What caught my eye this week.

A sign of the times: I woke up yesterday to headlines that chancellor Rachel Reeves had U-turned on her income tax plans, and I wasn’t immediately clear whether this was official confirmation that income tax rates were to rise, or whether Reeves was U-turning on the only just rumoured U-turn to hike rates after Labour had pledged to do no such thing.

Is everyone following at the back?

What a palaver. As you probably know by now, it was the latter – a U-turn of the U-turn. Or as boy racers would call it: a doughnut. Which seems appropriate.

Officially, Reeves’ 360 had nothing to do with all the briefings and counter-briefings that gripped Whitehall watchers this week.

Rather, the Office for Budget Responsibility (OBR) has thrown her a lifeline.

According to the BBC:

Newer assessments from the OBR appear to have increased the projected strength of wages and tax receipts in the coming years and offset several billion pounds of that gap, taking it closer to £20bn.

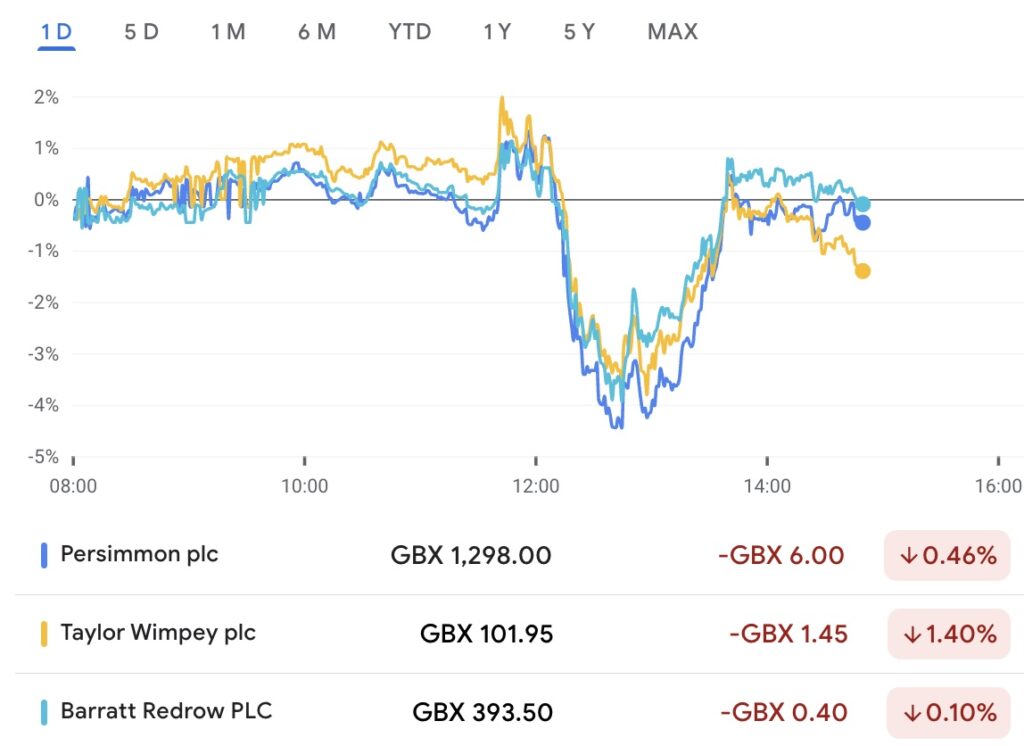

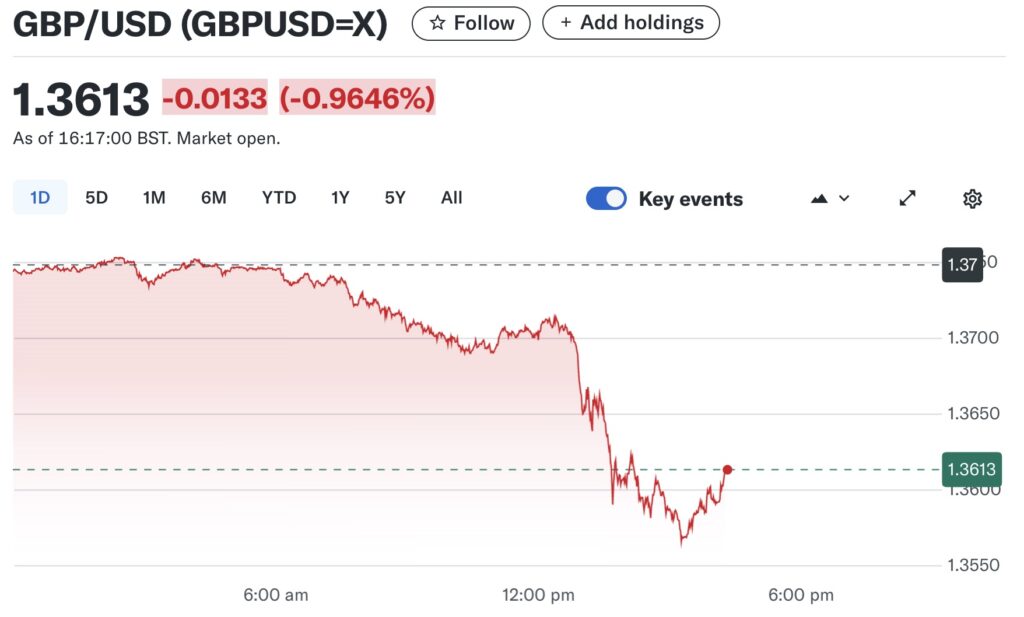

Gilts yields rose as traders panicked at Reeves chickening out over income tax hikes, and they barely calmed down when they heard the OBR had plumbed the depths of the black hole and found it less black than first feared.

Extra taxes will still have to be found from somewhere. Even £20bn is not chump change, especially when you’re also planning to scrap the limits on child benefit and potentially looking to top-up those WASPI pensions after all.

Someone’s money will have to be found to pay for it:

Source: JP Morgan / Chancery Lane

Putting income tax thresholds into an even deeper freeze is leading the runners and riders this week, along with curbs on salary sacrifice. But mucking about with the pension tax-free lump sum is reportedly now off the table.

Still ten days to go though punters! Place your bets.

Where’s the money, Lebowski?

As if the on/off vibes from Budget Bingo weren’t déjà vu enough, we also got the latest account of the economic damage wrought by Brexit to remind us of why we’re partly in this mess.

To quote the abstract to the new working paper from the NBER:

These estimates suggest that by 2025, Brexit had reduced UK GDP by 6% to 8%, with the impact accumulating gradually over time.

We estimate that investment was reduced by between 12% and 18%, employment by 3% to 4% and productivity by 3% to 4%.

These large negative impacts reflect a combination of elevated uncertainty, reduced demand, diverted management time, and increased misallocation of resources from a protracted Brexit process.

Not surprisingly – given there’s no economic benefit to leaving a vast trade bloc that other countries lobby for decades to enter, to replicating its bodies and functions, to becoming a rule taker, to creating friction for business, and to making investment into the UK less attractive – the estimate of the cumulative damage from Brexit has crept up on those made last year by the likes of Goldman Sachs and the OBR.

What’s the relevance to the budget?

Let’s take the NBER’s lower 6% hit-to-GDP estimate. UK GDP in 2024 is estimated at £2.88tn, so the NBER sees the economy as £173bn smaller than it would otherwise have been without the drag from Brexit.

At about a 39% tax take as per the House of Commons library, that implies the state has about £67bn less to spend than in the no-Brexit alternate universe.

Even at a lower 35% take there’s a £60bn shortfall.

Of course you can debate how precisely we can layer on this speculation. But I’m not taking the highest estimates here – and the point is the overall picture.

Which is that the UK government has tens of billions less to spend than it would have had, and that it likely needs to spend more too than in a Remain scenario, given Brexit’s hits to the economy as outlined by the NBER will have increased the various claims on benefits.

A boondogle with a bill that’s come due

Of course the Leave campaign warned us that long-term economic damage was the price we’d pay for the UK regaining our (technical) sovereignty.

A smaller economy than originally projected due to Brexit would present difficult choices about where we directed our spending after leaving the EU. The economic cost was plain – everyone predicted it – but the political argument carried the day with brave Britons.

Ho ho ho.

Of course they literally said we could have our cake and eat it. So now they are surprised when we’re running the economy based on the old inputs and we’re coming up short.

Brexit will carry on bleeding us out for another decade, I’d guess. Perhaps after that some compensatory factors will see things finally stabilise, as the Bank of England governor mused last month.

In 2016 I said Brexit would be a slow puncture that would hinder us for many years. My critics told me to shut up.

On we trundle.

Lies, damned lies, and the 52%

If you don’t discern the dead hand of Brexit – along with Covid, inflation, and Russia’s war of course – when looking at semi-stagnant out-of-puff Britain limping along with only these occasional bunfights over our shrunken tax pie to liven things up then I won’t persuade you.

