Investing is a swampland of hidden costs, semi-hidden costs smeared with camo paint, and costs hiding in plain sight shouting “I’M A COST” – but, alas, everyone’s too exhausted by the world to pay any attention. FX fees (foreign exchange charges) are of the semi-hidden variety.

FX fees are invariably buried deep in your broker’s Costs & Charges pages. They occasionally turn up in your transaction history but as often or not just aren’t mentioned – like an embarrassing uncle who exposed himself to the neighbour’s budgie.

The issue is FX fees are not only charged when you trade international shares or if you like to pick ‘n’ mix FOREX 1 [1] funds.

You may well find a slice of your income lopped off every time your apparently bog standard global or US or emerging market ETF pays dividends.

And some brokers charge a ridiculously high amount for FX conversion, making like a wealth mosquito that won’t quit harassing its favourite cash cow.

But there’s good news! You can squish FX charges.

Some brokers offer very competitive currency conversion rates. Moreover you can cut FX fees out completely by choosing the right ETF.

When are FX fees charged?

There are two main instances:

- When you trade in an ETF, fund, share, or other instrument that isn’t priced in sterling.

- When you receive dividends in a foreign currency.

In both cases, your broker will convert your money into the appropriate currency and take its cut.

Sounds fair – except that like a currency exchange machine in a hotel lobby, your platform may not be incentivised to give you the best rates.

How can I avoid FX fees on dividends?

This is easily done with ETFs by choosing the accumulation [2] version of the fund.

The accumulation variety of an ETF automatically reinvests your dividends back into the fund for you.

Because the dividends aren’t paid into your broker’s account, you don’t incur FX fees.

However ETF providers aren’t always great at listing the accumulating versions of their ETFs.

I mean, why make it too easy?

Vanguard is particularly bad at this. The company’s consumer-facing site typically lists the distributing versions of its ETF range.

The simplest way I’ve found to uncover accumulating ETFs is via justETF’s Screener page [3]:

Drop the name of your ETF into the search bar.

It’ll list all the ETFs different incarnations. (They are all clones in terms of what they hold, so don’t worry that there’s any intrinsic inequality between versions.)

You can usually tell how each version treats dividends by scanning the variations in the fund name.

It’ll be an accumulating ETF if its name contains any of the following abbreviations:

- Acc

- A

- C

- Cap

Whereas the ETF pays out dividends to your broker if its name is tagged with any of these tell-tales:

- Inc

- D

- Dis

- Dist

Sometimes an ETF’s name refuses to divulge its secrets. In that case click on the screener’s Use Of Profit filter on the left-hand side of the page. Choose the Accumulating option and you’re away.

See our fund names explained [4] post for more on decoding index trackers.

How can I avoid FX fees on trades?

You can dodge FX fees on trades if you choose an ETF that’s priced in pounds on the London Stock Exchange.

This time it’s not as simple as checking an ETF’s name to see whether it mentions GBP.

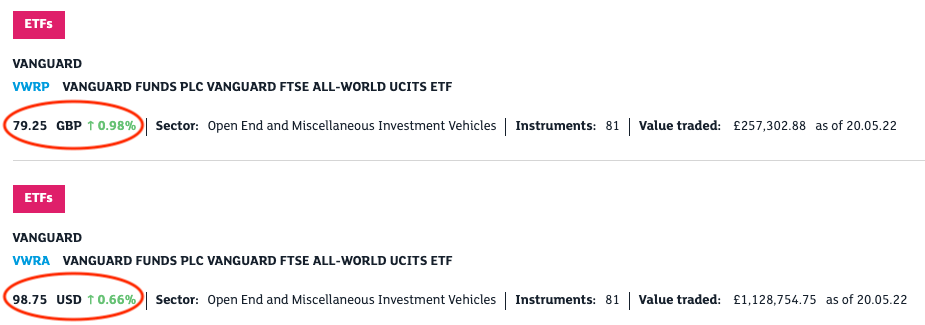

For example, Vanguard’s FTSE All-World UCITS ETF (USD) Accumulating trades in both:

- US dollars – using the ticker VWRA

- Pounds – via ticker VWRP

Choose VWRP to trade in pounds and so skip foreign currency conversion costs.

