What caught my eye this week.

Behold! Interest rates have risen from the dead! Excuse the fervent tone, but the Bank of England has not lifted rates for as long as Monevator has been in existence. That’s no mean feat given that my first articles were written in September 2007.

(Curious? The first article on this site explains how to calculate dividend yields. Heady days).

So will rates now steadily rise towards the dizzy heights of 5% or more of yore?

I doubt it. I wouldn’t hold your breath on them being above 1% in a year’s time, personally.

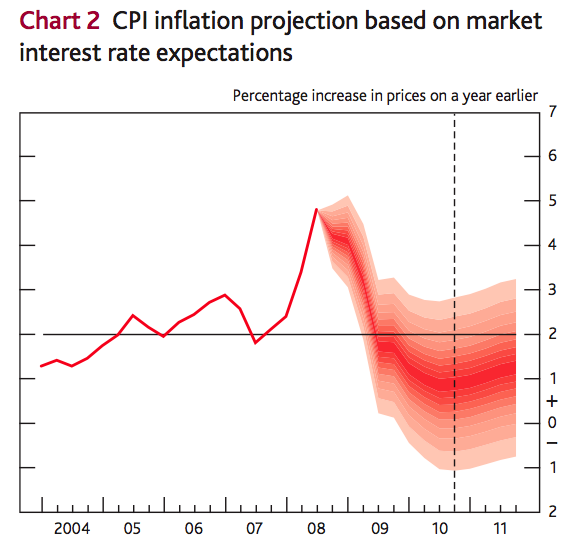

Who knows though? Neither the Bank nor the market expects more than a couple of hikes over the next two years, as the BBC reports, but such forecasts are far from infallible:

Mr Carney told the BBC that the Bank expected the UK economy to grow at about 1.7% for the next few years, which he said would require “about two more interest rate increases over the next three years” […]

The financial markets are indicating two more interest rate increases over the next three years, taking the official rate to 1%.

I had a discussion with a reader in the comments to last week’s Weekend Reading. The reader wondered ahead of the hike whether using an active bond fund might make sense?

His reasoning was that bond market moves were more predictable than the gyrations of equities, and hence the case for passive investing was weaker.

I begged to differ.

It still regularly surprises me how people who have sensibly decided they have no edge in the stock market appear to think they can saunter up to the multi-trillion pound bond market and know better than it – which is really what deciding you can select a market-beating bond fund manager amounts to.

I don’t mean to pick on this thoughtful reader in particular. There have been literally hundreds of people commenting on Monevator articles for the best part of a decade making calls on the bond market. Maybe two or three said they thought government bonds – which have mostly risen throughout – looked like a good buy. Most of the rest proclaimed they were getting out of bond funds, or at most suffering them through gritted teeth, before an imminent crash.

I’d guess at least half these people were self-declared passive investors.

The reader wrote:

If the BoE raises rates next week, the affect on bonds is entirely predicatable. I would have thought just buying a bond fund that re-rates downwards is not a great idea.

At least a bond manager should have been able to foresee and mitigate the affect of a rate hike (not entirely, but just so that the damage is less than in a simple tracker)?

Views appreciated.

But as I replied, things are not so clear cut:

The short answer is that the affect of a rate rise is NOT entirely predictable.

First-level thinking that says ‘rates have gone up so bond fund will go down’ will get a person nowhere in active investing. You need to be thinking second or third level (and be lucky!) and for years on end to beat the market as an active investor.

To give just a couple of counter examples, if rates rise but the BOE attaches commentary that’s more bearish than expected about the prospect of further rises, UK bonds and bond funds could easily rally.

If the rate rise spooks the stock market or drives the pound higher and there’s a mini equity crash, again bonds could rally.

Perhaps most obviously of all, since the BOE has been hinting at a rate rise for months, it could all be baked into the price by now and the actual rise be a non-event

These are just three of many dozens of possible scenarios.

Equally, rates could certainly rise and bond funds could fall — it’s totally possible. But in active investing (and I speak as one) you have to get these calls right again and again — so that you’re mostly right more than you’re wrong, and with the right-sized positions. Not once or twice to talk about at dinner parties. 🙂

Secondly, there’s the risk/reward of predicting and positioning for a rate rise, as an active bond fund manager. Pundits and commentators to this blog have been saying rates will rise and bonds crash for nearly a decade. Even I threw the towel in — after years of warning readers not to be so sure — and asked if a bond crash might finally be upon us back in June 2015.

Luckily, humility won the day and I concluded it looked that way but I wasn’t sure, and that pure passive investors should probably do nothing to change their strategy, or alternatively only tweak it.