Sure, the NBER report is the result of exhaustive work by big brains from Stanford, The Bank of England, and the Bundesbank among others.

And yes it tallies with what other studies have shown.

But hey, you’ve got a bloke on social media with three Union Jacks in his profile who can’t write complete sentences saying:

“LOL.. coz they can see the future yeah!! get over it pal! ✊“

Feel free to pick your side.

Just remember later this month when you’re set to pay more tax or the triple-lock pension is unpicked 1 that we were told this would happen, 52% voted for it, and we’re living with the result that the decision deserves.

And if you still don’t understand why I belabour this, here’s an article from The Telegraph via Yahoo on how “Britain faces worst decade for growth in a century”.

There’s no mention of Brexit from start to finish. Not even a nod.

It was one thing to be earnestly wrong in 2016. It’s another to stay wrong in 2025.

Have a great weekend!

From Monevator

Why you can’t trust the CAPE ratio [Members] – Monevator

End in sight for renewable trusts? – Monevator

From the archive-ator: What’s your financial origin story? – Monevator

News

Extending the income tax threshold freeze to 2030 raises £8.3bn extra a year – I.F.S.

NS&I Digital revamp is four years late and £1.3bn over budget – This Is Money

FCA doubles down on AI testing versus regulation… – City AM

…and warns CFD firms against failing consumers – Reuters

NHS gets go-ahead to cut thousands of admin jobs – BBC

A technocratic plan for Eurozone growth… – The Constitution of Innovation

…and also note the EU is actually a pretty good investor – Klement on Investing

Products and services

Disclosure: Links to platforms may be affiliate links, where we may earn a commission. This article is not personal financial advice. When investing, your capital is at risk and you may get back less than invested. With commission-free brokers other fees may apply. See terms and fees. Past performance doesn’t guarantee future results.

Hargreaves Lansdown launches a new best buy ISA paying 4.55% – This Is Money

Five major mortgage lenders cut rates – This Is Money

Get up to £1,500 cashback when you transfer your cash and/or investments to Charles Stanley Direct through this affiliate link. Terms apply – Charles Stanley

Santander’s new £200 switch offer – Be Clever With Your Cash

Royal Mint launches yellow gold sovereigns for £1,200 – This Is Money

The cost of car insurance is falling lately – Which

Get up to £3,000 cashback when you open or switch to an Interactive Investor SIPP. Terms and fees apply, affiliate link – Interactive Investor

How to get discounted gift cards – Be Clever With Your Cash

The loveliest towns to retire to in Britain – House & Garden

Homes for sale in former warehouses, in pictures – Guardian

Comment and opinion

The joy of giving up on having ‘enough’ – The Root of All

How a former hedge fund titan learned to invest with humility – Excess Returns

Bull market brains – A Wealth of Common Sense

How to earn £250 a day as a film or TV extra – Guardian

We don’t bury our dead – Fortunes & Frictions

‘Total portfolio approach’ could shake up asset allocation – Bloomberg via A.P.

Why everyday investors should stay away from private markets – CFA Institute

A golden year – Musings on Markets

Your time isn’t worth shit – The Falling Knife

Be a nerd – Financial Samurai

Warren Buffett’s Thanksgiving letter [PDF] – Berkshire Hathaway

Naughty corner: Active antics

Beware booming brokers in a bubble – Arcadian

Hedging AI bubble risk via Oracle CDS [My read, anyway] – Mind of Mojo

The case for business stewardship – Flyover Stocks

A poker pro turned quant explains trading [Video] – via YouTube

How to capture Japan’s value unlock – Verdad

Capital allocation [PDF] – Morgan Stanley

Kindle book bargains

Poor Charlie’s Almanack by Charlie Munger – £0.99 on Kindle

The Man Who Solved the Market by Gregory Zuckerman – £0.99 on Kindle

Chip War by Chris Miller – £0.99 on Kindle

Meltdown: The Collapse of Credit Suisse by Duncan Mavin – £0.99 on Kindle

Or pick up one of the all-time great investing classics – Monevator shop

Environmental factors

IEA: supply boom in renewables will end the fossil fuel era – Guardian

Millions of Australians to receive free electricity thanks to solar – TechCrunch

London congestion charge to rise to 20% and apply to EVs for first time – Autocar

Southern Water says sorry after millions of plastic beads pollute beach – BBC

Conservation projects falter as rich countries retreat from climate fight – Observer

Nature reserve uses new bird protection on windows – BBC

Robot overlord roundup

Big Short’s Michael Burry has some concerns about AI accounting – CNBC

The Slop cycle: media revolutions breed rubbish and art – Scientific American

DeepMind cracks a centuries-old physics problem with AI – Business Insider

Yes, it’s a bubble – SpyGlass

AI will transform the entertainment industry in a decade – Institutional Investor

When will we make god? – Uncharted Territories

From AI to ROI: some positive evidence [Paywall] – FT

Not at the dinner table

UK to limit refugees to temporary stays – BBC

Trump is set to sue the BBC – Sky

Fox to BBC: hold my pint – ProPublica

The last of the Old West – Money with Katie

Reform’s pretty quiet since Labour began exploring Danish immigration model – Sky

Musk’s trillion-dollar compensation – The Lefsetz Letter

Off our beat

The monks in the casino – Derek Thompson

Space food made from astronaut pee to be tested on ISS – Independent

Investor’s ‘dumb trans-humanist ideas’ setting back neurotech progress – Guardian

D&D and racism [2021 called and wants its culture war back!] – The Atlantic

Why do people love spicy food, even when it hurts to eat it? – Guardian

Scientists find surprise link between grey hair and cancer – Independent

Humanity is depopulating itself – London Review of Books

Why don’t people return their shopping carts? – Behavioural Scientist

The governance-industrial complex – 3652 Days

And finally…

“You may know that the Chinese word for ‘crisis’ is made up of two symbols, one of which can signify ‘opportunity’.”

– Andrew Craig, How to Own the World

Like these links? Subscribe to get them every Saturday. Note this article includes affiliate links, such as from Amazon and Interactive Investor.

- Haha, only kidding![↩]

Before the usual 3-4 suspects rush in to tell me what I’m allowed to write about on my website, here’s a pre-emptive response as to why Brexit again:

1) The NBER report was published just this week, and it meaningfully updates our understanding of the economic cost of Brexit.

2) Many Leavers, politicians, and especially the right-wing press that championed Brexit refuse to acknowledge its economic harm *at all*. Until it is factored into the everyday conversation about Britain’s fiscal plight – or, maybe, another ten years has passed – I’ll continue to suffer the burdensome task of trying to provide some small balance.

3) My taxes will go up this month because of your economically dumb decision. Own it.

4) You don’t have to read it. Feel free to skip to the links, or just take this website off your reading list if reality offends you that much. No hard feelings! 🙂

Looking forward to the comments on this one, should be entertaining. Do you keep a track of the prevalence of the Cassandra index over time on these responses @TI?

JimJim

@TI #1 Dude, logic does not trump emotion 🙁 They socked it to the technocrats, and felt better for it.

@ermine — I know, I know. But I don’t want mainstream readers who are understandably fed up with the subject to let Brexit off the hook. The Telegraph etc is fighting a phoney war. Things would not be great if we’d voted to Remain – still Covid, still Russia/Ukraine, still inflation – but they wouldn’t be quite so immediately desperate. So let’s talk about what’s really happened, especially as I’ve noted many times with Farage actually leading the polls!

@JimJim — Not sure what the Cassandra index is. But among several of my hard-suffering friends, it’s a nickname for me out of acknowledgement of my (dubious) gift of looking forward successfully, persuading few people at the time, then bemoaning it later when nobody cares when things turned out as predicted. (Brexit is far from my only rodeo).

I’m not prescient or anything like that, but if I have any skill as an investor besides pattern-matching it’s an ability to extrapolate forward and to not let go of the bone. 🙂

So after the Greta Thunberg fanboy post earlier in the week we now have the Remainer post, that seems to have been written whilst wearing a pair of EU rose tinted spectacles.

I get many of the points you raise, but you are raising them in isolation, which is a simplistic approach people have taken on both sides of the Brexit argument.

Approaching it from a true geo-political medium to long term approach using both micro and macro economic approaches, with a heavy dose of Austrian thrown in for good measure, makes these arguments so much more complex than you are making them out to be.

Yes, if you believe the mainstream media (most of whom were Remainer leaning) you will believe the numbers in isolation, but dig deeper … much deeper.

It is the same with when you came up with that old chestnut of ‘97% of climate scientists’ nonsense. Most well read readers will know that there is much more to that figure, but you seem to have just gone with the MSM rhetoric and not dug any deeper.

