Good reads from around the Web.

Brexit started with a bang in June. The stock market plunged and a bloodbath unfolded at the top of the major political parties. We were all hooked.

But like a TV drama with a limited budget, things tailed off as we got bogged down in turgid mid-season plot building.

Theresa May’s appointment was reassuring but hardly a thriller, as the crazy Andrea Leadsom story line went nowhere. The Bank of England did its best to liven things up by cutting interest rates and warning of a greater chance of a recession, but more positive data kept coming in.

Even I had to admit – not without some relief – that I’d been wrong about the initial impact of the Leave vote. I wondered aloud if commercial property in London was now a buy.

Many viewers began switching off.

But in the past week, Brexit got back to its barmy best.

Not so much like Game of Thrones as the early episodes, mind you. More The Man in the High Castle, as an alternative universe started to take shape around us.

The right kind of workforce

It all started when Prime Minister Theresa May announced that she would trigger Article 50 this coming March. That sent the pound falling.

Later, she made it clear that curbing immigration rather than preserving the economy was her top priority. Pandering to fear and prejudice – the fantasy and lies of the Leave campaign – was more important than trying to maintain the profits and tax revenues that might actually help address the very real inequalities that motivated a big chunk of the vote to Brexit, and that she identified in a conference speech that otherwise had much to commend it.

As a result of this posturing, a ‘hard Brexit’ now seems firmly on the table, to the dismay of business [search result]. The pound fell some more.

Then we had some sinister new plot twists. Talk from Jeremy Hunt that the UK should be “self-sufficient” in doctors set the tone, but worse were the almost unbelievable plans from Home Secretary Amber Rudd to force companies to publish the proportion of “international” staff on their books.

Rudd said she wanted to “flush out” companies that she deemed to be harbouring an inappropriate number of (entirely legal) foreign workers.

This would “nudge them into better behaviour”. (Better as defined by Amber Rudd and the new order in Britain.)

It didn’t take an LBC radio presenter to point out where we’ve heard this kind of language before. Still, James O’Brien did an excellent job of drawing the parallels.

Ukip won the war, but it’s losing the plot

Before some bold Brexiteer turns up in the comments to tell me to calm down, it does seem Rudd may row back on these plans.

But that is only because of the backlash from business and other commentators. Clearly they felt appropriate at the time her wonks drew them up.

Another sign of the times – we learned yesterday that foreign-born academics have apparently been barred from giving the government official advice on the upcoming Brexit negotiations:

It is understood up to nine LSE academics specialising in EU affairs have been briefing the Foreign Office on Brexit issues, but the school has received an email informing it that submissions from non-UK citizens would no longer be accepted.

Relevant departments subsequently sent notes to those in the group, telling them of the instruction.

One of the group is understood to be a dual national, with citizenship of both the UK and another EU member state.

The Foreign Office was said to be concerned about the risk of sensitive material being exposed as article 50 negotiations over Britain’s exit from the EU – and subsequent talks on its future trade and other relations with the bloc – start to get under way.

Because, you know, being born in a country is the best way to judge a person’s trustworthiness and loyalty!

It’s frightening how quickly we’ve got to a point where our vibrant economy that attracts talent from across the EU and the world has become in the language of politics a cartel of unpatriotic gangmasters, shiftily employing Johnny Foreigners who hop over the border to steal our wages as well as our benefits.

As Ian Dunt, the editor of Politics.co.uk puts it, the Conservative party is arguably morphing into Ukip and the direction is disturbing.

Take the government’s ongoing refusal to guarantee the right to remain for all EU citizens living in Britain. Dunt writes of the logical conclusion:

Mass deportations. It sounds alarmist doesn’t it?

No, it wouldn’t involve Nazi officers banging on doors. It would all be very polite and English. A very polite but firm Home Office letter would come through the letter box and it would have a deadline.

If you don’t make that deadline – or if the authorities say they have reason to believe you won’t – the immigration enforcement vans come.

The sudden exodus of three million people from the UK. That is the suggestion. That is the threat.

That is what is implicit in Fox’s card game. It might be the most shameful policy Britain has considered in living memory. It is so shameful no-one dares say it out loud. They only imply it. But that is what he is proposing. That is the reality.

This is the great and final victory of Ukip. They have taken their economically catastrophic EU agenda, their bizarre sense of thin-skinned personal victimhood, and their culture-war poison over immigration and embedded it in the guts of the Tory party.

Do I think it’s likely that millions of EU citizens will ultimately be asked to leave the UK?

No, not particularly. Not yet.

Am I ashamed and dismayed that we’ve come to this in three short months?

Absolutely.

Thankfully, there was also a comic thread running through the latest episodes to lighten things up. It also came from Ukip – the cast of characters who by giving voice to the common man (or more specifically voice to his or her bigotry and fearfulness, rather than his or her better nature) seeded the germ that’s now eating us up.

This week we saw the leader step down after 18 days at the helm and Nigel Farage come back from the political dead to resume his place as top dog. Then one of its MEPs was hospitalized after confrontations with another Ukip MEP in the European Parliament.

Yep, funny alright. Albeit like a Tarantino movie is funny.

Investment implications

The pound is around $1.24 as I type – down from $1.30 before the Conservative conference, and around $1.50 in the moments before the Leave win was confirmed.

Overnight the pound fell to $1.14 in a flash crash that was blamed on robots (there being no Romanians or Poles nearby to take the blame, presumably).

The precipitous fall in the pound is making our country and its citizens poorer. That’s true however much you personally are managing to offset the declines with your investments in a Vanguard global tracker fund, or however much you believe Blackpool and Skegness can beat anything a fancy pants foreign holiday has to offer.

The FT has a big piece on the winners and losers from the pound’s decline [search result]. So far foreign tourists are the biggest beneficiaries. Quelle ironie!

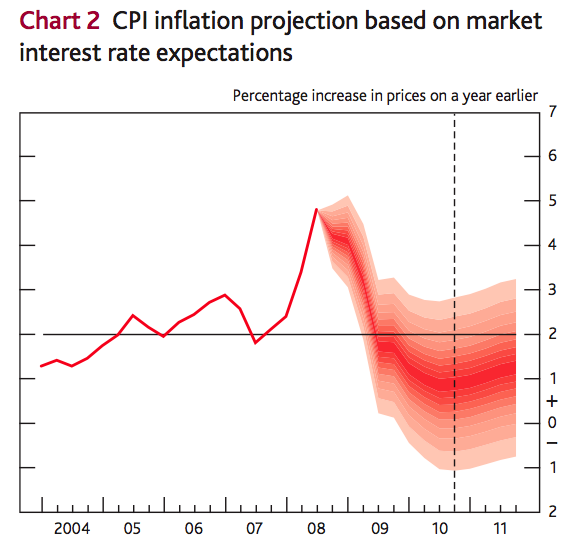

If the fall in the pound is followed by a decline in overseas investment and a widening of our current account deficit, then all bets really are off again. The least we can now expect is an inflation shock. We import far too much for sterling’s collapse not to show up in our grocery bills.

The iShares index-linked Gilt fund is 23% higher since Brexit day. That had seemed like a crazy move. Now it’s looking prescient.

It will also be interesting to see where Theresa May’s opinion that low interest rates may now be causing more problems than they’re worth fits into the picture.

Some onlookers say a political intervention to reverse low rates is being signaled. I think it’s more likely cover for a big fiscal push in the Autumn Statement.

Get with the programme

Investing aside, I hope the more reasonable end of the Brexit voting spectrum will be as dismayed as me that what was (wrongly) dismissed as a xenophobic fringe element during the EU Referendum campaign is alive and kicking in the mainstream body politic.

If I was that kind of reasonable Leave voter, then rather than downplaying every lurch to the right in the rhetoric, I would be speaking out against it.

Millions of people who came to the UK with the best of intentions – and who we welcomed in, employed, worked alongside, and enjoyed the company of for years – now find themselves the subject of a bogus political scrutiny.