As things turned out yields fell even further (i.e. Bond prices rose and there was no crash). The US 10-year yield has only this month finally gotten back to where it was that summer of 2015 — having nearly halved along the way! The UK 10-year gilt yield is still below where it was then, even after months of talk about an imminent Bank Rate rise.

Also — the US Federal Reserve raised rates for the first time in December 2015 and a second time in December 2016. Did bond funds fall as was “entirely predictable”? 🙂

No, yields rose (i.e. bond prices fell!) after the first rate rise. They then rallied with the Trump election, before sliding again after the second rate rise in December 2016.

See: https://www.bloomberg.com/quote/USGG10YR:IND

But let’s leave aside the fact that bonds did the opposite of what they would supposedly obviously do. At some point I am sure rates will rise and yields will indeed rise too (i.e. bond prices and bond funds will fall for a while).

The point is an active bond fund manager has to get these bets right with the right amount of money at the right times to outperform. If a bond manager had decided it was ‘obvious’ yields would rise after those rate cuts I mentioned above, positioned accordingly, and were wrong, then they were now down say 20% over a few months versus the benchmark. They now have to make that back by being right later, and more again to start to outperform.

This stuff is hard. 🙂

Active bond managers are about as expensive as active fund managers, and in corporate bond investing at least they take as much research oomph behind them too. Yet expected bond returns are lower than equities, and right now they are very low. This means the higher fees for active bond management eat up even more of your return.

Oh, and none of this is to even get into the mathematics of reinvestment — rising yields are bad for bond funds in the short term, but in the long-term they can boost returns (due to reinvesting higher yields) which means someone who only looks at their portfolio every five years say might not even notice there’d been much of a correction unless it was truly catastrophic.

So there we have it — bond price moves are not entirely predictable, the consensus about the direction of even central bank rates has been wrong for a decade, passive investors reinvesting their bond income might even welcome rate rises over the medium to long term, and in the meantime with active bond funds yielding maybe 3-4%, TERs of say 1+% are monstrously expensive.

I don’t see going active with bonds is an obvious decision. 🙂

Incidentally I’ve noticed that for some reason, even people who accept the logic of passive investing in shares seem to think bonds are no-brainers. They are not!

The bond market is an even bigger, deeper, harder, and even more competitive market. Perhaps only currencies are bigger/harder (bordering on random in my view over anything other than the multi-decade view, and perhaps even then.)

Oh, and as a coda, UK government bond yields fell and prices rose in the immediate wake of the Bank of England rate rise. Things clearly aren’t quite so predictable…

I didn’t know that would happen. And again I want to stress I have no problem (just far too little time) with readers finding their own way and asking questions. After 15 years as an investing obsessive, I’m still learning new things every day. If anything I’m less confident about what I do know than a decade ago.

I need to be uncertain, because for my sins I’m an active investor. My returns live and die by my speculations. My uncertainty has been hard won. Spend a few years honestly tracking your returns and you’ll discover nothing is “entirely predictable” in investing.

Happily, most readers are, like my co-blogger, passive investors. And if you’re going to be a passive investor, then be a passive investor. Whether in bonds or equities or anything else.

Embrace it! In most cases it will be better for your returns than being almost passive. And you will certainly have a lot more free time and less hassle in your life.

From Monevator

Another week where the universe caught up with Team Monevator and we produced no new articles. Let’s go back in time and pluck something…

…from the archive-ator: Who’s your Star Wars money hero? – Monevator

News

Note: Some links are Google search results – in PC/desktop view these enable you to click through to read the piece without being a paid subscriber.1

What was happening the last time the Bank of England raised rates – Evening Standard

Savills predicts UK house price growth to halve, with London worst hit – Guardian

Fees and charges decimate returns for European investors [Search result] – FT

One in five of the UK’s 55,000 free-to-use cash machines could be at risk of closure – Guardian

New state pension rules mean workers pay through their 40s and 50s ‘for nothing’ – Telegraph

Migrant labour shortage leaves fruit rotting on UK farms [Search result] – FT

Clients of US financial services giant Charles Schwab are spurning cash – The Value Perspective

Products and services

Build your own home — grand designs for beginners [Search result] – FT

Buy and sell shares as often as you like for £1.49 a month with new Dabbl app – ThisIsMoney

Bank of England interest rate rise: when is your lender increasing its rates? – Telegraph