I LOVE the investment advice on here, but from a geopolitical bigger world perspective, you seem to have very naive views that just parrot whatever the MSM says, and doesn’t seem to comprehend the bigger picture.

You know the BBC lied in a HUGE way about Jan 6th. It doesn’t matter if you are a Trump fan or not (I’m not), but it is undeniable that the BBC lied in a MASSIVE and deliberate way. Well, do you seriously think that everything else they report is true? The MSM has been playing the British public for years, but people are waking up and realising that just because the MSM says it, doesn’t automatically make it true – and that counts for Brexit, Trump, immigration, Europe, Ukraine … everything.

As I say, I absolutely LOVE and appreciate this amazing resource from an investment perspective. It is amazing, but from a geopolitical perspective, and issues such as climate and the EU, I feel you need to broaden your sources, as your points are clearly just an echo of the same talking points the MSM has been promoting ever since 2016, with very little variation.

…UK GDP in 2024 is estimated at £2.88bn… surely you mean Trillion.

“UK GDP in 2024 is estimated at £2.88bn”

I hope you mean £2.88trn, otherwise we are in worse trouble!

@Barn Owl @Jon — Ugh, where were you before I sent the email! *blush* Thanks!

@Fred — You are on non-constructive Troll-watch. Some people will think this is an over-reaction but I have over three decades of experience with this.

e.g. You are going on about the BBC when I quoted the NBER report and data. You are prattling on about January 6 and media conspiracies. You are accusing me of over-simplicity while offering nothing but social media agitator prattle. You are throwing me a bone about admiring the investment stuff on here (thanks) while telling me what to read, when I read more broadly than almost everyone I know and you just have Twitter soundbites.

Constructive points about the efficacy of the NBER report or how we can actually bring Brexit into the debate without it being futile and backwards looking are welcome.

But you are hovering by the auto-delete door. If you/people don’t like it there are other sites to read. This is a benign dicatorship.

Cheers!

David Allen Green (an actual lawyer) had a very informative look at the Trump / BBC spat. Although he does only concentrate on this from the point of view of UK law so if the BBC is really being sued in Florida then things might be different:

https://emptycity.substack.com/p/a-close-look-at-trumps-1-billion

Thanks for the links, as ever, TI.

I would not want to be Rachel. What the OBR giveth, the OBR can taketh away. And it does rather start to look like there isn’t a long term thesis and honestly not putting up taxes is starting to look like stubbornness and justifying it as unnecessary is starting to look like lying. I suppose cutting costs would be too much to hope for.

Trouble with pointing out that your predecessors are intellectual pygmies is that you then have to stand on their shoulders instead of those of giants.

Enjoyed the post from Falling Knife this week. The productive hour does seem more and more like the myth. However I’ve recently looked into a hobby of arm-wrestling AI (and getting paid a bounty when I train/defeat it) and it’s quite refreshing to have an absolute dollar value on an hour spent on an intruiging problem vs some other task.

Think this would be of interest for this weeks round up – Dan Neidle has put together an excellent calculator where you can model the impact of different income tax proposals – and see the impact on marginal rates: https://taxpolicy.org.uk/2025/11/12/the-budget-2025-tax-calculator/

Followed up with a Twitter thread showing the hundreds of thousands of people who have avoided the marginal rates by reducing their hours, forgoing promotions, stuffing pensions and/or employing as many salary sacrifice schemes as possible:

https://x.com/DanNeidle/status/1989312760052674697?s=20

If the treasury are interested in working out where the productivity gap is, surely this is the place to start?

Hi TIm thanks for the article.

On Brexit, I voted remain, somewhat reluctantly and was taken aback by the result. Like a lot of people, including the BBC, I didn’t read the room.

It wasn’t primarily an economic decision ( member sovereignty?). The economic justifications were an enabler which allowed people to overcome their reservations and vote leave.

The economic consequences were never going to be good but there is an argument to be made that our subsequent management of the leave process made matters worse. They were conducted by people who resented the leave vote.

A reasonable argument could be made that the wishes of the people were betrayed.

There is a danger that we continue to misread the room….look at the support for Reform.

The complacency that led up to the leave vote ( a vote that was lost more than it was won) is being repeated.

Rather than tell people they are wrong, do something to address their concerns. It is a problem rooted in the nature of a democracy.

As for RR…why on earth did she make that impromptu speech earlier in the week trailing a rise in income tax??

This is an omnishambles. Add this misstep to her weeping episode and I think it can confidently be said that this will be her last budget.

For my own part I worry the smorgasbord of measures we might now face means next week will see me selling down financial stocks and lobbing yet more cash over the iht wall.

You can chose your own truth, but you can’t chose your own facts.

And as @TI summarises so well above, in economic terms, those facts are clear. Brexit is a disaster.

You’re free to say that the price was indeed very high, but still worth it (for the purpose of your values – e g. sovereignty etc), but you can’t deny the price.

@old_eyes #35, in the thread to the last post of Renewables ITs, puts it best IMHO:

https://monevator.com/end-in-sight-for-renewable-infrastructure-trusts/#comment-1920538

“……you have to do the work to show the flaws in the accepted arguments and show how your explanations of the observed facts are better. “I don’t like the answer” is not a good argument.”

On the budget, bitterly disappointed doesn’t get close to my feelings on Starmer and Reeves. I did vote Labour out of revulsion at what the Conservatives have become, but the PM (and Reeves as well) really do seem like complete amateur politicians.

If there were 10 units of flack to be had for raising IT and 1 unit of flack each for the 50 smaller tax rises needed for the same effect, then RR has now gone and suffered 4 units of flack already just for putting IT increases into the spotlight and then double U turning on it, and then still has to face those same 50 units of flack.

And I thought people at the Treasury could do maths.

I would prefer, rather than having increasingly forensic reviews of the foot and the shotgun damage we inflicted, to have surgeons in charge who could at least mend the foot so that we might begin to hobble, with hope that we may get to a decent walking pace soon. The shot was fired, we can never go back to what we had.

Any changes to the salary sacrifice rules and the Monevator crew will need to rewrite the Pension vs ISA articles (again)!

My firm split the Employer NI with staff, so when I was hammering my DC pension it was the equivalent to a 3.5% pay rise.

Obviously it might just be speculation but it still distracted me from something more important, like looking out of the window to watch squirrels squirrelling away grub for the winter… and now I’m thinking about stashing funds away for my future again.

Rather minded to Douglas Adams’s sperm whale when considering our plunge towards the budget, much as with Brexit. Sadly, as with all positions based on belief over evidence, logic is not an effective counter. 100% agree with every word in your excellent piece @TI, thanks, but having feelings for the bowl of petunias.

@Mr Optimistic: Thanks for the balanced thoughts. On this though:

Boris Johnson, who led the Leave campaign, took us out of the EU. He had previously banished most of the Remainer Tory MPs who had tried to negotiate a softer exit.

We got pretty much the hardest Brexit possible and Brexiteers delivered it. Leavers own the economic results.

On immigration, I’m more in agreement. Of course I was extremely comfortable with free movement within the EU and remain that way (external borders are a much more difficult matter) but I could see a huge number of people had decided we had too much inward migration, and that this largely motivated the Leave vote. To then see nearly one million people enter in 2024 (under, again, Johnson’s arrangements) was ridiculous.

I’ve included links about this in Weekend Reading, including graphs and some links this week about a shift to a harder Danish model. Despite what the likes of ‘Fred’ say, I see the different sides.

With that allowed however, there was lots of wiggle room given you had Brexiteers during and after the campaign saying it was all about immigration and putting up (fake) posters showing huge lines of poor-looking immigrants etc, and others who said it was nothing to do with immigration, it was about economics or sovereignty.

Our own exiled commentator BBlimp and many others used to accuse me of being a devious Remainer for suggesting immigration motivated for Brexit. Seriously, go back and read the comments!

There was no consistency. Live by the double-sided sword and don’t be surprised when it swings back and cuts your own arm off I suppose.

Well brexit was a disaster but the more I think about how things have played out these last 15 or so years it just points to so many poor quality people making really poor decisions. The general standard of staff we have running the country is pathetic no one wants to say no, or make bold changes. So we find ourselves working in effectively a crap company which is full of rubbish at the top wasting money on ridiculous things and focused on minor issues ( id card for example) and ignoring big or hard problems. No wonder people are getting annoyed.

@TI. Wasting your time. The people that voted for Brexit are the same type of people who voted for Trump. The correlation is massive. They are not interested in empirical data. This is all about feelings – fear, anger, hate, envy – not logic.

Brexit was an irrational move. To have access to our biggest market, without having to give up forms of sovereignty that really matter: monetary or fiscal policy. Yoda says “Privileged, we were; stupid to leave that, we would be”. Already 4 years after peak globalisation, what idiot in 2016 would vote to leave our biggest regional market and try to become “global Britain”. Possibly 1990, not 2016.

