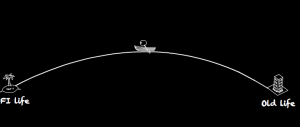

When I first looked into investing, it was like staring across the Atlantic Ocean. All I could see was a vast, churning deep, full of danger that could swallow my wealth whole.

I needed help to sail these seas, and among the competing offers I found a trusty vessel named index investing.

While you can make the journey in expensive luxury liners like actively managed funds or in a one-man skiff tossed hither and thither by your own stock picking, here are five reasons why a more modest seeming vehicle – a portfolio of index funds – makes the most sense:

1. Index investing is simple

Never invest in anything you don’t understand is a mantra repeated time and again in personal finance. Like never crossing the road between parked cars, it’s excellent advice that’s all too easy to ignore.

Happily, index investing is easy to understand, even for those with little investment experience.

- You use simple index tracker funds or Exchange Traded Funds (ETFs) to construct a diversified portfolio that keeps your eggs in many baskets.

- You make regular contributions to your funds and rebalance your portfolio as little as once a year (some prefer never).

- Holiest of holies: You don’t try to time the market or pick hot stocks.

2. Index investing works

Index investors will beat the average active investor after costs and taxes, according to Nobel Prize winners like William Sharpe and legendary investors like Warren Buffett.

Study after study shows that most actively managed funds are trumped by index funds over the long-term. Why? Because index trackers are dirt cheap. Their low costs nibble away less of your pie than pricier active funds, which rarely put in the consistently stellar performance required to justify their high fees.

Index investing is not a ticket to instant riches. It doesn’t aim to beat the market, but rather to capture the returns of the market. We’re putting our money on the tortoise, not the hare.

3. Index investing is affordable

Cheap index trackers can be bought from online brokers like Hargreaves Lansdown. You can buy in small, regular chunks and build up your portfolio slowly over time.

With a bit of confidence and self-education you can manage it all yourself. This means you avoid paying commission or fees to a financial advisor.

4. Index investing doesn’t waste your life

Stock-picking hoovers up vast amounts of time. Index investing leaves you free to sniff the roses. There’s no need to grapple with complex methodologies, pour over company accounts or entangle yourself in charts.

5. Index investing puts you in control

Ever hire a dodgy financial advisor only to discover later you’re paying sky-high fees for mediocre funds that didn’t suit your needs? (Or was that just me?)

Knowledge of index investing strategies can help you avoid a similar fate by revealing:

- The risks you’re taking and how to dilute those risks to a level you’re comfortable with.

- How much you need to invest to achieve your financial goals.

- A DIY approach that avoids rip-off merchants and saves you a bundle in the long term.

- Good questions to ask an advisor should you still want to hire one, which will help you find one of the good guys to work with.

To get you started we’ve a huge library of passive investing articles here on Monevator.

Dive in, and happy investing!

The Accumulator

Comments on this entry are closed.

6. Index investing has gone nowhere for over ten years.

Cheap they maybe, but perform they have not.

You need one where the dividends are not used to make up the tracking error.

.-= Neil Wilson on: The solution to the European debt crisis =-.

Interesting article on ETFs from alphaville:

http://ftalphaville.ft.com/blog/2010/09/18/346406/can-an-etf-collapse/

I was always in favor of index funds for people who lack the understanding or time to perform their own research on a consistent basis.

However, this shouldn’t mean that people just put everything on autopilot and never check or re-balance their holdings.

As with almost everything else in finance, there needs to be a balance.

.-= Khaleef @ KNS Financial on: How to Create a Budget – Evaluate Expenses =-.

@Edindie – That’s an astounding article. It gets even better in the comments when the author and swaldman start fencing like a pair of master swordsmen. Hopefully this is an angle that will get picked up by others and investigated thoroughly. It’s a salutary reminder that nothing is certain out there and risks abound, including the risk of being paralysed by every scare story that emerges. I don’t intend for that to sound like I’m trying to dismiss the article as a scare story. Doubtless this one will unfold over time.

@ Khaleef – I totally agree with you. And that’s a lot of people. Especially as we’re increasingly expected to rely on our own pension provision with little or no financial education. And especially as there’s lots of talk that as the UK moves to fee-only IFAs, small investors will find it ever more difficult to find someone who will give them the time of day.

Neil,

If index investing has gone nowhere the last ten years, can you tell us what has gone somewhere? Virtually every actively managed fund has done worse over the last ten years. And even the ones that survived…can you guarantee that they’ll do just as well in the future? Indexing is a terrible choice, if you can predict the future. The problem is that none of us seem to be able to predict the future very well.