How TSB’s current account can earn you £255 in a year – ThisIsMoney

Fund managers join rush to launch ETF products [Search result] – FT

Comment and opinion

Statistical illusions – Morningstar

What length of retirement should I plan for? – Oblivious Investor

US markets fly as media noise goes by – Investing Caffeine

Value investors are giving up, but we’ve seen this movie before – The Macro Tourist

Understanding evidence-based investing – ETF.com

What’s your Uncertainty/Humility score? – Morningstar

Locations versus size: Househunters discuss the compromises they made – Guardian

If people don’t save enough, where are all the bankrupt (US) retirees? [For nerds] – Kitces

Off our beat

Living by numbers – The Idler

Abandoned land in Japan will be the size of Austria by 2040 – Quartz

Should you sell your start-up for $50m, or try to build a unicorn? – SaaStr

Robots will build better jobs – Vanguard blog

Inside London’s huge experiment in predicting the future of housing – Bloomberg

Learning to spot fake news – NPR

The three-degree world: the cities that will be drowned by global warming – Guardian

And finally…

“Volatility is not an appropriate measure of risk for personal financial planning. When one is in the safety zone above the critical path, volatility may not be risky, but a low-volatility portfolio may be quite dangerous when one has fallen below the critical path and the portfolio value is plummeting toward zero.”

– Wade Pfau, How Much Can I Spend In Retirement?

Like these links? Subscribe to get them every Friday!

- Note some articles can only be accessed through the search results if you’re using PC/desktop view (from mobile/tablet view they bring up the firewall/subscription page). To circumvent, switch your mobile browser to use the desktop view. On Chrome for Android: press the menu button followed by “Request Desktop Site”. [↩]

Comments on this entry are closed.

Thanks for the link about Dabbl, interesting that. I’ve been following FreeTrade as I’m interested in getting into stock trading (I know it goes against everything Monevator has taught me, but index funds are just so… boring). If I’m going to be investing small amounts via the app, say £2k or £3k to start with, is it worth opening it in an ISA? Is there a lot of paperwork with filing a tax return for it? Currently I’m just PAYE so i’d rather not have to do lots of tax stuff each year.

@Gaz — Trading in an ISA will actually save you a ton of paperwork, and it is no more onerous to set up than a normal trading account.

See this article: http://monevator.com/get-an-isa-life/

Great set of links as always, although should that be clients of Charles Schwab, not Charles Stanley?

The rate rise only took away the reduction after the Brexit vote so I am not sure it is a historic moment! Given the ill advised rate cut Merv King made when asset prices were soaring in 2007 ( how did his reputation survive, he should be up there with the Northern Roch directors?), I think the experiment with an independent Bank of England has been a failure and should be undone.

“The three-degree world: the cities that will be drowned by global warming” that is concerning. On the bright side, they will make interesting dive sites 😉

There was another article in the Grauniad recently about the millions of people who will be displaced from their homes by the global warming by 2040 or 2050 or something like that. My question is this: how many of those people are nor yet born? And if they weren’t to be born, perhaps some of the others would not have to leave the deserts of their own making in search of green(er) pastures?

@Stuart — Eek, good catch, thanks! (Got UK platforms on the brain this week…)

Thanks @TI, but am I right in thinking I can’t contribute to my Lifestrategy fund in the same year as it’s also in an S&S ISA? Or is there a way round paying into 2 S&S ISAs in the same tax year?

— “If I’m going to be investing small amounts via the app, say £2k or £3k to start with, is it worth opening it in an ISA?” —

I had the same question about 20 years ago when I was trying to put about 200 pounds a month into a Halifax Sharebuilder account. Thankfully, I had the good sense to open an ssISA since the monthly dividends have long since overtaken my initial monthly contributions. Tempus fugit and all that!

Sorry to be very dull. But was there ever an archive monevator article on how to find a really good IFA? Particularly one specialising in tax?

Does anyone know of one in Hampshire?

Or maybe it’s worth me making the trek to cheddar to visit Mr meldon?

Following our discussion last week I selected five ‘active’ and five ‘tracker’ sterling investment grade corporate bond funds, to see how they performed on a rate hike. The result? I have to say it was quite random. Which confirms your point.

But the randomness of the result, and that most funds actually rose on the hike, leads me to question what (almost) everyone has been writing over the last 5+ years about the ‘bond bubble’ and how dangerous bonds are for a long term investor.

The whole point of ‘fixed income’ is that is it certain and predictable as to returns. Views appreciated.

Interest rate markets, like other markets, include a lot of expectations in the price. How much is always difficult to know, but sometimes you get a hint from the market reaction to an event or new information.

@TI is right, interest rate markets are as difficult to predict as any other. Even the central banks don’t always get the reaction they are looking for and they only have real control over very short term rates.