Even if it all comes to nothing, damage has been done on a personal level, and perhaps soon enough on an economic one.

We need to avoid worse.

Making good use of the things that we find…

Passive investing

- Using buffers to become a better investor – Cordant Wealth

- Investors are even more impatient with Smart Beta – Abnormal Returns

- How Jack Bogle made his lawyer rich – The Irrelevant Investor

Active investing

- Is Deutsche Bank now a buy? – Musings on Markets

- Reasons not to fear change in the US – Investing Caffeine

- How things have evolved in 50 years on Wall Street – A Wealth of Common Sense

- A discussion of the equity risk premium [PDF] – Norges Bank

Other articles

- Life lessons from Jesse Livermore – A Teachable Moment

- Using a ‘bond tent’ to navigate the retirement danger zone – Kitces

- Things you miss when you get a job – SexHealthMoneyDeath

- Walking and thinking [Podcast with Morgan Housel] – The Investor’s Field Guide

- I bought an electric car – Mr Money Mustache

- To gain an edge, run up stairs – The Investor’s Field Guide [Again!]

- It’s more important to be useful than happy – Darius Foroux

Product of the week: Santander will cut the interest paid on its 123 account in November, and now it has emerged that new customers will no longer be able to get its popular 123 cashback credit card, says ThisIsMoney. Instead they’ll be offered the All In One card, which pays 0.5% cashback and comes with a £3 monthly fee. If you like cashback you might instead consider the Platinum Cashback Card from American Express. It pays 1.25% cashback after a three-month 5% period. There’s a £25 annual fee.

Mainstream media money

Some links are Google search results – in PC/desktop view these enable you to click through to read the piece without being a paid subscriber of that site.1

Passive investing

- Dilbert shares our pain – Dilbert

- Indexing in less-efficient markets [US but relevant] – Morningstar

- Investors are turning to simple passive bond funds – Bloomberg

- Here’s how much the ETF industry makes – ETF.com

Active investing

- Questor is building a UK dividend income portfolio – Telegraph

- Fisher: The joyless bull market has longer to run [Search result] – FT

- Bottom-feeding stock picker in Japan crushes the market – Bloomberg

- Shiller’s market indicator is sending a false signal [Search result] – WSJ

- Hard Brexit could be a huge buying opportunity (for foreigners…) – MarketWatch

A word from a broker

- Houses cost 10x earnings in a third of England and Wales – Hargreaves Lansdown

- What does OPEC’s oil production cut talk mean for investors? – TD Direct Investing

Other stuff worth reading

- Why low interest rates are probably here to stay – Bloomberg

- Seven pieces of conventional money wisdom to question – MarketWatch

- Born lucky? Children of the ’60s, ’70s, and ’80s on buying a home – Guardian

- How your spending changes as you approach 100 – Telegraph

- One firm created a town of accidental millionaires – Our State [via Mike]

- Three steps to reinventing your career – Quartz

- The economics of dining as a couple – Bloomberg

- 91-year-old who dumped chemo for road-trip adventure dies – CBS

Book of the week: Brexit got you down? It could be worse. We could already be living in the The Age of Em. I listened to an interview with the author – futurologist Robin Hanson – in which he implied that it would be churlish for any humans surviving in his AI/robot dominated future to look on the amazing world of their super descendants with anything but pride – sighing wistfully before returning to scavenging about in the gaps for something to eat. Very Silicon Valley. But it’s an interesting read, and I’d at least take on board Hanson’s advice to make sure you are the owner of a few ems (crossbred Einstein-level geniuses on a chip) before the Age of Em dawns.

Like these links? Subscribe to get them every week!

- Note some articles can only be accessed through the search results if you’re using PC/desktop view (from mobile/tablet view they bring up the firewall/subscription page). To circumvent, switch your mobile browser to use the desktop view. On Chrome for Android: press the menu button followed by “Request Desktop Site”. [↩]

Comments on this entry are closed.

Mixed emotions with that MMM article and if I’m honest I couldn’t finish it. This is a person who I once read every word from and who I thought of as pretty environmentally conscious with his “pro-cycling” and “thoughtful” agenda but who now has two cars, a future disposal footprint (how much environmental damage will the disposal of those batteries cause) that must nearly rival some of the best consumers out there and a jet set (with subsequent fuel burn) lifestyle.

It’s not a personal attack though as I can understand the temptations that the success of his business has brought so good luck to him. It’s just no longer for me (at least for now) given the do vs say disparities.

Great post as always – the tone and announcements from the Tory conference were deeply alarming and the international and business reaction telling. Unfortunately there appear to be very few serious statesmen and women left in Westminster ready to speak sense and moderate the increasingly deranged positions of May and her cabinet.

From an investing perspective it makes all calls more tricky – any assets denominated in foreign currencies are now much more expensive, while it looks as if we’ll be seeing a great deal more volatility (especially in home and currency markets) over the coming months as these hang off every signal from May and European leaders about what Brexit really means.

@RIT — I think he’s sold (or is about to sell) at least one of his existing cars, as he includes the cashflow from the sale in his projections for the cost of the Leaf.

@ The Investor. The just reasonable (not MORE reasonable!) Brexiteers are indeed appalled by some of the things you observe. See Fraser Nelson, Charles Moore and this from Andrew Lillco:

http://reaction.life/may-government-making-big-mistake-eu-immigration/?utm_source=Web+Signup&utm_campaign=2583f65f2f-Daily+7%2F10&utm_medium=email&utm_term=0_146710a7a1-2583f65f2f-112817137

On the pound I see no reason to take a short-term panic fall in the pound as evidence in favour of Remain any more than I take the stock market rise (which isn’t all due to the falling pound) as evidence for Brexit.

IMHO the only questions to consider are

1. Is it better for the British public to have democratic control over the Executive? YES

2. Is it possible for Britain to thrive as an open optimistic trading economy outside the EU YES

3. Is any short-term disruption likely to be so great that we should remain anyway despite the answers to the above? NO

I don’t suppose we will agree but anyway…..

I’m a first time poster.

Perhaps the amount of Bremoaning could be turned down a notch? I enjoy the articles on investment but this whining about Brexit Is getting boring.

I work on a UK construction site. We have EU workers working for £5 an hour (yes I know that’s below minimum wage). If Brexit means that British workers don’t have to compete against migrants that will work for peanuts it has to be a good thing.

Should one keep passive investing at this time? I’ve been unable to bring myself to do so, as I get far less of overseas funds for my money than I did before. If the pound falls further then great, otherwise I could lose more than I gain.

Great post. Watching #CPC16 I felt like I’d woken up to a UKIP government. The fall in sterling and rising gilt yields look horribly reminiscent of the repeated crises in the 70s, 80s.

I think people need to realise that the next two and a half years are going to be largely made up of worries about how bad the deal we are going to get out of the EU

My own (very rough) calculations are that every month the U.K. needs at least £12bn of foreign direct investment (£9bn trade deficit + £3bn gilt sales to foreigners)

This is what Carney means by the UK being dependant “on the kindness of strangers

For context the sale of ARM to SoftBank will cover this for two months

It has surprised me how the idea of a soft brexit in which we left the EU, but carried on paying the fees and retained free movement etc ever got any traction. In 2015 only one party made a promise to have a referendum on taking us out of the EU. That party unexpectedly won. Any tory voters in 2015 that voted remain in June should reflect on that. A year later the referendum happened and the leave camp unexpectedly won. So the idea that somehow life can be made to carry on roughly as before has always seemed to me a massive piece of group think denial.