Yes, the EU is a piece of shit. It whiffs of corruption, it’s bureaucratic, we were paying more than our fair share. All true. Thing is, I could apply that view to Surrey County Council. The net benefit of being part of the EU was clearly positive. I’m less clear on Surrey Council.

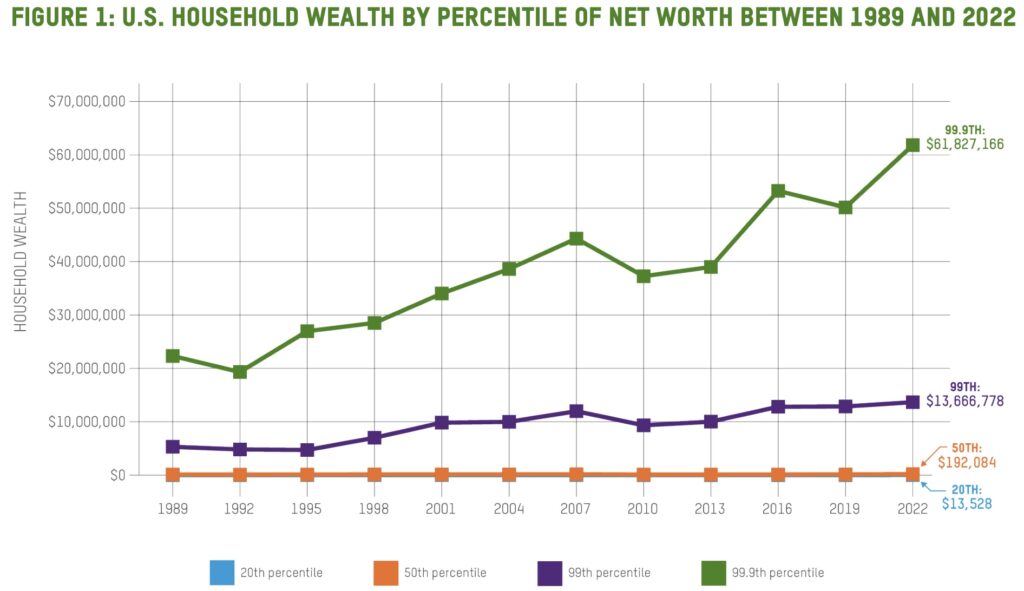

So these people don’t do logic. Look at the JPMorgan chart you provide. The ratio of workers to retired goes from 4:1 in 2000 to 2.2:1 in 2050. It means taxation has to at least double. Less workers, far more retired, who cost 5x more to maintain. Yet, many a Brexit voter doesn’t want their pensions slashed, their NHS slashed, income tax doubled. Oddly, what they do want is less young brown people in the country. Possibly the only way out economically, net of a productivity boom from AI. Their position makes no mathematical sense. Yet that is their position. You cannot rationalize with people who are irrational.

@TI, cheers. Immigration per se doesn’t bother me that much. Uncontrolled immigration with people arriving on beaches does. The security implications are immense.

Boris was an unfettered opportunist. But, another warning sign, look at the election result he returned. In retrospect, was Sue Grey to be admired :).

Tbf on Brexit, it along with tariffs are a clear headwind, but I think the issues are far broader. Right now I would characterize the UK as a kettle without a spout – the pressure builds but no steam escapes, and some of it looks avoidable to me.

Right now we have high interest rates and high house prices PLUS tax rises and declining services PLUS tough working peace of mind and plenty of redundancies. Consumer spending is struggling massively and every working person has some level of misery.

But to me the issue at its core is the decisions of the BoE. Interest rate increases have forced the government to tax harder to do less, amplifying the intended squeeze considerably and killing growth. Imo we should have raised rates to 3% AND done temporary tax rises that would unwind with any rate cuts (and return with rate increases) rather than go so hard on rates and create knock on issues.

When you combine tax rises and rate rises, the overall impact is pretty biblical. Imo they could cut rates to 2.5% right now and still maintain a squeeze on inflation bigger than their original intention. But as it is it all compounds.

Those JP Morgan charts are pretty depressing. I think even if Labour had done things perfectly, even if they had perfect decision making skills, we would still be in the economic position we’re in. They’ve obviously made misteps but it’s concerning how quickly the population (and the polls) has turned against them.

I suspect if Reform do win the next election, which is looking increasingly likely, they will come up against exactly the same issues and the bond market will keep them in check as it did with Truss. And then 5 years later Labour will be back in charge.

My main concern is that Fascist Farage, who let’s not forget is a majority shareholder in the limited company that is Reform, will take steps to consolidate power once he’s in (much like Trump is trying to do at the moment). Then we’re really screwed.

Brexit has worsened our trade position with the EU, and notwithstanding the fact that we have a largely service based economy who ran a significant trade deficit in goods with the EU, it is our own daft fault for making imports so much harder. Whilst the regulatory barriers of the EU has impacted services, our trade with the EU is greater in this area now than pre Brexit and growing.

The single biggest impact on the economy is COVID, not Brexit. The biggest impact on government debt is the growth in welfare, pensions and healthcare spending.

Revenue growth and GDP growth in nominal terms have been similar at around 4% per annum since 2005. Welfare and pension spending have grown at around 4.5% and health spending at 6.5%. Overall spending outpaced GDP growth 4.5% compared to 4%.

The blip was COVID where debt went from 85% of GDP to 100%.

Brexit hasn’t worked out the way I’d hoped, a reflection of the paucity of talent in the governing classes, but it isn’t the main driver of our fiscal problem. The hangover of COVID is way worse.

Re the “had we remained in the EU” with a larger GDP, I wonder how that bigger economy ALT Britain would look ?

Demographics, mix of nationalities , better paid jobs, more people working , types of business, prices, taxes, political mix … it goes on !

What would I look like…

@zxspectrum48k as an East London native the fear, anger, hate, envy is genuine, rock up to your councillor as a non-Bengali in Tower Hamlets and you are on a hiding to nowhere.

I could move tomorrow to Bath or York and temporarily duck out of this problem but most people cannot afford to do so. Address that and then we have a chance of making progress, don’t address it and the likes of Farage will.

@TI

The article you’ve linked, The Joy of Giving Up on “Having Enough” is a fascinating take on goals, accomplishment, and contentment. As a scientist, amateur artist (composer and musician), and retiree, the quote from Charlie Munger included in the article of “I think that a life properly lived is just learn, learn, learn all the time.” is one that particularly resonates with me.

ps As a complete aside (but related to the linked article), the cover of Gordon Lightfoots’s “Wreck of the Edmund Fitzgerald” by The Longest Johns (available on youtube and one of my favourite Folk bands) is as good a version of that song I’ve heard.

I really appreciate this site for it’s intended purpose, the valuable investment insights and the resulting comments shared here, and steering clear of political discussions. But some comments regarding “Leavers” compel me to offer a different, perhaps less represented, perspective.

While many discussions here revolve around FI, it is easy to forget that not everyone started their journey with the same educational or professional advantages. I grew up in an era and community where opportunities were severely limited and career paths often depended heavily on family or union connections.

When we consider the Brexit vote, It’s crucial to understand that for a large segment of the population, the older generation especially, were often overlooked by the urban elite, so their “Leave” decision was not based on abstract economic models or future investment potential, it was a vote driven by decades of feeling ignored by the establishment.

For those in essential support services, dustmen, shop assistants, care workers, drivers, auto assembly workers, whose jobs were moved to Turkey with the EU blessing and assistance, the opportunities within Europe that city dwellers experienced simply did not materialize for them. They couldn’t see the potential for a better life within the EU framework because , in their lived experience, there wasn’t one.

Comments not necessarily here, suggesting that Brexit voters were simply “uneducated” or “ignorant of the facts” are patronizing and miss the point entirely. Such a view shows a profound lack of appreciation for the daily struggles and genuine felt concerns for those who had very little then and feel they still have nothing now.

Brexit was for many, the only democratic opportunity given to try and force a change to their circumstances and make their voices heard.

Before an entire segment of the population is dismissed, I would add that those of you who have achieved success in your chosen path, consider the vast disparity in life chances. You are in a much better position than the majority of those who voted Leave and frankly, are unable to genuinely appreciate their anger, their mistrust, and the feeling of having their concerns continually marginalised.

Continuing to ignore this deep-seated sentiment has consequences. The persistent dismissal of their position and the perceived failure of the mainstream parties to address their concerns is precisely the reason that many are likely to vote for alternative parties like Reform UK in the next election, despite that party’s worrying lack of governing experience. People are voting for change, even an uncertain one, because the current system has consistently failed them.

I’d rather we focus on investing, but if politics must be discussed, let’s approach it with more empathy and an understanding of the socio-economic realities that shape people’s world views, instead of the opening gambit.

@ TI, Even Chris Eubank allowed his opponents to enter the ring before he KO’d them.

