by The Investor

on January 6, 2010

While life goes on in Canada and Siberia under drifts, Britain has been crippled by snow. Again.

London is cloaked by a smog of emissions and the hot air of millions of rat-racers, so the snow hasn’t got a hope of sticking – the view from my window is of a metropolis sprinkled with dandruff, not of gridlock.

But with many major roads blocked in the suburbs and trains marooned, lots of commuters have heeded police warnings not to travel to work due to snow. And with over 30% of schools closed, many who could dig their way to their office are instead watching Teletubbies and making snowmen with their kids.

So far, so no big deal. We don’t get snow often, so we shouldn’t spend billions on snowmobiles and fleets of gritters. And those ‘snow costs billions to the UK economy’ figures are always spurious, since they don’t consider the tangible benefit to millions of a day spent free from office politics!

What is shocking though is that some employers are docking pay if staff can’t get to work, or encouraging them to take the day off as holiday.

[continue reading…]

Thanks for reading! Monevator is a spiffing blog about making, saving, and investing money. Please do sign-up to get our latest posts by email for free. Find us on Twitter and Facebook. Or peruse a few of our best articles.

{ }

by The Investor

on January 5, 2010

According to the New York Times, venture capitalists want to put more money into technology investments, after parting with a mere $14 billion in 2009, compared to $36 billion in 2007.

Technology start-ups are doing everything from speeding up the Web to making office photocopiers more iPod-like, and as the article notes some will go public:

Venture capitalists make most of their money on initial public offerings of the tech companies they invested in.

But in each of the last two years, fewer than 10 companies have gone public, compared with 86 in 2007.

The new year could finally break the logjam, bringing more than 50 tech offerings, investment bankers say. That could include prominent companies like Facebook.

That is welcome news after a dark year, Mr. Dhaliwal said. “The mood is pretty optimistic, in that way that if you’re nearly killed in a car accident you’ve got a renewed positive outlook on life.”

Good news if you’re an investment banker, but what if you’re an investor?

[continue reading…]

{ }

by The Investor

on January 4, 2010

Unlike most money bloggers, I’ve not talked much about the blog’s progress with you. I’ve reasoned you’re here for thoughts on personal finance and investing, not for updates on my tiny media empire.

On the other hand:

- It’s January, a time for New Year plans

- I want to keep regular readers in the loop

- Monevator is finally getting some traction

- Some of those other bloggers have many more readers than me, so they must be doing something right!

So here’s a run through how the blog is going, and what to look out for in 2010.

Monevator: Where are we now?

Monevator is now over two years old, although it was only in mid-2008 that I really committed to regular posting. It remains a rare UK-based money and investing blog.

[continue reading…]

{ }

by The Investor

on January 2, 2010

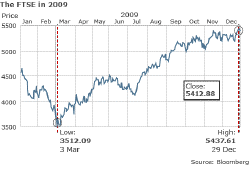

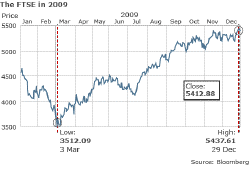

Everyone with an opinion about the stock market was confounded in 2009 – even those of us who thought shares were cheap in March covered our backs with long-term caveats.

Nobody predicted markets would bounce back 50% by December, proving again the adage that stock markets always do what will surprise the most people.

[continue reading…]

{ }