What caught my eye this week.

Fashion shop ASOS [1] reported full-year results this week. Revenues were up a fifth and profits surged, as the online retailer found itself with a – cough – captive audience during lockdown.

In the mercurial way they are wont to do though, its shares actually slumped despite this good news.

Everyone knows business is booming for online retailers, and ASOS shares have been on a tear for months. So like a seasoned Tinder swiper, investors focused on the negatives.

ASOS’s management fears its 20-something customers are set to suffer more job losses. That’s even assuming they’ve got anywhere to get dressed up to go to, with much of the country lurching into increasingly ubiquitous ‘local’ lockdowns.

Also, customers have begun to return a lot of what they buy, just like they used to in the good old days.

For a few months earlier this year, a sort of Blitz spirit saw most shoppers buy only what they felt most likely to keep. But more than a few have now resumed their habit of ordering with abandon like Julia Robert’s Pretty Woman run wild in Rodeo Drive, only to return most of it to ASOS [1]. That’s a big drag on margins.

I suppose it’s encouraging in a sense. A hint from the resilient younger generation that things will go back to normal someday, spendthriftery and all.

Office politics

I wondered about whether we’ve changed [2] and what will go back to normal [3] before. It still seems up in the air, at least from the perspective of UK citizens who find themselves restricted [4] again. (I daresay the existential questions are less prevalent in virus-free South East Asia.)

One place where the narrative is especially all over the place is working from home.

I’ve read countless reports from property companies this year that talk a good game before admitting their offices are open, yes, but mostly empty.

And it wasn’t long ago that Boris Johnson was urging people [5] to go back to work, eyeing city centers that remained more ring doughnut than jam-packed.

But even before the second wave, it wasn’t clear whether people actually wanted to go back to the office.

A study [6] by UK academics found that 88% of employees who’d had a taste of working from home during lockdown wanted to continue to do so, at least in some capacity.

Nearly half said they wanted to mostly work from home in the future.

Set against that are regular soundings from those who are finding working from home a strain, if not depressing or distracting.

As one person quoted by Slate [7] put it this week:

I didn’t think I would miss the office because I’m an introvert … until I was a few months deep into full-time WFH. I almost need the external accountability of going into the office.

Otherwise I tend to procrastinate and lose focus, and as a result I’ve really seen my work quality dip and my stress level go up as the months have gone on.

I recently got the opportunity to come back into the office on a part-time basis and I feel so much more productive and happy.

I have worked from home for most of the past two decades. I’ve long considered it one of the secret joys of modern life. (I did break the omertà and tell you so [8]).

Everything is easier without a commute or crowds at the shops, and with most of your chores done during screen breaks.

Not to mention you’re more likely to be in for those online deliveries!

Well, that cat is out of the bag. We’ll see how many newfound freedom lovers can transition to at least partially working from home, and how many are made miserable when the option is snatched back from them.

What do you think? Let’s have a rare Monevator poll:

I don’t expect our readership to mirror the general population. But it’ll be interesting to see what you all think.

If homeworking is here to stay, then some companies face a reckoning. You can definitely run a business with many or even all your workers at home (I have) but it must be set-up that way for the long-term. Institutional memory and goodwill got firms through the first lockdown. But those are wasting assets.

Have a great weekend, as best you can where you are.

From Monevator

Pension transfers: everything you need to know – Monevator [10]

From the archive-ator: How to Make a Million, Slowly, by John Lee – Monevator [11]

News

Note: Some links are Google search results – in PC/desktop view you can click to read the piece without being a paid subscriber. Try privacy/incognito mode to avoid cookies. Consider subscribing if you read them a lot! 1 [12]

Tax rises of more than £40bn a year ‘all but inevitable’, says IFS – BBC [13]

Working from home: could you be eligible for up to £125 in tax relief? – Guardian [14]

Just 16% of self-employed put money into a pension, compared to 48% 20 years ago – ThisIsMoney [15]

Government reveals proposals on how it will protect the future of cash – Which [16]

…including plans for UK shops to offer cashback without a purchase – Guardian [17]

National Grid warns on lack of wind recently [Says we will avoid blackouts] – ThisIsMoney [18]

US auction theorists Milgrom and Wilson win Nobel Prize for Economics… – BBC [19]

…and Monevator won the top spot in a ranking of UK personal finance blogs – Vuelio [20]