–Rick

@Edindie – Two articles rebutting the FT Alphaville ‘Can ETFs collapse’ story:

http://fridayinvegas.blogspot.com/2010/09/etf-lesson-part-i.html

http://www.morningstar.co.uk/uk/news/article.aspx?articleid=92112&categoryid=5&refsource=newsletter&lang=en-GB

Thanks for following these up, Accumulator! The length of the defenses at least reminds us that while buying ETF portfolios is a simple option for investors, ETFs themselves are not. But hey, I can fly to New York without understanding how a plane can fly. (Actually I do understand how a plane can fly – I’m talking about Mrs Miggins sitting to my right in seat B4!)

I actually see this wave of fear about a very technical subject as heartening. It shows many more people understanding investments can fail you for technical as well as market reasons, doubtless as a result of the credit crunch. I wonder how long such penicillin will last this time?

Hi

i am reading your articles since 2 months and really thankful for all this information.One thing i can’t get is yearly return and performance ratios .for example vanguard ls 60% income has been quoted 12 month yield as 1.68% and but 1 year return has been quoted as 10%.so, i will get 1.68% back on 100 pounds or 10% on 100 pounds.

Kind regards

@Accumulator: I just discovered this blog, and read your post. Disclosure — I have been a student of Passive Index Investing for a while; since I started, the more technical and financial data I have since continued to accumulate and digest only has serves to confirm in a mathematical and statistical sense what I grasped intuitively at the start. (I also don’t live or invest in the UK). I must admit, the initial intuitive hurdle was the most difficult to cross: the wonder at how could I, the untrained and naive investor possibly hope to do as well, let alone better than the highly trained expensive teams of financial wizards who have devoted their whole lives to this black art of discerning the economic future from divining the entrails of impossibly dense financial data.

I welcome reading comments from other followers of this principle; there is always some nugget of wisdom to learn from other practitioners. Particularly, learning subtle differences in practices in other countries can often lead one towards an objective re-looking at common wisdom in one’s own country.

I have no disagreement with your statements of principle above: however, I felt you did not go far enough.

It is difficult to explain Index Investing succinctly and accurately to the uninitiated, and unfortunately sometimes statements of truth lead to unintended conclusions by listeners.

For instance, I thought your mantra “Never invest in anything you don’t understand” was a necessary first statement to your explanation. However, the corollary to that statement, especially in this context, deduced by many listeners would be that those “experts” who have far deeper and sophisticated knowledge of financial parameters and data would have a far greater certainty of deducing future financial trends than anyone else. (And therefore the investor needs to spend vast amounts of time, effort and study to achieve this expertise, or alternatively needs to pay the high going price for such experts to advise you, or else you cannot hope to invest profitably and safely).

I thought it would have been useful specifically to explode that myth; unless it is explained specifically that this ain’t necessarily so (and, actually, it ain’t so at all!), investors are likely to come away with the idea that Index Advising is only second best, and is the refuge of those who are too stupid or too lazy to do the necessary diligence (the “grapple with complex methodologies… or entangle yourself in charts” of your point number 4). Investors, especially those exposed for years to the awe given to the so-called “wizards of Wall Street” etc., need to be exposed to the robust data that exists which demonstrates that, despite great depths of this arcane knowledge held by these experts (I would be the first to admit that these experts certainly have familiarity with these data far more than I could ever hope to achieve), this great knowledge has failed to translate in any predictable way to any consistent probability of improved investment profit for any given level of investment risk. This point is the most poorly understood to those trying, and failing, to grasp the fundamental wisdom underlying Passive Index Investing.

Unless this point is fully understood, which it must be before you can believe it, then your good advice given at the end of point number 1, “Holiest of holies: You don’t try to time the market or pick hot stocks” doesn’t make much sense, and will be forgotten, or worse, ignored, when all the financial experts are screaming in the papers that interest rates are going to rise, so get out bonds now, or equities are overvalued, so sell this and buy that, etc. I think the real test of the Index Adviser is his/her ability to hold true to an investment plan despite distractions like that, and, hopefully to give an adequate explanation, if questioned to the effect that nobody can predict the future in a way that enables one to exploit this prediction for a profit.

@Accumulater: I was just spouting off in immediate response to this single article. I just realized that this was only the first in an intended series of articles that will, no doubt, fill in the blanks indicated by my unnecessary prodding, for which I apologize. I, of course, am fully in agreement with what you say.

To be honest I have never heard of this kind of investing, but it sounds quite interesting. I hope it is actually simpler than Forex trading, which requires a lot of skills and knowledge.

@all — Updated this one, SEVEN years after we first published it. (Eek!)

Mostly just new links — we’ve now written the hundreds of articles we promised when the post initially went live and @TA’s ship first set sail.