@ZXSpectrum48K #20

Loved the comment “Yes, the EU is a piece of shit. It whiffs of corruption, it’s bureaucratic, we were paying more than our fair share. All true. Thing is, I could apply that view to Surrey County Council. The net benefit of being part of the EU was clearly positive. I’m less clear on Surrey Council.”

When thinking about how those who voted for Brexit voted for having their cake and eating it, and are now angry that the cake is gone (or much reduced), I always remember Hilaire Belloc’s cautionary poem “Jim”:

” …always keep a-hold of Nurse for fear of finding something worse”.

Thanks Barney, your comments resonate and are appreciated.

The experience of the top 15% (IQ, Parents lifestyle/wealth… eg. Middle class ) find it very hard to understand what’s it’s like for the bottom 20-40% of the population – what’s good for the elite isn’t usually as good for the average family in the bottom half of society*.

I generally try to ignore the politics here, but it’s getting harder.

* case in point – you probably need a IQ of 80+ to pass the driving theory test. It’s sounds great to marginally improve standards but excluding ~10% due to intelligence is just cruel. Better having a tougher practical. My grandson took about 5 years, his life is hard enough

@Barney #28

I have spent most of my life in the North-West of England and Wales. Both areas where Thatcherism bit deep. So I have a lot of sympathy for the ‘left-behind’ communities. They have indeed been badly treated by successive governments.

However, those who voted for Brexit chose to blame immigrants, the EU, whoever, for their troubles. In spite of the evidence on the nature and source of their problems, and the well-rehearsed consequences of leaving the EU, they actively chose to embrace a comforting myth of ‘Brittania Unleashed’ (and no more foreigners). That was an active choice. The fact that so many looked at the options and said “I don’t really understand what is going on, but I will opt for a leap into the complete unknown” is a worry. It poisons our politics, because soundbites and slogans become the currency, not policies and evidence.

And that matters for an investing site like this because it affects the performance of the UK economy. Something we all should/do care about. I am still working to help our economy succeed, and it frustrates me that politicians are constantly pandering to those who don’t want to engage with reality, don’t want to pay taxes, want to blame all problems on an assortment of ‘others’, so we never have the important discussions that will affect my life and the lives of my children and grandchildren.

These are not easy problems to solve, but they need to be thought through, not abandoned to ‘feelings’.

“…there is always a well-known solution to every human problem—neat, plausible, and wrong.” – H L Mencken

I too love the investment posts here, but I can’t resist picking up the Brexit bone when someone throws it with such abandon. Some of the “Leave voters were just overlooked” takes are… entertaining. Yes, hardship exists. Yes, opportunity is uneven. Also: someone can struggle in life and still be thick as pigshit — not mutually exclusive.

Holing the boat we’re all in just to “show the establishment” who’s boss? Bold strategy, if your goal is starring in a cautionary tale. Spoiler: the establishment floats better than you.

And the “only democratic opportunity” line? Really? Elections every five years, anyone can run, agency is still a thing. Council votes, pension committees, school boards — all open to you. Moaning about injustice while actively rejecting the levers of change is… ironic. That’s what happens when you cede control, and not to the EU.

Jobs weren’t outsourced to Turkey by Brussels. UK employers chasing cheap labour did that, helped by UK politicians running the laxest immigration policy in the whole of Europe. Quite a feat, given that the UK was never even in the Schengen zone. Exhibit 1: Danish border rules being imported years after the UK left the EU. Denmark, btw, *is* in Schengen zone. Exhibit 2: a million people entering the UK in 2024 — how exactly is the EU responsible for that? I thought we were supposed to have control over our borders.

Empathy is great, but let’s not confuse struggle with a free pass for irrationality. Financial independence is about agency, common sense, personal responsibility, and critical thinking. That shouldn’t be a stretch for the readership here.

@TI — sorry, it’s been a funny Sunday morning. Please don’t ban me from the site.

@ Boltt #30

“I generally try to ignore the politics here, but it’s getting harder.”

Agreed!

@TI If we must have tribal politics would you consider a paid subscription to remove all backward looking historical events (esp Brexit) and focus on the future? Im thinking of the upcoming anti-business Employment Rights Bill. I still enjoy the investment stuff.

@ Old-Eyes, I understand your concern about how the political climate affects the UK economy and investment performance.

The Mencken quote you provided highlights the core of the issue: the solutions presented were too neat and ultimately wrong for a large segment of the population.

The ‘solution’ of remaining in the EU offered by the establishment didn’t account for the socio-economic pain already present in the system.

We look for risk factors in our investments; I view the Brexit vote as a market correction of political risk. It was a clear signal that a significant economic input factor—the well-being and sentiment of hard working people—had been catastrophically undervalued by political analysts.

To have a healthy investing environment, we need stable politics, which requires addressing these fundamental concerns with policy, not just dismissing them as ‘feelings’ or myths. We can’t build a stable economy by ignoring half the players in the market.

Many of those “Brexit” voters were in at the “Start” and cannot help but compare to “before and after”

@ hosimpson 32.

I appreciate your perspective. However, when we discuss outsourcing, it’s worth noting the specifics. The Southampton Ford plant, where many Transits were made, closed in 2013. Its production was shifted to Turkey, a move aided by an £80 million loan from the EU’s own bank, the European Investment Bank. This occurred despite UK contributions to the EIB.

For the workers and communities affected, this strategic decision, facilitated by the EU, felt like a direct contradiction of promised benefits. The Ford case was just one prominent example among many companies (e.g., Philips moving production to the Netherlands, Sony moving its EU HQ, various banking operations shifting to Dublin/Frankfurt) making similar moves over the years for various cost-saving and market reasons.

It’s difficult to separate such clear-cut examples of economic shifts from the sentiment and mistrust that later fueled the Leave vote. The issue is not about “blame,” but about acknowledging that these tangible, negative experiences shaped the worldview of many voters more powerfully than abstract economic models.

@ TI please don’t ban him, been It’s enlightening

Thanks for the comments all. 🙂 Goodness knows I’ve written enough about Brexit myself so I am going to be general and brief.

Firstly, on the less affluent/successful. I am not going to laboriously repeat and source all the data, but IIRC only one study found any hit from EU migration on wages/jobs, and it only afflicted the bottom 5-10% of earners.

Sure that’s bad if you’re in the bottom 5-10% but (a) it was only the bottom 5-10% and (b) it was only one study that actually found this affect

People instinctively struggle with this and start making comments about supply and demand; the simplest way to say it is that immigration creates more demand in itself (so it’s not, like say, importing equipment to replace workers). There’s lots of literature on this, I won’t rehearse it all. (Also before anyone pipes up, this isn’t to say high immigration doesn’t present other challenges/problems. But we are talking about wages / opportunities here.)

Even if we overweight that one study and additionally we say the other studies are a few percent out, you simply will not get to 30-40% of people having lower wages / opportunities because of being in the EU. That’s just wrong. You might get to say 10-15% ( though I don’t think so).

So do I think the 52% voted on behalf of the 5-15%? Not in a million years though I’m sure a few did. They voted for a mix of other reasons, some legitimate and more IMHO misguided.

As has already been noted by others, we have political choices every five years, max. And as I’ve said many many times people could vote for greater redistribution, higher taxes, whatever, instead of Brexit.

But the Leave vote was predominantly more Tory!

I thought Corbyn was a terrible politician and my conception of capitalism in the round is radically different from his, but even I voted for him over Johnson because Johnson was even more unfit for office (at least Corbyn doesn’t continually lie) and Johnson already done vast damage with Brexit.

This struggling underclass could (a) bother to vote (b) vote Labour. The 52% who I am being asked to believe voted on behalf of them could do. They mostly don’t.

Finally, and back on brand (because I am slightly centre-left to independent and I admire Thatcher) people can take some responsibility.

Even if that 5-10% were suffering lower wages, they could look to improve their lot.

They are born here. They have friends here. They speak English natively. They face no anti-immigrant prejudices. At the least it was a fair fight.

I am from what I half-jokingly call the provinces and I was in the first generation in my family to go to university. No need for violins etc, but I am not some scion of the elite.

Anyway Leave vote motivation is all ancient history. I bring up Brexit not to change minds that can’t be changed (to @ZX’s point) but because I am offended to the core by the mendacity of Leavers and their media supporters (e.g. Telegraph) that dare to cast the blame about the UK’s economic issues without factoring Brexit into the picture. And I don’t want floating voters in the middle to be misled or to forget.

It’s not all Brexit, is the complaint. Fine, but let’s consistently say it is a bit Brexit, because it is.

Let’s have the honest discussion. I frequently cite other stuff. I have criticised many times the decision to raise employer NICs last budget, for instance.

Finally, whether I should write about this or whatnot?

