I read an article on dividend growth in the US, and asked an income fund manager contact for his view from a UK perspective, which follows. (He’s ended up posting anonymously to save all the bother of not doing so.)

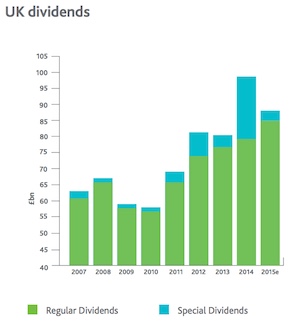

Capita has just published its latest analysis of the dividends that have been paid out by UK companies.

It found that third quarter dividend payments were at a record high.

See Capita’s graph, above right, and note it’s the green bars that show how regular dividends have grown.

Capita also warns, however, that the growth of distributions is slowing, and that dividend cover is shrinking.

Many people put a lot of faith in dividends and rightly so, but that should not mean our love is blind.

Dividends, like lots of numbers in finance, are both a target and a measure. They provide income and, if reinvested, contribute to capital growth.

They can also tell us how healthy – or not – companies are.

Dividends bounced back

The graph below (derived from Bloomberg’s collation of forecasts from analysts) shows the amount of cash that UK companies expect to pay out as dividends one year ahead (excluding special dividends) relative to a UK market capitalization-weighted index:

Two things stand out.

One is the sickening lurch downwards in 2009. This came as the big UK banks discovered that they hadn’t actually earned any money from all their clever traders, PPI salesmen, and borrowers, and so could not pay it out as dividends.

The second feature is the overall rise in distributions since the trough of 2009 to the peak earlier this year.

This rise in payments – from £59 billion in 2007 to over £91 billion in 2014 – has underpinned much of the recovery in the stock market since March 2009, which you can see in the red line.

The desire for yield is a powerful motivation in a near-zero interest rate world.

What goes up…

Recently, however, the trend is downwards.

Expectations are that dividends next year will be about £87 billion, notably lower than the £91.7 billion predicted as recently as April.

There have been some high profile cuts already, the two biggest being Standard Chartered and Glencore.

We learned last year that Tesco would cut its payments, too.

On top of that there is a background of profit warnings from a lots of smaller companies that have been hit by lower growth rates in China, a slightly stronger pound, and what’s simply a super competitive environment in the UK where the lack of inflation makes it difficult to raise prices and margins.

Down with dividends

Every data analyst knows that correlation is not causation.

Nevertheless, if the market had not risen as dividends did, its yield would be 50% greater than the current figure of 3.7%. That would make it even more attractive against gilts yielding less than 2%.

This suggests the increase we’ve seen in capital values has been warranted.

Everyone likes the warm feeling generated by rising capital values but we should not ignore the slower, tortoise-like returns from reinvesting dividends.

What we really don’t like is a sudden suspension as happened with Tesco, where investors faced the double whammy of falling capital values and lower income.

At least the slow motion car crash in the commodity sector has been a warning to investors that its dividends were under threat.

When Glencore succumbed to the inevitable, its cut and associated fund raising was not a total surprise. A yield of 11% on Anglo American indicates investors have similar fears there, too.

There are doubtless many more companies where directors are maintaining distributions in the hope that this positive ‘signal’ overwhelms the few nerds who actually look at the cash flow statement and question dividend sustainability.

The Financial Times quotes the current dividend cover for the FTSE All-Share Index at 1.59 but I don’t have a figure for the projected dividend cover.

Even if I did I probably wouldn’t believe it because so many executives are remunerated with share options based on adjusted earnings per share figures.

In my opinion, these are fantasy figures to make bosses richer.

Dividends, by contrast, are real numbers backed by cash, to makes shareholder richer.

That is why they tend to rise more slowly.

No need to panic

Low dividend cover and falling dividends are big red flags hanging over this market.

Does that mean sell?

Not to it doesn’t. But it does mean we have probably reached the end of this business cycle.

So what? Another one will start soon and the process can begin all over again. Then the question will be when to buy.

Why risk getting two decisions wrong when the alternative is to sit tight, stay invested, and let those dividends you still receive after the cuts do the heavy lifting by reinvesting your income through the bottom of the cycle?