Oh, and of course in the interim index investing has been vindicated by another seven years of average active fund-beating history… 🙂

Agreed on all fronts! I love the simplicity of Index Investing… no researching (beyond basics like expense ratios) or feeling like investing is a “gamble”.

Excellent article, spoiled a little imo by the name check for Hargreaves Lansdown. Why talk about low fund costs and then single out one of the most expensive brokers? If you have to name one, at least choose one that tops your own very excellent comparison table!

@VF – perhaps a relic of the original – remember that 7 years ago HL was a no brainer as it was big/reputable/profitable, had great customer service and had no ad valorem charges. RDR beggared all that up and we all had to switch out. I remember writing a hot letter of complaint to the CEO outraged when they bought in the £2/month charge which with hindsight was lovely compared to the eventual 0.45%. I was young and stupid then.. old and stupid now..

I have a six-figure sum with Hargreaves Lansdown and regularly recommend them to newcomers to investing among friends and family. Not everything is about costs IMHO. 🙂 (For context I use 4-5 brokers/platforms).

p.s. I should add my first port of call is now Vanguard’s Direct platform for those prepared to go pure passive, and not in need of SIPPs. And again I know it’s not the ultra cheapest. I’d hope anyone reading these comments and this site regularly considers going ultra-cheapest. But as I say IMHO more to it than that for everyday people. 🙂

If I ever get round to creating my ‘basket of ITs’ and its taxable, I’d prob go back to HL to do it.

I’d agree its not all about costs, but you always have to know what the cost is.

I struggle a bit with risk mitigation through diversification of products and brokers. I don’t think I’m doing very well in that dept.

Yes, I remember the big HL bail out. I predicted their price hike letter would be a suicide note, but they don’t seem to have run out of mugs.

@GM quite – as TI recently highlighted -> http://bit.ly/2tnuj76

Pretty dominant I would say..

Was there not another article on LISA’s that was meant to come out?

@Dartmout – yes, I was looking forward to that one!

Index investing has worked a treat since 2008 for the ‘ignorant’ investor (and I say that in the nicest possible way). Low-cost, accessible and little expertise required…..what’s not to like! But will the index investors who have dipped their toe into the markets during the QE era be willing to track the market down for sustained periods? i.e years (note: should that happen).

I agree with the sentiment towards HL expressed by The Investor. I have a 7 figure SIPP with them in drawdown. Just ETFs and gilts. I have used numerous brokers and for my purposes they are the best value and outright best for service.

However, I hold my ISA and most of my other investments with iWeb now due to their low costs, not least the zero platform fee for holding OEICs. Service with iWeb is not a patch on that provided by HL, but is good enough. I would not want to trust iWeb with my SIPP though, which is a much more complicated wrapper than an ISA.

@Chris, I am not the least bit an ignorant investor, but I am still going to stick with trackers. When share markets next go down significantly, and at some point they will, I accept my investments will track the markets down. But what is the alternative? Market timing? Scratching around for high cost active funds that might do better? There is no evidence that either route will lose me less money in a downturn.

I plan to continue to hold a 60/40 equity/bond+cash portfolio and rebalance annually.

@NC – You’re right, HL is really compelling if you can build a portfolio be it SIPP, ISA, taxable without recourse to any OEICs because of its super reasonable caps.

Note, if you hold a SIPP with iWeb, you’re really deciding on whether you trust AJ Bell Youinvest

I had not realised that A J Bell looked after the iWeb SIPP administration. That would boost my confidence in them, but the agreement might not last and if something goes wrong they may end up blaming each other.

I did consider switching to Youinvest before going into drawdown as they looked slightly cheaper than HL at the time. I had a Youinvest dealing account for a while, now closed, and although Youinvest seemed ok, I still had a better overall impression of HL and it did not seem worthwhile switching. If HL ever mess me around or try to bump up the charges, Youinvest would likely be my first choice for a switch.

The one thing I do find annoying with HL is the comparatively high charge for conversion of ETF dividends. They charge 1.7%, compared to only 0.5% at Youinvest. That foreign exchange fee costs me more than the capped SIPP fee.

However, HL do manage to avoid withholding tax on US listed ETFs. Something not all SIPP providers do, although I understand that Youinvest do as well. Avoiding that 15% tax completely overwhelms my SIPP charges, so I would definitely pick a provider that did the same.

@The Rhino, I thought iWeb was run by Halifax?

@NC – the iWeb SIPP is just allowing AJ Bell Youinvest to offer their SIPP in a flat-fee flavour as well as their standard ad valorem offering

your insight that the costs devil is very much in the detail is a good one..

