suspense of the wait is killing the academic community, I’m certain) — with a track record of oversights in CV-writing and questionable judgement on employment expense claims.

@Dodex (75)

Thanks for your thoughts – I hope you are wrong! My literal reading of ch(#66)’s link is that none of the stated constraints apply to over-65’s. My big fear, though, is that the distinction will just be too complicated for platforms and consequently no ‘cash-like’ securities will be allowed in their S&S ISA. The same situation as Flexible ISA, which is permitted but rarely offered.

I target a 50:50 allocation between equities and ‘lower-risk’ assets. Currently my ISA contains a large amount of short-duration gilts and TIPS funds for my ‘lower-risk’ allocation. If these are deemed ‘cash-like’ my provider could decide not to support them as the administration of exempting me from tax on the income would be too complex. This would then lead to the ridiculous situation of contemplating transferring up to 50% of my S&S ISA to Cash ISA(s) before 5 April 2027 to de-risk my ISA portfolio.

@DavidV

>>> This would then lead to the ridiculous situation of contemplating transferring up to 50% of my S&S ISA to Cash ISA(s) before 5 April 2027 to de-risk my ISA portfolio. <<<

I suspect this is what is going to happen, en masse! Rather than money flowing into investments, many people will be taking the (final!) opportunity to transfer out into Cash ISAs.

For the under 65s, there'll be only one opportunity to ever do this before they're 65, so it's not hard to imagine that many will take this once chance and increase their cash levels significantly. A mass equity and bond liquidation in Q1 2027 as ISA investors dash for cash! "Unexpected consequences" of ill-thought through changes.

Isn't it just great that while the government sees fit to consult with industry on this draft legislation, there's never consultation with the people who it really impacts – us. No voice.

Between the changes to cash ISAs and SS (although employer never shared their savings with me), I too know the latest my retirement date will be. Perhaps a bit petty, but it’s as good a trigger as any.

Still, it was a good run on SS – I managed to take a salary below minimum wage (and lived on savings outside of ISAs etc) for a good number of years.

Seriously, can anyone actually work out how the ISA interest charge and investment eligibility criteria changes can be made to ‘operate’ effectively? I can’t. It seems like something which an (overly influential) SPAd thought of around midday or early afternoon on the 25th November. To say that this idea hasn’t been thought through properly is an understatement. This is a p*** poor idea for everyone. HM Treasury (due to the second order effects of evidently unexpected but entirely predictable investor behavioural changes), investors, and of course also platforms (whom I usually have little sympathy for, but I make an exception for them here having to try and administer this mess). Lose. Lose. Lose. So stupid.

Instead of paying interest in a S&S ISA, a platform provider could notionally calculate it and offset it against platform fees – and call it a loyalty discount, on account that you are loyal by not moving money elsewhere. That would work for me.

“The state pensions triple lock has just become quadruple locked: State pensioners with no other income will not pay tax.” And some stupid, complex system will presumably be devised to allow Them some political boasting. The simple way, of course, would be just to apply the triple lock to the Personal Allowance too.

I found Martin (#76) rather persuasive on the savings allowance: presumably the same argument applies to the dividend allowance.

The ISA intricacies are madness in principle and in practice. Just don’t.

@HS #77 Cheers, that double taxation on dividends to explain the disparity is exactly what I’ve been scouring the internet trying to find out to no avail. Thanks for putting me out of my misery. Made no sense prior to your comment, now makes a ton of sense.

“The state pensions triple lock has just become quadruple locked: State pensioners with no other income will not pay tax.”

The state pension should be fixed to the lower tax limit. If we can’t afford to increase it then we can’t afford to increase pensions either.

Very well put here by Damien on the relentless interfering on ISAs:

https://youtu.be/knub0Rpg6PM?si=TsvdSkXugvw0rB-x

It’s all about trust and confidence. Now sorely lacking.

It’s almost as though the Treasury don’t actually realise that then when they do something then people’s behaviour changes in ways which achieve the very opposite of what the Treasury wants.

The more I think about HMG interfering on what can and can’t be held in an ISA under the thin guise of a technical change, then the angrier I get.

I don’t buy the market cycle crowd, but why shouldn’t someone have the opportunity to manage market risk by going partly into bonds or cash? It’s not like there is not a valuation case to do so. Noone in the market cycles crowd is talking about using S&S ISAs as a means to circumvent the restrictions on Cash ISA limits:

https://open.substack.com/pub/paretoinvestor/p/benner-cycle-2026-market-crash-warning-defensive-strategy

Nor are the decumulators saying any such thing.

Mucking about with the S&S ISA inclusion regulations is either 1). a not very convincing smokescreen being used to try to find a way to tap into our ISA wealth (in which case, then shame on you Labour, and you deserve everything coming your way in the 2029 GE), or 2). a bona fide blunder by No. 11 which reveals a colossal ignorance on RR’s part about investing generally and asset allocation in particular. Leave our ISAs alone. In either scenario, it’s not your wealth RR to mess with. It’s ours.

@Delta Hedge — When I said the budget smacked of ‘spreadsheet maths’, it wasn’t a throwaway line. (Well, not entirely 😉 )

I believe they sat there with 100 measures and they tweaked this one and deleted that one in a spreadsheet until they got the number they wanted at the bottom of it.

This and many other measures smack of this sort of thing. It’s more like fiddling with parameters in SimCity than setting out and implementing a vision for growing the economy and making us all better off.

@TI (#99):

As I said over at SLS (using many more words and examples) I completely concur. It is pathetic!

They have seemingly fallen into the trap of “confusing” a spreadsheet (ostensibly a tool for crunching numbers) with an over-riding coherent philosophy and a design method/process for implementation*. One out of ten; and that is only because they seem to have basically understood Excels goal seek functionality!

Makes me wonder what other nasties are lurking in the (IMO low-quality) supporting details, etc.

Phil Hammond used to be nicknamed spreadsheet Phil – but this lot are off the scale IMO.

On the night of the budget, Peston said on TV that the Red book contained a lot of “tooth fairy stuff” and he ain’t wrong!

Eeejjjiiittttsssss – the lot of them.

*and that is giving them a lot of benefit of the doubt; as I am not sure they are even capable of seeing it for what it is!

Someone needs to stand up for the spreadsheet here 🙂

It’s the best decision tool I know. I’d much rather have a government by spreadsheets and “wonks”.

The alternative is fantasy economics. Brexit will have fantastic dividends. Tax cuts (or increased spending) always pay for themselves. Immigrants are the root of all evil (so put them all in concentration camps and paradise ensues).

Who needs a spreadsheet?

@Sparschwein –Hah, fair retort. Spreadsheets are indeed super-useful, and yes, a nodding familiarity with some simple economic models might have turned a few more off the Brexit path!

I think there’s a difference though between “We want a lower (/higher) tax, lower (/higher) spending economy, we’re going to pull these 2-3 big levers and simplify elsewhere” and “we’re going to leak/trail several dozen tweaks and changes, see which get the least flack, put them in a spreadsheet, and then mess with the inputs until we get ‘£20bn’ in the cell AZ101.”

Obviously I don’t think *exactly* that happened but I genuinely believe it’s not far off…

@SS (#101):

Brave try, but ….

IMO, a spreadsheet is (an admittedly very useful) tool for capturing and crunching the numerical results of an intellectual process; it should never be used as a substitute for such a process – as is clearly what has happened in this case*.