Yes, I get it. Remember more investment writers / pundits lean Leave (although definitely not most fund managers, I’d say) so I am very used to being annoyed by political opinions intruding into other discussions.

For instance I’m a long-term fan of Merryn Somerset Webb but she continually winds me up me with her refusal to acknowledge the impact of Brexit, with the result that I’ll occasionally stop listening to her (excellent) podcast for a bit. But overall I bite the bullet and get on with it and go back to it.

More personally, you do not keep publishing to a website for 17 years 2-3 times a week by self-censoring yourself to appease a minority of readers who you believe to be wrong-headed in their thinking about a subject that is both intellectually and emotionally important to you.

So, with some empathy, nothing is going to change around here. I’m sure I’ll occasionally write about Brexit in a decade.

Finally, re: Eubank etc, tell me all about your experience of moderating well over 100,000 posts every day of the year and battling with troublesome trolls who do not engage with the argument, and we can talk.

I have a long history of that, and life is short. So I pattern match and reject an obvious troll.

(Notice the Leave-friendlier posts I have not deleted here, I don’t just delete people I don’t agree with. It’s about the motivation to debate and the constructiveness of the argument. This is the first time I’ve done this with a poster for many months.)

p.s. To be clear the poster I am talking about is ‘Fred’ not anyone else.

Re: Car production, obviously it’s bad if you’re individually affected and I don’t know the specifics of that particular closure. But generally this is the sort of anecdote that gets overweighted in debates such as Brexit.

The bald fact is UK car production hit a peak just before the 2016 decision and immediately afterwards. Since we’ve left the EU it’s collapsed.

See the graph here: https://www.bbc.co.uk/news/articles/c23p028p200o

Again, many factors, Covid, EV transition etc.

But being in the EU didn’t hurt the UK car industry and on the face of the evidence leaving it has.

After the Truss experience and the following bond rout, with Reform possibly heading the next government is it/will it be a dangerous time to hold bonds?

# 38

Really TI …

The bald fact is GERMAN car production hit a peak just before the 2016 decision and immediately afterwards. Since Germany stayed in the EU , it’s collapsed.

https://www.ceicdata.com/en/germany/motor-vehicle-production

about 6 millions in 2015. Declines through 2016, 2017, 2018. Then COVID. Recovers to about 4.1 millions in 2023, 2024.

The elephant in the room is of course Chinese car production and their exports that are affecting everyone, in the EU or out of the EU.

There is a recent article at UK In a Changing Europe (not a rabid Leaver outlet I think) : “https://ukandeu.ac.uk/brexit-and-trade-time-to-face-the-sectoral-facts/” Quote : ” But peer below the surface of individual sectors and a complex picture emerges. Big export ‘losses’ in autos and aerospace are primarily due to global downturns. Comparative failures in energy, chemicals and pharma can be traced to domestic policy choices. Brexit is a convenient scapegoat, but our future prosperity depends on analysts making a correct diagnosis of the UK’s recent trading performance.”

Credit to Monevator for sticking with the Brexit topic through the dark years of denial.

That said, I agree with much of what @Barney said. This is a country of unequal opportunities. The grievances were real, mostly justified, and need to be addressed. Where people were misled is to blame their situation on immigrants and the EU. So they shot themselves in the foot and made funding social support and public services harder.

It needs to be said because only a problem that’s recognised can be addressed. And those responsible should be on the hook for the mess. Farage, above all.

@ TI, If you are moderating 36Mn posts a year, no wonder you come out fighting.

It’s your ball, your game, and those who disagree with you, too bad . That said it’s a great place, and your input along with others is always appreciated But you shouldn’t be surprised if, occasionally, there’s a different point of view⚔️ and opinion, especially so with a subject in which you are so involved.

We certainly agree that life is short ﮩﮩﮩﮩﮩﮩ٨ـ♡ﮩ٨ـﮩﮩ٨ـ⏳ and in my 9th decade I should know by now, that nothing matters really, except, stay healthy, in the end it’s more important than all the other crapola.

@Boltt #30 > you probably need a IQ of 80+ to pass the driving theory test

I am not convinced. FWIW I passed my old style test in the early 1980s. If the theory test is typical as represented by this website then I passed this from a standing start, without preparation getting one question wrong out of 50 (if turning right onto a dual carriageway ensure there is enough gap in the reservation, as opposed to stop, engage low gear) which was daft fail to read the Q properly which was What should you do before emerging?

The pass mark appears to be 43/50, and IMO that’s about right. It’s more common sense than IQ and I’d worry about meeting people coming the other way on the King’s highway who got more than 10% of this wrong.

@ermine

I will do some digging and get back to you.

Needless to say your IQ is around 135-145 so comfortably top 2%, so I’m not sure how easy it is for your translates for the less gifted.

In the case of my grandson it’s reading and comprehension where he struggles.

In the last couple of days there’s been a few articles of people taking 60+ tests to pass, and clearly that excludes people still trying (157 attempts is the highest I saw)

If we accept the Brexit decision was driven by emotions / mythos then Remainers (including me) still need to ask how they failed and continue to fail to tell the better story. The Obama campaign is a great example of it done well: “yes we can”, “there are no red states, there are no blue states, there is only a United States”. Farage is excellent at it but it’s not exclusive to his type of politics. Blair’s campaign also nailed it.

I’ve banged this drum before but I’d hesitate to be so disparaging of mythos. We all understand the world through story. It’s not enough for the there to be a God, there also needs to be a Jesus. Even facts are interpreted through a narrative structure. The world is overwhelming otherwise. “Perception is demonstrably an active rather than passive process; it constructs rather than records reality.”

One typical example of mythos rather than logos helping you to act in the world is the rule that you should always act as if a gun is loaded (even when you know for a fact it is not).

@Boltt #44 I can see that the written part does have some reading comprehension so there’s a level of abstraction. You could have the questions read out to you so reading isn’t needed, there is some case to be made that were are becoming a post-literate society, which that addresses.

The hazard ID is in some ways more honest because it’s more akin to reality. I got 4/5 overall for the few they allowed me before kicking me off for being a freetard.

There was abstraction back in the day because there was a bit after the test, if you passed the examiner would show you some signs and asked what they meant, and all the jazz about prohibition, warning and commanding in the round, triangular and blue signs. And the stopping distances at certain speeds which was pure abstraction in the way it was described.

@platformer #45 > It’s not enough for the there to be a God, there also needs to be a Jesus.

I have learned something new here by the analogy to mythos/logos, thank you!

@platformer #45: you’d perhaps enjoy (former Guardianista) Damien Walters’ Patreon channel – searching for a new mythos for the 21st century (you can join for free).

https://www.patreon.com/DamienWalter

@TI #36, re “17 years”, believe it or not, you’ve been at this gig now for just a smigen over 18 years! The queues had not quite begun to form up outside Northern Rock branches, IIRC.

I appreciate the discussion here which is generally well tempered. I definitely come from the bottom 20% financially, but did ok at school and went to university.

When I came out in 1991 and there were no jobs in my field I went on spec to Germany with about £1000 saved, found a job easily, learned German and stayed for 5 years, having a very enjoyable time. That was the wonder of freedom of movement that was taken away from the young generations. Fair enough I was young and had nothing to lose, but facing a lack of opportunity I did something about it.

So I do definitely empathise with the areas left behind, that’s where I came from and where I have ended up going back to, but the 1950/60s are not coming back. It was these areas that benefited most from EU funding of course.

@ermine #46 Normally the God stuff is what turns people off 🙂 As you probably know, it was the Christian tradition that turned logos into flesh. In terms of linking logos and mythos you can’t get better than the very strange John 1:1: “In the beginning was the Word, and the Word was with God, and the Word was God.” (the KJV Bible translates ‘logos’ to ‘Word’)

@Delta Hedge #47 Thanks, hadn’t seen this before!

To quote @zxspectrum48k: ‘whiffs of corruption, it’s bureaucratic, we were paying more than our fair share.’

Not everyone who voted for Brexit were like Trump supporters. Some had knowledge of EU shenanigans in Brussels and – naively it now turns out – hoped that UK politicians would do a better job, not being fully aware of the economic trade-offs.

I think the tragedy is that we, the public, weren’t remotely qualified to know enough to vote on the subject. And separately it’s absurd there weren’t more guardrails e.g. having to have a 10% tilt majority.

But we are where we are – so 1) we need to learn lessons for the future, but 2) we need to do our best from here. And all our political choices are pretty depressing right now. So maybe more and more talent will leave until things (hopefully finally) improve?

To finish off though, I still believe we have the components of a great country, there are many wonderful things still about London (and the few other cities I know well) and it’s important to remember that and not think it’s all bad!

@tom_grlla “Not everyone who voted for Brexit were like Trump supporters.”

