What caught my eye this week.

There are some things you have to experience to fully understand. Losing your virginity is famously touted as one. Parents say bringing up a child is another. I haven’t had that pleasure and I am more than happy to take their word for it.

One I would add to the list though is reaching what I suppose we must call ‘middle age’ (excuse me while I pop off to shout into a pillow… okay, back now, that’s better) and looking back at the various ways your life to-date has fallen short of what might have been.

Sometimes you didn’t realize why at the time. Perhaps you were being paid a fair whack not to think about it. Occasionally you were having a blast. Sometimes you had an inkling. Sometimes you couldn’t pay the rent so it was pretty obvious.

Maybe the Japanese explain it best with this phrase and associated image, as shared by Rachel page on Twitter:

Looking at this diagram, I feel like I’ve lurked in the outer suburbs for most of my life, like some frustrated Home Counties adolescent poet – certainly not on the isolated fringes, so comfortable enough, but never in the thick of everything and completely fulfilled.

If I have achieved Ikigai then it was only fleetingly, and I’m not sure I noticed in the moment.

Many seekers after financial freedom, such as my co-blogger, don’t seem to believe they can ever achieve Ikigai through work, so they best opt-out ASAP. I’ve said many times I believe there’s a risk of swapping one dissatisfaction for another by bailing out entirely – not to mention the pain of getting there – but plenty disagree.

I like this diagram because it suggests a wonderful balance is possible. But I’d agree that like a Zen koan it’s probably more something to be than achieved by most of us.

From Monevator

10 things you can do today to reset your life – Monevator

From the archive-ator: Admit it, you miss the market meltdown – Monevator

News

Note: Some links are Google search results – in PC/desktop view you can click to read the piece without being a paid subscriber. Try privacy/incognito mode to avoid cookies. Consider subscribing if you read them a lot!1

Some landlords face a tax rate of up to 66% on rental profits – ThisIsMoney

Asset managers ‘have something to hide’ from pension trustees [Search result] – FT

House prices grow at the fastest rate in a year, says Halifax – Guardian

UK homeowners opt for five-year mortgages amid economic worries [Search result] – FT

Waterstones buys rival Foyles as ‘real bookshops’ strive to survive Amazon – ThisIsMoney

Thinktank calls for major overhaul of Britain’s economy to achieve ‘economic justice’ – Guardian

Products and services

New app AirWayBill enables you to turn courier to save money on flights – ThisIsMoney

Energy bills to be cut by around £75 for more than 11m households – Guardian

How high street banks reward premier customers [Search result] – FT

Downstairs bathrooms can wipe £13.5k off the value of an average property – ThisIsMoney

Ratesetter will pay you £100 [and me a cash bonus] if you invest £1,000 for a year – Ratesetter

An overview of Monzo, Starling, Revolut and the other fintech darlings – ThisIsMoney

Terry Smith launches global smaller companies trust – CityWire

More: Trust launches show potential and — for once — fairer fees [Search result] – FT

Cryptocurrencies slump amid fears regulatory uncertainty will deter finance giants – ThisIsMoney

A look into the underbelly of the cryptocurrency markets – Nic Carter

Comment and opinion

Why you should calculate imputed rent – My Deliberate Life

The misjudged Lifetime Isa works only for those most able to save [Search result] – FT

It’s not time to hit the ejector seat on emerging markets – Bloomberg

Gold, what’s it good for? – The Irrelevant Investor

Merryn S-W: The Bank of Mum and Dad risks going out of business [Search result] – FT

That’s rich – The Humble Dollar

How to run out of life before you run out of money [Search result] – FT

Small investors shouldn’t bother with factor investing – Dan Solin

Value investing in the Third Reich – Jamie Catherwood

Why you shouldn’t retire super-early, even if you can – MarketWatch

What really goes on at Mr Money Mustache headquarters – Mr Money Mustache

Why I sold Senior PLC after recent share price gains – UK Value Investor

Revisting the melt-up scenario – A Wealth of Common Sense

The cereal entrepreneur – Seth’s Blog

What if? [Provocative macro-economic speculation] – Dr Yardeni

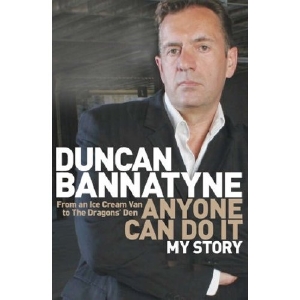

Kindle book bargains

The $100 Startup: Fire Your Boss, Do What You Love and Work Better To Live More by Chris Guillebeau – £0.99 on Kindle

My Fight to the Top by Michelle Mone – £1.19 on Kindle

Your Money or Your Life: A Practical Guide to Getting – and Staying – on Top of Your Finances by Alvin Hall – £0.99 on Kindle

Small Change: Money Mishaps and How to Avoid Them by Dan Ariely – £0.99 on Kindle

Off our beat

The way forward on immigration to the West – The Economist

Josh Rogan interviews Elon Musk [Video] – YouTube

Have the Famous Five got into boiler room fraud? – via Twitter

BBC admits it got climate change coverage wrong. No more deniers for ‘balance’- BBC

The YouTube stars heading for burnout – Guardian

And finally…

“[Rural Indian] women who recently got cable TV were significantly less willing to tolerate wife-beating, less likely to admit to having a son preference, and more likely to exercise personal autonomy. TV somehow seemed to be empowering women in a way that government interventions had not.”

