The first article in this series emphasised that dividends are best understood through cash flows rather than through stated earnings, which are intangible since they are simply an accountant’s opinion.

Using the cash flow framework also helps us better understand dividend policy – how companies decide when and how much to pay in dividends.

In the mix

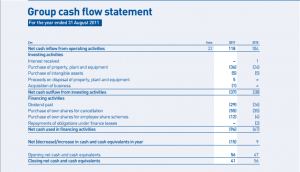

When we boil it down, companies can do four things with their cash flow:

1. Save it (cash and equivalents, pay down debt)

2. Spend it (acquisitions and so on.)

3. Reinvest it (new projects, expansion projects)

4. Distribute it (dividends, buybacks)

With a finite amount of cash flow each year, companies must decide how much cash each of these buckets receive. These decisions are driven by, among other things, the company’s stage in its growth cycle, its financial health, the tax environment, and what its shareholders want.

Capital allocation is the number one responsibility of a company’s leadership team. Strong capital allocators can compound a company’s growth rate and create more shareholder value; conversely, a team of poor capital allocators can lead a once-solid company into a sluggish existence.

Ultimately, we want to identify companies with management teams that have made wise capital allocation decisions in the past.

A company that is generating high returns on equity, for example, and can reinvest all of its cash in projects that produce returns well above the cost of equity should, in theory, do just that — reinvest all the cash.

Investors should want this, too, in lieu of a dividend, as it maximises shareholder value.

If the company can take the cash and invest it at 20%-plus returns, so be it!

More money, more problems

These are rare cases, however, and more often than not companies in the mature and mature-growth stages do not have enough value-enhancing projects for all of the cash they generate.

When this happens, the company’s board considers alternative uses for the extra cash flow.

In a situation where the board expects the extra cash flow to be a one-time event, they may declare a special one-time dividend or buyback shares. On the other hand, if they expect there will be extra cash flow year after year, they may establish a regular dividend programme where a portion of the company’s cash flow is returned to shareholders periodically throughout the year.

If these sound like over-simplified examples, you’re right. Dividend policy decisions are normally not so straightforward, but it’s important to first understand the core theory behind why companies pay dividends.

In the real world, shareholder preference and peer behaviour can complicate the process.

Pleasing the masses

Three important theories on dividends can help us understand why different companies’ shareholders have varying interests in dividends:

1. Dividend irrelevance

2. Tax aversion

3. Bird-in-hand

Dividend irrelevance

The dividend irrelevance theory is based largely on the important research done by Miller and Modigliani who reached the conclusion that in a world of no taxes, no investment costs, rational investor behaviour, and infinitely divisible shares that dividends should be irrelevant to shareholders.

If an investor wants cash, the theory maintains, he or she can simply sell a few shares and create their own dividend.

This theory might sound naïve given all the unrealistic assumptions it involves, but many investors subscribe to it! Institutional owners in particular, who tend to have a larger number of shares, can more easily create their own dividend without incurring a high percentage of trading costs, and thus may prefer lower dividends.

Such “homemade” dividends make less sense to individual investors, due to the more prohibitive trading costs.

Assuming you want to keep trading costs below 1% and that you pay £10 commissions, you’d need to sell at least £1,000 worth of your position each time to create your own dividend and keep costs in check. Whilst not out of reach for some wealthy individual investors with large positions in a particular share, it’s certainly less realistic for the average investor.

Tax aversion

Like trading costs, taxes reduce realised returns. Naturally, then, the tax aversion theory states that investors with higher tax rates should prefer to own shares that pay lower dividends or none at all.

This can be particularly true in countries where the capital gains rate is well below the dividend tax rate. In such a circumstance, it stands to reason that companies that pay high levels of dividends should attract investors in lower tax brackets or tax-exempt institutional investors.

Bird-in-hand

The bird-in-hand theory was developed by Myron Gordon and John Lintner and takes its namesake from the proverb that “a bird in hand is worth two in the bush.”

As the proverb suggests, an investor should prefer to have cash in hand today rather than uncertain capital gains down the road. As such, investors place a higher value on dividends than future capital appreciation.

In addition, the more-certain cash from dividends, the bird-in-hand theory contends, reduces the cost of equity that investors place on the share. The lower the cost of equity, all else being equal, the higher the value of the share.

Of the three, dividend-loving investors most frequently subscribe to the bird-in-hand theory. Understandably so.

Still, it’s important to recognise that the majority of a company’s shareholders may not have the same sentiment, and may prefer the company reinvest in its operations, to buyback shares, or to make an acquisition instead.

Policies are not created equal

Once a company has decided that it will pay a dividend, it can either adopt a (what I’ll call) “firm” or “loose” dividend policy.

A firm dividend policy is one in which the company spells out in detail its plans for future payouts (i.e. “a progressive payout with a target dividend cover of at least 2 times”).

Conversely, in a loose dividend policy the company does not explain its decision-making process behind the dividend payments.

All else being equal, dividend-focused investors should prefer to own companies with a firm dividend policy because they provide more transparency.