I’m not a big fan of bonds,but I realise they as John Bogle so eloquently puts it ‘provide an anchor to windward’. I hold 50% of my non equity holdings in a global bond fund and the other 50% in cash ISA’s

@Gaz,

Everyone except Vanguard direct will let you have an ISA that canholdboth Vanguard funds and other equities. If you’ve opened an ISA with Vanguard direct you’re looking at an ISA transfer to a different broker or waiting until the next tax year.

@Chris B “The whole point of ‘fixed income’ is that is it certain and predictable as to returns. Views appreciated.”

Yes bonds are predictable in the sense that once bought, all future cash flows are known, but that only really applies to bonds with no credit risk, such as gilts. Even then though, you don’t precisely know what the inflation adjusted cash flows will be. More generally, it is impossible to predict what the price of a bond will be at any particular point in time (apart from maturity date). What you can observe is particular behaviours with bonds that do not apply to shares, for example as maturity date approaches, the price will tend towards par value, so short dated bonds are usually less volatile than longer dated bonds.

I must say I was very pleased to see my gilt prices rise following the rate announcement. It is not easy being a gilt investor when the majority of opinion is against them, even if much of the spouted opinion is such utter nonsense.

What is frequently missed by commentators, even those who should no better is that bond yields do not march in step with base rates, so even though it is correct to say a 0.25% increase in a bond’s gross redemption yield will cause a drop in the price of that bond (a mathematical certainty), it is not true that a 0.25% rise in base rates will cause a 0.25% rise in bond yields.

How many future rate rises could be caused by the need to protect the pound should it come under further pressure (e.g if Brexit goes bad)? I always understood that higher rates would strengthen a currency by causing inflows of capital from overseas, and with so much inflation being “imported” via the price of fuel and food, a stronger pound would help keep the cost of living under control. Except that too many people have enormous cheap mortgages and wouldn’t be able to deal with a rise to “normal” interest rates. Agree it’s very complicated and hard to predict.

Bond investment boils down to views of credit risk (risk of the bond not getting paid) and duration risk (the way that market values before redemption go up and down in inverse relation to market yield, the more so the longer the duration). I am not convinced that most passive bond funds give you a credible chance in respect of either set of risks, particularly at this stage; we are just slowly emerging from a period of low interest rates unparalleled in history. Are people really just going to chuck their money into eg an all gilts tracker? Because (ignoring this week’s symbolic return to Brexit bank rates) if they do that and yields go up materially, they are in for an unpleasant experience. Similarly, are people really going to go for a passive bond fund promising to invest in eg “investment grade” corporates, when the only thing you have to rely on is that the rating agencies have given the paper an at least BBB rating – good luck with that; it went s0 well last time.

I am not sure your comment broadly to the effect that active bond fund expense ratios are as bad news as those for active equities funds is quite right; they are often lower. In any event, I gladly pay them in several cases for someone else to do the leg work in a very complex field. I cannot even begin to imagine trying to personally match the diversification, credit assessment and tenor risk management done by the likes of Jim Leaviss, Ian Spreadbury or Paul Causer/Paul Read. Passive funds are okay in my view only for real boiler-plate stuff like US Treasuries if you can eat the duration risk.

@xeny I’ve got my Lifestrategy ISA with Cavendish, except they don’t seem to offer equities at all? I’m interested in apps like Dabbl which make it easy & cheap to buy particular stocks (e.g Tesla).

Overall, empirical evidence from the US indicates that active bond funds are even worse underperformers than active equity funds. At least for government bonds, long duration corporates and (strangely) high yield debt and emerging markets the evidence is clear cut. It is true that there is some evidence that investment grade intermediate and short dated corporate bond funds have being doing better than their benchmarks over the last 5 or so years, as have “Munis”, if anyone has any interest in them.

http://us.spindices.com/documents/spiva/spiva-us-mid-year-2017.pdf?force_download=true

Page 15.

As for so called “Strategic” bond funds, I cannot see much point in them at all. Impossible to construct a sensible portfolio using funds where asset allocations swing all over the risk spectrum at the whims of fund managers.

I am confused by the analysis in the ‘Statistical illusions – Morningstar’ link which to defends the Morningstar ratings.

…

Doesn’t this suggest that 10% of rated funds receive a 5-star rating and, of those, only 14% maintain that performance? It is hardly a figure to demonstrate the quality of the rating system. My maths may be wrong but it seems that 0.1 x 0.14 = 0.014 or in other words, the 5-star rating is useful for 14% of the 5-star funds and overestimates performance for 86% of the rest?