– Steven Levitt, Stephen Dubner, Superfreakonomics

Like these links? Subscribe to get them every Friday!

- Note some articles can only be accessed through the search results if you’re using PC/desktop view (from mobile/tablet view they bring up the firewall/subscription page). To circumvent, switch your mobile browser to use the desktop view. On Chrome for Android: press the menu button followed by “Request Desktop Site”. [↩]

Comments on this entry are closed.

For some reason my click-through to The Blessed Merryn failed.

P.S. I saw the Economist this week for the first time in years. My God hasn’t it shrunk?

@dearieme — Link is good I believe. Perhaps try loading the page in private/incognito mode and clicking?

A case of everything Venn?

Once again; vague shapes and occasional perfect visions floated around my head at times. And someone else has done the thinking for me already.

Thanks for posting!

This is a bit like Maslows hierarchy of needs and it makes a bit of sense. I will print out a copy and use it for reference at work to keep me on track.

Finally. Remove the need for money and what would you be doing as a job?

I would disagree with them from my experience. One can, but not all the time. And it is easier when you are younger IMO. I would venture that once you reach middle age, it’s toast as far as work is concerned.

As Carl Jung said – What youth found and must find outside, the man of life’s afternoon must find within himself

In the West we already do our young adults damage by not having rites of passage from childhood to adulthood. But that’s not the only transition in life, and to ignore the changing currents means you end up swimming against your lifestream in a fruitless search for constancy IMO.

It is a tribute to the work of the Monevator team and the active community around them that I learned nothing new from the FT article “How to run out of life before you run out of money”.

Thanks everyone.

I find that Ikigai idea really interesting. It’s basically the same as Jim Collins Hedgehog Concept from Good to Great, but with a ‘what the world needs’ section added (there’s a large but incomplete intersection between what the world needs and what the world will pay for).

Warning – self-indulgent waffle ahead:

I spent the first ten years of my working life (~1988-1998) in the ‘vocational’ zone, doing jobs I was neither good at nor enjoyed (mechanical engineering, salesman, shelf stacker), but at least they paid the bills.

Then I moved into computer programming because I was good at maths and the pay was better, so I guess that was my ‘professional’ period. This wasn’t Ikigai because while I like programming as a hobby, it’s not so much fun as a job. This lasted just over a decade (~1998-2011).

I then moved out of IT and into investment research/writing/etc and I think this is much closer to Ikigai. It fits my strengths, I enjoy it and it pays the bills.

Not that my life’s some sort of nirvana, but I think this long journey towards Ikigai has been worth it (note that I said ‘towards’ and not ‘to’, because I’m not quite there yet). I just wish they’d had better (or at least some) career guidance when I was at school!

I seem to have achieved after 45 years over the past 12 days. Long may it last. I was familiar with the concept but have never engaged with it. I’m away to print out the diagram and tack it on my whiteboard. Thanks, Dave (Hi, @John.)

@I: thank you, the incognito tip worked. And thank you too for the most arcane IHT-avoidence tip of the week:-

“Downstairs bathrooms can wipe £13.5k off the value of an average property”.

May I ask a question of all and sundry? Can anyone report any known use of the “Pension Advice Allowance”?

Various diagrams such as Ikigai exist, and they all have as a key feature a quiet calm space at the eye of the hurricane where everything comes right. With an implication that this is where we should come to rest.

I don’t believe it. It might be an ideal space to aim at, but it must remain forever unachievable because both we as individuals, and the world in which we live, are in a constant state of change.

This is not like a Lagrange point in orbital mechanics where all the forces of gravity neatly balance out and you can find a stable orbit. This is a chaotic system where small adjustments to inputs fire you off in random and inexplicable directions.

I have passed through that Ikigai zone several times in my life, at various ages and in various industries. What you are good at, what pays, what you love and what the world needs all vary with time. I have had thrilling times when I was doing something I thought the world needed, that I loved, and where I could get paid, but where I actually wasn’t (yet) good at it. I have had exciting times when I was good, loved the work and was well paid, but (if I am honest) not doing anything that the world desperately needed.

Those periods have often gone on for years, but whenever I get into the magic space I seem to end up switching careers within a few months. Either the world changes, or I change, and I fall off the balance point.