If a firm does not explain its policy, there may be less commitment from the board and the framework for deciding each year’s payout can change year to year, leading to greater uncertainty.

Dividend policy in summary

A company’s dividend policy provides tremendous insight into its relationship with shareholders, and can help us better understand management’s strategy for enhancing shareholder value.

If a company has a loose dividend policy, lacks a track record of paying dividends, and has consistently bought back shares at high prices, it might be best to look elsewhere for dividend income.

You can bookmark all The Analyst’s articles on dividend investing. The archive will be updated as new dividend articles are posted.

Comments on this entry are closed.

Nice summary! I’m clearly a bird-in-hand type of guy 😉 However,

Those guys need to get out more. The real world is a fail on all four counts. It’s like predicating a paper ‘assuming the world is flat’… It is interesting is establishing the limit case, which is useful in mapping the boundaries of the problem space, but not necessarily practically useful.

The age old question… do you plump for the firm that is paying out today… or do you go for the more s0-called “sensible” outfit that is paying out less today but promising… jam tomorrow!

With high yielding shares I believe it can be best to go for jam today rather than having too much faith in jam tomorrow… Why — because firms are run by human beings… and also shares are traded by human beings…

Which do you believe? A firm that is paying a 3% yield and a chief exec who claims it will grow it for 10 years at 10% p.a. or a firm paying 6% because the shares have marked down… because other human beings think it’s likely to fail to keep paying…?

Either way human beings have made a mistake somewhere.

And that 6% share was probably a 3% yielder once… maybe six months ago!

It is a balancing act in my experience.

Lots of good thoughts in your piece here The Analyst (you are well named!!) but at the end of the day there are no rules I believe and you can draw too much comfort from a firm policy….

Keep up the good work…!

@ermine — Agreed. It’s amazing that there nevertheless remain investors and corporate boards who subscribe to such unrealistic assumptions when forming their opinion about dividend policy. Your line about the world being flat reminded me of the Buffett quote that “Ships will sail around the world, but the Flat Earth Society will flourish.” 🙂

@OldPro — Cheers! I concur that it is indeed a “balancing act” between high yield and dividend growth — in fact, that’s the topic of my next post. Understanding the various dividend policy theories (as you say, they’re clearly not firm “laws”) can help us decipher management’s decision making processes and perhaps future intent regarding payouts. I reckon these are valuable insights for dividend investors.

Its not as if a “firm” dividend policy can’t be changed by a bad years results or the uncovering of big accounting problems

Your bird in the hand can keel over and die

@Neverland: Yes, indeed, a “firm” policy can be changed when the need arises. Dividends are never guaranteed. Still, all else being equal, I’d prefer to own a company that has disclosed its framework for evaluating dividend payouts rather than one that withholds that information from shareholders.

I don’t get the no relevancy of dividends, what is the worth of a stock then, if it isn’t there to produce money?

@Diego: Dividend irrelevance theory doesn’t imply the company isn’t making money — just that (again assuming the no-cost, perfect world described in the article) dividend policy should have no effect on share price and should therefore be irrelevant to shareholders. The company could just as well use the cash for other purposes and not affect its value. The theory implies that if the investor feels that the dividend is too high, he can use the extra amount to repurchase additional shares; if the dividend is too low, he can sell some of his shares to meet his income needs. Hope that helps answer your question.

>but many investors subscribe to it

In practice, I suspect many investors cherish a belief that someday the company will pay a dividend (e.g. Apple), otherwise there is an increased danger of the greater fool theory taking hold.

@Diego — Have a look at my article on earnings yield for more on this.

Two words for anyone who thinks a stock *must* pay a dividend — Berkshire Hathaway. 🙂

One way that a private investor might be able to have low-paying stocks but be able to maintain an income stream is to have a parasitic OEIC fund. (e.g. a nice Vanguard L-S one, or perhaps a Strategic Bond fund if you like a little active management want want low volatility.) Assuming you are with a broker that has free dealing in OEICs, you could sell a big lump of a holding and put it all in the OEIC. Then you could tap the OEIC whenever you wanted.

I personally don’t need an income stream but I do have a couple of OEICs that I use to mop up any dividends that are paid out from my IT holdings.

I also think it’s quite an effective way of bucketing. I don’t plan on touching my IT shares for many years, but I do have a bucket of OEICs that I would be happy to dip into if I needed the cash for something productive.

Thinking about it, your four-part list is missing option 5 on what companies can do with their cash flow:

5 pay over-generous salaries to their executives

I’m not sure that we have seen an explosion in competence at the top as a result of Clinton trying to cap salaries in the late 1990s that resulted in a shift to bonuses. We could simple be seeing a widespread case of control fraud, which might be reflected the slower share price appreciation in the first decade of this century 🙁

Bloomberg ref for that otherwise unsubsatiated slur on Clinton’s intergrity. Apparently he meant well 😉

No, that doesn’t really help, sorry. Dividend is all you ever get from a company, so it boils down to dividends and nothing else.