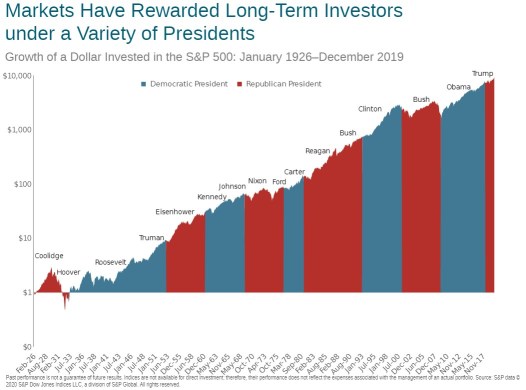

Don’t mix your politics with your portfolio – A Wealth of Common Sense [21]

Products and services

PayPal to charge £12 inactivity fee: how to avoid the charge and spot a scam email – Which [22]

Fears lenders are set to crack down on remortgaging and first-time buyer loans – ThisIsMoney [23]

Sign-up to Freetrade via my link and we can both get a free share worth between £3 and £200 – Freetrade [24]

FCA to ban sale of crypto-derivatives: will it protect you from investment scams? – Which [25]

On average, we should budget an extra £197 for working from home heating this winter – StartupsGeek [26]

Homes in former hospitals and infirmaries [Gallery] – Guardian [27]

Comment and opinion

Move over Help to Buy — now it’s help yourself to your pension [Search result] – FT [28]

First mover – Indeedably [29]

How old are you, really, and how should it affect your retirement planning? – Investment News [30]

Can you hold on to your accumulated wealth? [Search result] – FT [31]

Go long – Humble Dollar [32]

There’s no ‘bank of mum and dad’: What it’s like to be richer than your parents – BBC [33]

Haunted houses – Klement on Investing [34]

When to spend your money mini-special

Once you have enough, it’s time to help others – New York Times [35]

Carl Richards: spend on the things you love – The Evidence-based Investor [36]

Are you a toxic retirement saver? – A Teachable Moment [37]

Naughty corner: Active antics

Letter from the value investing mental asylum (or how I embraced the stoics) – Advisor Perspectives [38]

Japanese equities still look very cheap compared with the rest of the world – Verdad [39]

Buffettology Smaller Companies: IPO thoughts – IT Investor [40]

An alternative to the standard model of investment [Research] – SSRN [41]

Virus and Brexit

Source: FT [42]. Note: Log scale.

Covid-19: Is Sweden getting it right? [Video] – BBC [43]

How worried should the UK be? – BBC [44]

PM warns he may ‘need to intervene’ on Manchester – BBC [45]

Remdesivir has ‘little or no effect’ in reducing coronavirus deaths, WHO says – CNBC [46]

Covid reinfection: Man gets Covid twice and second hit ‘more severe’ – BBC [47]

Should airlines be promoting £5.99 flights during the Covid crisis? – Guardian [48]

Brexit: UK must ‘get ready’ for no EU trade deal, says PM… – BBC [49]

…I’m old enough to remember when “we would hold all the cards” – Steven Poole on Twitter [50]

Jonathan Pie: the second wave [Video] – YouTube [51]

Marina Hyde: What are the Conservatives conserving? Not us, and not even their own party – Guardian [52]

Kindle book bargains

How Will You Measure Your Life? by Clayton Christensen – £0.99 on Kindle [53]

The Looting Machine: Warlords, Tycoons, Smugglers and the Systematic Theft of Africa’s Wealth by Tom Burgis – £1.99 on Kindle [54]

Reinvention: How to Make the Rest of Your Life the Best of Your Life by Brian Tracy – £0.99 on Kindle [55]

RESET: How To Restart Your Life and Get F.U. Money by David Sawyer – £0.99 on Kindle [56]

Just Fuck*ng Do It: Stop Playing Small. Transform Your Life by Noor Hibbert – £0.99 on Kindle [57]

Off our beat

The dangers of cynical sci-fi disaster stories – Slate [58]

How iceman Wim Hof discovered the secrets to our health – Outside [59] [hat tip A.R. [60]]

Why save Secret Cinema when real cinemas are in ruins? [I see a case, but £1m?] – Guardian [61]

Cluttercore: the pandemic trend for celebrating stuff, mess, and comfort – Guardian [62]

And finally…

“It turns out that everyday meltdowns – failed projects, bad hiring decisions, and even disastrous dinner parties – have a lot in common with oil spills and mountaineering accidents.”

– Chris Clearfield, Meltdown: Why Our Systems Fail [63]

Like these links? Subscribe [64] to get them every Friday!

- Note some articles can only be accessed through the search results if you’re using PC/desktop view (from mobile/tablet view they bring up the firewall/subscription page). To circumvent, switch your mobile browser to use the desktop view. On Chrome for Android: press the menu button followed by “Request Desktop Site”.[↩ [69]]