So I suspect that whilst it is an interesting point to aim for, actually achieving it would be deathly dull. Life is lived on the edge of chaos, not in a state of cosmic balance.

I’ve had a nagging feeling all day that’s something’s not quite right.

Now it’s come to me: It’s Joe Rogan… not Josh Rogan.

Is it just me, or does the top 10% having 6.8 times the income of the bottom 10% seem pretty equal (considering the likely difference in responsibilities etc). I would think doing a 5% or a 1% bar would highlight in-equality a lot better.

I like this diagram a lot. I spend half my life on oil rigs with the other half spent doing whatever I like. As such, I oscillate on the vertical axis from top to bottom, aiming to average somewhere in the middle. On the horizontal axis I’m less clear…

Another life chart I have found very useful (regarding selection of a mate) is the “hot crazy matrix”. Well worth a watch on youtube.

Bob

Forever seeking the unicorn

Thanks for the links TI and wow — what a week. Back to school, or just coming off the bench from a weekend away and the blogosphere has come up with the goods?! The rest did you good…

I enjoyed the RESET article during the week, and clearly the author is condensing a lot of book into not a lot of space, but he does glaringly miss out health (other than the death bit), and divorce — two of the bigger contributors to older age penury and misery. Maybe his personal experience is lucky, but we are wise to work on both of these aspects of our lives as much as our financial well-being. This is also not explicitly stated in the main article — the Ikigai hurricane might be a Lagrange point, @old_eyes, it’s just L1 and therefore not stable. A plate spinning exercise where, ironically, one of the plates is “not spinning plates”. In Western Philosophy, Aristotle talked about the golden mean — being in balance and not being too far one way or another and how the “happy” man is able to maintain that balance. A very similar thought expressed differently. And sometimes when I’m falling flying tumbling in turmoil, I say oh so this is what she means, as expressed by another more contemporary philosopher.

The imputed rent article missed the point everso slightly for me. I couldn’t decide if it was a technical analysis of savings rates and some magic FI indicator, or a treatise on tax avoidance, or even a republican polemic. I think it’s important to consider imputed rent as both income and expenditure, but simply in recognition of the fact that you must live somewhere and the cost of your lifestyle should be explicit so you can make the choice to move if you had to. But it’s a pretty thin choice — it would be a bold/desperate act to move to rented accommodation and let out your dwelling to reduce your (imputed) rent, but one that you should be aware of. Or for example – choosing to live in one house instead of two. He also misses the point of mortgages as well — they are a leverage on your portfolio, not a reduction in the amount of house you own. If you own a house with a mortgage, you own all of the house, not just the unmortgaged bit. You also own all of the debt and that cash is investable — often in residential property, but also elsewhere.

Also good to to TII slipping on Merryn’s usual mantle of talking up gold as a counterweight. Although I’d simply republish Auther’s chart each week that shows allocation doesn’t matter as much as having one, the thing that freed me up from the gung-ho attitude you see in some of the groups (I’m 100% equities, me, says a man balanced on a log in the jungle cutting his chest with a Bowie knife, daring the markets to come at him) to one of a more sanguine and balanced approach. Rather than see a falling asset as a “rotten” part, I just rejoice that it’s finally getting cheap. How do you successfully time the market? By rebalancing with discipline.

So much more to enjoy this week — the LISA inevitably being seen as rubbish; Terry Smith launching a small cap fund after talking up small caps (Solin takes aim at them, but for me most factors are real but uncapturable net of fees — do the maths); asset managers hiding their fees (who knew?!); and AWOCS ominous melt-up analysis — which in fact ought to reassure passives — it’s remarkably hard to enter the market after the melt-up and before the crash. Miss buying at the Dec 1999 peak by being just 3 months early and you’d have had your first 14% drawdown for free (the other 36% will have smarted, but less).

“does the top 10% having 6.8 times the income of the bottom 10% seem pretty equal”

I’ve never seen – not ever – one of these comparisons that properly accounts for all income. Various sorts of doles, for instance, seem to be routinely omitted. Or again, do people with “tied cottages” – such as I once had – or subsidised housing get rational treatment?

Similarly, comparisons of wealth seem always to omit capitalised values of pension rights.

Wealth, of course, is harder anyway – how do you value someone’s family company, for example? Come to that, how would you know most people’s wealth anyway?

Ah mathmo, love your summaries – often go back to an article I’ve overlooked after you highlight it…

@Mathmo — Seconded… I may not add my own two penneth so much these days but I’m still tuning in each week… Mr Mathmo’s Digest is akin to enjoying two articles for the price of one… Agreed, the price is free but you follow my drift!

Awww shucks. It’s not me who does the hard work in digging these link out each week. We all owe TI our thanks for panning for the barbarous relics posted here. I just find it helpful to organise my thoughts when I react to them. Thanks TI.