To discover which currencies an ETF trades in, go to the London Stock Exchange’s home page [5].

Put your ETF’s name in the search box top-right.

If the search box waterfalls a list of candidates then tap on Show all instruments.

Each ETF’s trading currency is listed in its entry on the Instrument page. See the red circles in the pic below:

[6]

[6]

If you’re not sure, then click through to the ETF’s page and check the currency listed in the ‘Last 5 trades’ section. That will confirm whether it trades in GBP, USD, or whatever.

To completely eliminate FX fees, choose an accumulating ETF that’s priced in pounds on the exchange.

That’s because a distributing ETF that trades in pounds can still pay dividends in foreign currency.

Explain!

A fund’s currency status can be confusing:

Underlying currency – this is the currency in which the fund’s holdings are traded. If you hold a S&P 500 ETF then the underlying currency is US dollars – because it holds US shares. Whereas a FTSE 100 ETF’s underlying currency is pounds – it owns British shares. An All-World ETF has multiple underlying currencies because it trades in securities priced in dollars, euros, yen, baht…

This currency classification determines the nature of your currency risk [7]. You are exposed to the pound’s exchange rate, versus every currency that the fund’s underlying securities are traded in.

Base currency – this is the currency a fund reports its Net Asset Value (NAV) in. It distributes its dividends in this currency, too.

The ‘USD’ in Vanguard FTSE Emerging Markets UCITS ETF (USD) label tells you its base currency but nothing else. You aren’t exposed to currency risk against the dollar because it doesn’t invest in dollar-traded equities. Base currency may also be called denominated currency or fund currency.

Trading currency – the currency in which a fund is bought and sold. Most ETFs will be available in a pound-priced variety on the London Stock Exchange.

Currency hedged [8] – This is how you protect yourself from currency risk. If an ETF is GBP-hedged then it uses a financial instrument (such as a currency swap) to neutralise the effect of exchange rate fluctuations on your investment return.

Look out for the term GBP hedged in an ETF’s name or its documentation.

How can I avoid broker FX charges entirely?

You can avoid egregious FX fees by first finding a platform that enables you to hold foreign currency in your account with them. Then you can convert your currency using a more competitive service that will transfer your overseas readies to your investment account.

Good currency brokers should be able to beat your stockbroker or bank’s transaction costs as comfortably as Usain Bolt could beat me at the 100m.

But it’s worth knowing that you can’t even hold foreign currency in a Stocks & Shares ISA [9].

You can hold foreign currency in a SIPP. But your cash contributions must be made in pounds.

It’s probably less hassle just to choose a broker with a competitive currency conversion fee.

How bad can broker currency exchange fees be?

The worst rate I’ve seen is 1.5% on top of the spot rate (that is, whatever the market is offering at the time on the pound versus foreign cash).

Generally 0.5% or less is about as good as it gets for a platform aimed at regular Jo/Joes.

Some specialist share dealing brokers offer rates at a tiny fraction over the spot price.

But these are typically aimed at semi-pros. They may encourage portfolio churn, and there can be other charges such as non-fixed trading fees.

Such complex platforms don’t hold your hand. They’re suitable for the extremely confident and disciplined only.

Fish in the Zero commission platform table of our broker comparison [10] page if you want to optimise FX fees.

Final warning

Beware: some brokers make it very difficult to uncover their actual currency exchange fees.

Either they neglect to mention them. Or force you to spelunk their T&Cs to find them. Or they pop a little table on their fees page but make you read their Foreign Exchange FAQs to find out their cut is on top of the spot rate.

Be careful out there.

Take it steady,

The Accumulator

- Foreign exchange.[↩ [15]]