Not everyone but I again refer to the Lord Ashcroft poll (sample 12k) taken a few days after the Brexit vote. Of those who voted for Leave, 80% thought multi-culturalism/immigration a force for ill, 80% social liberalism, 74% feminism, 78% the Green movement, 69% globalisation, 71% the internet. I find it hard not to conclude that are majority were anti-science Luddites, racists, or ethno-nationalists. More than a sprinkling of superstition and conspiracy theories. That’s damn similar to early MAGA.

Going back to the economics of this: a person on the median salary of £37,856 only pays £7,080 in income tax and NI. Just 18.7%. If you pay very little, how can you expect a good service?

The options on the table remain the same: pay more, accept inferior services or accept more slave labour from abroad to execute those services cheaply. Which do the public want? Feelings don’t come into this. It’s just math.

@ ZXSpectrum48k

I really don’t want to continue the Brexit thing, because good or bad, it’s a done deal. But like many within government and positions of trust and accountability, who continue to frustrate and denigrate those who had the temerity to vote against the views of those in power, you continue with the slow drip, of what is not always accurate information. This is how I see it. It gives me no pleasure whatsoever but, you just cannot assume and publicise every vote leaver with your incorrect and unsubstantiated thoughts.”

EU vs. Local Council

I respect your view, but I think the core of your argument rests on some flawed comparisons and assumptions.

⚖️ Accountability: Surrey vs. Brussels

You admit the EU “whiffs of corruption” and compare it to Surrey Council, but this is a false equivalence that ignores accountability.

For Surrey Council, I can attend meetings, inspect documents, and, crucially, vote them out. I have direct democratic redress.

The EU is fundamentally different. While the books are signed, the European Court of Auditors (ECA) has historically given an adverse opinion on the legality and regularity of spending. That means funds were paid despite rules not being followed—a major issue fueling corruption concerns.

You have no direct, comparable route to remove a Member State administrator who mishandles EU funds. Dismissing this lack of accountability as “just like Surrey” misses the point of sovereignty and democratic control.

Implementation vs. Decision

You and others cite the poor economic results since 2016 as proof the decision was “irrational.” But we have to look at the implementation, not just the initial decision.

Following the vote, the implementation of Brexit was met with significant resistance, which continues, from major parts of the UK establishment: senior politicians, the House of Lords, and, crucially, the Civil Service.

It’s unrealistic to expect a smooth or beneficial outcome when the project itself was pushed through a political and administrative structure that was largely opposed to the policy. The current economic data reflects a hostile implementation process, not just the act of leaving.

The Trump Comparison

Finally, claiming Leave voters are “the same type of people who voted for Trump” and only driven by “fear, anger, hate, envy” is a sweeping, lazy generalisation.

This comparison is incorrect and would be offensive to millions of voters.

Concerns over legal sovereignty, the supremacy of the European Court of Justice (ECJ), and the democratic accountability gap are not “feelings”—they are legitimate matters of constitutional principle.

Framing the debate as rational “Remainers” versus emotional “Leavers” is just a way to avoid debating the serious foundational issues of governance that were central to the democratic choice.

I have to say that I always appreciate your ‘investing comments’ and look forward to your further input on the subject, especially as to where we are now, with many industry guru’s predicting a correction.”

A good reasoned political debate but this is/was an financial investment site

Can a site serve two masters ?-to continue the Biblical analogies-possibly -probably not …….

In the hands of the Moderator!

xxd09

@ ZX Spectrum48k

A Quick Look at the Poll Data and the Math

I appreciate you providing the Lord Ashcroft data, as it was definitely insightful. However, interpreting those percentages to label the majority of Leave voters as “racists” or “Luddites” is too simplistic and, frankly, unfair.

The Poll Nuance

The poll showed that two things truly dominated the decision to leave: sovereignty/control and immigration.

A voter can be concerned about the pace or infrastructure strain caused by rapid immigration without being an “ethno-nationalist.”

The attitudes you cite on things like “The Green movement” or “feminism” show a common thread of unease with rapid social or political change. This is less about rejecting science and more about a feeling of being left behind or unheard by the institutions driving these changes—which, again, points back to the need for accountability.

Reducing 17.4 million people to a collection of negative labels skips over the fundamental political and constitutional principles that drove the majority decision.

The Tax Math

Your comment on the median salary earner paying only 18.7% in tax is mathematically too narrow.

You are only factoring in Income Tax and NI. This ignores all indirect taxes that hit median earners hard, such as the 20% standard rate of VAT, Council Tax, and Fuel Duty.

When all these are included, the effective tax rate for a median earner is significantly higher—closer to 25%-30% of their salary, depending on location and spending habits.

Crucially, the UK’s overall tax burden (tax revenue as a share of GDP) is currently at a near-historic high, a level not sustained since the 1940s.

The issue is not that people are paying “very little,” but that the historically high amount of tax currently being collected is often not spent efficiently by the government, often through layers of administration and Quangos. The public wants better services, but the choice is not simply “pay more or accept inferior services.” It is: demand efficiency and proven value for the large amount of tax already being paid.

@ xxdog

Completely agree, but you cannot keep being labelled with incorrect information, no matter which way one voted.

My thanks to TI and his supporting crew, who continually strive to make this an excellent site for anyone interested in investing, even if I have to continually look up the many industry abbreviations used here. But thanks anyway.

Thanks for the comments all, some great stuff including some good pushback on my views. Appreciated.

I think it’s fine that we debate Brexit now and then, because I believe it’s a crucially important issue, even whilst accepting it’s a frustrating subject to many.

My whole contention is that Brexit is the elephant in the room regarding our finances from a fiscal perspective at the moment. Many of us are paying much higher taxes and/or getting a worst service as a result of it. (See my post for the maths). And my grievance is that this isn’t discussed more openly in debates about the UK’s fiscal position/trajectory.

And yes, because it seems I/we have to keep saying it, not only Brexit. But *also* Brexit. Yet Brexit has been taken out of the discussion. Politicians know it’s politically toxic and the media knows the public is mostly bored about it, beyond the tribal whistles on both sides.

I do get frustrated with this line that says “we can’t say Brexit voters were motived by X” because “me or some percentage of them were motivated by Y.”

Politics is always about a mix of things. Traditional party politics includes broad swathes of views, and until we can vote on micro-decisions we have to make our choice and lump what we don’t like in with it. Perhaps a future AI can chat to us for ten minutes and then divine our overall views but we’re not there yet.

Leavers and the media (and me in comments about) traditionally talk about Brexit having been partly a failure because of continued high immigration. Farage is basically running for office on this platform!

And yet (as I said above and now we see it) we have well-articulated pushback here saying “actually it was about sovereignty”. Well no. It was about sovereignty *for you* and some several million who voted Leave. But to get to 52% you need that wider cohort which Lord A. and others (and any number of articles and vox pops etc) have identified were driven by non-sovereignty related motivations.

@Barney — Without wishing to sound patronising, I hope I’m as fluent on relatively new media platforms in my ninth decade as you’re demonstrating here. That is some impressive character based emojiing after your ‘life is short’ comment above! All the best, cheers for continuing to include us in your media diet despite these political differences on Brexit.

@TI

I much prefer the investment side and comments too, always educational, although I don’t always get it.

Provided that it’s never personal or offensive, I don’t mind occasionally ditching the Zimmer to contribute to what is an excellent site, from which I continually learn. Thank you.”

@TI

Now that the political debate is settled (for now!), I’m genuinely keen to hear your thoughts on this predicted market correction, emanating from major institutions like the IMF and central banks.

Unlike the majority, time is not on my side. ⏳ ♂️➡️ …. So, having moved, good or bad, the majority of my funds temporarily into the money market, (not timing but preservation) I look forward to yours and other views on that potential correction.”

Touch surprised that so far nobody has picked up on the BBC story about NHS redundancies. As the article hints, and I was told face-to-face a few weeks back by an A&E nurse, those at risk of being made redundant (including him and several of his colleagues) are not [just or even?] what you and I might think of as “admin” staff.

As I see it, Turkeys never have and never will vote for Xmas so what on earth make anybody think NHS administrators are any different. Somebody needs to have a good look under the surface on this one – but very unlikely from the current lot in charge, who seem more interested in keeping their own pay and rations than what they are supposed to be doing! Just another example of todays broken Britain I guess; where some doctors who got huge pay-rises seem to think it is OK to strike for more. Does not bode well.

“My taxes will go up this month because of your economically dumb decision. Own it.”

I didn’t cite for Brexit, yet I think they you would be psychologically and financially better off if you stopped being so angry about having lost the last war.

@JtE — My taxes are going up. It was an economically dumb decision. Leave voters typically won’t own it, as we’ve even seeing in this relatively incredibly constructive and articulate thread. Everything I’ve written in that quote is correct and unemotional.

@AC – it’s a great point. I wonder whether a potential future MV article covers the effect of private health care on UK FIRE calculations?

My medic friends taking out private health care cover is the canary in the coal mine for sure!

