Good reads from around the Web.

I read at least 100 investing articles every week, probably twice as many company news stories and 30-40 RNS updates from companies reporting to the stock market.

Like every week, some of the better ones are collated below.

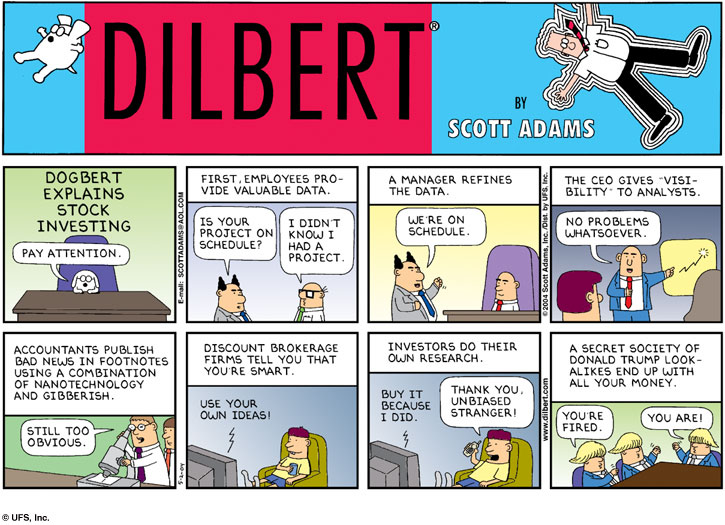

But let’s face it, you’re not going to enjoy any of them as much as a cartoon from Dilbert creator Scott Adams!

Adams has begun a new investing advice series:

He has actually written quite a bit over the years about investing – I’ve previously featured one of his old cartoons – and all his work offers a wry take on the world of business.

Adams advocates index funds and passive investing, obviously.

If only he could teach us how to be creative geniuses, too.

From the blogs

Making good use of the things that we find…

Passive investing

- A positive passive investing behaviour gap – A Wealth of Common Sense

- Why we don’t make good decisions – The Irrelevant Investor

Active investing

- Consumer defensives: A must own sector – Total Return Investor

- Keep your stock picking simple – Dividend Mantra

- The aging of the tech sector – Musings on Markets

- Where are the activist investors? – Oddball Stocks

- Bunzl’s metronomic growth – Richard Beddard

- How to respond to a dividend cut – UK Value Investor

Other articles

- The biology of stock market booms and busts – The Psy-Fi Blog

- Physical labour is good for the soul – The Escape Artist

- Fear of a frothy market – Simple Living in Suffolk

- Four paradoxes of the consumer society – FIREstarter

- The golden age of the introverted entrepreneur – Medium

Product of the week: Clydesdale Bank and Yorkshire Bank have increased their two-year cash ISA rates to 2.1%, which makes them Best Buys according to ThisIsMoney.

Mainstream media money

Some links are Google search results – in PC/desktop view these enable you to click through to read the piece without being a paid subscriber of that site.1

Passive investing

- Don’t make the trading gods laugh… – Bloomberg

- …particularly with your feeble forecasts – Motley Fool US

- Roth: Getting real about fund fees – AARP

- Active investors: Yes, the world is out to get you – Bloomberg

Active investing

- Generating returns from renewables [Search result] – FT

- Property crowding-funding is a great idea – in theory [Search result] – FT

- Housel: The case for leaving your portfolio alone – Motley Fool US

- 10 AIM shares for dividend growth – Interactive Investor

- Get ready for some terrible returns from equities – Business Insider

- Gold is the worst investment in history – Daily Finance

Other stuff worth reading

- Case studies as ‘pension freedom day’ approaches – Guardian

- Putting a pension into a fossil museum [Or similar business!] – Telegraph

- What about investing a pension into buy-to-let property? – ThisIsMoney

- How living frugally changed one man’s life – Daily Finance

- The state of UK housing in six charts – Guardian

Book of the week: UK property investor Rob Dix kindly sent me a PDF of his first book a few years ago, which I never got around to reviewing. I found it an approachable and useful read, albeit informed by a focus on an asset class that has almost only ever gone up over the period Dix has been involved! His latest book, 100 Property Investment Tips, was published this month.

Like these links? Subscribe to get them every week!

- Note some FT articles can only be accessed through the search results if you’re using PC/desktop view (from mobile/tablet view they bring up the firewall/subscription page). To circumvent, switch your mobile browser to use the desktop view. On Chrome for Android: press the menu button followed by “Request Desktop Site”. [↩]

Hi TI

As a STEM graduate Dilbert is a cartoon that I’ve followed for a long time. I sometimes think he’s taken inspiration via CCTV cameras from my office as some of them are very close to home.

It looks like his new investing series is going to be right on the money as well. Thanks for pointing it out.

Cheers

RIT

I went from laughing out loud at Dilbert, to chuckling, to chuckling nervously, to frowning and then eventually to being unable to read it because it was just too disturbingly accurate.

So Clydesdale/Yorkshire are now offering the best cash rates, the most generous incentive to switch your current account, the least stringent rental income test on their BTL mortgages, and the highest credit card limit I’ve personally been offered since 2007. Makes you wonder if they’re going to be grabbing a big market share over the next few years, or getting themselves into serious trouble, or both!

Warren Buffett / Berkshire’s annual letter for 2014 is now out:

http://www.berkshirehathaway.com/letters/2014ltr.pdf

Investor,

Thanks for sharing!

Spent all morning reading the new BRK letter. Always good stuff. 🙂

Best regards.

TI, Thanks. The annual Buffett is pure gold as usual. If nothing else his investment advice on pages 18 and 19 needs to be read.

Always entertained by a Gold article in the links section — it seems a surefire way to fire up a comments section and draw the conspiracy theorists out from their bunkers. Tremendous.

It does highlight — as usual — the divide between people who think about asset return and those who think about portfolio return (ie those who understand how uncorrelated assets increase long term performance).

And on that issue, one thing that always crops up is long term data on asset classes, volatility and correlation (or covariance if you prefer). Where does this data come from? Are there good sources out there for closing prices of major indices over time? When I attempted to measure the covariance of commercial property and equities, the answer I got was surprisingly high, compared with what I thought I’d see.

Why do all the reading as a passive investor? If you follow Warrens’s guidelines once a year is enough. Stop listening to the noise.

I must admit having switched to passive I enjoy the reading and do not del pressurised into doing anything at all. So enjoy watching the world go by.

@Gally — Fair point. 🙂

Here on Monevator my co-blogger is the pure passive.

I am this rough beast: http://monevator.com/passive-vs-active-investing-episode-1/