@passive investor

It’s not as if you weren’t warned there would be heavy mediium term damage from leaving the EU

We have already gone from having the fifth largest economy in the world to sixth (behind France, ironically)

Only 36% of the population voted to leave the EU but we all bear the cost

Next stop on the way down will be India, equally ironic. I reckon that would take £:$ parity

@Gordon — Appreciate you taking the time to comment. But I’ll write about what I like on my own site thanks. Feel free to ignore. 🙂

Well higher inflation implies increase in interest rates to strengthen the pound or curtail demand. Higher interest rates are bad for bonds, IL especially given long duration (owing to the market needing long duration to match liabilities in pension funds). So with impeccably poor timing no doubt, switched a chunk out of IL and into emerging markets passive fund and a diversified 40:60 fund. This is in my pension where the choices are pretty poor. Now what I want to see is the UK withdrawing from the egregious Eurovision Song Contest and a ban on it being shown in the UK. Surely we can all agree that would be A Good Thing?

Oh the confidence and jubilation that the sky hasn’t fallen in after Brexit, but 2 years is a long time in economics, the party hasn’t even started; there are none so blind as those who do not wish to see.

Having a loose canon, extremist, nut-job party mouthing off outrageous tip-pot dictatorial comments in your country is one thing, (and if harmless can even be amusing) but when it’s the ruling party with no opposition, it’s dangerous. The damage in international reputation will escalate and will then take at least a generation to recover from. (anyone remember the lingering dislike of South Africans after apartheid?) Even tourists will weigh up coming to shop here for bargains vs getting fk’ed up on the streets for speaking their language.

Interestingly, it’s not only Euro-nationals now that I know here who are getting increasingly scared with daily vilification from the actual Govt., but others who ‘look different enough’ have twigged that having a Brit passport wont stop you being attacked once the mob have their tails up. Embarrassing and sad times to live in if you happen to be educated, civilised and open-minded, especially when meeting people abroad who don’t know what your beliefs are, so regard you warily.

@Gordon. I am a first time poster (under this name) too.

As the consequences of Brexit bear very heavily on any investment and fiscal planning we all do, it is entirely correct for the Team here to write about it when and how they like. Any sane person can see that whatever the consequences in the very long term, in the short term just the uncertainty is going to cause ructions in the financial markets, and other than the boost to overseas earning for the majority of the FTSE, the main consequences are going to be negative.

So let the Investor get on with what he does, and if you don’t like the angle I respectfully suggest you ignore those posts!

TI, well put.

I agree with you that this conference was most disturbing, and really shows that despite protests to the contrary, the xenophobic element of the exit vote is the thing that has held the most sway. May seems to have been somewhat ambivalent on whether to Remain or Leave, but now she has the reins she appears to be led by the more extreme view of her Brexit MPs.

The planned policy examples you quote are very unsettling, and do indeed have a Man in the High Castle feel to them.

I for one will not be ignoring them, and have today written to my Conservative MP to complain and seek his views on these policies, and to remind him that as every single Brexit voter who I personally know, and almost every other one on social media and news comments, are all at pains to say they did not vote out because of immigration, then why are the Government trying to solve a non-existant problem? (Or could it be all these people are fibbing?)

Thanks for this.

The public doesn’t quite realises how it feels, when the government of the country you thought you were settled in openly discusses stripping your right to remain, and using you as a bargaining chip. How it feels as if the soil you were standing on suddenly turned to quicksand, and all your plans and dreams are kept hanging on a politician’s whim.

I don’t think the Conservatives have fully thought through even the internal politics consequences of this. Long term there will be 2-3 million new citizens who socially could have been right-leaning but will now viscerally, generationally vote for anybody but Tories, just like Scots with the Poll Tax. There just need to be a credible alternative party.

Anyway, for the time being I would suggest to lighten sterling assets and reduce duration on gilts holdings. The pound has further to fall…

@Gordon >I work on a UK construction site. We have EU workers working for £5 an hour (yes I know that’s below minimum wage). If Brexit means that British workers don’t have to compete against migrants that will work for peanuts it has to be a good thing.

Contract workers employed on behalf of Sports Direct have had some success in shaming the company for low pay and terrible work practices. The government has just published a list of employers who pay under the minimum wage, many being small enterprises. I believe HMRC are interested in companies who pay under the minimum wage.

So, what have you done to tackle this state of affairs? I don’t see low wages as being the fault of immigration but everything to do with sharp practice by employers. I share your outrage, but perhaps something should be done so EU employees/ contractors aren’t exploited? We appear to be in a state of fear where low-paid workers are scared to lose whatever income they have. Perhaps if more employers were dobbed by their employees matters might improve more quickly.

The Investor – can I like your reply to @Gordon …

I’ve always thought the British tolerantly racist, but sadly there now seems to be permission to be intolerantly racist. Good luck with finding a doctor when we’ve chucked them all out in 5 years. And all the UK born ones have sloped off to Australia or Canada where they get treated better and occasionally get a payrise.

Trouble is the low paid EU workers don’t feel exploited as they earn so much more than back home and feel better of for it. No different than China being able to make stuff cheaper than us and prospering in it while factories close elsewhere. Hence the mood shift against globalisation. Brexit part of the same momentum. Money, people and water find going downslope easier!

Incidentally, just had a mailshot from Money farm. Has there been a blog on these type of things?

Just to inject a bit of realism into this the EU’s free trade deal with Canada (like the one the UK will be wanting) is now in its eighth year of negotiation

The current stumbling block is the regional parliament of the French speaking region of Belgium, who can veto the agreement with respect to the entire EU

@Seeking Balance — Good for you for writing to your MP. I think anyone who feels strongly about this has to make those opinions felt — to the point hopefully where we look back in a few years and they seemed like hysterical concerns because the drift rightward was halted accordingly. It’s why I continue to post on Brexit here, especially where I see an intersection with investing — and despite the fact it’s unfortunately antagonized a sizeable cohort of readers. Some things are more important, and I think this transcends normal politics.

Indeed, given the un-electable fringe 1970s apologists now running the Labour Party, it’s up to citizens (and the press) to play the role of the loyal opposition.

@Olivier — You’re very welcome. Good luck, I hope this dark cloud does eventually pass.

Hmmm, a somewhat disappointing post. What an emotionally-led regressive view you seemed to have taken. Its very easy to admonish people who dont have the same view as you as being racist or bigoted. A good attempt at virtue-signalling, but its a nil point from me.

@TI… Gordon does have the right of it though, bremoaning is boring.

It’ll be interesting to see if the millions who wanted to ‘take back control’ of sh*t jobs like back-breaking fruitpicking, gutting fish in factories and running around mega-warehouses selecting deliveries for sociopathic billionaire owners, will turn up on the second day of work.

It’s hard to see the UK raising its game in other areas of the economy, a quick glance at any clone high street doesn’t inspire confidence when boarded up shops, charity shops, betting shops, pawn shops, pound shops, takeaways, nail salons and booze shops don’t represent world-class competition.

@TI, please continue using sophisticated lengthy grammar wherever possible, so as to render the subject material as ‘boring’ as possible to those who are mystified by the mere concept of free speech. Hopefully if bored enough, they’ll return to tabloids that agree with their single opinion and helpfully use as few syllables as possible, with frequent repetition to hammer the point home as well as simplistic illustrations to entertain.

I have no problem with Brexit being mentioned here, after all it seems very relevant to the stated purpose of Monevator being “a personal blog about money”. However I do feel The Investor is to an extent guilty of making the same mistake as the likes of Theresa May and Amber Rudd, being people who voted remain but who misunderstand the reasons why people voted to leave the EU.

It wasn’t primarily about controlling immigration (see here for example: http://lordashcroftpolls.com/wp-content/uploads/2016/06/Leave-vs-Remain-podium-rankings.jpg or here: http://www.comresglobal.com/polls/sunday-mirror-post-referendum-poll/), so to focus primarily on immigration is missing the point and leads to the sort of deluded, misguided and counterproductive policy proposals such as the ones TI blogs about above.

Even after some of the rhetoric and events that have happened in the aftermath of the Brexit vote, the UK at large is not an intolerant or xenophobic country, certainly not when you compare it to some of the anti-immigrant rhetoric that comes from our continental neighbours. Can you imagine Mrs May saying something like “To be honest, we don’t want a large Muslim population here”, which is what the Czech PM recently came out with? Can you imagine the reaction if she had said that?