@Andy – My understanding is that iWeb is operated by Halifax sharedealing. AJ Bell Youinvest is the SIPP scheme administrator for both iWeb and Halifax sharedealing.

Low cost Index Trackers make up the majority of my little newbie portfolio. Influenced by the “Tim Hale Home Bias – Global Style Tilts 4 Portfolio” I added an actively managed UK Micro Cap Growth fund which invests in smaller companies with a market capitalisation of less than £50m, the ongoing charge is 0.8% so it’s not massive but being new to investing I did get caught out a little bit with the initial fee of 1% being hidden in the Bid/Offer spread (Charles Stanley didn’t list any Initial Charge) Not that it really matters because It’s all part of the learning experience and I wanted in on the fund *hopefully for long term growth.

Maybe I’ll have to keep re-reading this article every now and then to keep myself from straying off track, I’ve already been taking an unhealthy interest in what’s happening with Acacia Mining.

Thanks Monevator, your site is invaluable.

When I first looked into investing, it was like the Atlantic Ocean. I have never seen it…

Hello

Have been reading the monevator for a week or two now trying learn the basics of passive investing.

I need to start a plan for my retirement I’m almost 49 and only have very small personal pension to my name, I’m obviously quite green re investing generally but have decided to open a Vanguard life strategy fund as it seems a good thing to do at least for starters but I can’t decide what ratio, I’m thinking 60/40 but I’m sure I read snippet on here that you should choose bonds equal to you age so that would suggest 50/50 but I don’t see that option from vanguard. Is there a way to do that?

Also can the life strategy fund be opened under an ISA wrapper to protect it from capital gains? And lastly being 49 my initial timeframe is 16 years to retirement but if I was to die within that time do my contributions to that point become part of my estate or can my family keep paying in/ or cash out under one their names?

Hi Chris, you could achieve a 50:50 mix by blending a 60:40 LifeStrategy fund with a 40:60 fund like this: http://monevator.com/lifestyle-vanguard-lifestrategy-funds/

Vanguard don’t do a 50:50 product. But bear in mind, you’re quoting a rule of thumb not a scientific theory. A 60:40 fund could be absolutely fine for someone in your position but it depends on more than just your age. These posts may give you some more helpful context:

http://monevator.com/asset-allocation-strategy-rules-of-thumb/

http://monevator.com/what-you-need-to-know-about-risk-tolerance/

http://monevator.com/how-to-estimate-your-risk-tolerance/

If you die then your ISA allowance can pass unharried by HMRC to your wife or civil partner. Google ISA and inheritance tax. The rules changed in the last couple of years where previously ISA’s lost tax protection upon death.

@The Accumulator – Thank-you very much for your detailed response, I’ve read the links more clearer now for me think I’ll be okay with 60/40 so will go for that and the answers for my other questions.

Just need to make that start and carry on learning, thank-you for an excellent site.

Sorry I have one more question, I have a small personal pension and even smaller old company pension at the moment I’ve tried to look for a definitive answer but I presuming I cannot transfer those to a scheme like Lifestrategy can I? Am I right I’d have to wait until I’m 55 and withdraw some of those funds and invest then?

Hi Chris, you may well be able to, but there are a lot of wrinkles. This is a good place to start:

https://www.gov.uk/transferring-your-pension/transferring-to-a-uk-pension-scheme

Also, get in touch with your pension providers and ask them if there is any reason if you can’t transfer / costs attached / benefits lost.

Thanks again, I will check it all out.

@The Accumulator – Love your site :o)

What are your views on this article …..

http://www.morningstar.co.uk/uk/news/161654/dont-buy-passives-for-best-returns-in-european-equities.aspx?ut=2

I contribute to a pension scheme with my employer L. C. Council and am considering starting A. V. C. to add to my pension pot. 10 years duration which will have tax benefits also but am now wondering whether I could invest in V. L. S. as a pension instead ls it legal and a good idea

The one thing I felt was that in good times, index funds outperform but in bad times, a competent active fund manager can rebalance their portfolio quicker. As such the downside is protected as compared to the index. Is that not the case ?

Thanks for a great series of articles.

@Viv — In theory any particular active fund manager can do this, but in practice they don’t have a great record. Partly that’s because active investing is a zero sum game (all the funds together are the market) so it’s impossible for more than 50% of actively invested money to do better, let alone all active funds. It all has to balance out. See this article:

http://monevator.com/is-active-investing-a-zero-sum-game/

That said you will sometimes see data showing active funds doing better in bear markets. However in my opinion that’s because they hold more cash than index funds, as they need it to meet redemptions from investors. This is a drag on returns in the good times but a small cushion in the bad.