Whisper it, but it does seem like the long shadow of Covid may at last be retreating [1] in the UK.

That’s not the case for the whole world. Countries like India [2] are feeling the full force of what some in Britain still march [3] and vote [4] to deny. Average global cases recently sustained a new peak of 800,000 a day [5].

But thanks to our long (and, yes, damaging) lockdown, high [6] vaccination rates, and the immunological protection granted by previous infection, the UK appears to be leaving the tunnel we entered back in February 2020 [7].

Now, as we blink back into a world of hugging and hubbub, we’ll finally find out what has changed [8] and what has not [9].

Just like starting over

At the start of Corona-crisis [10], there was talk that Covid would kill off [11] the quest for financial independence.

Even some esteemed contributors to Monevator’s comment section rushed to dance on the grave of the FIRE 1 [12] movement.

That was crazily premature, and proved that no matter how often you show someone a graph of the stock market going down and then going up again, they’ll struggle in a crash to grok it.

Fourteen months on, and it seems more middle-aged people in US than ever are pushing to retire earlier after their Covid experiences.

Booming US stock markets have to be part of that story. But as Bloomberg (via MSN) reported [13] this week, life re-evaluation is also in the mix:

About 2.7 million Americans age 55 or older are contemplating retirement years earlier than they’d imagined because of the pandemic, government data show. […]

Financial advisers say they’re seeing a new “life-is-short” attitude among clients with enough money socked away to carry them through retirement.

The prospect of going back to the daily grind is going to be “a really tough pill for a lot of people to swallow,” said Kenneth Van Leeuwen, founder of financial services firm Van Leeuwen & Co. in Princeton, New Jersey.

One of Van Leeuwen’s clients, an executive whose portfolio has soared, is retiring at 48. After the past year, the prospect of going back to traveling 10-12 nights a month just isn’t appealing anymore.

Many people have had a hard reset. Now we’ll see how we reboot.

Back to life, back to reality

Anyone wavering about whether to retire or not could do worse than read Debt-Free Doctor’s summary this week of Bill Perkin’s Die With Zero [14].

I’ve been around this block more than few times. The concept of doing more, spending mindfully, and working less is hardly novel.

But I was still struck by the force of Debt-Free Doctor’s [15] recap:

…if you spend hours of your life acquiring money and then die without spending all of it, then you’ve needlessly wasted too many precious hours of your life. There’s no way to get those hours back.

If you die with $1 million left, that’s $1 million of experiences you did NOT have.

I’ve added Die with Zero [15] to my reading list. If anyone has read it let us know your thoughts below.

Turn! Turn! Turn!

As you get older, these decisions take on a less theoretical hue.

Indeed I was also struck this week by a blog post [16] by one of the team at Bunker Riley about a teenage skateboarding hero of mine.

It seems veteran skater Tony Hawk has done his last ‘ollie 540’ – a signature trick with a very high wipeout-to-glory ratio.

Hawk explained:

“They’ve gotten scarier in recent years, as the landing commitment can be risky if your feet aren’t in the right places. And my willingness to slam unexpectedly into the flat bottom has waned greatly over the last decade.

So today I decided to do it one more time… and never again.”

When age – and risk versus reward – starts catching up with your childhood idols, these questions no longer feel quite so academic.

I can see clearly now

What will you do in the months and years following the great reopening?

Will you retire early? Move to the countryside [17]?

Or move back, because rural life proved to be a Covid fad with all the staying power of a Tamagotchi?

Of course if you’re younger – or poorer – some of these choices remain theoretical.

You might have decided the pandemic has shown you the rat race is a total kabuki show, but you’re 25 and £20,000 in debt. FIRE isn’t for you for a long time yet.

But at the risk of sounding too happy-clappy, that doesn’t mean there isn’t a spiritual Covid dividend for you, too.

It takes most people several decades – and a few funerals or a health scare – to really understand that life is precious and nothing is given to us.

If Covid has taught you how precarious normality can be in your 20s, then you’re ahead of the game. Even if you’re behind in your bank account.

Personally I’d suggest looking for a more fulfilling career than going full-tilt on extreme frugality [18] for an early and potentially under-funded retirement. But my co-blogger The Accumulator might disagree, so there’s definitely two sides.

One thing working in your favour if you’re young: companies may be desperate for talent as the economy takes off.

The venture capitalist Hunter Walk [19] believes we’re on the cusp of a ‘Great Talent Reshuffling’ as the psychological after-effects of Covid ripple through society, with younger workers looking for more meaning and older workers abandoning ship to find meaning elsewhere.

It could be the greatest economy-wide game of musical chairs we’ve ever seen, outside of the wartime.

Are you ready to dance?