I do wish people on all sides would stop banging on so much about immigration and xenophobia, there are far more important factors to be thinking about as we navigate our way towards Brexit.

This GBP move could be a wake up call to longer-term foreign investors. They didn’t repatriate GBP in the lead up to the referendum or the immediate aftermath. Most were awaiting clarity about what type of Brexit would be targeted, hoping for a softer Brexit that minimized economic damage. These hopes have been dashed at the Tory conference. GBP is pretty cheap on most valuation metrics but currencies tend to overshoot fair-value by a large margin. With the UK’s gross foreign liabilities standing at over 400% of GDP and with a current account deficit that puts to shame the most fragile of the “fragile five” emerging markets, GBP is going to find it hard to absorb repatriation without triggering further weakness. There is little the BoE can do given that it’s net FX reserves stand at just £36bn (1.5% of GDP). It’s difficult to hike rates, except as an extreme currency crisis prevention measure. The inflation is cost-push imported rather than demand-pull and tightening policy will only make any economic slowdown worse.

The question is with UK plc torpedoed below the waterline, how do you save your family from going down with the ship? Net of my house, I had 70%+ of my assets in foreign currencies prior to the vote; that felt punchy given my expectation for a marginal “remain” vote. I can’t take profit on the gains I have realized in GBP terms since they feel like an illusion; instead I’m focusing on how my net worth in “hard” currencies like USD or AUD has taken a hit. To transfer more into foreign currencies at these levels though makes me feel sick.

@bestace — I’ve been through this dozens of times with Leave voters and once (/twice!) was enough. 🙂 I’ve had hundreds of people tell me on this very site that I don’t understand, Brexit was really about sovereignty / inequality / immigration / uncontrolled immigration / London / the financial crisis / political disengagement / Thatcherism / Flat Earth-ism, depending on the Leave voter.

Worse, each does it in some kind of “don’t you understand?” tone, despite the fact their own reason is very different to the next Leave voter. Cognitive dissonance is rife, IMHO.

Meanwhile people who voted Remain all wanted… to Remain.

I don’t propose we run through all this again, just because we only live once. 🙂 The comments on the earlier Brexit posts give a flavour of it.

@Planting Acorns — Your card was marked when you brought up the foreign aid budget in a thread that was about housebuilding. Please feel free to take your commentary elsewhere. Cheers.

I don’t think this is in any way unique to the UK. It is happening in nearly every developed nation. The UK is just ahead of the curve with realising the impact. I think we are on the verge of a significant re-alignment in the way the world, particularly the developed world, operates as governments try to stave off the right parties by adopting versions of their policies. Brexit is only the start!

I have fears for a country that will now get to set its own agenda on the whims of the Tory party alone (where is the oposition telling us what they want in a post eu county?) – it certainly will be one heck of a ride.

What I would like to get some articles on is where to invest in this post brexit apocalypse – my simplistic view is if one is to assume the pound is to fall, then investing in overseas trackers makes sense (as instantly your asset increases in value, at the moment the rate of pound decline is way above any increase / decrease in overseas share markets). However, if the pound has bottommed now (???), then investing overseas is expensive and the share portfolio will drop in value just on the pound rebounding. So investing in FTSE trackers is better(?) as it means no currency impact on your money (but you are stuck with companies that are stuck in a non-eu market….)

Can we have some articles analysing these scenarios / options and using the crystal ball in where to passively invest some money?

@bestace perhaps you could let Mrs May know it’s not all about immigration

Hmm. Yes, as per Holmesy999, wondering if passive investing needs some change in strategy in this post Brexit mayhem …. Assuming pound has bottomed, then maybe quit while ahead, pocket the gains of overseas funds/ETF’s and put into short-term bonds…?

@Holmesy..999

Where to invest – abroad, perhaps?

@zxspectrum

Its not like the UK is “torpedoed below the waterline” its just going to be a significantly poorer country. Greece, Portugal or Russia didn’t stop existing simply because their economies went into significant long term decline. There were still rich people, there were just lots more poor people

If its any consolation that “sick feeling” is quite widespread

We should all blame the currency markets. They don’t seem to realise that Britain chose to leave the EU for a variety of noble reasons, which they should be supporting.

I’m married to a foreign national. Our children easily pass for English, so they should be safe if they decide to stay. I’m applying for my wife’s nationality, and we’ll push off if things get more alarming.

Interesting times.

Who could resist this claim?

This quote from a 13th century poet said it best: “Life is a balance between holding on and letting go.”

As Ken Fisher said in the FT “as investors fear evil at every turn, world stock markets grind higher”. The FTSE 100 on Friday is just 1% below the 52 week high achieved on Tuesday.

I see that Brexit is generating some talk and comment and noise. This distraction will likely continue until some actual policies and agreements emerge. I’m hopeful that a diversified international equity portfolio will continue to grind higher.

@ TI, it’s obviously your site and you can write what you like. However I’m surprised that you wish to alienate so many of your readers. People voted for Brexit because the arguments to leave were better than for staying in.

I think the lesson Bremainers need to learn is that reasoned arguments win referendums… Petty insults don’t win referendums…

@ FI Warrior. “Tabloids”? “Use as few syllables as possible”? Thanks for demonstrating the type of petty insults that forced a lot of people to vote for Brexit.

“People who just cant accept the world has changed, and their country has changed as well. People who look back to some imagined time when it was great, and only look at the future with fear, and who are intolerant of any other world view”.

Is that Remainers talking about Leavers or these days the other way around? .

I am rather disappointed at the lack of anti- Eurovision Song Contest sentiment here. Gather your thoughts, girdle your loins, remember we are men (PS not if you are a woman), and let’s do this. On another track, why are you anti- brexit? Do you know something, think you know something or is the uncertainty too much?

Many of our problems are self inflicted. 52% of the electorate voted exit and many want to still ignore their views. The same thing looks to be happening in the USA with Donald Trump having vast support despite being totally discredited in many peoples eyes. Whether Trump wins or loses that support will still exist and fester if not appeased. Where is the compromise, where is the give and take?

@Gordon Agree with you entirely – this mostly irrelevant Brexiter-bashing is becoming tedious in the extreme.

@TI. As usual you defend your ‘I know best’ assertions with nothing better than ‘I’ve told you all before’ statements and ‘if you don’t like it go away’. I cannot think of another similar site where the author is so willing to lose his audience. If you cannot accept people’s posts as being their opinions it makes it all the more apparent that you consider your own as facts. I’ve got news for you – they’re not.

Feel free to remove my post, as doubtless you will.

Another point, on a roll now, I’d like to make is on free movement. Most of us lock our homes, cars, bank accounts and have multiple passwords covering any number of interests. Why? Because we want to protect our own possessions and privacy. Many of us work in buildings where you need security clearance to move around. I don’t see it as a huge jump to want secure borders so that only people we trust enter. That’s how most of us run our personal affairs so why not our borders?

@Chris Evans – The only thing that cheers me up about writing these miserable Brexit articles is that they might annoy the likes of you.

I’m not going to delete your comment, or the searing and persuasive insights of your fellows there. It’s nice for me and the people I write this site for to be reminded who is out there from time to time.

I will be deleting from here though because I haven’t got time to clean up the mess all weekend.

This site never seems to acknowledge what voting for Europe actually meant. They do not hide the end game it is nothing less that a single European superstate run from Brussels. If you ticked remain you voted for that. I have pointed this out to numerous remainers, not one of who supports this end game. There are a number of reactions, the uninformed don’t believe it, however since the goal is not disguised after a little reasearch they have a hard job denying it. The gullible say that they don’t really mean it – well Juncker and his crew most definately do. The final set point out that it can’t happen because there is no political support, well there would have been had remain won, they would have viewed it as a a mandate.