@Mathmo — Morning. Cheers, and just to add I enjoy your summaries as much as everyone else. 🙂

I think the graph shows you cant attain ikagi by retiring, because then youre no longer doing something youre paid for or (the same thing) something the world needs (hence why its paid). You could do sonething youre good at if its a hobby, but theres no need to actually be good at it, so i suppose its all about the top quadrant, and learning to not give a toss (aka meditating) about what the world needs or being useful

We’re institutionalised into feeling like our whole identity is being useful

@Matthew

This fallacy is deep within what is rotten about capitalism; we have never found a satisfactory answer to it, but it would be a tragedy if we stopped trying.

Not everything that is needed is paid for (mother’s love etc) and not everything that is paid for is needed – anything that has Kardashian in it for starters but there’s a big field out there extending from gold dictator chic sanitary ware through to expensive yachts.

@ermine – arguably love is a currency in itself, and the mother invests this into the child – with plenty of risk and reward.

The money system isnt perfect by any stretch but i think we should recognise the good that certain underrated jobs do that is reflected in their pay but may feel unfulfilling – i.e the parking warden keeps the roads orderly (something the world needs), the financial adviser introduces people to products they otherwise wouldnt consider, the loan company provides people with the means to fulfil goals that the customer judges are worth borrowing for, the penpusher keeps their employer legal and financially sound, etc, even the daytrader provides liquidity and price discovery – nearly anyone who makes money legally has provided a service and thats important to remember

Its easy to wrongly feel like a meaningful job isnt meaningful, especially with division of labour and distance from what you percievs to be a problem, and ths monotony of what the world actually needs (i.e. nursing home carers)

What people want and what they need are two different things, and capitalism is mostly just an enabler of them them making the wrong decisions in my view — and more often an aid to them making the RIGHT decisions.

Huge swathes of the population could save far more for the old age care they’ll need if they wanted to. They want other things now, and when they need it later they say it isn’t there.

The entire financial independence movement is proof positive of the surplus that capitalism provides. It is feasible to work and save hard for 15-20 years and then never work again. That would have been unachievable for all but a sliver of the population until the last 100 years or so. The average farmer couldn’t take two days off until winter.

Arguably a more brutal form of capitalism that actually matched the complaints of its critics would focus the mind on needs a tad more, but like most thinking people I would never advocate anything like that… we’re too fallible creatures to be held to such harsh account. 🙂

@ti – i think capitalism also shows how much we value those needs – some people dont value the future , but also it inherantly gives them that free choice, in the uk we are complacent because of the welfare state, but even in america you’ll have a significant portion of yolo – and in a sense it is correct to be like that, i just personally cant derive pleasure from much you can buy, other than time, other people enjoy holidays etc

@ermine – also you made the interesting point about rich people buying luxury items – in capitalism the desires of rich people are more valuable, which is morally justified (as far as) wealth represents the good that theyve done

A pop singer or footballer adds a small bit of happiness to many peoples lives, wheras a teacher adds deeply to a small handfull of lives that will usually never have the wealth to show gratitude for it

I suspect that it still is, though the sliver is larger, and has much more advice and support available. Took me 29 years of not-so-hard work.

On Vanity Fair last Sunday, the butcher, already risen from estate servant to self-employed tradesman and retailer, was talking about getting into buy to let, with the possibility of never working again. That was set over 200 years ago, in 1815.

I don’t understand the hate the LISA gets. I only save a small amount in there each month into a vanguard retirement fund, but I also stick all the dividends I receive from my ISA into it (in the same vanguard fund). It’s an instant 25% dividend boost!

I think having the tax free cash after retirement will come in handy, especially if it’s been a rough few years for whatever reason.

@dan – just that for regular people there isn’t really an advantage using a lisa – for retirement a pension would give 25% back minimum and although it’s be taxed on the way out that would be outweighed by employer contributions (and helped by the tax free personal allowance) and there is enough trouble in even getting the poor to have pensions at all, let alone distract them with a product that would probably be inferior without employer contributions

And on property it’s covering similar ground to the help to buy isa, and from what I’ve read,not that well, but both types can be accused of inflating house prices. Also you’ve then essentially blown your pseudo pension (Lisa) just trying to get a property

The main real beneficiaries of a lisa are well off people who already have pensions and worry about their pensions lifetime allowance, it’s a bung to the rich

I don’t get the LISA hate either, from a consumer perspective anyway (it’s different when I stick on my taxpayer hat). If you have a workplace pension with employer contributions maxed out then the LISA is an excellent product to supplement it.

p.s. I can’t imagine there are many under 40s worried enough about the lifetime allowance (and therefore higher rate taxpayers, you’d think) that they contribute to a LISA for what’s effectively lower rate tax relief, rather than VCTs and the like (or just enjoying their money while they are young).