From Monevator

Vanguard LifeStrategy funds review – Monevator [20]

Never ever respond to a cold call – Monevator [21]

From the archive-ator: My 10 rules to stay sexy and save money – Monevator [22]

News

Note: Some links are Google search results – in PC/desktop view you can click to read the piece without being a paid subscriber. Try privacy/incognito mode to avoid cookies. Consider subscribing if you read them a lot! 2 [23]

Buy-to-let landlords spread their bets away from London [Search result] – FT [24]

HMRC pays back £716m in overpaid pension tax – Which [25]

Woman loses nearly £113,000 in scam dating site romance – BBC [26]

Gary Lineker’s political Tweets could help him avoid a £4.9m tax bill – Guardian [27]

Warren Buffett names Berkshire Hathaway CEO successor – BBC [28]

Also: Berkshire Hathaway broke Nasdaq’s 32-bit code with its monster share price – The Register [29]

Yale’s legendary portfolio [30] manager David Swensen has died at 67 – Yale [31]

Ethereum price momentum could see it “flip Bitcoin” – Independent [32]

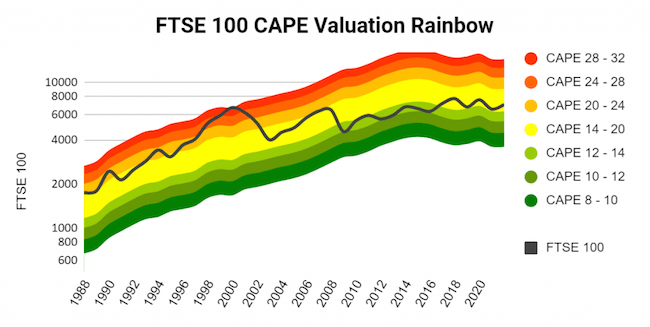

The FTSE 100 looks fairly-valued on the CAPE measure – UK Value Investor [33]

Products and services

American Express halves cashback on its market-leading cards – ThisIsMoney [34]

Comparing the monthly High Street coffee subscription deals [Search result] – FT [35]

Sign-up to Freetrade via my link and we can both get a free share worth between £3 and £200 – Freetrade [36]

Estate agents reveal the 10 biggest flaws that stop properties from selling – ThisIsMoney [37]

The race to the first US Bitcoin ETF – ETF Trends [38]

Homes for sale with a view, in pictures – Guardian [39]

Comment and opinion

Buffett and Munger are no longer relevant – The Reformed Broker [40]

Common mistakes that investors make – The Financial Bodyguard [41]

The US market really should be in a bubble – A Wealth of Common Sense [42]

ESG outperformance narrative ‘is flawed’, new research shows [Search result] – FT [43]

A 147-year old warning against stock market speculation – Novel Investor [44]

Why do smart people do dumb things, like investing actively? – TEBI [45]

Adapting to a world bent on falsifying the past – Abnormal Returns [46]

Resurrecting the value premium [Nerdy] – Alpha Architect [47]

Naughty corner: Active antics

Margin loans in the UK – Fire V London [48]

Bitcoin: we’re all HODLers now – Elm Funds [49]

Stocks, bonds, and higher inflation – Compound Advisors [50]

Data shows markets behave differently in the low-rate era – Klement On Investing [51]

Half of all VCs beat the stock market [US] – AVC [52]

How is Keystone Positive Change trust getting on under Baillie Gifford? – IT Investor [53]

Buffett’s investments: the great, the good, and the gruesome – Think Advisor [54]

Covid corner

Under-40s to be offered an alternative to the AstraZeneca vaccine – BBC [55]

Early cancer diagnoses plummeted in England during pandemic – Guardian [56]

The Covid lab escape theory is looking like the best fit – Nicholas Wade [57]

Kindle book bargains

What It Takes: Lessons in the Pursuit of Excellence by Stephen Schwarzman – £0.99 on Kindle [58]

Radical Candour by Kim Scott – £0.99 on Kindle [59]

Hired: Six months undercover in low-wage Britain – £0.99 on Kindle [60]

The Future Is Faster Than You Think by Peter Diamandis and Steven Kotler – £0.99 on Kindle [61]

Environmental factors

How much energy does Bitcoin really consume? – Harvard Business Review [62]

Rare fish set to return to River Severn breeding grounds – BBC [63]

How to regrow a wrecked coral reef – BBC [64]

Pension funds urged to help UK meet net zero goals – Guardian [65]

Why not turn airports into giant solar farms? – Wired [66]

How ‘insanely cheap’ solar power continues to shock the world – Guardian [67]

Off our beat

Take Ray Dalio’s free MBTI-style personality assessment – Principles You [68]

You may not like the coffee guys, but you like the coffee, guys – FdB [69]

Seeking stillness and sunlight: the art of fly-fishing – Lit Hub [70]

Taking an idea from invention to the marketplace – BBC [71]

How the Pentagon started taking UFOs seriously – The New Yorker [72]

And finally…

“There is much more to life than what gets measured in accounts. Even economists know that.”

– Tim Harford, The Undercover Economist [73]

Like these links? Subscribe [74] to get them every Friday! Like these links? Note this article includes affiliate links, such as from Amazon, Unbiased, and Freetrade. We may be compensated if you pursue these offers – that will not affect the price you pay.

- Financial Independence Retire Early[↩ [79]]

- Note some articles can only be accessed through the search results if you’re using PC/desktop view (from mobile/tablet view they bring up the firewall/subscription page). To circumvent, switch your mobile browser to use the desktop view. On Chrome for Android: press the menu button followed by “Request Desktop Site”.[↩ [80]]