One final point do you think that the problems with the Euro were not predicted? The problem of imbalance was obvious to both sides of the argument when the Euro was being created. Those against said it would create a straight jacket and force countries to align without any safet valve, people would suffer horribly. Those for the Euro said indeed and when they have suffered enough they will vote for deeper integration. For the more ardent pro-European it was felt a serious crisis would be necessary to push the electorates into supporting their vision.

You remainers voted for this and you should be ashamed.

The problem is such a huge issue the result of which will make this country poorer for many years should never have been put to a referendum. The semblance of ‘control’ will be seen for the lie and ‘hot air’ it so obviously is in a 21st century Europe. All we have done is remove ourselves from the table where the decisions will be made. Germany and France will not be reasonable over an eventual deal, whether it hurts them or not, they will have to be harsh to us because not being tough threatens the project. I wanted greater integration, for all the problems with the euro, Greece etc, the goal was a worthy one.

The talk of getting rid of foreign nationals reminds me of an episode of Doctor Who set in a dystopian timeline where long-time villain The Master has taken over the UK. I believe that one slogan used by that regime was “Britain for the British,” along with a downtrodden economy. Not an encouraging comparison to draw.

On the plus side, I’ve been considering taking a holiday in the UK so now might be a great time to take advantage of the exchange rates! As you noted, it is quite ironic that the group benefiting most from Brexit could indeed by foreign tourists.

30Holmesy999, investing (or not! there is no neutral position) when currency is volatile is no fun at all. It really does resemble gambling. I moved from the UK to the US nearly a year ago, with my life savings remaining in GBP. 2016 has been a trying time, forced to guess where the pound is going next month/week/day/hour to decide when and how much to bring across the pond. I try to forget the days of $1.60 just last year.

Love this debate. Brexit has been great for me shares up,payments on the house down and work busy as we export. Also my holiday in Greece with the weak pound was fine and a fair bit of Eu hatred as you would expect. My many friends from Southern Europe are telling me they wish to stay as their countries suffer high youth unemployment and don’t see a rosy future at home and feel abandoned by the Eu. But I can see these are the changes in my life and will be different in someone else’s experience. I think the government likes the weak pound and it’s scary we don’t have a opposition party. I can’t wait to exploit the gyrations in the market in the coming years as any wild statements will leave us with cool head plenty of room to profit. I think it’s strange that some delight in our potential catastrophe but feel our business are robust enough , our people are robust enough to succeed in or out of the EU single market. Time will tell but I am sure this little island will remain a fair, humorous,dynamic place because of the people we all are and that we should be proud of.

@SurreyBoy love it, you’ve put your finger on it

Hi All

Such an interesting thread

It reminds us that if managing money ignores the ultimate variable -the human factor-trouble ensues

No one seems to ask why so many people are against the status quo.

SNP in Scotland,a Tory government,BREXIT and Trump.

Thre are specific reasons-unmanaged borders,unaccountable elites and the PC BBC but it’s more than that

The people seem to feel ignored,abandoned and leaderless and are striking out with their only weapon-the vote

Until we get credible leaders to take us out of this perceived morass there are going to more suprises.

We are all going to be poorer but then we were anyway with all that sovereign debt

Maybe Reality is kicking in at last

xxd09

I don’t see any Bremoaning. What is potentially and probably one of the most significant changes to any western country in a generation deserves thought, challenge, and reflection by us all. Any suggestion that we treat it as “it’s done, let’s move on” totally misses the point that whatever side of the equation you are on, we are only just at the beginning of the process and it will be years before we realise the impact of our action.

It’s true that this might end up being a Y2K moment but the the proponents on both sides feel this is a fundamental change to the way our country works. We can’t just stop talking about it. If you’re sick of the talk now, just wait until the real talks start.

@MarrkT

Usual Brexit lies from you

Only 17.5m million people voted to leave the EU

This is not 52% of the electorate

UK has a population of c. 63m and an electorate of 47m (look it up on the Electoral Commision website, dummy)

I’m quite happy to leave the EU via a hard exit if those 18m are willing to write a blank cheque to the other 45m of us for the cost

But of course being older and poorer they expect the rest of us carry them on our backs

The Investor:

“The only thing that cheers me up about writing these miserable Brexit articles is that they might annoy the likes of you.”

If this is true then you got the reaction you wanted from your post and are hardly in a position to complain about it, much less start telling people that their reaction is unwanted. You don’t deliberately poke a stick in a wasp nest and then whinge about being stung afterwards, especially if it’s the third or fourth time you’ve done it.

Look, speaking as someone who has seen more than one website undergo a meltdown as the result of forum disagreements escalating into bitter civil war, I would advise caution about displaying too much bitterness and resentment towards the Leave camp when covering Brexit topics. Brexit is inevitably going to be a major theme on all UK economic/investment/money related websites like this one for the foreseeable future, so a wise course of action would be to assume that half your audience are Brexit supporters who do not wish to be told, directly or by insinuation, your own personal opinion of them. Not unless you want to be insulted back of course, which worryingly, from the above quote, appears to be your aim.

You have a fabulous website here. I check it several times a week because I’m passionate about investing and all things relating to the journey towards financial independence, so please don’t screw it up. Take the bitterness or resentment or whatever it is that makes you want to poke the Leave supporting half of your audience and lay it to one side when you write about Brexit, otherwise you will eventually get sick of the insults you get back and stop writing. I have seen it happen before. The website is too good to be spoilt

Excellent summary of the situation, and some incisive comments.

I’m paid in JPY and was buying more GBP denominated assets since June due to their cheapness. I was under the impression that some kind of sense would begin to prevail in the end. I still have some kind of hope that May et al were playing to the blue rinse brigade and won’t actually implement much of what they say.

What has been done unfortunately is that the UK will be increasingly come to be seen as hostile and closed. They have signalled this, and people will have taken note. Their impressions of the UK will be changing forever, and May et al’s talk of trying to attract the “brightest and best” will come to naught. The “kindness of strangers” will also dissipate.

Former colleagues working UK institutions from European countries have been rightly complaining about the things that have been said on Facebook – they have good PhDs and substantial knowledge that is difficult, nigh on impossible to replace from UK natives. It must be simply awful living and working in a country when you are bombarded with this kind of shit from the government. For the first time since the early 1990s I am ashamed to be British.

I now see the flash crash of -6% as a premonition of things to come for GBP, and part of me wishes worse on the country for what is being said and done by its irresponsible politicians.

@green_as_grass

‘You don’t deliberately poke a stick in a wasp nest and then whinge about being stung afterwards’ – a pretty ugly comment and telling how low discourse is getting in this country.

I’d like the investor to continue talking frankly. I think anyone who gets offended over the above article should be more offended with how the Conservatives are representing their vote than anything else, because it’s all just commenting on the reality of the situation.

Monevator used to be an excellent financial website before it appeared to morph into a political blog. I had hoped that it would regain it’s mojo, but I guess not. Oh well, another one off the bookmarks list.

@green_as_grass — Thanks for the generous words about the site (and same to the others above).

I didn’t say it was the reason *why* I wrote these articles, and I didn’t say I wanted to get people turning up and writing glib angry comments about Brexit. I did say the thought provides a bit of succor when it comes in the aftermath.

The reason I write such articles is because I think the political discussion in this country is changing fast, and potentially the economic climate is going to follow it — and already is, with respect to say the exchange rate — and in as much as my two pence on the subject is worth anything, my site would seem to be the place for me to share it.

@Dave P — Bon voyage!

Investment should be about cold rational decisions. It’s hard to trust the judgement of someone that lets emotion let him alienate half his audience.

I worked in the Middle East. In Kuwait migrants could get deported for driving through a red light. Cut up the wrong person when driving and the police could deport you the next day. ME countries used to hire ferries and deport hundreds of migrants at a time back to the subcontinent.

I worked with a Pakistani guy that had been born in the ME and had spent his whole life there. There is not a hope in hell that he would ever get a ME passport. It’s only the West that is happy dishing out passports like confetti. Places like the ME, Japan and Korea etc just don’t give migrants citizenship.

imho we should be following the migration policies of places like Japan ie let in migrants with useful skills but don’t give them citizenship. For clarity I wouldn’t consider the selling the ‘Big Issue’ as a useful skill.