That way you will be fully invested at the start of the next upturn.

Perfect!

Comments on this entry are closed.

I couldn’t agree more. I think the market’s dividend may come under some pressure for a while and may even fall back a bit, but the sensible thing to do is stick with it and just keep reinvesting or drawing down whatever dividends are paid out.

Jumping in and out of the market based on short-term ups and downs is – for the vast majority of people – just a good way to lose money.

What a refreshing article!

For those of us who base Asset Allocations on valuations, the conflict between the PE and Yield measures caused by declining Dividend Cover here in the UK and in some other global regions has been troubling and problematic.

The article is a breath of fresh air, if perhaps Panglossian, and keeps the investor’s focus where it should be, on the dividend stream, and maybe a resurgence in earnings and cover yet to come?

At times like these it can be reassuring to turn to the words of Chauncey Gardiner :-

” First comes the spring and summer

but then we have fall and winter

and then we have spring and summer again

In a garden, growth has its seasons as long as the roots are not severed,

all is well and all will be well, and all will be well in the garden”

Thank you Chauncey!

An helpful overview.

Is it right that many investors have turned to equities because of, not only healthy dividends but, a lack of interest paying alternatives. (cash, bonds, etc). Does this mean that when interest rates rise (maybe a while away) the enthusiasm for equities generally will decrease.?

Thanks for readable article.

Buying companies with a record of increasing dividends can certainly boost portfolio growth, if they keep upping their payouts.

But picking winners is (as always) tricky.

I’ve been chucking Shell and BHP Billiton into my ISA on recent weaknesses. The shares took a battering before I bought, but their dividend percentage is so high that even a 50% cut wouldn’t have me crying into my beer. Plus, they are both long-term holds for a bit of fun.

But despite dabbling in the dark arts away from index investing, I’m not about to turn my website into one hailing individual dividend champions.

Most people should check out the VHYL (All-World High Dividend Yield) ETF, and Vanguard’s UK Equity Income Index fund. Much more diversified.

@oldie — Something like that has almost certainly happened (and is indeed one of the aims of the Central Banks’ QE programmes — to move investors along the ‘yield curve’ into riskier assets). Also, equities are in theory priced off the value of the ‘risk free rate’, which is determined by government bond yields, which are in turn heavily influenced by Bank Rate.

So yes, in theory higher interest rates should mean equities are less attractive. However (1) If rates are raised because the economy is improving, that could overwhelm the negative connotations and still be good for equities and (2) The market is well aware of everything we’ve just discussed about interest rates, so in theory a rate rise is to some extent reflected in the price. Exactly “how much” it’s reflected is obviously uncertain, and one reason why we’re seeing markets move quite sharply on Central Bank comments.

As ever most people will be best of letting the market figure out the consequences, and investing broadly and passively for the long-term.

Hope this helps!

@MyRichFuture

“Most people should check out the VHYL (All-World High Dividend Yield) ETF, and Vanguard’s UK Equity Income Index fund. Much more diversified.”

Re VHYL, how do you view in portfolio construction the underperformance of VHYL to say IWRD or VWRL?

@magneto

Different beasts. VHYL would be for those seduced by the thoughts of higher dividends (rightly or wrongly). There’s an argument to be made that it could form part of a retiree’s portfolio. It also has only 1100 stocks compared to VWRL’s 3000.

This article reminds me that for a DIY/passive investor maybe the biggest challenge is to resist the persistent temptation of tinkering.

One of the things I have learnt in my investing journey of the last two years is that you have to find a way to feel comfortable with what you are doing and importantly not tinker which I struggle with. For me I like dividends, it makes me feel more secure like my capital is making money and not just relying on an increase in value. It gives me an incentive to keep up my regular monthly investments as I see earnings appearing in my portfolio (and growing as my holdings go up). It also to some degree lets me rebalance slowly as I go, buying more units/shares (especially in holdings where prices have come down) with the dividends so I get to tinker but hopefully in a non-destructive way. I don’t think I’d buy any more Acc funds…I like the Inc ones too much. Perhaps that’s not the best strategy but it works for me on a physiological level.