Apologies, text cut out of the previous post:

The Journal was not impressed by its findings. One pullout quote read, “Of funds with a five-star rating, three years later only 14% had performed at a five-star level.” Another: “Of funds with a four-star rating, three years later 25% received only a one- or two-star rating for that period.” The writers use the word “only” twice, to signal that these results were clear failures.

In this instance, the base rate for that first quote is 10%, because 10% of funds receive the top Morningstar Rating. Thus, at 14%, the Journal’s numbers demonstrated the predictive strength of the ratings, rather than the predictive weakness. Similarly, as 10% of funds receive a 1-star rating and 22.5% earn 2 stars, the news that 25% of 4-star funds subsequently scored inferior 1- or 2-star ratings meant that those funds had fared relatively well, not relatively poorly.

@subbuteo. If you follow the link in the article, I think the 2014 analysis explains the outperformance of 5* funds better http://beta.morningstar.com/articles/667868/the-fund-winner-curse-is-an-optical-illusion.html

“While the 10 largest five-star funds may not all have kept their five stars after 10 years–only one did as of July–all outperformed their peers.”

Basically what the article is stating if I have summarised correctly is that whilst a 5* morningstar fund will suffer ‘regression to the mean’ and is unlikely to still be a 5* fund a decade later, the statistical evidence is that its performance is more likely to be above average than a fund chosen at random.

I invest in index funds because index funds beat the majority of actively managed funds. However if 5* morningstar funds also deliver outperformance after 10 years, could an alternative strategy be to invest in 5* morningstar funds to obtain outperformance?

@ Naeclue

Well, it is possibly better to use strategic bond funds than to take the fully passive approach of praying that one lives long enough to claim that everything turned out okay in the end. There is a small group of such managers who have done well over long periods in good times and in bad, both relative to indices and to the strategic bond sector. The argument that you are handing management to them sounds strong prima facie but may be an illusion based on a notion that we who are not proven experts can do better than those who are.

@TI – “If anything I’m less confident about what I do know than a decade ago.”

“Ignorance more frequently begets confidence than does knowledge.” – Charles Darwin

“If anything I’m less confident about what I do know than a decade ago.” or how I learned to stop worrying and just buy VWRL

Sod Telsa as a stock (have held before, have done well, don’t hold now) but I do want a Model S as a retirement pressie to myself!

@Naeclue, you said above “it is correct to say a 0.25% increase in a bond’s gross redemption yield will cause a drop in the price of that bond (a mathematical certainty)” . I agree with your general point (a BoE rate rise doesn’t feed directly into a rise in yields), but wanted to point out that the causal link is actually the other way round. The coupon on the gilt (the amount the government will pay out) is fixed at the time of issue, so it is in fact the drop in price which causes the rise in the yield. What causes the drop in price is basically market sentiment, taking into account not only the actual BOE rate rise but expectations about future movements and other market conditions. So it is pretty complicated…

You missed the University of Manchester report on “unretirement”

http://www.manchester.ac.uk/discover/news/unretirement/

@Nebilon, I would simplify and say bond prices/yields (2 sides of the same coin) are driven by supply and demand. If short dated base rates rise and feeds through to bank deposit rates, that will lessen demand for short dated gilts from FSCS protected depositors. If base rates rise substantially that will have some knock on effect on longer dated gilts and bonds. Other factors matter as well, such as perceived risks of currency devalutation.

@Hospitaller “Well, it is possibly better to use strategic bond funds than to take the fully passive approach of praying that one lives long enough to claim that everything turned out okay in the end. ”

You have that the wrong way round. passive investors are simply accepting market returns (good or bad) less a few bps. It is active investors who are taking a punt/risk that they can get better than market returns. The cost of taking the risk to achieve outperformance is the higher higher likelihood of being landed with underperformance. Past performance is a terrible predictor of future performance, especially so once risk is properly taken into consideration. If all you are going on is past performance, going active with bond or share funds is “praying” that past performance is, against the odds, repeated.

As for “There is a small group of such managers..”, I completely endorse the Investor’s comment

“It still regularly surprises me how people who have sensibly decided they have no edge in the stock market appear to think they can saunter up to the multi-trillion pound bond market and know better than it – which is really what deciding you can select a market-beating bond fund manager amounts to.”

Thanks for another great list of articles. I really appreciate all your efforts and look forward to the Weekend Reading articles being posted. I’ve even started clicking on a few of the Adverts on your site every time I visit, which I never normally do on websites. Hope it makes a difference.