@Gordon — Still here? You haven’t voted with Leave to stop the UK government giving passports to *anyone*. You have voted to leave the European Union, which enabled citizens with passports issued by other European Union countries to come to Britain.

Leave voters want to debate the issues, but some of the loudest can’t even get the simplest facts right. Which of course we saw throughout the pre-vote debate.

I’d rather get on with my weeding in the garden. 🙂

2 points come to my mind reading through here.

1- Free movement, its a laudable notion and a cornerstone of the EU 4 freedoms, that said clearly wither in reality or just in perception it is not working. Now the key reason for FOM is economic benefit, therefore it seems an own goal from the EU not to have been willing to re assess this. Surely there is a halfway between closed borders and completely unrestricted that ensures economic prosperity and services cross borders and pretty free movement for travelling/ work but is not a free for all?

That this has not been addressed is surely a possible self inflicted death knell for the EU

2. Political and media classes. With out doubt the WHOLE political class have humiliated the UK. The PM steps down away from a mess he created through inter party politics, we have an unelected PM following her own agenda pandering to the right wind of her party and fears of UKIP. Labour are just a colossal joke and should be ashamed to have left the country defenceless and for the Tories to have a free for all. and well the other parties, could be Lib Dems come back, (thought they were harshly treated for going into coalition, was the democratic thing to do to offer to the largest party first) and the SNP just seem to want to profiteer whatever the cost…..happy days.

3- also sovereign matter….wtf does that mean anyway, we already make our own laws, personally I trust the EU to stand up to business and support poor communities more than the Torries who only know how to cut.

Long time reader of Monevator, first time poster.

This whole Brexit debate is both extremely fascinating and equally frustrating. As an Englishman that moved to the Netherlands to work for an international organisation (600 employees from 40 different countries in case you are reading Amber Rudd) maybe I see the debate through EU tinted glasses, but I just don’t get any of the brexit logic. Leave voters often say that it’s not about immigration. Well why aren’t they furious that the Tories and the media have turned the debate in to it being just about Immigration and immigrants? Why aren’t they mad about Amber Rudd’s proposals to force companies to publish foreigner employment numbers, or Jeremy Hunt saying foreign doctors are only here for the interim or Liam Fox saying that EU nationals in the UK are bargaining chips? Also racist crimes have risen significantly since the referendum. If I had voted brexit I’d be pretty damn annoyed that these crimes had been committed in my votes name.

I can drive across the border to Belgium or Germany freely, I can catch a flight to Spain and step off the plane without any passport control. I can buy a house in the Netherlands but get a German bank to mortgage it as they might have the best interest rate. We can purchase goods from across the EU safe in the knowledge of EU consumer protection and standards laws There are many benefits to integration and co-operation down to the level of EU citizens, not just benefits for big corporations. Maybe the benefits are difficult to see as an island nation. Or maybe t’s because the UK has a pretty biased media and politicians with the biggest mouths getting too much air time. I don’t know, but what I do know is that it’s a big mess that won’t go away for many years.

In the mean time, I have a Dutch girlfriend, a Dutch son and I bought a house here. In a drawer somewhere I have a little claret book that has “United Kingdon” written on it. That little book casts a bit of doubt on my future. Yes I could take a citizenship test and get a Dutch passport, but I think in 2016 it shouldn’t matter where you are from. What matters are your qualities as an individual.

@Phil : on your point 1, I think you suffer from a bit of UK-centric myopia. Other European countries do not have either a perception or reality issue with intra-European migration. For example, there are 3 times as many Poles residing in Germany as in the UK. Why should other European countries change their ways to pander to UK dog-whistle politics ? It is the job of the UK political class to combat the ‘perception’ whipped up by the Daily Express and publicise the actual positive economic contribution of EU immigrants here.

@Holmesy999 >What I would like to get some articles on is where to invest in this post brexit apocalypse…

I would second that. I have taken the opportunity of current market highs to sell quite a few UK-focused holdings since I really don’t feel comfortable being fully invested at the moment (am about one third cash at present in my investment portfolio). I’m content to trickle that back into an international tracker mixture; but with the Brexit interregnum, US Presidential election, European elections next year and that long anticiapated bear market, I am left feeling like a rabbit in car headlights.

I don’t gain or lose by being in cash (I don’t even pay platform fees) and if I can resist an itchy trading finger it makes life a tad more serene. That article on having a buffer was timely by the way; I have set up some rules for adding funds to my tracker mixture which are testing my resolve a bit at the moment but in the end I think I will be strong.

Why would the government guarantee the right to remain in UK for European citizens if the right to remain in Europe for UK citizens has not been guaranteed?

@Neverland. Why be so obnoxious? Why call me a dummy and liar for pointing out the vote was 52% – 48%? It was. The people that don’t vote are assumed not to care either way or would you have it that the only legal vote is where 32 million vote yes for something? Everyone knew the vote was a winner take all and it’s no credit to anyone who wants to wriggle out of the result with some childish maths.

Steve Hilton — Leave campaigner and former aide to David Cameron — has condemned Amber Rudd’s dangerous rhetoric and policies in the Sunday Times today, and good for him.

Unfortunately it’s behind the paywall (I got mine for free by spending £10 in Waitrose — obligatory personal finance mention 😉 ) but the BBC has carried his most punchy quote here:

The battle between the relatively liberal free trade-minded Conservatives and the Ukip-ifying Conservatives could actually be as divisive as anything going on in the Labour party. Again, what is business and the international investors who finance our current account deficit supposed to make of this uncertainty?

“Why aren’t they mad about Amber Rudd’s proposals to force companies to publish foreigner employment numbers…”

Probably because it isn’t a policy proposal which will ever make it to the statute books. It was nothing more than a kite flying exercise, a piece of red meat that was thrown to the blue rinse brigade at a party conference and which has already been abandoned:

https://www.theguardian.com/uk-news/2016/oct/09/plan-to-force-firms-to-reveal-foreign-staff-numbers-abandoned

Same goes for Jeremy Hunt’s comments about doctors and the Foreign Office’s decision not to take advice from foreigners, which by the way also turns out not be to true:

https://www.gov.uk/government/news/foreign-office-statement-clarifying-media-reports-on-working-with-international-academics

A bit less hysteria and polemics on the whole Brexit debate is sorely needed. Here’s hoping we can get back to the rational evidence-based way of thinking that permeates the rest of this site.

@bestace — I don’t doubt you’re right that these proposals were floated in front of the conference as a bit of a crowd-pleaser, rather than as a definitive glimpse at some incoming regulation.

But these are very testing times for the UK and its population, and as the ongoing debates show, divisive times. The Conservatives had a choice of what ‘red meat’ they chose to throw to their audience. They might have signaled a hope to cut taxes or be tough on crime or whatnot. But here they zeroed in on a massively sensitive area, that makes millions feel even more uncertain about their future than they already do — and that has many of the rest of us wondering exactly where the country is headed.

To which point:

I don’t believe I’ve been hysterical. But either way I feel any such duty of care to not inflame matters is rather more incumbent on the ruling party and the new prime minister than a humble blogger with a personal finance website.

If they weren’t proposing to name and shame companies who employ foreign workers to “flush out” what they call “bad behaviour”, I wouldn’t be responding to it.

It’s like the brains switch off as soon as brexit is mentioned in any opinion column. For those riled up about someone expressing thoughts contrary to your own, try actually reading the blog post above. TI is talking specifically about the radical shift occurring within the Conservative party, and the dramatic effects this has already had on the market, let alone what the future holds. Get a grip and spare us the sniffy comments about alienating “half” the audience.

This is by far the biggest event for the country in many years, the full effect is not yet known, it impacts *everyone* both positively and negatively, and you should be glad the implications (economic and social – this is a blog, and a weekend post at that) are being discussed.

In US news, second presidential debate tonight. Should be wild!