Having said that:

1 It’s not exactly, exactly like that, but for practical purposes we can assume it is.

2. Berkshire Hathaway is a special case, and a very unique company with a very unique CEO. But let’s say google, for instance. In my opinion google should be trading near 0. I hope that clarifies my point.

@Diego

Yes, it clarifies that you’re very wrong. 🙂

Your view would make sense if buying shares in a company was a one-time, one-way investment. In that case — where you couldn’t sell the shares later — it would make sense to focus entirely on the dividend, because you would have no other way of realizing a return on your investment.

In the real world, you can buy and sell shares, which gives you another way to benefit from compounded earnings. I suspect you well know this and are making a rather principled stand, but it bears repeating for novice readers who may be misled.

Google is going to compound its earnings at a high rate for at least some years to come — the debate is really when growth will slow or decline, not that it won’t be materially higher for the foreseeable future.

Investors will pay more for a company earning more per share, than one that earns less (this should really be self-evident, but it’s obviously not the case in a world where Google would be valued at $0…)

Most (though not all) companies in the mature phase will, as The Analyst writes above, switch from compounding earnings internally to paying a dividend. At that point, much of that cashflow they have generated from reinvesting their income over the years will be switched to pay outs to shareholders.

Many (most?) of today’s dividend-paying companies began as low/no yielding growth companies, I’d wager.

In that case, and from your second to last paragraph, we seem to agree. As long as a company pays dividends during its lifetime then it should have some value. I know that paying out dividends is tax inefficient, but it is the ultimate purpose of a company.

In the case of Google, while my comment was somewhat hyperbolic I wanted to highlight the fact that not only it doesn’t pay a dividend, but that it has a complete disregard for this matter. If I were Google I would try to explain this policy or be somewhat “apologetic” instead of simply stating that they “don’t pay a dividend nor do they expect to pay any dividends in the foreseeable future.”. Just my opinion.

@Diego:

“As long as a company pays dividends during its lifetime then it should have some value. I know that paying out dividends is tax inefficient, but it is the ultimate purpose of a company.”

If Google wanted to close down its operations today, liquidate its tangible assets and pay all its liabilities at stated book values, it would be worth about $150 per share. So Google has tangible value today, not including future growth, cash flows, or intangible assets.

In 10, 20, or 50 years Google could similarly choose to liquidate having never paid a dividend and still have value today.

The ultimate purpose of a company — from an investing standpoint — is to maximise shareholder value. Now, that can mean different things to different shareholders — some may want buybacks, some may want the company to reinvest more, some may want dividends, and some may want liquidation! — and it’s the company’s job to balance the business’s needs with these shareholder wants and try to strike a harmonious balance. That’s not an easy job, and it goes back to the points made in my article about dividend policy.

Because Buffett, for example, has been able to consistently grow book value at higher rates than Berkshire shareholders can likely do on their own, there’s less demand for a cash dividend. Same could be said for Apple during the Jobs era or perhaps at Google today, though that’s certainly debatable. On the other hand, most companies can’t consistently generate such high returns on equity and should distribute more free cash to shareholders.

I can your point however regarding this:

“The ultimate purpose of a company — from an investing standpoint — is to maximise shareholder value. Now, that can mean different things to different shareholders “.

I see it in a somewhat different way. To me the value of a company is the discounted value of all the money you can extract through its life. While I would agree that this definition is of little practical value I think is, nevertheless, the most exact one and the one that should serve as test of any other, more practical, method to assess a company.

Maybe I seem to be splitting hairs or being too strict, but something I do when I think about investing is trying to be very precise about the reasons behind my actions and fight constantly with my brain to avoid falling through the cracks of the psychological quirks so well illustrated in the video in the next of your articles.

“To me the value of a company is the discounted value of all the money you can extract through its life.”

I agree with you in principle. The problem is, since most of us are minority shareholders with non-controlling interests, we have no say over how much cash we can extract from the company. Again, this goes back to dividend policy.

How, then, might we determine value? We can estimate how much in dividends the company could have paid by calculating free cash flow to equity (FCFE) and then discounting those cash flows.

“Maybe I seem to be splitting hairs or being too strict…”

Not at all. I think it’s good to be thoughtful about your assumptions. The risk is that if you’re only valuing companies by expected cash dividends you might be a) overlooking good opportunities in non-dividend paying shares and b) might be consistently undervaluing companies, as very few firms pay 100% of FCFE in dividends (save utilities, perhaps). If you’re just counting the partial cash dividend distribution, you might be undervaluing the share when you run your valuation — using DDM or something else.

Diego… I will have all your Google shares old boy… type up your address here and I will send you a S.A.E., and then return you absolutely sweet FA by return of post. 🙂

Seriously, come on… Markets… and more importantly the traders that work in markets… they can be stupid but they are not THAT stupid…!

The Investor,

While I am lowly and SMALL individual investor I never understood those that don’t get the one in the hand theory. My dividend stocks never goes down by the exact amount as the paid dividend…in fact there are sometimes when the stock pays out the dividend and then 3 days later it is higher than it was prior to the pay out or ex-dividend date.