It’s a big part of US planning, and I think it will inevitably creep in over here too..

I can’t see how the NHS can get better given the changes in demographics highlighted by ZX et al.

@ ZX Spectrum48k

“The options on the table remain the same: pay more, accept inferior services or accept more slave labour from abroad to execute those services cheaply. Which do the public want?”

Why are these the only options ..?

I would think that for the planet generally a generation or so having an “aging” population would be a good thing as it would mean the population decreasing… less people on the planet ought to be more sustainable..?

What are we doing with all the technology , AI , automation etc. surely we should be increasing productivity astronomically ( I think some places proabbaly are like China) … which would then support a higher ratio of economically in-active older people..

Or is it that we are just not getting the tax revenue and wealth re-distribtion we should be getting from this technology and the tech companies that control it ? Surely it is a better idea to “tax the robots” to re-distibute the wealth gained from increased productivity …so we need less work from humans..

Just some musings and ramblings …I have never understood why in the 80s it was said we would be retiring at 50 as the techonolgy was advancing so much …. something seems to have gone badly wrong if the choices you offer are all there are in my view..

@Barney. Regarding your view that “demand efficiency and proven value for the large amount of tax already being paid” can somehow solve our fiscal issues.

I don’t think you appreciate the magnitude of the fiscal issue facing nearly all developed countries due to low fertility rates. UK real-terms spending on health and social care has risen 14x since 1950, from 3.6% to 7.8% of GDP. Most of that increase was funded by reducing defence spending from 6%+ of GDP to 2%. Moreover, that increase was during a period of positive demographic trends.

In 2000, we had around 4 workers for every retired person. By 2050 that will be closer to 2.2. That alone increases the relative burden on each worker by around 80%. Except retirees cost far more than workers. An 85-year-old costs the NHS about 8x as much as a 30-year-old.

I accept that the public sector could be more efficient. It has generated no productivity gains since 2008 (the private sector has only generated 0.5%/annum vs. around 2% pre-2008). Yet even if we got back to 2%, that wouldn’t be enough. We need growth more akin to an EM market than a developed one.

In the absence of some productivity miracle (AI, cheap nuclear fusion) this is not an issue that can be solved by tinkering. Efficiency gains, cutting benefit fraud, stopping immigrant boats etc. A few billion here or there is a drop in the ocean. Any politician, such as Farage, who implies that is simply lying or incapable of basic math. Having met Farage several times, I would suspect both.

Maybe China is a model with its world leading use of advanced robotics, high speed rail, cheap and effective small language models and mix of expert model architectures (as I’ve covered on the First they came for the Call Centres thread only today, DeepSeek 1 million tokens $0.14, OpenAI 1 million tokens $30. 214x more).

All coupled with energy efficient algorithm improvements (effective FLOP/FLOP) over expensive GPUs cycles.

A society benefitting from the cheapest electricity in the world, and by far and away the greatest installation rate of new renewables and nuclear power generation.

Admittedly they’ve had the mother of all property crashes, but, even so, it’s impressive to go from one of the worlds’ poorest countries in 1978 to a PPP GDP of $37 Tn, with many costal Chinese cities having per capita PPP GDP figures equivalent to parts of the US.

Average growth near double digit average for almost half a century.

What can be accomplished in a society led by engineers rather than politicians who have to tell comforting lies to get reflected every five years.

Of course, a multi party system has the advantage of ejecting a disastrous administration, but that only really helps if the alternative is actually better. In 2019 we had the Boris v Corby clown show. In 2024 it was Rich Rishi or Wooden Starmer. And in each of 2016, 2019 and 2022 we got a new PM with no election.

It’s no longer obvious to me thay our system is inherently superior or will ‘win’. Maybe I’m making false equivalences. But China has lifted more people further out of poverty than any other civilisation in history, and by some degree.

If China can overcome its demographics, and we can’t, and if we fall for populist fantasy compounding our shortcomings, then the moral victory of us being able to claim that we’re democrats won’t amount to much.

China’s economic ascent is impressive, but it’s worth remembering that the “secret sauce” is equal parts industrial policy, millions of engineers, some light intellectual-property osmosis, and the kind of resource mobilisation that can only happen when nobody is allowed to say, “hang on, shouldn’t we run a feasibility study on this thing first?”

This produces good things like high-speed rail, cheap LLMs, and enough solar panels to terraform Mars, but it also produces ghost cities, hidden local government debt, and worse demographics than ours.

Western democracies waste time on election-time nonsense, but they also have certain niche advantages, such as long-run innovation, “not accidentally building tens of millions of surplus apartments” and “having laws about property rights.” Swings and roundabouts.

As for the cheap AI models: yes, it’s remarkable what can be achieved through algorithmic efficiency combined with the time-honoured method of studying whatever the Americans just published on arXiv. Imitate, iterate, repeat. Civilisation in three steps.

The question of which system ‘wins’ probably hinges less on GDP and more on whose population burns out first from despair, student debt, and push-notification fatigue. The jury’s still out.

Caveat: if First Contact with the Vulcans is announced next week, I reserve a right to reconsider the virtues of authoritarian catch-up models. They do tend to work reasonably well up until the point you actually reach the frontier. Plus, nobody has ever proved the Federation was a real democracy anyway (those Starfleet uniforms say “bureaucratic technocracy” more than “vibrant pluralism” in my view). So let’s hope the Vulcans turn up soon and offer a five-year plan that actually works. 😉

@ZXSpectrum48k

That’s a formidable analysis, and I agree with your core premise—the demographic challenge is absolutely immense. The 2.2:1 worker-to-retiree ratio is a looming solvency issue.

However, I think the analysis needs to start where a much older, wiser perspective suggests it should: with the engine room of the economy. Our problem, historically, has always revolved around two things: productivity and labour relations. It’s a painful lesson we seem to keep forgetting.

If we agree that efficiency is just “tinkering,” then the immediate fiscal failure is the colossal drag on the current workforce. Before we even consider structural tax changes, we have to address three preventable drains that represent an enormous loss of national production:

A) Over 9.5 million working-age people are economically inactive, many of whom are healthy and refusing to work;

B) Lost production time due to strikes in the last 18 months;

C) The persistence of Working From Home (WFH) in sectors where it reduces managerial oversight contributes further to lost productivity and reduced innovation.

Solving the 2.2:1 ratio isn’t a long-term dream; it’s an immediate necessity to get healthy, working-age people back to work and productive. If we could seriously tackle these three immediate drains, and couple that with the added efficiency that AI is capable of delivering, a significant portion of the fiscal gap could be rapidly reduced.

And the clearest example of the cost of this failure is felt in every wallet: The average UK person is now £10,200 worse off compared to 2010. This catastrophic loss of living standards is the direct and brutal effect of our prolonged failure to solve the long-standing productivity and labour crisis—a problem that significantly predates the EU debate—and it will continue until those core issues are fixed.

Ultimately, this is where the political failures of the last few decades—which led to the volatility of 2016—originate. The country was in a fragile, distrustful state because the governments before 2016 had failed to solve these core, structural economic challenges of productivity and labour participation.

The demands of “Control” were a symptom, a desperate cry for competence, because the state failed to get the engine room of the economy running properly to begin with.

None of this even includes the significant cost of immigration, and the burden imposed on domestic services.

@ hosimpson / Delta Hedge

That’s a necessary perspective. The debate between technocracy and democracy is complex, but the tangible results are hard to ignore. For decades, the developed world stood by, convinced China still lived on a bowl of rice a day.

The reality is that their major cities and services—the high-speed rail, the general infrastructure—are now demonstrably superior to ours in almost every respect.

They didn’t just catch up; they’ve truly outstripped the rest of the modern world. That confirms that until every Western government stops the political tinkering and introduces similarly radical change focused on competence and execution, we will continue to lag further behind.

@Barney – just looking at your 3 main points above-

A- people may be ‘economically inactive’ for many reasons, caring responsibilities, further education etc. You can be economically inactive living off investments and make a greater tax contribution than many working people. Also, one of the main premises of this site is to invest to give ourselves the option of some degree of financial independence. For a lot of people that is because the world of work in 2025, especially employment, is not a good place to be.

B- I can’t believe that strikes are really a significant drag on productivity these days, I’ve never worked in a job where that was even an option. Cybersecurity perhaps , looking at JLR.

C- I spent my last few years of employment WFH, the myth of lower productivity I think is very popular among managers who realise that perhaps they weren’t really essential. For young workers, yes not the most suitable, but for those who know what they’re doing, perhaps with domestic responsibilities requiring flexibility, there is a huge advantage in having some degree of WFH.

And if AI ever gets to the stage of offering gains in productivity, surely the end goal for employers is to reduce employment?

On China I was just reading this

https://www.noahpinion.blog/p/chinas-people-are-on-a-treadmill

@Larsen