The absence of democracy and the denial of opportunity to millions has led to where we are today. The political impotence of the role of US president gave us Trump. The identikit politicians Miliband, Clegg and Cameron gave us a dominant SNP in Scotland and Corbyn at the helm of Labour. Now we have Brexit and today the Labour shadow brexit minister is calling for immigration to be reduced.

France is building walls along the motorway in Calais. In Hungary they had a referendum on refusing access to non EU immigrants. AFD is winning seats in Germany. Austria missed out on a far right President by a whisker. Bulgaria is following France and Netherlands in banning the Burqa. The Czech President advised journalists that Muslim non EU immigrants should be deported to empty places in North Africa.

The Brexit is a result of sweeping political change in the world. It is caused by growing anger. If anyone doubts this, re read the comments on this thread. When a bunch of mostly intelligent people with a shared interest in financial independence of all things can be reduced to Lord of the Flies in a few hours, you can see we have a problem here.

People writing off extremist ranting by ruling govts of actual industrialised countries as just some ‘high jinks’ forget at their peril that Nationalist parties also won control of their countries via slight majorities of the electorate (equating to a minority of the population) and went on to kick off WWII. What just seemed harmless jingoism morphed into xenophobia and culminated in genocide, after every genocide since then it’s been thought we are too civilised for it to happen again, until it does. If people are alarmed, they have every right to be, those who write us off as moaners/boring ought to acknowledge that if they claim to be open-minded and support the principles of democracy/free speech.

Endlessly threatening to stop reading a site whose owner wont be intimidated into self-censorship loses its power with every repeat proving the boast is empty; that should be obvious. (If you keep crying wolf they wont believe it)

Long time reader, first time commenter here. As an EU national living, and hoping to continue to live, in the UK I have been following the developments post the Brexit vote very closely. Like some of the reaction in the media, with all due respect I don’t think the above post is a fair representation of what was said at the conference, which I recorded off the Parliament Channel, or the government’s stance more generally.

Jeremy Hunt specifically acknowledged that the NHS would collapse without foreign doctors and nurses, but he questioned if that was right given a global shortage of doctors which could lead to the UK not having enough doctors in the future. In this context training more British doctors doesn’t seem unreasonable to me.

Amber Rudd’s proposals to force companies to disclose the proportion of foreign employees is more controversial, but even Jeremy Corbyn acknowledges that there’s a race to the bottom in wages for low and unskilled workers who are prepared to work for less. These are often workers from low wage economies and the pool of low and unskilled jobs is unlikely to grow as many have been moved abroad or become redundant through globalisation and automation. Again, it doesn’t seem unreasonable to me to address this if it means encouraging companies to employ local people on proper wages or train them up if they don’t have the required skills. Some companies, like Pret-A-Manger, admit that they prefer foreigners as they work harder, but is that a status quo the U.K. should be happy with? I’m not surprised that there are plans for educational and social reform as well.

As for Theresa May’s refusal to guarantee EU nationals the right to stay in the U.K., she has said repeatedly that this would only be an issue if U.K. citizens living in the EU were not guaranteed similar rights by the EU. Again, this doesn’t seem unreasonable to me. More generally, I’ve read as many of her past speeches as I could find online and would agree with the commenter who said that to defuse the populist threat the mainstream has to acknowledge the issues that feed it. Read her nasty party speech from 2002 – all of it, not just the few lines the media keeps quoting – and replace “BNP” with “Brexit” and it could have been written yesterday.

Lastly, unfortunately I don’t think soft Brexit was ever a realistic option. Even George Osborne, who recently came out in favour of a “softer” Brexit, has admitted that it would be difficult to not have some form of control over immigration given how people voted, while the EU insists that free movement of goods and services is inseparable from free movement of people. I’m sure the U.K. government doesn’t want to damage the economy – Mrs May’s 2015 Brexit speech suggests she’s aware of the risks – but it takes two to tango and given Mrs Merkel’s warning to German businesses not to lobby for a favourable U.K. deal I don’t see how this can be reconciled.

To cut a long story short, I’m not worried by anything I’ve heard so far, but the emotionally charged debate is making it difficult to get a clear picture. That’s not helpful when I have to decide if I should a) apply for U.K. citizenship, which would mean giving up my freedom of movement, b) go back home, which would mean giving up my job, selling my flat and jeopardising my not exactly lavish DC pension, or c) do nothing. In fact, it seems that not being able to debate issues which, as one other commenter pointed out, apply to most of the developed world without getting emotional is part of how we got into this situation. That’s the real tragedy to me – that Brexit could have been avoided – but now you can’t put the djini back into the bottle.

SurreyBoy: The absence of democracy and the denial of opportunity to millions are genuine issues but I can’t see the how people find that correlated with the EU.

The UK is weak on democracy. An inbred Monarchy, an unelected second house, a FPTP system (my vote has never yet counted in an GE and I’m in my early 40s). We give a good impression of being a democracy but I can never shake the feeling that if you scratch beneath the surface the land/property-obsessed feudal state in alive and kicking! In terms of opportunity and social mobility, the UK has nothing to be proud of. Our Gini coefficient on an income basis is through the roof. We look better in wealth terms but that’s just because our feudal overlords put it all in trust generations ago …

On the subject of how to invest in the wake of Brexit – or rather in the context of a devalueing currency.

Of course, as a passive investor with a globally diversified portfolio one shouldn’t really change anything per se. Personally I track my savings and investments in multiple currencies (not all are based in the UK), and I must admit that I am almost a bit stunned how effective diversification has been. While my net worth has gone up by more than a year’s salary in pounds it has barely moved in dollars and euros. I guess implicitly that means that I don’t need to worry too much about future inflation arising from a weak pound.

As somebody who is not entirely certain where they are going to live for the rest of their life, what has traditionally worried me more than the investment performance is how to hedge against future expenses that may occur in different countries. The most extreme case because of the long time horizon seems to be around retirement and pensions. If you already know what to expect (like RIT?), it is probably prudent to shift more investments to the relevant currencies? Personally I have sort of formed a weighted average between the likelihood of a long term move to different locations and the expected expenses in local currencies in those scenarios and then allocated the fixed income parts of my portfolio accordingly, e.g. some of my savings are in Euro accounts rather than pounds. It has the other benefit that I rarely need to worry about converting currencies for smaller expenses (like holidays).

Curious to hear if anyone has any pointers towards more systematic approaches to these type of “lifestyle” currency hedges?

WhiteSheep, that’s what keeps me up at night too. The currency risk of moving around the world can dwarf movements in equities. Reversion-to-mean doesn’t really apply, and while there are long term trends like the decline of GBP/USD, that can be completely disrupted as recent events have shown.

Could The PM’s position being a negotiating tactic ? Perhaps she is far more shrewd than she is portrayed?

If you start with I want to stay but must appear to leave, your negotiating position with the REU ( Remainder of European Union ) is very weak.

If you then say I accept that you could make life difficult, so I will leave anyway and take the consequences, WTO rules etc then REU is powerless, their negotiating power is gone.

Now hopefully over time a more accommodative tone will be set, when people on both sides get used to the idea, Euro elections are out of the way and the need to “cut your nose to spite your face” becomes less attractive to all and perhaps common sense takes hold, REU has demonstrated that leaving is unpleasant….. but an accommodation is reached, slowly…

In a relationship bust up, it starts we’ll be grown up about this and there is a phoney peace, then the shouting and throwing your toys out of the pram really gets going and 12 to 18 months or so later common sense often prevails, a new relationship is obtained.

@ Anarchy in the UK

Thanks for your well considered points.

@Harlesden

Unfortunately the national politics of the major players dictate the most brutal of ruptures

UK – Conservative party unity dictates a remain voting prime minister must be seen to be tough with the EU

France, Germany, Spanish and Italy – local politics dictate that any except the status quo and established political parties/frameworks will result in poverty and chaos. Remember the rough justice meted out to Southern Europe

Poland – Their current government just wants to stick to foreigners rather like ours

The only EU country in our corner is Ireland who are small and still on the EU naughty step

@ TI, yes I’m still here. It’s fascinating watching someone that has spent years building up a website declare war on a substantial part of his readership.

Perhaps one of your future articles could be on when business leaders drop a clanger? Gerald Ratner springs to mind.

Shortish term reader, first time commenter.

Some points to consider with respect to Hunt’s announcements:

– He announced in parallel increased medical student places, but these would produce fresh new junior doctors in 2023 at the very earliest. A good couple of years after we stand to lose our legions of EU doctors if the current Hard Brexit trajectory remains unchanged.

– Even then they would be fresh-faced provisionally registered juniors, not the variety of experienced foreign docs the NHS currently employs.

– Furthermore there already rota gaps throughout the NHS, a foreign exodus would exacerbate these for a solid decade, while the new doctors would only replace what’s left not solve the actual (rather than political/ideological) problem on our wards.

– Hunt also proposes chaining new medical graduates to the NHS for four years. Possibly a shrewd move, considering the moderately large (though overstated) cost of training medical students to that point. However even Beardy Branson knows that treating your staff right is the first step to a successful organisation, and as the aforementioned rota gaps are set to continue, engendering goodwill in those who cover them out of professional duty would seem more prudent than establishing a relationship of bad faith.

What does this add up to? The UK’s largest employer being once again used as a political pawn? Further impetus to buy in UK healthcare markets because their future is looking bright given Hunt’s seemingly endless drive to destroy the NHS by 1000 cuts?

Also interesting to note how the press largely took his speech at face value, possibly due to the more outright craziness being spouted by Rudd and even our dear PM.

DOI: Medically inclined

As human beings we frequently make bad decisions, and finance blogs spend a lot of time trying to prevent this. As for individuals, so for crowds. The fact that referenda are democratic only ensures that they accurately represent the average opinion of the electorate at the time. It doesn’t guarantee that the decision will be a good one.

Someone who thinks a referendum decision was bad is perfectly entitled to try to mitigate the effects of that decision, or to attempt to change public opinion by legal means (such as the writing of blogs).

Of course we are biased towards decisions we have already made. But when I see people getting emotionally upset when the referendum result is criticised, I suspect one of two things is happening. Either they subconsciously fear their decision may have been wrong, and have suppressed the thought, or they fear that public opinion may turn against the decision before it becomes irreversible.

Maybe both?

Thanks for the links TI. I must confess sterling’s drop triggered a bunch of rebalancing from me. Possibly over-balancing: I hope I don’t fall over. Like gilts last year, I’m calling it. Probably wrong again.

As for the comments induced by Brexit’s reemergence, I think Douglas Adams helps here:-

“Curiously enough, the only thing that went through the mind of the bowl of petunias as it fell was Oh no, not again.”

I worked in the Sultanate of Oman. Migrants were legally prohibited from doing certain jobs like taxi drivers. It was a major government policy to increase the amount of jobs done by Omanis and reduce the number of migrants. For instance my Zimbabwean friend was reported to the Government for doing a job that should have been done by an Omani.

All the things that the Tories are talking about are fairly standard practice in the rest of the world.

The Bremainers should either start listening

War? A touch melodramatic. Let’s look at what’s actually happened.

I’ve decided to occasionally write, on my own website, about the most important topic in the UK today, which I feel pretty engaged with, and which has at least a tangential relationship to wider investing themes.

When I do, invariably a few Leave voters turn up to tell me to knock it off.

I don’t — and won’t — and some of them won’t take no for an answer. I perfectly understand they might not like to read it. There’s stuff I don’t like reading on the Internet. I don’t read it. Perhaps they’re masochists.

There are reasonable and articulate Leave voters in the Monevator readership; I’ve had emails from them now and then, and they have commented from time to time. But there’s also this fairly inarticulate bully boy brigade who are frankly wasting their time.

They may count themselves among the majority in the UK population, judging by the referendum, but I highly doubt they’re even in a large minority here. But even if they were in the majority I wouldn’t stop writing about what I want to write about.

I keep these comments open because I feel it’s better to have different views aired than to talk in echo chambers, but if I decide in the end the Brexit articles have just become a platform to the sort of pointless trolling that has overrun places like The Telegraph and The Guardian, I’ll either delete their comments or turn comments off.

I’ve read a lot of crazy comments on this blog over the years. That one takes the cake.

Perhaps half of this country’s people would rather live in a civilised country rather than a third-world, tinpot dictatorship.

@ TI

I think you could usefully write more about the investment implications of Brexit and less about the politics, e.g. should we invest more in international and UK FTSE 100 equities and less in UK mid cap and small cap, or should we just invest in a Vanguard global tracker, and try and ignore the Brexit noise for the next two and a half years.

Gentlemen,Gentlemen

Should we return to our main purpose-investing

Brexit,2008 Banking Crisis,2000 Tec meltdown-we will see more of these before our game is done

Personally I work with the things I can control–my Portfolio

Thanks to Monevator and other websites like it I am Retired-13 years into Drawdown with a Portfolio of Index Trackers -Bonds and Equities-diversified across the world

As US is 50% of the world market my Portfolio is in a very healthy state

No doubt I will need the extra pounds to pay for more expensive holidays ,food etc!

Back to basics guys-tomorrow always comes-lets concentrate on what we can influence and

deal with world as it is-back to investing!

xxd09

@Gordon. I’m aghast that you want to the UK to converge with a dictatorship. Moreover, who cares what country any taxi driver comes from? There aren’t going to be any taxi drivers in 20 years; the cars will drive themselves.

Just popping in to say good morning before comments are inevitably closed.

Political risk is the biggest thing worrying me at the moment. Please don’t stop writing about it.

@Whitesheep

I now have a XDR/SDR box in my wealth spreadsheet, so I can measure it against a basket of currencies, and eliminate much of the pound down, FTSE 100 up problem.

As a rule of thumb it seems a good idea to have your wealth in the places where your expenses come from, so abroad for foreign holidays and imports like white goods, oil and food, UK for labour, which will dominate. Most of my long term costs will be UK based, but I plan to do lots and lots of foreign travel. I’m currently 1/3 abroad, but its actually more than that as the UK component is mostly FTSE 100. I plan to move some to the FTSE 250 over the next year. But with a house inheritance, civil service and state pension to come, there are other UK assets to add, so its really had to get a true exposure picture.

I’m badly underweight in the US, only 3% explicitly there, but even as a passive investor, I just felt the market timing was wrong for the last 5 years, for CAPE reasons as much as currency.

Closing comments now as the working week has begun and these Brexit debates take more than usual moderating. (Not just responding to views but making sure outright racist stuff doesn’t get through the filter and on to the site etc).

Thanks to *most* people who shared their views, whether pro or anti.

Have a good week! 🙂

So there you are MrInvestor. Standing square and facing us. We are the English. Look at us.

Just opening up this thread for a moment to transfer over Mroptimistic’s bizarre comment above, which was contaminating the latest Slow and Steady Update thread as the poor dab posted it on the wrong article in all the excitement yesterday.

While I’m here, I was just re-reading these comments and — not even considering the ones that I deleted for being too grim or that were even before then held by the spam software for various reasons — we see from a certain faction of Leave voters an ugly tone of nationalism, xenophobia, utterly incorrect information such as Brexit having anything to do with what passports are issued by the UK government, repeated calls for me to stop posting my own views on my own website, culminating in an appeal that we should look to an absolute monarchy for moral leadership.

(You can have a read of that exemplary country’s human rights record with this sourced article over at Wikipedia: https://en.wikipedia.org/wiki/Oman#Politics).

Whenever I or others suggest a significant faction of Leave voters (not all) hold xenophobic if not downright racist views, we’re accused of being some sneering Metropolitan elite.

Again and again though that faction reveals what it is within just a few exchanges — even when they know I’m deleting comments and so forth, and so are undoubtedly self-censoring.